Market news

-

23:29

Stocks. Daily history for Mar 23’2017:

(index / closing price / change items /% change)

Nikkei +43.93 19085.31 +0.23%

TOPIX +0.21 1530.41 +0.01%

Hang Seng +7.29 24327.70 +0.03%

CSI 300 +11.93 3461.98 +0.35%

Euro Stoxx 50 +31.48 3452.18 +0.92%

FTSE 100 +15.99 7340.71 +0.22%

DAX +135.56 12039.68 +1.14%

CAC 40 +38.06 5032.76 +0.76%

DJIA -4.72 20656.58 -0.02%

S&P 500 -2.49 2345.96 -0.11%

NASDAQ -3.95 5817.69 -0.07%

S&P/TSX +85.15 15433.61 +0.55%

-

20:08

Major US stock indexes finished trading in negative territory

Major US stock indexes finished the session with a slight decrease. Investors bought cheaper bank stocks, but remained cautious before voting on the health care bill, which is seen as the first political test of President Donald Trump.

As it became known today, last week the number of Americans who applied for unemployment benefits unexpectedly increased, but remained below the level associated with the strengthening of the labor market. Initial applications for unemployment benefits increased by 15,000 people and, taking into account seasonal fluctuations, reached 258,000 for the week ending March 18. The appeals for the previous week were revised, and showed 2,000 more applications received than previously reported. The four-week moving average of calls, which is considered to be the best indicator of labor market trends, increased by only 1,000 to 240,000.

However, the Ministry of Commerce said that sales of new single-family homes in the US rose to a seven-month high in February, indicating that the housing market recovery continued to gain momentum despite high prices and limited supplies. According to the data, sales of new buildings rose 6.1% to 592,000 units last month, the highest level since July 2016. The pace of sales in January was revised to 558,000 units from previously reported 555,000 units. Economists predicted that sales of new homes would grow by 0.7 percent to 565,000 units last month.

Most components of the DOW index recorded a decline (19 out of 30). More shares fell UnitedHealth Group Incorporated (UNH, -1.20%). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.74%).

Most sectors of the S & P index finished trading in the red. The technological sector fell most of all (-0.4%). The leader of growth was the financial sector (+ 0.3%).

At closing:

Dow -0.02% 20.656.51 -4.79

Nasdaq -0.07% 5,817.69 -3.95

S & P -0.11% 2,345.96 -2.49

-

19:00

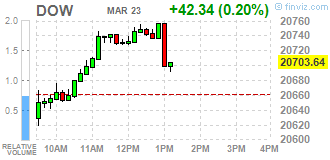

DJIA +0.32% 20,727.70 +66.40 Nasdaq +0.27% 5,837.09 +15.45 S&P +0.26% 2,354.46 +6.01

-

17:14

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes higher in late morning trading on Thursday as investors snapped up beaten-down bank stocks, but remained cautious ahead of a vote on a healthcare bill that is seen as President Donald Trump's first policy test.

Most of Dow stocks in positive area (24 of 30). Top loser - Intel Corporation (INTC-0.59%). Top gainer - NIKE, Inc. (NKE, +2.56%).

Almost all of S&P sectors in positive area. Top loser - Technology (-0.1%). Top gainer - Conglomerates (+1.1%).

At the moment:

Dow 20699.00 +103.00 +0.50%

S&P 500 2355.00 +12.50 +0.53%

Nasdaq 100 5376.00 +10.25 +0.19%

Oil 47.89 -0.15 -0.31%

Gold 1244.70 -5.00 -0.40%

U.S. 10yr 2.42 +0.02

-

17:00

European stocks closed: FTSE 100 +15.99 7340.71 +0.22% DAX +135.56 12039.68 +1.14% CAC 40 +38.06 5032.76 +0.76%

-

13:34

U.S. Stocks open: Dow -0.20%, Nasdaq -0.22, S&P -0.22%

-

13:27

Before the bell: S&P futures +0.16%, NASDAQ futures +0.07%

U.S. stock-index futures were flat as investors remained cautious ahead of a vote on the healthcare bill - President Donald Trump's first significant policy test.

Global Stocks:

Nikkei 19,085.31 +43.93 +0.23%

Hang Seng 24,327.70 +7.29 +0.03%

Shanghai 3,248.91 +3.69 +0.11%

FTSE 7,320.01 -4.71 -0.06%

CAC 5,001.99 +7.29 +0.15%

DAX 11,945.59 +41.47 +0.35%

Crude $48.19 (+0.31%)

Gold $1,250.30 (+0.05%)

-

12:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33.73

0.04(0.12%)

111

ALTRIA GROUP INC.

MO

74.49

-0.58(-0.77%)

9324

Amazon.com Inc., NASDAQ

AMZN

849.35

1.29(0.15%)

4480

Apple Inc.

AAPL

141.5

0.08(0.06%)

63675

AT&T Inc

T

41.75

0.10(0.24%)

1435

Barrick Gold Corporation, NYSE

ABX

19.6

0.12(0.62%)

32933

Cisco Systems Inc

CSCO

34.12

0.02(0.06%)

671

Citigroup Inc., NYSE

C

57.89

0.12(0.21%)

20546

Deere & Company, NYSE

DE

110.04

0.27(0.25%)

200

Exxon Mobil Corp

XOM

81.71

-0.05(-0.06%)

1573

Ford Motor Co.

F

11.88

0.11(0.93%)

51371

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13

0.14(1.09%)

13360

General Electric Co

GE

29.56

0.03(0.10%)

2761

General Motors Company, NYSE

GM

34.41

0.02(0.06%)

9096

Goldman Sachs

GS

231.7

0.63(0.27%)

5120

Google Inc.

GOOG

824.25

-5.34(-0.64%)

7047

Intel Corp

INTC

35.51

0.14(0.40%)

3051

International Business Machines Co...

IBM

174.99

0.21(0.12%)

5096

JPMorgan Chase and Co

JPM

87.7

0.17(0.19%)

21011

Microsoft Corp

MSFT

65

-0.03(-0.05%)

4499

Nike

NKE

54.45

0.53(0.98%)

59683

Pfizer Inc

PFE

34.39

-0.08(-0.23%)

367

Starbucks Corporation, NASDAQ

SBUX

56.15

0.26(0.47%)

5371

Tesla Motors, Inc., NASDAQ

TSLA

257.26

2.25(0.88%)

26150

The Coca-Cola Co

KO

42.45

0.07(0.17%)

747

Visa

V

88.49

-0.03(-0.03%)

269

Wal-Mart Stores Inc

WMT

70.1

-0.15(-0.21%)

176

Walt Disney Co

DIS

112.09

0.01(0.01%)

431

Yahoo! Inc., NASDAQ

YHOO

46.22

0.16(0.35%)

1467

Yandex N.V., NASDAQ

YNDX

22.52

0.10(0.45%)

4050

-

12:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Altria (MO) downgraded to Underperform from Sector Perform at RBC Capital Mkts; target $62

Other:

-

08:44

Major stock markets in Europe trading mixed: FTSE 7314.63 -10.09 -0.14%, DAX 11910.05 +5.93 + 0.05%, CAC 4987.55 -7.15 -0.14%

-

06:26

Global Stocks

European stocks fell to a one-week low Wednesday, with bank shares among the worst performing, as investors questioned whether the new U.S. administration can soon deliver the fiscal and regulatory changes needed to support the "Trump trade."

The Dow fell for a fifth straight session Wednesday as the broader market staged a modest rebound on the back of technology stocks. The selloff came as issues with the Republicans' health-care bill prompted investors to question Trump's ability to follow through on promises of tax reforms and $1 trillion in infrastructure spending, according to Connor Campbell, financial analyst at Spreadex. A vote on the bill has been set for Thursday.

Global markets stabilized after skidding a day earlier, though investors were on edge ahead of a vote on U.S. health care later Thursday that could be a barometer for future Trump administration policies. After U.S. stocks rebounded Wednesday and oil and the dollar seemed to have found near-term support, participants in Asia-Pacific markets were wary.

-