Market news

-

23:30

Commodities. Daily history for Mar 23’02’2017:

(raw materials / closing price /% change)

Oil 47.72 +0.04%

Gold 1,244.90 -0.18%

-

23:29

Stocks. Daily history for Mar 23’2017:

(index / closing price / change items /% change)

Nikkei +43.93 19085.31 +0.23%

TOPIX +0.21 1530.41 +0.01%

Hang Seng +7.29 24327.70 +0.03%

CSI 300 +11.93 3461.98 +0.35%

Euro Stoxx 50 +31.48 3452.18 +0.92%

FTSE 100 +15.99 7340.71 +0.22%

DAX +135.56 12039.68 +1.14%

CAC 40 +38.06 5032.76 +0.76%

DJIA -4.72 20656.58 -0.02%

S&P 500 -2.49 2345.96 -0.11%

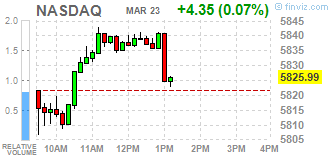

NASDAQ -3.95 5817.69 -0.07%

S&P/TSX +85.15 15433.61 +0.55%

-

23:28

Currencies. Daily history for Mar 23’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0782 -0,09%

GBP/USD $1,2514 +0,29%

USD/CHF Chf0,9929 +0,13%

USD/JPY Y110,97 -0,25%

EUR/JPY Y119,66 -0,34%

GBP/JPY Y138,86 +0,04%

AUD/USD $0,7624 -0,64%

NZD/USD $0,7027 -0,19%

USD/CAD C$1,3351 +0,15%

-

23:01

Schedule for today,Friday, Mar 24’2017 (GMT0)

00:30 Japan Manufacturing PMI (Preliminary) March 53.3 53.5

05:00 Japan Leading Economic Index (Finally) January 104.8 105.5

05:00 Japan Coincident Index (Finally) January 115.6

07:45 France GDP, Y/Y (Finally) Quarter IV 1.0% 1.1%

07:45 France GDP, q/q (Finally) Quarter IV 0.2% 0.4%

08:00 France Services PMI (Preliminary) March 56.4 56.1

08:00 France Manufacturing PMI (Preliminary) March 52.2 52.4

08:30 Germany Services PMI (Preliminary) March 54.4 54.6

08:30 Germany Manufacturing PMI (Preliminary) March 56.8 56.5

09:00 Eurozone Manufacturing PMI (Preliminary) March 55.4 55.3

09:00 Eurozone Services PMI (Preliminary) March 55.5 55.3

09:30 United Kingdom BBA Mortgage Approvals February 44.7 44.9

12:00 U.S. FOMC Member Charles Evans Speaks

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February 1.7%

12:30 Canada Consumer Price Index m / m February 0.9% 0.2%

12:30 Canada Consumer price index, y/y February 2.1% 2.1%

12:30 U.S. Durable goods orders ex defense February 1.5%

12:30 U.S. Durable Goods Orders ex Transportation February -0.2% 0.5%

12:30 U.S. Durable Goods Orders February 1.8% 1.2%

13:05 U.S. FOMC Member James Bullard Speaks

13:45 U.S. Manufacturing PMI (Preliminary) March 54.2 54.8

13:45 U.S. Services PMI (Preliminary) March 53.8 54.2

14:00 U.S. FOMC Member Dudley Speak

-

21:45

New Zealand: Trade Balance, mln, February -18 (forecast 160)

-

20:08

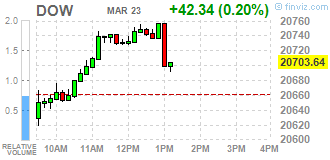

Major US stock indexes finished trading in negative territory

Major US stock indexes finished the session with a slight decrease. Investors bought cheaper bank stocks, but remained cautious before voting on the health care bill, which is seen as the first political test of President Donald Trump.

As it became known today, last week the number of Americans who applied for unemployment benefits unexpectedly increased, but remained below the level associated with the strengthening of the labor market. Initial applications for unemployment benefits increased by 15,000 people and, taking into account seasonal fluctuations, reached 258,000 for the week ending March 18. The appeals for the previous week were revised, and showed 2,000 more applications received than previously reported. The four-week moving average of calls, which is considered to be the best indicator of labor market trends, increased by only 1,000 to 240,000.

However, the Ministry of Commerce said that sales of new single-family homes in the US rose to a seven-month high in February, indicating that the housing market recovery continued to gain momentum despite high prices and limited supplies. According to the data, sales of new buildings rose 6.1% to 592,000 units last month, the highest level since July 2016. The pace of sales in January was revised to 558,000 units from previously reported 555,000 units. Economists predicted that sales of new homes would grow by 0.7 percent to 565,000 units last month.

Most components of the DOW index recorded a decline (19 out of 30). More shares fell UnitedHealth Group Incorporated (UNH, -1.20%). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.74%).

Most sectors of the S & P index finished trading in the red. The technological sector fell most of all (-0.4%). The leader of growth was the financial sector (+ 0.3%).

At closing:

Dow -0.02% 20.656.51 -4.79

Nasdaq -0.07% 5,817.69 -3.95

S & P -0.11% 2,345.96 -2.49

-

19:00

DJIA +0.32% 20,727.70 +66.40 Nasdaq +0.27% 5,837.09 +15.45 S&P +0.26% 2,354.46 +6.01

-

17:14

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes higher in late morning trading on Thursday as investors snapped up beaten-down bank stocks, but remained cautious ahead of a vote on a healthcare bill that is seen as President Donald Trump's first policy test.

Most of Dow stocks in positive area (24 of 30). Top loser - Intel Corporation (INTC-0.59%). Top gainer - NIKE, Inc. (NKE, +2.56%).

Almost all of S&P sectors in positive area. Top loser - Technology (-0.1%). Top gainer - Conglomerates (+1.1%).

At the moment:

Dow 20699.00 +103.00 +0.50%

S&P 500 2355.00 +12.50 +0.53%

Nasdaq 100 5376.00 +10.25 +0.19%

Oil 47.89 -0.15 -0.31%

Gold 1244.70 -5.00 -0.40%

U.S. 10yr 2.42 +0.02

-

17:00

European stocks closed: FTSE 100 +15.99 7340.71 +0.22% DAX +135.56 12039.68 +1.14% CAC 40 +38.06 5032.76 +0.76%

-

15:39

US treasury yields rise to session highs as stocks gain, 10-year note yields increase to 2.42 pct

-

15:14

Euro zone consumer confidence improves slightly

In March 2017, the DG ECFIN flash estimate of the consumer confidence indicator increased in both the euro area (by 1.2 points to -5.0) and the EU (by 1.0 point to -4.2), thereby broadly offsetting the decreases registered in February.

-

15:00

Eurozone: Consumer Confidence, March -5 (forecast -5.7)

-

14:36

IMF spokesman says not aware of fund seeking new loan conditions for Ukraine, IMF hopes to soon announce new board date to consider disbursement

-

Views shift in G20 communique language on trade as showing consensus to improve global trade architecture, not abandon it

-

Trump administration's proposed budget cuts for multilateral institutions would not have a direct impact on IMF finances, income

-

-

14:04

US new home sales rose 6.1% in February. USD/JPY almost flat for the day

Sales of new single-family houses in February 2017 were at a seasonally adjusted annual rate of 592,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.1 percent (±17.3 percent)* above the revised January rate of 558,000 and is 12.8 percent (±18.0 percent)* above the February 2016 estimate of 525,000.

The median sales price of new houses sold in February 2017 was $296,200. The average sales price was $390,400.

-

14:00

Belgium: Business Climate, March -1.6 (forecast -0.3)

-

14:00

U.S.: New Home Sales, February 592 (forecast 565)

-

13:44

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0680-90 (EUR 365m) 1.0700 (895m) 1.0725-35 (695m) 1.0770 (735m) 1.0800 (455m) 1.0830 (400m) 1.0850 (755m) 1.0900 (675m)

USDJPY: 110.40-50 (USD 325m) 111.60-70 (460m) 112.50 (245m) 112.75 (1.3bln) 112.85 (395m) 113.00 (1.4bln)

GBPUSD: 1.2440-50 (GBP 215m) 1.2480-1.2500 (230m)

USDCHF 0.9900 (USD 180m)

AUDUSD: 0.7500 (AUD 1.4bln) 0.7525 (1.5bln) 0.7575 (205) 0.7640-50 (320m)

-

13:34

U.S. Stocks open: Dow -0.20%, Nasdaq -0.22, S&P -0.22%

-

13:27

Before the bell: S&P futures +0.16%, NASDAQ futures +0.07%

U.S. stock-index futures were flat as investors remained cautious ahead of a vote on the healthcare bill - President Donald Trump's first significant policy test.

Global Stocks:

Nikkei 19,085.31 +43.93 +0.23%

Hang Seng 24,327.70 +7.29 +0.03%

Shanghai 3,248.91 +3.69 +0.11%

FTSE 7,320.01 -4.71 -0.06%

CAC 5,001.99 +7.29 +0.15%

DAX 11,945.59 +41.47 +0.35%

Crude $48.19 (+0.31%)

Gold $1,250.30 (+0.05%)

-

13:00

Orders

EUR/USD

Offers: 1.0800 1.0820 1.0830 1.0850 1.0880 1.0900

Bids: 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers: 1.2520 1.2550-55 1.2580 1.2600 1.2630 1.2650

Bids: 1.2465 1.2450 1.2425-30 1.2400 1.2380 1.2360 1.2335-40 1.2320 1.2300

EUR/JPY

Offers: 120.00 120.30 120.50 120.85 121.00 121.50

Bids: 119.50 119.30 119.00 118.80 118.65 118.50

EUR/GBP

Offers: 0.8655-60 0.8685 0.8700 0.8725-30 0.8750 0.8780-85 0.8800

Bids: 0.8625-30 0.8600 0.8580-85 0.8550 0.8530 0.8500

USD/JPY

Offers: 111.30 111.50 111.65 111.80 112.00 112.25 112.50112.80 113.00

Bids: 111.00 110.80 110.65110.50110.35110.20 110.00

AUD/USD

Offers: 0.7665 0.7680-85 0.7700 0.7720 0.0.7735 0.7750

Bids: 0.7625 0.7600 0.7580 0.7565 0.7550 0.7500

-

12:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33.73

0.04(0.12%)

111

ALTRIA GROUP INC.

MO

74.49

-0.58(-0.77%)

9324

Amazon.com Inc., NASDAQ

AMZN

849.35

1.29(0.15%)

4480

Apple Inc.

AAPL

141.5

0.08(0.06%)

63675

AT&T Inc

T

41.75

0.10(0.24%)

1435

Barrick Gold Corporation, NYSE

ABX

19.6

0.12(0.62%)

32933

Cisco Systems Inc

CSCO

34.12

0.02(0.06%)

671

Citigroup Inc., NYSE

C

57.89

0.12(0.21%)

20546

Deere & Company, NYSE

DE

110.04

0.27(0.25%)

200

Exxon Mobil Corp

XOM

81.71

-0.05(-0.06%)

1573

Ford Motor Co.

F

11.88

0.11(0.93%)

51371

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13

0.14(1.09%)

13360

General Electric Co

GE

29.56

0.03(0.10%)

2761

General Motors Company, NYSE

GM

34.41

0.02(0.06%)

9096

Goldman Sachs

GS

231.7

0.63(0.27%)

5120

Google Inc.

GOOG

824.25

-5.34(-0.64%)

7047

Intel Corp

INTC

35.51

0.14(0.40%)

3051

International Business Machines Co...

IBM

174.99

0.21(0.12%)

5096

JPMorgan Chase and Co

JPM

87.7

0.17(0.19%)

21011

Microsoft Corp

MSFT

65

-0.03(-0.05%)

4499

Nike

NKE

54.45

0.53(0.98%)

59683

Pfizer Inc

PFE

34.39

-0.08(-0.23%)

367

Starbucks Corporation, NASDAQ

SBUX

56.15

0.26(0.47%)

5371

Tesla Motors, Inc., NASDAQ

TSLA

257.26

2.25(0.88%)

26150

The Coca-Cola Co

KO

42.45

0.07(0.17%)

747

Visa

V

88.49

-0.03(-0.03%)

269

Wal-Mart Stores Inc

WMT

70.1

-0.15(-0.21%)

176

Walt Disney Co

DIS

112.09

0.01(0.01%)

431

Yahoo! Inc., NASDAQ

YHOO

46.22

0.16(0.35%)

1467

Yandex N.V., NASDAQ

YNDX

22.52

0.10(0.45%)

4050

-

12:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Altria (MO) downgraded to Underperform from Sector Perform at RBC Capital Mkts; target $62

Other:

-

12:34

US initial unemployment claims rose

In the week ending March 18, the advance figure for seasonally adjusted initial claims was 258,000, an increase of 15,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 241,000 to 243,000. The 4-week moving average was 240,000, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 1,750 from 237,250 to 239,000.

-

12:30

U.S.: Initial Jobless Claims, 258 (forecast 240)

-

12:30

U.S.: Continuing Jobless Claims, 2000 (forecast 2035)

-

11:51

Romania's Finance Ministry sells planned 600 mln Ron of 364 -day discount treasury bills at 0.97 pct average annual yield

-

11:16

UK CBI Distributive Trades Survey show a stronger than expected retail sales rise

The survey of 116 firms, consisting of 65 retailers, showed that growth in the volumes of sales was similar to that seen in February, but is set to accelerate in the year to April.

Sales for the time of year were considered to be slightly below seasonal norms. Orders placed on suppliers fell again over the year, but are set to rise somewhat next month.

The moderate increase in headline retail sales volumes was driven by the grocery and clothing sectors. Year-on-year growth in internet sales volumes picked up to broadly in line with the long-run average. Internet sales volumes are expected to grow at broadly similar pace in the year to April.

-

11:00

United Kingdom: CBI retail sales volume balance, March 9 (forecast 5)

-

10:53

Moody's says after the election, France's sovereign rating will be driven by fiscal and economic policies

-

French election candidates' policy plans carry mixed credit implications for rated sectors

-

Prevailing macroeconomic conditions to continue to drive credit profiles of french banks and insurers

-

While very unlikely, any significant increase in likelihood that France leaves EU would be "deeply credit negative for all rated sectors in France"

-

"Impact of elections on France's structured finance market will likely be limited, in the absence of a victory for Marine Le Pen"

-

-

10:13

London Fire Brigade say Four Fire Engines at Building 'The Gherkin', investigating reports of smoke in basement @zerohedge

-

09:32

UK retail sales rose more than expected in February. GBP/USD rose 60 pips after the release

Estimates of the quantity bought in retail sales increased by 3.7% compared with February 2016 and increased by 1.4% compared with January 2017; this monthly growth is seen across all store types.

The underlying pattern as suggested by the 3 month on 3 month movement decreased by 1.4% for the second month in a row; the largest decrease since March 2010 and only the second fall since December 2013.

Average store prices (including fuel) increased by 2.8% on the year, the largest growth since March 2012; the largest contribution came from petrol stations, where year-on-year average prices rose by 18.7%.

Online sales (excluding automotive fuel) increased year-on-year by 20.7% and by 3.3% on the month, accounting for approximately 15.3% of all retail spending.

-

09:30

United Kingdom: Retail Sales (MoM), February 1.4% (forecast 0.4%)

-

09:30

United Kingdom: Retail Sales (YoY) , February 3.7% (forecast 2.6%)

-

09:17

ECB says the economic recovery in the euro area is steadily firming, may see robust growth momentum in Q1: Bulletin

-

U.S. policy uncertainty, Brexit, Chinese rebalancing keep outlook clouded

-

Incoming data have increased confidence that the expansion will continue to firm

-

The future contribution from energy prices to global inflation is expected to be very limited

-

World trade expected to expand broadly in line with global activity despite U.S policy uncertainty

-

-

08:50

Bank Of Greece: ECB Raised Greek Banks’ Emergency Funding Cap By EUR400 Mln To EUR46.6 Bln @LiveSquawk

-

08:44

Major stock markets in Europe trading mixed: FTSE 7314.63 -10.09 -0.14%, DAX 11910.05 +5.93 + 0.05%, CAC 4987.55 -7.15 -0.14%

-

08:09

Moody's: potential slowdown in external demand and rising demographic pressures are amongst the risks facing Germany

-

Sees potential impact of Brexit upon Germany as muted in the short term, given the diversified structure of its exports

-

-

07:33

Options levels on thursday, March 23, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0975 (2265)

$1.0920 (989)

$1.0874 (47)

Price at time of writing this review: $1.0798

Support levels (open interest**, contracts):

$1.0729 (678)

$1.0685 (400)

$1.0631 (598)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 41951 contracts, with the maximum number of contracts with strike price $1,1450 (3954);

- Overall open interest on the PUT options with the expiration date June, 9 is 45018 contracts, with the maximum number of contracts with strike price $1,0350 (3977);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from March, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.2713 (826)

$1.2617 (324)

$1.2522 (734)

Price at time of writing this review: $1.2494

Support levels (open interest**, contracts):

$1.2384 (570)

$1.2287 (241)

$1.2190 (453)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 15139 contracts, with the maximum number of contracts with strike price $1,3000 (1198);

- Overall open interest on the PUT options with the expiration date June, 9 is 17226 contracts, with the maximum number of contracts with strike price $1,1500 (3088);

- The ratio of PUT/CALL was 1.14 versus 1.16 from the previous trading day according to data from March, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:30

French presidential candidate Le Pen says London attack shows importance of protecting borders, closing down mosques with extremist links

-

07:13

Consumer sentiment in Germany sends mixed signals in March - GfK

While economic expectation and the propensity to buy picked up again after a decline in the previous month, income expectations fell slightly. Because propensity to save also rose again in March, the consumer climate prognosis in April is 9.8 points, and thus slightly lower than the 10.0 points in March.

A rise in inflation in Germany and the resultant intensified concerns over income buying power have obviously hindered full recovery of consumer sentiment in March this year. While economic expectations and the propensity to buy largely compensated for losses from the previous month of February, income expectations were down for the second time in a row. Since the propensity to save increased once again, consumer climate declined overall in March.

-

07:00

10-year U.S treasury yield at 2.408 percent vs U.. close of 2.396 percent on Wednesday

-

07:00

Germany: Gfk Consumer Confidence Survey, April 9.8 (forecast 10)

-

06:58

China February crude oil imports from Russia +4.5 pct y/y at 1.12 mln bpd

-

Crude oil imports from Saudi Arabia -12.9 pct y/y at 1.24 mln bpd

-

Crude oil imports from Angola -31.9 pct y/y at 849,0

-

Crude oil imports from Iran +18.1 pct y/y at 657,9

-

-

06:56

SNB Spent CHF 67.1bln on currency intervention in 2016 @LiveSquawk

-

06:53

The Reserve Bank of New Zeeland left the Official Cash Rate unchanged at 1.75%

Statement by Reserve Bank Governor Graeme Wheeler:

"Macroeconomic indicators in advanced economies have been positive over the past two months. However, major challenges remain with on-going surplus capacity in the global economy and extensive geo-political uncertainty.

Global headline inflation has increased, partly due to a rise in commodity prices, although oil prices have fallen more recently. Core inflation has been low and stable. Monetary policy is expected to remain stimulatory, but less so going forward, particularly in the US.

The trade-weighted exchange rate has fallen 4 percent since February, partly in response to weaker dairy prices and reduced interest rate differentials. This is an encouraging move, but further depreciation is needed to achieve more balanced growth.

Quarterly GDP was weaker than expected in the December quarter, but some of this is considered to be due to temporary factors. The growth outlook remains positive, supported by on-going accommodative monetary policy, strong population growth, and high levels of household spending and construction activity. Dairy prices have been volatile in recent auctions and uncertainty remains around future outcomes.

House price inflation has moderated, and in part reflects loan-to-value ratio restrictions and tighter lending conditions. It is uncertain whether this moderation will be sustained given the continued imbalance between supply and demand".

-

06:26

Global Stocks

European stocks fell to a one-week low Wednesday, with bank shares among the worst performing, as investors questioned whether the new U.S. administration can soon deliver the fiscal and regulatory changes needed to support the "Trump trade."

The Dow fell for a fifth straight session Wednesday as the broader market staged a modest rebound on the back of technology stocks. The selloff came as issues with the Republicans' health-care bill prompted investors to question Trump's ability to follow through on promises of tax reforms and $1 trillion in infrastructure spending, according to Connor Campbell, financial analyst at Spreadex. A vote on the bill has been set for Thursday.

Global markets stabilized after skidding a day earlier, though investors were on edge ahead of a vote on U.S. health care later Thursday that could be a barometer for future Trump administration policies. After U.S. stocks rebounded Wednesday and oil and the dollar seemed to have found near-term support, participants in Asia-Pacific markets were wary.

-