Market news

-

23:59

Stocks. Daily history for Mar 21’2017:

(index / closing price / change items /% change)

Nikkei -65.71 19455.88 -0.34%

TOPIX -2.43 1563.42 -0.16%

Hang Seng +91.13 24593.12 +0.37%

CSI 300 +16.74 3466.35 +0.49%

Euro Stoxx 50 -7.86 3429.62 -0.23%

FTSE 100 -51.47 7378.34 -0.69%

DAX -90.77 11962.13 -0.75%

CAC 40 -9.73 5002.43 -0.19%

DJIA -237.85 20668.01 -1.14%

S&P 500 -29.45 2344.02 -1.24%

NASDAQ -107.70 5793.82 -1.83%

S&P/TSX -129.19 15313.13 -0.84%

-

23:58

Currencies. Daily history for Mar 21’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0806 +0,65%

GBP/USD $1,2474 +0,94%

USD/CHF Chf0,9938 -0,47%

USD/JPY Y111,77 -0,64%

EUR/JPY Y120,78 +0,01%

GBP/JPY Y139,4 +0,29%

AUD/USD $0,7684 -0,57%

NZD/USD $0,7041 -0,16%

USD/CAD C$1,3352 -0,01%

-

23:50

Japan: Trade Balance Total, bln, February 813.4 (forecast 822)

-

23:31

Australia: Leading Index, February -0.1%

-

22:59

Schedule for today,Wednesday, Mar 22’2017 (GMT0)

01:40 Australia RBA Assist Gov Debelle Speaks

04:30 Japan All Industry Activity Index, m/m January -0.3% 0.1%

09:00 Eurozone Current account, unadjusted, bln January 47

13:00 U.S. Housing Price Index, m/m January 0.4% 0.4%

14:00 Switzerland SNB Quarterly Bulletin

14:00 U.S. Existing Home Sales February 5.69 5.57

14:30 U.S. Crude Oil Inventories March -0.237

19:45 Canada BOC Deputy Governor Lawrence Schembri Speaks

20:00 New Zealand RBNZ Interest Rate Decision 1.75% 1.75%

20:00 New Zealand RBNZ Rate Statement

-

20:06

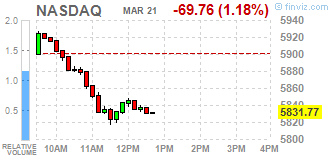

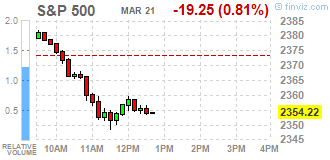

Major US stock indexes finished trading in negative territory

Major US stock indexes fell significantly, which was caused by the fall of shares of financial companies, as investors began to doubt how quickly the Trump administration could implement the growth policy.

Investors also analyzed the report from the Bureau of Economic Analysis. It reported that the current account deficit in the fourth quarter of 2016 fell to $ 112.4 billion from $ 116.0 billion in the third quarter. The deficit fell to 2.4 percent of GDP in dollar terms from 2.5 percent in the third quarter. The reduction in the current account deficit by $ 3.6 billion mainly reflected a surplus increase in primary revenues by $ 19.9 billion, which was largely offset by an increase in the commodity deficit by $ 17.5 billion. Changes in the surplus in services and The deficit for secondary incomes was relatively small.

The cost of oil moderately declined, reaching a weekly low, as the market was not impressed by reports that OPEC could extend oil production reduction agreements. Sources in the OPEC signaled that its members are increasingly advocating for an extension of the agreement to reduce production, but they want support from non-OPEC oil producers such as Russia, which has yet to fully meet the terms of the current arrangement.

The components of the DOW index mostly decreased (26 out of 30). More shares fell The Goldman Sachs Group, Inc. (GS, -3.79%). The leader of growth was the shares of The Coca-Cola Company (KO, + 0.84%).

Almost all sectors of the S & P index recorded a fall. The financial sector fell most (-2.0%). The leader of growth was the utilities sector (+ 1.0%).

At closing:

Dow -1.12% 20,670.67 -235.19

Nasdaq -1.80% 5,795.14 -106.39

S & P -1.24% 2,344.07 -29.46

-

19:00

DJIA -0.96% 20,704.26 -201.60 Nasdaq -1.43% 5,816.88 -84.65 S&P -1.02% 2,349.16 -24.31

-

17:00

European stocks closed: FTSE 100 -51.47 7378.34 -0.69% DAX -90.77 11962.13 -0.75% CAC 40 -9.73 5002.43 -0.19%

-

16:43

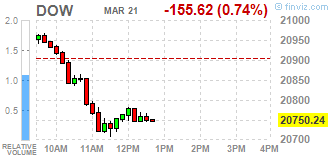

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes sharply lower on Tuesday, led by a fall in financial shares, as investors began to question how quickly the Trump administration can implement pro-growth policies. Financials have weakened in tandem with a pullback in bond yields following the Federal Reserve's policy announcement last week. The central bank raised rates by 25 basis points but signaled it would remain on a gradual pace of hike.

Most of Dow stocks in negative area (25 of 30). Top loser - Caterpillar Inc. (CAT-2.64%). Top gainer - The Coca-Cola Company (KO, +0.69%).

Almost all of S&P sectors in negative area. Top loser - Conglomerates (-1.7%). Top gainer - Utilities (+0.3%).

At the moment:

Dow 20714.00 -154.00 -0.74%

S&P 500 2353.00 -17.25 -0.73%

Nasdaq 100 5372.75 -45.75 -0.84%

Oil 48.35 -0.56 -1.14%

Gold 1243.20 +9.20 +0.75%

U.S. 10yr 2.44 -0.04

-

15:30

Brazil deputy energy minister sees interest from Russian, Chinese investors in Angra III, auction potentially by 2018

-

Sees Angra III plant ready by 2022, 2023

-

Ovt has decided to retake cemig power dams whose contracts expired, re-auction them off

-

Rules out deal with CEMIG over renewal

-

Fate of Angra III nuclear plant to be decided in April

-

-

15:18

Fitch expect EU banks in weaker-performing economies to be most affected by new requirements under IFRS 9 to provide for expected credit losses

-

14:59

Change in GDT Price Index from previous event +1.7%, Average price: $3,101. NZD/USD up 30 pips in the last hour, multi week high

-

14:55

Russia doesn't rule out extending oil pact with OPEC - Interfax

-

13:38

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600-10 (EUR 1.4bln) 1.0650 (325m) 1.0680 (185m) 1.0700 (495m) 1.0720-25 (735m) 1.0750-60 (444m) 1.825 (483m)

USDJPY: 112.00 (USD 205m) 112.25 (460m) 113.00 (445m) 113.50 (625m) 113.60 (865m) 113.80 (282m) 114.00 (334m)

GBPUSD 1.2200 (GBP 230m) 1.2350 (320m) 1.2427 (400m)

AUDUSD: 0.7600 (AUD 275m)

USDCAD 1.3200 (USD 200m) 1.3225 (220m) 1.3365 (185m)

NZDUSD 0.6925 (NZD 459m) 0.7125 (227m)

-

13:33

U.S. Stocks open: Dow +0.18%, Nasdaq +0.38%, S&P +0.28%

-

13:28

Before the bell: S&P futures +0.17%, NASDAQ futures +0.21%

U.S. stock-index futures rose as oil prices rebounded and ahead of speeches by a host of Federal Reserve officials, whose comments will be scrutinized for clues on the future path of interest rate hikes.

Global Stocks:

Nikkei 19,455.88 -65.71 -0.34%

Hang Seng 24,593.12 +91.13 +0.37%

Shanghai 3,262.20 +11.39 +0.35%

FTSE 7,414.66 -15.15 -0.20%

CAC 5,037.78 +25.62 +0.51%

DAX 12,070.04 +17.14 +0.14%

Crude $49.05 (+0.29%)

Gold $1,232.50 (-0.12%)

-

12:59

Orders

EUR/USD

Offers: 1.0800-05 1.0830 1.0850 1.0880 1.0900

Bids: 1.0780 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers: 1.2400 1.2420 1.2435 1.2445-50 1.2480 1.2500 1.2520 1.2550-55

Bids: 1.2360 1.2335-40 1.2320 1.2300 1.2285 1 .2250 1.2200

EUR/JPY

Offers: 121.85 122.00 122.30 122.50 122.65 122.85 123.00

Bids: 121.30 121.00 120.75 120.50 120.30 120.00

EUR/GBP

Offers: 0.8725-30 0.8750 0.8780-85 0.8800 0.8820 0.8850

Bids: 0.8700 0.8680-85 0.8665 0.8650 0.8630 0.8600 0.8580-85 0.8550

USD/JPY

Offers: 113.00 113.25-30 113.50 113.80 114.00 114.50

Bids: 112.45-50 112.25 112.00 111.85 111.65 111.50 111.00

AUD/USD

Offers: 0.7735 0.7750 0.7780 0.7800 0.7830 0.7850

Bids: 0.7700 0.7685 0.7665 0.7650 0.7600

-

12:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

859.3

2.33(0.27%)

11987

Apple Inc.

AAPL

142.11

0.65(0.46%)

216597

AT&T Inc

T

42.5

0.08(0.19%)

762

Barrick Gold Corporation, NYSE

ABX

19

-0.06(-0.31%)

30797

Caterpillar Inc

CAT

95

-0.40(-0.42%)

2595

Citigroup Inc., NYSE

C

59.88

0.29(0.49%)

15072

Exxon Mobil Corp

XOM

82.36

0.36(0.44%)

1870

Facebook, Inc.

FB

141

1.06(0.76%)

129368

FedEx Corporation, NYSE

FDX

192.51

0.24(0.12%)

150

Ford Motor Co.

F

12.32

0.04(0.33%)

23273

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.03

0.30(2.36%)

240845

General Electric Co

GE

29.8

0.06(0.20%)

8782

General Motors Company, NYSE

GM

35.76

0.05(0.14%)

5424

Goldman Sachs

GS

243.4

1.26(0.52%)

3473

Google Inc.

GOOG

850

1.60(0.19%)

1155

Intel Corp

INTC

35.42

-0.01(-0.03%)

7422

International Business Machines Co...

IBM

176.05

0.35(0.20%)

1144

JPMorgan Chase and Co

JPM

90.45

0.42(0.47%)

8657

Microsoft Corp

MSFT

65.01

0.08(0.12%)

3787

Nike

NKE

58.67

-0.01(-0.02%)

18465

Tesla Motors, Inc., NASDAQ

TSLA

262.88

0.96(0.37%)

19910

The Coca-Cola Co

KO

42.29

0.11(0.26%)

2397

Twitter, Inc., NYSE

TWTR

15.16

0.07(0.46%)

24534

Wal-Mart Stores Inc

WMT

70

0.02(0.03%)

921

Yahoo! Inc., NASDAQ

YHOO

46.93

0.16(0.34%)

10280

Yandex N.V., NASDAQ

YNDX

23.71

0.23(0.98%)

1710

-

12:49

Upgrades and downgrades before the market open

Upgrades:

Facebook (FB) upgraded to Buy from Neutral at BTIG Research

Freeport-McMoRan (FCX) upgraded to Hold from Sell at Deutsche Bank

Downgrades:

Other:

Procter & Gamble (PG) initiated with a Neutral at JP Morgan; target $98

Coca-Cola Co. (KO) initiated with a Neutral at JP Morgan; target $43

Apple (AAPL) target raised to $160 from $140 at Bernstein

-

12:40

Canadian retail sales rose more than expected in January

Retail sales rose 2.2% to $46.0 billion in January, led by four subsectors that rebounded from lower sales in December. Excluding sales at motor vehicle and parts dealers, retail sales advanced 1.7%.

After removing the effects of price changes, retail sales in volume terms increased 1.3%.

Sales were up in 10 of 11 subsectors in January, respresenting 98% of retail trade.

The largest increase in dollar terms was a 3.8% advance at motor vehicle and parts dealers, the fourth gain in five months. The increase in this subsector was mainly attributable to new car dealers (+4.2%). Gains were also reported at used car dealers (+4.3%) and other motor vehicle dealers (+4.2%).

-

12:38

The U.S current-account deficit decreased to $112.4 billion in the fourth quarter of 2016

The U.S current-account deficit decreased to $112.4 billion (preliminary) in the fourth quarter of 2016 from $116.0 billion (revised) in the third quarter of 2016, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit decreased to 2.4 percent of current-dollar gross domestic product (GDP) from 2.5 percent in the third quarter.

The $3.6 billion decrease in the current-account deficit mostly reflected a $19.9 billion increase in the surplus on primary income that was largely offset by a $17.5 billion increase in the deficit on goods. The changes in the surplus on services and the deficit on secondary income were relatively small.

-

12:30

Canada: Retail Sales, m/m, January 2.2% (forecast 1%)

-

12:30

Canada: Retail Sales ex Autos, m/m, January 1.7% (forecast 1.1%)

-

12:30

U.S.: Current account, bln, Quarter IV -112.4 (forecast -128.3)

-

12:30

Canada: Retail Sales YoY, January 4.5%

-

12:20

Italy's Padoan says discussed with EU's Vestager practical application of precautionary recapitalisation for Monte Paschi bank

-

11:37

Ukraine's Central Bank plans to cut volume of currency purchases on the market

-

Impact of economic blockade on Hryvnia will be limited

-

Revises 2017 gdp growth forecast to 1.9 pct from 2.8 pct

-

2017 inflation forecast unchanged at 9.1 pct

-

Revises end-2017 foreign exchange reserve forecast to $20.8 billion from $21.3 billion

-

Revises 2017 current account deficit forecast to $4.3 billion from $3.5 billion

-

-

11:07

The UK’s manufacturers report that export order books have risen to the highest level in over three years - CBI

The UK's manufacturers report that export order books have risen to the highest level in over three years, while expectations for growth are at a more than two-decade high, according to the latest CBI Industrial Trends Survey.

The survey of 423 firms found that export order books were the highest since December 2013, driven by a broad-based strengthening of which half was accounted for by the pharmaceutical and mechanical engineering sectors. Total order books remained firm in March, after strengthening to a two-year high in February.

-

11:00

United Kingdom: CBI industrial order books balance, March 8 (forecast 5)

-

10:40

Bank of England's Carney says former deputy governor Charlotte Hogg did not meet highest standards of governance and accountability

-

For those who question whether we "get it" on accountability, we do

-

BoE will learn lessons from "unfortunate events" around Hogg resignation to reinforce what is best in banking and BoE

-

Fully respect judgment of treasury committee on Hogg and her decision to resign

-

We know Hogg's honest mistake was a serious one

-

-

10:38

Fed's Dudley repeats bank culture needs improvement; does not comment on monetary policy

-

09:43

UK housing market indicators for January suggested moderate demand

Housing market indicators for January suggested moderate demand which continues to outmatch supply. UK House prices grew by 6.2% in the year to January 2017, 0.5 percentage points higher than December 2016. However this still remains below the average annual house price growth seen in 2016 which was 7.4%.

-

09:42

UK annual and monthly rate of producer price inflation increased in February 2017

Both the annual and monthly rate of producer price inflation increased in February 2017.

Factory gate prices (output prices) rose 3.7% on the year to February 2017, which is the eighth consecutive period of annual price increases and the highest they have been since December 2011.

Prices for materials and fuels paid by UK manufacturers for processing (input prices) rose 19.1% on the year, a slight decrease from the year to January 2017 but the second fastest rate of annual growth since September 2008.

Prices of imported materials and fuels increased 19.0% on the year, which is the first time the annual rate has been lower than the overall input PPI since December 2015.

-

09:33

UK CPI inflation rose more than expected in February

The Consumer Prices Index including owner occupiers' housing costs (CPIH, not a National Statistic) 12-month inflation rate was 2.3% in February 2017, up from 1.9% in January.

The rate in February 2017 was the highest since September 2013, having steadily increased since late 2015.

Rising transport costs, particularly for fuel, were the main contributors to the increase in the rate.

Prices for food increased by 0.3% between February 2016 and February 2017, following 31 consecutive months of prices falling on the year.

The Consumer Prices Index (CPI) 12-month rate was also 2.3% in February 2017, compared with 1.8% in January.

-

09:31

United Kingdom: PSNB, bln, February -1.08 (forecast -2.5)

-

09:30

United Kingdom: HICP, Y/Y, February 2.3% (forecast 2.1%)

-

09:30

United Kingdom: HICP, m/m, February 0.7% (forecast 0.5%)

-

09:30

United Kingdom: Retail prices, Y/Y, February 3.2% (forecast 2.9%)

-

09:30

United Kingdom: Producer Price Index - Input (YoY) , February 19.1% (forecast 20.1%)

-

09:30

United Kingdom: Producer Price Index - Output (MoM), February 0.2% (forecast 0.3%)

-

09:30

United Kingdom: Producer Price Index - Input (MoM), February -0.4% (forecast 0.1%)

-

09:30

United Kingdom: Retail Price Index, m/m, February 1.1% (forecast 0.8%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, February 2% (forecast 1.8%)

-

09:30

United Kingdom: Producer Price Index - Output (YoY) , February 3.7% (forecast 3.7%)

-

08:43

Major European stock exchanges trading in the green zone: FTSE 7434.60 +4.79 + 0.06%, DAX 12067.45 +14.55 + 0.12%, CAC 5026.86 +14.70 + 0.29%

-

08:26

BoJ Iwata: BoJ unlikely to conduct debt selling operations any time soon

-

BoJ can use rates on excess reserves and mkt operations to prevent inflation from getting out of control

-

Undesirable to create economic bubbles

-

Weak yen has some minus points, can't say it should weaken continuously

-

Difficult to narrow output gap with weak yen

-

BoJ not trying to reach 2 pct inflation target with weak yen

-

Don't expect yen to continually weaken due to rate spreads

-

-

07:48

Positive start of trading on the main European stock markets is expected: DAX + 0.1%, CAC 40 + 0.1%, FTSE flat

-

07:34

Annual record for migrants arrived in New Zealand

In the February 2017 year, 71,300 more migrants arrived in New Zealand than left, Stats NZ said today. This equalled the previous annual record set in January 2017. Migrant arrivals numbered 128,800 in the February 2017 year, a new annual record, while migrant departures were 57,500.

"About a third of all migrant arrivals for the year were people coming to New Zealand on work visas," population statistics senior manager Peter Dolan said. "Just over a quarter of all work-visa migrants were from the United Kingdom and France."

The next largest sources of migrants coming to New Zealand to work were from Germany, Australia, South Africa, and the United States.

-

07:30

Options levels on tuesday, March 21, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0875 (989)

$1.0853 (117)

$1.0821 (47)

Price at time of writing this review: $1.0784

Support levels (open interest**, contracts):

$1.0716 (153)

$1.0687 (571)

$1.0648 (387)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 39569 contracts, with the maximum number of contracts with strike price $1,1450 (3964);

- Overall open interest on the PUT options with the expiration date June, 9 is 43954 contracts, with the maximum number of contracts with strike price $1,0350 (4009);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from March, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2611 (329)

$1.2515 (755)

$1.2420 (306)

Price at time of writing this review: $1.2360

Support levels (open interest**, contracts):

$1.2282 (230)

$1.2186 (348)

$1.2089 (641)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 14714 contracts, with the maximum number of contracts with strike price $1,3000 (1160);

- Overall open interest on the PUT options with the expiration date June, 9 is 16862 contracts, with the maximum number of contracts with strike price $1,1500 (3147);

- The ratio of PUT/CALL was 1.15 versus 1.20 from the previous trading day according to data from March, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:24

BoJ’s Iwata: JPY Could Weaken Vs USD Based On Interest Rate Differentials - Reuters

-

07:16

Swiss Federal Government’s Expert Group is expecting growth in gross domestic product (GDP) to accelerate to +1.6% in 2017

Swiss economic growth turned out disappointingly weak in the second half of 2016. However, the leading indicators are pointing to a clear upward trend in early 2017 and the global economy is sending out positive signals.

The Federal Government's Expert Group is therefore expecting growth in gross domestic product (GDP) to accelerate to +1.6% in 2017 (previously +1.8%) and to +1.9% in 2018 (unchanged), underpinned by domestic demand in particular. The Group also expects the job market to benefit from the economic recovery, anticipating, as before, that unemployment will drop to 3.2% in 2017 and 3.1% in 2018.

-

07:15

Swiss trade balance surplus declined in February

In February 2017, foreign trade grew in both directions. Exports rose by 0.9% (real: - 2.5%) on working day terms. Thanks to three product groups, imports grew by + 5.4% (real: - 1.2%). The trade balance closed with a surplus of 3.3 billion francs.

-

07:00

Switzerland: Trade Balance, February 3.3 (forecast 3.85)

-

06:31

Global Stocks

European stocks finished lower Monday, with the week starting on a downbeat note in the wake of a Group of 20 meeting that stoked tensions about global trade. Among decliners Monday was Deutsche Bank AG DBK, -3.80% DB, -3.42% . Shares fell 3.7% as the German lending heavyweight said it will issue 687.5 million new shares at €11.65 each, to raise €8 billion ($8.6 billion) as it moves to shore up capital. Deutsche Bank earlier this month said it would make such a move.

The main U.S. stock indexes closed marginally lower Monday for the third straight day of losses, as investors were reluctant to make big bets without major economic or corporate news. In early trade, the Nasdaq Composite set an intraday all-time high, but settled within a few points of its previous closing record set earlier this month.

Investor appetite returned Tuesday in the Asia-Pacific region, even as Japanese equities saw weakness because of a stronger yen. Japanese markets were closed for a holiday on Monday. Since Friday, the yen has gained more than 1% against the dollar while bond yields have fallen. Neither development will be welcomed by a host of Japanese companies, from financial firms to exporters.

-

00:30

Australia: House Price Index (QoQ), Quarter IV 4.1%

-