Market news

-

23:29

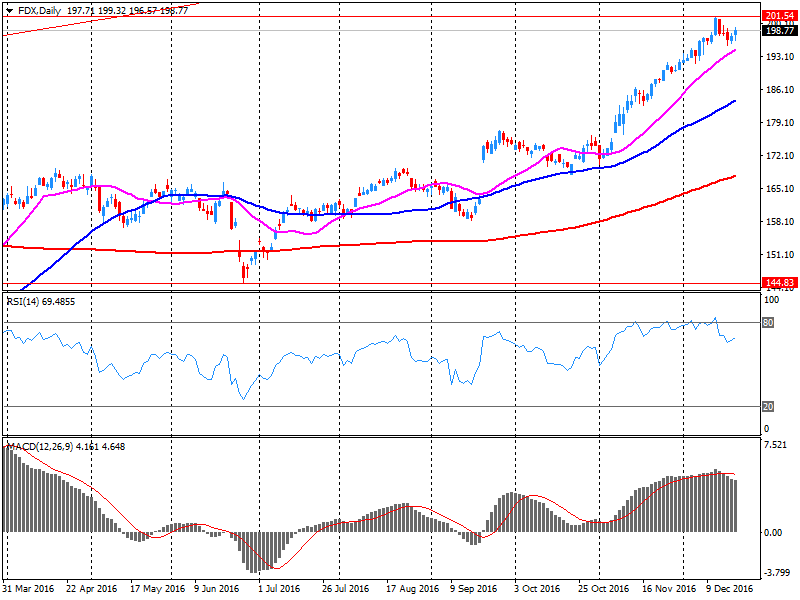

Stocks. Daily history for Dec 21’2016:

(index / closing price / change items /% change)

Nikkei 225 19,444.49 -50.04 -0.26%

Shanghai Composite 3,138.54 +35.67 +1.15%

S&P/ASX 200 5,613.47 0.00 0.00%

FTSE 100 7,041.42 -2.54 -0.04%

CAC 40 4,833.82 -16.07 -0.33%

Xetra DAX 11,468.64 +3.90 +0.03%

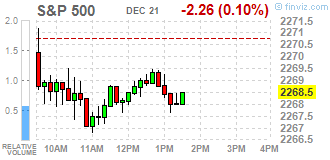

S&P 500 2,265.18 -5.58 -0.25%

Dow Jones Industrial Average 19,941.96 -32.66 -0.16%

S&P/TSX Composite 15,305.89 +12.93 +0.08%

-

21:06

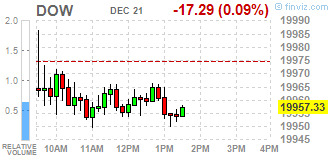

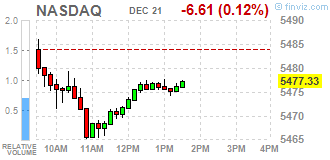

Major US stock indexes finished trading below zero

Major US stock indexes fell slightly as investors took profits after the rally of risky assets, which lasts for the past six weeks. Trading activity in the market is low and likely to remain so, as many market participants go on vacation.

As it became known, a big splash in the northeast and a smaller increase in the south has led to an increase in home sales in the secondary market in November, the third consecutive month. According to the National Association of Realtors, the total volume of housing sales in the secondary market, which includes single-family homes, townhouses, condominiums and co-ops, rose 0.7% to a seasonally adjusted annual rate of up to 5.61 million in November compared down from a revised 5.57 million in October. The November sales rate is the highest rate since February 2007 (5.79 million) and up to 15.4% higher than a year ago (4.86 million).

The price of oil fell, losing previously earned a position that was due to the publication of a report from the US Department of Energy, which pointed to an unexpected increase in oil inventories. US Department of Energy reported that a maximum of 5 weeks of commercial stocks increase, and the largest decline in stocks in the Cushing 2 months was recorded last week. According to the data unexpectedly oil reserves in the week of December 10-16 rose by 2.256 million barrels to 485.449 million barrels. Analysts had expected inventories fell by 2.425 million.

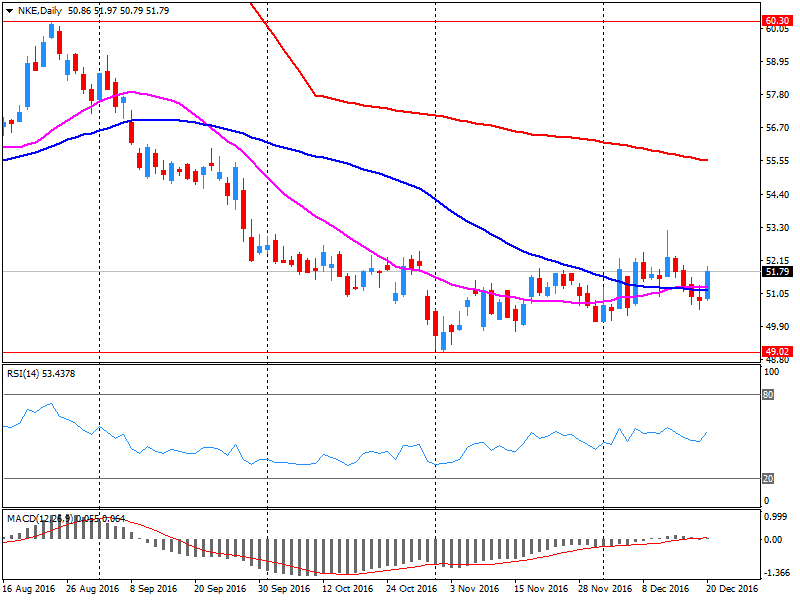

DOW index components closed mostly in the red (19 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.04%). Outsider were shares of Merck & Co., Inc. (MRK, -1.64%).

Most of the S & P sectors showed a decline. conglomerates (-1.5%) sectors fell most. The leader turned out to be the basic materials sector (+ 0.2%).

At the close:

Dow -0.16% 19,942.95 -31.67

Nasdaq -0.23% 5,471.43 -12.51

S & P -0.24% 2,265.23 -5.53

-

20:00

DJIA -0.03% 19,968.14 -6.48 Nasdaq -0.07% 5,480.00 -3.94 S&P -0.08% 2,268.99 -1.77

-

18:39

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Wednesday, giving back some of the gains chalked up since Donald Trump's U.S. election victory as investors took profits on the rally in risk assets over the past six weeks. U.S. stocks have been roaring ahead since the election, with the Dow up 9 percent and the S&P 500 gaining 6% since Nov 8 on hopes President-elect Trump's proposed deregulation and fiscal stimulus will boost economic growth.

Most of Dow stocks in negative area (18 of 30). Top gainer - NIKE, Inc. (NKE, +0.62%). Top loser - Merck & Co., Inc. (MRK, -1.52%).

Most of all S&P sectors in positive area. Top gainer - Basic Materials (+0.2%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 19911.00 +74.00 +0.37%

S&P 500 2267.75 +7.75 +0.34%

Nasdaq 100 4958.25 +19.50 +0.39%

Oil 53.62 +0.56 +1.06%

Gold 1129.00 -13.70 -1.20%

U.S. 10yr 2.58 +0.04

-

17:00

European stocks closed: FTSE 100 -2.54 7041.42 -0.04% DAX +3.90 11468.64 +0.03% CAC 40 -16.07 4833.82 -0.33%

-

16:31

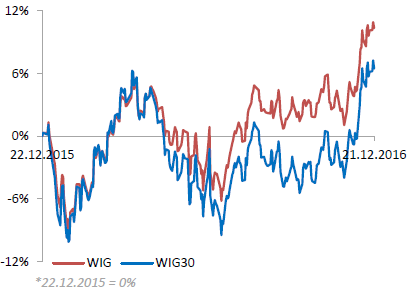

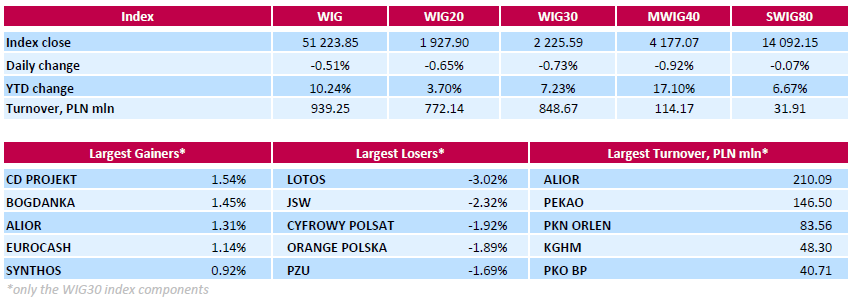

WSE: Session Results

Polish equity market closed lower on Wednesday with the broad market measure, the WIG Index, losing 0.51%. The WIG sub-sector indices were mainly lower with telecoms (-1.61%) lagging behind.

Large-cap stocks' measure the WIG30 Index went down by 0.73%. 2/3 of the 30 stocks in the index basket retreated, and oil refiner LOTOS (WSE: LTS) and coking coal miner JSW (WSE: JSW) performed particularly poorly, falling 3.02% and 2.32% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and insurer PZU (WSE: PZU), dropping by 1.92%, 1.89% and 1.69% respectively. On the plus side, videogame developer CD PROJEKT (WSE: CDR), thermal coal miner BOGDANKA (WSE: LWB) and bank ALIOR (WSE: ALR) were the biggest advancers, adding 1.54%, 1.45% and 1.31% respectively.

-

14:54

WSE: After start on Wall Street

The beginning of trading on Wall Street brought a modest changes in the major indexes. The key for investors seems to be meeting of the DJIA index with 20,000 points and the Nasdaq Composite with 5,500 pts. It also seems that the indexes do not hurry too much for this meeting. In our market after a series of basket sell orders index of the largest companies lost a few points, and entered the final hour of trading at the level of 1,943 points (+ 0.17%).

-

14:33

U.S. Stocks open: Dow -0.05%, Nasdaq -0.07%, S&P -0.09%

-

14:24

Before the bell: S&P futures -0.01%, NASDAQ futures +0.05%

U.S. stock-index futures were almost unchanged, a day after the Dow Jones Industrial Average and the Nasdaq Composite hit record highs.

Global Stocks:

Nikkei 19,444.49 -50.04 -0.26%

Hang Seng 21,809.80 +80.74 +0.37%

Shanghai 3,138.54 +35.67 +1.15%

FTSE 7,035.10 -8.86 -0.13%

CAC 4,828.33 -21.56 -0.44%

DAX 11,461.50 -3.24 -0.03%

Crude $53.39 (+0.17%)

Gold $1,136.70 (+0.27%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

67.49

0.15(0.2227%)

900

Amazon.com Inc., NASDAQ

AMZN

767.58

-3.64(-0.472%)

9042

American Express Co

AXP

74.9

-0.16(-0.2132%)

1600

AMERICAN INTERNATIONAL GROUP

AIG

241.83

-1.26(-0.5183%)

7468

Apple Inc.

AAPL

116.9

-0.05(-0.0428%)

22911

AT&T Inc

T

42.49

0.02(0.0471%)

1512

Barrick Gold Corporation, NYSE

ABX

14.38

0.04(0.2789%)

33434

Caterpillar Inc

CAT

94.21

-0.13(-0.1378%)

1247

Cisco Systems Inc

CSCO

30.5

-0.06(-0.1963%)

4764

Citigroup Inc., NYSE

C

60.6

-0.20(-0.3289%)

13058

Facebook, Inc.

FB

118.85

-0.24(-0.2015%)

14233

FedEx Corporation, NYSE

FDX

193.51

-5.23(-2.6316%)

30578

Ford Motor Co.

F

12.79

0.01(0.0782%)

871

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.26

0.10(0.7062%)

40627

General Electric Co

GE

32.18

-0.07(-0.2171%)

51344

General Motors Company, NYSE

GM

36.66

0.05(0.1366%)

700

Goldman Sachs

GS

241.83

-1.26(-0.5183%)

7468

Intel Corp

INTC

37.15

-0.06(-0.1612%)

3102

International Business Machines Co...

IBM

166.83

-0.77(-0.4594%)

2638

Johnson & Johnson

JNJ

116.1

0.44(0.3804%)

1036

JPMorgan Chase and Co

JPM

86.19

-0.34(-0.3929%)

5143

Merck & Co Inc

MRK

60.78

0.28(0.4628%)

1069

Microsoft Corp

MSFT

63.5

-0.04(-0.063%)

8239

Nike

NKE

52.65

0.86(1.6606%)

386584

Pfizer Inc

PFE

32.8

-0.05(-0.1522%)

8120

Procter & Gamble Co

PG

84.17

-0.40(-0.473%)

1871

Starbucks Corporation, NASDAQ

SBUX

57.56

-0.14(-0.2426%)

1419

Tesla Motors, Inc., NASDAQ

TSLA

208.11

-0.68(-0.3257%)

2205

Twitter, Inc., NYSE

TWTR

17.66

-0.26(-1.4509%)

83627

UnitedHealth Group Inc

UNH

162.5

0.91(0.5632%)

110

Verizon Communications Inc

VZ

53.24

0.12(0.2259%)

3983

Wal-Mart Stores Inc

WMT

72

0.18(0.2506%)

1009

Walt Disney Co

DIS

105.16

-0.30(-0.2845%)

2743

Yahoo! Inc., NASDAQ

YHOO

39.02

-0.14(-0.3575%)

2200

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Overweight from Neutral at Atlantic Equities

Citigroup (C) upgraded to Overweight from Neutral at Atlantic Equities

Downgrades:

Barrick Gold (ABX) downgraded to Hold from Buy at TD Securities

Goldman Sachs (GS) downgraded to Neutral from Overweight at Atlantic Equities

Procter & Gamble (PG) downgraded to Hold from Buy at Stifel

Other:

General Motors (GM) initiated with Market Perform at BMO Capital

Ford Motor (F) nitiated with Market Perform at BMO Capital

NIKE (NKE) target lowered to $65 at Telsey Advisory Group

Boeing (BA) initiated with a Buy at Seaport Global Securities; target $180

Alphabet (GOOG) initiated with a Buy at Aegis Capital; target $980

-

13:08

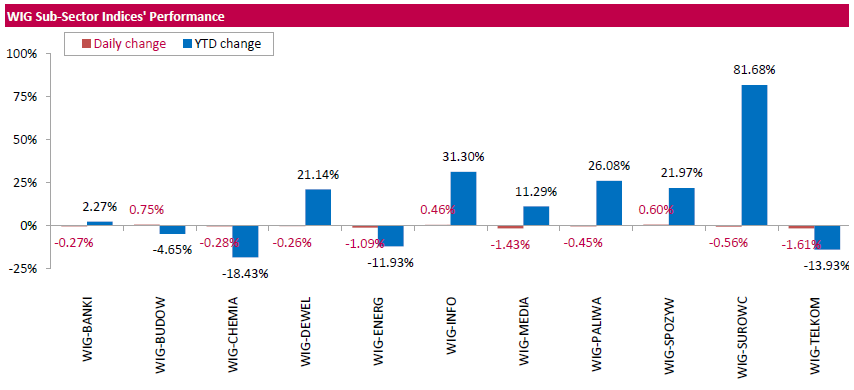

Company News: FedEx (FDX) Q2 EPS miss analysts’ estimate

FedEx reported Q2 FY 2017 earnings of $2.80 per share (versus $2.58 in Q2 FY 2016), missing analysts' consensus estimate of $2.91.

The company's quarterly revenues amounted to $14.900 bln (+19.2% y/y), generally in-line with analysts' consensus estimate of $14.914 bln.

FDX fell to $193.51 (-2.63%) in pre-market trading.

-

13:00

Company News: Nike (NKE) quarterly results beat analysts’ expectation

Nike reported Q2 FY 2017 earnings of $0.50 per share (versus $0.90 in Q2 FY 2016), beating analysts' consensus estimate of $0.43.

The company's quarterly revenues amounted to $8.180 bln (+6.4% y/y), beating analysts' consensus estimate of $8.094 bln.

NKE rose to $53.06 (+2.45%) in pre-market trading.

-

12:05

Major stock indices in Europe show a moderate decline

European stocks mostly declined after stock prices of Spanish and Italian banks.

Investors remain cautious after the tragic events that occurred on Monday, while the trading volume are reduced on the eve of holidays.

Market sentiment deteriorated after Monday night Russia's ambassador to Turkey, Andrei Karlov, was shot dead in an art gallery in the capital, Ankara.

A few hours later in a Christmas fair in the center of Berlin a truck crashed, killing 12 people and wounding about 50. Could be a terrorist act.

At the same time, the indices are near the highs of more than 11 months as companies active in the field of mergers and acquisitions continues to provide support to the market.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,2%, to 360.74 points.

Shares of Banco de Sabadell SA and CaixaBank fell by 3% and 3.5%.

Securities of the Italian Banca Monte dei Paschi di Siena fell 17% amid fears that the bank will not be able to bring the 5 billion euros needed. Trading was suspended.

Volkswagen shares jumped 1% after the German automaker confirmed the willingness to pay an additional $ 1 billion to settle claims by the US after the emisions scandal.

At the moment:

FTSE 7039.34 -4.62 -0.07%

DAX 11468.05 3.31 0.03%

CAC 4832.32 -17.57 -0.36%

-

12:04

WSE: Mid session comment

The appearance of forenoon phase of today's session showed that the market tried to play only at the beginning of trading and the next hours brought calm drifts around 1,950 points. This is not surprising in the context of the neutral behavior of the German DAX and flat trading of futures on the S&P500. So, only players from the US may bring some new impulses.

At the halfway point of today's quotations the WIG20 index was at the level of 1,945 points (+ 0.26%).

-

08:22

Major stock markets started trading with small losses: the FTSE 100 7,030.06 -13.90 -0.20%, DAX 11,444.54 -20.20 -0.18%, CAC 40 4,828.83 -21.06 -0.43%

-

08:18

WSE: After opening

WIG20 index opened at 1941.74 points (+0.07%)*

WIG 51550.41 0.13%

WIG30 2241.03 -0.04%

mWIG40 4202.54 -0.31%

*/ - change to previous close

The beginning of trading on the cash market was held at levels similar to yesterday's close, which is a response to similar behavior of Euroland. In front of us is another test of pre-Christmas sentiment around our parquet. The first transactions brought rising wave and after fifteen minutes of trading the WIG20 index reached the level of 1,944 points (+ 0.21%).

-

07:44

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.1%

-

07:32

WSE: Before opening

Tuesday's session on the New York stock exchange ended with increases in the major indexes. Eyes of the US market are facing on the Dow Jones Industrial, which at closing rose 0.46 percent. and approached the psychological limit of 20,000 points on 25 points. The S&P500 was firmer by 0.36 percent, while the Nasdaq Comp. went up by 0.49 percent. Oil was slightly expensive, strengthened the dollar.

In the morning, we see a cosmetic change in the valuation of the contract for the S&P500, which indicates the stabilization of confidence and allows us to expect a neutral beginning of the day in Europe. Today's macro calendar is virtually empty and there are no data that could affect the fate of the session.

On the Warsaw market the WIG20 index is in the area of 1,950 points and investors are already looking at the psychological and technical barrier of 2,000 points. At this point collapsed increases from the beginning of the year.

In addition virtually uninterrupted march from the region of 1,710 pts., encourages the pursuit of profits. For buyer helps a good atmosphere in the core markets and less pressure from the currency market, which stabilizes the valuation of the dollar.

-

06:18

Global Stocks

European stock markets moved mostly higher on Tuesday, with Italian banks among the biggest gainers after news the country's government is preparing a bailout package for struggling lenders. The pan-European index appeared to shake off the latest terror events in Berlin, Zurich and Ankara on Monday.

U.S. stocks finished higher on Tuesday, led by a rally in bank stocks, though the Dow Jones Industrial Average finished just below the psychologically important 20,000 level. Both the Dow and Nasdaq Composite Index closed at fresh all-time highs, with the S&P 500 index falling just short of its own record.

A record-breaking day in U.S. stocks overnight - with the Dow Jones Industrial Average hovering just below the symbolically significant 20,000 level - led Asian stocks higher Wednesday.

-