Market news

-

23:59

Stocks. Daily history for Mar 21’2017:

(index / closing price / change items /% change)

Nikkei -65.71 19455.88 -0.34%

TOPIX -2.43 1563.42 -0.16%

Hang Seng +91.13 24593.12 +0.37%

CSI 300 +16.74 3466.35 +0.49%

Euro Stoxx 50 -7.86 3429.62 -0.23%

FTSE 100 -51.47 7378.34 -0.69%

DAX -90.77 11962.13 -0.75%

CAC 40 -9.73 5002.43 -0.19%

DJIA -237.85 20668.01 -1.14%

S&P 500 -29.45 2344.02 -1.24%

NASDAQ -107.70 5793.82 -1.83%

S&P/TSX -129.19 15313.13 -0.84%

-

20:06

Major US stock indexes finished trading in negative territory

Major US stock indexes fell significantly, which was caused by the fall of shares of financial companies, as investors began to doubt how quickly the Trump administration could implement the growth policy.

Investors also analyzed the report from the Bureau of Economic Analysis. It reported that the current account deficit in the fourth quarter of 2016 fell to $ 112.4 billion from $ 116.0 billion in the third quarter. The deficit fell to 2.4 percent of GDP in dollar terms from 2.5 percent in the third quarter. The reduction in the current account deficit by $ 3.6 billion mainly reflected a surplus increase in primary revenues by $ 19.9 billion, which was largely offset by an increase in the commodity deficit by $ 17.5 billion. Changes in the surplus in services and The deficit for secondary incomes was relatively small.

The cost of oil moderately declined, reaching a weekly low, as the market was not impressed by reports that OPEC could extend oil production reduction agreements. Sources in the OPEC signaled that its members are increasingly advocating for an extension of the agreement to reduce production, but they want support from non-OPEC oil producers such as Russia, which has yet to fully meet the terms of the current arrangement.

The components of the DOW index mostly decreased (26 out of 30). More shares fell The Goldman Sachs Group, Inc. (GS, -3.79%). The leader of growth was the shares of The Coca-Cola Company (KO, + 0.84%).

Almost all sectors of the S & P index recorded a fall. The financial sector fell most (-2.0%). The leader of growth was the utilities sector (+ 1.0%).

At closing:

Dow -1.12% 20,670.67 -235.19

Nasdaq -1.80% 5,795.14 -106.39

S & P -1.24% 2,344.07 -29.46

-

19:00

DJIA -0.96% 20,704.26 -201.60 Nasdaq -1.43% 5,816.88 -84.65 S&P -1.02% 2,349.16 -24.31

-

17:00

European stocks closed: FTSE 100 -51.47 7378.34 -0.69% DAX -90.77 11962.13 -0.75% CAC 40 -9.73 5002.43 -0.19%

-

16:43

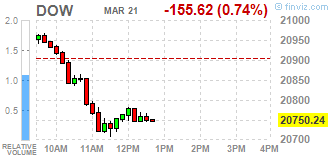

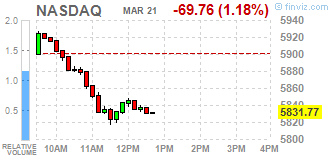

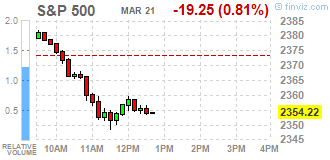

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes sharply lower on Tuesday, led by a fall in financial shares, as investors began to question how quickly the Trump administration can implement pro-growth policies. Financials have weakened in tandem with a pullback in bond yields following the Federal Reserve's policy announcement last week. The central bank raised rates by 25 basis points but signaled it would remain on a gradual pace of hike.

Most of Dow stocks in negative area (25 of 30). Top loser - Caterpillar Inc. (CAT-2.64%). Top gainer - The Coca-Cola Company (KO, +0.69%).

Almost all of S&P sectors in negative area. Top loser - Conglomerates (-1.7%). Top gainer - Utilities (+0.3%).

At the moment:

Dow 20714.00 -154.00 -0.74%

S&P 500 2353.00 -17.25 -0.73%

Nasdaq 100 5372.75 -45.75 -0.84%

Oil 48.35 -0.56 -1.14%

Gold 1243.20 +9.20 +0.75%

U.S. 10yr 2.44 -0.04

-

13:33

U.S. Stocks open: Dow +0.18%, Nasdaq +0.38%, S&P +0.28%

-

13:28

Before the bell: S&P futures +0.17%, NASDAQ futures +0.21%

U.S. stock-index futures rose as oil prices rebounded and ahead of speeches by a host of Federal Reserve officials, whose comments will be scrutinized for clues on the future path of interest rate hikes.

Global Stocks:

Nikkei 19,455.88 -65.71 -0.34%

Hang Seng 24,593.12 +91.13 +0.37%

Shanghai 3,262.20 +11.39 +0.35%

FTSE 7,414.66 -15.15 -0.20%

CAC 5,037.78 +25.62 +0.51%

DAX 12,070.04 +17.14 +0.14%

Crude $49.05 (+0.29%)

Gold $1,232.50 (-0.12%)

-

12:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

859.3

2.33(0.27%)

11987

Apple Inc.

AAPL

142.11

0.65(0.46%)

216597

AT&T Inc

T

42.5

0.08(0.19%)

762

Barrick Gold Corporation, NYSE

ABX

19

-0.06(-0.31%)

30797

Caterpillar Inc

CAT

95

-0.40(-0.42%)

2595

Citigroup Inc., NYSE

C

59.88

0.29(0.49%)

15072

Exxon Mobil Corp

XOM

82.36

0.36(0.44%)

1870

Facebook, Inc.

FB

141

1.06(0.76%)

129368

FedEx Corporation, NYSE

FDX

192.51

0.24(0.12%)

150

Ford Motor Co.

F

12.32

0.04(0.33%)

23273

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.03

0.30(2.36%)

240845

General Electric Co

GE

29.8

0.06(0.20%)

8782

General Motors Company, NYSE

GM

35.76

0.05(0.14%)

5424

Goldman Sachs

GS

243.4

1.26(0.52%)

3473

Google Inc.

GOOG

850

1.60(0.19%)

1155

Intel Corp

INTC

35.42

-0.01(-0.03%)

7422

International Business Machines Co...

IBM

176.05

0.35(0.20%)

1144

JPMorgan Chase and Co

JPM

90.45

0.42(0.47%)

8657

Microsoft Corp

MSFT

65.01

0.08(0.12%)

3787

Nike

NKE

58.67

-0.01(-0.02%)

18465

Tesla Motors, Inc., NASDAQ

TSLA

262.88

0.96(0.37%)

19910

The Coca-Cola Co

KO

42.29

0.11(0.26%)

2397

Twitter, Inc., NYSE

TWTR

15.16

0.07(0.46%)

24534

Wal-Mart Stores Inc

WMT

70

0.02(0.03%)

921

Yahoo! Inc., NASDAQ

YHOO

46.93

0.16(0.34%)

10280

Yandex N.V., NASDAQ

YNDX

23.71

0.23(0.98%)

1710

-

12:49

Upgrades and downgrades before the market open

Upgrades:

Facebook (FB) upgraded to Buy from Neutral at BTIG Research

Freeport-McMoRan (FCX) upgraded to Hold from Sell at Deutsche Bank

Downgrades:

Other:

Procter & Gamble (PG) initiated with a Neutral at JP Morgan; target $98

Coca-Cola Co. (KO) initiated with a Neutral at JP Morgan; target $43

Apple (AAPL) target raised to $160 from $140 at Bernstein

-

08:43

Major European stock exchanges trading in the green zone: FTSE 7434.60 +4.79 + 0.06%, DAX 12067.45 +14.55 + 0.12%, CAC 5026.86 +14.70 + 0.29%

-

07:48

Positive start of trading on the main European stock markets is expected: DAX + 0.1%, CAC 40 + 0.1%, FTSE flat

-

06:31

Global Stocks

European stocks finished lower Monday, with the week starting on a downbeat note in the wake of a Group of 20 meeting that stoked tensions about global trade. Among decliners Monday was Deutsche Bank AG DBK, -3.80% DB, -3.42% . Shares fell 3.7% as the German lending heavyweight said it will issue 687.5 million new shares at €11.65 each, to raise €8 billion ($8.6 billion) as it moves to shore up capital. Deutsche Bank earlier this month said it would make such a move.

The main U.S. stock indexes closed marginally lower Monday for the third straight day of losses, as investors were reluctant to make big bets without major economic or corporate news. In early trade, the Nasdaq Composite set an intraday all-time high, but settled within a few points of its previous closing record set earlier this month.

Investor appetite returned Tuesday in the Asia-Pacific region, even as Japanese equities saw weakness because of a stronger yen. Japanese markets were closed for a holiday on Monday. Since Friday, the yen has gained more than 1% against the dollar while bond yields have fallen. Neither development will be welcomed by a host of Japanese companies, from financial firms to exporters.

-