Noticias del mercado

-

21:00

DJIA 17723.51 90.40 0.51%, NASDAQ 4874.51 27.89 0.58%, S&P 500 2065.84 10.83 0.53%

-

19:20

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday, a day after Federal Reserve Chair Janet Yellen's comments eased some concerns about the path of interest rate hikes, but gains were limited by a dip in crude oil prices. Oil prices retreated from their day's highs after a report showed a weekly build in U.S. crude inventories. Yellen, in her first remarks since the Fed held steady on rates earlier this month, said the central bank should tread cautiously on raising rates this year.

Most of Dow stocks in positive area (24 of 30). Top looser - The Boeing Company (BA, -1,81%). Top gainer - Visa Inc. (V, +2,03%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,0%).

At the moment:

Dow 17595.00 +57.00 +0.33%

S&P 500 2053.50 +6.00 +0.29%

Nasdaq 100 4476.25 +18.00 +0.40%

Oil 38.25 -0.03 -0.08%

Gold 1229.50 -8.00 -0.65%

U.S. 10yr 1.84 +0.02

-

18:00

European stocks close: stocks closed higher on comments by the Fed Chairwoman Janet Yellen and on a rise in oil prices

Stock indices closed higher on comments by Fed Chairwoman Janet Yellen. She said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually.

Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

"Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy," Fed chairwoman said.

A rise in oil prices also supported stock markets. Oil prices rose as an increase in U.S. crude inventories was lower than expected.

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with Politico published on the central bank's website on Wednesday that negative interest rates were not the central bank's main monetary policy tool. He pointed out that the ECB would not cut interest rates "into absurdly negative territory", adding that further actions were possible.

Market participants also eyed the economic data from the Eurozone. Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%. Goods prices dropped 1.2% year-on-year in March, while services prices increased 1.6%.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,203.17 +97.27 +1.59 %

DAX 10,046.61 +158.67 +1.60 %

CAC 40 4,444.42 +77.75 +1.78 %

-

18:00

European stocks closed: FTSE 6203.17 97.27 1.59%, DAX 10046.61 158.67 1.60%, CAC 40 4444.42 77.75 1.78%

-

17:39

International Energy Agency executive director Fatih Birol: Iran does not add as much as expected oil to the market

The International Energy Agency (IEA) executive director Fatih Birol said in an interview with Reuters on Wednesday that Iran was expected to add 500,000 barrels a day within a year after the lift-off of sanctions in January.

"It was misleading to believe that there would be a huge amount of new Iranian crude and natural gas production entering market in the short term," he said.

Birol said that the country would need time to develop new oil fields.

-

17:38

WSE: Session Results

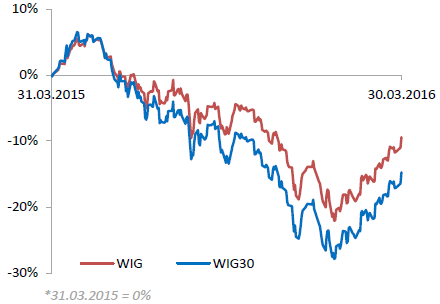

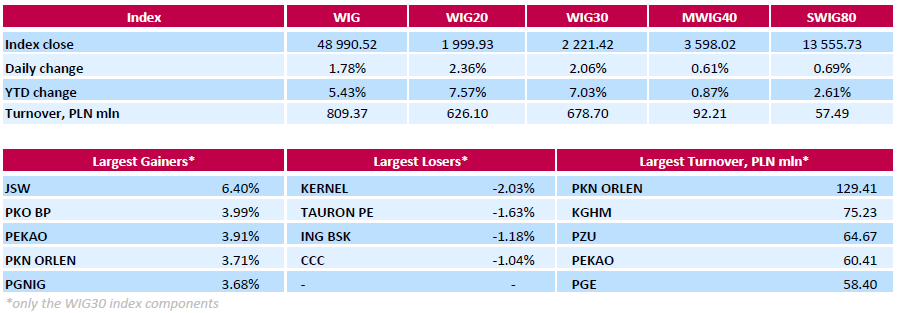

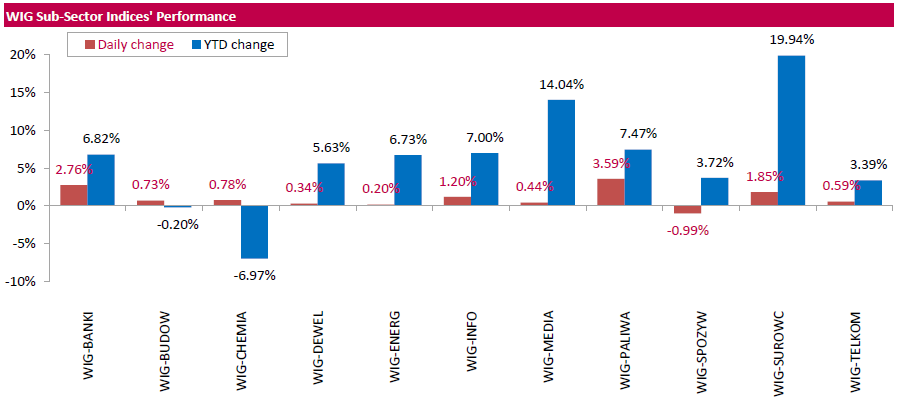

Polish equity market continued to march upwards on Wednesday. The broad market benchmark, the WIG index, rose by 1.78%. Almost all sectors in the WIG generated positive returns. Food sector (-0.99%) was the only exception. At the same time, oil and gas sector (+3.59%) posed the biggest advance.

The large-cap stocks' measure, the WIG30 Index, surged by 2.06%. In the index basket, coking coal miner JSW (WSE: JSW) led the gainers with a 6.4% advance, followed by two banking names PKO BP (WSE: PKO) and PEKAO (WSE: PEO), growing by 3.99% and 3.91% respectively. Other most prominent risers were oil and gas sector stocks PKN ORLEN (WSE: PKN), PGNIG (WSE: PGN) and LOTOS (WSE: LTS), as well as insurer PZU (WSE; PZU), which added between 2.4% and 3.71%. On the other side of the ledger, agri name KERNEL (WSE: KER), genco TAURON PE (WSE: TPE), bank ING BSK (WSE: ING) and footwear retailer CCC (WSE: CCC) underperformed, slumping by 1.04%-2.03%.

-

17:03

Iran will likely participate in the meeting between OPEC and non-OPEC countries in Doha next month

Bloomberg reported on Wednesday that Iran would likely participate in the meeting between OPEC and non-OPEC countries in Doha on April 17. OPEC and non-OPEC countries plan to discuss the freeze of the oil output.

Iran said this month that it was not ready to freeze its oil production until output of 4.0 million barrels a day was reached.

-

16:52

U.S. crude inventories rise by 2.3 million barrels to 534.8 million in the week to March 25

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 2.3 million barrels to 534.8 million in the week to March 25.

Analysts had expected U.S. crude oil inventories to rise by 3.0 million barrels.

Gasoline inventories decreased by 2.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 272,000 barrels.

U.S. crude oil imports fell by 636,000 barrels per day.

Refineries in the U.S. were running at 90.4% of capacity, up from 88.4% the previous week.

-

16:32

Asian Development Bank downgrades growth forecast for China

The Asian Development Bank (ADB) downgraded growth forecast for China on Wednesday. According to the ADB, China is expected to expand by 6.5% in 2016, down from the previous estimate of a 6.7%, and 6.3% in 2017. The bank noted that the Chinese economy would continue to expand moderately due to lower exports, a drop in labour supply and supply-side reforms.

The economic growth of developing Asia is expected to be 5.7% this year, down from the previous estimate of a 6.0%, and 5.7% in 2017.

Southeast Asia is expected to grow 4.5% in 2016 and 4.8% in 2017.

"China's growth moderation and uneven global recovery are weighing down overall growth in Asia. Despite these pressures, the region will continue to contribute over 60% of total global growth," ADB Chief Economist Shang-Jin Wei said.

-

16:30

U.S.: Crude Oil Inventories, March 2.299 (forecast 3.0)

-

15:57

Chicago Fed President Charles Evans: an interest rate hike by the Fed in April is unlikely

Chicago Fed President Charles Evans said in an interview with CNBC on Wednesday that an interest rate hike by the Fed in April was unlikely as the confidence was needed U.S. inflation accelerating toward the Fed's 2% target. He added that an interest rate hike in June was possible if the U.S. labour market continued to strengthen.

Evans noted that the Fed could hike its interest rate more than two times this year if the U.S. economic data would be better than expected.

Evans is not a voting member of the Federal Open Market Committee this year.

-

15:46

WSE: After start on Wall Street

The US market began today with about 0.5% increase in the major indexes, which, combined with yesterday's achievements leads them higher and higher. We can not say the same about the German DAX, which is still bogged down in terms of the volatility of the last two weeks. Now, of course, our eyes will be in large part beyond the ocean. Developing of rises there will also allow for the Warsaw Stock Exchange to get close to the area of 2000 points of the WIG20. Of course, in case of difficulties in maintaining the initial levels beyond the ocean will create for us the risk of a final short of breath, which in turn would combine with already noticeable weakening of the Polish currency.

U.S. Stocks open: Dow +0.39%, Nasdaq +0.59%, S&P +0.43%

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY 111.64 (USD 1.02bln) 112.40-50 (470m) 113.00 (758m) 113.50 (660m)

EURUSD 1.1050 (EUR 674m) 1.1090-1.1100 ( EUR 438m) 1.1210-20 (1.32bln) 1.1250 (772m) 1.1300 (229m) 1.1500 (466m)

GBPUSD 1.4500 (GBP 401m)

EURGBP 0.7850-55 (EUR 236m)

AUDUSD 0.7200 (AUD 251m) 0.7300 (220m) 0.7400 (475m) 0.7500 (246m) 0.7550 (393m)

USDCAD 1.3200 (USD 474m) 1.3230 (560m) 1.3420 (248m)

-

15:42

Greek producer prices decrease 0.4% in February

The Hellenic Statistical Authority released its producer price index (PPI) data on Wednesday. Greek producer prices decreased 0.4% in February, after a 3.2% drop in January.

Domestic market prices fell by 0.6% in February, while foreign market prices rose 0.1%.

On a yearly basis, Greek PPI plunged 11.4% in February, after a 7.3% drop in January.

Domestic market prices slid 9.9% year-on-year in February, while foreign market prices dropped 16.0%.

Energy prices plunged 24.6% year-on-year in February, while non-durable consumer goods industrial prices were up 0.6%.

-

15:32

U.S. Stocks open: Dow +0.39%, Nasdaq +0.59%, S&P +0.43%

-

15:21

Before the bell: S&P futures +0.55%, NASDAQ futures +0.68%

U.S. stock-index rose.

Global Stocks:

Nikkei 16,878.96 -224.57 -1.31%

Hang Seng 20,803.39 +437.09 +2.15%

Shanghai Composite 3,000.3 +80.47 +2.76%

FTSE 6,205.07 +99.17 +1.62%

CAC 4,450.68 +84.01 +1.92%

DAX 10,049.09 +161.15 +1.63%

Crude oil $38.98 (+1.83%)

Gold $1232.10 (-0.30%)

-

15:08

German consumer price inflation increases 0.8% in March

Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%.

Energy prices slid 8.9% year-on-year in March.

Goods prices dropped 1.2% year-on-year in March, while services prices increased 1.6%.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.84

0.12(1.2346%)

27124

ALTRIA GROUP INC.

MO

62.34

0.31(0.4998%)

3078

Amazon.com Inc., NASDAQ

AMZN

596.6

2.74(0.4614%)

21537

AMERICAN INTERNATIONAL GROUP

AIG

54.14

0.75(1.4048%)

1857

Apple Inc.

AAPL

109.07

1.39(1.2909%)

436593

AT&T Inc

T

39.61

0.16(0.4056%)

45897

Barrick Gold Corporation, NYSE

ABX

13.89

-0.16(-1.1388%)

62567

Boeing Co

BA

131.84

0.96(0.7335%)

13574

Caterpillar Inc

CAT

76.6

0.59(0.7762%)

22731

Chevron Corp

CVX

96.44

1.12(1.175%)

11300

Cisco Systems Inc

CSCO

28.27

0.17(0.605%)

23701

Citigroup Inc., NYSE

C

42

0.28(0.6711%)

51296

Deere & Company, NYSE

DE

80.82

0.32(0.3975%)

3717

Exxon Mobil Corp

XOM

84.98

0.45(0.5324%)

22373

Facebook, Inc.

FB

116.7

0.56(0.4822%)

208699

FedEx Corporation, NYSE

FDX

162.37

-0.62(-0.3804%)

3996

Ford Motor Co.

F

13.28

0.08(0.6061%)

4522

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.36

0.22(2.1696%)

185458

General Electric Co

GE

31.6

0.12(0.3812%)

28692

Goldman Sachs

GS

156.31

1.28(0.8256%)

5918

Google Inc.

GOOG

747.67

2.90(0.3894%)

8012

Intel Corp

INTC

32.55

0.17(0.525%)

25865

International Business Machines Co...

IBM

149.7

0.37(0.2478%)

16208

Johnson & Johnson

JNJ

109.68

0.54(0.4948%)

23231

JPMorgan Chase and Co

JPM

59.39

0.36(0.6099%)

15390

McDonald's Corp

MCD

124.59

0.62(0.5001%)

450

Microsoft Corp

MSFT

55.03

0.32(0.5849%)

123896

Nike

NKE

61.97

0.48(0.7806%)

26267

Pfizer Inc

PFE

30.27

0.22(0.7321%)

3011

Procter & Gamble Co

PG

82.99

0.19(0.2295%)

2043

Starbucks Corporation, NASDAQ

SBUX

59.99

0.44(0.7389%)

5775

Tesla Motors, Inc., NASDAQ

TSLA

233.82

3.69(1.6034%)

26435

The Coca-Cola Co

KO

46.6

0.12(0.2582%)

26073

Twitter, Inc., NYSE

TWTR

16.14

0.17(1.0645%)

36541

United Technologies Corp

UTX

101

0.88(0.8789%)

347

Verizon Communications Inc

VZ

54.2

0.15(0.2775%)

101644

Visa

V

75.8

0.42(0.5572%)

3028

Walt Disney Co

DIS

98.63

0.47(0.4788%)

10220

Yahoo! Inc., NASDAQ

YHOO

36.65

0.33(0.9086%)

264829

-

14:50

U.S. ADP Employment Report: private sector adds 200,000 jobs in March

Private sector in the U.S. added 200,000 jobs in March, according the ADP report on Wednesday. February's figure was revised down to 205,000 jobs from a previous reading of 214,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

Services sector added 191,000 jobs in March, while goods-producing sector added 9,000.

"The job market continues on its amazing streak. The March job gain of 200,000 is consistent with average monthly job growth of the past more than four years. The only industry reducing payrolls is energy as has been the case for over a year. All indications are that the job machine will remain in high gear," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in March. The U.S. economy is expected to add 205,000 jobs in March, after adding 242,000 jobs in February.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Apple (AAPL) upgraded to Outperform from Market Perform at Cowen; target raised to $135 from $125

Downgrades:

Other:

Freeport-McMoRan (FCX) resumed with an Equal Weight at Barclays

3M (MMM) target raised to $190 from $170 at UBS; maintain Buy

-

14:41

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Switzerland UBS Consumption Indicator February 1.45 Revised From 1.66 1.53

07:00 Switzerland KOF Leading Indicator March 102.6 Revised From 102.4 101.9 102.5

09:00 Eurozone Economic sentiment index March 103.9 Revised From 103.8 103.8 103

09:00 Eurozone Industrial confidence March -4.1 Revised From -4 -4.2 -4.2

09:00 Eurozone Consumer Confidence (Finally) March -8.8 -9.7 -9.7

09:00 Eurozone Business climate indicator March 0.09 Revised From 0.07 0.08 0.11

11:00 U.S. MBA Mortgage Applications March -3.3% -1%

12:00 Germany CPI, m/m (Preliminary) March 0.4% 0.6% 0.8%

12:00 Germany CPI, y/y (Preliminary) March 0.0% 0.1% 0.3%

12:15 U.S. ADP Employment Report March 205 Revised From 214 194 200

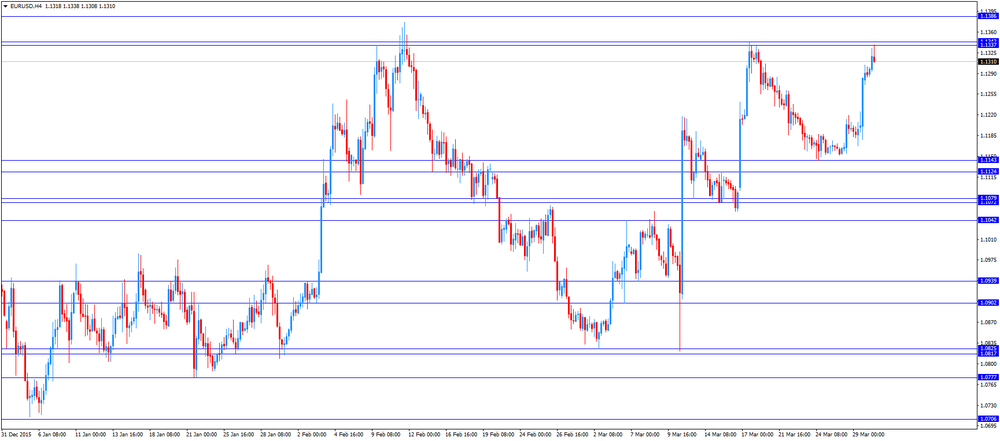

The U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report. Private sector in the U.S. added 200,000 jobs in March, according the ADP report on Wednesday. February's figure was revised down to 205,000 jobs from a previous reading of 214,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

The greenback remained under pressure on comments by Fed Chairwoman Janet Yellen. She said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually. Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

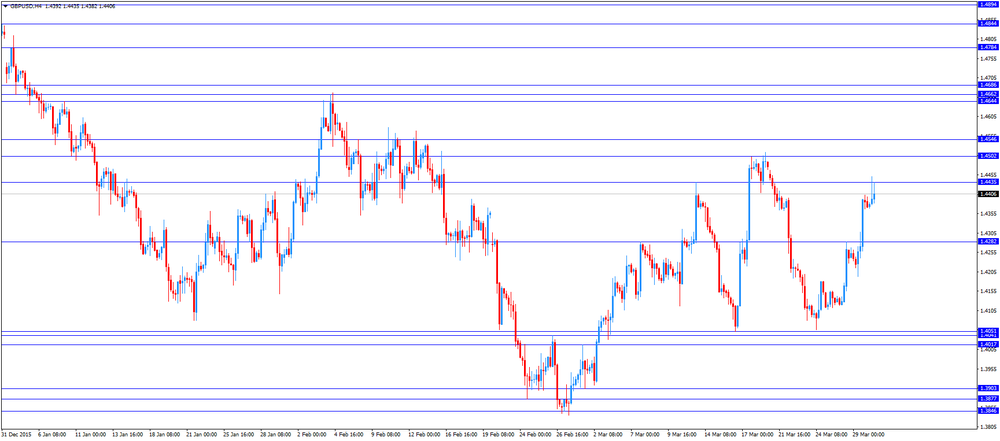

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.53 in February from 1.45 in January. The increase was driven by higher demand for automobiles, which climbed 1.2% year-on-year in February.

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator fell to 102.5 in March from 102.6 in February, beating expectations for a decline to 101.9. The decline was mainly driven by negative indicators for the manufacturing sector and the export.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.4377

USD/JPY: the currency pair rose Y112.67

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories March 9.357 3.0

23:05 United Kingdom Gfk Consumer Confidence March 0 -1

-

14:15

U.S.: ADP Employment Report, March 200 (forecast 194)

-

14:00

Germany: CPI, y/y , March 0.3% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, March 0.8% (forecast 0.6%)

-

13:45

Orders

EUR/USD

Offers 1.1330-35 1.1360 1.1380 1.1400 1.1430 1.1450

Bids 1.1300 1.1275-80 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4450 -55 1.4480 1.4500 1.4520 1.4550 1.4565 1.4585 1.4600

Bids 1.4420 1.4400 1.4385 1.4350 1.4330 1.4300 1.4280 1.4265 1.4250 1.4200

EUR/JPY

Offers 127.25 127.50 127.80 128.00 128.30 128.50

Bids 126.75-80 126.50 126.30 126.00 125.80-85 125.50 125.00

EUR/GBP

Offers 0.7865 0.7880 0.7900 0.7925-30 0.7950 0.7975-80 0.8000

Bids 0.7825-30 0.7800 0.7785 0.7765 0.7750 0.7730 0.7700

USD/JPY

Offers 112.50 112.80 113.00 113.40 113.80-85 114.00

Bids 112.00 111.80-85 111.65 111.50 111.30 1111.00

AUD/USD

Offers 0.7700 0.7720 0.7735-40 0.7750 0.7765 0.7780 0.7800

Bids 0.7670 0.7650 0.7620 0.7600 0.7575 0.7550 0.7520 0.7500

-

13:00

U.S.: MBA Mortgage Applications, March -1%

-

12:55

WSE: Mid session comment

As expected, the pressure of the core markets and the peaceful consolidation under the resistance were the main factors for the Warsaw market to go over 1,970 points on the WIG20 index. It also confirms the appetite of the bulls for a meeting with 2000 points, however the market showed earlier sensitivity to equal levels, and the area of 2000 points will provoke sellers to attacking.

Increases in the German market with every hour are getting bigger and now deviation goes there almost by 2%. The main index of the Warsaw Stock Exchange, the WIG20, reached the level of 1,980 points (+ 1.37%)

-

12:07

European stock markets mid session: stocks traded higher on “dovish” comments by Fed Chairwoman Janet Yellen

Stock indices traded higher on comments by Fed Chairwoman Janet Yellen. She said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually.

Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

"Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy," Fed chairwoman said.

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with Politico published on the central bank's website on Wednesday that negative interest rates were not the central bank's main monetary policy tool. He pointed out that the ECB would not cut interest rates "into absurdly negative territory", adding that further actions were possible.

Market participants also eyed the economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

Current figures:

Name Price Change Change %

FTSE 100 6,197.89 +91.99 +1.51 %

DAX 10,035.17 +147.23 +1.49 %

CAC 40 4,436.18 +69.51 +1.59 %

-

11:47

European Central Bank Executive Board member Benoit Coeure: negative interest rates are not the central bank’s main monetary policy tool

European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview with Politico published on the central bank's website on Wednesday that negative interest rates were not the central bank's main monetary policy tool.

"Negative interest rates are not our main instrument, they just support our overall policy," he said.

Coere pointed out that the ECB would not cut interest rates "into absurdly negative territory", adding that further actions were possible.

He noted that the central bank did not discuss the introducing of "helicopter money".

-

11:28

UBS consumption index rises to 1.53 in February

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.53 in February from 1.45 in January. January's figure was revised down from 1.66.

The increase was driven by higher demand for automobiles, which climbed 1.2% year-on-year in February.

The bank noted that the indicator showed a solid growth in private consumption.

"New car registrations remained high, but retailer sentiment was rather subdued," the bank said.

-

11:13

Eurozone’s economic sentiment index slides to 103.0 in March

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

-

11:01

Eurozone: Business climate indicator , March 0.11 (forecast 0.08)

-

11:00

Eurozone: Consumer Confidence, March -10 (forecast -9.7)

-

11:00

Eurozone: Industrial confidence, March -4 (forecast -4.2)

-

11:00

Eurozone: Economic sentiment index , March 103 (forecast 103.8)

-

10:56

KOF leading indicator for Switzerland falls to 102.5 in March

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator fell to 102.5 in March from 102.6 in February, beating expectations for a decline to 101.9. February's figure was revised up from 102.4.

The decline was mainly driven by negative indicators for the manufacturing sector and the export.

"The new standing of the Economic Barometer signals an ongoing positive development of the Swiss economy in the coming months," the KOF said.

-

10:42

Dallas Fed President Robert Kaplan: the Fed should hike its interest rate gradually

Dallas Fed President Robert Kaplan said in a speech on Tuesday that the Fed should hike its interest rate gradually. He expressed concerns over the impact on the U.S. economy from developments in China, noting that the transition of the Chinese economy would affect global finance.

-

10:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.64 (USD 1.02bln) 112.40-50 (470m) 113.00 (758m) 113.50 (660m)

EUR/USD 1.1050 (EUR 674m) 1.1090-1.1100 ( EUR 438m) 1.1210-20 (1.32bln) 1.1250 (772m) 1.1300 (229m) 1.1500 (466m)

GBP/USD 1.4500 (GBP 401m)

EUR/GBP 0.7850-55 (EUR 236m)

AUD/USD 0.7200 (AUD 251m) 0.7300 (220m) 0.7400 (475m) 0.7500 (246m) 0.7550 (393m)

USD/CAD 1.3200 (USD 474m) 1.3230 (560m) 1.3420 (248m)

-

10:22

Fed Chairwoman Janet Yellen: the Fed will hike its interest rate gradually

Fed Chairwoman Janet Yellen said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually. She did not mention the timing of possible interest rate hikes.

Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

"Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy," Fed chairwoman said.

Yellen pointed out that the Fed could cut its interest rate if needed.

"If the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero," she noted.

-

10:10

Preliminary industrial production in Japan drops 6.2% in February

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Tuesday evening. Preliminary industrial production in Japan dropped 6.2% in February, missing expectations for a 6.0% decline, after a 3.7% rise in January.

The drop was mainly driven by declines in transport equipment, electronic parts and devices, general-purpose, production and business oriented machinery.

According to a survey by the ministry, industrial production is expected to increase 3.9% in March, and to rise 5.3% in April.

On a yearly basis, Japan's industrial production was down 1.5% in February, after a 3.8% decrease in January.

-

09:20

WSE: Before opening

The June series of future contracts on the WIG20 index (WSE: FW20M16) started the day on a rise by 0.8 per cent (1954 points).

Europe begins the day of increases that build upward pressure on the WSE. As a result, WIG20 gained 0.44 percent at the opening, however the resistance in the region of 1,970 points remains valid and technically we can not talk about change. Indeed, the market balances near maximum of the last week, so we can talk about that poor clearance from the consolidation, the defeat should be a prelude to the confrontation of 2000 points. Opening was dominated by two companies, KGHM and PKN, which provide half of total trading in the WIG20 index. The beginning seems to be optimistic, but there is no doubt that it is built on the correlation with the environment.

WIG20 index opened at 1962.38 points (+0.44%)*

WIG 48380.66 0.51%

WIG30 2188.92 0.57%

mWIG40 3590.05 0.39%

*/- change to previous close

-

09:00

Switzerland: KOF Leading Indicator, March 102.5 (forecast 101.9)

-

08:28

WSE: Before opening

Tuesday's session on Wall Street can be divided into two parts which are separated by speech of Janet Yellen.

Investors found out in the theses of Ms. Yellen signals that the Federal Reserve will take into account the risk that draw around the US economy and a possible drop in oil prices.

Market reactions were clear - the EUR / USD and USD / JPY currency pairs have responded with strong movements weaken the US currency. Wall Street raised the share price and Nasdaq Composite gained 1.7 percent, the DJIA rose by 0.6 percent and the broad S&P 500 added 0.9 percent.

In this context it seems to assume that in the morning also Europe will follow the path of the US, but it is worth to pay attention to the Nikkei, which focused more on the strengthening of the yen against the dollar than the Wall Street reactions to Yellen speech.

However, the contract for the DAX-a indicates that the DAX index may gain about 0.5 percent at the opening and the Warsaw market should feel the pressure of the core markets today.

Also we can not forget about the technical situation on the WIG20 index which consolidating yesterday in the area of 1950 points built a base to attack the region of 1,970 points.

-

08:18

Asian session: Dollar bulls were on the defensive

The yen firmed even as dismal data released early in the session heightened speculation that Japan will need to muster more stimulus to avert another recession. Factory output fell 6.2 percent last month from the previous month, the biggest tumble since 2011 when the devastating earthquake, tsunami and nuclear crisis disrupted Japan's supply chain.

Dollar bulls were on the defensive on Wednesday after Federal Reserve chair Janet Yellen's cautious tone left markets wondering if there will be even one hike to U.S. interest rates this year.In a speech to the Economic Club of New York, Yellen stressed the need to be cautious in raising rates and highlighted external risks including low oil prices and slower growth abroad.

EUR/USD: during the Asian session the pair traded in the range of $1.1285-00

GBP/USD: during the Asian session the pair traded in the range of $1.4365-00

USD/JPY: during the Asian session the pair fell to Y113.35

Based on Reuters materials

-

08:13

Options levels on wednesday, March 30, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1404 (2662)

$1.1378 (3235)

$1.1345 (3003)

Price at time of writing this review: $1.1306

Support levels (open interest**, contracts):

$1.1244 (1707)

$1.1177 (2144)

$1.1092 (3862)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 47875 contracts, with the maximum number of contracts with strike price $1,1500 (4433);

- Overall open interest on the PUT options with the expiration date April, 8 is 68818 contracts, with the maximum number of contracts with strike price $1,0900 (6031);

- The ratio of PUT/CALL was 1.44 versus 1.44 from the previous trading day according to data from March, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.4701 (1663)

$1.4603 (1100)

$1.4505 (1817)

Price at time of writing this review: $1.4398

Support levels (open interest**, contracts):

$1.4293 (581)

$1.4196 (683)

$1.4098 (937)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20741 contracts, with the maximum number of contracts with strike price $1,4400 (1906);

- Overall open interest on the PUT options with the expiration date April, 8 is 23134 contracts, with the maximum number of contracts with strike price $1,4000 (2914);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from March, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: UBS Consumption Indicator, February 1.53

-

06:25

Global Stocks: Stocks Gain as Yellen Signals Slow Pace on Rates

European stocks finished higher Tuesday, notching their first gain in five sessions, as investors appeared ready to receive a further signal that U.S. interest rates will be raised at a slow pace this year. Travel-related stocks in the region gained even in the wake of a Tuesday morning hijacking of an EgyptAir plane, which was forced to land at Larnaca Airport in Cyprus.

U.S. stocks reversed early losses Tuesday, with the S&P 500 and the Dow industrials rising to their highest close of 2016 after Federal Reserve Chairwoman Janet Yellen emphasized a cautious approach to normalizing monetary policy in light of fears about the domestic and international economy.

Based on MarketWatch materials

-

04:04

Nikkei 225 17,059.92 -43.61 -0.25 %, Hang Seng 20,643.97 +277.67 +1.36 %, Shanghai Composite 2,949.77 +29.94 +1.03 %

-

01:51

Japan: Industrial Production (YoY), February -1.5%

-

01:50

Japan: Industrial Production (MoM) , February -6.2% (forecast -6%)

-

00:31

Commodities. Daily history for Mar 29’2016:

(raw materials / closing price /% change)

Oil 38.49 +0.55%

Gold 1,242.50 +0.54%

-

00:30

Stocks. Daily history for Sep Mar 29’2016:

(index / closing price / change items /% change)

Nikkei 225 17,103.53 -30.84 -0.18 %

Hang Seng 20,366.3 +20.69 +0.10 %

S&P/ASX 200 5,004.52 -79.69 -1.57 %

Shanghai Composite 2,920.55 -37.27 -1.26 %

FTSE 100 6,105.9 -0.58 -0.01 %

CAC 40 4,366.67 +36.99 +0.85 %

Xetra DAX 9,887.94 +36.59 +0.37 %

S&P 500 2,055.01 +17.96 +0.88 %

NASDAQ Composite 4,846.62 +79.84 +1.67 %

Dow Jones 17,633.11 +97.72 +0.56 %

-

00:29

Currencies. Daily history for Mar 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1290 +0,82%

GBP/USD $1,4385 +0,92%

USD/CHF Chf0,966 -0,79%

USD/JPY Y112,60 -0,70%

EUR/JPY Y127,24 +0,22%

GBP/JPY Y162,11 +0,31%

AUD/USD $0,7632 +1,22%

NZD/USD $0,6866 +2,05%

USD/CAD C$1,3059 -0,96%

-

00:16

New Zealand: Building Permits, m/m, February 10.8% (forecast 5%)

-

00:01

Schedule for today, Wednesday, Mar 30’2016:

(time / country / index / period / previous value / forecast)

06:00 Switzerland UBS Consumption Indicator February 1.66

07:00 Switzerland KOF Leading Indicator March 102.4 101.8

09:00 Eurozone Economic sentiment index March 103.8 103.8

09:00 Eurozone Industrial confidence March -4 -4.1

09:00 Eurozone Consumer Confidence (Finally) March -8.8 -9.7

09:00 Eurozone Business climate indicator March 0.07

11:00 U.S. MBA Mortgage Applications March -3.3%

12:00 Germany CPI, m/m (Preliminary) March 0.4% 0.6%

12:00 Germany CPI, y/y (Preliminary) March 0.0% 0.2%

12:15 U.S. ADP Employment Report March 214 194

14:30 U.S. Crude Oil Inventories March 9.357

23:05 United Kingdom Gfk Consumer Confidence March 0 -1

-