Noticias del mercado

-

16:32

Asian Development Bank downgrades growth forecast for China

The Asian Development Bank (ADB) downgraded growth forecast for China on Wednesday. According to the ADB, China is expected to expand by 6.5% in 2016, down from the previous estimate of a 6.7%, and 6.3% in 2017. The bank noted that the Chinese economy would continue to expand moderately due to lower exports, a drop in labour supply and supply-side reforms.

The economic growth of developing Asia is expected to be 5.7% this year, down from the previous estimate of a 6.0%, and 5.7% in 2017.

Southeast Asia is expected to grow 4.5% in 2016 and 4.8% in 2017.

"China's growth moderation and uneven global recovery are weighing down overall growth in Asia. Despite these pressures, the region will continue to contribute over 60% of total global growth," ADB Chief Economist Shang-Jin Wei said.

-

16:30

U.S.: Crude Oil Inventories, March 2.299 (forecast 3.0)

-

15:57

Chicago Fed President Charles Evans: an interest rate hike by the Fed in April is unlikely

Chicago Fed President Charles Evans said in an interview with CNBC on Wednesday that an interest rate hike by the Fed in April was unlikely as the confidence was needed U.S. inflation accelerating toward the Fed's 2% target. He added that an interest rate hike in June was possible if the U.S. labour market continued to strengthen.

Evans noted that the Fed could hike its interest rate more than two times this year if the U.S. economic data would be better than expected.

Evans is not a voting member of the Federal Open Market Committee this year.

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY 111.64 (USD 1.02bln) 112.40-50 (470m) 113.00 (758m) 113.50 (660m)

EURUSD 1.1050 (EUR 674m) 1.1090-1.1100 ( EUR 438m) 1.1210-20 (1.32bln) 1.1250 (772m) 1.1300 (229m) 1.1500 (466m)

GBPUSD 1.4500 (GBP 401m)

EURGBP 0.7850-55 (EUR 236m)

AUDUSD 0.7200 (AUD 251m) 0.7300 (220m) 0.7400 (475m) 0.7500 (246m) 0.7550 (393m)

USDCAD 1.3200 (USD 474m) 1.3230 (560m) 1.3420 (248m)

-

15:42

Greek producer prices decrease 0.4% in February

The Hellenic Statistical Authority released its producer price index (PPI) data on Wednesday. Greek producer prices decreased 0.4% in February, after a 3.2% drop in January.

Domestic market prices fell by 0.6% in February, while foreign market prices rose 0.1%.

On a yearly basis, Greek PPI plunged 11.4% in February, after a 7.3% drop in January.

Domestic market prices slid 9.9% year-on-year in February, while foreign market prices dropped 16.0%.

Energy prices plunged 24.6% year-on-year in February, while non-durable consumer goods industrial prices were up 0.6%.

-

15:08

German consumer price inflation increases 0.8% in March

Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%.

Energy prices slid 8.9% year-on-year in March.

Goods prices dropped 1.2% year-on-year in March, while services prices increased 1.6%.

-

14:50

U.S. ADP Employment Report: private sector adds 200,000 jobs in March

Private sector in the U.S. added 200,000 jobs in March, according the ADP report on Wednesday. February's figure was revised down to 205,000 jobs from a previous reading of 214,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

Services sector added 191,000 jobs in March, while goods-producing sector added 9,000.

"The job market continues on its amazing streak. The March job gain of 200,000 is consistent with average monthly job growth of the past more than four years. The only industry reducing payrolls is energy as has been the case for over a year. All indications are that the job machine will remain in high gear," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in March. The U.S. economy is expected to add 205,000 jobs in March, after adding 242,000 jobs in February.

-

14:41

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Switzerland UBS Consumption Indicator February 1.45 Revised From 1.66 1.53

07:00 Switzerland KOF Leading Indicator March 102.6 Revised From 102.4 101.9 102.5

09:00 Eurozone Economic sentiment index March 103.9 Revised From 103.8 103.8 103

09:00 Eurozone Industrial confidence March -4.1 Revised From -4 -4.2 -4.2

09:00 Eurozone Consumer Confidence (Finally) March -8.8 -9.7 -9.7

09:00 Eurozone Business climate indicator March 0.09 Revised From 0.07 0.08 0.11

11:00 U.S. MBA Mortgage Applications March -3.3% -1%

12:00 Germany CPI, m/m (Preliminary) March 0.4% 0.6% 0.8%

12:00 Germany CPI, y/y (Preliminary) March 0.0% 0.1% 0.3%

12:15 U.S. ADP Employment Report March 205 Revised From 214 194 200

The U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report. Private sector in the U.S. added 200,000 jobs in March, according the ADP report on Wednesday. February's figure was revised down to 205,000 jobs from a previous reading of 214,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

The greenback remained under pressure on comments by Fed Chairwoman Janet Yellen. She said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually. Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.53 in February from 1.45 in January. The increase was driven by higher demand for automobiles, which climbed 1.2% year-on-year in February.

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator fell to 102.5 in March from 102.6 in February, beating expectations for a decline to 101.9. The decline was mainly driven by negative indicators for the manufacturing sector and the export.

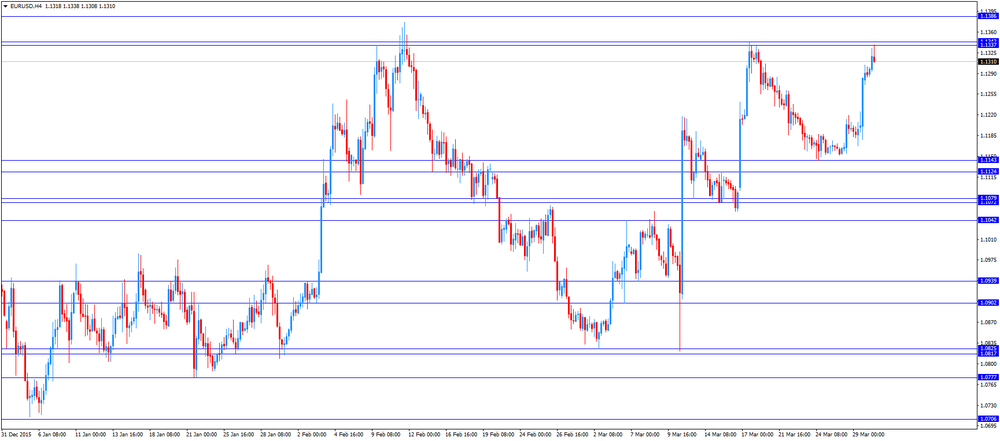

EUR/USD: the currency pair traded mixed

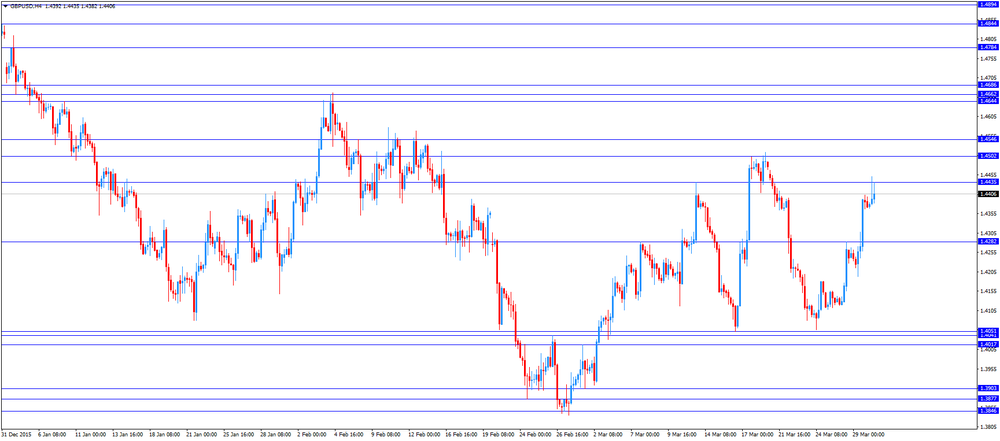

GBP/USD: the currency pair fell to $1.4377

USD/JPY: the currency pair rose Y112.67

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories March 9.357 3.0

23:05 United Kingdom Gfk Consumer Confidence March 0 -1

-

14:15

U.S.: ADP Employment Report, March 200 (forecast 194)

-

14:00

Germany: CPI, y/y , March 0.3% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, March 0.8% (forecast 0.6%)

-

13:45

Orders

EUR/USD

Offers 1.1330-35 1.1360 1.1380 1.1400 1.1430 1.1450

Bids 1.1300 1.1275-80 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4450 -55 1.4480 1.4500 1.4520 1.4550 1.4565 1.4585 1.4600

Bids 1.4420 1.4400 1.4385 1.4350 1.4330 1.4300 1.4280 1.4265 1.4250 1.4200

EUR/JPY

Offers 127.25 127.50 127.80 128.00 128.30 128.50

Bids 126.75-80 126.50 126.30 126.00 125.80-85 125.50 125.00

EUR/GBP

Offers 0.7865 0.7880 0.7900 0.7925-30 0.7950 0.7975-80 0.8000

Bids 0.7825-30 0.7800 0.7785 0.7765 0.7750 0.7730 0.7700

USD/JPY

Offers 112.50 112.80 113.00 113.40 113.80-85 114.00

Bids 112.00 111.80-85 111.65 111.50 111.30 1111.00

AUD/USD

Offers 0.7700 0.7720 0.7735-40 0.7750 0.7765 0.7780 0.7800

Bids 0.7670 0.7650 0.7620 0.7600 0.7575 0.7550 0.7520 0.7500

-

13:00

U.S.: MBA Mortgage Applications, March -1%

-

11:47

European Central Bank Executive Board member Benoit Coeure: negative interest rates are not the central bank’s main monetary policy tool

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with Politico published on the central bank's website on Wednesday that negative interest rates were not the central bank's main monetary policy tool.

"Negative interest rates are not our main instrument, they just support our overall policy," he said.

Coere pointed out that the ECB would not cut interest rates "into absurdly negative territory", adding that further actions were possible.

He noted that the central bank did not discuss the introducing of "helicopter money".

-

11:28

UBS consumption index rises to 1.53 in February

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.53 in February from 1.45 in January. January's figure was revised down from 1.66.

The increase was driven by higher demand for automobiles, which climbed 1.2% year-on-year in February.

The bank noted that the indicator showed a solid growth in private consumption.

"New car registrations remained high, but retailer sentiment was rather subdued," the bank said.

-

11:13

Eurozone’s economic sentiment index slides to 103.0 in March

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

-

11:01

Eurozone: Business climate indicator , March 0.11 (forecast 0.08)

-

11:00

Eurozone: Consumer Confidence, March -10 (forecast -9.7)

-

11:00

Eurozone: Industrial confidence, March -4 (forecast -4.2)

-

11:00

Eurozone: Economic sentiment index , March 103 (forecast 103.8)

-

10:56

KOF leading indicator for Switzerland falls to 102.5 in March

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator fell to 102.5 in March from 102.6 in February, beating expectations for a decline to 101.9. February's figure was revised up from 102.4.

The decline was mainly driven by negative indicators for the manufacturing sector and the export.

"The new standing of the Economic Barometer signals an ongoing positive development of the Swiss economy in the coming months," the KOF said.

-

10:42

Dallas Fed President Robert Kaplan: the Fed should hike its interest rate gradually

Dallas Fed President Robert Kaplan said in a speech on Tuesday that the Fed should hike its interest rate gradually. He expressed concerns over the impact on the U.S. economy from developments in China, noting that the transition of the Chinese economy would affect global finance.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.64 (USD 1.02bln) 112.40-50 (470m) 113.00 (758m) 113.50 (660m)

EUR/USD 1.1050 (EUR 674m) 1.1090-1.1100 ( EUR 438m) 1.1210-20 (1.32bln) 1.1250 (772m) 1.1300 (229m) 1.1500 (466m)

GBP/USD 1.4500 (GBP 401m)

EUR/GBP 0.7850-55 (EUR 236m)

AUD/USD 0.7200 (AUD 251m) 0.7300 (220m) 0.7400 (475m) 0.7500 (246m) 0.7550 (393m)

USD/CAD 1.3200 (USD 474m) 1.3230 (560m) 1.3420 (248m)

-

10:22

Fed Chairwoman Janet Yellen: the Fed will hike its interest rate gradually

Fed Chairwoman Janet Yellen said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually. She did not mention the timing of possible interest rate hikes.

Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

"Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy," Fed chairwoman said.

Yellen pointed out that the Fed could cut its interest rate if needed.

"If the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero," she noted.

-

10:10

Preliminary industrial production in Japan drops 6.2% in February

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Tuesday evening. Preliminary industrial production in Japan dropped 6.2% in February, missing expectations for a 6.0% decline, after a 3.7% rise in January.

The drop was mainly driven by declines in transport equipment, electronic parts and devices, general-purpose, production and business oriented machinery.

According to a survey by the ministry, industrial production is expected to increase 3.9% in March, and to rise 5.3% in April.

On a yearly basis, Japan's industrial production was down 1.5% in February, after a 3.8% decrease in January.

-

09:00

Switzerland: KOF Leading Indicator, March 102.5 (forecast 101.9)

-

08:18

Asian session: Dollar bulls were on the defensive

The yen firmed even as dismal data released early in the session heightened speculation that Japan will need to muster more stimulus to avert another recession. Factory output fell 6.2 percent last month from the previous month, the biggest tumble since 2011 when the devastating earthquake, tsunami and nuclear crisis disrupted Japan's supply chain.

Dollar bulls were on the defensive on Wednesday after Federal Reserve chair Janet Yellen's cautious tone left markets wondering if there will be even one hike to U.S. interest rates this year.In a speech to the Economic Club of New York, Yellen stressed the need to be cautious in raising rates and highlighted external risks including low oil prices and slower growth abroad.

EUR/USD: during the Asian session the pair traded in the range of $1.1285-00

GBP/USD: during the Asian session the pair traded in the range of $1.4365-00

USD/JPY: during the Asian session the pair fell to Y113.35

Based on Reuters materials

-

08:13

Options levels on wednesday, March 30, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1404 (2662)

$1.1378 (3235)

$1.1345 (3003)

Price at time of writing this review: $1.1306

Support levels (open interest**, contracts):

$1.1244 (1707)

$1.1177 (2144)

$1.1092 (3862)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 47875 contracts, with the maximum number of contracts with strike price $1,1500 (4433);

- Overall open interest on the PUT options with the expiration date April, 8 is 68818 contracts, with the maximum number of contracts with strike price $1,0900 (6031);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from March, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.4701 (1663)

$1.4603 (1100)

$1.4505 (1817)

Price at time of writing this review: $1.4398

Support levels (open interest**, contracts):

$1.4293 (581)

$1.4196 (683)

$1.4098 (937)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20741 contracts, with the maximum number of contracts with strike price $1,4400 (1906);

- Overall open interest on the PUT options with the expiration date April, 8 is 23134 contracts, with the maximum number of contracts with strike price $1,4000 (2914);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from March, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: UBS Consumption Indicator, February 1.53

-

01:51

Japan: Industrial Production (YoY), February -1.5%

-

01:50

Japan: Industrial Production (MoM) , February -6.2% (forecast -6%)

-

00:29

Currencies. Daily history for Mar 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1290 +0,82%

GBP/USD $1,4385 +0,92%

USD/CHF Chf0,966 -0,79%

USD/JPY Y112,60 -0,70%

EUR/JPY Y127,24 +0,22%

GBP/JPY Y162,11 +0,31%

AUD/USD $0,7632 +1,22%

NZD/USD $0,6866 +2,05%

USD/CAD C$1,3059 -0,96%

-

00:16

New Zealand: Building Permits, m/m, February 10.8% (forecast 5%)

-

00:01

Schedule for today, Wednesday, Mar 30’2016:

(time / country / index / period / previous value / forecast)

06:00 Switzerland UBS Consumption Indicator February 1.66

07:00 Switzerland KOF Leading Indicator March 102.4 101.8

09:00 Eurozone Economic sentiment index March 103.8 103.8

09:00 Eurozone Industrial confidence March -4 -4.1

09:00 Eurozone Consumer Confidence (Finally) March -8.8 -9.7

09:00 Eurozone Business climate indicator March 0.07

11:00 U.S. MBA Mortgage Applications March -3.3%

12:00 Germany CPI, m/m (Preliminary) March 0.4% 0.6%

12:00 Germany CPI, y/y (Preliminary) March 0.0% 0.2%

12:15 U.S. ADP Employment Report March 214 194

14:30 U.S. Crude Oil Inventories March 9.357

23:05 United Kingdom Gfk Consumer Confidence March 0 -1

-