Market news

-

20:13

The main US stock indexes finished trading in different directions

The major US stock indexes finished the session without a single dynamic, as investors waited for the results of the voting on the health care bill, which is seen as testing the ability of President Donald Trump to convey his legislative agenda through Congress.

The focus was also on the US. As it became known, new orders for basic goods produced in the US unexpectedly fell in February, but a sharp increase in supply volumes against the backdrop of demand for machinery and electrical equipment. The US Department of Commerce said on Friday that orders for the purchase of non-productive capital goods, with the exception of aircraft that are closely monitored for meeting business spending plans, were down 0.1% last month after rising 0.1% in January.

Oil has risen slightly in price during today's trading, but the week ends with losses, which is caused by concern over the preservation of surplus oil in the world market.

The components of the DOW index have mostly grown (17 out of 30). More shares fell The Goldman Sachs Group, Inc. (GS, -1.45%). Leader of the growth were shares of NIKE, Inc. (NKE, + 1.91%).

Most sectors of the S & P index finished trading in positive territory. The leader of growth was the utilities sector (+ 0.5%). The largest drop was shown by the sector of industrial goods (-0.3%).

At closing:

Dow -0.29% 20.596.72 -59.86

Nasdaq + 0.19% 5,828.74 + 11.05

S & P -0.08% 2,343.98 -1.98

-

19:00

DJIA -0.31% 20,591.64 -64.94 Nasdaq +0.03% 5,819.31 +1.62 S&P -0.16% 2,342.31 -3.65

-

17:00

European stocks closed: FTSE 100 -3.89 7336.82 -0.05% DAX +24.59 12064.27 +0.20% CAC 40 -11.86 5020.90 -0.24%

-

17:00

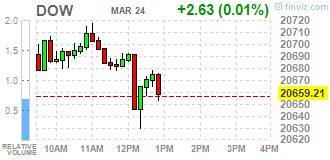

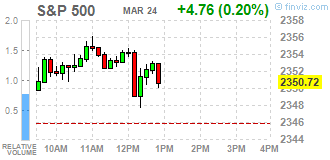

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes slightly higher on Friday as investors awaited the outcome of a vote on a healthcare bill that is seen as a test of President Donald Trump's ability to pass his legislative agenda through Congress. Republican lawmakers struggled to overcome differences over the bill after Trump walked away from negotiations, telling them to pass the bill on Friday or keep Obamacare in place. The back-and-forth over the bill has led to some of the choppiest trading Wall Street has seen since Trump's election in November.

Most of Dow stocks in positive area (18 of 30). Top loser - The Goldman Sachs Group, Inc. (GS-1.10%). Top gainer - NIKE, Inc. (NKE, +1.68%).

All of S&P sectors in positive area. Top Gainer - Utilities (+0.7%).

At the moment:

Dow 20618.00 +30.00 +0.15%

S&P 500 2348.75 +8.75 +0.37%

Nasdaq 100 5389.25 +34.75 +0.65%

Oil 47.83 +0.13 +0.27%

Gold 1247.40 +0.20 +0.02%

U.S. 10yr 2.41 -0.01

-

13:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.38%, S&P +0.22%

-

13:26

Before the bell: S&P futures +0.15%, NASDAQ futures +0.23%

U.S. stock-index futures advanced, helped by higher oil prices, and ahead of a closely watched vote on a healthcare bill, considered as a test of President Donald Trump's ability to pass his legislative agenda through Congress.

Global Stocks:

Nikkei 19,262.53 +177.22 +0.93%

Hang Seng 24,358.27 +30.57 +0.13%

Shanghai 3,268.93 +20.38 +0.63%

FTSE 7,338.95 -1.76 -0.02%

CAC 5,011.11 -21.65 -0.43%

DAX 12,030.10 -9.58 -0.08%

Crude $48.02 (+0.67%)

Gold $1,244.70 (-0.20%)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

73.75

-0.27(-0.36%)

4065

Amazon.com Inc., NASDAQ

AMZN

851

3.62(0.43%)

5981

AMERICAN INTERNATIONAL GROUP

AIG

62.19

0.85(1.39%)

300

Apple Inc.

AAPL

141.3

0.38(0.27%)

78428

AT&T Inc

T

41.52

-0.13(-0.31%)

1129

Barrick Gold Corporation, NYSE

ABX

19.31

-0.06(-0.31%)

4450

Citigroup Inc., NYSE

C

58.15

0.10(0.17%)

17264

Exxon Mobil Corp

XOM

82.54

0.68(0.83%)

1968

Facebook, Inc.

FB

139.79

0.26(0.19%)

20547

FedEx Corporation, NYSE

FDX

190

0.81(0.43%)

1959

Ford Motor Co.

F

11.68

0.01(0.09%)

16236

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.85

0.02(0.16%)

3149

General Electric Co

GE

29.65

0.03(0.10%)

5605

General Motors Company, NYSE

GM

34.45

0.19(0.55%)

905

Goldman Sachs

GS

232.5

0.60(0.26%)

2960

Google Inc.

GOOG

819.71

2.13(0.26%)

1482

Intel Corp

INTC

35.64

0.37(1.05%)

26406

International Business Machines Co...

IBM

174.7

-0.12(-0.07%)

322

Johnson & Johnson

JNJ

125.73

-0.17(-0.14%)

3250

JPMorgan Chase and Co

JPM

87.76

0.37(0.42%)

3939

Merck & Co Inc

MRK

63.4

0.12(0.19%)

697

Microsoft Corp

MSFT

64.92

0.05(0.08%)

1283

Nike

NKE

55.25

-0.12(-0.22%)

5568

Pfizer Inc

PFE

34.3

0.01(0.03%)

869

Starbucks Corporation, NASDAQ

SBUX

56.13

0.28(0.50%)

7000

Tesla Motors, Inc., NASDAQ

TSLA

255.6

0.82(0.32%)

7199

Twitter, Inc., NYSE

TWTR

15.1

0.17(1.14%)

167665

UnitedHealth Group Inc

UNH

166.1

0.81(0.49%)

1524

Walt Disney Co

DIS

112.51

0.27(0.24%)

943

-

12:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Buy from Strong Buy at Needham; target raised to $165 from $150

Other:

-

08:47

Major stock markets in Europe started trading in the red zone: FTSE 7339.30 -1.41 -0.02%, DAX 12028.48 -11.20 -0.09%, CAC 5014.44 -18.32 -0.36%

-

06:32

Global Stocks

European stocks shook off early weakness to close firmly higher Thursday, getting a boost from an upbeat session in the U.S. ahead of a key vote on a health-care bill.

U.S. stocks closed slightly lower on Thursday, with the Dow edging into negative territory to extending its losing streak to six sessions as a delay in a closely watched health-care vote raised questions about the Trump administration's ability to win passage of its ambitious legislative agenda.

Investors in Asia-Pacific equities regained some risk appetite Friday, despite a delay in Donald Trump's attempt to repeal and replace the Affordable Care Act, as regional markets maintained cautious optimism ahead of a planned final vote.

-