Market news

-

23:30

Commodities. Daily history for Dec 22’2016:

(raw materials / closing price /% change)

Oil 52.65 -0.57%

Gold 1,130.00 -0.06%

-

23:29

Stocks. Daily history for Dec 22’2016:

(index / closing price / change items /% change)

Nikkei 225 19,427.67 -16.82 -0.09%

Shanghai Composite 3,140.15 +2.73 +0.09%

S&P/ASX 200 5,643.94 0.00 0.00%

FTSE 100 7,063.68 +22.26 +0.32%

CAC 40 4,834.63 +0.81 +0.02%

Xetra DAX 11,456.10 -12.54 -0.11%

S&P 500 2,260.96 -4.22 -0.19%

Dow Jones Industrial Average 19,918.88 -23.08 -0.12%

S&P/TSX Composite 15,335.23 +29.34 +0.19%

-

23:27

Currencies. Daily history for Dec 22’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0436 +0,12%

GBP/USD $1,2282 -0,57%

USD/CHF Chf1,0253 -0,13%

USD/JPY Y117,53 -0,03%

EUR/JPY Y122,65 +0,08%

GBP/JPY Y144,32 -0,62%

AUD/USD $0,7215 -0,29%

NZD/USD $0,6902 +0,06%

USD/CAD C$1,348 +0,52%

-

23:00

Schedule for today,Friday, Dec 23’2016 (GMT0)

07:00 Germany Gfk Consumer Confidence Survey January 9.8 9.9

08:00 Switzerland KOF Leading Indicator December 102.2 103.1

09:30 United Kingdom Current account, bln Quarter III -27.5 -27.45

09:30 United Kingdom GDP, q/q (Finally) Quarter III 0.7% 0.5%

09:30 United Kingdom GDP, y/y (Finally) Quarter III 2.1% 2.3%

13:30 Canada GDP (m/m) October 0.3% 0.1%

15:00 U.S. New Home Sales November 563 575

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 98 98

-

21:06

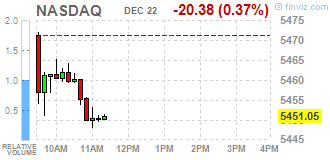

Major US stock indexes finished trading below zero

Major US stock indexes fell moderately amid falling shares of Apple (AAPL) after the Finnish Nokia said it has filed a series of lawsuits against the iPhone maker for patent infringement.

In addition, as it became known, the US economy grew faster than previously estimated in the third quarter, noting its best performance in two years, on the back of strong consumer spending and a jump in soybean exports. Gross domestic product grew by 3.5% instead of the previously reported 3.2%, the Commerce Ministry said in its third evaluation. The growth was the strongest since the third quarter of 2014 after increasing by 1.4% in the second quarter.

At the same time, the number of Americans who applied for unemployment benefits rose to a six-month high last week, but remain below the level that is associated with a strong labor market. unemployment initial claims for benefits rose by 21,000 and reached a seasonally adjusted 275,000 for the week ending 17 December. This is the highest rate since June. The data for the previous week were not revised.

It should also be noted that new orders for US-made core capital goods rose more than expected in November, amid strong demand for machinery and primary metals, suggesting that the effect on the production of some of the negative factors associated with the oil, began to fade. Non-defense capital goods orders excluding aircraft, closely watched gauge of business spending plans, rose 0.9% after growth of 0.2% in October.

Also, the Commerce Department reported that consumer spending, which accounts for over two-thirds of US economic activity, rose 0.2% after increasing 0.4% in October (revised from + 0.3%). Economists had expected an increase of 0.3%.

DOW index components closed mostly in the red (17 of 30). Outsider were shares of Wal-Mart Stores, Inc. (WMT, -2.40%). Most remaining shares rose Verizon Communications Inc. (VZ, + 1.29%).

Most of the S & P sectors registered a decline. the services sector fell the most (-1.1%). The leader turned conglomerates sector (+ 1.8%).

At the close:

Dow -0.12% 19,918.95 -23.01

Nasdaq -0.44% 5,447.42 -24.01

S & P -0.19% 2,260.94 -4.24

-

20:00

DJIA -0.12% 19,918.70 -23.26 Nasdsq -0.46% 5,446.43 -25.00 S&P -0.20% 2,260.72 -4.46

-

17:03

European stocks closed: FTSE 100 +22.26 7063.68 +0.32% DAX -12.54 11456.10 -0.11% CAC 40 +0.81 4834.63 +0.02%

-

16:59

WSE: Session Results

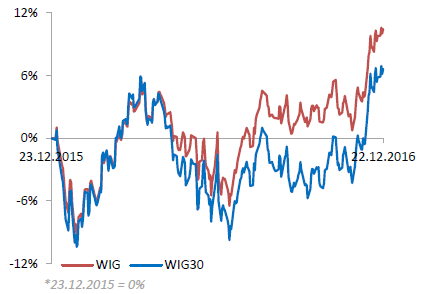

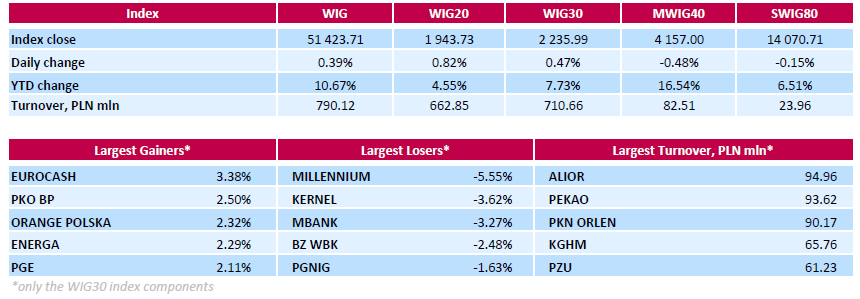

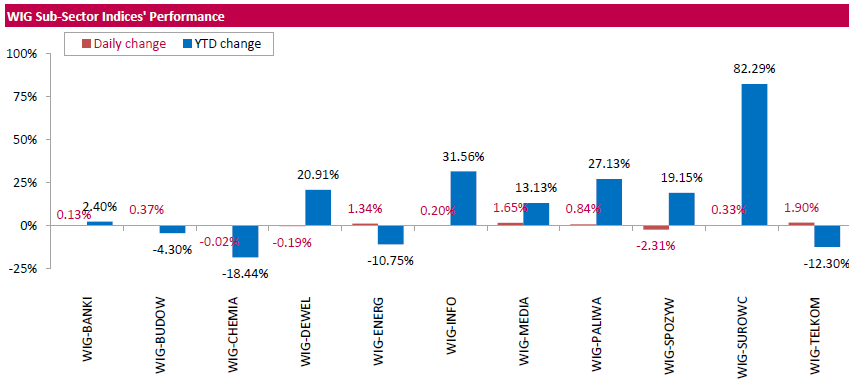

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, added 0.39%. The WIG sub-sector indices were mainly higher with telecoms (+1.90%) outperforming.

The large-cap stocks' measure, the WIG30 index, surged by 0.47%. The session's major advancers were FMCG-wholesaler EUROCASH (WSE: EUR), bank PKO BP (WSE: PKO), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two gencos ENERGA (WSE: ENG) and PGE (WSE: PGE), advancing 2.11%-3.38% respectively. On the country, bank MILLENNIUM (WSE: MIL) led decliners with a 5.55% drop, followed by agricultural producer KERNEL (WSE: KER) and two more banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), tumbling by 3.62%, 3.27% and 2.48% respectively.

-

16:23

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Thursday as a fall in Apple's shares weighed. Apple (AAPL) fell 0,8% to $116,38 after Nokia said it had filed a number of lawsuits against the iPhone maker for patent infringement.

Market showed little reaction to data showing that the U.S. economy grew faster than initially thought in the third quarter, notching up its best performance in two years. Gross domestic product increased at a 3,5% annual rate instead of the previously reported 3,2% pace, the Commerce Department said in its third GDP estimate.

Most of Dow stocks in negative area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.01%). Top loser - Wal-Mart Stores, Inc. (WMT, -1.48%).

Most of all S&P sectors in negative area. Top gainer - Conglomerates (+1.3%). Top loser - Services (-0.8%).

At the moment:

Dow 19853.00 -38.00 -0.19%

S&P 500 2254.75 -5.75 -0.25%

Nasdaq 100 4934.25 -15.25 -0.31%

Oil 52.89 +0.40 +0.76%

Gold 1133.50 +0.30 +0.03%

U.S. 10yr 2.56 +0.01

-

15:03

US personal income and PCE flat in November

Personal income increased $1.6 billion (less than 0.1 percent) in November according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $1.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $24.0 billion

(0.2 percent).

Real DPI decreased 0.1 percent in November and Real PCE increased 0.1 percent. The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent. -

15:01

U.S.: Leading Indicators , November 0.0% (forecast 0.2%)

-

15:00

U.S.: PCE price index ex food, energy, m/m, November 0% (forecast 0.1%)

-

15:00

U.S.: Personal Income, m/m, November 0.0% (forecast 0.3%)

-

15:00

U.S.: PCE price index ex food, energy, Y/Y, November 1.6%

-

15:00

U.S.: Personal spending , November 0.2% (forecast 0.3%)

-

14:52

WSE: After start on Wall Street

The market in the US started from a small discount, which after the first transactions has been deepened in the wake of a similar movement on futures contracts which set new session lows. The worse-than-expected attitude of the Americans broke the mood on the Warsaw Stock Exchange, where the WIG20 index also went down to session lows and an hour before the close of trading stood at the level of 1,919 (-0.45%).

-

14:33

U.S. Stocks open: Dow -0.08%, Nasdaq -0.13%, S&P -0.21%

-

14:27

Before the bell: S&P futures -0.07%, NASDAQ futures -0.01%

U.S. stock-index futures were flat, as investors assessed a raft of important U.S. macroeconomic data.

Global Stocks:

Nikkei 19,427.67 -16.82 -0.09%

Hang Seng 21,636.20 -173.60 -0.80%

Shanghai 3,140.15 +2.73 +0.09%

FTSE 7,040.67 -0.75 -0.01%

CAC 4,830.90 -2.92 -0.06%

DAX 11,463.06 -5.58 -0.05%

Crude $52.40 (-0.17%)

Gold $1,130.20 (-0.26%)

-

14:13

U.S. house prices rose in line with expectations

U.S. house prices rose in October, up 0.4 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.6 percent increase in September remained unchanged.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From October 2015 to October 2016, house prices were up 6.2 percent.

-

14:08

U.S.: Housing Price Index, m/m, October 0.4% (forecast 0.4%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.39

-0.04(-0.1315%)

200

ALTRIA GROUP INC.

MO

67.2

-0.07(-0.1041%)

2751

Amazon.com Inc., NASDAQ

AMZN

770.01

-0.59(-0.0766%)

7119

Apple Inc.

AAPL

117.03

-0.03(-0.0256%)

59839

AT&T Inc

T

42.3

-0.06(-0.1416%)

2191

Barrick Gold Corporation, NYSE

ABX

14.1

-0.06(-0.4237%)

123886

Boeing Co

BA

159.16

1.68(1.0668%)

231

Caterpillar Inc

CAT

93.51

-0.31(-0.3304%)

1241

Chevron Corp

CVX

117.67

-0.24(-0.2035%)

2416

Cisco Systems Inc

CSCO

30.5

0.08(0.263%)

426

Citigroup Inc., NYSE

C

60.77

0.02(0.0329%)

23202

Exxon Mobil Corp

XOM

90.4

0.12(0.1329%)

811

Facebook, Inc.

FB

118.98

-0.06(-0.0504%)

17278

FedEx Corporation, NYSE

FDX

192.25

0.13(0.0677%)

616

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.9

-0.15(-1.0676%)

39269

General Electric Co

GE

31.91

0.02(0.0627%)

9525

General Motors Company, NYSE

GM

36.32

-0.10(-0.2746%)

2473

Goldman Sachs

GS

241.2

-0.24(-0.0994%)

2112

Google Inc.

GOOG

793.39

-1.17(-0.1472%)

1176

Home Depot Inc

HD

136.41

-0.42(-0.3069%)

403

Intel Corp

INTC

37.16

0.18(0.4867%)

10195

International Paper Company

IP

32.34

-0.06(-0.1852%)

6422

JPMorgan Chase and Co

JPM

86.84

0.09(0.1037%)

6376

Merck & Co Inc

MRK

59.6

0.17(0.286%)

731

Microsoft Corp

MSFT

63.84

0.30(0.4721%)

44868

Nike

NKE

52.53

0.23(0.4398%)

37969

Pfizer Inc

PFE

32.34

-0.06(-0.1852%)

6422

Procter & Gamble Co

PG

83.92

-0.36(-0.4271%)

1229

Tesla Motors, Inc., NASDAQ

TSLA

207.5

-0.20(-0.0963%)

8082

The Coca-Cola Co

KO

41.58

0.01(0.0241%)

658

Twitter, Inc., NYSE

TWTR

16.88

-0.20(-1.171%)

153406

United Technologies Corp

UTX

59.6

0.17(0.286%)

731

UnitedHealth Group Inc

UNH

160.5

-0.83(-0.5145%)

230

Verizon Communications Inc

VZ

52.93

-0.04(-0.0755%)

3425

Wal-Mart Stores Inc

WMT

59.6

0.17(0.286%)

731

Walt Disney Co

DIS

105.08

-0.48(-0.4547%)

3153

Yahoo! Inc., NASDAQ

YHOO

38.6

-0.55(-1.4049%)

11935

Yandex N.V., NASDAQ

YNDX

20.5

0.21(1.035%)

1900

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Procter & Gamble (PG) downgraded to Hold from Buy at SunTrust

Other:

Microsoft (MSFT) initiated with a Overweight at Piper Jaffray; target $80

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0350 (EUR 971m) 1.0800 (1.98bln)

USD/JPY 115.00 (USD 2.67bln) 116.00 (870m) 116.50 (1.07bln) 117.00 (975m) 117.50 (928m) 118.00 (760m)

GBP/USD 1.2000 (GBP 2.76bln) 1.2600 (2.75bln)

Информационно-аналитический отдел TeleTrade

-

13:42

Important slowdown of US durable goods orders in November

New orders for manufactured durable goods in November decreased $11.0 billion or 4.6 percent to $228.2 billion, the U.S. Census Bureau announced today. This decrease, down following four consecutive monthly increases, followed a 4.8 percent October increase. Excluding transportation, new orders increased 0.5 percent. Excluding defense, new orders decreased 6.6 percent. Transportation equipment, also down following four consecutive monthly increases, drove the decrease, $11.7 billion or 13.2 percent to $76.6 billion.

Nondefense new orders for capital goods in November decreased $15.6 billion or 19.5 percent to $64.4 billion. Shipments decreased $0.9 billion or 1.2 percent to $70.3 billion. Unfilled orders decreased $5.9 billion or 0.8 percent to $697.1 billion. Inventories increased $0.5 billion or 0.3 percent to $170.1 billion.

-

13:40

Canadian inflation rose less than expected in November. USD/CAD up 35 pips on the news

The Consumer Price Index (CPI) rose 1.2% on a year-over-year basis in November, following a 1.5% gain in October.

Prices were up in six of the eight major components in the 12 months to November, with the shelter and transportation indexes contributing the most to the year-over-year rise in the CPI. The food index and the clothing and footwear index declined on a year-over-year basis.

The transportation index rose 1.4% year over year in November, following a 3.0% gain in October. This deceleration was led by gasoline prices, which declined 1.7% year over year in November after increasing 2.5% in October. The purchase of passenger vehicles index rose less year over year in November (+3.0%) than in October (+4.4%), but remained the main upward contributor to the 12-month change in the transportation index.

-

13:37

US initial jobless claims a little higher than expected

In the week ending December 17, the advance figure for seasonally adjusted initial claims was 275,000, an increase of 21,000 from the previous week's unrevised level of 254,000. The 4-week moving average was 263,750, an increase of 6,000 from the previous week's unrevised average of 257,750.

There were no special factors impacting this week's initial claims. This marks 94 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:36

Canadian retail sales rose for the third consecutive month

Retail sales rose for the third consecutive month, rising 1.1% to $45.0 billion in October. Higher sales at gasoline stations and general merchandise stores were the main contributors to the gain. Excluding sales at motor vehicle and parts dealers, retail sales were up 1.4% in October.

Sales were up in 9 of 11 subsectors, representing 90% of total retail trade.

After removing the effects of price changes, retail sales in volume terms increased 0.6%.

-

13:35

US GDP and Price index rose more than expected. Dollar little changed so far

Real gross domestic product increased at an annual rate of 3.5 percent in the third quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.

Real gross domestic income (GDI) increased 4.8 percent in the third quarter, compared with an increase of 0.7 percent in the second. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 4.1 percent in the third quarter, compared with an increase of 1.1 percent in the second.

The price index for gross domestic purchases increased 1.5 percent in the third quarter, compared with an increase of 2.1 percent in the second quarter (table 4). The PCE price index increased 1.5 percent, compared with an increase of 2.0 percent. Excluding food and energy prices, the PCE price index increased 1.7 percent, compared with an increase of 1.8 percent.

-

13:31

Canada: Retail Sales ex Autos, m/m, October 1.4% (forecast 0.7%)

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter III 1.7% (forecast 1.7%)

-

13:31

Canada: Retail Sales YoY, October 3.8%

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, November 1.5% (forecast 1.8%)

-

13:30

U.S.: Durable Goods Orders , November -4.6% (forecast -4.7%)

-

13:30

U.S.: Initial Jobless Claims, 275 (forecast 256)

-

13:30

Canada: Consumer price index, y/y, November 1.2% (forecast 1.4%)

-

13:30

U.S.: GDP, q/q, Quarter III 3.5% (forecast 3.3%)

-

13:30

U.S.: Continuing Jobless Claims, 2036 (forecast 2015)

-

13:30

Canada: Retail Sales, m/m, October 1.1% (forecast 0.2%)

-

13:30

Canada: Consumer Price Index m / m, November -0.4% (forecast -0.2%)

-

13:01

Orders

EUR/USD

Offers : 1.0465 1.0485 1.0500 1.05251.0550-551.0585 1.0600

Bids: 1.0425-30 1.0400 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers : 1.2380-85 1.2400 1.2425-30 1.2450 1.2485 1.2500-10 1.2530 1.2550

Bids: 1.2325-30 1.2300 1.2285 1.2250 1.220-25 1.2200

EUR/GBP

Offers : 0.8480 0.8500 0.8520 0.8550 0.8575 0.8600

Bids: 0.8435-40 0.8400 0.8375 0.8350-55 0.8330-35 0.8300

EUR/JPY

Offers : 123.00 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids: 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers :117.80-85 118.00 118.20-25118.45-50118.80 119.00 120.00

Bids: 117.40 117.15-20 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers : 0.7260 0.7280 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids: 0.7220-25 0.7200 0.7170 0.7145-50 0.7100

-

12:21

ECB's Weidmann says ECB shouldn't leave it too late to hike rates - Forexlive

-

12:05

WSE: Mid session comment

The first half of today's trading shows that in the market has already arrived noticeably Christmas atmosphere. The changes are small and dominated by consolidation. After an initial drop the demand side in the second hour of trading was trying to take the initiative, but this was not successful and in the noon phase of trading the WIG20 index went at session minima.

There is no supply-side signals from Euroland and for any more active trading we will have to wait the entry to the game of American capital.

At the halfway point of today's session the WIG20 index was at the level of 1,922 points (-0.30%).

-

11:17

Dollar Steady; Jobs, GDP, and Durable Goods Figures in Focus . US Q3 GDP expected to rise 3.3% vs 3.2 prior estimate

-

10:20

Italian retail trade rose more than expected in October

In October 2016 the seasonally adjusted retail trade index increased by 1.2% with respect to September 2016 (+1.1% for food goods and +1.3% for non-food goods). The average of the last three months decreased with respect to the previous three months (-0.2%). The unadjusted index decreased by 0.2% with respect to October 2015.

The retail trade index measures the monthly evolution of the turnover at current prices of enterprises with retail sale outlets.

-

09:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 115.00 (USD 2.67bln) 116.00 (870m) 116.50 (1.07bln) 117.00 (975m) 117.50 (928m) 118.00 (760m)

GBP/USD 1.2000 (GBP 2.76bln) 1.2600 (2.75bln)

Информационно-аналитический отдел TeleTrade

-

09:44

Oil is trading higher

This morning, the New York futures for Brent rose by 0.28% to $ 54.61 and WTI rose 0.17% to $ 52.58 per barrel. Thus, the black gold is gaining weakening of the dollar. Additional support is provided by optimism over the fact that OPEC will stick to previously scheduled plan to reduce oil production.

-

09:05

ECB Economic Bulletin: Looking further ahead, the Governing Council expects the economic expansion to proceed at a moderate but firming pace

The assessment confirmed the need to extend the asset purchase programme beyond March 2017 to preserve the very substantial amount of monetary support that is necessary to secure a sustained convergence of inflation rates towards levels below, but close to, 2% over the medium term.

Global activity has improved in the second half of the year and is expected to continue strengthening, although remaining below its pre-crisis pace. Continued accommodative policies and improving labour markets have supported activity in the United States, but uncertainty about the US and global outlook has increased since the US election. In Japan the pace of expansion is expected to remain moderate, while the medium-term growth prospects of the United Kingdom are likely to be restrained by heightened uncertainty related to the country's future relations with the EU.

Euro area sovereign yields have risen recently and the EONIA forward curve has steepened.

-

08:40

Monte dei Paschi struggling to sell fresh shares to avert a state bailout

-

08:23

Major stock markets trading little changed: FTSE -0.2%, DAX -0.3%, CAC40 -0.1%, FTMIB -0.1%, IBEX -0.4%

-

08:17

WSE: After opening

WIG20 index opened at 1927.70 points (-0.01%)*

WIG 51145.03 -0.15%

WIG30 2220.32 -0.24%

mWIG40 4180.58 0.08%

*/ - change to previous close

The futures market began the day from a discount of 0.3 percent, thus extending the weakness seen in the final phase of yesterday's session. Red in the morning is also on other European parquets, where a lesser extent, but also falling futures for the major indices Euroland.

The cash market started neutrally and with modest turnover. We may see a light supply for banks and commodity companies (decline in commodity prices). However, the market is not falling harder and subsidence appears, at least for the time being, controlled.

After fifteen minutes of trading WIG20 index was at 1,922 points (-0.30%).

-

07:58

US dollar's best days are behind it - CIBC

"The ECB announced a coming reduction in its monthly asset purchases, but tried not say it was "tapering" by combining two announcements in one. European monetary policymakers retained their existing €80 bn per month in assets purchases that was due to end after March, but tacked on a further €60 bn in monthly buying through the end of December 2017, or longer if necessary.

The reduction in the pace of purchases is more of a reflection of the strains in some bond markets than it is of the ECB's view that the economy requires less stimulus. President Draghi highlighted low core inflation, even though the central bank's forecast shows headline inflation reaching target in 2019. The central bank appeared keen on taking the spotlight off of headline which is being buoyed by higher energy prices. The central bank is likely also trying to push back against the post-Trump move in bond markets, which has seen both interest rates and inflation expectations rebound sharply (Chart 3).

Ongoing balance sheet expansion, coupled with political risks in a number of Eurozone countries should keep the euro contained in the first quarter of next year.

Thereafter, a brighter outlook for both the economy and political risks should begin to see the currency gain ground against a US dollar that's best days are behind it. Look for a disappointing result for the populist Front National party in France's upcoming elections to be a turning point for political risk in the region".

Copyright © 2016 CIBC, eFXnews™

-

07:25

WSE: Before opening

Wednesday brought declines in major indices on the New York stock exchanges. Dow Jones was not able to overcome the barrier of 20 000 points, however in the first part of the session was close to that goal. The dollar weakened against the euro and the yen, and oil become cheaper after the publication of data on stocks of fuel.

The Dow Jones Industrial dropped at the closing of 0.16 percent, the S&P500 lost 0.25 per cent, while the Nasdaq Comp. went down by 0.23 percent. The market feels already pre-Christmas mood and investor activity decreases.

On the market there is a noticeable pressure of the supply side on the main raw materials: oil and copper and the Asian parquets are dominates by the red color. Add to this slight discount of contracts in the United States. Thus, the mood in the morning can mean a return to an earlier consolidation.

The macro calendar will show today data on GDP growth in the US in the third quarter and information about the income and expenditure of Americans and orders for durable goods. It will not be data that could significantly change the balance of power in today's session.

-

07:25

Options levels on thursday, December 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0732 (1890)

$1.0652 (510)

$1.0593 (233)

Price at time of writing this review: $1.0446

Support levels (open interest**, contracts):

$1.0375 (1086)

$1.0340 (2206)

$1.0295 (2819)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 43558 contracts, with the maximum number of contracts with strike price $1,1500 (3209);

- Overall open interest on the PUT options with the expiration date March, 13 is 54037 contracts, with the maximum number of contracts with strike price $1,0000 (5077);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from December, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.2612 (995)

$1.2516 (409)

$1.2421 (211)

Price at time of writing this review: $1.2360

Support levels (open interest**, contracts):

$1.2281 (460)

$1.2185 (558)

$1.2088 (397)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 10469 contracts, with the maximum number of contracts with strike price $1,3000 (1043);

- Overall open interest on the PUT options with the expiration date March, 13 is 13467 contracts, with the maximum number of contracts with strike price $1,1500 (2948);

- The ratio of PUT/CALL was 1.29 versus 1.31 from the previous trading day according to data from December, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.2%, FTSE -0.2%

-

07:21

German Ministry of Finance: GDP will increase in Q4

According to the latest monthly report published by the Ministry of Finance of Germany, in the last quarter of this year, GDP will show a positive trend despite the weak performance of the individual indicators. In particular, the Ministry of Finance is worried about weak growth in exports and increases risk of foreign trade. However, employment recovery and the normal indicators of inflation are good signs. Also in the fourth quarter, an improvement in business sentiment and the growth of industrial orders is expected.

.

-

07:14

New Zealand’s seasonally adjusted current account deficit increased to $1.9 billion

New Zealand's seasonally adjusted current account deficit increased to $1.9 billion in the September 2016 quarter, Statistics New Zealand said today. This is a small increase from the June quarter deficit of $1.8 billion and was funded by the banking sector.

Within the current account, New Zealand's export goods were worth $686 million less than import goods in the September 2016 quarter. The goods trade shortfall in the latest quarter was up $190 million from the June 2016 quarter, after accounting for usual seasonal patterns.

"New Zealand spent more on imports of goods, and earned less from exports of goods this quarter," international statistics senior manager Jason Attewell said.

-

07:12

New Zeeland gross domestic product rose 1.1 percent

Gross domestic product rose 1.1 percent in the September 2016 quarter, following an increase of 0.7 percent (revised) in the June 2016 quarter, Statistics New Zealand said today.

"This quarter's rise points to broad-based growth," national accounts senior manager Gary Dunnet said. "Thirteen of the 16 industries were up, with the main weakness coming from agriculture."

Household spending continued its strong growth, increasing 1.6 percent this quarter, following a 2.0 percent increase in the June quarter.

"We've seen Kiwis spend more on domestic travel, accommodation, eating out, and recreation," Mr Dunnet said.

Exports edged back from last quarter's increase. While growth fell over the September quarter, export volumes remain high. Imports rose in the September quarter, reflecting large purchases of aircraft.

Service industries continued to grow, increasing 1.1 percent in the September quarter. The main drivers were business services; transport, postal and warehousing; and arts, recreation, and other services.

-

07:10

Trump: Met some really great Air Force GENERALS and Navy ADMIRALS today, talking about airplane capability and pricing

-

07:09

German index of import prices increased by 0.3% in November

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 0.3% in November 2016 compared with the corresponding month of the preceding year. This was the first increase of a yearly rate of change since November 2012 (+1.0%). In October and in September 2016 the annual rates of change were -0.6% and -1.8%, respectively. From October to November 2016 the index rose by 0.7%.

The index of import prices, excluding crude oil and mineral oil products, increased by 0.4% compared with the level of a year earlier.

The index of export prices increased by 0.3% in November 2016 compared with the corresponding month of the preceding year. In October and in September 2016 the annual rates of change were -0.1% and -0.6%, respectively. From October to November 2016 the export price index rose by 0.5%.

-

06:13

Global Stocks

European stocks slipped Wednesday, with pressure on Spanish and other European bank shares pulling the market away from its highest level of the year. BMPS sank as much as 19% and were halted a few times as the bank said its liquidity could be wiped out in four months, compared with its previous projection of 11 months.

U.S. stocks closed modestly lower Wednesday, with the Dow industrials and Nasdaq Composite retreating from all-time highs set a day earlier. The market traded in a relatively tight range amid thinning volumes ahead of the December holidays. Wall Street has been in rally mode since the U.S. presidential election on Nov 8, with investors wagering that the pro-business policies of President-elect Donald Trump will spur faster economic growth.

Asian shares were a mixed bag early Thursday, as market volumes began to thin out in the run-up to the Christmas holidays, while trading was range-bound with many investors sitting on the sidelines. Many major markets in Asia will close on Monday (and a few on Tuesday as well) to observe Christmas, though Japan and China will remain open.

-