Noticias del mercado

-

17:47

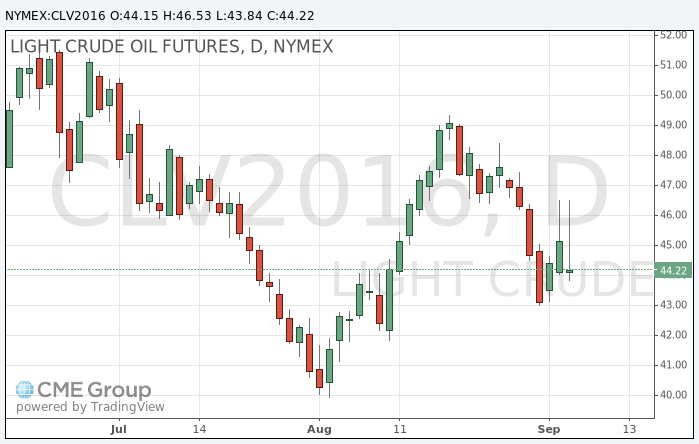

Choppy trading conditions for oil today

Brent traded in the red zone on skepticism about the likelihood of achieving an effective agreement between the producers, WTI adjusted upward as yesterday's trading on the New York Mercantile Exchange was on hault due to the holiday in the US.

Brent jumped monday more than 5% to $ 49.40 session after Saudi Arabia and Russia pledged to work together to support the market.

However, prices have lost gains during the session and closed well below session highs amid disappointment about the details of the agreement.

The two world's largest oil producer said to establish a working group to monitor the performance of the oil market for joint action to ensure the stability of the market.

Oil Minister of Saudi Arabia Khalid al-Falih and his Russian counterpart Alexander Novak will meet in Algeria in October and November to discuss co-operation in the framework of the new agreement.

OPEC members will discuss potential limitation of production in the course of an informal meeting on the sidelines of the International Energy Conference in Algiers on 26-28 September.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 46.53 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of mark Brent fell to 46.29 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

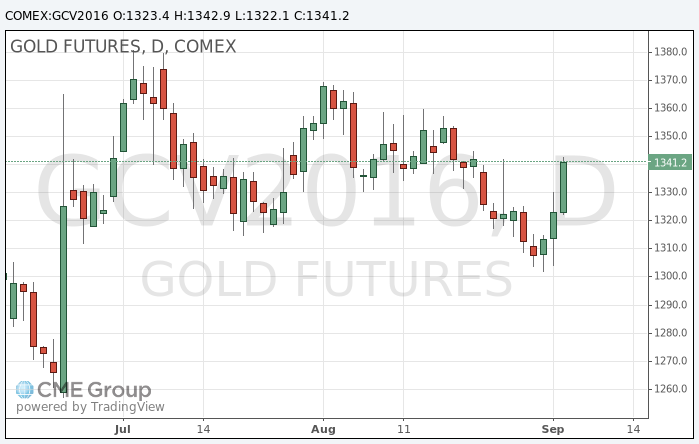

The price of gold continue to rise

Gold prices rose as the dollar fell after weak data from the non-manufaturing sector, calculated by the Institute of Supply Management (ISM).

According to the data, the index fell in August to 51.4 after 55.5 in July, signaling a deterioration of the situation in a key sector of the US economy. Published on Friday,

After the most recent set o economic data the likelihood of a Fed hike this year declines. According to Fed funds futures, the probability of a hike in September is estimated at only 15% against 30% earlier.

"By itself, a possible increase in rates would not have a material adverse effect on the gold in September - said a senior analyst at Danske Bank. Really important for gold is whether the increase in rates this year signal that now the Fed is ready to speed up the cycle, because then again on the agenda will be the final normalization of interest rates. "

The market will be closely watching the release of new data from the US and any speeches by the Fed.

The cost of the October futures for gold on COMEX rose to $ 1342.9 per ounce.

-

10:50

Oil is trading higher

This morning in New York WTI crude oil futures increased by 1.67% to $ 45.19 and Brent oil futures were at $ 47.62 per barrel. Thus, the black gold is gaining on the background of the agreement between Russia and Saudi Arabia on possible joint action to stabilize the market. At the same time, Iran continues to ramp up production to return to desired levels of exports. In October, Russia and Saudi Arabia will hold the first meeting in the in the field of oil and gas. Also, a ministerial meeting is scheduled in Algiers in November.

-

00:30

Commodities. Daily history for Sep 05’2016:

(raw materials / closing price /% change)

Oil 45.17 +1.64%

Gold 1,330.70 +0.30%

-