Noticias del mercado

-

23:59

Schedule for today, Friday, Apr 01’2016:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI March 49.0 49.3

01:00 China Non-Manufacturing PMI March 52.7

01:45 China Markit/Caixin Manufacturing PMI March 48

02:00 Japan Manufacturing PMI (Finally) March 50.1 49.1

07:15 Switzerland Retail Sales (MoM) February -0.3%

07:15 Switzerland Retail Sales Y/Y February 0.2% 0.5%

07:30 Switzerland Manufacturing PMI March 51.6 51

07:50 France Manufacturing PMI (Finally) March 50.2 49.6

07:55 Germany Manufacturing PMI (Finally) March 50.5 50.4

08:00 Eurozone Manufacturing PMI (Finally) March 51.2 51.4

08:30 United Kingdom Purchasing Manager Index Manufacturing March 50.8 51.2

09:00 Eurozone Unemployment Rate February 10.3% 10.3%

12:30 U.S. Average hourly earnings March -0.1% 0.2%

12:30 U.S. Average workweek March 34.4 34.5

12:30 U.S. Unemployment Rate March 4.9% 4.9%

12:30 U.S. Nonfarm Payrolls March 242 205

13:45 U.S. Manufacturing PMI (Finally) March 51.3 51.4

14:00 U.S. Construction Spending, m/m February 1.5% 0.1%

14:00 U.S. ISM Manufacturing March 49.5 50.7

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) March 91.7 90.5

16:00 U.S. FOMC Member Mester Speaks

20:00 U.S. Total Vehicle Sales, mln March 17.54 17.5

-

18:18

Spanish government misses its 2015 budget deficit target

Spanish Budget Minister Cristobal Montoro said on Thursday that the country missed its budget deficit target in 2015. Spain's budget deficit was 5.2% of gross domestic product (GDP), higher than target of 4.2% of GDP set by the European Commission.

Spain's Prime Minister Mariano Rajoy in February predicted a deficit of 4.5% of GDP.

Montoro said that regions failed to reach their deficit targets. Only 3 of 17 regions met their targets.

-

18:06

Atlanta Fed President Dennis Lockhart expects three interest rate hikes by the Fed this year

Atlanta Fed President Dennis Lockhart said in an interview with Japan's The Nikkei on Thursday that he expected three interest rate hikes by the Fed this year.

"I just think there's still scope for three increases this year. I do not expect four increases, but I think there is scope for three," he said.

Lockhart noted that the Fed could raise its interest rate at its next meeting in April if the economic is strong.

Atlanta Fed president also said that the U.S. economy continued to expand moderately, adding that he expected the economy to grow "a bit better than 2%" in 2016.

-

17:54

Chicago Fed President Charles Evans would support an interest rate hike in June

Chicago Fed President Charles Evans said on Thursday that he would support an interest rate hike in June, adding that two interest rate hikes this year were possible.

"It's not really critical when those take place. I guess I would sort of say one in the middle of the year and one at the end of the year," he said.

-

17:48

Bank of England Governor Mark Carney: problems of the low economic growth cannot be solved by monetary policy alone

Bank of England (BoE) Governor Mark Carney said in a speech in Tokyo on Thursday that problems of the low economic growth cannot be solved by monetary policy alone. He noted that structural reforms were needed.

-

17:39

Bank of Japan Governor Haruhiko Kuroda: the monetary policy easing has no limit

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Thursday that the monetary policy easing had no limit. He pointed out that the central bank would continue with quantitative easing its inflation target was reached.

-

17:34

The ANZ business confidence index for New Zealand slides to 3.2% in February

ANZ Bank released its latest business sentiment survey for New Zealand on Thursday. The ANZ business confidence index for New Zealand slid to 3.2% in February from 7.1% in January. The index means that 3.2% of respondents expected the country's economy to improve over the coming year.

"Business confidence continues to wane. However, firms are more optimistic about prospects for their own business and this is a far more important signal for economic direction," the ANZ Chief Economist Cameron Bagrie said.

-

17:29

Housing starts in Japan jump 7.8% year-on-year in February

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Thursday. Housing starts in Japan rose 7.8% year-on-year in February, beating expectations for a 2.4% drop, after a 0.2% increase in January. It was the biggest rise since August 2015.

On a yearly basis, housing starts were up to 974,000 in February from 873,000 in January.

Construction orders slid 12.4% year-on-year in February, after a 13.8% drop in January.

-

17:25

Private sector credit in Australia rises 0.6% in February

The Reserve Bank of Australia (RBA) released its private sector credit data on Thursday. The total value of private sector credit in Australia rose 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.5% increase in January.

Housing credit increased 0.5% in February, personal credit declined 0.1%, while business credit rose 0.7%.

On a yearly basis, the private sector credit in Australia jumped 6.6% in February, after a 6.5% rise in January.

-

17:21

HIA new home sales in Australia drop 5.3% in February

The Housing Industry Association (HIA) released its new home sales data for Australia on Thursday. New home sales fell 5.3% in February, after a 0.6% rise in January. January's figure was revised down from a 3.1% increase.

"HIA New Home Sales are losing some of their lustre as a downward trend becomes more firmly entrenched. While the monthly result is a soft one, there is no need to loudly ring alarm bells as often seems to automatically occur every time an economic update disappoints," the HIA's chief economist Harley Dale said.

Sales of detached homes decreased 3.9% in February, while sales for multi-units slid 10.6%.

-

16:54

Standard & Poor's downgrades China’s outlook to ‘negative’

Rating agency Standard & Poor's (S&P) affirmed China's sovereign debt rating at 'AA-' but downgraded the outlook to 'negative' from 'stable'. The agency said that the downward revision was driven by a slower-than-expected pace of the implementation of reforms.

"Economic and financial risks to the Chinese government's creditworthiness are gradually increasing," the agency noted.

S&P affirmed Hong Kong's rating at 'AAA'. The agency also downgraded the outlook to 'negative' from 'stable'.

-

16:44

European Central Bank Governing Council member Francois Villeroy de Galhau: the central bank could add further stimulus measures if needed

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Thursday that the central bank could add further stimulus measures if needed to provide favourable financial conditions. He pointed out that the ECB's latest stimulus measures aimed to provide favourable financial conditions.

-

16:38

Spanish current account surplus turns into a deficit of €0.66 billion in January

The Bank of Spain released its current account data on Thursday. Spain's current account surplus turned into a deficit of €0.66 billion in January from a surplus of €3.98 billion in December. December's figure was revised down from a surplus of €4.49 billion.

The surplus on trade in goods and services totalled €0.6 billion in January, while the deficit on primary and second income totalled €1.3 billion.

-

16:29

Preliminary consumer price inflation in Spain is up 0.6% in March

The Spanish statistical office INE released its preliminary consumer price inflation data on Thursday. Consumer price inflation in Spain was up 0.6% in March, after a 0.4% fall in February.

On a yearly basis, consumer prices fell by 0.8% in March, after a 0.8% decrease in February.

The annual decline was mainly driven by the drop in in the prices of fuels (gas and diesel oil), and food and non-alcoholic beverages.

-

16:14

Retail sales in Spain rise at a seasonally adjusted rate of 0.2% in February

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.2% in February, after a 0.4% increase in January.

Food sales were down 0.3% in February, while non-food sales decreased by 0.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.9% in February, after a 3.3% rise in January.

Sales of non-food products jumped 5.6% in February from a year ago, while food sales rose 1.8%.

-

16:08

Greek retail sales fall 1.0% in January

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Thursday. Greek retail sales fell 1.0% in January.

On a yearly basis, Greek retail sales slid by 2.2% in January, after a 0.2% rise in December. December's figure was revised down from a 0.4% increase.

Sales of food products decreased by 2.8% year-on-year in January, sales of non-food products increased by 2.5%, while sales of automotive fuel dropped by 9.0%.

-

16:02

Chicago purchasing managers' index climbs to 53.6 in March

The Institute for Supply Management released its Chicago purchasing managers' index on Thursday. The Chicago purchasing managers' index climbed to 53.6 in March from 47.6 in February, exceeding expectations for an increase to 50.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was mainly driven by rises in production and employment. The production index rose to 53.7 in March from 44.0 in February, while the employment index climbed to 52.8 from 45.2.

New orders were up to 55.6 in March from 51.7 in February.

"The most significant result from the March survey is the pick-up in the Employment component which has remained weak for much of the past year. Looking through some of the recent volatility, the data are consistent with steady, not spectacular, economic growth in the US," Chief Economist of MNI Indicators Philip Uglow said.

-

15:53

Preliminary consumer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Thursday. Preliminary consumer prices in Italy increased 0.2% in March, after a 0.2% fall in February.

The monthly increase was driven by rises in prices of services related to transport and of diesel for personal transport equipment. Prices for services related to transport rose 1.0% in March, while prices of diesel for personal transport equipment increased 2.5%.

On a yearly basis, consumer prices fell 0.2% in March, after a 0.3% decrease in February.

The decline was driven by lower prices for energy, which slid 7.0% year-on-year in March.

Prices for goods declined 1.0% year-on-year in March, while services prices rose 0.7%.

Consumer price inflation excluding unprocessed food and energy prices climbed to 0.6% year-on-year in March from 0.5% in February.

-

15:51

Option expiries for today's 10:00 ET NY cut

USDJPY 110.00 (USD 1.94bln) 112.00 (1.07bln) 112.50 (660m) 113.00 (758m) 113.00 (557m) 113.40 (460m) 113.50 (612m) 113.80-85 (830m) 114.00 (1.05bln) 114.25 (730m)

EURUSD 1.1050 (EUR 1.13bln) 1.1064 (397m) 1.1075 (524m) 1.1100 (438m) 1.1175 (732m) 1.1200 (471m) 1.1268 (388m) 1.1295-1.1300 (884m) 1.1320 (230m) 1.1365 (426m) 1.1382 (256m) 1.1500 (344m)

GBPUSD 1.4050 (GBP 284m) 1.4250 (198m) 1.4397 (194m)

EURGBP 0.7610 (EUR 300m) 0.7860 (229m)

AUDUSD 0.7590 (AUD 300m)

USDCAD 1.3200 (USD 1.45bln) 1.3245-50 (841m) 1.3350 (653m) 1.3420 (248m)

NZDUSD 0.6750 (NZD 444m) 0.6805 (202m)

AUDJPY 84.00 (AUD 452m) 84.35 (1.07bln) 86.00 (407m)

AUDNZD 1.0852 (AUD 774m) 1.1050 (202m) 1.1100 (209m) 1.1200 (229m)

USDCNY 6.5000 (USD 2bln)

-

15:45

U.S.: Chicago Purchasing Managers' Index , March 53.6 (forecast 50)

-

15:42

Producer prices in Italy decrease 0.4% in February

The Italian statistical office Istat released its producer price inflation data for Italy on Thursday. Italian producer prices decreased 0.4% in February, after a 0.7% decline in January.

Producer price declined by 0.5% on domestic market and by 0.4% on non-domestic market in February.

On a yearly basis, Italian PPI fell 3.5% in February, after a 2.5% drop in January.

Producer price slid 4.1% on domestic market and by 1.8% on non-domestic market in February.

-

14:50

Canada's GDP rises 0.6% in January

Statistics Canada released GDP (gross domestic product) growth data on Thursday. Canada's GDP growth rose 0.6% in January, exceeding expectations for a 0.3% gain, after a 0.2% increase in December.

The increase was mainly driven by rises in manufacturing, retail trade, and mining, quarrying, and oil and gas extraction.

The mining, quarrying, and oil and gas extraction sector rose 0.9% in January, manufacturing output increased 1.9%, while the retail trade sector climbed 1.5%.

-

14:45

Initial jobless claims rise to 276,000 in the week ending March 26

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 26 in the U.S. increased by 11,000 to 276,000 from 265,000 in the previous week. Analysts had expected jobless claims to remain unchanged at 265,000.

Jobless claims remained below 300,000 the 56th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 7,000 to 2,173,000 in the week ended March 19.

-

14:30

U.S.: Initial Jobless Claims, March 276 (forecast 265)

-

14:30

Canada: GDP (m/m) , January 0.6% (forecast 0.3%)

-

14:30

U.S.: Continuing Jobless Claims, March 2173 (forecast 2205)

-

14:24

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the better-than-expected consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m February 0.6% Revised From 3.1% -5.3%

00:00 New Zealand ANZ Business Confidence February 7.1 3.2

00:30 Australia Private Sector Credit, m/m February 0.5% 0.5% 0.6%

00:30 Australia Private Sector Credit, y/y February 6.5% 6.6%

05:00 Japan Construction Orders, y/y February -13.8% -12.4%

05:00 Japan Housing Starts, y/y February 0.2% -2.4% 7.8%

06:00 Germany Retail sales, real adjusted February -0.1% Revised From 0.7% 0.3% -0.4%

06:00 Germany Retail sales, real unadjusted, y/y February -1.2% Revised From -0.8% 2.2% 5.4%

07:00 United Kingdom BOE Gov Mark Carney Speaks

07:55 Germany Unemployment Rate s.a. March 6.2% 6.2% 6.2%

07:55 Germany Unemployment Change March -9 Revised From -10 -7 0

08:30 United Kingdom Consumer credit, mln February 1607 Revised From 1564 1400 1287

08:30 United Kingdom Mortgage Approvals February 74.08 Revised From 74.58 73.5 73.87

08:30 United Kingdom Net Lending to Individuals, bln February 5.4 Revised From 5.3 5.1 4.9

08:30 United Kingdom Current account, bln Quarter IV -20.1 Revised From -17.5 -21.1 -37.2

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.4% 0.5% 0.6%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.1% 1.9% 2.1%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) March -0.2% -0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) March 0.8% 0.9% 1.0%

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to remain unchanged at 265,000 last week.

The Chicago purchasing managers' index is expected to increase to 50.0 in March from 47.6 in February.

The euro traded higher against the U.S. dollar after the better-than-expected consumer price inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in March from -0.2% in February, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in March from 0.8% in February. Analysts had expected the index to increase to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in March, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany was flat in March, missing expectations for a 7,000 decline, after a 9,000 decrease in February. February's figure was revised down from a 10,000 fall.

The unemployment rate remained unchanged at 6.2% in March, in line with expectations.

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales fell 0.4% in February, missing forecasts of a 0.3% gain, after a 0.1% decrease in January. January's figure was revised down from a 0.7% increase.

On a yearly basis, German unadjusted retail sales climbed 5.4% in February, beating expectations for a 2.2% gain, after a 1.2% drop in January. January's figure was revised down from a 0.8% decline.

Sales of non-food products increased at an annual rate of 3.9% in February, while sales of food, beverages and tobacco products rose by 7.1%.

The British pound traded higher against the U.S. dollar after the release of the U.K. final GDP data. The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Thursday. The final U.K. GDP expanded at 0.6% in the fourth quarter, up from the February estimate of 0.5%, after a 0.4% rise in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.1% in the fourth quarter, up from the February estimate of 1.9%, after a 2.1% gain in the third quarter.

The upward revision was driven by revisions in services, industrial output and construction.

In 2015 as whole, GDP expanded 2.3%, up from the previous estimate of 2.2%.

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Thursday. The U.K. current account deficit widened to £37.2 billion in the fourth quarter from £20.1 billion in the third quarter. The third quarter's figure was revised down from a deficit of £17.5 billion.

Analysts had expected the current account deficit to increase to £21.1 billion.

The fourth quarter's current account deficit amounted to 7.0% of GDP, the highest share since 1955.

Declines in the current account deficit were driven by a drop in the deficit on primary and secondary income, and total trade.

In 2015 as a whole, the current account deficit was £96.2 billion or 5.2% of GDP. It was the biggest deficit since 1948.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian GDP data. Canada's GDP growth is expected to rise 0.3% in January, after a 0.2% gain in December.

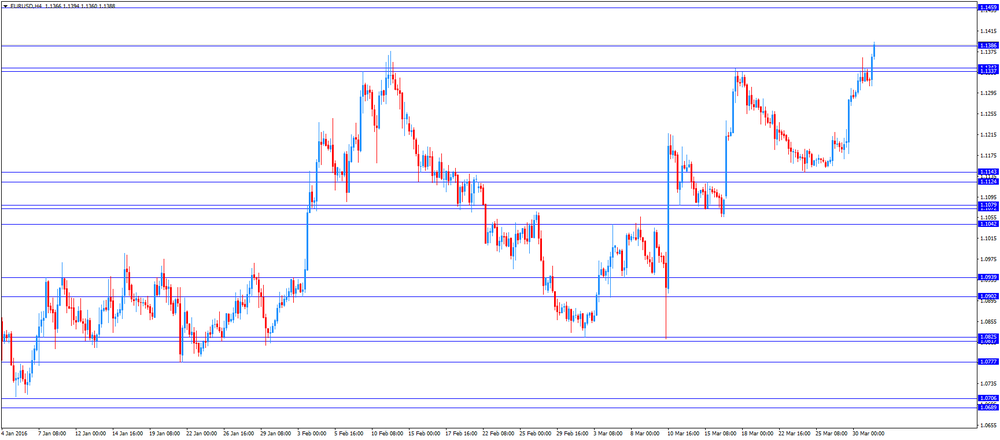

EUR/USD: the currency pair increased to $1.1394

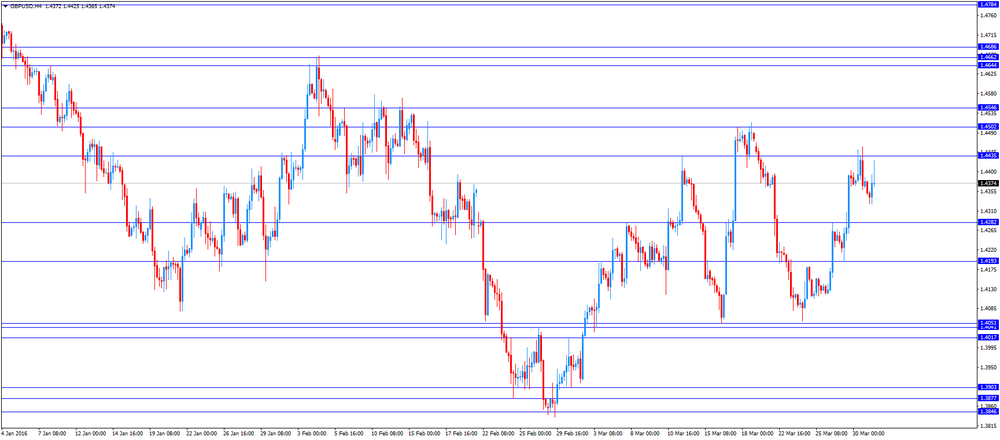

GBP/USD: the currency pair climbed to $1.4425

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) January 0.2% 0.3%

12:30 U.S. Initial Jobless Claims March 265 265

13:45 U.S. Chicago Purchasing Managers' Index March 47.6 50

21:00 U.S. FOMC Member Dudley Speak

22:30 Australia AIG Manufacturing Index March 53.5

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter I 25 24

23:50 Japan BoJ Tankan. Manufacturing Index Quarter I 12 8

-

14:00

Orders

EUR/USD

Offers 1.1350 1.1365 1.1380 1.1400 1.1430 1.1450 1.1480 1.1500

Bids 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4365 1.4380 1.4400 1.4425-30 1.4450 -55 1.4480 1.4500 1.4520 1.4550

Bids 1.4320-25 1.4300 1.4280 1.4265 1.4250 1.4200 1.4175 1.4150

EUR/JPY

Offers 127.80 128.00 128.30 128.50 129.00

Bids 127.30 127.00 126.75-80 126.50 126.30 126.00

EUR/GBP

Offers 0.7920-25 0.7950 0.7975-80 0.8000

Bids 0.7880-85 0.7865 0.7850 0.7825-30 0.7800 0.7785 0.7765 0.7750

USD/JPY

Offers 112.50 112.65 112.80 113.00 113.40 113.80-85 114.00

Bids 112.00 111.80-85 111.50 111.30 1111.00

AUD/USD

Offers 0.7675-80 0.7700 0.7720 0.7735-40 0.7750 0.7765 0.7780 0.7800

Bids 0.7625-30 0.7600 0.7575 0.7550 0.7520 0.7500

-

11:57

French preliminary consumer price inflation increases 0.7% in March

The French statistical office Insee released its preliminary consumer price inflation for France on Thursday. The French consumer price inflation increased 0.7% in March, after a 0.3% rise in February.

The monthly increase was mainly driven by a seasonal price upturn in manufactured product after the end of winter sales.

On a yearly basis, the consumer price index remained unchanged at -0.2% in March.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.4% year-on-year in March, services prices climbed 0.8%, while energy prices dropped by 7.0%.

-

11:52

French producer prices decrease 0.5% in February

French statistical office INSEE released its producer price index (PPI) data on Thursday. French producer prices decreased 0.5% in February, after a 0.9% drop in January. January's figure was revised down from a 0.8% fall.

The decrease was mainly driven a drop in prices for refined petroleum products.

On a yearly basis, French PPI fell 4.1% in February.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 40.1 year-on-year in February.

Import prices decreased 0.6% in February, after a 1.7% fall in January.

-

11:46

French consumer spending rises 0.6% in February

French statistical office INSEE released its consumer spending data on Thursday. French consumer spending rose 0.6% in February, after a 1.0% gain in January. January's figure was revised up from a 0.6% increase.

The increase was mainly driven by a rise in expenditure on energy and food. Spending on energy climbed by 1.2% in February, spending on food rose 1.5%.

On a yearly basis, consumer spending climbed 1.8% in February.

-

11:42

U.K. current account deficit widens to £37.2 billion in the fourth quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Thursday. The U.K. current account deficit widened to £37.2 billion in the fourth quarter from £20.1 billion in the third quarter. The third quarter's figure was revised down from a deficit of £17.5 billion.

Analysts had expected the current account deficit to increase to £21.1 billion.

The fourth quarter's current account deficit amounted to 7.0% of GDP, the highest share since 1955.

Declines in the current account deficit were driven by a drop in the deficit on primary and secondary income, and total trade.

In 2015 as a whole, the current account deficit was £96.2 billion or 5.2% of GDP. It was the biggest deficit since 1948.

-

11:33

Final U.K. GDP grows at 0.5% in the fourth quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Thursday. The final U.K. GDP expanded at 0.6% in the fourth quarter, up from the February estimate of 0.5%, after a 0.4% rise in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.1% in the fourth quarter, up from the February estimate of 1.9%, after a 2.1% gain in the third quarter.

The upward revision was driven by revisions in services, industrial output and construction.

In 2015 as whole, GDP expanded 2.3%, up from the previous estimate of 2.2%.

-

11:21

Number of mortgages approvals in the U.K. declines to 73,871 in February

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Thursday. The number of mortgages approvals in the U.K. was down to 73,871 in February from 74,085 in January, beating expectations for a decrease to 73,500. January's figure was revised down from 74,581.

Consumer credit in the U.K. rose by £1.287 billion in February, missing expectations for an £1.400 billion increase, after a £1.607 billion gain in January. January's figure was revised up from £1.564 billion.

Net lending to individuals in the U.K. increased by £4.9 billion in February, missing expectations for a £5.1 billion rise, after a £5.4 billion gain in January. January's figure was revised up from a £5.3 rise.

-

11:15

Preliminary consumer price inflation in the Eurozone rises to -0.1% year-on-year in March

Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in March from -0.2% in February, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in March from 0.8% in February. Analysts had expected the index to increase to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in March, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

-

11:09

Number of unemployed people in Germany is flat in February

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany was flat in March, missing expectations for a 7,000 decline, after a 9,000 decrease in February. February's figure was revised down from a 10,000 fall.

The unemployment rate remained unchanged at 6.2% in March, in line with expectations.

The number of unemployed people was 1.81 million in February, down from 1.83 million in January, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.3% in February.

The employment rate rose to an adjusted rate of 65.8% in February from 65.7% in January, according to Destatis.

-

11:02

Eurozone: Harmonized CPI ex EFAT, Y/Y, March 1.0% (forecast 0.9%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, March -0.1% (forecast -0.1%)

-

10:59

German adjusted retail sales fall 0.4% in February

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales fell 0.4% in February, missing forecasts of a 0.3% gain, after a 0.1% decrease in January. January's figure was revised down from a 0.7% increase.

On a yearly basis, German unadjusted retail sales climbed 5.4% in February, beating expectations for a 2.2% gain, after a 1.2% drop in January. January's figure was revised down from a 0.8% decline.

Sales of non-food products increased at an annual rate of 3.9% in February, while sales of food, beverages and tobacco products rose by 7.1%.

-

10:42

Bank of Canada Deputy Governor Lynn Patterson: the Canadian economy will need more than two years to recover

Bank of Canada (BoC) Deputy Governor Lynn Patterson said in a speech on Wednesday that the Canadian economy would need more than two years to recover from low commodity prices.

"Our best guess is that the full adjustment will take longer than two years, our normal forecast horizon," she said.

Patterson noted that households would likely restrain their spending and the consumption growth was expected to be lower due to lower real incomes.

-

10:42

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.25 (USD 500m) 112.00 (344m) 112.25 (240m) 114.00 (223m) 114.25 (400m) 114.50 (200m0

EUR/USD 1.1110 ( EUR 298m) 1.1190 (298m) 1.1200 (411m) 1.1250 (325m) 1.1275 (790m) 1.1300 (267m)

GBP/USD 1.4195 (GBP 156m) 1.4250-55 (170m)

EUR/GBP 0.7850 (EUR 220m)

AUD/USD 0.7200 (AUD 635m) 0.7270 (390m) 0.7300 (1.22bln)

AUD/NZD 1.1050 (AUD 666m)

-

10:32

United Kingdom: Net Lending to Individuals, bln, February 4.9 (forecast 5.1)

-

10:31

United Kingdom: Consumer credit, mln, February 1287 (forecast 1400)

-

10:30

United Kingdom: Current account, bln , Quarter IV -37.2 (forecast -21.1)

-

10:30

United Kingdom: GDP, q/q, Quarter IV 0.6% (forecast 0.5%)

-

10:30

United Kingdom: GDP, y/y, Quarter IV 2.1% (forecast 1.9%)

-

10:30

United Kingdom: Mortgage Approvals, February 73.87 (forecast 73.5)

-

10:25

European Central Bank Governing Council member Jens Weidmann: both Britain and the Eurozone profited from the European Union’s internal market

European Central Bank (ECB) Governing Council member Jens Weidmann said on Wednesday that both Britain and the Eurozone profited from the European Union's internal market. He warned that Britain's exit from the European Union could lead to less competition.

Weidmann noted that the economic impact of Britain's exit from the European Union will depend on levels of cooperation.

-

10:14

GfK’s U.K. consumer confidence index remains unchanged at 0 in March

Gfk released its consumer confidence index for the U.K. on late Wednesday evening. GfK's U.K. consumer confidence index remained unchanged at 0 in March, beating expectations for a decline to -1.

1 of 5 measures increased, 2 declined and 2 remained unchanged.

"Whilst UK consumers remain resolutely upbeat about their personal financial situation, even showing a +1 point increase this month when asked about expectations for the year ahead, concerns about prospects for the general economic situation continue to dampen our mood," Joe Staton, Head of Market Dynamics at GfK, said.

-

09:56

Germany: Unemployment Rate s.a. , March 6.2% (forecast 6.2%)

-

08:27

Options levels on thursday, March 31, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1446 (3383)

$1.1397 (3153)

$1.1373 (3031)

Price at time of writing this review: $1.1313

Support levels (open interest**, contracts):

$1.1263 (2387)

$1.1227 (1508)

$1.1187 (1612)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48506 contracts, with the maximum number of contracts with strike price $1,1500 (4490);

- Overall open interest on the PUT options with the expiration date April, 8 is 69839 contracts, with the maximum number of contracts with strike price $1,0900 (6016);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from March, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.4602 (1604)

$1.4505 (1855)

$1.4409 (1935)

Price at time of writing this review: $1.4336

Support levels (open interest**, contracts):

$1.4294 (571)

$1.4197 (907)

$1.4098 (913)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 21341 contracts, with the maximum number of contracts with strike price $1,4400 (1935);

- Overall open interest on the PUT options with the expiration date April, 8 is 23378 contracts, with the maximum number of contracts with strike price $1,4000 (2917);

- The ratio of PUT/CALL was 1.10 versus 1.12 from the previous trading day according to data from March, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Retail sales, real unadjusted, y/y, February 5.4% (forecast 2.2%)

-

08:00

Germany: Retail sales, real adjusted , February -0.4% (forecast 0.3%)

-

07:02

Japan: Construction Orders, y/y, February -12.4%

-

07:02

Japan: Housing Starts, y/y, February 7.8% (forecast -2.4%)

-

02:31

Australia: Private Sector Credit, y/y, February 6.6%

-

02:30

Australia: Private Sector Credit, m/m, February 0.6% (forecast 0.5%)

-

02:00

New Zealand: ANZ Business Confidence, February 3.2

-

02:00

Australia: HIA New Home Sales, m/m, February -5.3%

-

00:29

Currencies. Daily history for Mar 30’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1333 +0,38%

GBP/USD $1,4377 -0,06%

USD/CHF Chf0,9646 -0,15%

USD/JPY Y112,44 -0,14%

EUR/JPY Y127,43 +0,15%

GBP/JPY Y161,65 -0,28%

AUD/USD $0,7668 +0,47%

NZD/USD $0,6913 +0,68%

USD/CAD C$1,2961 -0,76%

-

00:01

Schedule for today, Thursday, Mar 31’2016:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m February 3.1%

00:00 New Zealand ANZ Business Confidence February 7.1

00:30 Australia Private Sector Credit, m/m February 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y February 6.5%

05:00 Japan Construction Orders, y/y February -13.8%

05:00 Japan Housing Starts, y/y February 0.2% -2.4%

06:00 Germany Retail sales, real adjusted February 0.7% 0.3%

06:00 Germany Retail sales, real unadjusted, y/y February -0.8% 2.2%

07:00 United Kingdom BOE Gov Mark Carney Speaks

07:55 Germany Unemployment Rate s.a. March 6.2% 6.2%

07:55 Germany Unemployment Change March -11 -7

08:30 United Kingdom Consumer credit, mln February 1564 1400

08:30 United Kingdom Mortgage Approvals February 74.58 73.5

08:30 United Kingdom Net Lending to Individuals, bln February 5.3 5.1

08:30 United Kingdom Current account, bln Quarter IV -17.5 -21.1

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.4% 0.5%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.1% 1.9%

09:00 Eurozone Harmonized CPI, Y/Y Preliminary) March -0.2% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) March 0.8% 0.9%

12:30 Canada GDP (m/m) January 0.2% 0.3%

12:30 U.S. Continuing Jobless Claims March 2179 2210

12:30 U.S. Initial Jobless Claims March 265 265

13:45 U.S. Chicago Purchasing Managers' Index March 47.6 50

21:00 U.S. FOMC Member Dudley Speak

22:30 Australia AIG Manufacturing Index March 53.5

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter I 25 24

23:50 Japan BoJ Tankan. Manufacturing Index Quarter I 12 8

-