Noticias del mercado

-

22:10

U.S. stocks closed

U.S. stocks swung between gains and losses, amid the best month in five, as the March rebound that had global equities on the brink of erasing losses for 2016 faltered. The dollar headed for its worst quarter in more than five years.

The Standard & Poor's 500 Index pushed its March rally to 6.9 percent, while European equities fell with shares in Tokyo and Hong Kong. Emerging-market stocks added to a quarterly rally, and the Bloomberg Dollar Spot Index headed for its worst month since 2010. Treasury yields slumped to the largest quarterly drop since 2012. Gold headed for its biggest three-month gain since 1986.

Global equities rose 7.1 percent in March, paring their quarterly decline to 0.3 percent as central banks from Asia to Europe and America signaled they stand ready to bolster flagging growth around the world. That spurred demand for risk assets after a six-week rout punished equities, commodities and emerging-market currencies amid concern China's slowdown would spread. Equities trading remained light Thursday, and assets from Treasuries to metals were little changed ahead of jobs data in the U.S. Friday that will focus attention on the strength of the world's largest economy as the second quarter kicks off.

Data Thursday showed that the number of applications for unemployment benefits climbed last week to a two-month high, a sign of more moderate labor market progress. Investors are awaiting Friday's key non-farm payroll data for indications of the strength of the world's biggest economy.

-

21:00

DJIA 17683.38 -33.28 -0.19%, NASDAQ 4871.19 1.90 0.04%, S&P 500 2059.42 -4.53 -0.22%

-

18:23

European stocks close: stocks closed lower on a fall in telecom and banking stocks

Stock indices closed lower on a drop in telecom and banking stocks. Market participants are also awaiting the release of the U.S. labour market tomorrow.

Market participants also eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in March from -0.2% in February, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in March from 0.8% in February. Analysts had expected the index to increase to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in March, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany was flat in March, missing expectations for a 7,000 decline, after a 9,000 decrease in February. February's figure was revised down from a 10,000 fall.

The unemployment rate remained unchanged at 6.2% in March, in line with expectations.

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales fell 0.4% in February, missing forecasts of a 0.3% gain, after a 0.1% decrease in January. January's figure was revised down from a 0.7% increase.

On a yearly basis, German unadjusted retail sales climbed 5.4% in February, beating expectations for a 2.2% gain, after a 1.2% drop in January. January's figure was revised down from a 0.8% decline.

Sales of non-food products increased at an annual rate of 3.9% in February, while sales of food, beverages and tobacco products rose by 7.1%.

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Thursday. The final U.K. GDP expanded at 0.6% in the fourth quarter, up from the February estimate of 0.5%, after a 0.4% rise in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.1% in the fourth quarter, up from the February estimate of 1.9%, after a 2.1% gain in the third quarter.

The upward revision was driven by revisions in services, industrial output and construction.

In 2015 as whole, GDP expanded 2.3%, up from the previous estimate of 2.2%.

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Thursday. The U.K. current account deficit widened to £37.2 billion in the fourth quarter from £20.1 billion in the third quarter. The third quarter's figure was revised down from a deficit of £17.5 billion.

Analysts had expected the current account deficit to increase to £21.1 billion.

The fourth quarter's current account deficit amounted to 7.0% of GDP, the highest share since 1955.

Declines in the current account deficit were driven by a drop in the deficit on primary and secondary income, and total trade.

In 2015 as a whole, the current account deficit was £96.2 billion or 5.2% of GDP. It was the biggest deficit since 1948.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,174.9 -28.27 -0.46 %

DAX 9,965.51 -81.10 -0.81 %

CAC 40 4,385.06 -59.36 -1.34 %

-

18:18

Spanish government misses its 2015 budget deficit target

Spanish Budget Minister Cristobal Montoro said on Thursday that the country missed its budget deficit target in 2015. Spain's budget deficit was 5.2% of gross domestic product (GDP), higher than target of 4.2% of GDP set by the European Commission.

Spain's Prime Minister Mariano Rajoy in February predicted a deficit of 4.5% of GDP.

Montoro said that regions failed to reach their deficit targets. Only 3 of 17 regions met their targets.

-

18:06

Atlanta Fed President Dennis Lockhart expects three interest rate hikes by the Fed this year

Atlanta Fed President Dennis Lockhart said in an interview with Japan's The Nikkei on Thursday that he expected three interest rate hikes by the Fed this year.

"I just think there's still scope for three increases this year. I do not expect four increases, but I think there is scope for three," he said.

Lockhart noted that the Fed could raise its interest rate at its next meeting in April if the economic is strong.

Atlanta Fed president also said that the U.S. economy continued to expand moderately, adding that he expected the economy to grow "a bit better than 2%" in 2016.

-

18:00

European stocks closed: FTSE 6174.90 -28.27 -0.46%, DAX 9965.51 -81.10 -0.81%, CAC 40 4385.06 -59.36 -1.34%

-

17:54

Chicago Fed President Charles Evans would support an interest rate hike in June

Chicago Fed President Charles Evans said on Thursday that he would support an interest rate hike in June, adding that two interest rate hikes this year were possible.

"It's not really critical when those take place. I guess I would sort of say one in the middle of the year and one at the end of the year," he said.

-

17:52

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly rose in quiet trading on Thursday, helped by energy stocks, as a tumultuous quarter draws to a close. The first quarter was marked by a steep selloff in stocks at the start of the year that sent the S&P 500 down about 11% before a rebound in oil prices sparked a recovery. Investors held off on making big bets ahead of the critical U.S. non-farm payrolls report due on Friday.

Most of Dow stocks in positive area (17 of 30). Top looser - The Boeing Company (BA, -1,91%). Top gainer - International Business Machines Corporation (IBM, +2,58%).

S&P sectors mixed. Top looser - Industrial Goods (-0,2%). Top gainer - Conglomerates (+0,6%).

At the moment:

Dow 17631.00 +9.00 +0.05%

S&P 500 2057.00 +1.75 +0.09%

Nasdaq 100 4486.25 +4.25 +0.09%

Oil 38.82 +0.50 +1.30%

Gold 1237.70 +9.10 +0.74%

U.S. 10yr 1.80 -0.03

-

17:48

Bank of England Governor Mark Carney: problems of the low economic growth cannot be solved by monetary policy alone

Bank of England (BoE) Governor Mark Carney said in a speech in Tokyo on Thursday that problems of the low economic growth cannot be solved by monetary policy alone. He noted that structural reforms were needed.

-

17:40

WSE: Session Results

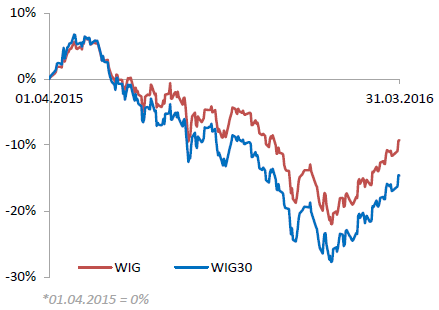

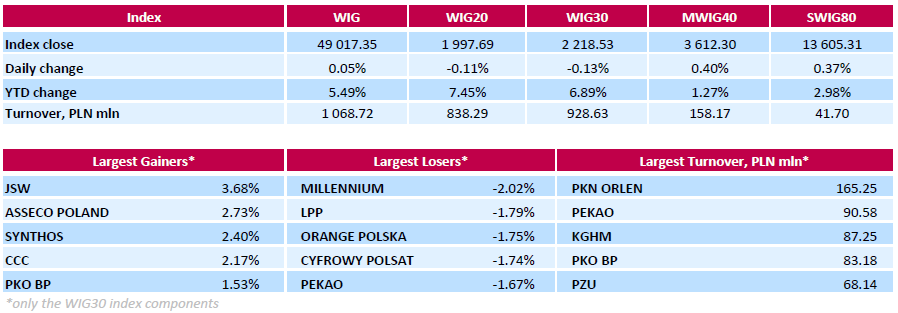

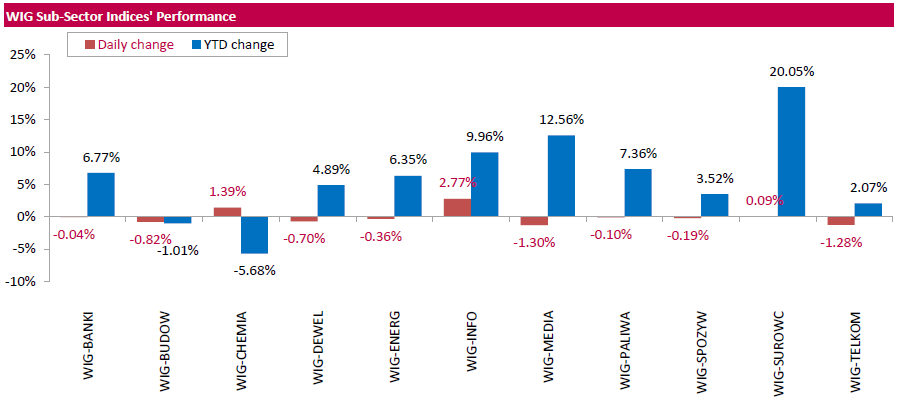

Polish equity market closed flat Thursday. The broad market measure, the WIG index, inched up 0.05%. Sector-wise, informational technology names (+2.77%) fared the best, while media sector stocks (-1.30%) fell the most.

The large-cap stocks' benchmark, the WIG30 Index, slid down 0.13%. In the index basket, coking coal miner JSW (WSE: JSW) was the strongest performer, jumping 3.68%. It was followed by IT-company ASSECO POLAND (WSE: ACP), chemical producer SYNTHOS (WSE: SNS) and footwear retailer CCC (WSE: CCC), adding 2.73%, 2.4% and 2.17% respectively. On the other side of the ledger, banking sector name MILLENNIUM (WSE: MIL) recorded the biggest decline of 2.02% on news the bank will allocate the entire 2015 profit to reserve capital. Other major laggards were by clothing retailer LPP (WSE: LPP), telecommunication services provider ORANGE POLSKA (WSE: OPL) and media group CYFROWY POLSAT (WSE: CPS), losing 1.74%-1.79%.

-

17:39

Bank of Japan Governor Haruhiko Kuroda: the monetary policy easing has no limit

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Thursday that the monetary policy easing had no limit. He pointed out that the central bank would continue with quantitative easing its inflation target was reached.

-

17:34

The ANZ business confidence index for New Zealand slides to 3.2% in February

ANZ Bank released its latest business sentiment survey for New Zealand on Thursday. The ANZ business confidence index for New Zealand slid to 3.2% in February from 7.1% in January. The index means that 3.2% of respondents expected the country's economy to improve over the coming year.

"Business confidence continues to wane. However, firms are more optimistic about prospects for their own business and this is a far more important signal for economic direction," the ANZ Chief Economist Cameron Bagrie said.

-

17:29

Housing starts in Japan jump 7.8% year-on-year in February

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Thursday. Housing starts in Japan rose 7.8% year-on-year in February, beating expectations for a 2.4% drop, after a 0.2% increase in January. It was the biggest rise since August 2015.

On a yearly basis, housing starts were up to 974,000 in February from 873,000 in January.

Construction orders slid 12.4% year-on-year in February, after a 13.8% drop in January.

-

17:25

Private sector credit in Australia rises 0.6% in February

The Reserve Bank of Australia (RBA) released its private sector credit data on Thursday. The total value of private sector credit in Australia rose 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.5% increase in January.

Housing credit increased 0.5% in February, personal credit declined 0.1%, while business credit rose 0.7%.

On a yearly basis, the private sector credit in Australia jumped 6.6% in February, after a 6.5% rise in January.

-

17:21

HIA new home sales in Australia drop 5.3% in February

The Housing Industry Association (HIA) released its new home sales data for Australia on Thursday. New home sales fell 5.3% in February, after a 0.6% rise in January. January's figure was revised down from a 3.1% increase.

"HIA New Home Sales are losing some of their lustre as a downward trend becomes more firmly entrenched. While the monthly result is a soft one, there is no need to loudly ring alarm bells as often seems to automatically occur every time an economic update disappoints," the HIA's chief economist Harley Dale said.

Sales of detached homes decreased 3.9% in February, while sales for multi-units slid 10.6%.

-

16:54

Standard & Poor's downgrades China’s outlook to ‘negative’

Rating agency Standard & Poor's (S&P) affirmed China's sovereign debt rating at 'AA-' but downgraded the outlook to 'negative' from 'stable'. The agency said that the downward revision was driven by a slower-than-expected pace of the implementation of reforms.

"Economic and financial risks to the Chinese government's creditworthiness are gradually increasing," the agency noted.

S&P affirmed Hong Kong's rating at 'AAA'. The agency also downgraded the outlook to 'negative' from 'stable'.

-

16:44

European Central Bank Governing Council member Francois Villeroy de Galhau: the central bank could add further stimulus measures if needed

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Thursday that the central bank could add further stimulus measures if needed to provide favourable financial conditions. He pointed out that the ECB's latest stimulus measures aimed to provide favourable financial conditions.

-

16:38

Spanish current account surplus turns into a deficit of €0.66 billion in January

The Bank of Spain released its current account data on Thursday. Spain's current account surplus turned into a deficit of €0.66 billion in January from a surplus of €3.98 billion in December. December's figure was revised down from a surplus of €4.49 billion.

The surplus on trade in goods and services totalled €0.6 billion in January, while the deficit on primary and second income totalled €1.3 billion.

-

16:29

Preliminary consumer price inflation in Spain is up 0.6% in March

The Spanish statistical office INE released its preliminary consumer price inflation data on Thursday. Consumer price inflation in Spain was up 0.6% in March, after a 0.4% fall in February.

On a yearly basis, consumer prices fell by 0.8% in March, after a 0.8% decrease in February.

The annual decline was mainly driven by the drop in in the prices of fuels (gas and diesel oil), and food and non-alcoholic beverages.

-

16:14

Retail sales in Spain rise at a seasonally adjusted rate of 0.2% in February

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.2% in February, after a 0.4% increase in January.

Food sales were down 0.3% in February, while non-food sales decreased by 0.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.9% in February, after a 3.3% rise in January.

Sales of non-food products jumped 5.6% in February from a year ago, while food sales rose 1.8%.

-

16:08

Greek retail sales fall 1.0% in January

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Thursday. Greek retail sales fell 1.0% in January.

On a yearly basis, Greek retail sales slid by 2.2% in January, after a 0.2% rise in December. December's figure was revised down from a 0.4% increase.

Sales of food products decreased by 2.8% year-on-year in January, sales of non-food products increased by 2.5%, while sales of automotive fuel dropped by 9.0%.

-

16:02

Chicago purchasing managers' index climbs to 53.6 in March

The Institute for Supply Management released its Chicago purchasing managers' index on Thursday. The Chicago purchasing managers' index climbed to 53.6 in March from 47.6 in February, exceeding expectations for an increase to 50.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was mainly driven by rises in production and employment. The production index rose to 53.7 in March from 44.0 in February, while the employment index climbed to 52.8 from 45.2.

New orders were up to 55.6 in March from 51.7 in February.

"The most significant result from the March survey is the pick-up in the Employment component which has remained weak for much of the past year. Looking through some of the recent volatility, the data are consistent with steady, not spectacular, economic growth in the US," Chief Economist of MNI Indicators Philip Uglow said.

-

15:53

Preliminary consumer prices in Italy increase 0.2% in March

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Thursday. Preliminary consumer prices in Italy increased 0.2% in March, after a 0.2% fall in February.

The monthly increase was driven by rises in prices of services related to transport and of diesel for personal transport equipment. Prices for services related to transport rose 1.0% in March, while prices of diesel for personal transport equipment increased 2.5%.

On a yearly basis, consumer prices fell 0.2% in March, after a 0.3% decrease in February.

The decline was driven by lower prices for energy, which slid 7.0% year-on-year in March.

Prices for goods declined 1.0% year-on-year in March, while services prices rose 0.7%.

Consumer price inflation excluding unprocessed food and energy prices climbed to 0.6% year-on-year in March from 0.5% in February.

-

15:49

WSE: After start on Wall Street

The Wall Street starts neutrally in the vicinity of the equilibrium level for the indexes S&P 500, Nasdaq and DJIA. Looking at the futures on the S&P500 there is no atmosphere to confirm morning moods from Euroland. Currently is hard to put the forecast about the direction of changes in the following hours. Bulls should be favored by the nature of the last session of the quarter following increases of the previous weeks .

U.S. Stocks open: Dow +0.02%, Nasdaq -0.07%, S&P -0.06%

On the WSE before opening on the Wall Street bulls attacked with a little more determination, hoping that the Americans will provide a new fuel to the market. As a result, we saw new highs on the WIG20 index. This process had no follow-up, by which we still have no attack on the level of 2,000 points.

-

15:42

Producer prices in Italy decrease 0.4% in February

The Italian statistical office Istat released its producer price inflation data for Italy on Thursday. Italian producer prices decreased 0.4% in February, after a 0.7% decline in January.

Producer price declined by 0.5% on domestic market and by 0.4% on non-domestic market in February.

On a yearly basis, Italian PPI fell 3.5% in February, after a 2.5% drop in January.

Producer price slid 4.1% on domestic market and by 1.8% on non-domestic market in February.

-

15:32

U.S. Stocks open: Dow +0.02%, Nasdaq -0.07%, S&P -0.06%

-

15:23

Before the bell: S&P futures +0.01%, NASDAQ futures -0.01%

U.S. stock-index were flat.

Global Stocks:

Nikkei 16,758.67 -120.29 -0.71%

Hang Seng 20,776.7 -26.69 -0.13%

Shanghai Composite 3,004.38 +3.73 +0.12%

FTSE 6,188.02 -15.15 -0.24%

CAC 4,403.72 -40.70 -0.92%

DAX 9,985.95 -60.66 -0.60%

Crude oil $38.02 (-0.78%)

Gold $1239.10 (+0.87%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.71

0.03(0.3099%)

7566

Amazon.com Inc., NASDAQ

AMZN

600

1.31(0.2188%)

6494

AMERICAN INTERNATIONAL GROUP

AIG

54.95

0.43(0.7887%)

7664

Apple Inc.

AAPL

109.32

-0.24(-0.2191%)

127177

AT&T Inc

T

39.34

-0.03(-0.0762%)

5371

Barrick Gold Corporation, NYSE

ABX

14.05

0.31(2.2562%)

56558

Boeing Co

BA

128.5

-0.08(-0.0622%)

4359

Chevron Corp

CVX

95.15

-0.10(-0.105%)

1157

Cisco Systems Inc

CSCO

28.46

-0.00(-0.00%)

210

Citigroup Inc., NYSE

C

41.82

-0.06(-0.1433%)

2435

Facebook, Inc.

FB

114.88

0.18(0.1569%)

224357

Ford Motor Co.

F

13.34

-0.01(-0.0749%)

1046

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.25

-0.04(-0.3887%)

57251

General Electric Co

GE

31.82

-0.01(-0.0314%)

31757

General Motors Company, NYSE

GM

30.98

-0.01(-0.0323%)

980

Google Inc.

GOOG

750.5

-0.03(-0.004%)

1348

International Business Machines Co...

IBM

148.85

0.44(0.2965%)

1736

Johnson & Johnson

JNJ

108.98

0.00(0.00%)

2761

JPMorgan Chase and Co

JPM

59.7

-0.01(-0.0167%)

743

McDonald's Corp

MCD

126.4

0.57(0.453%)

3819

Microsoft Corp

MSFT

55.28

0.23(0.4178%)

14607

Nike

NKE

61.9

-0.14(-0.2257%)

1487

Pfizer Inc

PFE

30.1

0.03(0.0998%)

1119

Starbucks Corporation, NASDAQ

SBUX

60.08

0.07(0.1167%)

1382

Tesla Motors, Inc., NASDAQ

TSLA

229.5

2.61(1.1503%)

30455

The Coca-Cola Co

KO

46.55

-0.03(-0.0644%)

4821

Twitter, Inc., NYSE

TWTR

16.45

0.09(0.5501%)

22789

Verizon Communications Inc

VZ

53.9

-0.14(-0.2591%)

15052

Yahoo! Inc., NASDAQ

YHOO

36.5

-0.06(-0.1641%)

16090

Yandex N.V., NASDAQ

YNDX

15.43

0.03(0.1948%)

10240

-

14:50

Canada's GDP rises 0.6% in January

Statistics Canada released GDP (gross domestic product) growth data on Thursday. Canada's GDP growth rose 0.6% in January, exceeding expectations for a 0.3% gain, after a 0.2% increase in December.

The increase was mainly driven by rises in manufacturing, retail trade, and mining, quarrying, and oil and gas extraction.

The mining, quarrying, and oil and gas extraction sector rose 0.9% in January, manufacturing output increased 1.9%, while the retail trade sector climbed 1.5%.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) initiated with an Overweight at Barclays

Microsoft (MSFT) reiterated with a Buy at Stifel; target $58

-

14:45

Initial jobless claims rise to 276,000 in the week ending March 26

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 26 in the U.S. increased by 11,000 to 276,000 from 265,000 in the previous week. Analysts had expected jobless claims to remain unchanged at 265,000.

Jobless claims remained below 300,000 the 56th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 7,000 to 2,173,000 in the week ended March 19.

-

13:21

WSE: Mid session comment

The first half of the session ends with departure of the WIG20 index from resistance at around 14 points. However the turnover does not look impressive.

Nevertheless, at the moment the market rather slumps to the south because of the withdrawal of demand than appearance of an aggressive supply. Withdrawal is peaceful and only another hours of the session will determine the balance of power on the market after meeting the level of 2,000 points. It is worth to remember that the first support area is now at 1,970 pts. level.

-

12:02

European stock markets mid session: stocks traded lower on falling oil prices

Stock indices traded lower on a fall in oil prices. Oil prices declined on yesterday's U.S. crude oil inventories data.

Market participants also eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in March from -0.2% in February, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in March from 0.8% in February. Analysts had expected the index to increase to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in March, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany was flat in March, missing expectations for a 7,000 decline, after a 9,000 decrease in February. February's figure was revised down from a 10,000 fall.

The unemployment rate remained unchanged at 6.2% in March, in line with expectations.

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales fell 0.4% in February, missing forecasts of a 0.3% gain, after a 0.1% decrease in January. January's figure was revised down from a 0.7% increase.

On a yearly basis, German unadjusted retail sales climbed 5.4% in February, beating expectations for a 2.2% gain, after a 1.2% drop in January. January's figure was revised down from a 0.8% decline.

Sales of non-food products increased at an annual rate of 3.9% in February, while sales of food, beverages and tobacco products rose by 7.1%.

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Thursday. The final U.K. GDP expanded at 0.6% in the fourth quarter, up from the February estimate of 0.5%, after a 0.4% rise in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.1% in the fourth quarter, up from the February estimate of 1.9%, after a 2.1% gain in the third quarter.

The upward revision was driven by revisions in services, industrial output and construction.

In 2015 as whole, GDP expanded 2.3%, up from the previous estimate of 2.2%.

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Thursday. The U.K. current account deficit widened to £37.2 billion in the fourth quarter from £20.1 billion in the third quarter. The third quarter's figure was revised down from a deficit of £17.5 billion.

Analysts had expected the current account deficit to increase to £21.1 billion.

The fourth quarter's current account deficit amounted to 7.0% of GDP, the highest share since 1955.

Declines in the current account deficit were driven by a drop in the deficit on primary and secondary income, and total trade.

In 2015 as a whole, the current account deficit was £96.2 billion or 5.2% of GDP. It was the biggest deficit since 1948.

Current figures:

Name Price Change Change %

FTSE 100 6,166.06 -37.11 -0.60 %

DAX 9,991.08 -55.53 -0.55 %

CAC 40 4,395.44 -48.98 -1.10 %

-

11:57

French preliminary consumer price inflation increases 0.7% in March

The French statistical office Insee released its preliminary consumer price inflation for France on Thursday. The French consumer price inflation increased 0.7% in March, after a 0.3% rise in February.

The monthly increase was mainly driven by a seasonal price upturn in manufactured product after the end of winter sales.

On a yearly basis, the consumer price index remained unchanged at -0.2% in March.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.4% year-on-year in March, services prices climbed 0.8%, while energy prices dropped by 7.0%.

-

11:52

French producer prices decrease 0.5% in February

French statistical office INSEE released its producer price index (PPI) data on Thursday. French producer prices decreased 0.5% in February, after a 0.9% drop in January. January's figure was revised down from a 0.8% fall.

The decrease was mainly driven a drop in prices for refined petroleum products.

On a yearly basis, French PPI fell 4.1% in February.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 40.1 year-on-year in February.

Import prices decreased 0.6% in February, after a 1.7% fall in January.

-

11:46

French consumer spending rises 0.6% in February

French statistical office INSEE released its consumer spending data on Thursday. French consumer spending rose 0.6% in February, after a 1.0% gain in January. January's figure was revised up from a 0.6% increase.

The increase was mainly driven by a rise in expenditure on energy and food. Spending on energy climbed by 1.2% in February, spending on food rose 1.5%.

On a yearly basis, consumer spending climbed 1.8% in February.

-

11:42

U.K. current account deficit widens to £37.2 billion in the fourth quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Thursday. The U.K. current account deficit widened to £37.2 billion in the fourth quarter from £20.1 billion in the third quarter. The third quarter's figure was revised down from a deficit of £17.5 billion.

Analysts had expected the current account deficit to increase to £21.1 billion.

The fourth quarter's current account deficit amounted to 7.0% of GDP, the highest share since 1955.

Declines in the current account deficit were driven by a drop in the deficit on primary and secondary income, and total trade.

In 2015 as a whole, the current account deficit was £96.2 billion or 5.2% of GDP. It was the biggest deficit since 1948.

-

11:33

Final U.K. GDP grows at 0.5% in the fourth quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Thursday. The final U.K. GDP expanded at 0.6% in the fourth quarter, up from the February estimate of 0.5%, after a 0.4% rise in the third quarter.

On a yearly basis, the revised U.K. GDP rose 2.1% in the fourth quarter, up from the February estimate of 1.9%, after a 2.1% gain in the third quarter.

The upward revision was driven by revisions in services, industrial output and construction.

In 2015 as whole, GDP expanded 2.3%, up from the previous estimate of 2.2%.

-

11:21

Number of mortgages approvals in the U.K. declines to 73,871 in February

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Thursday. The number of mortgages approvals in the U.K. was down to 73,871 in February from 74,085 in January, beating expectations for a decrease to 73,500. January's figure was revised down from 74,581.

Consumer credit in the U.K. rose by £1.287 billion in February, missing expectations for an £1.400 billion increase, after a £1.607 billion gain in January. January's figure was revised up from £1.564 billion.

Net lending to individuals in the U.K. increased by £4.9 billion in February, missing expectations for a £5.1 billion rise, after a £5.4 billion gain in January. January's figure was revised up from a £5.3 rise.

-

11:16

WSE: Communiqué of the WSE Management Board (Alert List)

Pursuant to the Resolution No 1387/2013 of the Warsaw Stock Exchange Management Board of 2 December 2013 on the separation of the regulated market segment ALERT LIST and the rules and procedure of classification in the segment, the Warsaw Stock Exchange has reviewed and classified stock issuers' shares in the ALERT LIST segment.

Shares of 23 issuers have been classified to the ALERT LIST segment.

The list of issuers classified to the ALERT LIST segment with the indication of number of subsequent classification

Lp.

Kod ISIN

Nazwa

Skrót

Średni kurs (PLN)

Liczba kwalifikacji*

No.

ISIN code

Name

Ticker

The average price (PLN)

No of qualification*

1

PLSRBEX00014

ALTERCO

ALT

0,19

5

2

PLAMPLI00019

AMPLI

APL

0,22

7

3

PLBDPWR00014

BUDOPOL

BDL

0,04

9

4

PLCASHF00018

CASHFLOW

CFL

0,20

6

5

PLKAREN00014

CCENERGY

CCE

0,06

9

6

PLEFH0000022

EFH

EFH

0,03

7

7

PLWDM0000029

GRAVITON

GRT

0,26

2

8

PLCNTZP00010

IDEON

IDE

0,01

9

9

PLLSTIA00018

INDYGO

IDG

0,49

1

10

PLPONAR00012

KCI

KCI

0,03

9

11

PLHGNKA00028

KERDOS

KRS

0,20

2

12

PLMSTEX00017

MSXRESOUR

MSX

0,19

3

13

GB00B42CTW68

NEWWORLDR

NWR

0,02

7

14

PLGUARD00019

PCGUARD

PCG

0,08

6

15

PLPEMUG00016

PEMUG

PMG

0,45

3

16

PLPTRLI00018

PETROLINV

OIL

0,21

9

17

NL0000686772

PLAZACNTR

PLZ

0,09

7

18

AU000000PDZ2

PRAIRIE

PDZ

0,48

1

19

SE0001856519

REINHOLD

RHD

0,29

2

20

LU0564351582

SADOVAYA

SGR

0,27

4

21

PLHRDEX00021

STARHEDGE

SHG

0,42

1

22

PLPTIW000014

TOPMEDICA

TPM

0,18

2

23

LU0627170920

WESTAISIC

WES

0,08

7

* liczba kwalifikacji z rzędu/ number of subsequent qualification

The Warsaw Stock Exchange Management Board hereby informs the market participants that pursuant to Par. 3, Division IV of the Detailed Exchange Trading Rules in UTP System, the change of trading system arising from the quarterly review and classification to the ALERT LIST segment, shall come into force as of trading session on 1 April 2016.

Consequences of qualifying the shares to the Lower Liquidity Space:

- the shares of the issuer shall be removed from the index portfolio;

- the shares of the issuer shall be moved to the single-price auction system;

- the name of the shares of the issuer shall be marked with a specific designation in the Exchange information services and WSE Daily Bulletin (Ceduła);

- the shares of the issuer shall be removed from the list of securities available for short selling orders.

- the shares of the issuer shall be removed from the index portfolio;

-

11:15

Preliminary consumer price inflation in the Eurozone rises to -0.1% year-on-year in March

Eurostat released its consumer price inflation data for the Eurozone on Thursday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in March from -0.2% in February, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco climbed to an annual rate of 1.0% in March from 0.8% in February. Analysts had expected the index to increase to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in March, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.3%, while energy prices dropped 8.7%.

-

11:09

Number of unemployed people in Germany is flat in February

The Federal Labour Agency released its unemployment figures for Germany on Thursday. The number of unemployed people in Germany was flat in March, missing expectations for a 7,000 decline, after a 9,000 decrease in February. February's figure was revised down from a 10,000 fall.

The unemployment rate remained unchanged at 6.2% in March, in line with expectations.

The number of unemployed people was 1.81 million in February, down from 1.83 million in January, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.3% in February.

The employment rate rose to an adjusted rate of 65.8% in February from 65.7% in January, according to Destatis.

-

10:59

German adjusted retail sales fall 0.4% in February

Destatis released its retail sales for Germany on Thursday. German adjusted retail sales fell 0.4% in February, missing forecasts of a 0.3% gain, after a 0.1% decrease in January. January's figure was revised down from a 0.7% increase.

On a yearly basis, German unadjusted retail sales climbed 5.4% in February, beating expectations for a 2.2% gain, after a 1.2% drop in January. January's figure was revised down from a 0.8% decline.

Sales of non-food products increased at an annual rate of 3.9% in February, while sales of food, beverages and tobacco products rose by 7.1%.

-

10:42

Bank of Canada Deputy Governor Lynn Patterson: the Canadian economy will need more than two years to recover

Bank of Canada (BoC) Deputy Governor Lynn Patterson said in a speech on Wednesday that the Canadian economy would need more than two years to recover from low commodity prices.

"Our best guess is that the full adjustment will take longer than two years, our normal forecast horizon," she said.

Patterson noted that households would likely restrain their spending and the consumption growth was expected to be lower due to lower real incomes.

-

10:25

European Central Bank Governing Council member Jens Weidmann: both Britain and the Eurozone profited from the European Union’s internal market

European Central Bank (ECB) Governing Council member Jens Weidmann said on Wednesday that both Britain and the Eurozone profited from the European Union's internal market. He warned that Britain's exit from the European Union could lead to less competition.

Weidmann noted that the economic impact of Britain's exit from the European Union will depend on levels of cooperation.

-

10:14

GfK’s U.K. consumer confidence index remains unchanged at 0 in March

Gfk released its consumer confidence index for the U.K. on late Wednesday evening. GfK's U.K. consumer confidence index remained unchanged at 0 in March, beating expectations for a decline to -1.

1 of 5 measures increased, 2 declined and 2 remained unchanged.

"Whilst UK consumers remain resolutely upbeat about their personal financial situation, even showing a +1 point increase this month when asked about expectations for the year ahead, concerns about prospects for the general economic situation continue to dampen our mood," Joe Staton, Head of Market Dynamics at GfK, said.

-

09:24

WSE: Before opening

The WIG20 futures contracts take off 2 points below yesterday's close. At today's market sentiment negatively affected by declines in the metals market and crude oil, which translates into a drop of contracts for major European markets. To positives include better than expected retail sales data in Germany.

Cash market starts first from the return of growth forced during yesterday's outstretched fixing. Thus, the dream of defeating the level of 2,000 points need to be postpone, which does not mean that the subject will not return soon. There is no willingness to greater growth for that very moment either on the Warsaw market, or on major European stock exchanges. We also need to bear in mind that we have the end of the quarter, which may lead to shill courses within windows dressing.

WIG20 index opened at 1982.94 points (-0.85%)*

WIG 48788.28 -0.41%

WIG20 1982.94 -0.85%

WIG30 2209.92 -0.52%

mWIG40 3599.56 0.04%

*/ - change to previous close

-

08:28

WSE: Before opening

Wednesday's trading on Wall Street ended with increases of the major indexes. The S&P500 has set a session peak about 17:00 and in the following hours rather sought consolidation and correction of the morning strength than continuation. The current valuation of the contract for the S&P500 allows the thesis that the opening of indexes in Europe will be downward, but the scale of price reductions should be relatively modest compare to yesterday increases.

Investors are waiting for data from the US labor market, the first Friday of the month is a monthly report of the US Department of Labor. Its importance should also have raw material market that morning overestimates oil and copper, which makes it difficult to continue yesterday's stock exchanges increases. It therefore seems reasonable to assume that on Thursday the world would rather strengthen the day of correction and will wait for Friday's data. For the calm scenario will contribute ending today the month and the quarter, when transactions are usually associated with attempts to improve the results by institutional investors.

Given the importance of resistance in the area of 2,000 points and the fact that the March boosters the WIG20 index already nearly to 10 percent, it's hard not to think of a correction. The market is locally bought, which indicate many technical analysis tools.

-

06:19

Global Stocks: Stocks Gain

European stocks leapt Wednesday, rising for a second straight day, in a broad-based rally prompted by the prospect that U.S. interest rates won't be raised quickly.

U.S. stocks closed up for a third session in a row Wednesday following dovish comments from Federal Reserve Chairwoman Janet Yellen, helping the Dow Jones Industrial Average set a record for the most up days in a month in six years.

Asian shares edged up to a four-month high on Thursday, taking cues from Wall Street gains overnight, as receding worries of near-term U.S. interest rate hikes continued to buoy risk sentiment. Investor risk appetite has increased since Fed Chair Yellen said on Tuesday that the U.S. central bank should proceed cautiously as it looks to hike rates, pushing back against some colleagues who have suggested another move may be just around the corner.

Based on MarketWatch materials

-

04:00

Nikkei 225 16,906.9 +27.94 +0.17 %, Hang Seng 20,796.86 -6.53 -0.03 %, Shanghai Composite 3,009.37 +8.72 +0.29 %

-

00:31

Stocks. Daily history for Sep Mar 30’2016:

(index / closing price / change items /% change)

Nikkei 225 17,103.53 -30.84 -0.18 %

Hang Seng 20,366.3 +20.69 +0.10 %

S&P/ASX 200 5,004.52 -79.69 -1.57 %

Shanghai Composite 2,920.55 -37.27 -1.26 %

FTSE 100 6,105.9 -0.58 -0.01 %

CAC 40 4,366.67 +36.99 +0.85 %

Xetra DAX 9,887.94 +36.59 +0.37 %

S&P 500 2,055.01 +17.96 +0.88 %

NASDAQ Composite 4,846.62 +79.84 +1.67 %

Dow Jones 17,633.11 +97.72 +0.56 %

-