Market news

-

23:29

Stocks. Daily history for Dec 22’2016:

(index / closing price / change items /% change)

Nikkei 225 19,427.67 -16.82 -0.09%

Shanghai Composite 3,140.15 +2.73 +0.09%

S&P/ASX 200 5,643.94 0.00 0.00%

FTSE 100 7,063.68 +22.26 +0.32%

CAC 40 4,834.63 +0.81 +0.02%

Xetra DAX 11,456.10 -12.54 -0.11%

S&P 500 2,260.96 -4.22 -0.19%

Dow Jones Industrial Average 19,918.88 -23.08 -0.12%

S&P/TSX Composite 15,335.23 +29.34 +0.19%

-

21:06

Major US stock indexes finished trading below zero

Major US stock indexes fell moderately amid falling shares of Apple (AAPL) after the Finnish Nokia said it has filed a series of lawsuits against the iPhone maker for patent infringement.

In addition, as it became known, the US economy grew faster than previously estimated in the third quarter, noting its best performance in two years, on the back of strong consumer spending and a jump in soybean exports. Gross domestic product grew by 3.5% instead of the previously reported 3.2%, the Commerce Ministry said in its third evaluation. The growth was the strongest since the third quarter of 2014 after increasing by 1.4% in the second quarter.

At the same time, the number of Americans who applied for unemployment benefits rose to a six-month high last week, but remain below the level that is associated with a strong labor market. unemployment initial claims for benefits rose by 21,000 and reached a seasonally adjusted 275,000 for the week ending 17 December. This is the highest rate since June. The data for the previous week were not revised.

It should also be noted that new orders for US-made core capital goods rose more than expected in November, amid strong demand for machinery and primary metals, suggesting that the effect on the production of some of the negative factors associated with the oil, began to fade. Non-defense capital goods orders excluding aircraft, closely watched gauge of business spending plans, rose 0.9% after growth of 0.2% in October.

Also, the Commerce Department reported that consumer spending, which accounts for over two-thirds of US economic activity, rose 0.2% after increasing 0.4% in October (revised from + 0.3%). Economists had expected an increase of 0.3%.

DOW index components closed mostly in the red (17 of 30). Outsider were shares of Wal-Mart Stores, Inc. (WMT, -2.40%). Most remaining shares rose Verizon Communications Inc. (VZ, + 1.29%).

Most of the S & P sectors registered a decline. the services sector fell the most (-1.1%). The leader turned conglomerates sector (+ 1.8%).

At the close:

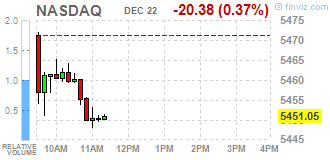

Dow -0.12% 19,918.95 -23.01

Nasdaq -0.44% 5,447.42 -24.01

S & P -0.19% 2,260.94 -4.24

-

20:00

DJIA -0.12% 19,918.70 -23.26 Nasdsq -0.46% 5,446.43 -25.00 S&P -0.20% 2,260.72 -4.46

-

17:03

European stocks closed: FTSE 100 +22.26 7063.68 +0.32% DAX -12.54 11456.10 -0.11% CAC 40 +0.81 4834.63 +0.02%

-

16:59

WSE: Session Results

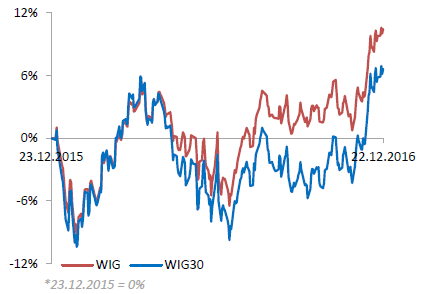

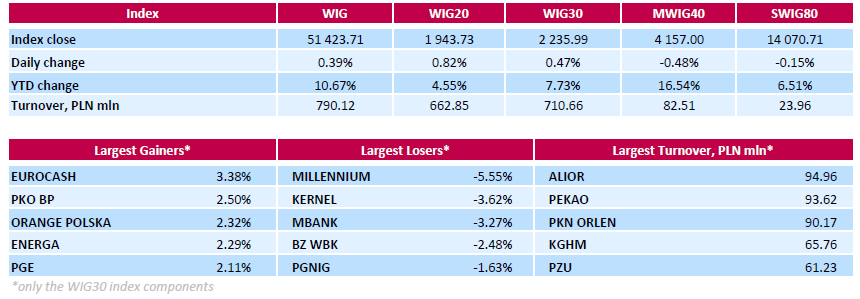

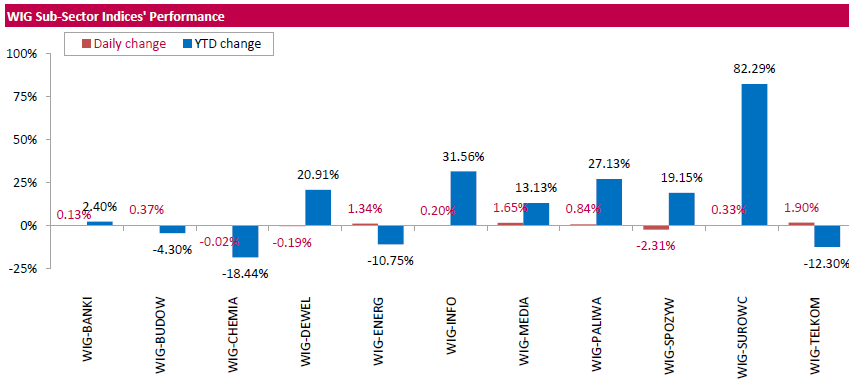

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, added 0.39%. The WIG sub-sector indices were mainly higher with telecoms (+1.90%) outperforming.

The large-cap stocks' measure, the WIG30 index, surged by 0.47%. The session's major advancers were FMCG-wholesaler EUROCASH (WSE: EUR), bank PKO BP (WSE: PKO), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two gencos ENERGA (WSE: ENG) and PGE (WSE: PGE), advancing 2.11%-3.38% respectively. On the country, bank MILLENNIUM (WSE: MIL) led decliners with a 5.55% drop, followed by agricultural producer KERNEL (WSE: KER) and two more banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), tumbling by 3.62%, 3.27% and 2.48% respectively.

-

16:23

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Thursday as a fall in Apple's shares weighed. Apple (AAPL) fell 0,8% to $116,38 after Nokia said it had filed a number of lawsuits against the iPhone maker for patent infringement.

Market showed little reaction to data showing that the U.S. economy grew faster than initially thought in the third quarter, notching up its best performance in two years. Gross domestic product increased at a 3,5% annual rate instead of the previously reported 3,2% pace, the Commerce Department said in its third GDP estimate.

Most of Dow stocks in negative area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.01%). Top loser - Wal-Mart Stores, Inc. (WMT, -1.48%).

Most of all S&P sectors in negative area. Top gainer - Conglomerates (+1.3%). Top loser - Services (-0.8%).

At the moment:

Dow 19853.00 -38.00 -0.19%

S&P 500 2254.75 -5.75 -0.25%

Nasdaq 100 4934.25 -15.25 -0.31%

Oil 52.89 +0.40 +0.76%

Gold 1133.50 +0.30 +0.03%

U.S. 10yr 2.56 +0.01

-

14:52

WSE: After start on Wall Street

The market in the US started from a small discount, which after the first transactions has been deepened in the wake of a similar movement on futures contracts which set new session lows. The worse-than-expected attitude of the Americans broke the mood on the Warsaw Stock Exchange, where the WIG20 index also went down to session lows and an hour before the close of trading stood at the level of 1,919 (-0.45%).

-

14:33

U.S. Stocks open: Dow -0.08%, Nasdaq -0.13%, S&P -0.21%

-

14:27

Before the bell: S&P futures -0.07%, NASDAQ futures -0.01%

U.S. stock-index futures were flat, as investors assessed a raft of important U.S. macroeconomic data.

Global Stocks:

Nikkei 19,427.67 -16.82 -0.09%

Hang Seng 21,636.20 -173.60 -0.80%

Shanghai 3,140.15 +2.73 +0.09%

FTSE 7,040.67 -0.75 -0.01%

CAC 4,830.90 -2.92 -0.06%

DAX 11,463.06 -5.58 -0.05%

Crude $52.40 (-0.17%)

Gold $1,130.20 (-0.26%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.39

-0.04(-0.1315%)

200

ALTRIA GROUP INC.

MO

67.2

-0.07(-0.1041%)

2751

Amazon.com Inc., NASDAQ

AMZN

770.01

-0.59(-0.0766%)

7119

Apple Inc.

AAPL

117.03

-0.03(-0.0256%)

59839

AT&T Inc

T

42.3

-0.06(-0.1416%)

2191

Barrick Gold Corporation, NYSE

ABX

14.1

-0.06(-0.4237%)

123886

Boeing Co

BA

159.16

1.68(1.0668%)

231

Caterpillar Inc

CAT

93.51

-0.31(-0.3304%)

1241

Chevron Corp

CVX

117.67

-0.24(-0.2035%)

2416

Cisco Systems Inc

CSCO

30.5

0.08(0.263%)

426

Citigroup Inc., NYSE

C

60.77

0.02(0.0329%)

23202

Exxon Mobil Corp

XOM

90.4

0.12(0.1329%)

811

Facebook, Inc.

FB

118.98

-0.06(-0.0504%)

17278

FedEx Corporation, NYSE

FDX

192.25

0.13(0.0677%)

616

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.9

-0.15(-1.0676%)

39269

General Electric Co

GE

31.91

0.02(0.0627%)

9525

General Motors Company, NYSE

GM

36.32

-0.10(-0.2746%)

2473

Goldman Sachs

GS

241.2

-0.24(-0.0994%)

2112

Google Inc.

GOOG

793.39

-1.17(-0.1472%)

1176

Home Depot Inc

HD

136.41

-0.42(-0.3069%)

403

Intel Corp

INTC

37.16

0.18(0.4867%)

10195

International Paper Company

IP

32.34

-0.06(-0.1852%)

6422

JPMorgan Chase and Co

JPM

86.84

0.09(0.1037%)

6376

Merck & Co Inc

MRK

59.6

0.17(0.286%)

731

Microsoft Corp

MSFT

63.84

0.30(0.4721%)

44868

Nike

NKE

52.53

0.23(0.4398%)

37969

Pfizer Inc

PFE

32.34

-0.06(-0.1852%)

6422

Procter & Gamble Co

PG

83.92

-0.36(-0.4271%)

1229

Tesla Motors, Inc., NASDAQ

TSLA

207.5

-0.20(-0.0963%)

8082

The Coca-Cola Co

KO

41.58

0.01(0.0241%)

658

Twitter, Inc., NYSE

TWTR

16.88

-0.20(-1.171%)

153406

United Technologies Corp

UTX

59.6

0.17(0.286%)

731

UnitedHealth Group Inc

UNH

160.5

-0.83(-0.5145%)

230

Verizon Communications Inc

VZ

52.93

-0.04(-0.0755%)

3425

Wal-Mart Stores Inc

WMT

59.6

0.17(0.286%)

731

Walt Disney Co

DIS

105.08

-0.48(-0.4547%)

3153

Yahoo! Inc., NASDAQ

YHOO

38.6

-0.55(-1.4049%)

11935

Yandex N.V., NASDAQ

YNDX

20.5

0.21(1.035%)

1900

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Procter & Gamble (PG) downgraded to Hold from Buy at SunTrust

Other:

Microsoft (MSFT) initiated with a Overweight at Piper Jaffray; target $80

-

12:05

WSE: Mid session comment

The first half of today's trading shows that in the market has already arrived noticeably Christmas atmosphere. The changes are small and dominated by consolidation. After an initial drop the demand side in the second hour of trading was trying to take the initiative, but this was not successful and in the noon phase of trading the WIG20 index went at session minima.

There is no supply-side signals from Euroland and for any more active trading we will have to wait the entry to the game of American capital.

At the halfway point of today's session the WIG20 index was at the level of 1,922 points (-0.30%).

-

08:40

Monte dei Paschi struggling to sell fresh shares to avert a state bailout

-

08:23

Major stock markets trading little changed: FTSE -0.2%, DAX -0.3%, CAC40 -0.1%, FTMIB -0.1%, IBEX -0.4%

-

08:17

WSE: After opening

WIG20 index opened at 1927.70 points (-0.01%)*

WIG 51145.03 -0.15%

WIG30 2220.32 -0.24%

mWIG40 4180.58 0.08%

*/ - change to previous close

The futures market began the day from a discount of 0.3 percent, thus extending the weakness seen in the final phase of yesterday's session. Red in the morning is also on other European parquets, where a lesser extent, but also falling futures for the major indices Euroland.

The cash market started neutrally and with modest turnover. We may see a light supply for banks and commodity companies (decline in commodity prices). However, the market is not falling harder and subsidence appears, at least for the time being, controlled.

After fifteen minutes of trading WIG20 index was at 1,922 points (-0.30%).

-

07:25

WSE: Before opening

Wednesday brought declines in major indices on the New York stock exchanges. Dow Jones was not able to overcome the barrier of 20 000 points, however in the first part of the session was close to that goal. The dollar weakened against the euro and the yen, and oil become cheaper after the publication of data on stocks of fuel.

The Dow Jones Industrial dropped at the closing of 0.16 percent, the S&P500 lost 0.25 per cent, while the Nasdaq Comp. went down by 0.23 percent. The market feels already pre-Christmas mood and investor activity decreases.

On the market there is a noticeable pressure of the supply side on the main raw materials: oil and copper and the Asian parquets are dominates by the red color. Add to this slight discount of contracts in the United States. Thus, the mood in the morning can mean a return to an earlier consolidation.

The macro calendar will show today data on GDP growth in the US in the third quarter and information about the income and expenditure of Americans and orders for durable goods. It will not be data that could significantly change the balance of power in today's session.

-

07:22

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.2%, FTSE -0.2%

-

06:13

Global Stocks

European stocks slipped Wednesday, with pressure on Spanish and other European bank shares pulling the market away from its highest level of the year. BMPS sank as much as 19% and were halted a few times as the bank said its liquidity could be wiped out in four months, compared with its previous projection of 11 months.

U.S. stocks closed modestly lower Wednesday, with the Dow industrials and Nasdaq Composite retreating from all-time highs set a day earlier. The market traded in a relatively tight range amid thinning volumes ahead of the December holidays. Wall Street has been in rally mode since the U.S. presidential election on Nov 8, with investors wagering that the pro-business policies of President-elect Donald Trump will spur faster economic growth.

Asian shares were a mixed bag early Thursday, as market volumes began to thin out in the run-up to the Christmas holidays, while trading was range-bound with many investors sitting on the sidelines. Many major markets in Asia will close on Monday (and a few on Tuesday as well) to observe Christmas, though Japan and China will remain open.

-