Noticias del mercado

-

17:44

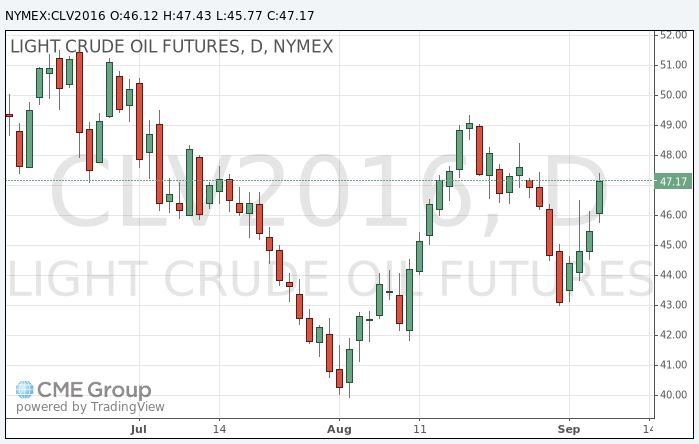

Oil rose after the biggest decline in the volume of US oil holdings in three decades

Oil quotes rose sharply after data showed a significant reduction in stocks of crude oil storage tanks in the United States by US Department of Energy and the American Petroleum Institute (API).

Commercial US crude stocks last fell last week by 14,513 thousand barrels to 511.357 million barrels

Commercial gasoline inventories decreased by 4211 thousand barrels and totaled 227.793 million barrels.

Commercial stocks of distillates rose 3382 thousand barrels, reaching 158.135 million barrels.

The market expected a increase of oil reserves by 905 th. barrels, a decline in gasoline stocks of 750 th. aarrels and a distillate stocks increase of 1150 th. barrels.

On Wednesday, the American Petroleum Institute said that inventories in the US last week fell by 12.1 million barrels. Observers note that this situation can be explained by the tropical storms in the Gulf of Mexico, which led to a decrease in drilling activity.

Oil prices also boosted the August increase in imports of crude oil to China by 5.7%. In addition, the dollar weakenek, thereby increasing demand for oil.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 47.43 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of Brent crude rose to 49.87 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:39

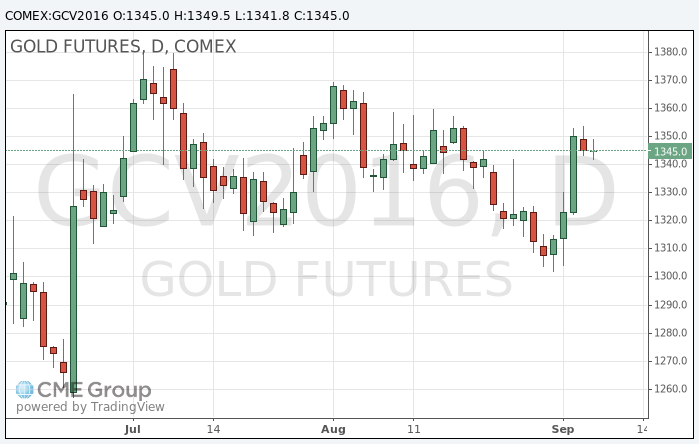

Gold price lower in today’s trading

During today's trading gold declined as investors digested the latest US statistical data, as well as the comments of the European Central Bank President Mario Draghi.

As shown by official data, the number of applicants for unemployment claims in the US fell to a six-week low, which is associated with a healthy labor market.

US Department of Labor said the number of initial applications for unemployment benefits for the week ending September 3 fell by a seasonally adjusted 4,000 to 259,000 from 263,000 the previous week. Analysts had forecast a decline of 2,000 to 265,000.

The cost of the October futures for gold on COMEX is trading in the range of $ 1341.8 - $ 1349.5 per ounce.

-

17:12

Huge drawdown for US oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 14.5 million barrels from the previous week. At 511.4 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 4.2 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories increased by 3.4 million barrels last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.6 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories decreased by 13.7 million barrels last week.

-

12:03

The average annual price of oil in 2016 is estimated at $ 41-42 per barrel - MED

The average annual price of oil in 2016 will develop in the range of $ 41-42 per barrel - director of the Department for Macroeconomic Forecasting of the Ministry of Economic Development, Kirill Tremasov.

"This year is likely to be somewhere in the 41-42 (per barrel) average price. The following 3 years $ 40 per barrel as stated by the forecast for budget projections," - Tremasov said.

In January - August 2016, according to the Ministry of Finance, the average price of Urals oil decreased compared to the same period of the previous year by more than 16 dollars to 39.36 dollars per barrel.

The average price of Urals oil in 2015 has developed at a average rate of $ 51.23 per barrel vs $ 97.6 per barrel in 2014.

-

00:30

Commodities. Daily history for Sep 07’2016:

(raw materials / closing price /% change)

Oil 46.14 +1.41%

Gold 1,349.50 +0.02%

-