Noticias del mercado

-

17:04

Bank of England’s Financial Policy Committee: the referendum on Britain’s membership in the European Union (EU) is the most significant short-term domestic risk to financial stability

Bank of England's (BoE) Financial Policy Committee (FPC) released the minutes from its meeting on March 23. The FPC said that the referendum on Britain's membership in the European Union (EU) was the most significant short-term domestic risk to financial stability. The committee noted that the uncertainty around the outcome of the referendum could lead to a further depreciation of the pound and to higher costs for U.K. borrowers.

-

16:32

European Central Bank Governing Council member Jozef Makuch: the effect of negative interest rates is almost exhausted

European Central Bank (ECB) Governing Council member Jozef Makuch said on Tuesday that the effect of negative interest rates was almost exhausted. He added that the central bank was ready to add further stimulus measures if needed.

-

16:27

U.S. consumer confidence index climbs to 96.2 in March

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index climbed to 96.2 in March from 94.0 in February. February's figure was revised up from 92.2. Analysts had expected the index to remain unchanged at 94.0.

The present conditions index dropped to 113.5 in March from 115.0 in February.

The Conference Board's consumer expectations index for the next six months increased to 84.7 in March from 79.9 in February.

The percentage of consumers expecting more jobs in the coming months was up to 12.9% in March from 12.2% in February.

"Consumers' assessment of current conditions posted a moderate decline, while expectations regarding the short-term turned more favourable as last month's turmoil in the financial markets appears to have abated. On balance, consumers do not foresee the economy gaining any significant momentum in the near-term, nor do they see it worsening," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:00

U.S.: Consumer confidence , March 96.2 (forecast 94)

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY 111.25 (USD 500m) 112.00 (344m) 112.25 (240m) 114.00 (223m) 114.25 (400m) 114.50 (200m0

EURUSD 1.1110 ( EUR 298m) 1.1190 (298m) 1.1200 (411m) 1.1250 (325m) 1.1275 (790m) 1.1300 (267m)

GBPUSD 1.4195 (GBP 156m) 1.4250-55 (170m)

EURGBP 0.7850 (EUR 220m)

AUDUSD 0.7200 (AUD 635m) 0.7270 (390m) 0.7300 (1.22bln)

AUDNZD 1.1050 (AUD 666m)

-

15:18

S&P/Case-Shiller home price index rises 5.7% in January

The S&P/Case-Shiller home price index increased 5.7% year-on-year in January, missing expectations for a 5.9% rise, after a 5.7% gain in December.

Portland, Seattle, and San Francisco were the largest contributors to the rise, where prices climbed by 11.8%, 10.7% and 10.5%, respectively.

"Home prices continue to climb at more than twice the rate of inflation. The low inventory of homes for sale - currently about a five month supply - means that would-be sellers seeking to trade-up are having a hard time finding a new, larger home," managing director chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index was flat in January.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:11

San Francisco Fed President John Williams: inflation in the U.S. will reach the Fed’s 2% target over the next two years

San Francisco Fed President John Williams said in Singapore on Tuesday that inflation in the U.S. would reach the Fed's 2% target over the next two years. He noted that inflation could reach 2% target sooner.

"Recent developments have been very encouraging and add to my confidence that we're on course to reach our goal," San Francisco Fed president noted.

Williams pointed out that the Fed should continue to raise its interest rate.

"My view is essentially, let's just stay on track. Let's not get side-lined by the noise and distraction commentary can sometimes cause," he said.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, January 5.7% (forecast 5.9%)

-

14:38

Canadian industrial product prices drop 1.1% in February

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) dropped 1.1% in February, missing expectations for a 0.2% decline, after a 0.5% rise in January.

The increase was mainly driven by lower prices for energy and petroleum products, which plunged 4.1% in February.

4 of the 21 commodity groups increased, 15 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) slid 2.6% in February, after a 0.4% fall in January.

The drop was driven by lower prices for crude energy products. Crude energy products dropped by 9.4% in February.

2 of the 6 commodity groups rose and 4 decreased.

-

14:30

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Private Loans, Y/Y February 1.4% 1.4% 1.6%

08:00 Eurozone M3 money supply, adjusted y/y February 5.0% 5% 5.0%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.9% in January, after a 5.7% gain in December.

The U.S. consumer confidence is expected to increase to 94.0 in March from 92.2 in February.

The euro traded higher against the U.S. dollar. The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. The Industrial Product Price Index (IPPI) is expected to decline 0.2% in February, after a 0.5% rise in January.

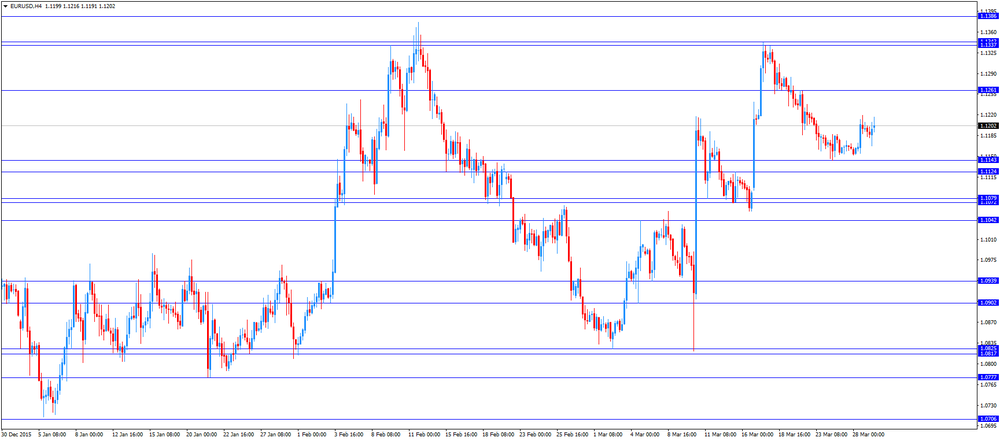

EUR/USD: the currency pair increased to $1.1216

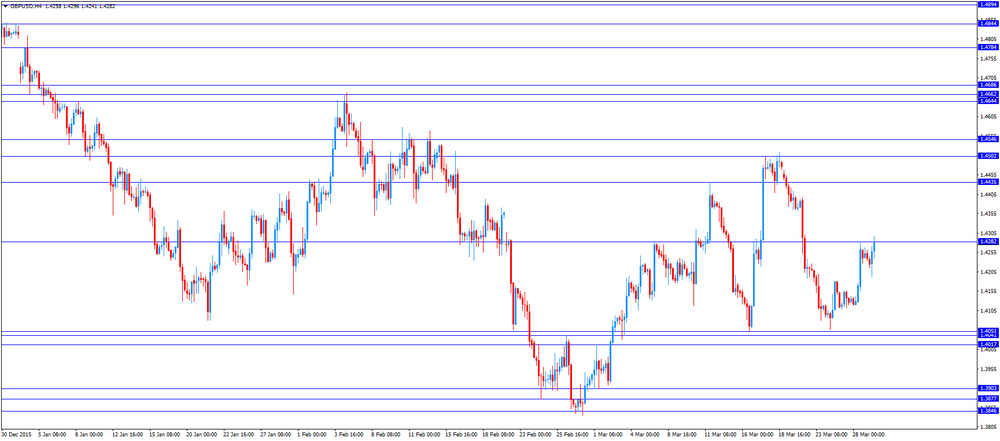

GBP/USD: the currency pair climbed to $1.4296

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, m/m February 0.5% -0.2%

12:30 Canada Industrial Product Price Index, y/y February 1.7%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January 5.7% 5.9%

14:00 U.S. Consumer confidence March 92.2 94

16:20 U.S. Fed Chairman Janet Yellen Speaks

21:45 New Zealand Building Permits, m/m February -8.2% 5%

23:50 Japan Industrial Production (MoM) (Preliminary) February 3.7% -6%

23:50 Japan Industrial Production (YoY) (Preliminary) February -3.8%

-

14:30

Canada: Industrial Product Price Index, m/m, February -1.1% (forecast -0.2%)

-

14:30

Canada: Industrial Product Price Index, y/y, February -1.4%

-

14:00

Orders

EUR/USD

Offers 1.1200 1.1220 1.1235 1.1250 1.1275-80 1.1300 1.1320 1.1350

Bids 1.1150 1.1130 1.1100 1.1080-85 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4250 1.4270 1.4285 1.4300 1.4320 1.4335 1.4350 1.4380 1.4400 1.4420

Bids 1.4200 1.4180 1.4165 1.4150 1.4130 1.4100-10 1.4085 1.4065 1.4050

EUR/JPY

Offers 127.20 127.50 127.80 128.00 128.30 128.50

Bids 126.75-80 126.50 126.30 126.00 125.80-85 125.50 125.00

EUR/GBP

Offers 0.7875-80 0.7900 0.7925-30 0.7950 0.7975-80 0.8000

Bids 0.7845-50 0.7825-30 0.7800 0.,7785 0.7765 0.7750

USD/JPY

Offers 113.80-85 114.00 114.30 114.50 114.75 115.00

Bids 113.50 113.25-30 113.00 112.85 112.70 112.50 112.20 112.00 111.80-85 111.50

AUD/USD

Offers 0.7550 0.7575-80 0.7600 0.7620 0.7650 0.7680 0.7700

Bids 0.7520 0.7500 0.7480 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

12:01

U.S. personal spending rises 0.1% in February

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending climbed 0.1% in February, in line with expectations, after a 0.1% increase in January. January's figure was revised down from a 0.5% gain.

The lower spending was driven by a drop in spending on goods. Spending on goods slid 0.7% in February, while spending on services rose 0.4%.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.0% in the fourth quarter, after a 3.0% increase in the third quarter.

This data suggests that American consumers remained cautious.

The saving rate increased to 5.4% in February from 5.3% in January. It was the highest level since 2012.

Personal income increased 0.2% in February, exceeding expectations for 0.1% rise, after a 0.5% gain in January.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in February, missing forecasts of a 0.2% increase, after a 0.3% gain in January.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.7% in February.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

11:47

Japan’s unemployment rate rises to 3.3% in February

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Monday evening. Unemployment rate in Japan rose to 3.3% in February from 3.2% in January. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

The number of unemployed persons fell by 130,000 year-on-year in February to 2.13 million.

The number of employed persons rose by 290,000 year-on-year in February to 63.51 million.

-

11:42

Retail sales in Japan are up at an annual rate of 0.5% in February

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan were up at an annual rate of 0.5% in February, missing expectations for a 1.7% gain, after a 0.1% fall in January.

Sales at large-scale retailers increased 2.2% year-on-year in February, after a 0.9% rise in January.

On a monthly basis, retail sales were down 2.3% in February, after a 0.4% decrease in January.

-

11:38

Italian consumer confidence index rises to 115.0 in March

The Italian statistical office Istat released its consumer confidence index for Italy on Monday. The Italian consumer confidence index increased to 115.0 in March from 114.5 in February.

The increase was driven by economic, current and future sub-indexes, while the personal sub-index declined.

The business confidence index rose to 102.2 in March from 102.0 in February.

The rise was driven by a more favourable assessments on order books and by a rise in inventories, while production expectations remained unchanged.

-

11:14

Japanese government is considering to add further stimulus measures

News reported on Tuesday that the Japanese government was considering to add further stimulus measures. According sources, the government could spend more than 5 trillion yen ($44 billion) to stimulate the economy.

-

11:06

M3 money supply in the Eurozone rises 5.0% in February from last year

The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

-

10:59

San Francisco Fed President John Williams: the Fed’s interest rate decision will depend on the incoming economic data

San Francisco Fed President John Williams said in an interview with CNBC on Monday that the Fed's interest rate decision will depend on the incoming economic data, adding that he was concerned about low inflation.

He also said that the Fed would not introduce negative interest rates.

Williams noted that the global financial and economic developments abroad had an impact on the U.S. economy and the Fed's monetary policy, saying the U.S. economy was doing well.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.25 (USD 500m) 112.00 (344m) 112.25 (240m) 114.00 (223m) 114.25 (400m) 114.50 (200m0

EUR/USD 1.1110 ( EUR 298m) 1.1190 (298m) 1.1200 (411m) 1.1250 (325m) 1.1275 (790m) 1.1300 (267m)

GBP/USD 1.4195 (GBP 156m) 1.4250-55 (170m)

EUR/GBP 0.7850 (EUR 220m)

AUD/USD 0.7200 (AUD 635m) 0.7270 (390m) 0.7300 (1.22bln)

AUD/NZD 1.1050 (AUD 666m)

-

10:38

Atlanta Fed cuts its GDP forecasts for the U.S.

Atlanta Fed downgraded its GDP forecasts for the U.S. GDP is expected to be 0.6% in the first quarter, down from the previous estimate of 1.4%. The downward revision was driven by yesterday's release of the personal income and spending data.

Consumer spending was lowered to 1.8% from 2.5%.

-

10:22

Household spending in Japan rises 1.2% year-on-year in February

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Monday evening. Household spending in Japan rose 1.2% year-on-year in February, beating expectations of a 1.5% decline, after a 3.1% drop in January.

The rise was mainly driven by increases in spending on education and medical care.

Spending on education soared 17.9% year-on-year in February, while spending on medical care climbed 13.1%.

-

10:09

U.S. pending home sales climb 3.5% in February

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. climbed 3.5% in February, exceeding expectations for a 1.0% gain, after a 3.0% drop in January. January's figure was revised down from a 2.5% decline.

The increase was mainly driven by a rise in the Midwest.

"After some volatility this winter, the latest data is encouraging in that a decent number of buyers signed contracts last month, lured by mortgage rates dipping to their lowest levels in nearly a year and a modest, seasonal uptick in inventory," the NAR's chief economist Lawrence Yun said.

"Looking ahead, the key for sustained momentum and more sales than last spring is a continuous stream of new listings quickly replacing what's being scooped up by a growing pool of buyers. Without adequate supply, sales will likely plateau," he added.

-

10:01

Eurozone: Private Loans, Y/Y, February 1.6% (forecast 1.4%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, February 5.0% (forecast 5%)

-

08:22

Asian session: The dollar clawed back ground lost

The dollar clawed back ground lost after downbeat U.S. economic data contributed to an uninspiring session on Wall Street. Investors awaited Federal Reserve Chair Janet Yellen's speech at 1620 GMT for fresh signals on the outlook for U.S. interest rate hikes, after a chorus of hawkish comments from other Fed officials.

Japanese household spending rose 1.2 percent in February from a year earlier in price-adjusted real terms, in contrast with the median forecast for a 1.5 percent fall, partly because of the extra Leap Year day. But the country's jobless rate inched up to 3.3 percent, and retail sales fell short.

Speculation of more monetary stimulus and talk that Japanese Prime Minister Shinzo Abe might delay an unpopular sales tax hike and call a snap election kept the yen under pressure, though Abe insisted on Tuesday that neither option was planned.

EUR/USD: during the Asian session the pair traded in the range of $1.1180-00

GBP/USD: during the Asian session the pair fell to $1.4230

USD/JPY: during the Asian session the pair rose to Y113.65

Based on Reuters materials -

08:15

Options levels on tuesday, March 29, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1342 (3131)

$1.1286 (2925)

$1.1232 (3108)

Price at time of writing this review: $1.1184

Support levels (open interest**, contracts):

$1.1141 (2103)

$1.1073 (3920)

$1.1033 (2165)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 46939 contracts, with the maximum number of contracts with strike price $1,1500 (4397);

- Overall open interest on the PUT options with the expiration date April, 8 is 67685 contracts, with the maximum number of contracts with strike price $1,0900 (6035);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from March, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.4503 (1687)

$1.4405 (1906)

$1.4309 (964)

Price at time of writing this review: $1.4228

Support levels (open interest**, contracts):

$1.4191 (630)

$1.4095 (900)

$1.3997 (2932)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20544 contracts, with the maximum number of contracts with strike price $1,4400 (1906);

- Overall open interest on the PUT options with the expiration date April, 8 is 23014 contracts, with the maximum number of contracts with strike price $1,4000 (2932);

- The ratio of PUT/CALL was 1.12 versus 1.09 from the previous trading day according to data from March, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:50

Japan: Retail sales, y/y, February 0.5% (forecast 1.7%)

-

01:31

Japan: Household spending Y/Y, February 1.2% (forecast -1.5%)

-

01:30

Japan: Unemployment Rate, February 3.3% (forecast 3.2%)

-

00:30

Currencies. Daily history for Mar 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1197 +0,29%

GBP/USD $1,4253 +0,83%

USD/CHF Chf0,9736 -0,44%

USD/JPY Y113,39 +0,30%

EUR/JPY Y126,96 +0,54%

GBP/JPY Y161,61 +1,11%

AUD/USD $0,7539 +0,45%

NZD/USD $0,6725 +0,59%

USD/CAD C$1,3185 -0,65%

-