Market news

-

23:28

Currencies. Daily history for Dec 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0423 +0,35%

GBP/USD $1,2352 -0,11%

USD/CHF Chf1,0266 -0,19%

USD/JPY Y117,56 -0,24%

EUR/JPY Y122,55 +0,11%

GBP/JPY Y145,21 -0,35%

AUD/USD $0,7236 -0,30%

NZD/USD $0,6898 -0,23%

USD/CAD C$1,341 +0,33%

-

23:00

Schedule for today,Thursday, Dec 22’2016 (GMT0)

13:30 Canada Retail Sales, m/m October 0.6% 0.2%

13:30 Canada Retail Sales YoY October 2.5%

13:30 Canada Retail Sales ex Autos, m/m October 0% 0.7%

13:30 Canada Consumer Price Index m / m November 0.2% -0.2%

13:30 Canada Consumer price index, y/y November 1.5% 1.4%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 1.7% 1.8%

13:30 U.S. Continuing Jobless Claims 2018 2018

13:30 U.S. Durable Goods Orders November 4.8% -4.7%

13:30 U.S. Durable Goods Orders ex Transportation November 1% 0.2%

13:30 U.S. Durable goods orders ex defense November 5.2% -0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 1.5% 1.7%

13:30 U.S. Initial Jobless Claims 254 256

13:30 U.S. GDP, q/q (Finally) Quarter III 1.4% 3.3%

14:00 U.S. Housing Price Index, m/m October 0.6% 0.4%

15:00 U.S. Leading Indicators November 0.1% 0.2%

15:00 U.S. PCE price index ex food, energy, Y/Y November 1.7%

15:00 U.S. PCE price index ex food, energy, m/m November 0.1% 0.1%

15:00 U.S. Personal Income, m/m November 0.6% 0.3%

15:00 U.S. Personal spending November 0.3% 0.3%

-

21:46

New Zealand: Current Account , Quarter III -4.89 (forecast -5.015)

-

21:46

New Zealand: GDP y/y, Quarter III 3.5% (forecast 3.7%)

-

21:45

New Zealand: GDP q/q, Quarter III 1.1% (forecast 0.9%)

-

15:30

U.S.: Crude Oil Inventories, December 2.256 (forecast -2.425)

-

15:09

Euro area consumer confidence rose

In December 2016, the DG ECFIN flash estimate of the consumer confidence indicator increased markedly in both the euro area (by 1.1 points to -5.1) and the EU (by 1.2 points to -4.6) compared to November.

-

15:07

US existing-home sales ascended in November

A big surge in the Northeast and a smaller gain in the South pushed existing-home sales up in November for the third consecutive month, according to the National Association of Realtors.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 0.7 percent to a seasonally adjusted annual rate of 5.61 million in November from a downwardly revised 5.57 million in October. November's sales pace is now the highest since February 2007 (5.79 million) and is 15.4 percent higher than a year ago (4.86 million).

-

15:00

Eurozone: Consumer Confidence, December -5.1 (forecast -6)

-

15:00

U.S.: Existing Home Sales , November 5.61 (forecast 5.5)

-

14:00

Belgium: Business Climate, December -0.2 (forecast -1.3)

-

13:57

Italy lower house approves government request to hike debt for bank rescue - Reuters

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

-

12:59

Orders

EUR/USD

Offers : 1.0420-25 1.0450-55 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers : 1.2380-85 1.2400 1.2425-30 1.2450 1.2485 1.2500-10 1.2530 1.2550

Bids: 1.2325-30 1.2300 1.2285 1.2250 1.220-25 1.2200

EUR/GBP

Offers : 0.8435 0.8450-55 0.8480 0.8500

Bids: 0.8400 0.8375 0.8350-55 0.8330-35 0.8300

EUR/JPY

Offers : 122.60 122.80 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.30 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers : 117.80 118.00 118.20-25 118.45-50 118.80 119.00 120.00

Bids: 117.40 117.20 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers : 0.7270-75 0.7300 0.7320 0.7350 0.7365 0.73800.7400

Bids: 0.7250 0.7225-30 0.7200 0.7170 0.7145-50 0.7100

-

10:25

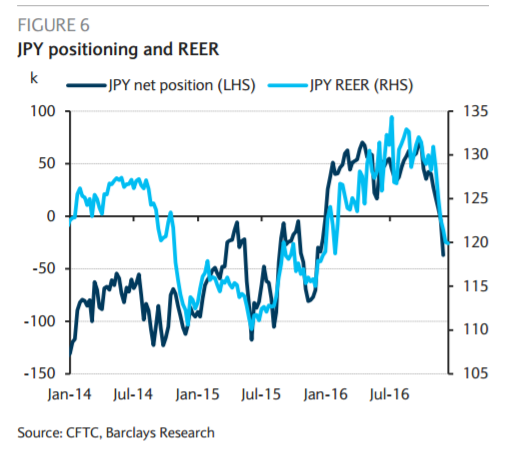

Round trip for USD/JPY; Seasonal factors in play for USD/CAD - Barclays

"USDJPY is poised to finish 2016 as the year of the great round trip, with the pair declining from 120 to 99 just after the Brexit vote and almost fully reversing this move after the US election and the hawkish Fed hike. The BoJ's yield curve control has helped this sharp rally by squeezing volatility out of JGB markets into FX markets, increasing its sensitivity to US yields.

Solid US data and expectations for Trump policies are likely to keep USDJPY supported at least into early next year, with upside risk when US policy outlook should become clearer, although we remain wary of some downside risk from unexpected risk-off events, given the resurging undervaluation of the JPY and speculative positioning now turning net short JPY.

....Historically, the loonie trades weakly in December, as typical seasonal factors favor the USD and hurt oil prices. After the OPEC agreement, we expect limited upside for oil prices in the next couple of weeks, and the more hawkish tone of the FOMC poses upside risks for the USD globally.

However, significantly short CAD positioning and short-term undervaluation limits CAD downside, in our view, and the loonie is likely to remain range-bound in the next few weeks, amid light year-end flows".

Copyright © 2016 Barclays Capital, eFXnews™

-

09:54

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

Информационно-аналитический отдел TeleTrade

-

09:52

SEK Rises As Riksbank Leaves Rates Unchanged

SEK hits the day's high against the EUR around 9.6828, according to Factset, after Sweden's central bank leaves its main repo rate unchanged at minus 0.5%.

-

09:37

UK public sector net borrowing decreased by £7.7 billion

Public sector net borrowing (excluding public sector banks) decreased by £7.7 billion to £59.5 billion in the current financial year-to-date (April to November 2016), compared with the same period in 2015.

Public sector net borrowing (excluding public sector banks) decreased by £0.6 billion to £12.6 billion in November 2016, compared with November 2015.

Public sector net debt (excluding public sector banks) was £1,655.1 billion at the end of November 2016, equivalent to 84.5% of gross domestic product (GDP); an increase of £58.6 billion compared with November 2015.

-

09:30

United Kingdom: PSNB, bln, November -12.21 (forecast -11.3)

-

09:14

Italian wage inflation little changed

The index of wages according to collective labour agreements measures the evolution of wages and salaries (per employee or per hour) determined by contractual provisions set by collective agreements; the indices are calculated with reference to the fixed employment structure of the base period (December 2010).

At the end of November 2016 the coverage rate (share of national collective agreements in force for the wage setting aspects) was 32.0 per cent in terms of employees and 30.9 per cent in terms of the total amount of wages.

In November 2016 the hourly index increased by 0.1 per cent while the per employee rose by 0.2 per cent from last month.

-

09:07

Riksbank: Further purchases of government bonds for SEK 30 billion, repo rate unchanged at -0.50 per cent

Increasingly strong economic activity creates the conditions for inflation to continue rising. But there are risks that can jeopardise the upturn in inflation. Monetary policy therefore needs to remain very expansionary. The Executive Board of the Riksbank has decided to continue purchasing government bonds during the first six months of 2017, both nominal and real bonds, each corresponding to SEK 15 billion. The repo rate is retained at −0.50 per cent and there is still a greater probability that the rate will be cut than that it will be raised in the near term. Increases in the repo rate are not expected to begin until the beginning of 2018.

-

08:26

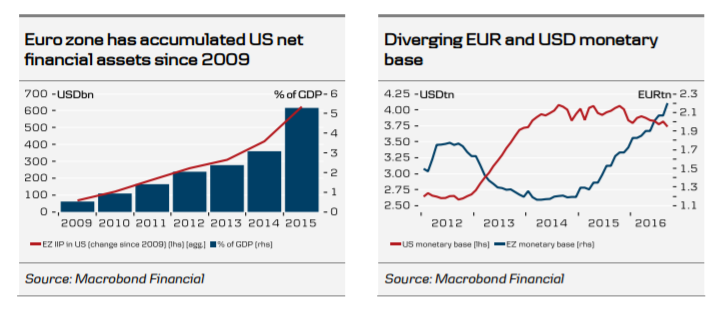

Danske says EUR/USD set to bottom around 1.02 in 1-Month

"Short term (1-3M horizon): In the short term, on the one hand there will be downward pressure on the US monetary base from the higher federal funds target and from the impact of new banking regulation with US banks set to be required to have an LCR of 100% by 1 January 2017. On the other hand, deposits on the US treasury account may fall at the beginning of next year after a resuspension of the debt ceiling, which will tend to increase the monetary base. Overall, this is likely to be marginally positive for USD and weigh on USD FX forward points vis- à-vis EUR and the Scandinavian currencies on top of the impact of the repricing of the path of Federal Reserve rate hikes, e.g. keeping the 3M EUR/USD basis spread around the present 70-80bp, and thus maintaining a significant negative carry on short USD positions. We look for EUR/USD to bottom at 1.02 in 1M.

Medium-term (6-12M horizon): Implementation of new regulation will continue in 2017, which is likely to continue to put downward pressure on the US monetary base. Additional rate hikes from the Federal Reserve in 2017 (we forecast a 25bp hike in June and December) are likely to be less of a strain on the monetary base than before and after the rate hike in December 2015, as the hiking cycle seems better aligned now with a recovery in the natural rate of interest. If the Federal Reserve attempts to push rates higher at a faster pace, it may become an issue though. This will maintain a higher negative carry on short USD positions vis-à-vis EUR and Scandinavian currencies than can be explained by the spread in interest rates, e.g. the 3M EUR/USD basis spread should stay around the present 70-80bp. Over the medium term, we look for the USD to fall back on valuation and the beginning of a correction of the large US current account deficit. As implementation of new regulation moves closer to the end, it should furthermore be less of a supportive factor for the USD. We forecast that EUR/USD will rise to 1.12 on 12M".

Copyright © 2016 Danske, eFXnews™

-

08:24

Bank of Thailand Keeps Benchmark Rate Unchanged At 1.5%

-

08:20

Thai Central Bank Raises 2017 Export Growth Projection to 0.0% From -0.5%

-

08:18

Today’s events

-

At 14:00 GMT quarterly inflation report from the SNB for the 4th quarter

-

At 15:30 GMT data from the US Department of Energy on crude oil inventorie

-

-

07:26

-

07:23

Japan's all industry activity increased at a faster-than-expected pace in October

Japan's all industry activity increased at a faster-than-expected pace in October after remaining flat in the previous month, said the Ministry of Economy cited by rttnews.

The all industry activity index rose 0.2 percent month-over-month in October, just above the 0.1 percent gain expected by economists.

In September, the index showed no variations, which was revised down from a 0.2 percent climb reported earlier.

-

07:23

Options levels on wednesday, December 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0723 (1889)

$1.0640 (478)

$1.0577 (223)

Price at time of writing this review: $1.0412

Support levels (open interest**, contracts):

$1.0346 (1079)

$1.0313 (2133)

$1.0271 (2916)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 43444 contracts, with the maximum number of contracts with strike price $1,1500 (3217);

- Overall open interest on the PUT options with the expiration date March, 13 is 53379 contracts, with the maximum number of contracts with strike price $1,0000 (5599);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2613 (995)

$1.2518 (340)

$1.2422 (183)

Price at time of writing this review: $1.2364

Support levels (open interest**, contracts):

$1.2281 (401)

$1.2185 (547)

$1.2088 (397)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 10214 contracts, with the maximum number of contracts with strike price $1,2600 (995);

- Overall open interest on the PUT options with the expiration date March, 13 is 13376 contracts, with the maximum number of contracts with strike price $1,1500 (2948);

- The ratio of PUT/CALL was 1.31 versus 1.28 from the previous trading day according to data from December, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Japanese government raised the economic forecast for the first time in 21 months

Today, the Government of Japan has published its monthly economic forecasts and said that the economy is on a path of moderate recovery and increased assessment of the economy for the first time in 21 last month. According to the authorities, the most positive developments observed in exports and household spending. In addition, the Government emphasized the improvement in business conditions, while in the previous report, business activity was estimated as neutral.

-

07:19

New Zeeland Overseas Merchandise Trade

Beef and lamb exports fell in November, as the amount of meat sold dropped heavily compared with last year's record season, Statistics New Zealand said today.

Meat and edible offal exports fell $158 million (31 percent) from November 2015, contributing to a $219 million (5.4 percent) fall in overall exports.

Beef exports fell 41 percent in value and 31 percent in quantity, and lamb exports fell 27 percent in value and 23 percent in quantity.

"Beef exports to the United States, our top beef export destination, fell by around half when compared to November last year" senior manager Jason Attewell said. "When compared to the same month of the previous year, the value of beef exports to the US have fallen in nearly every month since October 2015, only rising once in April 2016."

-

04:31

Japan: All Industry Activity Index, m/m, October 0.2% (forecast 0.1%)

-