Noticias del mercado

-

21:00

DJIA 17624.69 89.30 0.51%, NASDAQ 4841.21 74.43 1.56%, S&P 500 2053.00 15.95 0.78%

-

18:00

European stocks close: stocks closed mixed ahead of a speech by the Fed Chairwoman Janet Yellen

Stock indices closed mixed ahead of a speech by the Fed Chairwoman Janet Yellen later in the day. Market participants will closely monitor her comments for hints of further monetary policy actions.

European Central Bank (ECB) Governing Council member Jozef Makuch said on Tuesday that the effect of negative interest rates was almost exhausted. He added that the central bank was ready to add further stimulus measures if needed.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

Bank of England's (BoE) Financial Policy Committee (FPC) released the minutes from its meeting on March 23. The FPC said that the referendum on Britain's membership in the European Union (EU) was the most significant short-term domestic risk to financial stability. The committee noted that the uncertainty around the outcome of the referendum could lead to a further depreciation of the pound and to higher costs for U.K. borrowers.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,105.9 -0.58 -0.01 %

DAX 9,887.94 +36.59 +0.37 %

CAC 40 4,366.67 +36.99 +0.85 %

-

18:00

European stocks closed: FTSE 6105.90 -0.58 -0.01%, DAX 9887.94 36.59 0.37%, CAC 40 4366.67 36.99 0.85%

-

17:47

WSE: Session Results

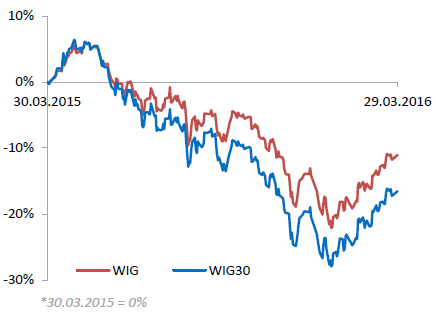

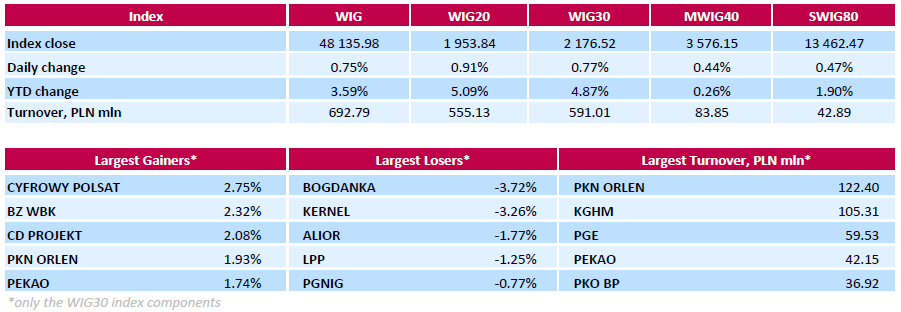

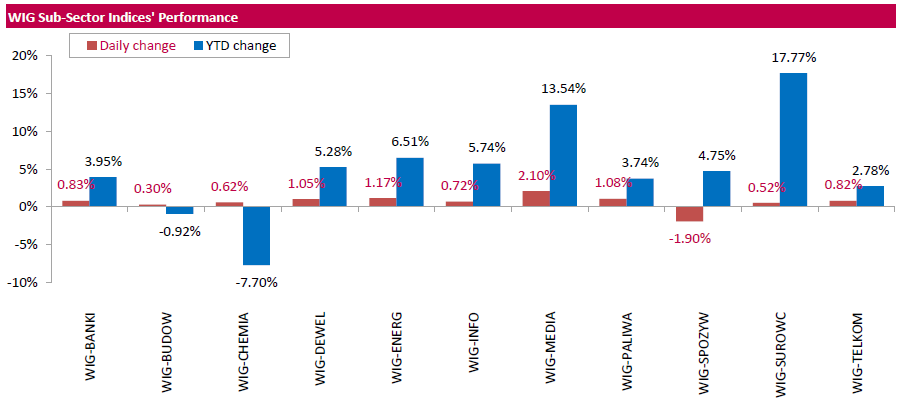

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.75%. Food sector (-1.90%) was sole decliner within the WIG Index, while media group (+2.10%) outpaced.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.77%. In the WIG30 index, the strongest performers were media group CYFROWY POLSAT (WSE: CPS), bank BZ WBK (WSE: BZW) and videogame developer CD PROJEKT (WSE: CDR), gaining 2.75%, 2.32% and 2.08% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) led the decliners with a 3.72% drop, followed by agricultural producer KERNEL (WSE: KER), plunging by 3.26%.

-

17:28

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday, ahead of Federal Reserve Chair Janet Yellen's speech on monetary policy. Yellen, who is due to speak before the Economic Club of New York at 16:20 GMT, will make her first remarks since the Fed's meeting in March. The central bank has said it will depend on economic data before it makes a decision on rates, but several policymakers have voiced support for more than one increase this year. Investors will keep a close eye on Yellen's speech as they look for fresh drivers that could push stocks higher.

Dow stocks mixed (15 vs 15). Top looser - The Boeing Company (BA, -1,71%). Top gainer - Apple Inc. (AAPL, +1,51%).

S&P sectors also mixed. Top looser - Basic Materials (-1,7%). Top gainer - Consumer goods (+0,3%).

At the moment:

Dow 17392.00 -56.00 -0.32%

S&P 500 2024.00 -4.00 -0.20%

Nasdaq 100 4403.75 +14.25 +0.32%

Oil 37.94 -1.45 -3.68%

Gold 1225.80 +5.70 +0.47%

U.S. 10yr 1.86 -0.01

-

17:04

Bank of England’s Financial Policy Committee: the referendum on Britain’s membership in the European Union (EU) is the most significant short-term domestic risk to financial stability

Bank of England's (BoE) Financial Policy Committee (FPC) released the minutes from its meeting on March 23. The FPC said that the referendum on Britain's membership in the European Union (EU) was the most significant short-term domestic risk to financial stability. The committee noted that the uncertainty around the outcome of the referendum could lead to a further depreciation of the pound and to higher costs for U.K. borrowers.

-

16:32

European Central Bank Governing Council member Jozef Makuch: the effect of negative interest rates is almost exhausted

European Central Bank (ECB) Governing Council member Jozef Makuch said on Tuesday that the effect of negative interest rates was almost exhausted. He added that the central bank was ready to add further stimulus measures if needed.

-

16:27

U.S. consumer confidence index climbs to 96.2 in March

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index climbed to 96.2 in March from 94.0 in February. February's figure was revised up from 92.2. Analysts had expected the index to remain unchanged at 94.0.

The present conditions index dropped to 113.5 in March from 115.0 in February.

The Conference Board's consumer expectations index for the next six months increased to 84.7 in March from 79.9 in February.

The percentage of consumers expecting more jobs in the coming months was up to 12.9% in March from 12.2% in February.

"Consumers' assessment of current conditions posted a moderate decline, while expectations regarding the short-term turned more favourable as last month's turmoil in the financial markets appears to have abated. On balance, consumers do not foresee the economy gaining any significant momentum in the near-term, nor do they see it worsening," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:04

WSE: After start on Wall Street

Wall Street began the trading with decline of the S&P500 index similar to that indicated by the futures contracts, -0.2 percent. The WSE takes the start of the US session without reaction. Probably by the end of the day Europe and the Warsaw Stock Exchange will look towards the US, seeking guidance on how Wall Street will set up for the evening Fed speech. The problem with the final hours of session may come from the oil market, where we see a nearly 3% decline in future contracts. This can be a very important day for the short-term situation of the raw material.

U.S. Stocks open: Dow -0.34%, Nasdaq -0.24%, S&P -0.26%

-

16:00

U.S.: Consumer confidence , March 96.2 (forecast 94)

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY 111.25 (USD 500m) 112.00 (344m) 112.25 (240m) 114.00 (223m) 114.25 (400m) 114.50 (200m0

EURUSD 1.1110 ( EUR 298m) 1.1190 (298m) 1.1200 (411m) 1.1250 (325m) 1.1275 (790m) 1.1300 (267m)

GBPUSD 1.4195 (GBP 156m) 1.4250-55 (170m)

EURGBP 0.7850 (EUR 220m)

AUDUSD 0.7200 (AUD 635m) 0.7270 (390m) 0.7300 (1.22bln)

AUDNZD 1.1050 (AUD 666m)

-

15:32

U.S. Stocks open: Dow -0.34%, Nasdaq -0.24%, S&P -0.26%

-

15:23

Before the bell: S&P futures -0.26%, NASDAQ futures -0.20%

U.S. stock-index fell.

Global Stocks:

Nikkei 17,103.53 -30.84 -0.18%

Hang Seng 20,366.3 +20.69 +0.10%

Shanghai Composite 2,920.55 -37.27 -1.26%

FTSE 6,096.3 -10.18 -0.17%

CAC 4,350.12 +20.44 +0.47%

DAX 9,839.89 -11.46 -0.12%

Crude oil $38.47 (-2.34%)

Gold $1220.40 (+0.02%)

-

15:18

S&P/Case-Shiller home price index rises 5.7% in January

The S&P/Case-Shiller home price index increased 5.7% year-on-year in January, missing expectations for a 5.9% rise, after a 5.7% gain in December.

Portland, Seattle, and San Francisco were the largest contributors to the rise, where prices climbed by 11.8%, 10.7% and 10.5%, respectively.

"Home prices continue to climb at more than twice the rate of inflation. The low inventory of homes for sale - currently about a five month supply - means that would-be sellers seeking to trade-up are having a hard time finding a new, larger home," managing director chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index was flat in January.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:11

San Francisco Fed President John Williams: inflation in the U.S. will reach the Fed’s 2% target over the next two years

San Francisco Fed President John Williams said in Singapore on Tuesday that inflation in the U.S. would reach the Fed's 2% target over the next two years. He noted that inflation could reach 2% target sooner.

"Recent developments have been very encouraging and add to my confidence that we're on course to reach our goal," San Francisco Fed president noted.

Williams pointed out that the Fed should continue to raise its interest rate.

"My view is essentially, let's just stay on track. Let's not get side-lined by the noise and distraction commentary can sometimes cause," he said.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, January 5.7% (forecast 5.9%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

166

-0.28(-0.1684%)

900

ALCOA INC.

AA

9.55

-0.15(-1.5464%)

28794

Amazon.com Inc., NASDAQ

AMZN

579.4

-0.47(-0.081%)

2183

Apple Inc.

AAPL

104.97

-0.22(-0.2091%)

48007

AT&T Inc

T

39.02

-0.05(-0.128%)

1530

Barrick Gold Corporation, NYSE

ABX

13.6

-0.01(-0.0735%)

54940

Boeing Co

BA

128.5

-2.79(-2.1251%)

7197

Caterpillar Inc

CAT

74.9

-0.42(-0.5576%)

165

Chevron Corp

CVX

93.79

-0.89(-0.94%)

6196

Cisco Systems Inc

CSCO

27.85

-0.05(-0.1792%)

1722

Deere & Company, NYSE

DE

79.28

-0.29(-0.3645%)

1600

Exxon Mobil Corp

XOM

83.65

-0.57(-0.6768%)

4431

Facebook, Inc.

FB

113.51

-0.18(-0.1583%)

38040

Ford Motor Co.

F

13.09

0.00(0.00%)

6240

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.78

-0.36(-3.5503%)

157182

General Electric Co

GE

31.41

-0.08(-0.254%)

21222

Goldman Sachs

GS

153.44

-0.40(-0.26%)

1020

Google Inc.

GOOG

732.34

-1.19(-0.1622%)

325

Hewlett-Packard Co.

HPQ

12.01

-0.06(-0.4971%)

2500

Intel Corp

INTC

31.85

-0.05(-0.1567%)

1515

Johnson & Johnson

JNJ

108.15

-0.08(-0.0739%)

1400

JPMorgan Chase and Co

JPM

59.4

0.00(0.00%)

2320

McDonald's Corp

MCD

123.55

0.38(0.3085%)

3254

Microsoft Corp

MSFT

53.39

-0.15(-0.2802%)

1484

Nike

NKE

61.15

-0.19(-0.3097%)

7735

Pfizer Inc

PFE

29.75

-0.03(-0.1007%)

2023

Starbucks Corporation, NASDAQ

SBUX

58.7

-0.26(-0.441%)

1333

Tesla Motors, Inc., NASDAQ

TSLA

229.5

-0.76(-0.3301%)

24070

The Coca-Cola Co

KO

45.67

-0.13(-0.2838%)

418

Twitter, Inc., NYSE

TWTR

15.66

0.06(0.3846%)

52572

Verizon Communications Inc

VZ

53.31

-0.09(-0.1685%)

2355

Wal-Mart Stores Inc

WMT

68

-0.12(-0.1762%)

652

Yahoo! Inc., NASDAQ

YHOO

35.4

0.17(0.4825%)

14549

Yandex N.V., NASDAQ

YNDX

14.83

-0.08(-0.5366%)

1000

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) target raised to $775 from $750 at Stifel

McDonald's (MCD) target raised to $135 from $130 at Credit Suisse

-

14:38

Canadian industrial product prices drop 1.1% in February

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) dropped 1.1% in February, missing expectations for a 0.2% decline, after a 0.5% rise in January.

The increase was mainly driven by lower prices for energy and petroleum products, which plunged 4.1% in February.

4 of the 21 commodity groups increased, 15 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) slid 2.6% in February, after a 0.4% fall in January.

The drop was driven by lower prices for crude energy products. Crude energy products dropped by 9.4% in February.

2 of the 6 commodity groups rose and 4 decreased.

-

14:30

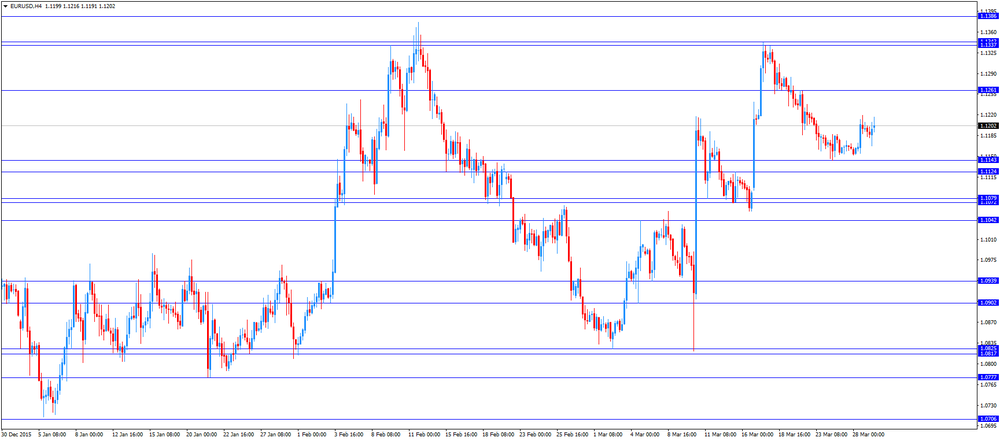

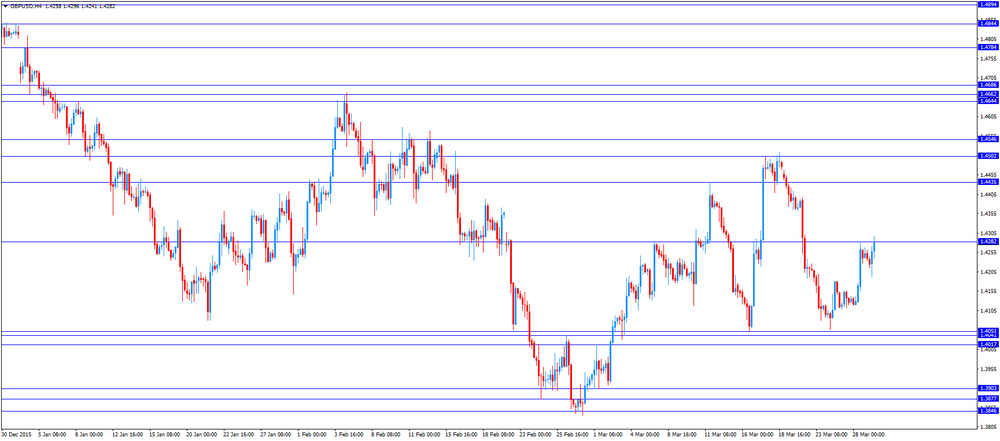

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Private Loans, Y/Y February 1.4% 1.4% 1.6%

08:00 Eurozone M3 money supply, adjusted y/y February 5.0% 5% 5.0%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.9% in January, after a 5.7% gain in December.

The U.S. consumer confidence is expected to increase to 94.0 in March from 92.2 in February.

The euro traded higher against the U.S. dollar. The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. The Industrial Product Price Index (IPPI) is expected to decline 0.2% in February, after a 0.5% rise in January.

EUR/USD: the currency pair increased to $1.1216

GBP/USD: the currency pair climbed to $1.4296

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, m/m February 0.5% -0.2%

12:30 Canada Industrial Product Price Index, y/y February 1.7%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January 5.7% 5.9%

14:00 U.S. Consumer confidence March 92.2 94

16:20 U.S. Fed Chairman Janet Yellen Speaks

21:45 New Zealand Building Permits, m/m February -8.2% 5%

23:50 Japan Industrial Production (MoM) (Preliminary) February 3.7% -6%

23:50 Japan Industrial Production (YoY) (Preliminary) February -3.8%

-

14:30

Canada: Industrial Product Price Index, m/m, February -1.1% (forecast -0.2%)

-

14:30

Canada: Industrial Product Price Index, y/y, February -1.4%

-

14:00

Orders

EUR/USD

Offers 1.1200 1.1220 1.1235 1.1250 1.1275-80 1.1300 1.1320 1.1350

Bids 1.1150 1.1130 1.1100 1.1080-85 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4250 1.4270 1.4285 1.4300 1.4320 1.4335 1.4350 1.4380 1.4400 1.4420

Bids 1.4200 1.4180 1.4165 1.4150 1.4130 1.4100-10 1.4085 1.4065 1.4050

EUR/JPY

Offers 127.20 127.50 127.80 128.00 128.30 128.50

Bids 126.75-80 126.50 126.30 126.00 125.80-85 125.50 125.00

EUR/GBP

Offers 0.7875-80 0.7900 0.7925-30 0.7950 0.7975-80 0.8000

Bids 0.7845-50 0.7825-30 0.7800 0.,7785 0.7765 0.7750

USD/JPY

Offers 113.80-85 114.00 114.30 114.50 114.75 115.00

Bids 113.50 113.25-30 113.00 112.85 112.70 112.50 112.20 112.00 111.80-85 111.50

AUD/USD

Offers 0.7550 0.7575-80 0.7600 0.7620 0.7650 0.7680 0.7700

Bids 0.7520 0.7500 0.7480 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

12:55

WSE: Mid session comment

There is no trace after the morning strengthening in Euroland, as well as other asset classes see a slight shortness of breath. If we look at today's calendar, we can detect potential reasons for this caution of investors. At the 18:20 (Warsaw time) is scheduled the public appearance of Janet Yellen.

The WIG20 index ignores the revocation of the oil market and the rapid decline in the DAX index. It is worth noting that there was a change of leaders on the parquet . The financial sector and the mining companies took over the role of locomotive from KGHM, which reduced the three-percent growth to 0.97 percent.

-

12:06

European stock markets mid session: stocks traded mixed ahead of a speech by the Fed Chairwoman Janet Yellen

Stock indices traded mixed ahead of a speech by the Fed Chairwoman Janet Yellen later in the day. Market participants will closely monitor her comments for hints of further monetary policy actions.

Market participants also eyed the economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

Current figures:

Name Price Change Change %

FTSE 100 6,096.78 -9.70 -0.16 %

DAX 9,814.43 -36.92 -0.37 %

CAC 40 4,336.46 +6.78 +0.16 %

-

12:01

U.S. personal spending rises 0.1% in February

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending climbed 0.1% in February, in line with expectations, after a 0.1% increase in January. January's figure was revised down from a 0.5% gain.

The lower spending was driven by a drop in spending on goods. Spending on goods slid 0.7% in February, while spending on services rose 0.4%.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.0% in the fourth quarter, after a 3.0% increase in the third quarter.

This data suggests that American consumers remained cautious.

The saving rate increased to 5.4% in February from 5.3% in January. It was the highest level since 2012.

Personal income increased 0.2% in February, exceeding expectations for 0.1% rise, after a 0.5% gain in January.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in February, missing forecasts of a 0.2% increase, after a 0.3% gain in January.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.7% in February.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

11:47

Japan’s unemployment rate rises to 3.3% in February

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Monday evening. Unemployment rate in Japan rose to 3.3% in February from 3.2% in January. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

The number of unemployed persons fell by 130,000 year-on-year in February to 2.13 million.

The number of employed persons rose by 290,000 year-on-year in February to 63.51 million.

-

11:42

Retail sales in Japan are up at an annual rate of 0.5% in February

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan were up at an annual rate of 0.5% in February, missing expectations for a 1.7% gain, after a 0.1% fall in January.

Sales at large-scale retailers increased 2.2% year-on-year in February, after a 0.9% rise in January.

On a monthly basis, retail sales were down 2.3% in February, after a 0.4% decrease in January.

-

11:38

Italian consumer confidence index rises to 115.0 in March

The Italian statistical office Istat released its consumer confidence index for Italy on Monday. The Italian consumer confidence index increased to 115.0 in March from 114.5 in February.

The increase was driven by economic, current and future sub-indexes, while the personal sub-index declined.

The business confidence index rose to 102.2 in March from 102.0 in February.

The rise was driven by a more favourable assessments on order books and by a rise in inventories, while production expectations remained unchanged.

-

11:14

Japanese government is considering to add further stimulus measures

News reported on Tuesday that the Japanese government was considering to add further stimulus measures. According sources, the government could spend more than 5 trillion yen ($44 billion) to stimulate the economy.

-

11:06

M3 money supply in the Eurozone rises 5.0% in February from last year

The European Central Bank (ECB) released its M3 money supply figures on Monday. M3 money supply rose 5.0% in February from last year, in line with expectations, after a 5.0 % increase in January.

Loans to the private sector in the Eurozone climbed 1.6% in February from the last year, beating expectations for a 1.4% rise, after a 1.4% gain in January.

Total credit to euro area residents increased to 3.2% year-on-year in February from 2.6% in January.

Loans to non-financial corporations rose to 0.9% year-on-year in February from 0.6% in January.

-

10:59

San Francisco Fed President John Williams: the Fed’s interest rate decision will depend on the incoming economic data

San Francisco Fed President John Williams said in an interview with CNBC on Monday that the Fed's interest rate decision will depend on the incoming economic data, adding that he was concerned about low inflation.

He also said that the Fed would not introduce negative interest rates.

Williams noted that the global financial and economic developments abroad had an impact on the U.S. economy and the Fed's monetary policy, saying the U.S. economy was doing well.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:56

WSE: Uniwheels recommends Euro 1.65 dividend per share for 2015.

The Board of Uniwheels AG (WSE: UNW) recommended shareholders to pay a dividend of Euro 1.65 per share for 2015 (which means a dividend of 50% of the profits), the company said in the report.

According to board member and CFO Karsten Obenaus, payment of 50% of the profits is the "level of dividends, which clearly exceeds the average in the European automotive industry."

Uniwheels Group is one of the leading suppliers of aluminum wheels for passenger cars in Europe and one of the few technology leaders in the field of aluminum wheels. Manufacturing plants are located in Germany and Poland. The Group supplies wheels for the majority of the most respected car manufacturers.

The company is a component of the index sWIG80 (3.169%) and the WIG (0.262%) index.

-

10:47

Saudi Arabia lost its oil market share in top markets between 2013 and 2015

Saudi Arabia lost its oil market share in 9 of 15 top markets between 2013 and 2015, including China, South Africa and the U.S. Saudi Arabian oil market share in China fell to 15% in 2015 from 19% in 2013 due to higher imports from Russia, its share in the U.S. dropped to 14% from 17%, while its share in South Africa declined to 22% from 53% due to higher imports from Nigeria and Angola.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.25 (USD 500m) 112.00 (344m) 112.25 (240m) 114.00 (223m) 114.25 (400m) 114.50 (200m0

EUR/USD 1.1110 ( EUR 298m) 1.1190 (298m) 1.1200 (411m) 1.1250 (325m) 1.1275 (790m) 1.1300 (267m)

GBP/USD 1.4195 (GBP 156m) 1.4250-55 (170m)

EUR/GBP 0.7850 (EUR 220m)

AUD/USD 0.7200 (AUD 635m) 0.7270 (390m) 0.7300 (1.22bln)

AUD/NZD 1.1050 (AUD 666m)

-

10:38

Atlanta Fed cuts its GDP forecasts for the U.S.

Atlanta Fed downgraded its GDP forecasts for the U.S. GDP is expected to be 0.6% in the first quarter, down from the previous estimate of 1.4%. The downward revision was driven by yesterday's release of the personal income and spending data.

Consumer spending was lowered to 1.8% from 2.5%.

-

10:22

Household spending in Japan rises 1.2% year-on-year in February

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Monday evening. Household spending in Japan rose 1.2% year-on-year in February, beating expectations of a 1.5% decline, after a 3.1% drop in January.

The rise was mainly driven by increases in spending on education and medical care.

Spending on education soared 17.9% year-on-year in February, while spending on medical care climbed 13.1%.

-

10:09

U.S. pending home sales climb 3.5% in February

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. climbed 3.5% in February, exceeding expectations for a 1.0% gain, after a 3.0% drop in January. January's figure was revised down from a 2.5% decline.

The increase was mainly driven by a rise in the Midwest.

"After some volatility this winter, the latest data is encouraging in that a decent number of buyers signed contracts last month, lured by mortgage rates dipping to their lowest levels in nearly a year and a modest, seasonal uptick in inventory," the NAR's chief economist Lawrence Yun said.

"Looking ahead, the key for sustained momentum and more sales than last spring is a continuous stream of new listings quickly replacing what's being scooped up by a growing pool of buyers. Without adequate supply, sales will likely plateau," he added.

-

10:01

Eurozone: Private Loans, Y/Y, February 1.6% (forecast 1.4%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, February 5.0% (forecast 5%)

-

09:14

WSE: After opening

Futures contracts on the WIG20 index (WSE: FW20M16) started from light pluses: 1936 pts. (+0,21%).

The WIG20 index opened at 1939.41 points (+0.17%)*

WIG 47885.22 0.22%

WIG20 1939.41 0.17%

WIG30 2165.83 0.28%

mWIG40 3561.37 0.02%

*/ - change to previous close

The situation on the markets in the period of public holidays was not too variable, so for now the beginning of the session is without significant impulses both from the behavior of other market or economic data.

-

08:30

WSE: Before opening

Wall Street returned to play on Monday. Unfortunately, yesterday's session in the US was uninspiring, same like the end of the last pre-holiday session. Enough to say that on Thursday, the S&P500 index lost 0.04 percent, and on Monday gained 0.05 percent. Thus Europe, today returned to the game after a four day break, will not find on Wall Street major inspiration. The Nikkei index lost 0.18 percent and Shanghai 0.85 percent - but the current trading of contract futures on the S&P500, which grow by 0.16 percent indicate a stabilization in sentiment.

Oil, which loses its value and is trading below the psychological barrier of $ 40 per barrel, supports bears.

Europe return today to play in the context of conflicting impulses, which will strengthen the expectation of what today Janet Yellen will say.

In this context, it is difficult to expect any big changes on the WSE, especially in the first half.

Last week the Wig20 index ended up in the region of 1,936 pts., which means technically neutral levels and in the middle shelf of the consolidation between resistance in the region of 2,000 pts. and support in the area of 1900 pts.

The only element that is conducive to serious shifts is approaching the end of the month and quarter, which provokes institutional players pull indices aim to increase the value of portfolios.

-

08:22

Asian session: The dollar clawed back ground lost

The dollar clawed back ground lost after downbeat U.S. economic data contributed to an uninspiring session on Wall Street. Investors awaited Federal Reserve Chair Janet Yellen's speech at 1620 GMT for fresh signals on the outlook for U.S. interest rate hikes, after a chorus of hawkish comments from other Fed officials.

Japanese household spending rose 1.2 percent in February from a year earlier in price-adjusted real terms, in contrast with the median forecast for a 1.5 percent fall, partly because of the extra Leap Year day. But the country's jobless rate inched up to 3.3 percent, and retail sales fell short.

Speculation of more monetary stimulus and talk that Japanese Prime Minister Shinzo Abe might delay an unpopular sales tax hike and call a snap election kept the yen under pressure, though Abe insisted on Tuesday that neither option was planned.

EUR/USD: during the Asian session the pair traded in the range of $1.1180-00

GBP/USD: during the Asian session the pair fell to $1.4230

USD/JPY: during the Asian session the pair rose to Y113.65

Based on Reuters materials -

08:15

Options levels on tuesday, March 29, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1342 (3131)

$1.1286 (2925)

$1.1232 (3108)

Price at time of writing this review: $1.1184

Support levels (open interest**, contracts):

$1.1141 (2103)

$1.1073 (3920)

$1.1033 (2165)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 46939 contracts, with the maximum number of contracts with strike price $1,1500 (4397);

- Overall open interest on the PUT options with the expiration date April, 8 is 67685 contracts, with the maximum number of contracts with strike price $1,0900 (6035);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from March, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.4503 (1687)

$1.4405 (1906)

$1.4309 (964)

Price at time of writing this review: $1.4228

Support levels (open interest**, contracts):

$1.4191 (630)

$1.4095 (900)

$1.3997 (2932)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20544 contracts, with the maximum number of contracts with strike price $1,4400 (1906);

- Overall open interest on the PUT options with the expiration date April, 8 is 23014 contracts, with the maximum number of contracts with strike price $1,4000 (2932);

- The ratio of PUT/CALL was 1.12 versus 1.09 from the previous trading day according to data from March, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:07

Global Stocks: Investors now turn their attention to a speech from Janet Yellen

European stocks slumped for a fourth straight day, with commodity shares dropping as the U.S. dollar continued to march higher. Shares of commodity producers were stung as the dollar extended gains against its rivals, which puts pressure on dollar-denominated oil and metals prices.

U.S. stocks finished flat on Monday as gains in consumer-discretionary and materials shares were mitigated by weakness in utilities and energy.

Most stock markets in Asia fell Tuesday as investors weighed when the U.S. central bank might next raise interest rates. Investors were being cautious before U.S. Federal Reserve Chairwoman Janet Yellen was scheduled to speak Tuesday in New York on her views of the U.S. economy and monetary policy. Her comments could offer hints to when the Fed expects to raise rates, a move that Fed official James Bullard recently said could be as soon as April or June.

Based on MarketWatch materials

-

04:01

Nikkei 225 17,125.85 -8.52 -0.05 %, Hang Seng 20,343.02 -2.59 -0.01 %, Shanghai Composite 2,951.91 -5.91 -0.20 %

-

01:50

Japan: Retail sales, y/y, February 0.5% (forecast 1.7%)

-

01:31

Japan: Household spending Y/Y, February 1.2% (forecast -1.5%)

-

01:30

Japan: Unemployment Rate, February 3.3% (forecast 3.2%)

-

00:32

Commodities. Daily history for Mar 28’2016:

(raw materials / closing price /% change)

Oil 39.30 -0.23%

Gold 1,221.80 +0.14%

-

00:31

Stocks. Daily history for Sep Mar 28’2016:

(index / closing price / change items /% change)

Nikkei 225 17,134.37 +131.62 +0.77 %

Shanghai Composite 2,957.84 -21.59 -0.72 %

Topix 1,381.85 +15.80 +1.16 %

S&P 500 2,037.05 +1.11 +0.05 %

NASDAQ Composite 4,766.79 -6.72 -0.14 %

Dow Jones 17,535.39 +19.66 +0.11 %

-

00:30

Currencies. Daily history for Mar 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1197 +0,29%

GBP/USD $1,4253 +0,83%

USD/CHF Chf0,9736 -0,44%

USD/JPY Y113,39 +0,30%

EUR/JPY Y126,96 +0,54%

GBP/JPY Y161,61 +1,11%

AUD/USD $0,7539 +0,45%

NZD/USD $0,6725 +0,59%

USD/CAD C$1,3185 -0,65%

-