Market news

-

23:28

Stocks. Daily history for Mar 20’2017:

(index / closing price / change items /% change)

TOPIX -6.84 1565.85 -0.43%

Hang Seng +192.06 24501.99 +0.79%

CSI 300 +3.80 3449.61 +0.11%

Euro Stoxx 50 -10.93 3437.48 -0.32%

FTSE 100 +4.85 7429.81 +0.07%

DAX -42.34 12052.90 -0.35%

CAC 40 -17.08 5012.16 -0.34%

DJIA -8.76 20905.86 -0.04%

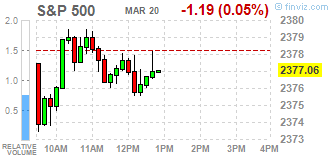

S&P 500 -4.78 2373.47 -0.20%

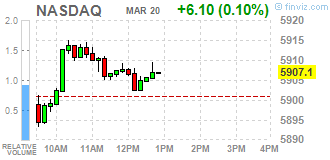

NASDAQ +0.53 5901.53 +0.01%

S&P/TSX -48.17 15442.32 -0.31%

-

20:06

The main US stock indexes finished trading almost unchanged

Major US stock indexes finished the session near the zero mark, as growth in the consumer market was offset by a fall in the utility sector.

A certain impact on the mood of market participants had a fall in prices on the oil market, as well as the outcome of the meeting of the G20 countries, which ended at the weekend in Germany. Recall, the key point of the annual meeting of the G20 finance ministers was their inability to reach an agreement on protecting free trade and combating protectionism because of the US refusal to sign the document.

The cost of oil slightly declined amid fears of investors that a growing volume of oil production in the US could hamper OPEC's efforts to reduce production. Pressure on quotes also provided the latest data from Baker Hughes on the number of drilling rigs in the US. On Friday, Baker Hughes reported that from March 11 to 17, the number of active oil drilling rigs in the US increased to 631 units from 617 units.

The focus was also the statements of representatives of the Fed, namely Evans, Kashkari and Harker. Head of the Federal Reserve Bank of Chicago, Evans, said that this year the Fed can start raising rates faster against the backdrop of positive economic outlook. In the meantime, the head of the Federal Reserve Bank of Minneapolis Kashkari noted that since inflation is now below 2% and there is still uncertainty about the weakness of the market, there are prerequisites for a more cautious increase in rates. Meanwhile, FRB President Philadelphia Harker said that, probably, the Central Bank will continue to raise rates gradually throughout 2017. Harker also noted that the rate increase last week was appropriate given all the data on the economy.

The components of the DOW index have mostly grown (19 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 2.70%). More shares fell The Home Depot, Inc. (HD, -1.09%).

Most sectors of the S & P index recorded a decline. The utilities sector fell most of all (-0.5%). The leader of growth was the consumer goods sector (+ 0.3%).

At closing:

Dow -0.04% 20,907.12 -7.50

Nasdaq + 0.01% 5,901.53 +0.53

S & P -0.20% 2,373.46 -4.79

-

19:00

DJIA -0.09% 20,895.83 -18.79 Nasdaq -0.15% 5,892.39 -8.61 S&P -0.30% 2,371.09 -7.16

-

17:00

European stocks closed: FTSE 100 +4.85 7429.81 +0.07% DAX -42.34 12052.90 -0.35% CAC 40 -17.08 5012.16 -0.34%

-

16:52

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday. The U.S. stock market has been on record-setting spree since the election of Donald Trump as president, but the rally has faltered in recent weeks as investors fret over the lack of clarity on his proposals to reform taxes and cut regulation.

Most of Dow stocks in positive area (18 of 30). Top loser - Visa Inc. (V, -1.13%). Top gainer - Caterpillar Inc. (CAT, +2.41%).

Most of S&P sectors in negative area. Top loser - Utilities (-0.5%). Top gainer - Consumer goods (+0.4%).

At the moment:

Dow 20883.00 +20.00 +0.10%

S&P 500 2372.75 -2.50 -0.11%

Nasdaq 100 5418.00 +9.50 +0.18%

Oil 49.12 -0.19 -0.39%

Gold 1232.80 +2.60 +0.21%

U.S. 10yr 2.48 -0.03

-

13:31

U.S. Stocks open: Dow -0.05%, Nasdaq -0.03%, S&P -0.11%

-

13:19

Before the bell: S&P futures -0.18%, NASDAQ futures -0.05%

U.S. stock-index futures were flat, as investors lacked a catalyst to decisively move the major averages in one direction or the other.

Global Stocks:

Nikkei -

Hang Seng 24,501.99 +192.06 +0.79%

Shanghai 3,250.81 +13.36 +0.41%

FTSE 7,413.81 -11.15 -0.15%

CAC 5,013.10 -16.14 -0.32%

DAX 12,056.63 -38.61 -0.32%

Crude $48.05 (-1.50%)

Gold $1,230.80 (+0.05%)

-

12:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

192.65

0.29(0.15%)

550

ALTRIA GROUP INC.

MO

75.3

0.14(0.19%)

675

Amazon.com Inc., NASDAQ

AMZN

852.55

0.24(0.03%)

2494

AMERICAN INTERNATIONAL GROUP

AIG

62

-0.42(-0.67%)

1260

Apple Inc.

AAPL

140.31

0.32(0.23%)

97675

Barrick Gold Corporation, NYSE

ABX

18.97

0.12(0.64%)

14254

Caterpillar Inc

CAT

92.85

-0.06(-0.06%)

2674

Chevron Corp

CVX

107.81

0.13(0.12%)

924

Citigroup Inc., NYSE

C

60.05

-0.32(-0.53%)

17030

Exxon Mobil Corp

XOM

81.6

-0.40(-0.49%)

5800

Facebook, Inc.

FB

139.9

0.06(0.04%)

7809

Ford Motor Co.

F

12.49

0.01(0.08%)

11602

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.67

-0.09(-0.71%)

17358

General Electric Co

GE

29.9

0.02(0.07%)

558

General Motors Company, NYSE

GM

36.45

0.12(0.33%)

234

Goldman Sachs

GS

243

-0.94(-0.39%)

6089

Home Depot Inc

HD

149.3

-0.30(-0.20%)

5301

Intel Corp

INTC

35.36

0.09(0.26%)

12289

International Business Machines Co...

IBM

175.49

-0.16(-0.09%)

1537

Johnson & Johnson

JNJ

127.78

-0.28(-0.22%)

2729

JPMorgan Chase and Co

JPM

90.23

-0.45(-0.50%)

13568

Microsoft Corp

MSFT

65.01

0.14(0.22%)

1380

Nike

NKE

57.85

0.05(0.09%)

16215

Procter & Gamble Co

PG

91.04

0.04(0.04%)

1010

Starbucks Corporation, NASDAQ

SBUX

55.87

0.09(0.16%)

1042

Tesla Motors, Inc., NASDAQ

TSLA

261.35

-0.15(-0.06%)

14045

The Coca-Cola Co

KO

42.05

0.02(0.05%)

1837

Twitter, Inc., NYSE

TWTR

15.1

0.02(0.13%)

21949

Visa

V

90.48

0.24(0.27%)

1373

Wal-Mart Stores Inc

WMT

70.05

0.16(0.23%)

9099

Walt Disney Co

DIS

112.5

0.74(0.66%)

9910

Yahoo! Inc., NASDAQ

YHOO

46.71

0.12(0.26%)

192

Yandex N.V., NASDAQ

YNDX

23.43

-0.19(-0.80%)

601

-

12:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $155 from $135 at Cowen

-

09:36

Major stock exchanges in Europe started trading in the red zone: FTSE 7404.30 -20.66 -0.28%, DAX 12065.15 -30.09 -0.25%, CAC 5011.18 -18.06 -0.36%

-

06:30

Global Stocks

U.K. blue-chip stocks edged higher Friday, enough for the market to close at a second consecutive record high, as focus turned to the Group of 20 meeting of finance chiefs in Germany. Investors moved with caution Friday as the G-20 meeting of finance ministers and central bankers from the world's largest economies kicked off in the German spa town of Baden-Baden.

U.S. stocks edged lower on Friday but managed to post moderate weekly gains with investors awaiting further catalysts before jumping back into the market.

Equity markets kicked off the week lacking direction as investors digested news from the G-20 meeting over the weekend, while major U.S. indexes didn't provide much of a lead. As trading got underway, bearish sentiment reigned and volumes were lighter with Japan away on vacation; cautious investors stayed on the sidelines.

-