Market news

-

20:13

The main US stock indexes finished trading in different directions

The major US stock indexes finished the session without a single dynamic, as investors waited for the results of the voting on the health care bill, which is seen as testing the ability of President Donald Trump to convey his legislative agenda through Congress.

The focus was also on the US. As it became known, new orders for basic goods produced in the US unexpectedly fell in February, but a sharp increase in supply volumes against the backdrop of demand for machinery and electrical equipment. The US Department of Commerce said on Friday that orders for the purchase of non-productive capital goods, with the exception of aircraft that are closely monitored for meeting business spending plans, were down 0.1% last month after rising 0.1% in January.

Oil has risen slightly in price during today's trading, but the week ends with losses, which is caused by concern over the preservation of surplus oil in the world market.

The components of the DOW index have mostly grown (17 out of 30). More shares fell The Goldman Sachs Group, Inc. (GS, -1.45%). Leader of the growth were shares of NIKE, Inc. (NKE, + 1.91%).

Most sectors of the S & P index finished trading in positive territory. The leader of growth was the utilities sector (+ 0.5%). The largest drop was shown by the sector of industrial goods (-0.3%).

At closing:

Dow -0.29% 20.596.72 -59.86

Nasdaq + 0.19% 5,828.74 + 11.05

S & P -0.08% 2,343.98 -1.98

-

19:00

DJIA -0.31% 20,591.64 -64.94 Nasdaq +0.03% 5,819.31 +1.62 S&P -0.16% 2,342.31 -3.65

-

17:00

European stocks closed: FTSE 100 -3.89 7336.82 -0.05% DAX +24.59 12064.27 +0.20% CAC 40 -11.86 5020.90 -0.24%

-

17:00

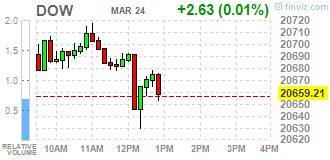

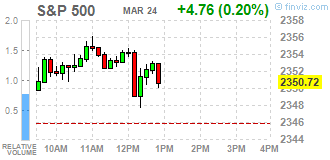

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes slightly higher on Friday as investors awaited the outcome of a vote on a healthcare bill that is seen as a test of President Donald Trump's ability to pass his legislative agenda through Congress. Republican lawmakers struggled to overcome differences over the bill after Trump walked away from negotiations, telling them to pass the bill on Friday or keep Obamacare in place. The back-and-forth over the bill has led to some of the choppiest trading Wall Street has seen since Trump's election in November.

Most of Dow stocks in positive area (18 of 30). Top loser - The Goldman Sachs Group, Inc. (GS-1.10%). Top gainer - NIKE, Inc. (NKE, +1.68%).

All of S&P sectors in positive area. Top Gainer - Utilities (+0.7%).

At the moment:

Dow 20618.00 +30.00 +0.15%

S&P 500 2348.75 +8.75 +0.37%

Nasdaq 100 5389.25 +34.75 +0.65%

Oil 47.83 +0.13 +0.27%

Gold 1247.40 +0.20 +0.02%

U.S. 10yr 2.41 -0.01

-

15:16

Trump says Charter Communications has committed to investing $25 billion in U.S and hire 20,000 workers over four years

-

14:36

Fed's Dudley: may have inflation problem if you push unemployment much lower

-

Economy at pretty good place right now

-

Pretty close to employment, inflation objectives

-

U.S trade, immigration policies could hit international tourism to New York city

-

-

14:10

US services sector expanded slower than expected in March

The seasonally adjusted Markit Flash U.S. Composite PMI Output Index registered 53.2 in March, to remain above the 50.0 no-change value for the thirteenth consecutive month. However, the latest reading was down from 54.1 in February and signalled the slowest expansion of private sector output since September 2016. Softer business activity growth was driven by a loss of momentum in the service economy ('flash' index at 52.9, down from 53.8 in February).

Manufacturing production also expanded at a weaker pace in March ('flash' output index: 54.4, down from 55.6). March data also revealed a slowdown in staff hiring by private sector companies. The latest rise in payroll numbers was only marginal and the weakest for six months. The composite index is based on original survey data from the Markit U.S. Services PMI and the Markit U.S. Manufacturing PMI.

-

13:46

U.S.: Services PMI, March 52.9 (forecast 54.2)

-

13:45

U.S.: Manufacturing PMI, March 53.4 (forecast 54.8)

-

13:43

Bullard says Fed should be allowing balance sheet to shrink now

-

Inflation has essentially returned to 2 pct, expected to remain there

-

Unwise to forecast growth pickup in 2017

-

Labor market improvements have been slowing

-

Relatively low policy rate likely to remain appropriate

-

Fed can wait to see how fiscal policy evolves

-

-

13:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.38%, S&P +0.22%

-

13:26

Before the bell: S&P futures +0.15%, NASDAQ futures +0.23%

U.S. stock-index futures advanced, helped by higher oil prices, and ahead of a closely watched vote on a healthcare bill, considered as a test of President Donald Trump's ability to pass his legislative agenda through Congress.

Global Stocks:

Nikkei 19,262.53 +177.22 +0.93%

Hang Seng 24,358.27 +30.57 +0.13%

Shanghai 3,268.93 +20.38 +0.63%

FTSE 7,338.95 -1.76 -0.02%

CAC 5,011.11 -21.65 -0.43%

DAX 12,030.10 -9.58 -0.08%

Crude $48.02 (+0.67%)

Gold $1,244.70 (-0.20%)

-

13:25

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0650 (EUR 620m) 1.0740 (735m) 1.0750 (260m) 1.0785 (575m) 1.0800 (540m) 1.0850-55 (500m)

USDJPY: 110.00 (USD 1.6bln) 111.75 (910m) 111.90 (330m) 112.00 (1.5bln) 112.50 (365m) 112.90-113.00 (720m)

GBPUSD: 1.2370 (GBP 230m)

AUDUSD: 0.7525 (560m) 0.7675 (235m)

USDCAD 1.3200 (USD 400m) 1.3285 (400m) 133.00 (525m) 1.3340-50 (895m) 1.3400 (205m) 1.3430 (515m) 1.3490 (330m)

NZDUSD 0.6825 (NZD 590m) 0.7000 (225m) 0.7100 (250m)

EURJPY 121.00 (415m)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

73.75

-0.27(-0.36%)

4065

Amazon.com Inc., NASDAQ

AMZN

851

3.62(0.43%)

5981

AMERICAN INTERNATIONAL GROUP

AIG

62.19

0.85(1.39%)

300

Apple Inc.

AAPL

141.3

0.38(0.27%)

78428

AT&T Inc

T

41.52

-0.13(-0.31%)

1129

Barrick Gold Corporation, NYSE

ABX

19.31

-0.06(-0.31%)

4450

Citigroup Inc., NYSE

C

58.15

0.10(0.17%)

17264

Exxon Mobil Corp

XOM

82.54

0.68(0.83%)

1968

Facebook, Inc.

FB

139.79

0.26(0.19%)

20547

FedEx Corporation, NYSE

FDX

190

0.81(0.43%)

1959

Ford Motor Co.

F

11.68

0.01(0.09%)

16236

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.85

0.02(0.16%)

3149

General Electric Co

GE

29.65

0.03(0.10%)

5605

General Motors Company, NYSE

GM

34.45

0.19(0.55%)

905

Goldman Sachs

GS

232.5

0.60(0.26%)

2960

Google Inc.

GOOG

819.71

2.13(0.26%)

1482

Intel Corp

INTC

35.64

0.37(1.05%)

26406

International Business Machines Co...

IBM

174.7

-0.12(-0.07%)

322

Johnson & Johnson

JNJ

125.73

-0.17(-0.14%)

3250

JPMorgan Chase and Co

JPM

87.76

0.37(0.42%)

3939

Merck & Co Inc

MRK

63.4

0.12(0.19%)

697

Microsoft Corp

MSFT

64.92

0.05(0.08%)

1283

Nike

NKE

55.25

-0.12(-0.22%)

5568

Pfizer Inc

PFE

34.3

0.01(0.03%)

869

Starbucks Corporation, NASDAQ

SBUX

56.13

0.28(0.50%)

7000

Tesla Motors, Inc., NASDAQ

TSLA

255.6

0.82(0.32%)

7199

Twitter, Inc., NYSE

TWTR

15.1

0.17(1.14%)

167665

UnitedHealth Group Inc

UNH

166.1

0.81(0.49%)

1524

Walt Disney Co

DIS

112.51

0.27(0.24%)

943

-

12:59

Orders

EUR/USD

Offers: 1.0820 1.0830 1.0850 1.0880 1.0900

Bids: 1.0780 1.0765 1.0750 1.0730 1.0700 1.0680 1.0650

GBP/USD

Offers: 1.2500 1.2530 1.2550-55 1.2580 1.2600 1.2630 1.2650

Bids: 1.2465 1.2450 1.2425-30 1.2400 1.2380 1.2360 1.2335-40 1.2320 1.2300

EUR/JPY

Offers: 120.30 120.50 120.85 121.00 121.50

Bids: 119.80 119.50 119.30 119.00 118.80 118.65 118.50

EUR/GBP

Offers: 0.8650-55 0.8685 0.8700 0.8725-30 0.8750 0.8780-85 0.8800

Bids: 0.8620 0.8600 0.8580-85 0.8550 0.8530 0.8500

USD/JPY

Offers: 111.50-55 111.65 111.80 112.00 112.25 112.50 112.80 113.00

Bids: 111.00 110.85 110.65 110.50 110.35 110.20 110.00

AUD/USD

Offers:0.7650 0.7665 0.7680-85 0.7700 0.7720 0.7735 0.7750

Bids: 0.7600 0.7580 0.7565 0.7550 0.7500

-

12:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Buy from Strong Buy at Needham; target raised to $165 from $150

Other:

-

12:48

Canadian CPI inflation in line with expectations in February

The Consumer Price Index (CPI) rose 2.0% on a year-over-year basis in February, following a 2.1% gain in January.

Excluding gasoline, the CPI was up 1.3% year over year in February, following a 1.5% increase in January.

Prices were up in seven of the eight major components in the 12 months to February, with the transportation and shelter indexes contributing the most to the year-over-year rise in the CPI. The food index decreased for a fifth consecutive month.

Consumer prices increase in seven of the eight major components:

Transportation costs rose 6.6% over the 12-month period ending in February, after increasing 6.3% in January; this acceleration occurred despite a 0.8% monthly decline in February. On a year-over-year basis, consumers paid 23.1% more for gasoline and the purchase of passenger vehicles index was up 3.6%.

-

12:46

US orders for manufactured durable goods in February increased $3.9 billion or 1.7 percent

New orders for manufactured durable goods in February increased $3.9 billion or 1.7 percent to $235.4 billion, the U.S. Census Bureau announced today. This increase, up two consecutive months, followed a 2.3 percent January increase. Excluding transportation, new orders increased 0.4 percent. Excluding defense, new orders increased 2.1 percent. Transportation equipment, also up two consecutive months, led the increase, $3.3 billion or 4.3 percent to $80.4 billion.

Shipments of manufactured durable goods in February, up three of the last four months, increased $0.6 billion or 0.3 percent to $239.2 billion. This followed a 0.1 percent January decrease. Machinery, also up three of the last four months, led the increase, $0.3 billion or 0.9 percent to $31.1 billion.

-

12:30

Canada: Bank of Canada Consumer Price Index Core, y/y, February 1.7%

-

12:30

U.S.: Durable goods orders ex defense, February 2.1%

-

12:30

U.S.: Durable Goods Orders , February 1.7% (forecast 1.2%)

-

12:30

Canada: Consumer price index, y/y, February 2.0% (forecast 2.1%)

-

12:30

Canada: Consumer Price Index m / m, February 0.2% (forecast 0.2%)

-

12:30

U.S.: Durable Goods Orders ex Transportation , February 0.4% (forecast 0.5%)

-

11:38

German foreign ministry spokesman says foreign Min Gabriel had the impression in Greece that we are not far off reaching an agreement on the current reform review

-

11:10

Russian Central Bank lowers key rate to 9.75% from 10% expected

-

11:07

Russian economy minister says 4 pct inflation level will be reached no later than July

-

This should speed cutting of key rate

-

Steps to establish stable and predictable economic environment to anchor inflationary expectations

-

Obvious that Central Bank next steps to be linked to mid-term inflationary expectations

-

-

10:22

EU's Dombrovskis says modest recovery ongoing in Italy, GDP seen at +1% in 2017

-

09:47

UK mortgage approvals declined in February

The BBA's latest high street banking data shows that household borrowing of £13.4 billion in February was 4.6% higher than in the same month last year.

The BBA's latest high street banking data show that consumer credit is growing at an annual rate of 6.6%.

Gross mortgage borrowing of £13.4 billion in February was 4.6% higher than in the same month last year. After allowing for repayments, February's net mortgage borrowing was 2.5% higher than in February 2016.

Business borrowing continues to be subdued growing by 0.9% annually.

-

09:30

United Kingdom: BBA Mortgage Approvals, February 42.6 (forecast 44.9)

-

09:13

Eurozone economic growth gathered further momentum in March

Eurozone economic growth gathered further momentum in March, according to PMI survey data, reaching a near six-year high. The survey also saw the best employment growth for almost a decade as both manufacturing and service sector firms responded to surging order books. Business optimism meanwhile hit a new peak, but price pressures also intensified to a near six-year high.

The Markit Eurozone PMI rose to 56.7 in March, according to the preliminary 'flash' estimate (based on approximately 85% of final replies). Up from 56.0 in February, the latest reading was the highest since April 2011. The first quarter average of 55.7 is the highest since the first quarter of 2011.

-

09:00

Eurozone: Manufacturing PMI, March 56.2 (forecast 55.3)

-

09:00

Eurozone: Services PMI, March 56.5 (forecast 55.3)

-

08:47

Major stock markets in Europe started trading in the red zone: FTSE 7339.30 -1.41 -0.02%, DAX 12028.48 -11.20 -0.09%, CAC 5014.44 -18.32 -0.36%

-

08:44

Germany posted the fastest rate of private sector output growth in nearly six years - Markit

Germany posted the fastest rate of private sector output growth in nearly six years at the end of the first quarter of 2017. The March PMI survey data also signalled a near-record rate of employment growth and the strongest cost pressures for nearly six years.

The Markit Flash Germany Composite Output Index rose for the second month running from 56.1 in February to 57.0, the highest since May 2011 and signalling marked economic growth in the eurozone's largest economy. The current sequence of continuous expansion now stretches to 47 months.

-

08:30

Germany: Services PMI, March 55.6 (forecast 54.6)

-

08:30

Germany: Manufacturing PMI, March 58.3 (forecast 56.5)

-

08:07

March’s flash France PMI data highlighted a ninth consecutive month of private sector growth

The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 57.6, compared to February's reading of 55.9.

The latest figure pointed to the sharpest rate of growth since May 2011. Service providers continued to raise their activity levels during March, thereby extending the latest sequence of growth to nine months. Moreover, the rate of expansion accelerated to a 70-month peak. Manufacturing output also continued to increase at a solid pace, albeit to a slightly weaker extent than in February.

-

08:00

France: Manufacturing PMI, March 53.4 (forecast 52.4)

-

08:00

France: Services PMI, March 58.5 (forecast 56.1)

-

07:46

France: GDP, Y/Y, Quarter IV 1.1% (forecast 1.1%)

-

07:45

France: GDP, q/q, Quarter IV 0.4% (forecast 0.4%)

-

07:30

Options levels on friday, March 24, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0966 (2334)

$1.0910 (990)

$1.0863 (47)

Price at time of writing this review: $1.0768

Support levels (open interest**, contracts):

$1.0723 (686)

$1.0680 (399)

$1.0626 (652)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 42148 contracts, with the maximum number of contracts with strike price $1,1450 (3934);

- Overall open interest on the PUT options with the expiration date June, 9 is 46160 contracts, with the maximum number of contracts with strike price $1,0350 (4017);

- The ratio of PUT/CALL was 1.10 versus 1.07 from the previous trading day according to data from March, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2811 (1168)

$1.2714 (826)

$1.2618 (324)

Price at time of writing this review: $1.2478

Support levels (open interest**, contracts):

$1.2385 (574)

$1.2288 (251)

$1.2191 (478)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 15197 contracts, with the maximum number of contracts with strike price $1,3000 (1215);

- Overall open interest on the PUT options with the expiration date June, 9 is 17337 contracts, with the maximum number of contracts with strike price $1,1500 (3088);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from March, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:03

The first round of the 2017 French presidential election will be held on 23 April. Should no candidate win a majority, a run-off election between the top two candidates will be held on 7 May 2017

-

07:01

Bank of America Merrill says EUR/USD will fall to 0.90 in days if Le Pen wins

Bank of America Merrill Lynch Research argues that there are highly asymmetric EUR implications into the French elections.

In that regard, BofAML believes the FX market is not pricing substantial risks for the elections in France.

In the most likely scenario in which Le Pen loses the second round, BofAML expects EUR/USD to strengthen towards 1.10.

"However, we see substantial EUR downside if Le Pen wins, believing that EUR/USD could weaken all the way to 0.90 within days," BofAML argues.

Source: Bank of America Merrill Lynch Rates and Currencies Research, efxnews.

-

06:58

US to vote on healthcare bill on Friday afternoon - AP

-

06:56

Flash Japan Manufacturing PMI slips to 3-month low - Markit

-

Flash Japan Manufacturing PMI slips to 3-month low of 52.6 in March (53.3 in February).

-

Flash Manufacturing Output Index at 53.4 (54.1 in February). Growth eases but remains marked.

-

Business confidence softens to four-month low.

Commenting on the Japanese Manufacturing PMI survey data, Paul Smith, Senior Economist at IHS Markit, which compiles the survey, said: "Although signalling a slower rate of expansion during March, the latest PMI data again point to a Japanese manufacturing economy expanding at a decent clip. Indeed, the data are consistent with manufacturing output expanding at an underlying trend rate of just below 2.0%. "New order books remain in solid growth territory, with gains seemingly supported by the weaker yen. However, this comes at the cost of ongoing marked rises in purchase costs: input price inflation remained close to a two-year high in March."

-

-

06:52

ECB's Praet: Euro Area doing better, return to Lira won't solve Italy's problems @LiveSquawk

-

06:32

Global Stocks

European stocks shook off early weakness to close firmly higher Thursday, getting a boost from an upbeat session in the U.S. ahead of a key vote on a health-care bill.

U.S. stocks closed slightly lower on Thursday, with the Dow edging into negative territory to extending its losing streak to six sessions as a delay in a closely watched health-care vote raised questions about the Trump administration's ability to win passage of its ambitious legislative agenda.

Investors in Asia-Pacific equities regained some risk appetite Friday, despite a delay in Donald Trump's attempt to repeal and replace the Affordable Care Act, as regional markets maintained cautious optimism ahead of a planned final vote.

-

05:04

Japan: Coincident Index, January 115.1

-

05:03

Japan: Leading Economic Index , January 104.9 (forecast 105.5)

-

00:30

Japan: Manufacturing PMI, March 52.6 (forecast 53.5)

-