Market news

-

21:07

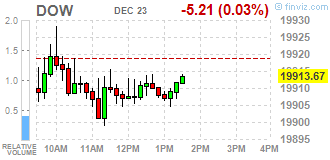

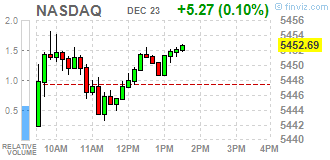

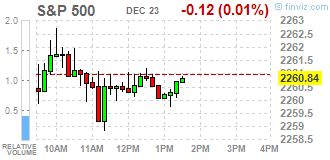

Major US stock indexes finished trading above zero

Major US stock indexes closed slightly higher as investors refrained from large investments in anticipation of the holiday season.

As shown by the final results of the studies submitted by Thomson-Reuters and Institute of Michigan in December, US consumers felt more optimistic about the economy than last month. According to the data, in December consumer sentiment index rose to 98.2 points compared with a final reading of 93.8 points in November and December preliminary value of 98 points. It was predicted that the index was 98 points.

However, the US Department of Commerce published a report, which showed a much larger-than-expected new home sales growth in the US in November. The report said that the sale of new buildings increased by 5.2% to an annual rate of 592,000 in November, compared with 563,000 in October. Economists had expected new home sales to increase by 3% to 575,000.

DOW index closed mixed components (15 black, 15 red). Most remaining shares increased UnitedHealth Group Incorporated (UNH, + 0.77%). Outsider were shares of Microsoft Corporation (MSFT, -0.54%).

Most of the S & P sectors recorded increase. The leader turned conglomerates sector (+ 0.9%). Most of the basic materials sector fell (-0.1%).

-

20:00

DJIA -0.02% 19,915.62 -3.26 Nasdaq +0.11% 5,453.50 +6.08 S&P +0.01% 2,261.17 +0.21

-

18:34

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly lower on Friday as investors held back from making big bets ahead of the holiday season, but the three major indexes were still on track to post weekly gains. U.S. markets are shut for the Christmas holiday on Monday.

Most of Dow stocks in negative area (19 of 30). Top gainer - The Procter & Gamble Company (PG, +0.63%). Top loser - Microsoft Corporation (MSFT, -0.91%).

Most of S&P sectors in negative area. Top gainer - Healthcare (+0.6%). Top loser - Utilities (-0.2%).

At the moment:

Dow 19856.00 -17.00 -0.09%

S&P 500 2256.00 -2.75 -0.12%

Nasdaq 100 4934.75 -1.75 -0.04%

Oil 52.81 -0.14 -0.26%

Gold 1133.90 +3.20 +0.28%

U.S. 10yr 2.54 -0.02

-

17:00

European stocks closed: FTSE 100 +4.49 7068.17 +0.06% DAX -6.17 11449.93 -0.05% CAC 40 +5.05 4839.68 +0.10%

-

14:46

WSE: After start on Wall Street

The last pre-Christmas session in the US begins exactly as was foretold by contracts on the S&P500. Total cosmetics and changes visible only on the second decimal place say it all.

The Warsaw market also extinguishing the volatility and the WIG20 index is drifting in the area of 1930 points. Investors thoughts are already on Christmas Eve.

-

14:31

U.S. Stocks open: Dow -0.04%, Nasdaq -0.05%, S&P -0.02%

-

14:16

Before the bell: S&P futures -0.09%, NASDAQ futures -0.10%

U.S. stock-index futures were flat, trading in a quiet mode ahead of a three-day holiday weekend.

Global Stocks:

Nikkei Closed

Hang Seng 21,574.76 -61.44 -0.28%

Shanghai 3,110.00 -29.55 -0.94%

FTSE 7,068.17 +4.49 +0.06%

CAC 4,835.61 +0.98 +0.02%

DAX 11,437.08 -19.02 -0.17%

Crude $52.33 (-1.17%)

Gold $1,132.00 (+0.10%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

67.65

-0.03(-0.0443%)

2172

Amazon.com Inc., NASDAQ

AMZN

765.1

-1.24(-0.1618%)

1587

Apple Inc.

AAPL

115.8

-0.49(-0.4214%)

31416

AT&T Inc

T

42.63

-0.09(-0.2107%)

4062

Barrick Gold Corporation, NYSE

ABX

14.18

0.06(0.4249%)

35937

Boeing Co

BA

158.25

0.79(0.5017%)

1019

Citigroup Inc., NYSE

C

60.39

-0.10(-0.1653%)

3944

Deere & Company, NYSE

DE

102.96

-0.13(-0.1261%)

140

Facebook, Inc.

FB

117.35

-0.05(-0.0426%)

16192

FedEx Corporation, NYSE

FDX

193

2.11(1.1053%)

1232

Ford Motor Co.

F

12.45

0.05(0.4032%)

53608

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.73

-0.07(-0.5072%)

16041

General Electric Co

GE

31.79

-0.03(-0.0943%)

6124

General Motors Company, NYSE

GM

35.7

0.01(0.028%)

12429

Goldman Sachs

GS

239.98

-0.14(-0.0583%)

3525

JPMorgan Chase and Co

JPM

86.8

-0.09(-0.1036%)

1658

Merck & Co Inc

MRK

59.75

0.17(0.2853%)

1590

Nike

NKE

52.3

0.16(0.3069%)

6437

Pfizer Inc

PFE

32.27

-0.07(-0.2164%)

425

Tesla Motors, Inc., NASDAQ

TSLA

208.5

0.05(0.024%)

1351

The Coca-Cola Co

KO

41.66

0.11(0.2647%)

536

Twitter, Inc., NYSE

TWTR

16.24

-0.17(-1.036%)

94341

United Technologies Corp

UTX

109.71

-0.75(-0.679%)

1200

Verizon Communications Inc

VZ

53.66

0.01(0.0186%)

789

Wal-Mart Stores Inc

WMT

69.65

0.06(0.0862%)

1060

Walt Disney Co

DIS

105.1

-0.32(-0.3035%)

1350

Yahoo! Inc., NASDAQ

YHOO

38.6

0.10(0.2597%)

1854

Yandex N.V., NASDAQ

YNDX

20.35

-0.15(-0.7317%)

800

-

13:37

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

FedEx (FDX) initiated with a Buy at Aegis Capital; target $215

-

12:04

WSE: Mid session comment

The first half of today's session has confirmed that the market today is lack of capital capable of courageous game. The drop in activity is accompanied by a decline in volatility, which froze the WIG20 in the region of 1,930 points. A similar situation we may see in the German market, where the volatility of the DAX index is almost invisible. This style definitely fits the Christmas mood. If we were not yesterday's final bulls rally, probably from the beginning of the session we would have a similar style. We are, however, after the correction of this growth and now further trading hours should already be quiet.

In the middle of today's trading the WIG index was at the level of 1,930 points and the turnover among the largest companies was amounted to PLN 170 million.

-

08:39

Major stock markets started trading with a slight increase: the FTSE 100 7,060.19 -3.49 -0.05%, DAX 11,467.47 11.37 0.10%, CAC 40 4,841.76 7.13 0.15%

-

08:18

WSE: After opening

WIG20 index opened at 1942.49 points (-0.06%)*

WIG 51527.27 0.20%

WIG30 2241.41 0.24%

mWIG40 4166.68 0.23%

*/ - change to previous close

As could be expected the Warsaw market starts from the renewal of the good mood from the yesterday's session. The WIG20 at the beginning of the session violated Wednesday highs, which means that we are on the highest level since April and the upward phase began in mid-November is continued. This in turn can provide opportunities to test the approach to the level of 2,000 points at the end of the year. Low turnover may foster such a scenario.

After fifteen minutes of trading the WIG20 index was at the level of 1,948 points (+0,24%).

-

07:24

WSE: Before opening

Thursday's session on the New York stock exchange ended with declines in major indices. At the close the Dow Jones Industrial fell by 0.12 percent, the Nasdaq Comp. went down by 0.44 percent and the S&P 500 fell by 0.19 percent. Thus, there is a clear hesitation of the demand when indices are confronted with round levels (DJIA with 20,000 pts., S&P500 with 2300 points and the Nasdaq Composite with 5500 points).

For most markets Friday will be the last session before Christmas, after which most stock markets will close for three days.

On the Warsaw market yesterday ending of the session was dominated by news that the government may move towards partial nationalization of the funds accumulated in open pension funds (i.e. 25%). The market took this statement with increases in stock prices, however, there are still only vague plans and declarations.

Nevertheless this information should help stabilize the market at the end of the year and foster confrontation the WIG20 index with 2000 points level.

-

06:36

Global Stocks

European stocks slipped Thursday, as Banca Monte dei Paschi di Siena SpA's 11th-hour bid to raise capital failed, dragging financial shares lower. BMPS, the world's oldest lender, had been trying to raise 5 billion euros in new private capital as it struggles under a bad loan burden. Those efforts look to have failed, after the bank said it had lost a key investor-thought to be Qatari-leaving BMPS waiting to hear whether the Italian government will bail it out.

U.S. stocks ended Thursday's thinly-traded preholiday session with modest losses as investors seemed reluctant to bid up prices of indexes that are already hovering near all-time highs. The S&P 500 and Nasdaq Composite booked their first consecutive losses in three weeks, as the "Trump rally" lost momentum over the past few sessions.

Asian markets were broadly lower early Friday, tracking the overnight declines on Wall Street, as participants eased into the holiday season. "You're coming closer to the Christmas holiday," said Hue Lu, senior investment specialist at BNP Paribas Investment Partners. "[Traders] want to bring down the risk. They don't want any surprises."

-