Noticias del mercado

-

16:47

Japan PM, Abe: There is no change to stance of watching FX markets

-

Government is responding as needed

-

Specific monetary policy steps is up to the BOJ

-

Trusts Kuroda to take the right steps on mon pol

*via forexlive -

-

15:41

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 330m) 1.1200 (426m) 1.1400 (643m)

USD/JPY: 102.00 (USD 361m) 103.50 (255m) 104.00 (231m) 105.00 (278m)

AUD/USD: 0.7500 ( AUD 266m) 0.7620 (361m) 0.7770 (322m)

-

15:26

RBA, BoC, ECB Meet Next Week: What To Expect? - BNP

"We think the European Central Bank (ECB) will announce a lengthening of its asset purchase programme for at least six months, in tandem with the publication of its new economic projections, at its policy meeting next Thursday (8 September). Such an announcement is likely to be supportive of a grind lower in the EUR broadly and, if combined with the market increasing pricing for a September Fed hike, consistent with EURUSD falling towards our end-Q3 target of 1.07.

We are not expecting any surprise easing announcements from the Reserve Bank of Australia (6 September) or the Bank of Canada (7 September).

We think the AUD and CAD will be driven lower by external factors, as the adjustment higher in Fed tightening expectations challenges the risk environment.

We continue to favour positioning for AUDUSD downside through options in our portfolio of recommendations, and target a move to 0.70 in the coming months. With WTI prices falling to USD 45/bbl in the past week, in line with our commodity strategy team's forecasts, we also see the CAD at risk and continue to target a rise in USDCAD to 1.40 by the year end".

Copyright © 2016 BNP Paribas™, eFXnews™

-

14:29

European session review: the pound rose on strong UK data

The following data was published:

(Time / country / index / period / previous value / forecast)

7:50 France Business activity index in the services sector (final data) August 50.5 52 52.3

7:55 Germany Index of business activity in the services sector (final data) August 54.4 53.3 51.7

8:00 Eurozone business activity index in the services sector (final data) August 52.9 53.1 52.8

8:30 Eurozone indicator of investor confidence from Sentix in September 4.2 5.1 5.6

8:30 UK PMI index for the services sector in August 47.4 50 52.9

9:00 Eurozone Retail Sales m / m in July from -0.1% Revised 0% 0.6% 1.1%

09:00 Eurozone Retail sales, y / y in July from 1.7% Revised 1.6% 1.9% 2.9%

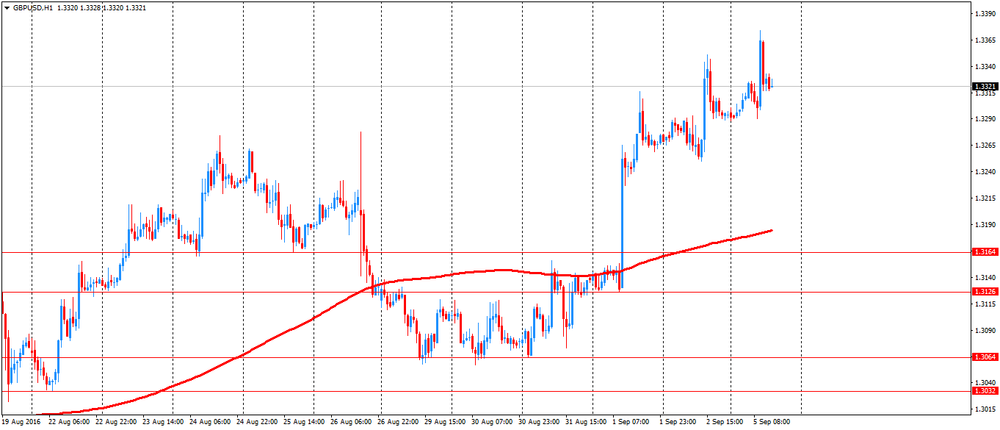

The British pound rose to a high of seven weeks on positive data on activity in the country's services sector. The British pound also rose on Thursday last week, as the Purchasing Managers Index (PMI) for the manufacturing sector also exceeded expectations.

The data published by Markit Economics, showed that activity in the UK's services sector has increased significantly by the end of August, which is another evidence of economic recovery after the shock caused by the decision to leave the European Union.

According to the report, the purchasing managers index (PMI) for the services sector rose in August to 52.9 points versus 47.4 points in July (seven years low), recording the biggest monthly increase in 20 years. Analysts had expected the index to improve to 50.0 points. Recall a value above 50 indicates expansion of activity in the sector.

The return to growth in most of the economy is likely to reinforce speculation that the Bank of England will refrain from launching further stimulus measures this year. Markit believe that "the inevitable downturn will be avoid," but urged caution because the data point to stagnation in the quarter, and many companies are still concerned about the prospects. "It's too early to say that the rise in August is the beginning of a long period of recovery after the shock," - said Chris Williamson, economist at Markit. - But there is a lot of evidence that the initial shock of the vote in June began to dissipate The pound broke August 4 high.

After Brexit investors have begun to actively sell the pound, because it was believed that this decision will put pressure on the economy.

Euro moderately weakened against the US dollar amid mixed data on the index of business activity in the services sector of the eurozone countries, and strong data on investor confidence and retail sales.

Economics reported that the eurozone economy continued to expand in August, but the pace of growth slowed to a 19-month low, which was mainly due to the weaker expansion in Germany. According to the data, the index of business activity in the services sector fell to 52.8 points from 52.9 points in July. Previously it was reported that the index improved to 53.1 points. Analysts predicted that the figure will be 53.1 points. The final composite PMI index fell in August to 52.9 points from 53.2 points in July.

Meanwhile, the results of a survey presented by research group Sentix, showed that investor sentiment in the euro area improved significantly in September, registering the second consecutive monthly increase, and reached its highest level in three months. Indicator of investor confidence rose in September to 5.6 points compared with 4.2 points in August. Analysts had expected the index to rise to 5.1 points. The last reading was the highest since June (when the index was 9.9 points). The sub-index of current conditions jumped to 4.5 points from 3.8 points in July, while the expectations index rose to 6.8 points from 4.8 points.

In addition, Eurostat Statistical Office stated that retail sales in the euro zone rose more than expected in July, showing the biggest monthly gain this year. According to the data, seasonally adjusted retail sales increased by 1.1% compared to June, and rose 2.9% on an annualized basis. Analysts had forecast an increase of 0.6% and 1.9% respectively.

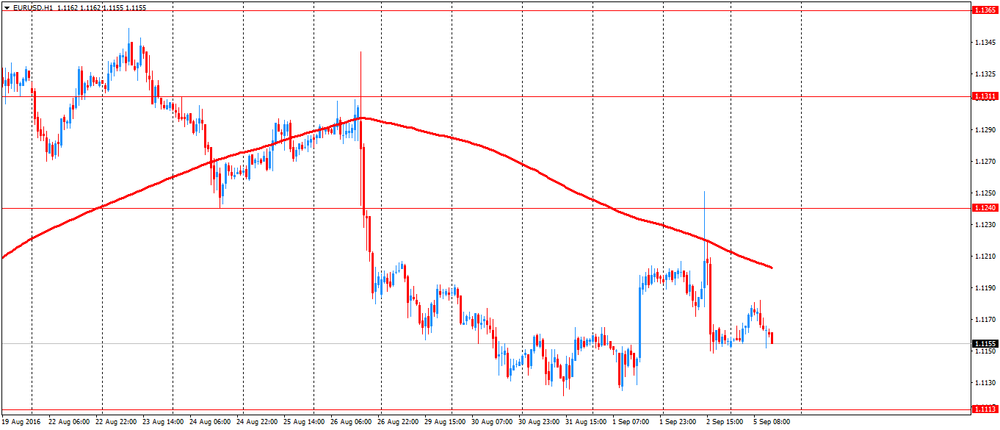

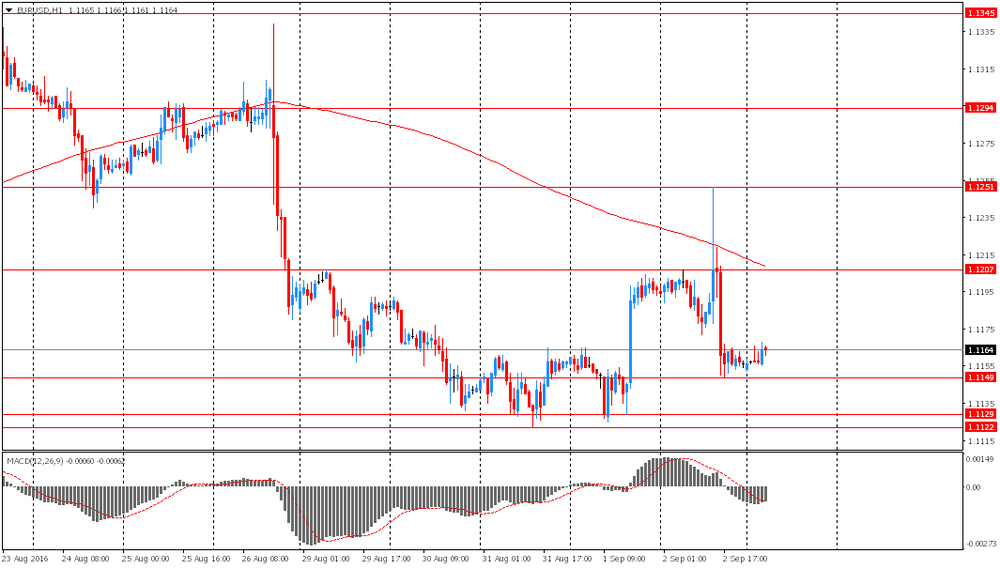

EUR / USD: during the European session, the pair fell to $ 1.1152

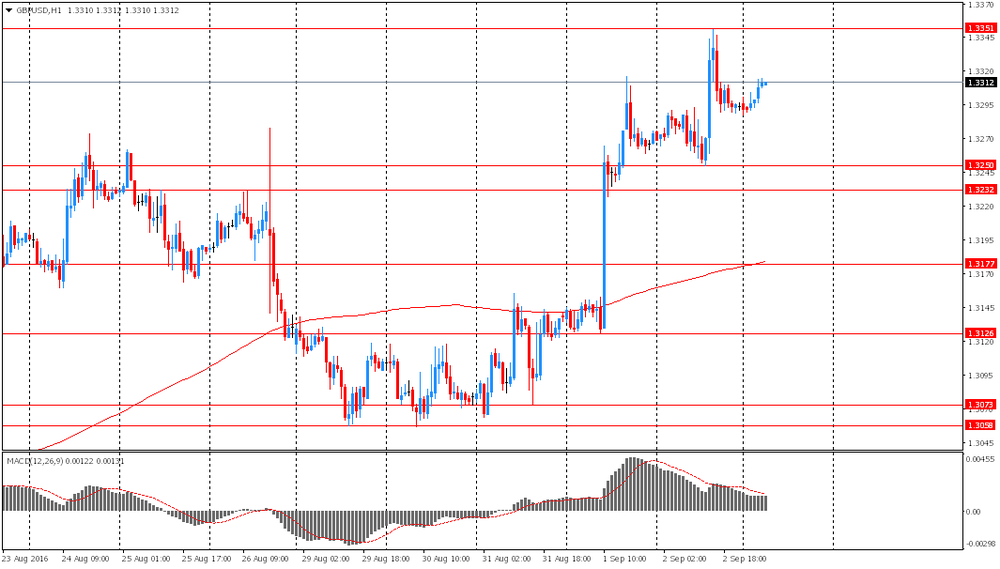

GBP / USD: during the European session, the pair rose to $ 1.3374

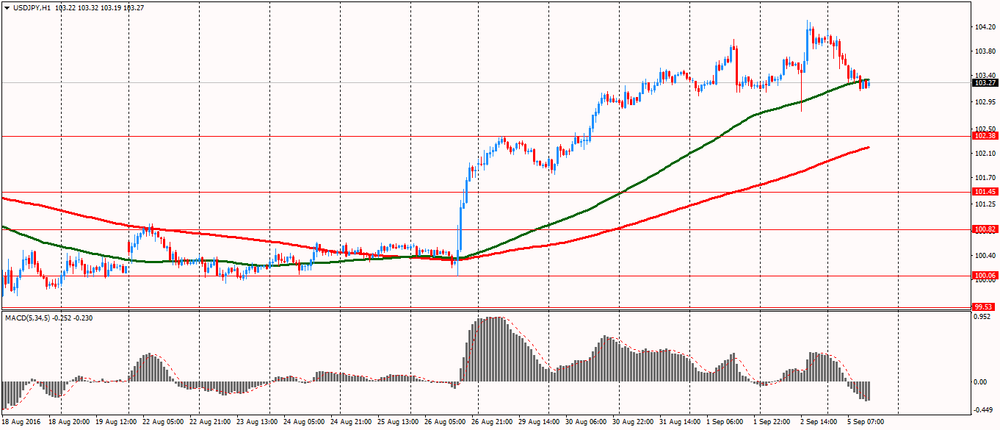

USD / JPY: during the European session, the pair fell to Y103.14

-

13:59

Orders

EUR/USD

Offers 1.1185 1.1200 1.1225-30 1.1250 1.1280 1.1300 1.1320 1.1350-55

Bids 1.1145-50 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.3330 1.3350 1.3370-75 1.3390-1.3400 1.3420 1.3450

Bids 1.3275-80 1.3255-60 1.3230 1.3200 1.3175-80 1.3250 1.3120 1.3100

EUR/GBP

Offers 0.8420 0.8445-50 0.8480 0.8500 0.8520-25 0.8535 0.8550

Bids 0.8380 0.8365 0.8350 0.8330 0.8300

EUR/JPY

Offers 115.85 116.00 116.20 116.50 117.00

Bids 115.30 115.00 114.80 114.50 114.00 113.80 113.50

USD/JPY

Offers 103.55-60 103.80 104.00 104.45-50 104.75 105.00 105.50

Bids 103.20 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers 0.7610 0.7625-30 0.7650 0.7680 0.7700 0.7730 0.7750

Bids 0.7580 0.7560 0.7520 0.7500 0.7485 0.7450 0.7430 0.7400

-

12:57

Saudi, Russian Energy Ministers Sign Agreement in China

-

11:30

Sentix says that global trend points upwards

Economic expectations for the eurozone continue to improve. The September data of the "first mover" for the euro zone reveals that both the current situation (+4.5) as well as expectations (+6.75) have slightly improved. Consequently, the overall index rises from 4.4 points to 5.6 points. The catch-up process of the emerging market economies overcompensates the heterogeneous developments of the industrialised world regions. Therefore, the global trend points upwards.

-

11:28

Retail trade rose by 1.1% in the euro area

In July 2016 compared with June 2016, the seasonally adjusted volume of retail trade rose by 1.1% in the euro area (EA19) and by 1.0% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In June the retail trade volume decreased by 0.1% in the euro area and by 0.2% in the EU28. In July 2016 compared with July 2015 the calendar adjusted retail sales index increased by 2.9% in the euro area and by 3.5% in the EU28.

-

11:00

Eurozone: Retail Sales (MoM), July 1.1% (forecast 0.6%)

-

11:00

Eurozone: Retail Sales (YoY), July 2.9% (forecast 1.9%)

-

10:35

Very strong UK services PMI. The pound is rising

Markit says that the UK service sector returned to growth in August, according to PMI® survey data from IHS Markit and CIPS. Following abrupt contractions in output and new business in July linked to disruption related to the outcome of the EU referendum, the latest data signalled a return to growth as companies reported that uncertainty had abated somewhat. Moreover, the forward-looking business expectations index recovered most of the ground lost in July when confidence took a knock from the Brexit vote amid political and economic uncertainty, albeit remaining weak by historical standards.

The latest data also signalled rising inflationary pressure linked to the weak pound. The survey's headline figure is the seasonally adjusted Markit/CIPS UK Services Business Activity Index, a single-figure measure designed to track changes in total UK services activity compared with one month previously. Readings above 50.0 signal growth of activity compared with the previous month, and below 50.0 contraction.

The Business Activity Index rebounded to 52.9 in August, from 47.4 in July, signalling a rise in UK services output. The month-on-month gain in the index, at 5.5 points, was the largest observed over the 20-year survey history, following a record drop of 4.9 points in July. The rate of expansion in the latest period was the fastest since May, but weaker than the long-run survey average.

-

10:33

Eurozone: Sentix Investor Confidence, September 5.6 (forecast 5.1)

-

10:30

United Kingdom: Purchasing Manager Index Services, August 52.9 (forecast 50)

-

10:12

Final German services PMI significantly lower in August

According to markiteconomics, August data pointed to a growth slowdown in Germany's service sector, with new business and activity rising at the weakest rates in more than one and three years, respectively. Moreover, confidence towards the year ahead reached its lowest level since last October. Sharply rising employment levels helped alleviate pressure on operating capacity, with backlogs of work declining for the second month running.

The final seasonally adjusted Markit Germany Services PMI Business Activity Index fell from July's 54.4 to 51.7 in August. Although still signalling growth of output, the rate of expansion was the weakest since mid-2013 and below the long-run series average (53.1). Meanwhile, sector data suggested that activity growth remained particularly strong at Hotels & Restaurants and Financial Intermediation companies, while firms in the Transport & Storage category reported a fall. The slowdown in the service sector impacted overall growth in Germany during August, with the final Markit Germany Composite Output Index - which measures the combined output of the manufacturing and service sectors - falling from July's 55.3 to a 15-month low of 53.3.

-

10:09

The eurozone economy continued to expand at a broadly steady pace in August - Markit

The eurozone economy continued to expand at a broadly steady pace in August. The rate of increase edged down to a 19-month low, however, mainly due to a weaker rate of expansion in Germany. The final Markit Eurozone PMI® Composite Output Index posted 52.9 in August, down from 53.2 in July and below the earlier flash estimate of 53.3.

The rate of growth in new order inflows was also the weakest in just over one-and-half years. August data indicated that rates of output expansion ticked lower in both the manufacturing and service sectors. Manufacturing production rose at the slowest pace since May, while the expansion in service sector business activity was the jointweakest since the start of 2015. National PMI data indicated that the slowdown was mainly due to weaker economic growth in Germany, as output in the eurozone's largest nation rose at the slowest pace for 15 months.

-

10:00

Eurozone: Services PMI, August 52.8 (forecast 53.1)

-

09:55

Germany: Services PMI, August 51.7 (forecast 53.3)

-

09:50

France: Services PMI, August 52.3 (forecast 52)

-

09:33

US and Canada in holiday so lower trading volumes but UK services PMI can spice things up

-

09:30

The yen strengthened

The yen strengthened despite the dovish statements by the Bank of Japan. During his speech today the head of the Central Bank, Haruhiko Kuroda said that there is still room for easing monetary policy, and that the negative interest rates introduced in January are starting to have a positive impact. In addition, signaled that the benefits of further policy easing exceed its costs.

The US dollar traded in a narrow range after the publication of US labor market data on Friday. Recall, the Ministry of Labor said that the number of people employed in non-farm payrolls rose by 151,000 after a gain to 275,000 in July. The unemployment rate remained at around 4.9%, as more people entered the labor market. Economists had forecast a rise in the number of employees by 180 000 and the reduction in unemployment to 4.8%. Lowering employment growth came after the economy created a total of 546,000 jobs in June and July. Given the fact that the labor market has almost reached full employment and economic recovery from the recession years of 2007-09, the slowdown in job growth seems normal.

The Australian dollar rose after the publication of positive data on the index of China's service sector business activity and growth in operating profits of Australian companies. The Index of purchasing managers Caixin, published by Markit Economics, which is a leading indicator of China's state sector services in August was 52.1 points higher than the previous value of 51.7 and analysts' expectations of 51.9. Published by the Australian Bureau of Statistics the measure of profit from operations of the companies, in the second quarter grew by 6.6%, after declining by -4.4% in the first quarter. Analysts had expected an increase of 2.0%. This indicator reflects the total amount of pre-tax profits derived from commercial activities, excluding the cost of interest payments on debt and the cost of adjustment.

EUR / USD: during the Asian session, the pair rose to $ 1.1180

GBP / USD: during the Asian session, the pair rose to $ 1.3325

USD / JPY: it fell to Y103.25

-

08:36

We maintain our bullish EUR view - Morgan Stanley

"We maintain our bullish EUR view. A higher Fed rate would likely support the USD vs. currencies sensitive to front-end rate differentials. Generally, low-yielding currencies fall into this category, but even here differentiation is required. The EUR and CHF should remain supported as both regions have financial institutions with weak balance sheets and so are unable to export sufficient local-currency-denominated long-term capital to compensate for the current account surpluses. Resistance from core EMU countries to more aggressive policies that could push inflation rates higher should keep local real rates high, pushing the EUR and CHF higher against most other currencies

Fiscal policy debate in the Eurozone. The EMU is not leading the debate about policies; instead, it lags. Italy is considering more fiscal spending to deal with the devastating damage to its infrastructure caused the recent earthquake, but that is all we should expect to see. The EMU is not ready to remove the debt brakes implemented in 2009, even if fiscal stimulus could boost the economic outlook. A similar interpretation applies to the inflation target discussion. All in all, the EMU's policy approach will not be progressive enough to sufficiently boost its inflation expectations,allowing its real rate levels to fall to a level that would weaken the currency. Internally, the EMU may find it difficult to boost inflation given the slack within its labor market, its poor corporate profitability and weak financial institution balance sheets preventing credit picking up.

Exhibit 10 shows the weak banking sector share price performance, predicting weaker credit growth within the eurozone. A central-bank induced liquidity impulse will find it difficult to develop multiplying effects, but without improving credit demand inflation is unlikely moving higher. International aspects have stayed deflationary too. Commodity prices have rolled over and China's exchange rate adjusted PPI,now falling at a 7.5%Y rate, does not bode well for the G-7 core inflation outlook.

The EMU's disruptively high real rates could not only undermine fixed asset investment prospects within EMU they may also take the EUR into overvalued territory.

The EUR does not rise due to a better economic outcome within EMU. Instead it may rise due to the lack of capital exports held back by balance sheet constraints of EMU financial institutions and too high real EUR rates allowing the recycling of EMU's current account surplus at current FX levels.

For now, the EUR may punch well above its economic weight. Due to the 'exhausted' position of EMU's yield curve, there is very little the ECB can do to prevent EUR strength".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:25

Bank of Japan Governor Kuroda: There are limits to what BOJ can do in the sense it cannot underwrite debt due to legal constraints

-

Don't share view that monetary policy is reaching its limits

-

Even within current framework there is ample room for further easing

-

First issue to analyze is what factors have hampered achievement of price target

-

What we should bear in mind when conducting monetary policy is not its limit but comparison between its benefits and costs

-

Negative rates have had impact on mkt liquidity, banks' profits, so need to assess this policy

-

Given we have been implementing large-scale monetary easing, any additional easing entails costs

-

We should not hesitate to go ahead with monetary easing as long as it's necessary for Japan's economy as a whole

*via forexlive -

-

08:21

The latest set of Caixin China Composite PMI data pointed to a further rise in Chinese business activity

The latest set of Caixin China Composite PMI™ data (which covers both manufacturing and services) pointed to a further rise in Chinese business activity during August, with the rate of expansion little changed from that seen in July. This was shown by the Composite Output Index falling only fractionally from July's 22-month high of 51.9 to 51.8 in August.

A further increase in total business activity was supported by moderate expansions of activity and output across the services and manufacturing sectors in August. The Caixin China General Services Business Activity Index rose from 51.7 to 52.1 in August. Although this showed that the rate of services activity growth picked up slightly from July, it remained moderate overall and slower than the series average. Meanwhile, manufacturers raised output for the second successive month, though the rate of expansion softened since July.

-

08:18

South Korea says North Korea has fired three missiles off its east coast in a show of force timed to coincide with the G20 summit in China

-

07:06

Options levels on monday, September 5, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1308 (4349)

$1.1266 (4926)

$1.1205 (3163)

Price at time of writing this review: $1.1174

Support levels (open interest**, contracts):

$1.1110 (3171)

$1.1078 (4559)

$1.1038 (5710)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52786 contracts, with the maximum number of contracts with strike price $1,1250 (4926);

- Overall open interest on the PUT options with the expiration date September, 9 is 58292 contracts, with the maximum number of contracts with strike price $1,1000 (5757);

- The ratio of PUT/CALL was 1.10 versus 1.12 from the previous trading day according to data from September, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.3600 (817)

$1.3501 (1818)

$1.3402 (2234)

Price at time of writing this review: $1.3322

Support levels (open interest**, contracts):

$1.3197 (874)

$1.3099 (1051)

$1.3000 (1856)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32510 contracts, with the maximum number of contracts with strike price $1,3300 (2716);

- Overall open interest on the PUT options with the expiration date September, 9 is 27378 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.84 versus 0.82 from the previous trading day according to data from September, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:45

China: Markit/Caixin Services PMI, August 52.1

-

03:31

Australia: ANZ Job Advertisements (MoM), August 1.8%

-

03:30

Australia: Company Gross Profits QoQ, Quarter II 6.9% (forecast 2%)

-

02:33

Currencies. Daily history for Sep 02’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1156 -0,36%

GBP/USD $1,3294 +0,15%

USD/CHF Chf0,9803 +0,06%

USD/JPY Y103,99 +0,74%

EUR/JPY Y115,89 +0,28%

GBP/JPY Y138,03 +0,74%

AUD/USD $0,7570 +0,28%

NZD/USD $0,7290 -0,04%

USD/CAD C$1,2986 -0,82%

-

02:04

Schedule for today, Monday, Sep 05’2016

(time / country / index / period / previous value / forecast)

02:30 Australia AIG Services Index August 53.9

03:00 Japan Labor Cash Earnings, YoY July 1.4% Revised From 1.3% 0.5% 1.4%

03:30 Australia MI Inflation Gauge, m/m August -0.3%

04:30 Australia ANZ Job Advertisements (MoM) August -0.8%

04:30 Australia Company Gross Profits QoQ Quarter II -4.7% 2%

04:45 China Markit/Caixin Services PMI August 51.7

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

10:50 France Services PMI (Finally) August 50.5 52

10:55 Germany Services PMI (Finally) August 54.4 53.3

11:00 Eurozone Services PMI (Finally) August 52.9 53.1

11:30 United Kingdom Purchasing Manager Index Services August 47.4 50

12:00 Eurozone Retail Sales (MoM) July 0% 0.6%

12:00 Eurozone Retail Sales (YoY) July 1.6% 1.9%

15:00 Canada Bank holiday

15:00 U.S. Bank holiday

-

02:00

Japan: Labor Cash Earnings, YoY, July 1.4% (forecast 0.5%)

-