Noticias del mercado

-

17:52

Oil prices stable

Oil prices have stabilized, as market participants focused attention on US weekly data on oil and petroleum products.

Today at 20:30 GMT the American Petroleum Institute will issue its weekly inventory report. Official data from Energy Information Administration will be published on Thursday.

Reports will be a day later than usual due to the celebrations of Labor Day in the US on Monday.

Traders continue to assess the prospects of oil exporters meeting later this month.

The Organization of Petroleum Exporting Countries, led by Saudi Arabia and other major exporters of crude oil in the Middle East, will meet non-OPEC producers, led by Russia, on the sidelines of the International Energy Conference in Algiers on 26-28 September.

On Monday, Brent soared in value after Saudi Arabia and Russia pledged to work together to stabilize the market. However, since the agreement does not provide for early action to combat oversaturation supply the moves could not be sustained.

On Tuesday, Iranian Oil Minister Bijan Zanganeh met with OPEC Secretary General Mohammed Barkindo in Tehran and said that he would support any measures to stabilize crude oil around $ 50-60 per barrel.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 45.42 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of Brent crude rose to 47.94 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

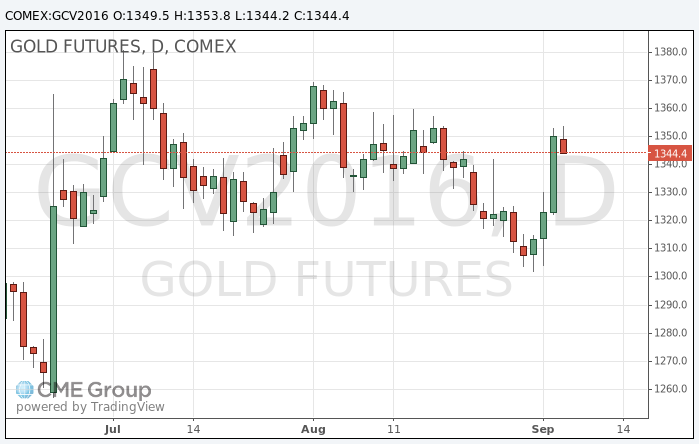

Gold price fell slightly

Gold remained almost unchanged, as investors tried to assess the likelihood of interest rate hike by the Federal Reserve later this year.

The volume of trading in the market after a strong growth in recent days have been reduced, as investors' expectations about the Fed raising US interest rates decreased, said William Adams of FastMarkets.

"I think, on this background, the dollar weakened giving the necessary support for gold," - said the analyst. If expectations of rising interest rates will continue to decrease, the price of gold may continue to rise, he said.

Fed officials have previously made it clear that this year the interest rates may be increased twice. However, weak economic data last week has convinced market participants that the central bank is unlikely to raise interest rates in the short term.

Investors are also awaiting the outcome of the meeting of the European Central Bank, which will end on Thursday. Analysts generally do not expect announcements of further measures to stimulate the European economy. Soft monetary policy usually provides support to gold

The cost of the October futures for gold on the COMEX fell to $ 1343.5 per ounce.

-

10:15

Oil continue to rise

This morning New York WTI crude oil futures rose by 0.89% to $ 45.26 and Brent crude oil futures rose by + 0.97% to $ 47.70 per barrel. Thus, the black gold is trading in the green zone on the background of the collapse of the dollar and forecasts relating to the agreement between Moscow and Riyadh on a possible joint action to stabilize the market.

-

00:45

Commodities. Daily history for Sep 06’2016:

(raw materials / closing price /% change)

Oil$44.88+0.11%

Gold$1,354.00-0.07%

-