Noticias del mercado

-

20:19

American focus: the US dollar significantly depreciated against the pound

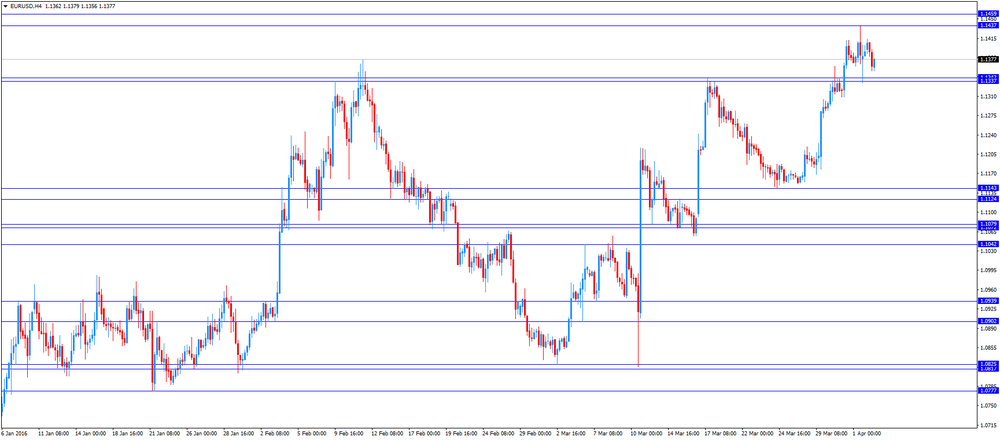

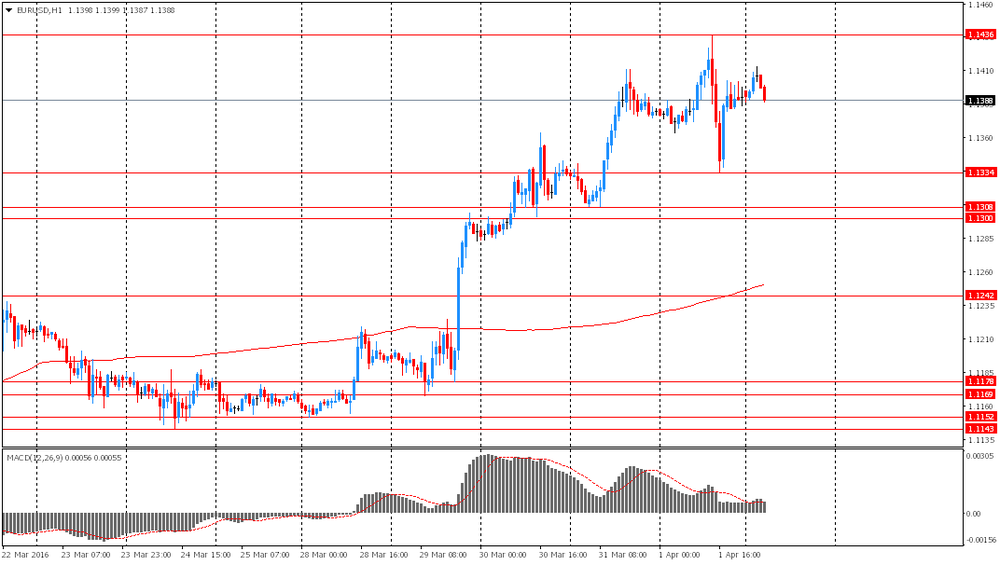

The dollar traded mixed against the euro, but generally remained within a narrow range, due to the lack of significant drivers and expectations of the ECB meeting and the publication of the Fed minutes. Minutes of the ECB is likely to help you understand why the ECB Governing Council chose the stimulus measures and whether he considered there any other options for action. Also, they may contain clues as to the reasons for the revision of economic forecasts. Meanwhile, the minutes of the last FOMC meeting may provide a better idea of when the Fed plans next rate hike. Futures on interest rates Fed indicate only a 5% chance of a rate hike in April and 26% probability in June. However, today the head of the Federal Reserve Bank of Boston Eric Rosengren said that the Fed's rate futures are not significantly reflect the pace of rate hikes in the short term. Rosengren sees fit gradual increase in rates, but, in his opinion, it will not be so gradual, according to market participants.

Little influence is also exerted on the US data. The Commerce Department reported that new orders for manufactured goods in the US fell in February, as business spending on capital goods were significantly weaker than initially anticipated. This recent signs that economic growth remains sluggish in the first quarter. New orders for manufactured goods fell by 1.7 percent, as demand has fallen as a whole, leveling revised down January's growth of 1.2 percent. Orders decreased in 14 of the last 19 months. The February drop in industrial orders was in line with economists' expectations. Earlier it was reported that orders rose by 1.6 percent in January.

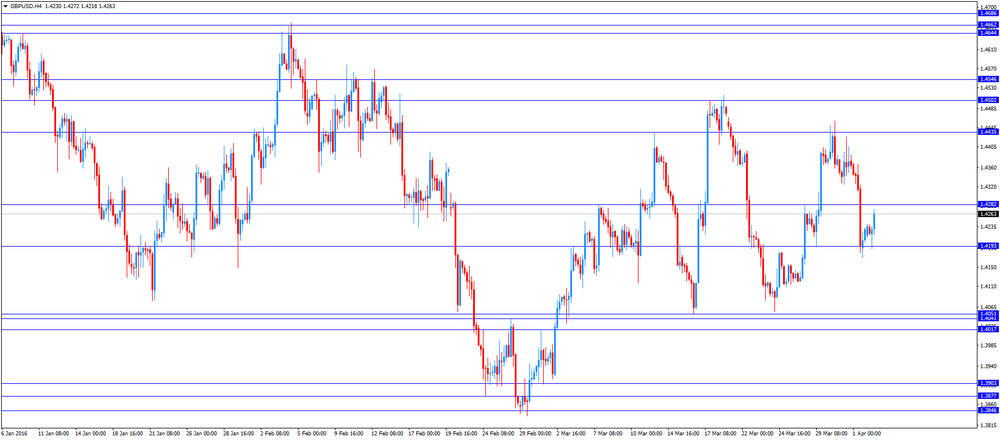

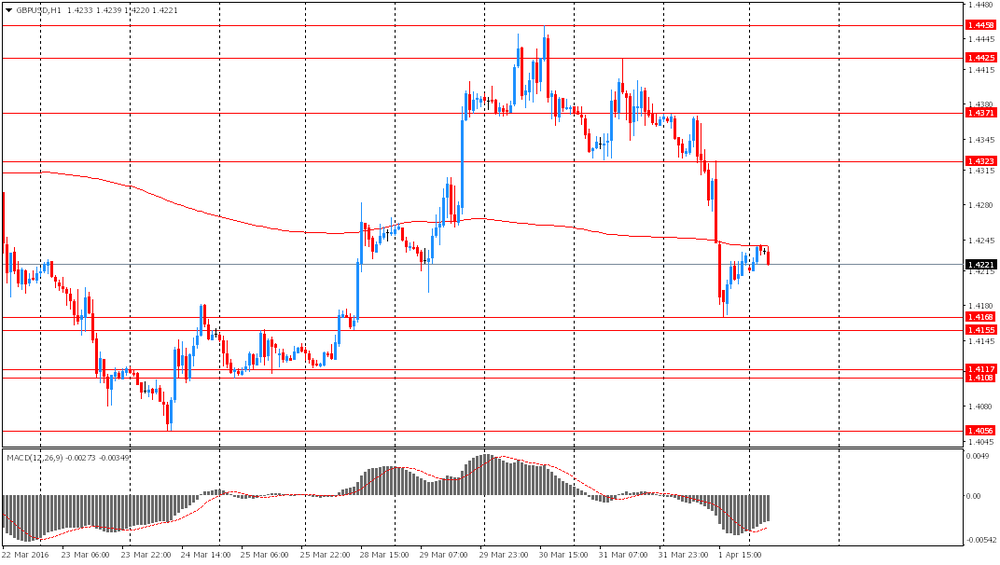

The pound rose against the dollar significantly, restoring most of the ground lost on Friday. Analysts say that the pound strengthened, despite the absence of basic catalysts. Probably, investors are buying the currency in anticipation of the publication of important reports.

This week the focus will be the results of a survey of purchasing managers for the UK service sector, as well as data on industrial production and trade balance. The PMI for the services sector must show that the restoration of the country's economy is still dependent on the service sector. At the same time, data on industrial production is likely to point to the difficulty faced by the manufacturing sector.

Meanwhile, market participants are almost ignored the warning agency S & P on the potential loss of Britain's rating in case Brekzita, as well as data on the PMI index in the construction sector. The report from Markit Economics and the Chartered Institute of Purchasing and Supply showed that remained stable in March, contrary to expectations, decrease economists in Britain Activity in the construction sector. UK Purchasing Managers' Index in the construction sector by Markit / CIPS was 54.2 in March, at the same level as the 10-month low in February. Economists expected the index to decline slightly to 54. Any value above 50 indicates expansion in the sector. In addition, recent data indicate the slowest rate of expansion of activity since June of 2013.

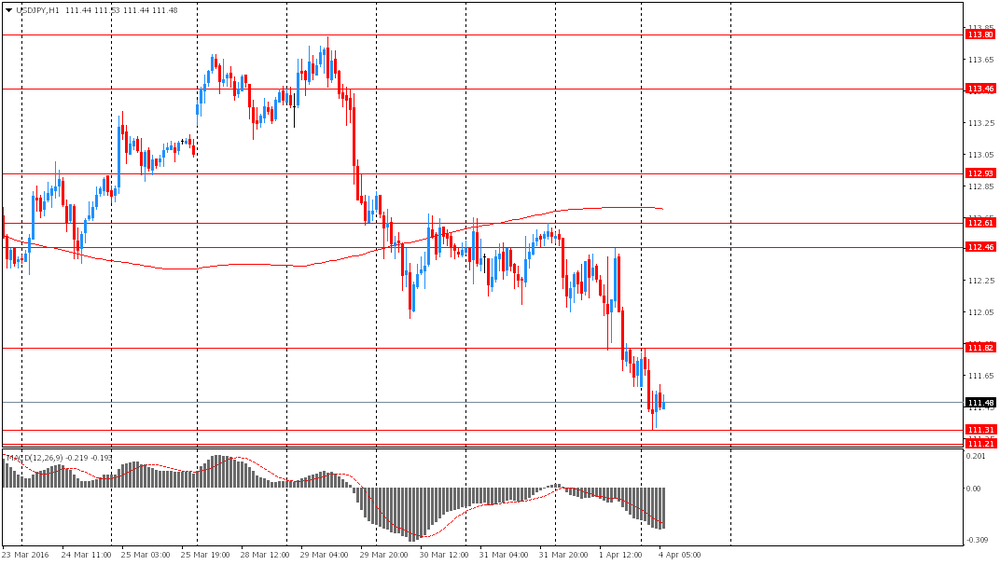

The yen strengthened against the dollar, reaching a peak on March 18 due to the adjustment of its expectations of investors about the prospects for the Fed raising interest rates. Many traders use caution due to the contradiction between the strong and the data of the central bank's tendency to mitigate policy. Recall that in the course of the March meeting of the Fed's policy to keep interest rates unchanged, but noted that short-term interest rates will rise by 0.5%, implying two rate hikes to 0.25% by the end of 2016. In December, it predicted four rate hikes. The next meeting will be held April 26-27. Most traders do not expect a rate hike in April, explaining that it is not after the press conference will be held. Currently, futures on interest rates Fed indicate only a 5% chance of a rate hike in April

-

17:53

International Monetary Fund’s Currency Composition of Official Foreign Exchange Reserves data: the U.S. dollar is the most popular reserve currency worldwide in 2015

According to the International Monetary Fund's (IMF) Currency Composition of Official Foreign Exchange Reserves (COFER) data, the U.S. dollar was the most popular reserve currency worldwide in 2015. The euro dropped to the lowest level since 2002.

Shares of the U.S. dollar remained unchanged at 64.06% in fourth quarter of 2015, while shares of the euro declined to 19.91% from 20.21%, the lowest level since 2002.

Shares of the pound rose to 4.88% in the fourth quarter from 4.72% in the third quarter, while shares of the yen increased to 4.08% from 3.80%.

-

17:41

Standard & Poor’s: Britain could lose its ‘AAA’ sovereign debt rating if the country exits the European Union

Rating agency Standard & Poor's (S&P) said on Monday that Britain could lose its 'AAA' sovereign debt rating if the country exits the European Union (EU).

"Brexit also heightens potential risks to economic growth and the balance of payments, as well as domestic political threats to territorial integrity," S&P's chief sovereign ratings officer Moritz Kraemer wrote on the politico.eu website.

-

17:27

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 127.48 in March

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index decreased to 127.48 in March from 128.54 in February. February's figure was revised down from 129.10.

Four of the eight components declined.

"The Employment Trends Index has been showing signs of weakening in recent months, suggesting that employment growth is likely to slow through the summer. With GDP barely growing at a two percent rate, it's difficult to see how employment can continue to expand by 200,000 or more jobs per month," , Chief Economist, North America, at The Conference Board, Gad Levanon, said.

-

17:23

Boston Fed President Eric Rosengren: the Fed could hike its interest rate sooner than expected by markets

Boston Fed President Eric Rosengren said in a speech on Monday that the Fed could hike its interest rate sooner than expected by markets.

"If the incoming data continue to show a moderate recovery - as I expect they will - I believe it will likely be appropriate to resume the path of gradual tightening sooner than is implied by financial-market futures," he said.

Rosengren noted that the U.S. economy could withstand developments abroad, and financial market volatility subsided.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:13

Bank of Japan’s Inflation Outlook of Enterprises: inflation expectations decline in the first quarter

The Bank of Japan (BoJ) released its Inflation Outlook of Enterprises on Monday. 3-year inflation expectations fell to 1.1% in the first quarter from 1.3% in the fourth quarter.

5-year inflation expectations declined to 1.2% in the first quarter from 1.4% in the fourth quarter.

One-year inflation expectations decreased to 0.8% in the first quarter from 1.0% in the fourth quarter.

-

16:48

European Central Bank purchases €8.76 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €8.76 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €102 million of covered bonds, and the value of asset-backed securities fell by €239 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:44

U.S. factory orders decline 1.7% in February

The U.S. Commerce Department released factory orders data on Monday. Factory orders in the U.S. declined 1.7% in February, in line with expectations, after a 1.2% rise in January. January's figure was revised down from a 1.6% increase.

The drop was mainly driven by a decline in orders for transportation equipment. Orders for transportation equipment plunged 6.2% in February, while orders for machinery slid 3.4%.

Durable goods orders were down 3.0% in February.

Factory orders excluding transportation declined 0.8% in February, after a 0.6% drop in January. January's figure was revised down from a 0.2% fall.

-

16:05

U.S.: Labor Market Conditions Index, March -2.1

-

16:00

U.S.: Factory Orders , February -1.7% (forecast -1.7%)

-

15:58

MI Inflation gauge for Australia is flat in March

The Melbourne Institute (MI) released its monthly inflation data for Australia on Monday. MI Inflation gauge for Australia was flat in March, after a 0.2% decline in February.

On a yearly basis, inflation gauge climbed 1.7% in March, after a 2.1% increase in February.

Prices for fruit and vegetables dropped 3.4% in March, audio, visual and computing equipment prices declined 2.2%, while prices for tobacco climbed 4.7% and holiday travel and accommodation prices were up 1.5%.

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 110.00 (USD 1.94bln) 112.00 (1.07bln) 112.50 (660m) 113.00 (758m) 113.00 (557m) 113.40 (460m) 113.50 (612m) 113.80-85 (830m) 114.00 (1.05bln) 114.25 (730m)

EUR/USD 1.1050 (EUR 1.13bln) 1.1064 (397m) 1.1075 (524m) 1.1100 (438m), 1.1175 (732m) 1.1200 (471m) 1.1268 (388m) 1.1295-1.1300 (884m), 1.1320 (230m) 1.1365 (426m), 1.1382 (256m) 1.1500 (344m)

GBP/USD 1.4050 (GBP 284m) 1.4250 (198m) 1.4397 (194m)

EUR/GBP 0.7610 (EUR 300m) 0.7860 (229m)

AUD/USD 0.7590 (AUD 300m)

USD/CAD 1.3200 (USD 1.45bln) 1.3245-50 (841m) 1.3350 (653m) 1.3420 (248m)

NZD/USD 0.6750 (NZD 444m) 0.6805 (202m)

AUD/JPY 84.00 (AUD 452m) 84.35 (1.07bln) 86.00 (407m)

AUD/NZD 1.0852 (AUD 774m) 1.1050 (202m) 1.1100 (209m) 1.1200 (229m)

USD/CNY 6.5000 (USD 2bln)

-

15:28

Australian ANZ job advertisements rise 0.2% in March

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements rose 0.2% in March, after a 1.2% fall in February.

The increase was mainly driven by a rise in internet job advertisements, which climbed by 0.4% in March.

"The number of job ads has been broadly unchanged for four months now, signalling an easing in hiring intentions. To some extent this is unsurprising given the strong pace of jobs growth over much of 2015 and modest improvement in the unemployment rate," the ANZ Senior Economist Justin Fabo noted.

-

14:53

Building permits in Australia climb 3.1% in February

The Australian Bureau of Statistics released its building permits data on Monday. Building permits in Australia climbed 3.1% in February, exceeding expectations for a 2.0% gain, after a 6.6% drop in January. January's figure was revised up from a 7.5% decrease.

Building permits for private sector houses declined 0.9% in February, while building permits for private sector dwellings excluding houses decreased 0.4%.

The seasonally adjusted estimate of the value of total building approved was down 0.8% in February.

On a yearly basis, building permits fell 9.0% in February, after a 14.5% decrease in January. January's figure was revised up from a 15.5% drop.

-

14:43

Retail sales in Australia are flat in February

The Australian Bureau of Statistics released its retail sales data on Monday. Retail sales in Australia were flat in February, missing expectations for a 0.4% rise, after a 0.3% increase in January.

Household goods sales were up 0.4% in February, department stores sales increased 0.4%, and food sales were flat, while clothing, footwear and personal accessory sales climbed 0.1%.

On a yearly basis, retail sales climbed 3.7% in February, after a 4.0% rise in January.

-

14:20

European Central Bank Executive Board member Peter Praet: the ECB will ease its monetary policy further to boost inflation in the Eurozone if needed

European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Monday that the central bank would ease its monetary policy further to boost inflation in the Eurozone if needed.

"The prolonged period of low inflation we are in today has increased the risks that inflation misses might become persistent, which would be deeply damaging for the economy. This is why we have reacted so forcefully to secure our objective - and will continue to do so in the future if necessary," he said.

Praet pointed out that central banks should be active to reach price stability.

"The ECB has demonstrated through its actions that it does not wait for others to move first," he noted.

-

14:11

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the better-than-expected construction PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia MI Inflation Gauge, m/m March -0.2% 0.0%

01:30 Australia ANZ Job Advertisements (MoM) March -1.2% 0.2%

01:30 Australia Building Permits, m/m February -6.6% Revised From -7.5% 2% 3.1%

01:30 Australia Retail Sales, M/M February 0.3% 0.4% 0.0%

08:30 Eurozone Sentix Investor Confidence April 5.5 5.7

08:30 United Kingdom PMI Construction March 54.2 54 54.2

09:00 Eurozone Producer Price Index, MoM February -1.1% Revised From -1% -0.6% -0.7%

09:00 Eurozone Producer Price Index (YoY) February -3.0% Revised From -2.9% -4% -4.2%

09:00 Eurozone Unemployment Rate February 10.4% Revised From 10.3% 10.3% 10.3%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. factory orders data. The U.S. factory orders are expected to drop 1.7% in February, after a 1.6% rise in January.

The greenback remained supported by Friday's labour market data from the U.S. According to the U.S. Labor Department on Friday, the U.S. economy added 215,000 jobs in March, exceeding expectations for a rise of 205,000 jobs, after a gain of 245,000 jobs in February. February's figure was revised up from a rise of 242,000 jobs. The U.S. unemployment rate rose to 5.0% in March from 4.9% in February. Analysts had expected the unemployment rate to remain unchanged at 4.9%. Average hourly earnings increased 0.3% in March, beating forecasts of a 0.2% gain, after a 0.1% decline in February.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Monday. Eurozone's unemployment rate declined to 10.3% in February from 10.4% in January, in line with expectations. It was the lowest reading since August 2011. January's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in February was recorded in Germany (4.3%) and the highest in Greece (24.0% in December 2015) and Spain (20.4%).

Eurostat's producer price index for the Eurozone declined 0.7% in February, missing expectations for a 0.6% fall, after a 1.1% decrease in January's figure was revised down from a 1.0% drop.

Intermediate goods prices fell 0.4% in February, capital goods prices were flat, non-durable consumer goods prices were down 0.2% and durable consumer goods prices were up 0.1%, while energy prices decreased 2.1%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in February, missing expectations for a 4.0% decline, after a 3.0% fall in January. January's figure was revised down from a 2.9% decrease.

Eurozone's producer prices excluding energy fell 0.8% year-on-year in February. Energy prices dropped at an annual rate of 12.8%.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 5.7 in April from 5.5 in March. A reading above 0.0 indicates optimism, below indicates pessimism.

"The process of economic stabilization of investors expectations has continued at the beginning of April," Sentix said in its statement.

"The Eurozone can benefit neither from a stabilization of the global economy nor from the measures of the ECB," Sentix added.

The British pound traded higher against the U.S. dollar after the release of the better-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. remained unchanged at 54.2 in March, beating expectations for a decrease to 54.0.

A reading above 50 indicates expansion in the construction sector.

A slowdown in residential work offset rebound in civil engineering and commercial work. New business growth slowed down in March, while job creation weakened.

The Canadian dollar traded higher against the U.S. dollar ahead of a speech by the Bank of Canada Governor Stephen Poloz at 14:00 GMT.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.4272

USD/JPY: the currency pair rose to Y111.74

The most important news that are expected (GMT0):

14:00 Canada BOC Gov Stephen Poloz Speaks

14:00 U.S. Factory Orders February 1.6% -1.7%

14:00 U.S. Labor Market Conditions Index March -2.4

23:30 Australia AIG Services Index March 51.8

-

13:50

Orders

EUR/USD

Offers: 1.1400 1.1420 1.1435 1.1450 1.1480 1.1500 1.1530 1.1550

Bids: 1.1370 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250

GBP/USD

Offers: 1.4235 1.4250 1.4275-80 1.4300 1.4325-30 1.4350 1.4380 1.4400

Bids: 1.4200 1.4175-80 1.4150 1.4130 1.4100 1.4085 1.4065 1.4050

EUR/JPY

Offers: 127.20 127.50 127.80 128.00 128.30 128.50

Bids: 126.70-75 126.50 126.30 126.00 125.80 125.50

EUR/GBP

Offers: 0.8020 0.8030 0.8060-65 0.8085 0.8100

Bids: 0.8000 0.7985 0.7970 0.7950 0.7930 0.7900 0.7880-85 0.7865 0.7850

USD/JPY

Offers: 111.60 111.80 112.00 112.20 112.50 112.65 112.80 113.00 113.40 113.80-85 114.00

Bids: 111.30 111.00 110.80 110.50 110.30 110.00

AUD/USD

Offers: 0.7700 0.7720 0.7735-40 0.7750 0.7765 0.7780 0.7800

Bids: 0.7600 0.7575-80 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450

-

11:47

Number of registered unemployed people in Spain decrease by 58,216 in March

Spain's labour ministry release its labour market figures on Monday. The number of registered unemployed people decreased by 58,216 in March, after a 2,231 rise in February.

The decline was driven by a rise in employment in the services sector during Easter holidays.

The number of registered youth unemployed people fell by 43,416 in March from the last year.

The total number of jobless in Spain was 4,094,770.

-

11:41

Eurozone's producer price index declines 0.7% in February

Eurostat released its producer price index for the Eurozone on Monday. Eurozone's producer price index declined 0.7% in February, missing expectations for a 0.6% fall, after a 1.1% decrease in January's figure was revised down from a 1.0% drop.

Intermediate goods prices fell 0.4% in February, capital goods prices were flat, non-durable consumer goods prices were down 0.2% and durable consumer goods prices were up 0.1%, while energy prices decreased 2.1%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in February, missing expectations for a 4.0% decline, after a 3.0% fall in January. January's figure was revised down from a 2.9% decrease.

Eurozone's producer prices excluding energy fell 0.8% year-on-year in February. Energy prices dropped at an annual rate of 12.8%.

-

11:34

Eurozone's unemployment rate drops to 10.3% in February, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Monday. Eurozone's unemployment rate declined to 10.3% in February from 10.4% in January, in line with expectations. It was the lowest reading since August 2011.

January's figure was revised up from 10.3%.

There were 16.634 million unemployed in the Eurozone in February, down by 39.000 from January.

The lowest unemployment rate in the Eurozone in February was recorded in Germany (4.3%) and the highest in Greece (24.0% in December 2015) and Spain (20.4%).

The youth unemployment rate was 21.6% in the Eurozone in February, compared to 22.7% in February a year ago.

-

11:26

Sentix investor confidence index for the Eurozone rises to 5.7 in April

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 5.7 in April from 5.5 in March.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The process of economic stabilization of investors expectations has continued at the beginning of April," Sentix said in its statement.

"The Eurozone can benefit neither from a stabilization of the global economy nor from the measures of the ECB," Sentix added.

The current conditions index fell to 6.0 in April from 8.3 in March.

The expectations index climbed to 5.5 in April from 2.8 in March.

German investor confidence index rose to 17.6 in April from 16.9 in March.

-

11:00

Eurozone: Producer Price Index, MoM , February -0.7% (forecast -0.6%)

-

11:00

Eurozone: Unemployment Rate , February 10.3% (forecast 10.3%)

-

11:00

Eurozone: Producer Price Index (YoY), February -4.2% (forecast -4%)

-

10:55

UK construction PMI remains unchanged at 54.2 in March

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. remained unchanged at 54.2 in March, beating expectations for a decrease to 54.0.

A reading above 50 indicates expansion in the construction sector.

A slowdown in residential work offset rebound in civil engineering and commercial work. New business growth slowed down in March, while job creation weakened.

"March's survey confirms that the UK construction sector is experiencing its weakest growth phase since the summer of 2013. Residential building has seen the greatest loss of momentum through the first quarter of 2016, which is a surprising reversal of fortunes given strong market fundamentals and its clear outperformance over the past three years," Senior Economist at Markit, Tim Moore, said.

-

10:41

Fitch Ratings affirms Germany’s sovereign debt rating at ‘AAA'

Rating agency Fitch Ratings on Friday affirmed Germany's sovereign debt rating at 'AAA'. The outlook is 'stable'.

"The 'AAA' ratings primarily reflect Germany's strong institutions and diversified, high value-added economy. A large structural current account surplus supports the country's net external creditor position," the agency said.

Fitch added that Germany was able to manage the migrant crisis without any downgrades in rating.

The agency expects the German economy to expand 1.7% in 2016 and 1.8% in 2017, driven by domestic demand.

-

10:30

United Kingdom: PMI Construction, March 54.2 (forecast 54)

-

10:23

Bank of Canada’s Business Outlook Survey: business sentiment improves but remains subdued overall

The Bank of Canada (BoC) released its Spring Business Outlook Survey on Friday. The BoC's survey showed that business sentiment in Canada improved but remained subdued overall. The improvement of the sentiment was driven by foreign demand, according to the survey.

Expectations for future sales growth remained positive, supported by U.S. demand, the BoC said.

Investment and hiring intentions rose but remained modest, so BoC Business Outlook Survey.

-

09:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 110.00 (USD 1.94bln) 112.00 (1.07bln) 112.50 (660m) 113.00 (758m) 113.00 (557m) 113.40 (460m) 113.50 (612m) 113.80-85 (830m) 114.00 (1.05bln) 114.25 (730m)

EUR/USD 1.1050 (EUR 1.13bln) 1.1064 (397m) 1.1075 (524m) 1.1100 (438m), 1.1175 (732m) 1.1200 (471m) 1.1268 (388m) 1.1295-1.1300 (884m), 1.1320 (230m) 1.1365 (426m), 1.1382 (256m) 1.1500 (344m)

GBP/USD 1.4050 (GBP 284m) 1.4250 (198m) 1.4397 (194m)

EUR/GBP 0.7610 (EUR 300m) 0.7860 (229m)

AUD/USD 0.7590 (AUD 300m)

USD/CAD 1.3200 (USD 1.45bln) 1.3245-50 (841m) 1.3350 (653m) 1.3420 (248m)

NZD/USD 0.6750 (NZD 444m) 0.6805 (202m)

AUD/JPY 84.00 (AUD 452m) 84.35 (1.07bln) 86.00 (407m)

AUD/NZD 1.0852 (AUD 774m) 1.1050 (202m) 1.1100 (209m) 1.1200 (229m)

USD/CNY 6.5000 (USD 2bln)

-

08:17

Asian session

The dollar was on the defensive on Monday, after Friday's firm U.S. jobs report failed to shift the broadly held view that the Federal Reserve will remain cautious on interest rate hikes this year.

"I don't see any reason that many people would want to buy the yen against the dollar," he said, in light of the mostly positive U.S. employment report as well as the likelihood of more monetary stimulus from Japan.

According to Friday's data, U.S. non-farm payrolls rose by 215,000 last month, slightly above expectations, and average hourly earnings rose after slipping in February. But the unemployment rate edged up to 5.0 percent from an eight-year low of 4.9 percent.

Japanese companies' long-term inflation expectations weakened in March from three months ago, a Bank of Japan survey showed on Monday, a sign that the central bank's January decision to adopt negative interest rates has so far failed to convince firms price rises will accelerate over time.

Sterling failed to capitalise on the dollar's broad weakness, weighed down by a weak UK manufacturing survey. Muted retail sales, subdued inflation and a survey suggesting that labour demand may have peaked all pressured the Aussie.

EUR/USD: during the Asian session the pair traded in the range of $1.1380-15

GBP/USD: during the Asian session the pair traded in the range of $1.4215-40

USD/JPY: during the Asian session the pair dropped to Y111.30

Based on Reuters materials

-

07:08

Options levels on monday, April 4, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1521 (4286)

$1.1486 (2616)

$1.1459 (3650)

Price at time of writing this review: $1.1385

Support levels (open interest**, contracts):

$1.1327 (1403)

$1.1289 (3478)

$1.1245 (1012)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 49024 contracts, with the maximum number of contracts with strike price $1,1500 (4286);

- Overall open interest on the PUT options with the expiration date April, 8 is 74949 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.53 versus 1.52 from the previous trading day according to data from April, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.4501 (1955)

$1.4402 (2009)

$1.4304 (1000)

Price at time of writing this review: $1.4221

Support levels (open interest**, contracts):

$1.4097 (911)

$1.3998 (2998)

$1.3899 (1091)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 22373 contracts, with the maximum number of contracts with strike price $1,4400 (2009);

- Overall open interest on the PUT options with the expiration date April, 8 is 23518 contracts, with the maximum number of contracts with strike price $1,4000 (2998);

- The ratio of PUT/CALL was 1.05 versus 1.09 from the previous trading day according to data from April, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

Australia: ANZ Job Advertisements (MoM), March 0.2%

-

03:30

Australia: Retail Sales, M/M, February 0.0% (forecast 0.4%)

-

03:30

Australia: Building Permits, m/m, February 3.1% (forecast 2%)

-

03:00

Australia: MI Inflation Gauge, m/m, March 0.0%

-

01:01

Currencies. Daily history for Apr 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1390 +0,09%

GBP/USD $1,4229 -0,96%

USD/CHF Chf0,9576 -0,40%

USD/JPY Y111,74 -0,71%

EUR/JPY Y127,27 -0,62%

GBP/JPY Y158,87 -1,74%

AUD/USD $0,7677 +0,18%

NZD/USD $0,6904 -0,13%

USD/CAD C$1,3012 +0,22%

-