Noticias del mercado

-

21:00

Dow -0.32% 17,735.09 -57.66 Nasdaq -0.43% 4,893.55 -20.99 S&P -0.35% 2,065.47 -7.31

-

18:00

European stocks closed: FTSE 100 6,164.72 +18.67 +0.30% CAC 40 4,345.22 +22.98 +0.53% DAX 9,822.08 +27.44 +0.28%

-

17:59

European stocks close: stocks closed higher despite mixed economic data from the Eurozone

Stock indices closed higher despite mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Monday. Eurozone's unemployment rate declined to 10.3% in February from 10.4% in January, in line with expectations. It was the lowest reading since August 2011. January's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in February was recorded in Germany (4.3%) and the highest in Greece (24.0% in December 2015) and Spain (20.4%).

Eurostat's producer price index for the Eurozone declined 0.7% in February, missing expectations for a 0.6% fall, after a 1.1% decrease in January's figure was revised down from a 1.0% drop.

Intermediate goods prices fell 0.4% in February, capital goods prices were flat, non-durable consumer goods prices were down 0.2% and durable consumer goods prices were up 0.1%, while energy prices decreased 2.1%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in February, missing expectations for a 4.0% decline, after a 3.0% fall in January. January's figure was revised down from a 2.9% decrease.

Eurozone's producer prices excluding energy fell 0.8% year-on-year in February. Energy prices dropped at an annual rate of 12.8%.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 5.7 in April from 5.5 in March. A reading above 0.0 indicates optimism, below indicates pessimism.

"The process of economic stabilization of investors expectations has continued at the beginning of April," Sentix said in its statement.

"The Eurozone can benefit neither from a stabilization of the global economy nor from the measures of the ECB," Sentix added.

European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Monday that the central bank would ease its monetary policy further to boost inflation in the Eurozone if needed. He pointed out that central banks should be active to reach price stability.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. remained unchanged at 54.2 in March, beating expectations for a decrease to 54.0.

A reading above 50 indicates expansion in the construction sector.

A slowdown in residential work offset rebound in civil engineering and commercial work. New business growth slowed down in March, while job creation weakened.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,164.72 +18.67 +0.30 %

DAX 9,822.08 +27.44 +0.28 %

CAC 40 4,345.22 +22.98 +0.53 %

-

17:53

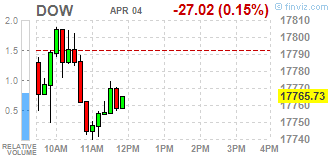

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slightly fell on Monday as a fall in oil prices hit materials stocks, offsetting a rise in healthcare shares. Crude prices were slightly lower as hopes that top oil producers would reach an agreement to help tackle a stubborn global glut faded. Investors have also been skittish following U.S. Federal Reserve Chair Janet Yellen's comments last week urging caution on raising rates, which were in contrast with remarks made by some policymakers supporting more aggressive stance on rates.

Most of Dow stocks in negative area (19 of 30). Top looser - NIKE, Inc. (NKE, -2,92%). Top gainer - Pfizer Inc. (PFE, +2,15%).

Most of S&P sectors in negative area. Top looser - Industrial goods (-0,9%). Top gainer - Healthcare (+1,3%).

At the moment:

Dow 17676.00 -30.00 -0.17%

S&P 500 2060.25 -4.75 -0.23%

Nasdaq 100 4506.50 -22.00 -0.49%

Oil 36.55 -0.24 -0.65%

Gold 1220.40 -3.10 -0.25%

U.S. 10yr 1.77 -0.02

-

17:41

Standard & Poor’s: Britain could lose its ‘AAA’ sovereign debt rating if the country exits the European Union

Rating agency Standard & Poor's (S&P) said on Monday that Britain could lose its 'AAA' sovereign debt rating if the country exits the European Union (EU).

"Brexit also heightens potential risks to economic growth and the balance of payments, as well as domestic political threats to territorial integrity," S&P's chief sovereign ratings officer Moritz Kraemer wrote on the politico.eu website.

-

17:37

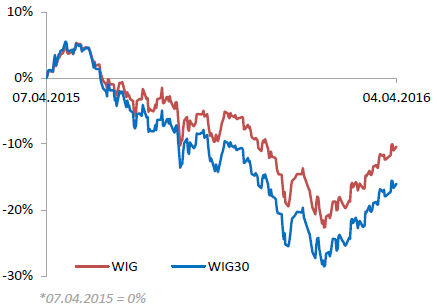

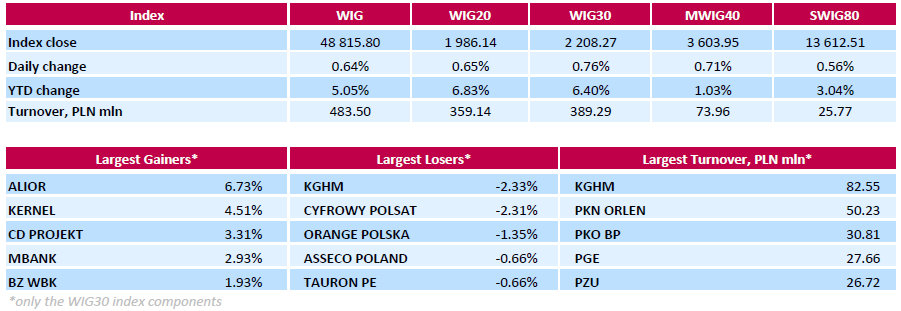

WSE: Session Results

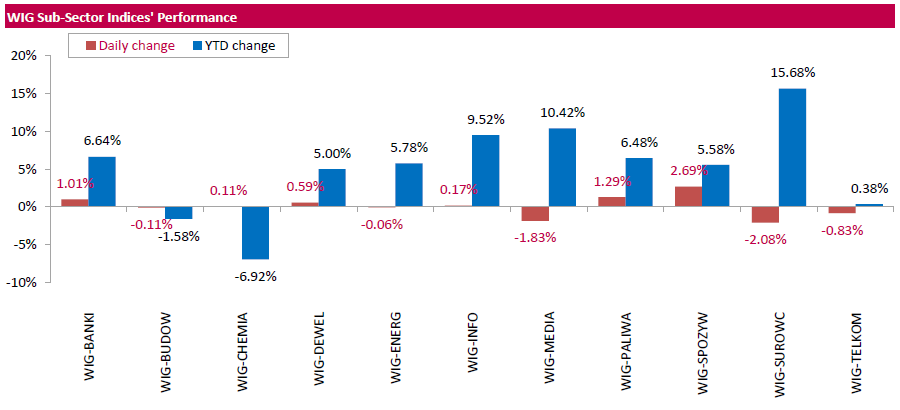

Polish equity surged on Monday. The broad market measure, the WIG Index, added 0.64%. Sector performance within the WIG Index was mixed. Food sector (+2.69%) outperformed, while materials (-2.08%) lagged behind.

The large-cap stocks' benchmark, the WIG30 Index, grew by 0.76%. In the index basket, ALIOR (WSE: ALR) continued its strong run, gaining a further 6.73%, following the news about its takeover of BPH. It was followed by agricultural holding KERNEL (WSE: KER), recovering by 4.51% after four consecutive sessions of declines. Other major advancers were videogame developer CD PROJEKT (WSE: CDR) and bank MBANK (WSE: MBK), adding 3.31% and 2.93% respectively. On the other side of the ledger, copper producer KGHM (WSE: KGH) and media group CYFROWY POLSAT (WSE: CPS) recorded the worst results, declining by 2.33% and 2.31% respectively.

-

17:27

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 127.48 in March

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index decreased to 127.48 in March from 128.54 in February. February's figure was revised down from 129.10.

Four of the eight components declined.

"The Employment Trends Index has been showing signs of weakening in recent months, suggesting that employment growth is likely to slow through the summer. With GDP barely growing at a two percent rate, it's difficult to see how employment can continue to expand by 200,000 or more jobs per month," , Chief Economist, North America, at The Conference Board, Gad Levanon, said.

-

17:23

Boston Fed President Eric Rosengren: the Fed could hike its interest rate sooner than expected by markets

Boston Fed President Eric Rosengren said in a speech on Monday that the Fed could hike its interest rate sooner than expected by markets.

"If the incoming data continue to show a moderate recovery - as I expect they will - I believe it will likely be appropriate to resume the path of gradual tightening sooner than is implied by financial-market futures," he said.

Rosengren noted that the U.S. economy could withstand developments abroad, and financial market volatility subsided.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:13

Bank of Japan’s Inflation Outlook of Enterprises: inflation expectations decline in the first quarter

The Bank of Japan (BoJ) released its Inflation Outlook of Enterprises on Monday. 3-year inflation expectations fell to 1.1% in the first quarter from 1.3% in the fourth quarter.

5-year inflation expectations declined to 1.2% in the first quarter from 1.4% in the fourth quarter.

One-year inflation expectations decreased to 0.8% in the first quarter from 1.0% in the fourth quarter.

-

16:48

European Central Bank purchases €8.76 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €8.76 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €102 million of covered bonds, and the value of asset-backed securities fell by €239 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:44

U.S. factory orders decline 1.7% in February

The U.S. Commerce Department released factory orders data on Monday. Factory orders in the U.S. declined 1.7% in February, in line with expectations, after a 1.2% rise in January. January's figure was revised down from a 1.6% increase.

The drop was mainly driven by a decline in orders for transportation equipment. Orders for transportation equipment plunged 6.2% in February, while orders for machinery slid 3.4%.

Durable goods orders were down 3.0% in February.

Factory orders excluding transportation declined 0.8% in February, after a 0.6% drop in January. January's figure was revised down from a 0.2% fall.

-

15:58

MI Inflation gauge for Australia is flat in March

The Melbourne Institute (MI) released its monthly inflation data for Australia on Monday. MI Inflation gauge for Australia was flat in March, after a 0.2% decline in February.

On a yearly basis, inflation gauge climbed 1.7% in March, after a 2.1% increase in February.

Prices for fruit and vegetables dropped 3.4% in March, audio, visual and computing equipment prices declined 2.2%, while prices for tobacco climbed 4.7% and holiday travel and accommodation prices were up 1.5%.

-

15:40

WSE: After start on Wall Street

Today's turnover on the Warsaw Stock Exchange is very modest and in conjunction with minor changes shows a picture of the consolidation and peaceful trade. Increases in Euroland also slowed down. Contracts in the US gained a modest 0.1%, and also did not indicate dynamic changes. Nevertheless the WSE is now calmer compare to environment and preserves its independence.

U.S. Stocks open: Dow -0.04%, Nasdaq -0.07%, S&P -0.07%

Market opening on Wall Street was neutral and the market does not go over Friday's closing, which coincided with the area of resistance. The first bars after opening were slightly downward and consistent with the behavior of the futures market.

-

15:33

U.S. Stocks open: Dow -0.04%, Nasdaq -0.07%, S&P -0.07%

-

15:28

Australian ANZ job advertisements rise 0.2% in March

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements rose 0.2% in March, after a 1.2% fall in February.

The increase was mainly driven by a rise in internet job advertisements, which climbed by 0.4% in March.

"The number of job ads has been broadly unchanged for four months now, signalling an easing in hiring intentions. To some extent this is unsurprising given the strong pace of jobs growth over much of 2015 and modest improvement in the unemployment rate," the ANZ Senior Economist Justin Fabo noted.

-

15:13

Before the bell: S&P futures +0.13%, NASDAQ futures +0.06%

U.S. stock-index fluctuated.

Global Stocks:

Nikkei 16,123.27 -40.89 -0.25%

Hang Seng Closed

Shanghai Composite Closed

FTSE 6,169.83 +23.78 +0.39%

CAC 4,343.07 +20.83 +0.48%

DAX 9,851.12 +56.48 +0.58%

Crude oil $36.66 (-0.35%)

Gold $1222.20 (-0.11%)

-

14:53

Building permits in Australia climb 3.1% in February

The Australian Bureau of Statistics released its building permits data on Monday. Building permits in Australia climbed 3.1% in February, exceeding expectations for a 2.0% gain, after a 6.6% drop in January. January's figure was revised up from a 7.5% decrease.

Building permits for private sector houses declined 0.9% in February, while building permits for private sector dwellings excluding houses decreased 0.4%.

The seasonally adjusted estimate of the value of total building approved was down 0.8% in February.

On a yearly basis, building permits fell 9.0% in February, after a 14.5% decrease in January. January's figure was revised up from a 15.5% drop.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

168

0.47(0.2805%)

314

ALCOA INC.

AA

9.67

0.04(0.4154%)

18957

Amazon.com Inc., NASDAQ

AMZN

600

1.50(0.2506%)

4510

American Express Co

AXP

60

-1.10(-1.8003%)

329

Apple Inc.

AAPL

110.83

0.84(0.7637%)

234019

AT&T Inc

T

39.15

0.10(0.2561%)

14000

Barrick Gold Corporation, NYSE

ABX

13.62

-0.03(-0.2198%)

22836

Boeing Co

BA

126.9

-0.06(-0.0473%)

4833

Caterpillar Inc

CAT

77

0.21(0.2735%)

3920

Chevron Corp

CVX

94.48

0.22(0.2334%)

743

Cisco Systems Inc

CSCO

28.46

0.03(0.1055%)

7379

Citigroup Inc., NYSE

C

42.55

0.08(0.1884%)

4005

Deere & Company, NYSE

DE

76.48

-0.02(-0.0261%)

1201

Exxon Mobil Corp

XOM

83.2

0.24(0.2893%)

2658

Facebook, Inc.

FB

114.51

-1.55(-1.3355%)

693486

Ford Motor Co.

F

13.15

0.05(0.3817%)

48574

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.95

0.06(0.6067%)

49869

General Electric Co

GE

31.68

-0.25(-0.783%)

72671

Hewlett-Packard Co.

HPQ

12.22

-0.04(-0.3263%)

791

Home Depot Inc

HD

136.7

1.85(1.3719%)

15473

Intel Corp

INTC

32.25

-0.20(-0.6163%)

18167

International Business Machines Co...

IBM

152.4

-0.12(-0.0787%)

1145

Johnson & Johnson

JNJ

109.1

-0.09(-0.0824%)

1451

JPMorgan Chase and Co

JPM

59.54

0.11(0.1851%)

9410

McDonald's Corp

MCD

127.4

0.38(0.2992%)

1026

Merck & Co Inc

MRK

53.7

0.00(0.00%)

265

Microsoft Corp

MSFT

55.5

-0.07(-0.126%)

6571

Nike

NKE

61.82

0.23(0.3734%)

481

Pfizer Inc

PFE

30.1

0.06(0.1997%)

3101

Procter & Gamble Co

PG

83.5

-0.03(-0.0359%)

549

Starbucks Corporation, NASDAQ

SBUX

61.04

0.02(0.0328%)

1240

Tesla Motors, Inc., NASDAQ

TSLA

248.1

10.51(4.4236%)

305958

The Coca-Cola Co

KO

46.77

-0.06(-0.1281%)

9180

Twitter, Inc., NYSE

TWTR

16.09

0.11(0.6884%)

71188

United Technologies Corp

UTX

100.2

0.23(0.2301%)

268

Wal-Mart Stores Inc

WMT

68.95

-0.11(-0.1593%)

1626

Walt Disney Co

DIS

99.3

0.23(0.2322%)

3029

Yahoo! Inc., NASDAQ

YHOO

36.6

0.12(0.3289%)

22129

Yandex N.V., NASDAQ

YNDX

15.32

-0.06(-0.3901%)

600

-

14:43

Retail sales in Australia are flat in February

The Australian Bureau of Statistics released its retail sales data on Monday. Retail sales in Australia were flat in February, missing expectations for a 0.4% rise, after a 0.3% increase in January.

Household goods sales were up 0.4% in February, department stores sales increased 0.4%, and food sales were flat, while clothing, footwear and personal accessory sales climbed 0.1%.

On a yearly basis, retail sales climbed 3.7% in February, after a 4.0% rise in January.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded to Neutral from Outperform at Exane BNP Paribas

General Electric (GE) downgraded to Hold from Buy at Berenberg

Other:

Yahoo! (YHOO) target raised to $37 from $32 at Mizuho

Facebook (FB) target raised to $150 from $145 at Axiom Capital; maintain Buy

Coca-Cola (KO) target raised to $52 from $49 at UBS; maintain Buy

Apple (AAPL) target raised to $150 from $140 at Credit Suisse; added to US Focus List

-

14:20

European Central Bank Executive Board member Peter Praet: the ECB will ease its monetary policy further to boost inflation in the Eurozone if needed

European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Monday that the central bank would ease its monetary policy further to boost inflation in the Eurozone if needed.

"The prolonged period of low inflation we are in today has increased the risks that inflation misses might become persistent, which would be deeply damaging for the economy. This is why we have reacted so forcefully to secure our objective - and will continue to do so in the future if necessary," he said.

Praet pointed out that central banks should be active to reach price stability.

"The ECB has demonstrated through its actions that it does not wait for others to move first," he noted.

-

13:01

WSE: Mid session comment

After a difficult start of the session, the markets of Western Europe came to a straight line and indexes record growth of about 1.0%. Thus we can speak of a successful defense of the support levels.

The WSE presents interesting behavior on the wide market, where demand selectively looking for the next topics to play or fights for the continuation of the current trend. Such activity of the broad market shows that small players are active all the time, and this is a big change compare to the second half of the last year.

-

12:00

European stock markets mid session: stocks traded higher despite mixed economic data from the Eurozone

Stock indices traded higher despite mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Monday. Eurozone's unemployment rate declined to 10.3% in February from 10.4% in January, in line with expectations. It was the lowest reading since August 2011. January's figure was revised up from 10.3%. The lowest unemployment rate in the Eurozone in February was recorded in Germany (4.3%) and the highest in Greece (24.0% in December 2015) and Spain (20.4%).

Eurostat's producer price index for the Eurozone declined 0.7% in February, missing expectations for a 0.6% fall, after a 1.1% decrease in January's figure was revised down from a 1.0% drop.

Intermediate goods prices fell 0.4% in February, capital goods prices were flat, non-durable consumer goods prices were down 0.2% and durable consumer goods prices were up 0.1%, while energy prices decreased 2.1%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in February, missing expectations for a 4.0% decline, after a 3.0% fall in January. January's figure was revised down from a 2.9% decrease.

Eurozone's producer prices excluding energy fell 0.8% year-on-year in February. Energy prices dropped at an annual rate of 12.8%.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 5.7 in April from 5.5 in March. A reading above 0.0 indicates optimism, below indicates pessimism.

"The process of economic stabilization of investors expectations has continued at the beginning of April," Sentix said in its statement.

"The Eurozone can benefit neither from a stabilization of the global economy nor from the measures of the ECB," Sentix added.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. remained unchanged at 54.2 in March, beating expectations for a decrease to 54.0.

A reading above 50 indicates expansion in the construction sector.

A slowdown in residential work offset rebound in civil engineering and commercial work. New business growth slowed down in March, while job creation weakened.

Current figures:

Name Price Change Change %

FTSE 100 6,181.5 +35.45 +0.58 %

DAX 9,883.4 +88.76 +0.91 %

CAC 40 4,367.52 +45.28 +1.05 %

-

11:47

Number of registered unemployed people in Spain decrease by 58,216 in March

Spain's labour ministry release its labour market figures on Monday. The number of registered unemployed people decreased by 58,216 in March, after a 2,231 rise in February.

The decline was driven by a rise in employment in the services sector during Easter holidays.

The number of registered youth unemployed people fell by 43,416 in March from the last year.

The total number of jobless in Spain was 4,094,770.

-

11:41

Eurozone's producer price index declines 0.7% in February

Eurostat released its producer price index for the Eurozone on Monday. Eurozone's producer price index declined 0.7% in February, missing expectations for a 0.6% fall, after a 1.1% decrease in January's figure was revised down from a 1.0% drop.

Intermediate goods prices fell 0.4% in February, capital goods prices were flat, non-durable consumer goods prices were down 0.2% and durable consumer goods prices were up 0.1%, while energy prices decreased 2.1%.

On a yearly basis, Eurozone's producer price index dropped 4.2% in February, missing expectations for a 4.0% decline, after a 3.0% fall in January. January's figure was revised down from a 2.9% decrease.

Eurozone's producer prices excluding energy fell 0.8% year-on-year in February. Energy prices dropped at an annual rate of 12.8%.

-

11:34

Eurozone's unemployment rate drops to 10.3% in February, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Monday. Eurozone's unemployment rate declined to 10.3% in February from 10.4% in January, in line with expectations. It was the lowest reading since August 2011.

January's figure was revised up from 10.3%.

There were 16.634 million unemployed in the Eurozone in February, down by 39.000 from January.

The lowest unemployment rate in the Eurozone in February was recorded in Germany (4.3%) and the highest in Greece (24.0% in December 2015) and Spain (20.4%).

The youth unemployment rate was 21.6% in the Eurozone in February, compared to 22.7% in February a year ago.

-

11:26

Sentix investor confidence index for the Eurozone rises to 5.7 in April

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 5.7 in April from 5.5 in March.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The process of economic stabilization of investors expectations has continued at the beginning of April," Sentix said in its statement.

"The Eurozone can benefit neither from a stabilization of the global economy nor from the measures of the ECB," Sentix added.

The current conditions index fell to 6.0 in April from 8.3 in March.

The expectations index climbed to 5.5 in April from 2.8 in March.

German investor confidence index rose to 17.6 in April from 16.9 in March.

-

10:55

UK construction PMI remains unchanged at 54.2 in March

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. remained unchanged at 54.2 in March, beating expectations for a decrease to 54.0.

A reading above 50 indicates expansion in the construction sector.

A slowdown in residential work offset rebound in civil engineering and commercial work. New business growth slowed down in March, while job creation weakened.

"March's survey confirms that the UK construction sector is experiencing its weakest growth phase since the summer of 2013. Residential building has seen the greatest loss of momentum through the first quarter of 2016, which is a surprising reversal of fortunes given strong market fundamentals and its clear outperformance over the past three years," Senior Economist at Markit, Tim Moore, said.

-

10:41

Fitch Ratings affirms Germany’s sovereign debt rating at ‘AAA'

Rating agency Fitch Ratings on Friday affirmed Germany's sovereign debt rating at 'AAA'. The outlook is 'stable'.

"The 'AAA' ratings primarily reflect Germany's strong institutions and diversified, high value-added economy. A large structural current account surplus supports the country's net external creditor position," the agency said.

Fitch added that Germany was able to manage the migrant crisis without any downgrades in rating.

The agency expects the German economy to expand 1.7% in 2016 and 1.8% in 2017, driven by domestic demand.

-

10:23

Bank of Canada’s Business Outlook Survey: business sentiment improves but remains subdued overall

The Bank of Canada (BoC) released its Spring Business Outlook Survey on Friday. The BoC's survey showed that business sentiment in Canada improved but remained subdued overall. The improvement of the sentiment was driven by foreign demand, according to the survey.

Expectations for future sales growth remained positive, supported by U.S. demand, the BoC said.

Investment and hiring intentions rose but remained modest, so BoC Business Outlook Survey.

-

09:16

WSE: After opening

Futures market began the week with an increase of 0.15% to 1,972 points (WSE: FW20M16 - futures contracts on the WIG20). At the same time futures on the DAX went down about 0.6%. It means that Europe remains relatively weak and would not help today for the Warsaw market.

WIG20 index opened at 1970.39 points (-0.14%)*

WIG 48535.72 0.06%

WIG30 2191.99 0.01

mWIG40 3585.51 0.19

*/ - change to previous close

Together with crude also copper is cheaper today, which is reflected in the behavior of KGHM (WSE: KGH), which at the beginning of the session recorded the largest decrease, as well as the highest turnover among the components of the WIG20 index.

The beginning of the session runs calm and so far there is no desire for significant deviations from Friday's closing.

-

08:27

WSE: Before opening

In the second week of the month we have relatively empty macroeconomic calendar. Investors will have to wait for the next Monday, when the Alcoa company reports will start the next season of companies earnings in the USA. Today's session promises to be relatively calm. Friday's data from the US labor market has been positively welcomed on the Wall Street and the dollar after closing of the Warsaw Stock Exchange began to weaken. This morning we see light falls of the Nikkei index in Japan, in China, due to holidays, quotations are missing. Raw material prices are still under a slight pressure, and the price of oil on Friday fell significantly, but still relatively weak dollar makes capital does not turn away from the emerging markets.

However we have to remember, that the market in the US and on the Warsaw Stock Exchange is close to the major resistance, which may encourage correction. On the Warsaw market we do not expect the dynamic changes today, and do not expect a breakthrough, or even an attack on the level of 2,000 points on the WIG20 index.

-

01:02

Stocks. Daily history for Sep Apr 01’2016:

(index / closing price / change items /% change)

Nikkei 225 16,164.16 -594.51 -3.55 %

Hang Seng 20,498.92 -277.78 -1.34 %

S&P/ASX 200 4,999.39 -83.40 -1.64 %

Shanghai Composite 3,008.98 +5.06 +0.17 %

FTSE 100 6,146.05 -28.85 -0.47 %

CAC 40 4,322.24 -62.82 -1.43 %

Xetra DAX 9,794.64 -170.87 -1.71 %

S&P 500 2,072.78 +13.04 +0.63 %

NASDAQ Composite 4,914.54 +44.70 +0.92 %

Dow Jones 17,792.75 +107.66 +0.61 %

-