Noticias del mercado

-

21:59

U.S.: Total Vehicle Sales, mln, March 16.57 (forecast 17.5)

-

17:57

Italy’s unemployment rate climbs to 11.7% in February

The Italian statistical office Istat released its unemployment data on Friday. The seasonally adjusted unemployment rate increased to 11.7% in February from 11.6% in January. January's figure was revised up from 11.5%.

The number of unemployed people was 2.980 million in February, up 0.3% from the month before.

The youth unemployment rate decreased to 39.1 in February from 39.2% in January.

The employment rate fell to 56.4% in February from 56.6% in January.

-

17:51

New York Federal Reserve President William Dudley: the Fed should be cautious in raising its interest rate

New York Federal Reserve President William Dudley said on Thursday that he agreed with Fed Chairwoman Janet Yellen and the Fed should be cautious in raising its interest rate. He noted that the Fe should hike its interest rate gradually.

-

17:47

Cleveland Federal Reserve Bank President Loretta Mester: gradual interest rate hikes are appropriate

Cleveland Federal Reserve Bank President Loretta Mester said in an interview with Fox Business on Friday that gradual interest rate hikes were appropriate. She noted that she did not know how she would vote in April, adding that she wanted to see the incoming economic data.

Mester also said that she downgraded its forecast slightly compared to December, due to a slower economic growth in the fourth quarter.

-

16:43

Canadian manufacturing PMI rises to 51.5 in March

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Friday. The index rose to 51.5 in March from 49.4 in February. It was the highest level since December 2014.

The rise was mainly driven by stronger export demand.

"The low Canadian dollar contributed to further improvement in export volumes during the first quarter of 2016 and a return to growth in the manufacturing sector. In the remainder of 2016, we expect manufacturing conditions to continue to improve, driven by firm U.S. domestic demand and a weaker Canadian dollar which will drive demand for exports of autos, consumer goods, machinery, equipment and lumber," RBC senior vice-president and chief economist, Craig Wright, said.

-

16:36

Greece’s manufacturing PMI rises to 49.0 in March

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Friday. Greece's manufacturing purchasing managers' index (PMI) rose to 49.0 in March from 48.4 in February.

New orders and production remained below 50 in March, while employment rose slightly.

"Survey data for March signals a further deterioration of operating conditions in the manufacturing sector of Greece. However, the downturn has eased considerably from the lows of last summer," Markit economist Samuel Agass said.

-

16:28

Thomson Reuters/University of Michigan final consumer sentiment index declines to 91.0 in March

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 91.0 in March from 91.7 in February, up from the preliminary estimate of 90.0 and beating expectations a fall to 90.5.

"Despite the recent small monthly variations, the overall level of confidence has remained largely unchanged during the past nine months," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"Consumers anticipated that the slower pace of economic growth will more than likely put an end to further declines in the unemployment rate. What was surprising was that the expectations of higher gas prices and higher unemployment have not caused an increase in uncertainty about personal financial prospects," he added.

The current economic conditions index fell to 105.6 in March from 106.8 in February, in line with the preliminary reading.

The index of consumer expectations declined to 81.5 in March from 81.9 in February, up from a preliminary reading of 80.0.

The one-year inflation expectations increased to 2.7% in March from 2.5% in February, in line with the preliminary reading.

-

16:21

Construction spending in the U.S. is down 0.5% in February

The U.S. Commerce Department released construction spending data on Friday. Construction spending in the U.S. fell 0.5% in February, missing expectations for a 0.1% gain, after a 2.1% increase in January. January's figure was revised up from a 1.5% rise.

The decrease was mainly driven by a drop in total public spending. Total public construction spending slid 1.7% in February, while total spending on private construction projects decreased 0.1%.

-

16:15

ISM manufacturing purchasing managers’ index rises to 51.8 in March

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Friday. The index rose to 51.8 in March from 49.5 in February. Analysts had expected the index to increase to 50.7.

A reading above 50 indicates expansion, below indicates contraction.

The increase was mainly driven by rises in production and new orders. The production index increased to 55.3 in March from 52.8 in February, while the new orders index jumped to 58.3 from 51.5.

The employment index was down to 48.1 in March from 48.5 in February.

The price index increased to 51.5 in March from 38.5 in February.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, March 91 (forecast 90.5)

-

16:00

U.S.: Construction Spending, m/m, February -0.5% (forecast 0.1%)

-

16:00

U.S.: ISM Manufacturing, March 51.8 (forecast 50.7)

-

15:53

Option expiries for today's 10:00 ET NY cut

USDJPY: 112.50 (USD 330m) 112.90-113.00 (863m) 113.45-50 (490m) 113.60 (260m) 114.00 (719m) 115.00 (624m)

EURUSD: 1.1150 (EUR 1.09bn) 1.1260 (310m) 1.1350 (238m) 1.1410 (536m) 1.1500 (431m)

GBPUSD: 1.4400 (GBP 431m) 1.4425 (182m) 1.4475 (173m)

AUDUSD: 0.7600 (AUD 665m) 0.7675 (219m)

NZDUSD: 0.6675 (NZD 200m)

USDCAD: 1.3200-05 (CAD 410m) 1.3300 (239m) 1.3415-20 (445m) 1.3445 (260m)

-

15:50

U.S. final manufacturing purchasing managers' index (PMI) increases to 51.5 in March

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 51.5 in March from 51.3 in February, up from the previous estimate of 51.4.

A reading above 50 indicates expansion in economic activity.

The index was driven by a faster pace of growth in new business.

"March's survey highlights sustained weakness across the US manufacturing sector, meaning that overall growth through the first quarter slowed to its lowest since late-2012," Markit's Senior Economist Tim Moore said.

-

15:45

U.S.: Manufacturing PMI, March 51.5 (forecast 51.4)

-

15:44

Bank of Japan board member Makoto Sakurai: the downside risks to the Japanese economy increased in the recent six months

Bank of Japan (BoJ) board member Makoto Sakurai said on Friday that the downside risks to the Japanese economy increased in the recent six months. He supported the central bank's monetary policy easing, saying that bold monetary policy measures should be used.

"When you need to take steps, you obviously want to do something effective so you need to take bold steps," he said.

Sakurai also said that new tools were needed to ease the monetary policy further.

-

15:26

Australian Industry Group’s manufacturing purchasing managers’ index for Australia rises to 58.1 in March, the highest level since April 2004

The Australian Industry Group (AiG) released its manufacturing purchasing managers' index (PMI) for Australia on the late Thursday evening. The index rose to 58.1 in March from 53.5 in February. It was the highest level since April 2004.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Main contributor to the rise was new orders.

-

15:18

Final Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 49.1 in March

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 49.1 in March from 50.1 in February, in line with the preliminary reading.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

The index was driven by drops in output and in new orders. New export orders slid at the fastest rate since January 2013.

"Manufacturing conditions in Japan worsened at the end of the first quarter of 2016. Both production and new orders contracted, with total incoming work declining at the sharpest rate in nearly two years," economist at Markit, Amy Brownbill, said.

-

15:08

Spain’s manufacturing PMI drops to 53.4 in March

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Friday. Spain's manufacturing purchasing managers' index (PMI) declined to 53.4 in March from 54.1 in February.

The decrease was driven by a slower growth in output and new orders, while input costs dropped.

"Although growth in the Spanish manufacturing sector has slowed from the start of the year, the latest monthly improvements in output and new orders were still respectable and there is little sign at this stage of a move towards stagnation," a senior economist at Markit Andrew Harker said.

-

15:03

Italy’s manufacturing PMI increases to 53.5 in March

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Friday. Italy's Markit/ADACI manufacturing PMI increased to 53.5 in March from 52.2 in February.

The increase was driven by a faster growth in output, new orders and exports.

"The manufacturing sector ended the first quarter on a solid footing, according to the latest PMI data, with March seeing accelerated growth in output and inflows of new orders. Moreover, with inventories of finished goods falling sharply, there's a good chance that production will be ramped up further to replenish stock," Markit economist Phil Smith said.

-

14:49

U.S. unemployment rate rises to 5.0% in March, 215,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 215,000 jobs in March, exceeding expectations for a rise of 205,000 jobs, after a gain of 245,000 jobs in February. February's figure was revised up from a rise of 242,000 jobs.

The increase was driven by rises in retail trade, construction, and health care.

The retail trade added 47,700 jobs in March, while the manufacturing sector shed 29,000 jobs.

Construction added 37,000 in March, while mining sector shed 12,400 jobs.

The U.S. unemployment rate rose to 5.0% in March from 4.9% in February. Analysts had expected the unemployment rate to remain unchanged at 4.9%.

Average hourly earnings increased 0.3% in March, beating forecasts of a 0.2% gain, after a 0.1% decline in February.

The labour-force participation rate increased to 63.0% in March from 62.9% in February.

As the U.S. labour market continues to strengthen, the Fed could raise its interest rate gradually this year.

-

14:30

U.S.: Average hourly earnings , March 0.3% (forecast 0.2%)

-

14:30

U.S.: Unemployment Rate, March 5% (forecast 4.9%)

-

14:30

U.S.: Average workweek, March 34.4 (forecast 34.5)

-

14:30

U.S.: Nonfarm Payrolls, March 215 (forecast 205)

-

14:19

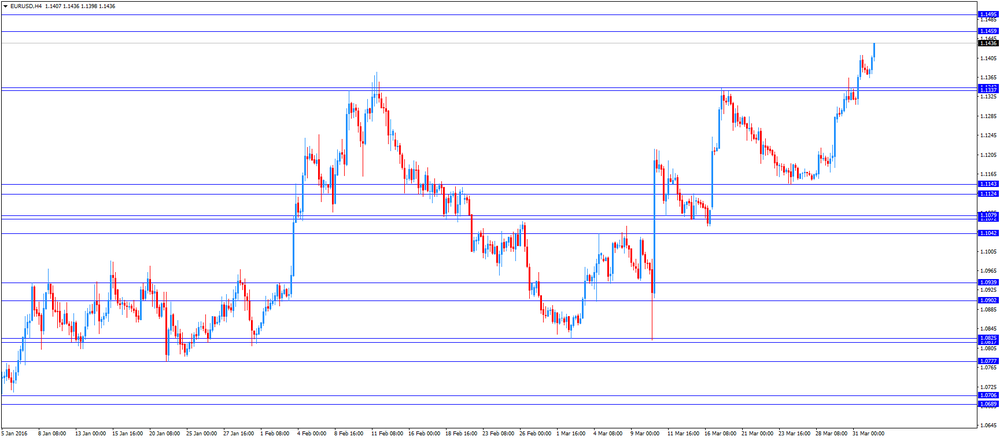

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mostly better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI March 49.0 49.3 50.2

01:00 China Non-Manufacturing PMI March 52.7 53.8

01:45 China Markit/Caixin Manufacturing PMI March 48 49.7

02:00 Japan Manufacturing PMI (Finally) March 50.1 49.1 49.1

07:15 Switzerland Retail Sales (MoM) February -0.6% Revised From -0.3% -0.4%

07:15 Switzerland Retail Sales Y/Y February -0.1% Revised From 0.2% 0.5% -0.2%

07:30 Switzerland Manufacturing PMI March 51.6 51 53.2

07:50 France Manufacturing PMI (Finally) March 50.2 49.6 49.6

07:55 Germany Manufacturing PMI (Finally) March 50.5 50.4 50.7

08:00 Eurozone Manufacturing PMI (Finally) March 51.2 51.4 51.6

08:30 United Kingdom Purchasing Manager Index Manufacturing March 50.8 51.2 51

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in March.

The U.S. economy is expected to add 205,000 jobs in March, after adding 242,000 jobs in February.

The final manufacturing purchasing managers' index is expected to rise to 51. 4 in March from 51.3 in February.

The ISM manufacturing purchasing managers' index is expected to increase to 50.7 in March from 49.5 in February.

The euro traded higher against the U.S. dollar after the mostly better-than-expected economic data from the Eurozone. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final manufacturing purchasing managers' index (PMI) climbed to 51.6 in March from 51.2 in February, up from the preliminary reading of 51.4.

The rise was driven by a faster growth in production and new orders.

"Although the PMI ticked higher, March still saw the second-weakest improvement in manufacturing conditions seen for just over a year. The data suggest manufacturing grew by only around 0.2% in the first quarter, acting as a drag on the wider economy," Chris Williamson, Chief Economist at Markit said.

"Policymakers will also be worried by the further intensification of deflationary pressures in manufacturing supply chains, with prices charged at the factory gate falling at the steepest rate since late-2009," he added.

Germany's final Markit/BME manufacturing purchasing managers' index (PMI) rose to 50.7 in March from 50.5 in February, up from the preliminary reading of 50.4. The index was mainly driven by rises in output and new business. Employment declined in March.

France's final manufacturing purchasing managers' index (PMI) decreased to 49.6 in March from 50.2 in February, in line with the preliminary reading. The index was driven by drops in new business and output prices. Output rose slightly.

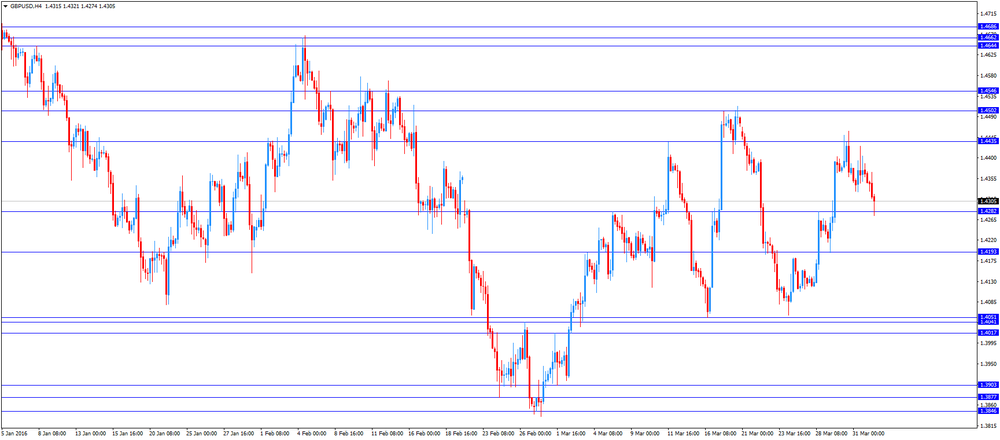

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Friday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 51.0 in March from 50.8 in February, missing expectations for a rise to 51.2.

The increase was driven by a rise in new business.

"The UK manufacturing sector remained in the doldrums during the opening quarter of the year. Although March saw modest improvements in the trends for production and new orders, industry is still hovering close to the stagnation mark and will struggle to make a meaningful contribution to the next set of GDP growth figures," Markit's Senior Economist Rob Dobson said.

The Swiss franc traded higher against the U.S. dollar. Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Friday. The manufacturing purchasing managers' index in Switzerland climbed to 53.2 in March from 51.6 in February, beating expectations for a decrease to 51.0. It was the highest level since October 2014.

The Federal Statistical Office released its retail sales data for Switzerland on Friday. Retail sales in Switzerland were down at an annual rate of 0.2% in February, missing expectations for a 0.5% rise, after a 0.1% decrease in January. January's figure was revised down from a 0.2% increase.

On a monthly basis, retail sales fell by 0.4% in February, after a 0.6% drop in January. January's figure was revised down from a 0.3% fall.

EUR/USD: the currency pair increased to $1.1437

GBP/USD: the currency pair declined to $1.4274

USD/JPY: the currency pair fell to Y111.99

The most important news that are expected (GMT0):

12:30 U.S. Average hourly earnings March -0.1% 0.2%

12:30 U.S. Average workweek March 34.4 34.5

12:30 U.S. Unemployment Rate March 4.9% 4.9%

12:30 U.S. Nonfarm Payrolls March 242 205

13:45 U.S. Manufacturing PMI (Finally) March 51.3 51.4

14:00 U.S. Construction Spending, m/m February 1.5% 0.1%

14:00 U.S. ISM Manufacturing March 49.5 50.7

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) March 91.7 90.5

16:00 U.S. FOMC Member Mester Speaks

-

13:46

Orders

EUR/USD

Ордера на продажу: 1.1400 1.1420-25 1.1450 1.1480 1.1500 1.1530 1.1550

Ордера на покупку: 1.1370 1.1350 1.1325-30 1.1310 1.1300 1.1275-80 1.1250

GBP/USD

Ордера на продажу: 1.4380 1.4400 1.4425-30 1.4450 -55 1.4480 1.4500 1.4520 1.4550

Ордера на покупку: 1.4320-25 1.4300 1.4280 1.4265 1.4250 1.4200 1.4175 1.4150

EUR/JPY

Ордера на продажу: 128.00 128.30 128.50 129.00 129.50 129.75 130.00

Ордера на покупку: 127.50 127.30 127.00 126.75-80 126.50 126.30 126.00

EUR/GBP

Ордера на продажу: 0.7950 0.7975-80 0.8000 0.8030 0.8050-60

Ордера на покупку: 0.7900 0.7880-85 0.7865 0.7850 0.7825-30 0.7800 0.7785 0.7765 0.7750

USD/JPY

Ордера на продажу: 112.50 112.65 112.80 113.00 113.40 113.80-85 114.00

Ордера на покупку: 112.00 111.80-85 111.50 111.30 111.00

AUD/USD

Ордера на продажу: 0.7700 0.7720 0.7735-40 0.7750 0.7765 0.7780 0.7800

Ордера на покупку: 0.7650 0.7625-30 0.7600 0.7575 0.7550 0.7520 0.7500

-

11:56

Nationwide: UK house prices rise 0.8% in March

The Nationwide Building Society released its house prices data for the U.K. on Friday. UK house prices were up 0.8% in March, after a 0.4% increase in February.

On a yearly basis, house prices rose to 5.7% in March from 4.8 in February. It was the biggest rise since January 2015.

"There has been a pickup in housing market activity in recent months, with the number of housing transactions and mortgage approvals rising strongly. This is likely to have been driven, at least in part, by upcoming changes to stamp duty on second homes, where buyers have brought forward purchases in order to avoid the additional tax liabilities, Nationwide's Chief Economist, Robert Gardner, said.

-

11:49

Swiss manufacturing PMI climbs to 53.2 in March, the highest level since October 2014

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Friday. The manufacturing purchasing managers' index in Switzerland climbed to 53.2 in March from 51.6 in February, beating expectations for a decrease to 51.0. It was the highest level since October 2014.

A reading above 50 indicates expansion.

The increase was driven by rises in all sub-indexes.

The production increased to 58.0 in March from 56.9 in February, while the backlog of orders sub-index jumped to 54.9 from 53.3, the highest level since July 2014.

Purchase prices were up to 47.0 in March from 43.8 in February.

Employment rose to 46.1 in March from 45.6 in February.

-

11:43

Swiss retail sales decline 0.2% year-on-year in February

The Federal Statistical Office released its retail sales data for Switzerland on Friday. Retail sales in Switzerland were down at an annual rate of 0.2% in February, missing expectations for a 0.5% rise, after a 0.1% decrease in January. January's figure was revised down from a 0.2% increase.

Sales of food, beverages and tobacco climbed at an annual rate of 0.7% in February, while non-food sales climbed 0.9%.

On a monthly basis, retail sales fell by 0.4% in February, after a 0.6% drop in January. January's figure was revised down from a 0.3% fall.

Sales of food, beverages and tobacco declined 0.8% in February, while non-food sales were flat.

-

11:32

France’s final manufacturing PMI decreases to 49.6 in March

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Friday. France's final manufacturing purchasing managers' index (PMI) decreased to 49.6 in March from 50.2 in February, in line with the preliminary reading.

The index was driven by drops in new business and output prices. Output rose slightly.

"Although output returned to growth in March, a sharper fall in new orders dragged the PMI below the neutral 50.0 mark and highlighted the ongoing weakness of demand facing manufacturers," Markit Senior Economist Jack Kennedy said.

-

11:28

Germany’s final manufacturing PMI rises to 50.7 in March

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's final Markit/BME manufacturing purchasing managers' index (PMI) rose to 50.7 in March from 50.5 in February, up from the preliminary reading of 50.4.

The index was mainly driven by rises in output and new business. Employment declined in March.

"German manufacturers ended their worst quarter in over a year in March, with overall growth in the sector slowing to a crawl. Although production growth was maintained, the pace of expansion was little-changed from February's 14-month low," Markit economist Oliver Kolodseike said.

-

11:24

Eurozone’s final manufacturing PMI climbs to 51.6 in March

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final manufacturing purchasing managers' index (PMI) climbed to 51.6 in March from 51.2 in February, up from the preliminary reading of 51.4.

The rise was driven by a faster growth in production and new orders.

"Although the PMI ticked higher, March still saw the second-weakest improvement in manufacturing conditions seen for just over a year. The data suggest manufacturing grew by only around 0.2% in the first quarter, acting as a drag on the wider economy," Chris Williamson, Chief Economist at Markit said.

"Policymakers will also be worried by the further intensification of deflationary pressures in manufacturing supply chains, with prices charged at the factory gate falling at the steepest rate since late-2009," he added.

-

11:12

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increases to 51.0 in March

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Friday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 51.0 in March from 50.8 in February, missing expectations for a rise to 51.2.

A reading above 50 indicates expansion.

The increase was driven by a rise in new business.

"The UK manufacturing sector remained in the doldrums during the opening quarter of the year. Although March saw modest improvements in the trends for production and new orders, industry is still hovering close to the stagnation mark and will struggle to make a meaningful contribution to the next set of GDP growth figures," Markit's Senior Economist Rob Dobson said.

-

10:45

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 42.8 in in the week ended March 26

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.8 in in the week ended March 26 from 43.6 the prior week.

The decrease was mainly driven by a less favourable assessment of the economy. The measure of views of the economy declined to 32.6 from 34.0, the buying climate index was unchanged, while the personal finances index fell by 1 point to 57.6 from 55.9.

-

10:39

Official data: Chinese manufacturing PMI rises to 50.2 in March

The Chinese manufacturing PMI rose to 50.2 in March from 49.0 in February, according to the Chinese government. February's reading was the lowest reading since November 2011.

Analysts had expected the index to increase to 49.3.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by rises in output and new orders, while employment fell.

The services PMI increased to 53.8 in March from 52.7 in February.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , March 51 (forecast 51.2)

-

10:22

Chinese Markit/Caixin manufacturing PMI increases to 49.7 in March

The Chinese Markit/Caixin manufacturing PMI increased to 49.7 in March from 48.0 in February. The increase was driven by rises output, total new orders and output prices. But companies continued to shed jobs.

"All categories of the index showed improvement over the previous month. The output and new order categories rose above the neutral 50-point level, indicating that the stimulus policies the government has implemented have begun to take hold," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"However, considering that current conditions remain uncertain, the government needs to continue with moderate stimulus measures to reinforce market confidence," he added.

-

10:11

Tankan Survey: the large manufacturers’ index drops to +6 in the first quarter

The Bank of Japan released its quarterly Tankan business survey on late Thursday evening. The large manufacturers' index dropped to +6 in the first quarter from +12 in the fourth quarter, missing expectations for a fall to +8.

The outlook fell to +3 in the first quarter from +7 in the fourth quarter.

The large non-manufacturers' index fell to +22 in the first quarter from +25 in the fourth quarter, beating expectations for a decline to +24.

The outlook decreased to +17 from +18.

-

10:00

Eurozone: Manufacturing PMI, March 51.6 (forecast 51.4)

-

09:55

Germany: Manufacturing PMI, March 50.7 (forecast 50.4)

-

09:50

France: Manufacturing PMI, March 49.6 (forecast 49.6)

-

09:30

Switzerland: Manufacturing PMI, March 53.2 (forecast 51)

-

09:16

Switzerland: Retail Sales (MoM), February -0.4%

-

09:15

Switzerland: Retail Sales Y/Y, February -0.2% (forecast 0.5%)

-

09:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 110.00 (USD 1.94bln) 112.00 (1.07bln) 112.50 (660m) 113.00 (758m) 113.00 (557m) 113.40 (460m) 113.50 (612m) 113.80-85 (830m) 114.00 (1.05bln) 114.25 (730m)

EUR/USD 1.1050 (EUR 1.13bln) 1.1064 (397m) 1.1075 (524m) 1.1100 (438m), 1.1175 (732m) 1.1200 (471m) 1.1268 (388m) 1.1295-1.1300 (884m), 1.1320 (230m) 1.1365 (426m), 1.1382 (256m) 1.1500 (344m)

GBP/USD 1.4050 (GBP 284m) 1.4250 (198m) 1.4397 (194m)

EUR/GBP 0.7610 (EUR 300m) 0.7860 (229m)

AUD/USD 0.7590 (AUD 300m)

USD/CAD 1.3200 (USD 1.45bln) 1.3245-50 (841m) 1.3350 (653m) 1.3420 (248m)

NZD/USD 0.6750 (NZD 444m) 0.6805 (202m)

AUD/JPY 84.00 (AUD 452m) 84.35 (1.07bln) 86.00 (407m)

AUD/NZD 1.0852 (AUD 774m) 1.1050 (202m) 1.1100 (209m) 1.1200 (229m)

USD/CNY 6.5000 (USD 2bln)

-

08:24

Options levels on friday, April 1, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1501 (2931)

$1.1474 (3348)

$1.1437 (3191)

Price at time of writing this review: $1.1383

Support levels (open interest**, contracts):

$1.1338 (3745)

$1.1275 (2687)

$1.1192 (1712)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48829 contracts, with the maximum number of contracts with strike price $1,1500 (4422);

- Overall open interest on the PUT options with the expiration date April, 8 is 74291 contracts, with the maximum number of contracts with strike price $1,0900 (6430);

- The ratio of PUT/CALL was 1.52 versus 1.44 from the previous trading day according to data from March, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.4602 (1603)

$1.4504 (1942)

$1.4407 (2034)

Price at time of writing this review: $1.4360

Support levels (open interest**, contracts):

$1.4295 (672)

$1.4197 (970)

$1.4099 (935)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 21676 contracts, with the maximum number of contracts with strike price $1,4400 (2034);

- Overall open interest on the PUT options with the expiration date April, 8 is 23633 contracts, with the maximum number of contracts with strike price $1,4000 (2915);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from March, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Asian session

The dollar found some respite on Friday after steep quarterly losses against major rivals, as investors awaited a U.S. nonfarm payrolls report that could give clues to the monetary policy outlook.

The Bank of Japan's quarterly tankan survey of business confidence, published earlier on Friday, showed large manufacturers' business sentiment deteriorated to its lowest level in nearly three years and was expected to worsen in the coming quarter. Large manufacturers expect the dollar to average 117.46 yen in the fiscal year which began on Friday, the tankan survey showed.

The Australian dollar edged down, but remained not far from a nine-month peak of $0.7723 set on Thursday, underpinned by surprisingly upbeat Chinese manufacturing surveys. Chinese manufacturing activity expanded in March for the first time in nine months, with the official Purchasing Managers' Index (PMI) squeaking above the boom-or-bust threshold to 50.2. A private PMI survey also beat forecasts and rose to its highest in 13 months.

EUR/USD: during the Asian session the pair traded in the range of $1.1365-85

GBP/USD: during the Asian session the pair fell to $1.4325

USD/JPY: during the Asian session the pair fell to a Y112.05

Based on Reuters materials

-

04:00

Japan: Manufacturing PMI, March 49.1 (forecast 49.1)

-

03:46

China: Markit/Caixin Manufacturing PMI, March 49.7

-

02:59

China: Manufacturing PMI , March 53.8 (forecast 49.3)

-

02:59

China: Non-Manufacturing PMI, March 53.8

-

01:56

Japan: BoJ Tankan. Manufacturing Index, Quarter I 6 (forecast 8)

-

01:55

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter I 22 (forecast 24)

-

00:30

Australia: AIG Manufacturing Index, March 58.1

-

00:29

Currencies. Daily history for Mar 31’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1380 +0,41%

GBP/USD $1,4365 -0,08%

USD/CHF Chf0,9614 -0,33%

USD/JPY Y112,53 +0,08%

EUR/JPY Y128,06 +0,49%

GBP/JPY Y161,64 -0,01%

AUD/USD $0,7663 -0,07%

NZD/USD $0,6913 0,00%

USD/CAD C$1,2983 +0,17%

-