Market news

-

23:30

Commodities. Daily history for Dec 21’2016:

(raw materials / closing price /% change)

Oil 52.51 +0.04%

Gold 1,133.20 0.00%

-

23:29

Stocks. Daily history for Dec 21’2016:

(index / closing price / change items /% change)

Nikkei 225 19,444.49 -50.04 -0.26%

Shanghai Composite 3,138.54 +35.67 +1.15%

S&P/ASX 200 5,613.47 0.00 0.00%

FTSE 100 7,041.42 -2.54 -0.04%

CAC 40 4,833.82 -16.07 -0.33%

Xetra DAX 11,468.64 +3.90 +0.03%

S&P 500 2,265.18 -5.58 -0.25%

Dow Jones Industrial Average 19,941.96 -32.66 -0.16%

S&P/TSX Composite 15,305.89 +12.93 +0.08%

-

23:28

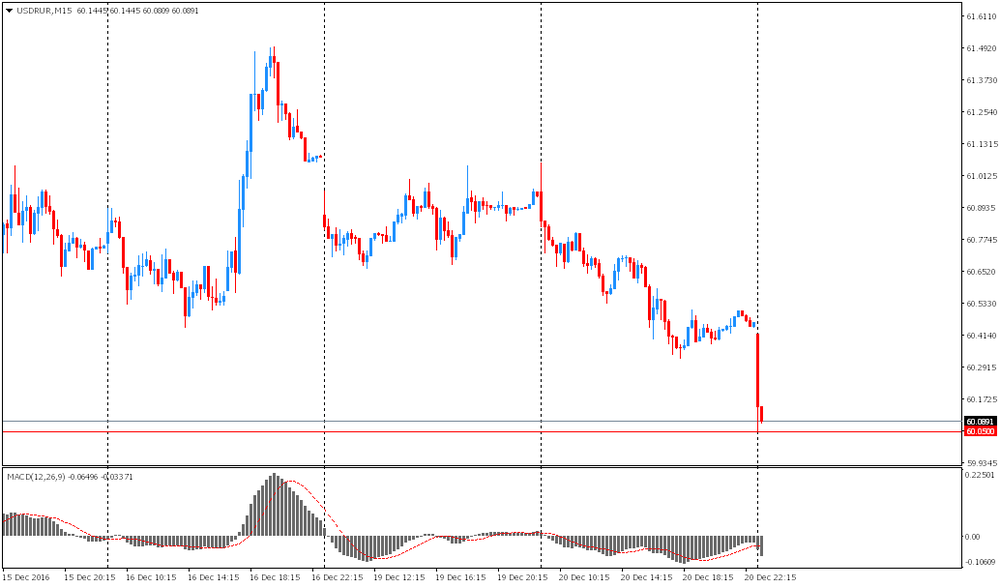

Currencies. Daily history for Dec 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0423 +0,35%

GBP/USD $1,2352 -0,11%

USD/CHF Chf1,0266 -0,19%

USD/JPY Y117,56 -0,24%

EUR/JPY Y122,55 +0,11%

GBP/JPY Y145,21 -0,35%

AUD/USD $0,7236 -0,30%

NZD/USD $0,6898 -0,23%

USD/CAD C$1,341 +0,33%

-

23:00

Schedule for today,Thursday, Dec 22’2016 (GMT0)

13:30 Canada Retail Sales, m/m October 0.6% 0.2%

13:30 Canada Retail Sales YoY October 2.5%

13:30 Canada Retail Sales ex Autos, m/m October 0% 0.7%

13:30 Canada Consumer Price Index m / m November 0.2% -0.2%

13:30 Canada Consumer price index, y/y November 1.5% 1.4%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 1.7% 1.8%

13:30 U.S. Continuing Jobless Claims 2018 2018

13:30 U.S. Durable Goods Orders November 4.8% -4.7%

13:30 U.S. Durable Goods Orders ex Transportation November 1% 0.2%

13:30 U.S. Durable goods orders ex defense November 5.2% -0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 1.5% 1.7%

13:30 U.S. Initial Jobless Claims 254 256

13:30 U.S. GDP, q/q (Finally) Quarter III 1.4% 3.3%

14:00 U.S. Housing Price Index, m/m October 0.6% 0.4%

15:00 U.S. Leading Indicators November 0.1% 0.2%

15:00 U.S. PCE price index ex food, energy, Y/Y November 1.7%

15:00 U.S. PCE price index ex food, energy, m/m November 0.1% 0.1%

15:00 U.S. Personal Income, m/m November 0.6% 0.3%

15:00 U.S. Personal spending November 0.3% 0.3%

-

21:46

New Zealand: Current Account , Quarter III -4.89 (forecast -5.015)

-

21:46

New Zealand: GDP y/y, Quarter III 3.5% (forecast 3.7%)

-

21:45

New Zealand: GDP q/q, Quarter III 1.1% (forecast 0.9%)

-

21:06

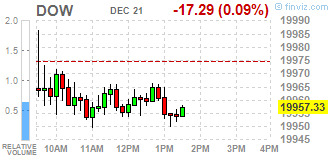

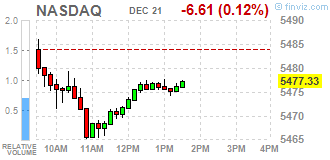

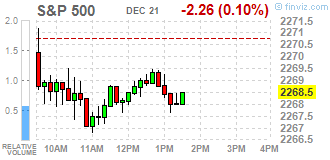

Major US stock indexes finished trading below zero

Major US stock indexes fell slightly as investors took profits after the rally of risky assets, which lasts for the past six weeks. Trading activity in the market is low and likely to remain so, as many market participants go on vacation.

As it became known, a big splash in the northeast and a smaller increase in the south has led to an increase in home sales in the secondary market in November, the third consecutive month. According to the National Association of Realtors, the total volume of housing sales in the secondary market, which includes single-family homes, townhouses, condominiums and co-ops, rose 0.7% to a seasonally adjusted annual rate of up to 5.61 million in November compared down from a revised 5.57 million in October. The November sales rate is the highest rate since February 2007 (5.79 million) and up to 15.4% higher than a year ago (4.86 million).

The price of oil fell, losing previously earned a position that was due to the publication of a report from the US Department of Energy, which pointed to an unexpected increase in oil inventories. US Department of Energy reported that a maximum of 5 weeks of commercial stocks increase, and the largest decline in stocks in the Cushing 2 months was recorded last week. According to the data unexpectedly oil reserves in the week of December 10-16 rose by 2.256 million barrels to 485.449 million barrels. Analysts had expected inventories fell by 2.425 million.

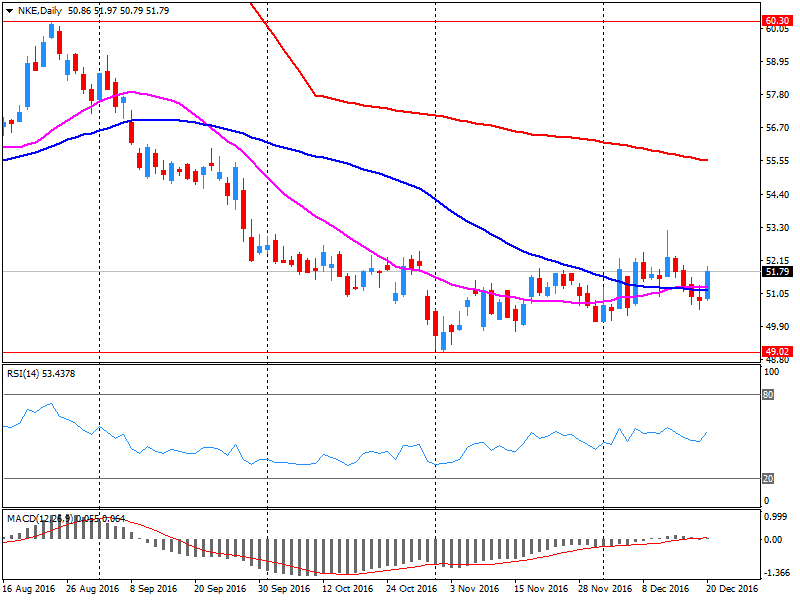

DOW index components closed mostly in the red (19 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.04%). Outsider were shares of Merck & Co., Inc. (MRK, -1.64%).

Most of the S & P sectors showed a decline. conglomerates (-1.5%) sectors fell most. The leader turned out to be the basic materials sector (+ 0.2%).

At the close:

Dow -0.16% 19,942.95 -31.67

Nasdaq -0.23% 5,471.43 -12.51

S & P -0.24% 2,265.23 -5.53

-

20:00

DJIA -0.03% 19,968.14 -6.48 Nasdaq -0.07% 5,480.00 -3.94 S&P -0.08% 2,268.99 -1.77

-

18:39

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Wednesday, giving back some of the gains chalked up since Donald Trump's U.S. election victory as investors took profits on the rally in risk assets over the past six weeks. U.S. stocks have been roaring ahead since the election, with the Dow up 9 percent and the S&P 500 gaining 6% since Nov 8 on hopes President-elect Trump's proposed deregulation and fiscal stimulus will boost economic growth.

Most of Dow stocks in negative area (18 of 30). Top gainer - NIKE, Inc. (NKE, +0.62%). Top loser - Merck & Co., Inc. (MRK, -1.52%).

Most of all S&P sectors in positive area. Top gainer - Basic Materials (+0.2%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 19911.00 +74.00 +0.37%

S&P 500 2267.75 +7.75 +0.34%

Nasdaq 100 4958.25 +19.50 +0.39%

Oil 53.62 +0.56 +1.06%

Gold 1129.00 -13.70 -1.20%

U.S. 10yr 2.58 +0.04

-

17:00

European stocks closed: FTSE 100 -2.54 7041.42 -0.04% DAX +3.90 11468.64 +0.03% CAC 40 -16.07 4833.82 -0.33%

-

16:31

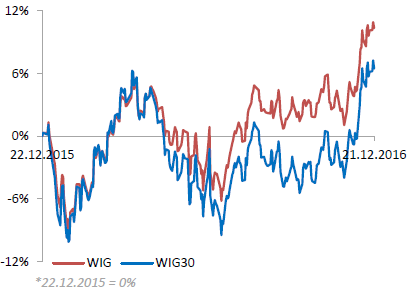

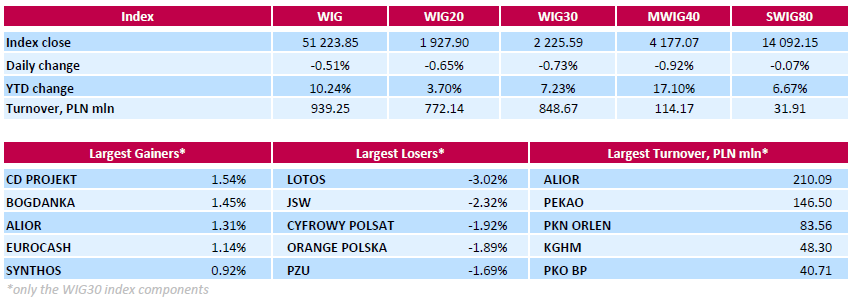

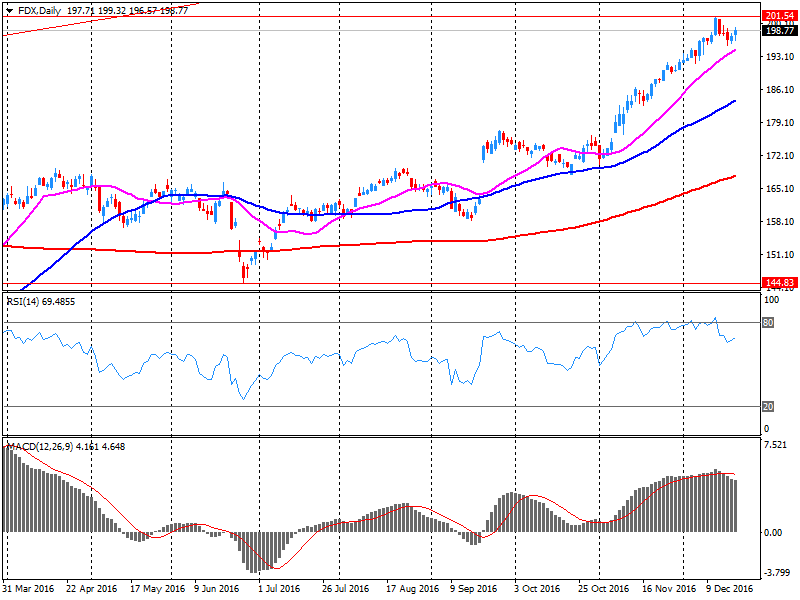

WSE: Session Results

Polish equity market closed lower on Wednesday with the broad market measure, the WIG Index, losing 0.51%. The WIG sub-sector indices were mainly lower with telecoms (-1.61%) lagging behind.

Large-cap stocks' measure the WIG30 Index went down by 0.73%. 2/3 of the 30 stocks in the index basket retreated, and oil refiner LOTOS (WSE: LTS) and coking coal miner JSW (WSE: JSW) performed particularly poorly, falling 3.02% and 2.32% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and insurer PZU (WSE: PZU), dropping by 1.92%, 1.89% and 1.69% respectively. On the plus side, videogame developer CD PROJEKT (WSE: CDR), thermal coal miner BOGDANKA (WSE: LWB) and bank ALIOR (WSE: ALR) were the biggest advancers, adding 1.54%, 1.45% and 1.31% respectively.

-

16:21

Gold takes advantage of dollar's breathing room

Gold for February delivery was recently up 0.4% at $1.137.60 a troy ounce on the Comex division of the New York Mercantile Exchange.

On Wednesday, the WSJ Dollar Index, which measures the dollar against other currencies, was down 0.3% at 93.06. A weaker dollar is bullish for the metal, because it makes dollar-priced commodities more affordable for investors who hold other currencies.

According to Dow Jones, the dollar's decline provided some breathing room for gold, which has been under pressure as the U.S. currency strengthened to a 14-year high on Tuesday. The metal has also been under pressure from an interest-rate increase by the U.S. Federal Reserve last week, paired with comments indicating that further raises are expected for next year.

-

15:36

U.S. commercial crude oil inventories increased

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.3 million barrels from the previous week. At 485.4 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 1.3 million barrels last week, but are well above the upper limit of the average range. Finished gasoline inventories increased while blending components inventories decreased last week.

Distillate fuel inventories decreased by 2.4 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 3.1 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories decreased by 11.9 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, December 2.256 (forecast -2.425)

-

15:09

Euro area consumer confidence rose

In December 2016, the DG ECFIN flash estimate of the consumer confidence indicator increased markedly in both the euro area (by 1.1 points to -5.1) and the EU (by 1.2 points to -4.6) compared to November.

-

15:07

US existing-home sales ascended in November

A big surge in the Northeast and a smaller gain in the South pushed existing-home sales up in November for the third consecutive month, according to the National Association of Realtors.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 0.7 percent to a seasonally adjusted annual rate of 5.61 million in November from a downwardly revised 5.57 million in October. November's sales pace is now the highest since February 2007 (5.79 million) and is 15.4 percent higher than a year ago (4.86 million).

-

15:00

Eurozone: Consumer Confidence, December -5.1 (forecast -6)

-

15:00

U.S.: Existing Home Sales , November 5.61 (forecast 5.5)

-

14:54

WSE: After start on Wall Street

The beginning of trading on Wall Street brought a modest changes in the major indexes. The key for investors seems to be meeting of the DJIA index with 20,000 points and the Nasdaq Composite with 5,500 pts. It also seems that the indexes do not hurry too much for this meeting. In our market after a series of basket sell orders index of the largest companies lost a few points, and entered the final hour of trading at the level of 1,943 points (+ 0.17%).

-

14:33

U.S. Stocks open: Dow -0.05%, Nasdaq -0.07%, S&P -0.09%

-

14:24

Before the bell: S&P futures -0.01%, NASDAQ futures +0.05%

U.S. stock-index futures were almost unchanged, a day after the Dow Jones Industrial Average and the Nasdaq Composite hit record highs.

Global Stocks:

Nikkei 19,444.49 -50.04 -0.26%

Hang Seng 21,809.80 +80.74 +0.37%

Shanghai 3,138.54 +35.67 +1.15%

FTSE 7,035.10 -8.86 -0.13%

CAC 4,828.33 -21.56 -0.44%

DAX 11,461.50 -3.24 -0.03%

Crude $53.39 (+0.17%)

Gold $1,136.70 (+0.27%)

-

14:00

Belgium: Business Climate, December -0.2 (forecast -1.3)

-

13:57

Italy lower house approves government request to hike debt for bank rescue - Reuters

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

67.49

0.15(0.2227%)

900

Amazon.com Inc., NASDAQ

AMZN

767.58

-3.64(-0.472%)

9042

American Express Co

AXP

74.9

-0.16(-0.2132%)

1600

AMERICAN INTERNATIONAL GROUP

AIG

241.83

-1.26(-0.5183%)

7468

Apple Inc.

AAPL

116.9

-0.05(-0.0428%)

22911

AT&T Inc

T

42.49

0.02(0.0471%)

1512

Barrick Gold Corporation, NYSE

ABX

14.38

0.04(0.2789%)

33434

Caterpillar Inc

CAT

94.21

-0.13(-0.1378%)

1247

Cisco Systems Inc

CSCO

30.5

-0.06(-0.1963%)

4764

Citigroup Inc., NYSE

C

60.6

-0.20(-0.3289%)

13058

Facebook, Inc.

FB

118.85

-0.24(-0.2015%)

14233

FedEx Corporation, NYSE

FDX

193.51

-5.23(-2.6316%)

30578

Ford Motor Co.

F

12.79

0.01(0.0782%)

871

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.26

0.10(0.7062%)

40627

General Electric Co

GE

32.18

-0.07(-0.2171%)

51344

General Motors Company, NYSE

GM

36.66

0.05(0.1366%)

700

Goldman Sachs

GS

241.83

-1.26(-0.5183%)

7468

Intel Corp

INTC

37.15

-0.06(-0.1612%)

3102

International Business Machines Co...

IBM

166.83

-0.77(-0.4594%)

2638

Johnson & Johnson

JNJ

116.1

0.44(0.3804%)

1036

JPMorgan Chase and Co

JPM

86.19

-0.34(-0.3929%)

5143

Merck & Co Inc

MRK

60.78

0.28(0.4628%)

1069

Microsoft Corp

MSFT

63.5

-0.04(-0.063%)

8239

Nike

NKE

52.65

0.86(1.6606%)

386584

Pfizer Inc

PFE

32.8

-0.05(-0.1522%)

8120

Procter & Gamble Co

PG

84.17

-0.40(-0.473%)

1871

Starbucks Corporation, NASDAQ

SBUX

57.56

-0.14(-0.2426%)

1419

Tesla Motors, Inc., NASDAQ

TSLA

208.11

-0.68(-0.3257%)

2205

Twitter, Inc., NYSE

TWTR

17.66

-0.26(-1.4509%)

83627

UnitedHealth Group Inc

UNH

162.5

0.91(0.5632%)

110

Verizon Communications Inc

VZ

53.24

0.12(0.2259%)

3983

Wal-Mart Stores Inc

WMT

72

0.18(0.2506%)

1009

Walt Disney Co

DIS

105.16

-0.30(-0.2845%)

2743

Yahoo! Inc., NASDAQ

YHOO

39.02

-0.14(-0.3575%)

2200

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Overweight from Neutral at Atlantic Equities

Citigroup (C) upgraded to Overweight from Neutral at Atlantic Equities

Downgrades:

Barrick Gold (ABX) downgraded to Hold from Buy at TD Securities

Goldman Sachs (GS) downgraded to Neutral from Overweight at Atlantic Equities

Procter & Gamble (PG) downgraded to Hold from Buy at Stifel

Other:

General Motors (GM) initiated with Market Perform at BMO Capital

Ford Motor (F) nitiated with Market Perform at BMO Capital

NIKE (NKE) target lowered to $65 at Telsey Advisory Group

Boeing (BA) initiated with a Buy at Seaport Global Securities; target $180

Alphabet (GOOG) initiated with a Buy at Aegis Capital; target $980

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

-

13:08

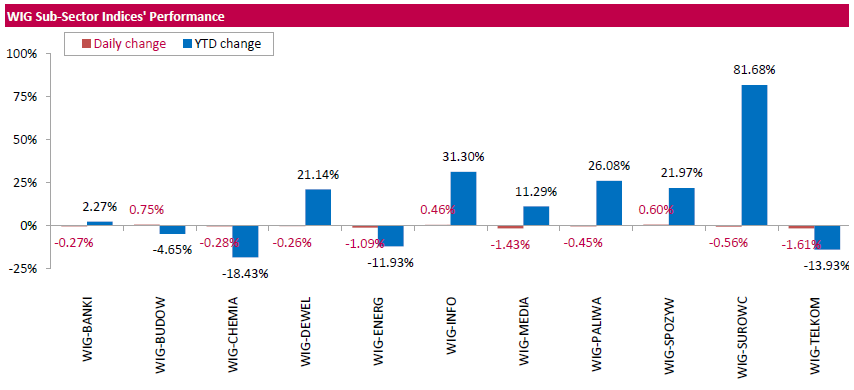

Company News: FedEx (FDX) Q2 EPS miss analysts’ estimate

FedEx reported Q2 FY 2017 earnings of $2.80 per share (versus $2.58 in Q2 FY 2016), missing analysts' consensus estimate of $2.91.

The company's quarterly revenues amounted to $14.900 bln (+19.2% y/y), generally in-line with analysts' consensus estimate of $14.914 bln.

FDX fell to $193.51 (-2.63%) in pre-market trading.

-

13:00

Company News: Nike (NKE) quarterly results beat analysts’ expectation

Nike reported Q2 FY 2017 earnings of $0.50 per share (versus $0.90 in Q2 FY 2016), beating analysts' consensus estimate of $0.43.

The company's quarterly revenues amounted to $8.180 bln (+6.4% y/y), beating analysts' consensus estimate of $8.094 bln.

NKE rose to $53.06 (+2.45%) in pre-market trading.

-

12:59

Orders

EUR/USD

Offers : 1.0420-25 1.0450-55 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers : 1.2380-85 1.2400 1.2425-30 1.2450 1.2485 1.2500-10 1.2530 1.2550

Bids: 1.2325-30 1.2300 1.2285 1.2250 1.220-25 1.2200

EUR/GBP

Offers : 0.8435 0.8450-55 0.8480 0.8500

Bids: 0.8400 0.8375 0.8350-55 0.8330-35 0.8300

EUR/JPY

Offers : 122.60 122.80 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.30 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers : 117.80 118.00 118.20-25 118.45-50 118.80 119.00 120.00

Bids: 117.40 117.20 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers : 0.7270-75 0.7300 0.7320 0.7350 0.7365 0.73800.7400

Bids: 0.7250 0.7225-30 0.7200 0.7170 0.7145-50 0.7100

-

12:05

Major stock indices in Europe show a moderate decline

European stocks mostly declined after stock prices of Spanish and Italian banks.

Investors remain cautious after the tragic events that occurred on Monday, while the trading volume are reduced on the eve of holidays.

Market sentiment deteriorated after Monday night Russia's ambassador to Turkey, Andrei Karlov, was shot dead in an art gallery in the capital, Ankara.

A few hours later in a Christmas fair in the center of Berlin a truck crashed, killing 12 people and wounding about 50. Could be a terrorist act.

At the same time, the indices are near the highs of more than 11 months as companies active in the field of mergers and acquisitions continues to provide support to the market.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,2%, to 360.74 points.

Shares of Banco de Sabadell SA and CaixaBank fell by 3% and 3.5%.

Securities of the Italian Banca Monte dei Paschi di Siena fell 17% amid fears that the bank will not be able to bring the 5 billion euros needed. Trading was suspended.

Volkswagen shares jumped 1% after the German automaker confirmed the willingness to pay an additional $ 1 billion to settle claims by the US after the emisions scandal.

At the moment:

FTSE 7039.34 -4.62 -0.07%

DAX 11468.05 3.31 0.03%

CAC 4832.32 -17.57 -0.36%

-

12:04

WSE: Mid session comment

The appearance of forenoon phase of today's session showed that the market tried to play only at the beginning of trading and the next hours brought calm drifts around 1,950 points. This is not surprising in the context of the neutral behavior of the German DAX and flat trading of futures on the S&P500. So, only players from the US may bring some new impulses.

At the halfway point of today's quotations the WIG20 index was at the level of 1,945 points (+ 0.26%).

-

11:20

Russia to increase oil export by the end of 2016 by 4.8%, to 253 million tons - Novak

Russian oil exports will increase by the end of 2016 by 4.8%, to 253 million tonnes, Russian Energy Minister Alexander Novak said.

"Supply of oil exports to rise ti 253.5 million tonnes, an increase of 4.8%", - he said.

-

10:25

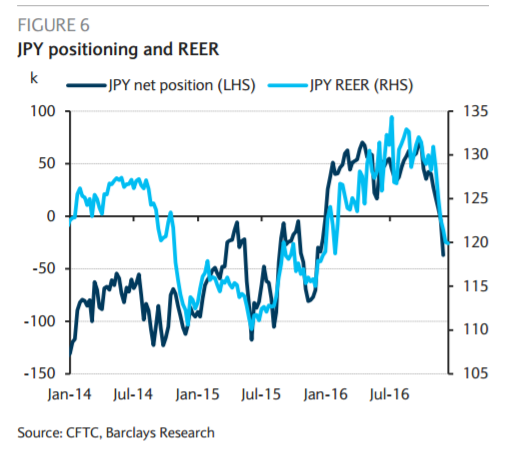

Round trip for USD/JPY; Seasonal factors in play for USD/CAD - Barclays

"USDJPY is poised to finish 2016 as the year of the great round trip, with the pair declining from 120 to 99 just after the Brexit vote and almost fully reversing this move after the US election and the hawkish Fed hike. The BoJ's yield curve control has helped this sharp rally by squeezing volatility out of JGB markets into FX markets, increasing its sensitivity to US yields.

Solid US data and expectations for Trump policies are likely to keep USDJPY supported at least into early next year, with upside risk when US policy outlook should become clearer, although we remain wary of some downside risk from unexpected risk-off events, given the resurging undervaluation of the JPY and speculative positioning now turning net short JPY.

....Historically, the loonie trades weakly in December, as typical seasonal factors favor the USD and hurt oil prices. After the OPEC agreement, we expect limited upside for oil prices in the next couple of weeks, and the more hawkish tone of the FOMC poses upside risks for the USD globally.

However, significantly short CAD positioning and short-term undervaluation limits CAD downside, in our view, and the loonie is likely to remain range-bound in the next few weeks, amid light year-end flows".

Copyright © 2016 Barclays Capital, eFXnews™

-

09:54

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

Информационно-аналитический отдел TeleTrade

-

09:52

SEK Rises As Riksbank Leaves Rates Unchanged

SEK hits the day's high against the EUR around 9.6828, according to Factset, after Sweden's central bank leaves its main repo rate unchanged at minus 0.5%.

-

09:37

UK public sector net borrowing decreased by £7.7 billion

Public sector net borrowing (excluding public sector banks) decreased by £7.7 billion to £59.5 billion in the current financial year-to-date (April to November 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) decreased by £0.6 billion to £12.6 billion in November 2016, compared with November 2015.

Public sector net debt (excluding public sector banks) was £1,655.1 billion at the end of November 2016, equivalent to 84.5% of gross domestic product (GDP); an increase of £58.6 billion compared with November 2015.

-

09:30

United Kingdom: PSNB, bln, November -12.21 (forecast -11.3)

-

09:14

Italian wage inflation little changed

The index of wages according to collective labour agreements measures the evolution of wages and salaries (per employee or per hour) determined by contractual provisions set by collective agreements; the indices are calculated with reference to the fixed employment structure of the base period (December 2010).

At the end of November 2016 the coverage rate (share of national collective agreements in force for the wage setting aspects) was 32.0 per cent in terms of employees and 30.9 per cent in terms of the total amount of wages.

In November 2016 the hourly index increased by 0.1 per cent while the per employee rose by 0.2 per cent from last month.

-

09:13

Oil is trading higher

This morning, the New York futures for Brent rose 0.89% to $ 55.84 WTI + 0.83% to $ 53.74 per barrel. Thus, the black gold is trading in the green zone on expectations regarding the reduction of oil reserves in the United States. According to the American Petroleum Institute, stocks fell by 4.1 million barrels last week, while experts predicted a decline of 2.5 million barrels.

-

09:07

Riksbank: Further purchases of government bonds for SEK 30 billion, repo rate unchanged at -0.50 per cent

Increasingly strong economic activity creates the conditions for inflation to continue rising. But there are risks that can jeopardise the upturn in inflation. Monetary policy therefore needs to remain very expansionary. The Executive Board of the Riksbank has decided to continue purchasing government bonds during the first six months of 2017, both nominal and real bonds, each corresponding to SEK 15 billion. The repo rate is retained at −0.50 per cent and there is still a greater probability that the rate will be cut than that it will be raised in the near term. Increases in the repo rate are not expected to begin until the beginning of 2018.

-

08:26

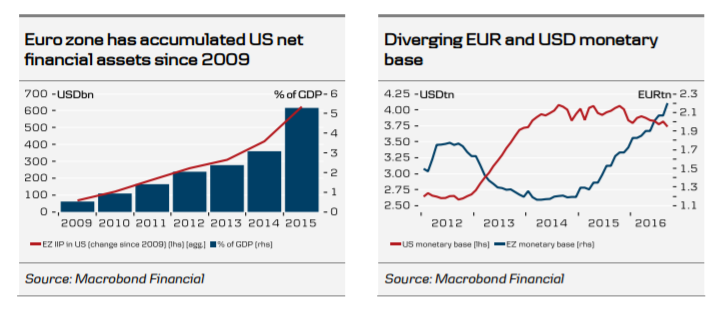

Danske says EUR/USD set to bottom around 1.02 in 1-Month

"Short term (1-3M horizon): In the short term, on the one hand there will be downward pressure on the US monetary base from the higher federal funds target and from the impact of new banking regulation with US banks set to be required to have an LCR of 100% by 1 January 2017. On the other hand, deposits on the US treasury account may fall at the beginning of next year after a resuspension of the debt ceiling, which will tend to increase the monetary base. Overall, this is likely to be marginally positive for USD and weigh on USD FX forward points vis- à-vis EUR and the Scandinavian currencies on top of the impact of the repricing of the path of Federal Reserve rate hikes, e.g. keeping the 3M EUR/USD basis spread around the present 70-80bp, and thus maintaining a significant negative carry on short USD positions. We look for EUR/USD to bottom at 1.02 in 1M.

Medium-term (6-12M horizon): Implementation of new regulation will continue in 2017, which is likely to continue to put downward pressure on the US monetary base. Additional rate hikes from the Federal Reserve in 2017 (we forecast a 25bp hike in June and December) are likely to be less of a strain on the monetary base than before and after the rate hike in December 2015, as the hiking cycle seems better aligned now with a recovery in the natural rate of interest. If the Federal Reserve attempts to push rates higher at a faster pace, it may become an issue though. This will maintain a higher negative carry on short USD positions vis-à-vis EUR and Scandinavian currencies than can be explained by the spread in interest rates, e.g. the 3M EUR/USD basis spread should stay around the present 70-80bp. Over the medium term, we look for the USD to fall back on valuation and the beginning of a correction of the large US current account deficit. As implementation of new regulation moves closer to the end, it should furthermore be less of a supportive factor for the USD. We forecast that EUR/USD will rise to 1.12 on 12M".

Copyright © 2016 Danske, eFXnews™

-

08:24

Bank of Thailand Keeps Benchmark Rate Unchanged At 1.5%

-

08:22

Major stock markets started trading with small losses: the FTSE 100 7,030.06 -13.90 -0.20%, DAX 11,444.54 -20.20 -0.18%, CAC 40 4,828.83 -21.06 -0.43%

-

08:20

Thai Central Bank Raises 2017 Export Growth Projection to 0.0% From -0.5%

-

08:18

WSE: After opening

WIG20 index opened at 1941.74 points (+0.07%)*

WIG 51550.41 0.13%

WIG30 2241.03 -0.04%

mWIG40 4202.54 -0.31%

*/ - change to previous close

The beginning of trading on the cash market was held at levels similar to yesterday's close, which is a response to similar behavior of Euroland. In front of us is another test of pre-Christmas sentiment around our parquet. The first transactions brought rising wave and after fifteen minutes of trading the WIG20 index reached the level of 1,944 points (+ 0.21%).

-

08:18

Today’s events

-

At 14:00 GMT quarterly inflation report from the SNB for the 4th quarter

-

At 15:30 GMT data from the US Department of Energy on crude oil inventorie

-

-

07:44

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.1%

-

07:32

WSE: Before opening

Tuesday's session on the New York stock exchange ended with increases in the major indexes. Eyes of the US market are facing on the Dow Jones Industrial, which at closing rose 0.46 percent. and approached the psychological limit of 20,000 points on 25 points. The S&P500 was firmer by 0.36 percent, while the Nasdaq Comp. went up by 0.49 percent. Oil was slightly expensive, strengthened the dollar.

In the morning, we see a cosmetic change in the valuation of the contract for the S&P500, which indicates the stabilization of confidence and allows us to expect a neutral beginning of the day in Europe. Today's macro calendar is virtually empty and there are no data that could affect the fate of the session.

On the Warsaw market the WIG20 index is in the area of 1,950 points and investors are already looking at the psychological and technical barrier of 2,000 points. At this point collapsed increases from the beginning of the year.

In addition virtually uninterrupted march from the region of 1,710 pts., encourages the pursuit of profits. For buyer helps a good atmosphere in the core markets and less pressure from the currency market, which stabilizes the valuation of the dollar.

-

07:26

-

07:23

Japan's all industry activity increased at a faster-than-expected pace in October

Japan's all industry activity increased at a faster-than-expected pace in October after remaining flat in the previous month, said the Ministry of Economy cited by rttnews.

The all industry activity index rose 0.2 percent month-over-month in October, just above the 0.1 percent gain expected by economists.

In September, the index showed no variations, which was revised down from a 0.2 percent climb reported earlier.

-

07:23

Options levels on wednesday, December 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0723 (1889)

$1.0640 (478)

$1.0577 (223)

Price at time of writing this review: $1.0412

Support levels (open interest**, contracts):

$1.0346 (1079)

$1.0313 (2133)

$1.0271 (2916)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 43444 contracts, with the maximum number of contracts with strike price $1,1500 (3217);

- Overall open interest on the PUT options with the expiration date March, 13 is 53379 contracts, with the maximum number of contracts with strike price $1,0000 (5599);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2613 (995)

$1.2518 (340)

$1.2422 (183)

Price at time of writing this review: $1.2364

Support levels (open interest**, contracts):

$1.2281 (401)

$1.2185 (547)

$1.2088 (397)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 10214 contracts, with the maximum number of contracts with strike price $1,2600 (995);

- Overall open interest on the PUT options with the expiration date March, 13 is 13376 contracts, with the maximum number of contracts with strike price $1,1500 (2948);

- The ratio of PUT/CALL was 1.31 versus 1.28 from the previous trading day according to data from December, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Japanese government raised the economic forecast for the first time in 21 months

Today, the Government of Japan has published its monthly economic forecasts and said that the economy is on a path of moderate recovery and increased assessment of the economy for the first time in 21 last month. According to the authorities, the most positive developments observed in exports and household spending. In addition, the Government emphasized the improvement in business conditions, while in the previous report, business activity was estimated as neutral.

-

07:19

New Zeeland Overseas Merchandise Trade

Beef and lamb exports fell in November, as the amount of meat sold dropped heavily compared with last year's record season, Statistics New Zealand said today.

Meat and edible offal exports fell $158 million (31 percent) from November 2015, contributing to a $219 million (5.4 percent) fall in overall exports.

Beef exports fell 41 percent in value and 31 percent in quantity, and lamb exports fell 27 percent in value and 23 percent in quantity.

"Beef exports to the United States, our top beef export destination, fell by around half when compared to November last year" senior manager Jason Attewell said. "When compared to the same month of the previous year, the value of beef exports to the US have fallen in nearly every month since October 2015, only rising once in April 2016."

-

06:18

Global Stocks

European stock markets moved mostly higher on Tuesday, with Italian banks among the biggest gainers after news the country's government is preparing a bailout package for struggling lenders. The pan-European index appeared to shake off the latest terror events in Berlin, Zurich and Ankara on Monday.

U.S. stocks finished higher on Tuesday, led by a rally in bank stocks, though the Dow Jones Industrial Average finished just below the psychologically important 20,000 level. Both the Dow and Nasdaq Composite Index closed at fresh all-time highs, with the S&P 500 index falling just short of its own record.

A record-breaking day in U.S. stocks overnight - with the Dow Jones Industrial Average hovering just below the symbolically significant 20,000 level - led Asian stocks higher Wednesday.

-

04:31

Japan: All Industry Activity Index, m/m, October 0.2% (forecast 0.1%)

-