Noticias del mercado

-

17:50

Oil retreated from highs on the background of controversial news (buy the rumors sell the facts)

Oil prices retreated from session highs on the background of the controversial news flow about the possible freezing of oil production at the end of the month.

Russia and Saudi Arabia, which control the production of more than 21% of world oil, on the margins of the G20 summit in China signed a joint statement in order to stabilize the oil market. Oil prices have soared by more than 5% in anticipation of this event. Thus, the cost of the futures on Brent crude oil rose by 5.4%, to $ 49.15 a barrel.

However, soon after the statement prices retreated from session highs. By 13:00 GMT Brent crude oil traded near $ 47.50 per barrel (+ 1.4%) and WTI futures traded at $ 45.20 (+ 2.3%).

The two world's largest oil producer intend to establish a working group for monitoring the oil market and to make recommendations to ensure its stability. It is expected that in October, Russia and Saudi Arabia to hold the first meeting of the working group on oil and gas cooperation. In addition, the ministers will hold regular meetings on the "margins" of the ministerial meeting of the International Energy Forum (IEF) in Algeria and the November meeting of the Organization of Petroleum Exporting Countries (OPEC) in Vienna.

"Investors had hoped that Russia and Saudi Arabia will manifest more specific statement on the limitation of production," - said Naeem Aslam of Think Markets.

The cost of the October futures for WTI rose to 46.53 dollars per barrel.

October futures for Brent crude rose to 49.40 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

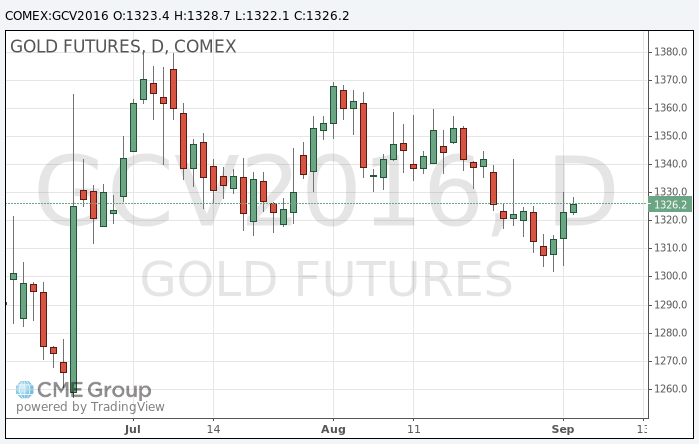

Gold price moderately higher

Gold price rose moderately, keeping the position reached last week after the release of weaker-than-expected US labor market data. Such data have weakened the US currency.

On Friday, gold prices rose about 1% after the National Bureau of Labor Statistics reported a lower than expected US employment growth in August.

This week, investors will monitor the statements by John Williams, head of the Federal Reserve Bank of San Francisco. On Tuesday will deliver a speech on the state of the US economy in Reno, Nevada.

On Thursday, European Central Bank President Mario Draghi will hold a press conference in Frankfurt after a two-day meeting of the Bank dedicated to the issue of monetary policy.

According to CFTC in the week of 24-30 August investment managers reduced net long positions in gold to 3-week low at 238,152.

The cost of the October futures for gold on COMEX rose to $ 1328.7 per ounce.

-

10:16

Oil is gaining in early trading

This morning New York WTI crude oil futures rose by 0.59% to $ 44.41 and crude oil futures for Brent rose by + 0.11% to $ 46.88 per barrel. Thus, the black gold is traded moderately higher in the background of weak US labor market data. Expectations for a Fed hike this month weakened. It was also reported that analysts, for the first time in six monyhs, reduced the forecast for oil prices to 45.44 dollars per barrel. 34 experts surveyed by Reuters lowered the forecast for oil prices to 45 dollars in February 2016 a barrel.

-

02:35

Commodities. Daily history for Sep 02’2016:

(raw materials / closing price /% change)

Oil$44.15-0.65%

Gold$1,326.60-0.01%

-