Market news

-

23:29

Commodities. Daily history for Dec 20’2016:

(raw materials / closing price /% change)

Oil 53.51 +0.39%

Gold 1,133.90 +0.03%

-

23:29

Stocks. Daily history for Dec 20’2016:

(index / closing price / change items /% change)

Nikkei 225 19,494.53 0.00 0.00%

Shanghai Composite 3,102.48 -15.61 -0.50%

S&P/ASX 200 5,591.08 0.00 0.00%

FTSE 100 7,043.96 +26.80 +0.38%

CAC 40 4,849.89 +27.12 +0.56%

Xetra DAX 11,464.74 +38.04 +0.33%

S&P 500 2,270.76 +8.23 +0.36%

Dow Jones Industrial Average 19,974.62 +91.56 +0.46%

S&P/TSX Composite 15,292.96 +23.11 +0.15%

-

23:28

Currencies. Daily history for Dec 20’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0386 -0,14%

GBP/USD $1,2366 -0,21%

USD/CHF Chf1,0286 +0,16%

USD/JPY Y117,84 +0,64%

EUR/JPY Y122,41 +0,51%

GBP/JPY Y145,72 +0,45%

AUD/USD $0,7258 +0,22%

NZD/USD $0,6914 -0,19%

USD/CAD C$1,3366 -0,30%

-

23:00

Schedule for today,Wednesday, Dec 21’2016 (GMT0)

04:30 Japan All Industry Activity Index, m/m October 0.2%

09:30 United Kingdom PSNB, bln November -4.3 -11.3

14:00 Belgium Business Climate December -1.8 -1.3

14:00 Switzerland SNB Quarterly Bulletin

15:00 Eurozone Consumer Confidence (Preliminary) December -6.1 -6

15:00 U.S. Existing Home Sales November 5.6 5.5

15:30 U.S. Crude Oil Inventories December -2.563

21:45 New Zealand Current Account Quarter III -0.94 -5.015

21:45 New Zealand GDP q/q Quarter III 0.9% 0.9%

21:45 New Zealand GDP y/y Quarter III 3.6% 3.7%

-

22:01

New Zealand: Visitor Arrivals, November 11%

-

21:45

New Zealand: Trade Balance, mln, November -705

-

21:06

Major US stock indexes finished trading in positive territory

Major US stock indexes rose on Tuesday, with the Dow hit a record high against the background of growth of Goldman Sachs (GS), which gave the biggest boost blue-chip index. The market reacted calmly to the deadly attacks in Germany and Turkey, as well as fire at the Islamic center of Zurich in Switzerland. Trading activity in the market is low and likely to remain so, as many market participants go on vacation.

Market participants are focused on the promises of the newly elected President of the United States, Donald Trump and prospects of the Fed's monetary policy in 2017. Recall, at its last meeting, which ended on Wednesday, 14 December, the regulator will not only increase the interest for the first time this year (by 0.25 percentage points to 0.50% -0.75%), but also improved predictions about the pace of rate hikes in the next year: at the moment it predicted three raises rates by 25 bps against two waiting at previous meetings. Optimism added as a comment yesterday Fed Chairman Janet Yellen relatively labor market prospects in the US and accelerating inflation. Ms. Yellen said that the labor market has improved his fortune to the most severe in a decade, wage growth has increased, which has helped to increase inflation expectations and the expectations of the Fed interest rates.

It is also worth noting that after the closure of the trading session is expected to publish quarterly reports FedEx (FDX) and Nike (NKE).

DOW index components closed mostly in positive territory (21 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.72%). Outsider were shares of Merck & Co., Inc. (MRK, -1.05%).

Almost all sectors of the S & P ended the session in positive territory. The leader turned out to be the financial sector (+ 0.7%). Decreased only utilities sector (-0.1%).

At the close:

Dow + 0.46% 19,973.73 +90.67

Nasdaq + 0.49% 5,483.94 +26.50

S & P + 0.36% 2,270.73 +8.20

-

20:00

DJIA +0.32% 19,946.23 +63.17 Nasdaq +0.29% 5,473.52 +16.08 S&P +0.20% 2,267.14 +4.61

-

17:00

European stocks closed: FTSE 100 +26.80 7043.96 +0.38% DAX +38.04 11464.74 +0.33% CAC 40 +27.12 4849.89 +0.56%

-

16:30

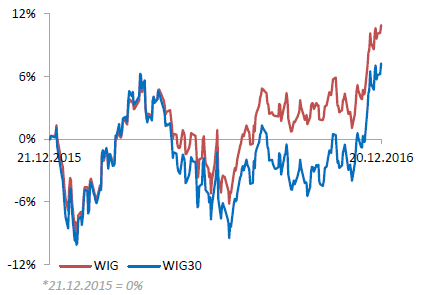

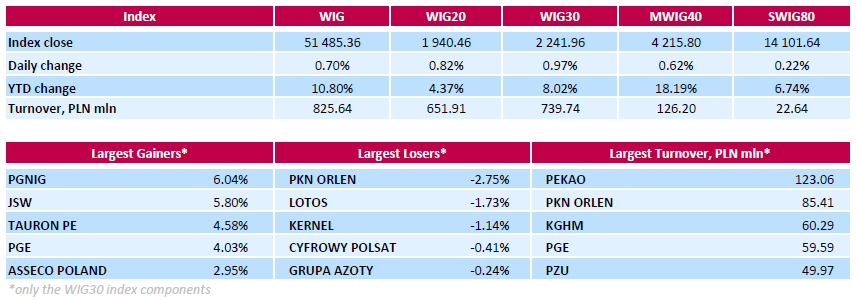

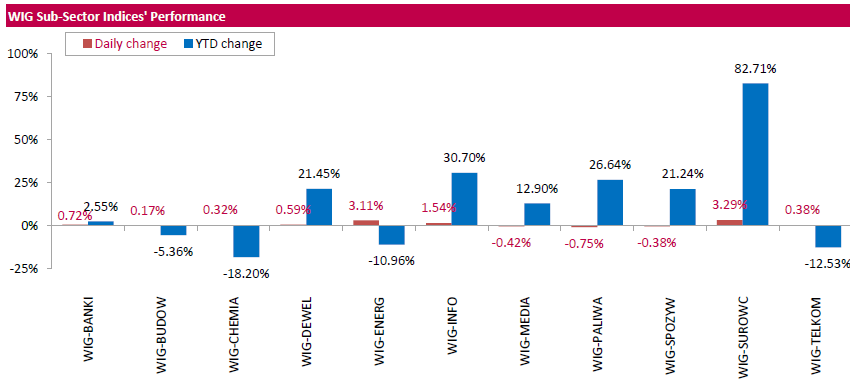

WSE: Session Results

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.7%. The WIG sub-sector indices were mainly higher with materials (+3.29%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 0.97%. A majority of the index components returned gains, with the way up led by oil and gas producer PGNIG (WSE: PGN), which soared by 6.04%. Other major advancers were coking coal miner JSW (WSE: JSW) and two genco TAURON PE (WSE TPE) and PGE (WSE: PGE), which added between 4.03% and 5.8%. Among few decliners, two oil refiners PKN ORLEN (WSE: PKN) and LOTOS (WSE: LTS) were the weakest performers, tumbling by 2.75% and 1.73% respectively, weighted down by analyst downgrade.

-

16:21

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday. Financial stocks pushed the Dow to a record high, Goldman Sachs (GS), which was up 1,2%, gave the biggest boost to the blue-chip index. U.S. stocks have been on a tear since the November 8 presidential election, with the S&P rising nearly 6 percent on bets that President-elect Donald Trump's plans for deregulation and infrastructure spending will boost the economy.

Most of Dow stocks in positive area (17 of 30). Top gainer - Caterpillar Inc. (CAT, +1.81%). Top loser - Pfizer Inc. (PFE, -0.70%).

All S&P sectors in positive area. Top gainer - Conglomerates (+0.9%).

At the moment:

Dow 19911.00 +74.00 +0.37%

S&P 500 2267.75 +7.75 +0.34%

Nasdaq 100 4958.25 +19.50 +0.39%

Oil 53.62 +0.56 +1.06%

Gold 1129.00 -13.70 -1.20%

U.S. 10yr 2.58 +0.04

-

15:49

Gold trading lower today as terror incidents in Europe did not perturb financial markets

Gold prices retreated on Tuesday as an assassination in Turkey and a suspected terror attack in Germany failed to perturb financial markets, says Down Jones.

Gold pulled back 0.36% to $1,133.33 a troy ounce in morning trade in London, as other precious metals also fell. The dollar strengthened, with the WSJ Dollar Index up 0.3% at 93.45, and stocks climbed after U.S. Federal Reserve Chairwoman Janet Yellen in a speech hailed the strength of the graduate employment market.

"[The] gold price is back on the decline having enjoyed three sessions of gains, with risk sentiment doing little to attract investors as the U.S. dollar once again rallies due to the Bank of Japan maintaining accommodative monetary policy and Fed Chair Janet Yellen claiming the U.S. jobs market is at its strongest in a decade," wrote analysts at Accendo Markets.

-

15:22

EUR/SEK is moving lower as market participants don't believe the Riksbank will cut rates on Wednesday

-

15:08

Hungary's central bank revises considerably its 2017 growth forecast to 3.6% from 3.0%

-

14:52

WSE: After start on Wall Street

The market in the United States opens with an increase of 0.22%, which is fully consistent with the behavior of the futures market. It helps increase in oil prices, which de facto also improved climate around the Stock Exchange and listed on the Warsaw mining companies. On Wall Street still we are seeing consolidation and aversion to discounts should be considered as a bulls success. Slowly we enter the Christmas period, and then the end of the year, which in principle would be positive for shareholders.

An hour before the end of today's trading the WIG20 index was at the level of 1,940 points (+0.79%).

-

14:48

UK PM May: Exit negotiations will not be extended but they might be concluded sooner than two years

-

Art. 50 process will not be extended

-

The governments machinery to prepare for Brexit is running well

-

Will not give a running commentary on negotiations

-

Fully expects to operate within the timetable set out by art50 and to leave the EU by Apr 2019

-

Will introduce a repeal bill next year to come into effect when we leave the EU

-

Will make a speech early next year to set out the Brexit approach

-

When we are outside the EU, British courts will set all the law in UK

*via forexlive -

-

14:32

U.S. Stocks open: Dow +0.25%, Nasdaq +0.29%, S&P +0.21%

-

14:19

Before the bell: S&P futures +0.27%, NASDAQ futures +0.24%

U.S. stock-index futures advanced as markets reacted calmly to deadly attacks in Germany and Turkey, and a shooting at an Islamic center in Zurich, Switzerland.

Global Stocks:

Nikkei 19,494.53 +102.93 +0.53%

Hang Seng 21,729.06 -103.62 -0.47%

Shanghai 3,102.48 -15.61 -0.50%

FTSE 7,040.13 +22.97 +0.33%

CAC 4,845.24 +22.47 +0.47%

DAX 11,452.24 +25.54 +0.22%

Crude $53.44 (+0.72%)

Gold $1,130.50 (-1.07%)

-

14:16

Global dairy trade price index -0.5%

-

Prior 3.5%

-

Average auction price $3656 MT

-

-

14:14

EUR/USD Falls to Lowest Since 2003

-

14:07

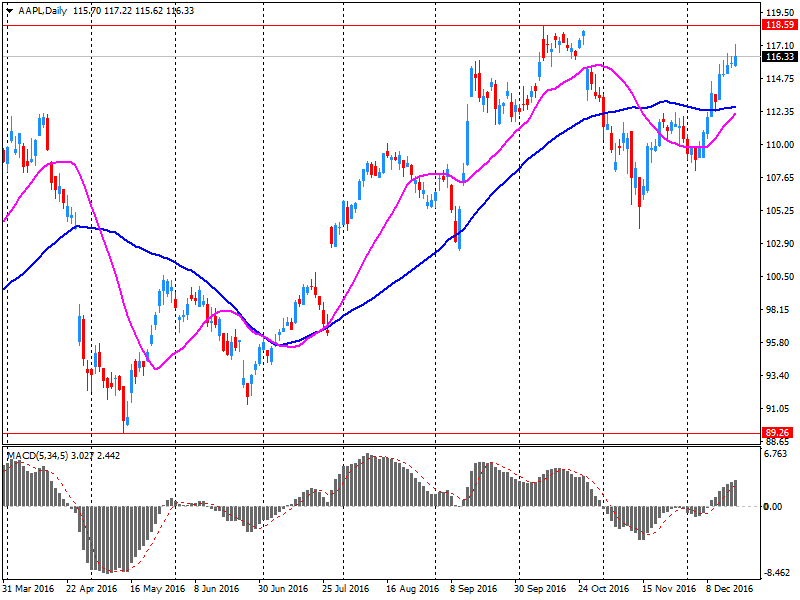

Apple is discussing with the Indian authorities the possibility of production in the country

According to WSJ, citing two senior government officials, Apple has discussed with the Indian government the ability to manufacture its products in the country as it seeks to increase sales and presence there.

In a letter to the government the company outlined its plans and financial measures it needs to achieve them, officials said. After that, representatives of the Ministry of Commerce held a meeting to discuss the matter.

A spokesman for Apple has not responded on the WSJ information.

The implementation of the process of production will enable Apple to open its own stores in India, which will help promote its brand in the country with the fastest growing smartphone market, where its share at the moment is less than 5%.

Indian smartphone market is expected to surpass the US market, and will be the second largest in the world after China, according to research firm IDC. Over the years, sales in China have fueled the growth of Apple, but now it slows down the pace.

AAPL shares rose in premarket trading to $ 116.80 (+ 0.14%).

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

29.76

0.47(1.6046%)

937

ALTRIA GROUP INC.

MO

67.31

0.16(0.2383%)

513088

Amazon.com Inc., NASDAQ

AMZN

768.6

2.60(0.3394%)

15273

Apple Inc.

AAPL

116.75

0.11(0.0943%)

83778

AT&T Inc

T

42.22

0.10(0.2374%)

4397

Barrick Gold Corporation, NYSE

ABX

14.04

-0.20(-1.4045%)

127784

Boeing Co

BA

156.5

0.32(0.2049%)

3619

Caterpillar Inc

CAT

93.55

0.84(0.9061%)

6614

Citigroup Inc., NYSE

C

59.99

0.33(0.5531%)

54083

Exxon Mobil Corp

XOM

90.8

0.38(0.4203%)

26215

Facebook, Inc.

FB

119.31

0.07(0.0587%)

68506

FedEx Corporation, NYSE

FDX

198.5

0.88(0.4453%)

3315

Ford Motor Co.

F

12.7

0.04(0.316%)

28614

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.64

0.09(0.6642%)

55976

General Electric Co

GE

31.98

0.06(0.188%)

18109

Goldman Sachs

GS

240

0.93(0.389%)

9909

Intel Corp

INTC

36.99

0.10(0.2711%)

43632

JPMorgan Chase and Co

JPM

85.78

0.35(0.4097%)

23419

McDonald's Corp

MCD

123.25

0.26(0.2114%)

7955

Microsoft Corp

MSFT

63.77

0.15(0.2358%)

61987

Nike

NKE

51.15

0.30(0.59%)

18514

Pfizer Inc

PFE

32.85

0.02(0.0609%)

34676

Tesla Motors, Inc., NASDAQ

TSLA

203.58

0.85(0.4193%)

7444

Twitter, Inc., NYSE

TWTR

18.3

0.06(0.3289%)

19991

Walt Disney Co

DIS

105.7

0.40(0.3799%)

16185

Yandex N.V., NASDAQ

YNDX

20.16

0.20(1.002%)

16600

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Positive from Mixed at OTR Global

Downgrades:Other:

-

13:39

Ex Deutsche Bank employee has earned 255 million rubles by manipulating "blue chip" stocks

The Bank of Russia has established that the Moscow stock exchange trading of 8 large companies was manipulated from January 2013 to July 2015, in which a group of people made a profit of about 255 million rubles.

Transactions within the specified period of time were made with ordinary shares of Gazprom, VTB, MMC Norilsk Nickel, Lukoil, Magnet and Rosneft.

-

13:33

Canadian wholesale sales increased offsetting most of September's 1.5% decrease

Wholesale sales increased 1.1% to $56.6 billion in October, offsetting most of September's 1.5% decrease. Gains were recorded in five subsectors, led by higher sales in the building material and supplies, motor vehicle and parts, and food, beverage and tobacco subsectors.

In volume terms, wholesale sales increased 0.9%.

Sales rose in five of seven subsectors, representing approximately 87% of total wholesale sales.

The building material and supplies subsector recorded the largest increase in dollar terms, up 2.8% to $7.6 billion on the strength of sales in the lumber, millwork, hardware and other building supplies industry, which recorded the lone increase (+5.6%) and reached a record high. Exports of forestry products and building and packaging materials increased in October.

Sales in the motor vehicle and parts subsector rose 1.8% to $11.3 billion in October. While sales increased in two of three industries in the subsector, sales in the motor vehicle industry (+1.2%) rose to a record high and accounted for more than half of the advance in the subsector. Imports and exports of motor vehicles and parts increased in October.

-

13:30

Canada: Wholesale Sales, m/m, October 1.1% (forecast 0.6%)

-

13:05

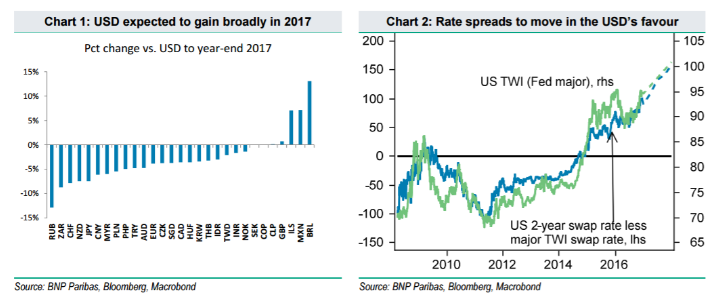

BNP expects USD to gain broadly in 2017

"We think FX market price action in Q4 2016 will prove to be a reliable template for much of the year ahead, with the USD expected to gain broadly.

Our forecasts, as illustrated in Chart 1, call for the USD to gain ground vs most major and EM currencies, with the BRL and MXN representing notable exceptions.

We expect EURUSD to reach parity by year-end 2017, and we are even more ambitious for USDJPY, which we target at 128.

we remain positioned for USD gains via derivatives in USDJPY (targeting 128 by the end of 2017) and USDCAD (targeting 1.36 by the end of Q1 2017

Our forecasts imply that the Fed's broad tradeweighted USD index will appreciate by about 3% in 2017, topping its 2002 peak, and the major currency index will gain about 4%, falling short of its best levels in 2002. As has been the case for most of the past five years, the case for USD appreciation vs. G10 currencies is based on expectations for policy divergence. However, while policy divergence during 2011-16 was mainly driven by policy easing outside of the US, the next phase of USD gains is likely to be driven by Fed rate hikes. Our economists forecast above-trend growth averaging 2.4% in the US in 2017, spurred by fiscally stimulative tax reform and infrastructure spending programs we expect to be passed in the second half of the year.

With the US labour market operating close to full capacity and growth running above trend, we expect wage pressures to rise in 2017 and CPI to accelerate to a 2.2% y/y pace. Against this backdrop, we expect the Fed to deliver two rate hikes in the second half of 2017 and markets will likely price for rate hikes to continue through 2018. Consistent with this, we expect the two-year Treasury yield to reach 1.9% by the end of 2017, up from the current 1.28%. And, with other G10 central banks on hold or even easing further, front-end rate differentials should move substantially further in the USD's favour".

Copyright © 2016 BNP Paribas™, eFXnews™

-

13:00

Orders

EUR/USD

Offers : 1.0400 1.0420-25 1.0450-55 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers : 1.2400 1.2425-30 1.2450 1.2485 1.2500-10 1.2530 1.2550

Bids: 1.2355-60 1.2330-35 1.2300 1.2285 1.2250 1.220-25 1.2200

EUR/GBP

Offers : 0.8400-05 0.8420-25 0.8450 0.8460-65 0.8480 0.8500

Bids: 0.8370 0.8350-55 0.8330-35 0.8300 0.8285 0.8250

EUR/JPY

Offers : 122.60 122.80 123.00-05 123.30 123.60 123.85 124.00-10

Bids: 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers : 118.00 118.20-25 118.45-50 118.80 119.00 120.00

Bids: 117.70 117.50 117.25-30 117.00-116.95 116.70 116.50 116.30 116.00

AUD/USD

Offers : 0.7270 0.7285 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids: 0.7220-25 0.7200 0.7170 0.7145-50 0.7100

-

12:01

WSE: Mid session comment

The first half of today's session on the Warsaw market has brought breakout to new highs in case of the largest companies index. The environment is clearly calmer and thus, like yesterday, the Warsaw Stock Exchange stands out positively.

At the halfway point of today's quotations the WIG20 index was at the level 1,941 points (+0,90%) and the turnover in the segment of the largest companies was amounted to PLN 270 million.

-

11:45

Turkish central bank held interest rates steady despite hike exptectations

The Turkish central bank on Tuesday held interest rates steady, surprising economists who had expected an increase, while the local currency remained under pressure against the dollar amid rising security threats, mounting geopolitical risks and expectations of further rate increases by the U.S. Federal Reserve, says Dow Jones.

-

11:42

Major stock indices in Europe little changed

Stock indices in Europe are trading without major dynamics. The market has a burst of activity in mergers and acquisitions (M & A).

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2%, to 360.43 points.

Mediaset shares soared 17% on the information that the French Vivendi SA intends to increase its stake in the Italian broadcasting company founded and controlled by former Italian Prime Minister Silvio Berlusconi, to 30%.

The cost of Lloyds Banking Group shares increased by 1%. The Bank said it was buying British credit card issuer MBNA Ltd. at the FIA Jersey Holdings Ltd., owned by Bank of America, for 1.9 billion pounds ($ 2.4 billion) in cash.

Share of Italian banks rose on the information that the government will offer 20 billion euros to support the most troubled banks.

Shares of Monte dei Paschi rose 1,1%, Banca Popolare di Milano +2,6%, UniCredit +2%.

The Italian Government, in spite of the appeal to the Parliament, is still hoping that will be able to avoid the infusion of taxpayers' money in the troubled banking sector. This will depend on the ability of Monte dei Paschi, the third by market capitalization in the country to implement a plan of recapitalization of 5 billion euros by the end of the year, writes FT.

Meanwhile, the shares of mining companies decline after falling prices for base metals.

Randgold Resources fell 1,2%, Glencore - 0,7%, BHP Billiton - 0.5%.

Shares of individual transport companies and tourism sector react negatively to reports about the murder of the Russian ambassador in Turkey and the death of people in Berlin as a result of a truck collison, suspected terorist attack.

Thus, the value of International Consolidated Airlines Group (IAG), which includes British Airways, fell 0,5%, InterContinental Hotels Group - also by 0.5%.

At the moment:

FTSE 7013.00 -4.16 -0.06%

DAX 11432.75 6.05 0.05%

CAC 4837.91 15.14 0.31%

-

11:06

UK retail sales growth accelerated - CBI

Retail sales growth accelerated in the year to December, with volumes rising at the fastest pace since September 2015, according to the CBI's latest monthly Distributive Trades Survey.

The survey of 112 firms consisting of 53 retailers showed that sales volumes for the time of year were considered well above average, but growth is expected to slow somewhat in the year to January. Meanwhile, orders placed on suppliers rose at the fastest pace in over a year, but are expected to be broadly stable in January.

-

11:02

GBP/USD Falls to 1-Month Low of $1.2344

-

10:31

Thailand's Central Bank Expected to Keep Policy Rate Stable: Poll

-

09:55

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 937m) 1.0500 (1.65bln) 1.0510-15 (836m)

USD/JPY 115.35-50 (USD 1bln) 116.25 (441m)

GBP/USD 1.2100 (GBP 405m)

AUD/USD 0.7200 (AUD 997m) 0.7390-0.7400 (818m) 0.7500 444m)

USD/CAD 1.3300 (USD 808m) 1.3800 (801m)

NZD/USD 0.6900 (526m)

Информационно-аналитический отдел TeleTrade

-

09:40

Oil trading flat in low activity

This morning New York crude oil futures for Brent and WTI trading almost flat. The market has already started to experience low activity and decreased trading volume on the eve of Christmas and New Year holidays. In addition, many experts are not waiting for activity on this trading week, as well as the possible factors that could push up the price of oil.

-

09:29

Switzerland's foreign trade surplus increased in November

Switzerland's foreign trade surplus increased in November, as imports fell faster than exports, the State Secretariat for Economic Affairs said Tuesday.

The trade surplus rose to CHF 3.6 billion in November from CHF 2.7 billion in October. Economists had expected the surplus to climb to CHF 3.56 billion.

In real terms, exports dropped 0.4 percent month-over-month in November and their by reaching at its lowest level since September 2015. Imports declined 4.2 percent over the month, rttnews says.

-

09:07

The current account of the euro area recorded a higher than expected surplus

The current account of the euro area recorded a surplus of €28.4 billion in October 2016 (see Table 1). This reflected surpluses for goods (€26.0 billion), services (€9.3 billion) and primary income (€6.1 billion), which were partly offset by a deficit for secondary income (€13.0 billion).

The 12-month cumulated current account for the period ending in October 2016 recorded a surplus of €344.3 billion (3.2% of euro area GDP), compared with one of €320.2 billion (3.1% of euro area GDP) for the 12 months to October 2015 (see Table 1 and Chart 1). This was due to increases in the surpluses for goods (from €340.2 billion to €364.8 billion) and services (from €60.0 billion to €62.4 billion), as well as a decrease in the deficit for secondary income (from €132.5 billion to €129.9 billion). These were partly offset by a decrease in the surplus for primary income (from €52.6 billion to €47.1 billion).

-

09:00

Eurozone: Current account, unadjusted, bln , October 32.8

-

08:52

Major stock markets trading lower: FTSE -0.2%, DAX -0.1%, CAC40 -0.1%, FTMIB flat, IBEX -0.1%

-

08:19

WSE: After opening

WIG20 index opened at 1929.47 points (+0.25%)*

WIG 51294.59 0.32%

WIG30 2230.90 0.47%

mWIG40 4195.52 0.14%

*/ - change to previous close

Cash market opens with an increase of 0.25% with the turnover clearly focused on the GTC. Yesterday's session was so successful that roused appetites for more. The environment is clearly calmer and the German DAX lost slightly in value.

After fifteen minutes of trading WIG20 index was at the level of 1,938 points (+0.74%).

-

08:09

Today’s events

-

At 14:00 GMT China will publish leading indicators index for November

-

At 12:00 GMT the global dairy product auction

-

-

07:45

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.1%

-

07:29

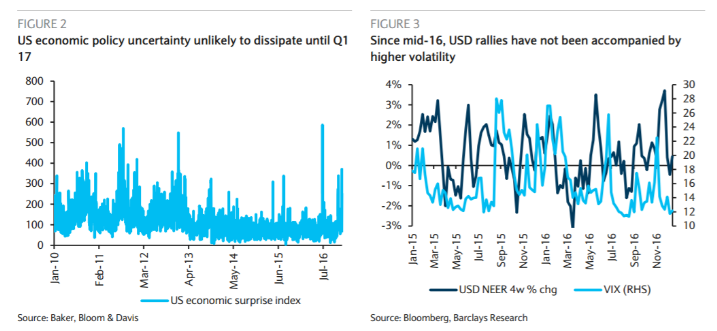

Barclays has 3 reasons for sharper near-term USD upside risks

"Last week's FOMC meeting was more eventful than what we and the market were expecting. We read subtle hawkish signals regarding the outlook of monetary policy, therefore tilting risks for the USD toward a sharper appreciation in the months to come (see USD upside risks), against our expectations of USD consolidation

First, because any potential fiscal boost from the Trump administration is still very uncertain (Figure 2), it has yet to be incorporated into the FOMC's economic outlook, as only "some" members included it in their projections. Therefore, we see further room for the market to price in a steeper path for the fed funds rate in 2017, as fed funds futures are pricing only 55bp of hikes in the year to come.

Second, the FOMC seems less concerned about the effect of a higher USD and rates. Unlike previous episodes, the USD recent uptrend has not been accompanied by higher volatility or a sharp move lower in commodity prices (Figure 3), something that had constrained the Fed before from accelerating its normalization pace. It looks like Chair Yellen now sees the re-pricing in US assets as consistent with the improvement in the job, growth and inflation outlook stemming from the market's implicitly pricing a more expansionary fiscal policy.

Third, the appetite for running a "high pressure" economy to boost productivity growth at this point of the business cycle is diminishing. Although Chair Yellen emphasized the fact that the revision in the median projection of the 2017 dots, employment and growth outlook was very moderate, she did not stress as much as in the past the fact that the normalization process should be gradual".

Copyright © 2016 Barclays Capital, eFXnews™

-

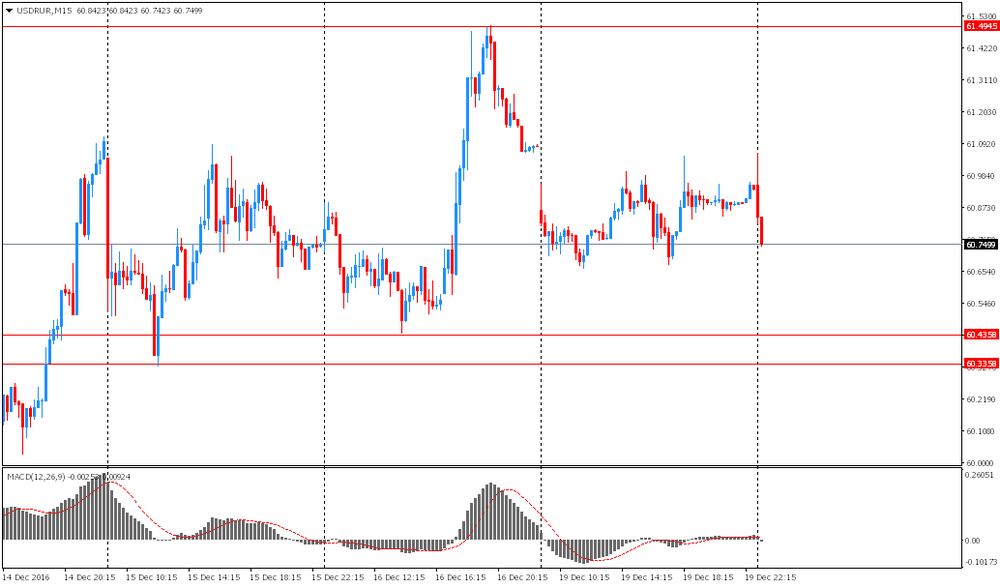

07:25

USD / RUR opened lower

USD / RUR was marked by a slight decrease by 15 cents to 60.75. Yesterday the pair traded in a range of 40 cents, while remaining in the correction, however, the overall trend remains downward. Immediate support is the area of 15 and 16 December lows (60.34-44), and resistance - Friday's high (61.49).

-

07:22

Options levels on tuesday, December 20, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0675 (795)

$1.0628 (201)

$1.0589 (223)

Price at time of writing this review: $1.0388

Support levels (open interest**, contracts):

$1.0354 (1079)

$1.0318 (1988)

$1.0274 (2860)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 43112 contracts, with the maximum number of contracts with strike price $1,1500 (3217);

- Overall open interest on the PUT options with the expiration date March, 13 is 53157 contracts, with the maximum number of contracts with strike price $1,0000 (5599);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.2615 (995)

$1.2520 (329)

$1.2425 (172)

Price at time of writing this review: $1.2391

Support levels (open interest**, contracts):

$1.2282 (342)

$1.2186 (545)

$1.2089 (378)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 10087 contracts, with the maximum number of contracts with strike price $1,2600 (995);

- Overall open interest on the PUT options with the expiration date March, 13 is 12932 contracts, with the maximum number of contracts with strike price $1,1500 (2947);

- The ratio of PUT/CALL was 1.28 versus 1.28 from the previous trading day according to data from December, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Italy will allocate $ 21 billion to rescue troubled banks

Bloomberg published a report on the intention of the Government of Italy to expand the country's public debt by 20 billion euros (21 billion dollars) in order to support the country's troubled banks. Sources say that it is primarily about Banca Monte dei Paschi di Siena.

-

07:20

WSE: Before opening

Monday's session on the New York stock markets brought slight increases in the major indexes. At the close the Dow Jones Industrial rose by 0.20 percent, Nasdaq Composite was firmer by 0.37 percent and the S&P500 gained 0.20 percent.

In yesterday's speech Janett Yellen, the head of the Fed, assessed that the US currently has the strongest job market in a decade, and there are signs of accelerating wage growth.

At the opening of Europe may be of importance yesterday evening events, it is a coup in Berlin, where the truck drove into the crowd of people and the assassination of the Russian ambassador in Ankara. It is increasing geopolitical tension, but investors after previous similar events are more immune.

In Asian markets, the Nikkei gained approx. 0.5% and on other parquets are dominates by the red colour, which in China is slightly higher and the stock market index in Shanghai loses approx. 0.9%. The US futures are stable in the morning and so it should begin sessions in Europe.

-

07:19

IMF board reaffirms "full confidence" in Lagarde despite French ruling

-

07:16

Bank of Japan: Japan's economy continues a moderate recovery trend

-

We continue to buy government bonds in accordance with the previous rate of 80 trillion yen per year

-

The target level for 10-year bonds remained at about 0%

-

Inflation will reach 1.1% in fiscal year 2017 versus 0% in 2016 fiscal year

-

We forecast GDP growth of 1.5% in the 2017 fiscal year, compared to 1.3% in 2016 fiscal year

-

Inflation expectations remained weak

-

Production increased against the background of exports above expectations

-

-

07:15

Bank of Japan holds interest rate at -0.10%. USD/JPY up 100 pips on the asian session

-

07:12

RBA meeting minutes: Wage growth had remained low and continued to be lower than implied by the historical relationship with the unemployment rate

Members commenced their discussion of the domestic economy by noting that the unemployment rate was unchanged at 5.6 per cent in October, somewhat more than ½ percentage point below its peak in mid 2015. Despite a rise in full-time employment in October, all of the growth in employment over 2016 had been in part-time employment, with an increased share of people in the labour force reporting that they would like to work more hours. Members discussed various measures of labour underutilisation, including those that account for the number of hours sought by the unemployed and the additional hours desired by those who are underemployed (and who are also recorded as actively searching for additional hours). Such hours-based measures of underutilisation had declined to a similar extent as the unemployment rate since late 2015 and, unlike the heads-based measure, had not increased recently.

Wage growth had remained low and continued to be lower than implied by the historical relationship with the unemployment rate. The wage price index (WPI) had increased by a little less than expected in the September quarter and year-ended growth in the WPI had eased a little further. Although there had been some evidence from enterprise agreements that growth in construction wages had picked up recently, these agreements covered a relatively small share of the total workforce.

-

07:03

German producer prices for industrial products rose by 0.1%

In November 2016 the index of producer prices for industrial products rose by 0.1% compared with the corresponding month of the preceding year. This was the first positive annual rate of change since June 2013 (+0.1%). In October 2016 the annual rate of change all over had been -0.4%.

Compared with the preceding month October 2016 the overall index rose by 0.3% in November 2016 (0.7% in October and - 0.2% in September).

In November 2016 energy prices decreased by 1.7% compared with November 2015, prices of intermediate goods rose by 0.4%. In contrast prices of non-durable consumer goods rose by 1.5%, prices of capital goods by 0.6% and prices of durable consumer goods by 1.0%.

The overall index disregarding energy rose by 0.8% compared with November 2015 and by 0.3% compared with October 2016.

-

07:01

Germany: Producer Price Index (YoY), November 0.1% (forecast -0.2%)

-

07:00

Switzerland: Trade Balance, November 3.64

-

07:00

Germany: Producer Price Index (MoM), November 0.3% (forecast 0.1%)

-

06:14

Global Stocks

European stock markets dropped from a 2016 high on Monday, with the recent rally in banks on pause as troubled lender Banca Monte dei Paschi di Siena SpA made a last-ditch effort to avoid a state bailout. Banks have been a major factor in the recent rally, rising on hopes for a resolution to the Italian banking crisis and tracking sharp gains in the U.S. financial services sector.

U.S. stocks advanced tepidly on Monday with investors somewhat reluctant to make big bets in a preholiday week while the main benchmarks were sitting near all-time highs set last week. Trading volumes were thinner than usual, with the New York Stock Exchange reporting volume at 60% of the 30-year average, according to FactSet. After a mild knee-jerk reaction to news of the assassination of the Russian ambassador to Turkey, markets resumed their climb to close modestly higher.

A strong outlook on the U.S. economy by U.S. Federal Reserve chair Janet Yellen and positive economic data from Germany lifted Asian shares Tuesday, even as traders reacted to the attacks in Berlin and Turkey. Speaking at the University of Baltimore's midyear commencement ceremony Monday, Yellen said recent improvements in the economy have created one of the strongest job markets in years for graduates.

-

03:00

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-