Noticias del mercado

-

21:01

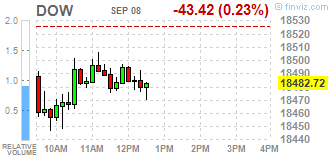

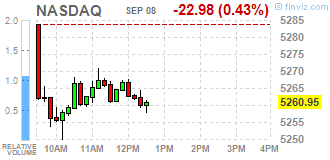

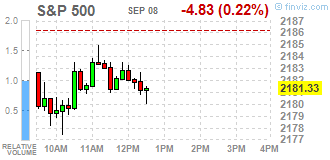

DJIA 18490.35 -35.79 -0.19%, NASDAQ 5261.24 -22.69 -0.43%, S&P 500 2182.53 -3.63 -0.17%

-

21:00

U.S.: Consumer Credit , July 17.71 (forecast 16)

-

18:41

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes lower on Thursday as a drop in Apple shares weighed, a day after the tech giant unveiled the new iPhone 7 that failed to impress Wall Street. Oil prices soared more than 3%, limiting some losses on Wall Street. Investor reaction to a drop in weekly jobless claims and the European Central Bank's expected decision to leave rates and stimulus program unchanged was largely muted.

Most of Dow stocks in negative area (21 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.13%). Top loser - Apple Inc. (AAPL, -2.40%).

Most of S&P sectors also in negative area. Top gainer - Basic Materials (+0.8%). Top loser - Consumer goods (-0.9%).

At the moment:

Dow 18397.00 -36.00 -0.20%

S&P 500 2172.75 -5.25 -0.24%

Nasdaq 100 4799.00 -25.25 -0.52%

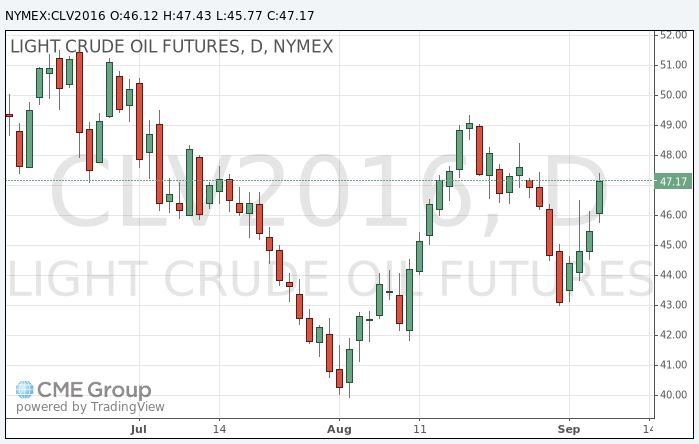

Oil 47.15 +1.65 +3.63%

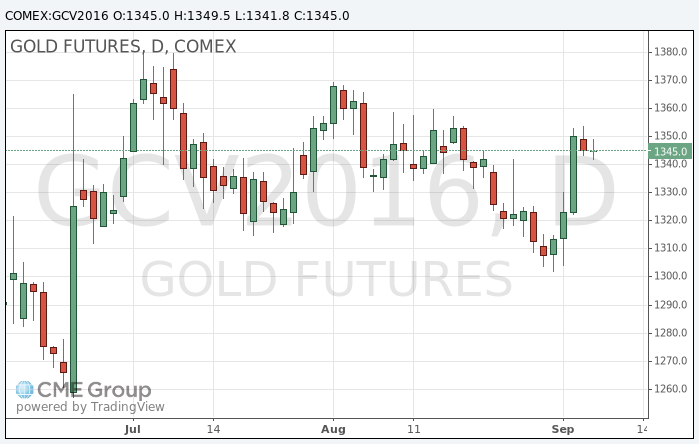

Gold 1341.20 -8.00 -0.59%

U.S. 10yr 1.59 +0.05

-

18:01

European stocks closed: FTSE 6859.06 12.48 0.18%, DAX 10672.23 -80.75 -0.75%, CAC 4543.08 -14.58 -0.32%

-

17:50

WSE: Session Results

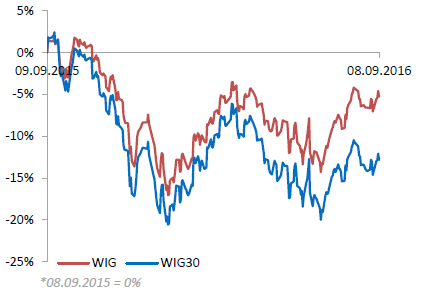

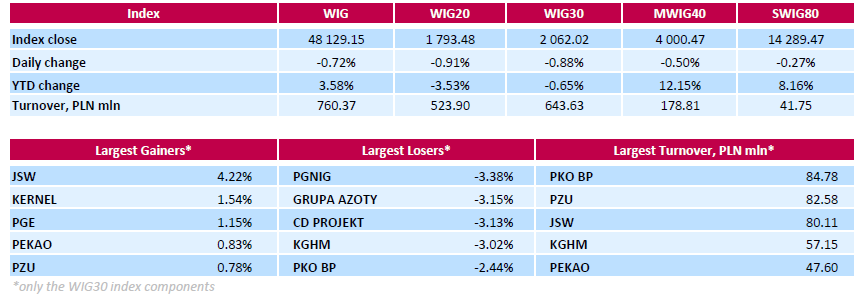

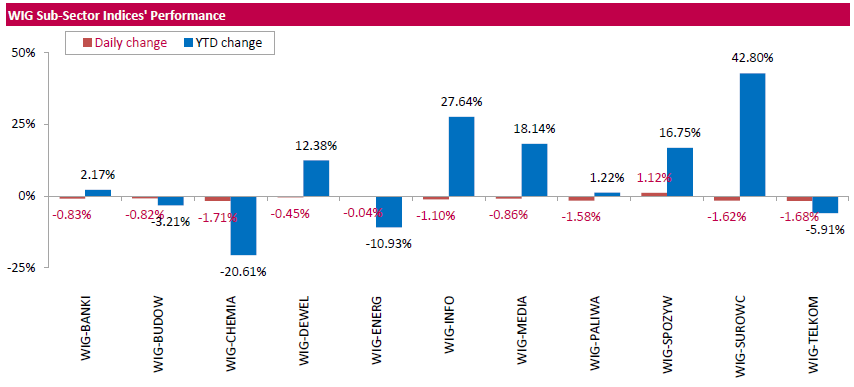

Polish equities were lower on Thursday, with the broad-market measure, the WIG index, losing 0.72%. All sectors, but for food (+1.12%), were down, with chemicals (-1.71%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, slid down 0.88%. Within the index components, oil and gas producer PGNIG (WSE: PGN) suffered the steepest decline of 3.38%. The company's CEO Piotr Wozniak announced plans to buy gas deposits in Norway. According to Mr. Wozniak, PGNIG wants to increase its gas output in Norway to 2.0-2.5 bln cubic meters annually by 2022 (up from 573 mln cubic meters in 2015). Elsewhere, chemical producer GRUPA AZOTY (WSE: ATT) sank by 3.15% on news the Russian fertilizer manufacturer ACRON is in talks with Poland's treasury ministry on selling its ~20% stake in GRUPA AZOTY. Other biggest decliners were videogame developer CD PROJEKT (WSE: CDR), copper producer KGHM (WSE: KGH) and two banking sector names PKO BP (WSE: PKO) and MBANK (WSE: MBK), plunging by 2.22%-3.13%. On the other side of the ledger, coking coal producer JSW (WSE: JSW) topped the gainers' list, correcting upwards by 4.22% after two consecutive sessions of declines. It was followed by agricultural producer KERNEL (WSE: KER) and genco PGE (WSE: PGE), advancing 1.54% and 1.15% respectively.

-

17:44

Oil rose after the biggest decline in the volume of US oil holdings in three decades

Oil quotes rose sharply after data showed a significant reduction in stocks of crude oil storage tanks in the United States by US Department of Energy and the American Petroleum Institute (API).

Commercial US crude stocks last fell last week by 14,513 thousand barrels to 511.357 million barrels

Commercial gasoline inventories decreased by 4211 thousand barrels and totaled 227.793 million barrels.

Commercial stocks of distillates rose 3382 thousand barrels, reaching 158.135 million barrels.

The market expected a increase of oil reserves by 905 th. barrels, a decline in gasoline stocks of 750 th. aarrels and a distillate stocks increase of 1150 th. barrels.

On Wednesday, the American Petroleum Institute said that inventories in the US last week fell by 12.1 million barrels. Observers note that this situation can be explained by the tropical storms in the Gulf of Mexico, which led to a decrease in drilling activity.

Oil prices also boosted the August increase in imports of crude oil to China by 5.7%. In addition, the dollar weakenek, thereby increasing demand for oil.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 47.43 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of Brent crude rose to 49.87 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:39

Gold price lower in today’s trading

During today's trading gold declined as investors digested the latest US statistical data, as well as the comments of the European Central Bank President Mario Draghi.

As shown by official data, the number of applicants for unemployment claims in the US fell to a six-week low, which is associated with a healthy labor market.

US Department of Labor said the number of initial applications for unemployment benefits for the week ending September 3 fell by a seasonally adjusted 4,000 to 259,000 from 263,000 the previous week. Analysts had forecast a decline of 2,000 to 265,000.

The cost of the October futures for gold on COMEX is trading in the range of $ 1341.8 - $ 1349.5 per ounce.

-

17:12

Huge drawdown for US oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 14.5 million barrels from the previous week. At 511.4 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 4.2 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories increased by 3.4 million barrels last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.6 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories decreased by 13.7 million barrels last week.

-

17:00

U.S.: Crude Oil Inventories, September -14.513 (forecast 0.4)

-

16:34

-

15:55

WSE: After start on Wall Street

Behind us the press conference after the ECB meeting. The communication of the ECB announced that it does not change any parameters of their policies. Interest rates remain maintained, as the scope and duration of the purchase of assets (that is, to March the next year). This was a slight disappointment, which causes the strengthening of the euro and the weakening of the DAX-a.

At a press conference on the direct question whether during the meeting was discussed the extend of the asset purchase program, Mario Draghi denied. This negative answer was not quite a big surprise, but caused a clear deterioration in sentiment in the markets.

The market in the United States began a decline of 0.2%, which was obvious growing. This is to some extent due to the disappointing words of the head of the ECB. However ECB policy impact is greater in Europe and here the market effect is also greater. The WIG20 index an hour before the close of trading falls by 0.85%.

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1100 (EUR 788m) 1.1115 (324m) 1.1130-32 (624m) 1.1150 (353m) 1.1160 (621m) 1.1197-1.1200 (746m) 1.1300 (421m) 1.1335 (550m)

USDJPY: 100.50 (USD 312m) 101.00 (318m) 102.00 (520m) 102.14 (500m) 102.30 (550m) 103.00 (610m) 103.30 (256m) 103.50 (580m) 103.70 (912m) 104.50 (1.8bln)

GBPUSD: 1.3400 (GBP 343m) 1.3500 (743m)

AUDUSD: 0.7550 ( AUD 519m) 0.7600 (363m) 0.7640 (558m) 0.7800 (364m)

USDCAD 1.2600 (USD 300m) 1.2650-55 (290m) 1.2800 (436m) 1.2950 (942m)1.3000 (320m)

NZDUSD 0.7260 (450m) 0.7300 (233m)

-

15:33

U.S. Stocks open: Dow -0.27%, Nasdaq -0.35%, S&P -0.24%

-

15:25

Before the bell: S&P futures -0.23%, NASDAQ futures -0.24%

U.S. stock-index futures fell as European Central Bank policy President Mario Draghi downplayed the need for more stimulus.

Global Stocks:

Nikkei 16,958.77 -53.67 -0.32%

Hang Seng 23,919.34 +177.53 +0.75%

Shanghai 3,096.60 +4.67 +0.15%

FTSE 6,864.08 +17.50 +0.26%

CAC 4,556.84 -0.82 -0.02%

DAX 10,719.09 -33.89 -0.32%

Crude $46.29 (+1.74%)

Gold $1352.00 (+0.21%)

-

14:58

-

14:53

Draghi: No additional stimulus needed for the time being

-

14:43

ECB revised slightly down inflation and GDP forecasts

-

2016 GDP growth at 1.7% vs 1.6% in June

-

2017 GDP at 1.6% vs 1.7% in June

-

2018 GDP at 1.6% vs 1.7% in June

-

2016 inflation 0.2% vs 0.2% in June

-

2017 inflation 1.2% vs 1.3% in June

-

2018 inflation 1.6% vs 1.6% in June

-

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Neutral from Overweight at Piper Jaffray

Hewlett Packard Enterprise (HPE) downgraded to Market Perform at Wells Fargo

Apple (AAPL) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Tesla Motors (TSLA) initiated with a Underperform at Cowen; target $160

Hewlett Packard Enterprise (HPE) target raised to $20 from $16 at Mizuho

Hewlett Packard Enterprise (HPE) target raised to $24 from $22 at Needham

-

14:41

Canadian capacity utilization rate declines slightly in Q2

Canadian industries operated at 80.0% of their production capacity in the second quarter, down from 81.4% in the previous quarter.

The decline in the industrial capacity utilization rate was widespread, with 19 of the 21 major groups in the manufacturing sector recording a lower rate. A decrease was also observed in every other non-manufacturing industry surveyed, except electric power generation, transmission and distribution.

Oil and gas extraction was the main source of the decline in the capacity utilization rate in the second quarter, with its rate down 4.2 percentage points to 73.9%, after an increase the previous quarter. A decrease in the volume of oil extraction following the wildfire in Fort McMurray was the main reason for the decline.

The construction capacity utilization rate fell for the fifth time in six quarters, down from 83.8% in the first quarter to 83.5% in the second quarter. The decrease in the second quarter was attributable to a widespread decline in activity in this industry.

-

14:39

US unemployment claims continue to decline

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 259,000, a decrease of 4,000 from the previous week's unrevised level of 263,000. The 4-week moving average was 261,250, a decrease of 1,750 from the previous week's unrevised average of 263,000. There were no special factors impacting this week's initial claims. This marks 79 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:38

ECB Draghi: baseline scenario is subject to downside risk

-

We will continue to monitor economic and financial developments very closely

-

Evidence suggests economic resilience

-

Baseline scenario is subject to downside risk

-

We continue to expect moderate, steady growth

-

Will preserve substation amount of monetary support

-

Governing council tasked committees with evaluating various options

-

Will look at all options for smooth implementation of asset purchase program

*via forexlive -

-

14:30

Canada: Capacity Utilization Rate, Quarter II 80% (forecast 81.5%)

-

14:30

U.S.: Initial Jobless Claims, 259 (forecast 265)

-

14:30

Canada: New Housing Price Index, MoM, July 0.4% (forecast 0.2%)

-

14:30

Canada: Building Permits (MoM) , July 0.8% (forecast 3%)

-

14:30

U.S.: Continuing Jobless Claims, 2144 (forecast 2153)

-

14:27

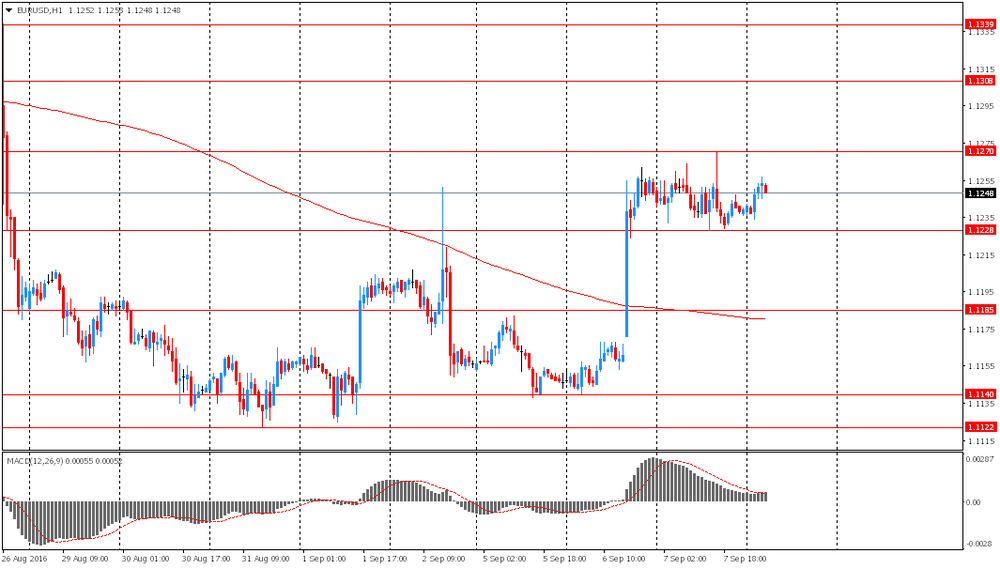

European session review: Euro rose significantly against the US currency

The following data was published:

(Time / country / index / period / previous value / forecast)

5:30 France Change number (final data) employed in non-agricultural sector II quarter 0.2% 0.2% 0.2%

11:45 Eurozone ECB decision on interest rates 0.0% 0.0% 0.0%

The euro has appreciated considerably against the US dollar for the first time from 26 August to break the mark of $ 1.1300. Support for the single currency provided expectations of the ECB meeting. As expected, the Central Bank left its benchmark interest rate unchanged at the level of 0.0%. Also, the ECB stated that the monthly asset purchases in the amount of 80 billion euros will be continued until the end of March 2017, or longer if necessary. Regarding rates the CB noted that key rates will remain at or below current levels for long periods of time.

Now attention is turning to the press conference of the head of the ECB. It is expected that Draghi will reaffirm their intention to continue the current monetary policy as long as necessary to achieve the inflation target of 2%. Moreover, Draghi will present updated forecasts for GDP growth and inflation. Most likely, the projections for GDP will be revised down, taking into account the outcome of the British referendum. In addition, the assessment on inflation is also likely to be degraded. "Although the evidence of a significant slowdown in the third quarter was not observed, the euro zone continues to face low inflation expectations, as well as recent significant strengthening of the euro", - noted experts Capital Economics.

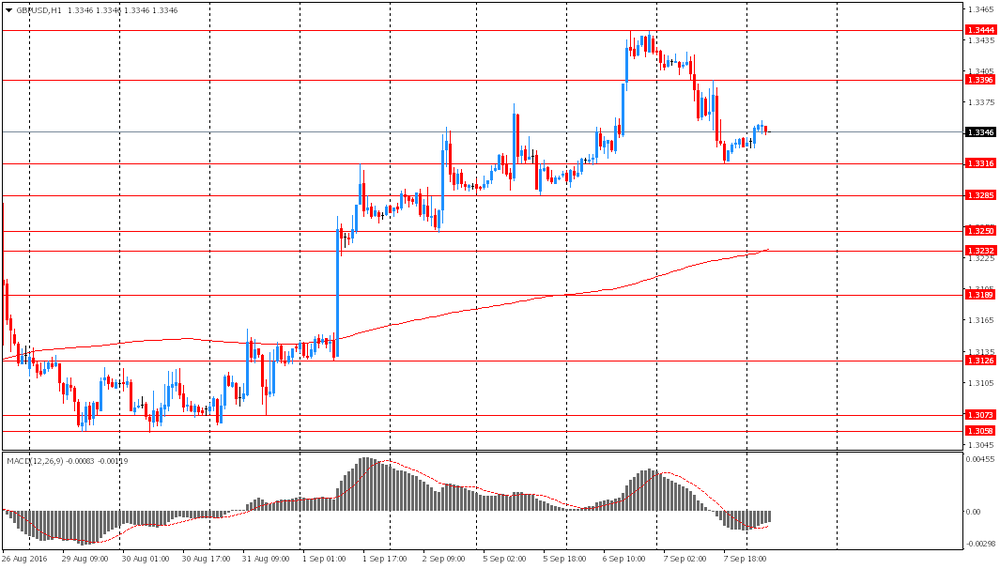

The pound rose slightly against the dollar, helped by strengthening risk appetite in response to higher oil prices. In addition, support for the pair GBP / USD has a general weakening of the American currency - the dollar index is now trading lower by 0.35 percent, near a session low.

EUR / USD: during the European session, the pair rose to $ 1.1315

GBP / USD: during the European session, the pair has risen to $ 1.3374, but then declined slightly

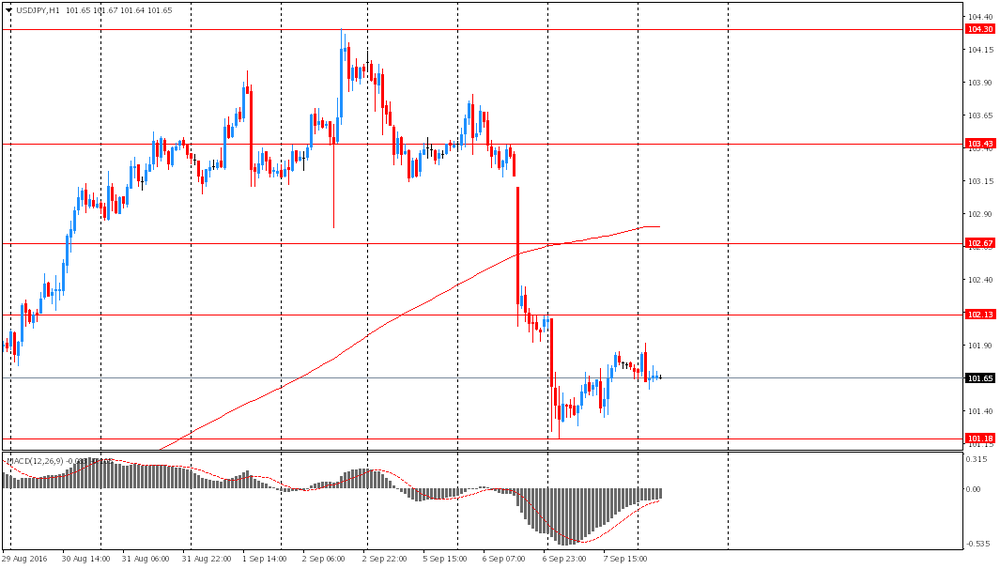

USD / JPY: during the European session, the pair traded in a narrow range

-

14:00

Orders

EUR/USD

Offers 1.1280 1.1300-10 1.1325 1.1350-55 1.1380 1.1400

Bids 1.1240 1.1220-25 1.1200 1.1185 1.1170 1.1145-50 1.1120 1.1100

GBP/USD

Offers 1.3465 1.3480 1.3400 1.3425 1.3435 1.3450 1.3475-80 1.3500

Bids 1.3325 1.3300 1.3275-801.3255-60 1.3230 1.3200

EUR/GBP

Offers 0.8445-50 0.8480 0.8500 0.8520-25 0.8550

Bids 0.8420 0.8400 0.8385 0.8365 0.8350 0.8330 0.8300

EUR/JPY

Offers 114.50 114.80 115.00 115.40 115.85 116.00

Bids 114.00 113.80 113.50 113.00 112.80 112.50

USD/JPY

Offers 101.75-80 102.00 102.20 102.50 102.75-80 103.00

Bids 101.40 101.20 101.00 100.80 100.50 100.30 100.00

AUD/USD

Offers 0.7720-25 0.7750 0.7765 0.7785 0.7800

Bids 0.7680 0.7665 0.7650 0.7625-30 0.7600 0.7580

-

13:54

Company News: Hewlett Packard Enterprise (HPE) posts mixed Q3 financials and announces plans for a spin-off and merger of its non-core software assets with British software firm Micro Focus

Hewlett Packard Enterprise (HPE) reported Q3 FY2016 earnings of $0.49 per share, beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $12.210 bln (-3.9% y/y), missing analysts' consensus estimate of $12.611 bln.

Hewlett Packard Enterprise issued downside guidance for Q4, projecting EPS of $0.44-0.49 versus analysts' consensus estimate of $0.60.

In addition, the company announced plans for a spin-off and merger of its non-core software assets with British software firm Micro Focus in a transaction valued at approx. $8.8 bln. HPE shareholders will own 50.1% of the newly merged firm.

HPE fell to $21.82 (-1.22%) in pre-market trading.

-

13:47

ECB holds rates. No QE extension and EUR/USD continue to rise

At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that the monthly asset purchases of €80 billion are intended to run until the end of March 2017, or beyond, if necessary, and in any case until it sees a sustained adjustment in the path of inflation consistent with its inflation aim.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today.

-

13:45

Eurozone: ECB Interest Rate Decision, 0.0% (forecast 0.0%)

-

13:05

WSE: Mid session comment

The Warsaw market in the first phase of the session, after an initial decline, smoothly passed to the expected stabilization. Only the mid companies correct somewhat, which is supported among others by the downward movement of the JSW shares.

In Europe, the euro slightly strengthened, but banks gain, which may indicate a lack of distinct expectations about the tone of comments from the ECB. The stronger growth of the Eurodollar pair due to approach of EBC decisions and conference, may signal that markets are discounting a future element of expression. However, it seems that the market is positive about the prospects for the euro in the context of today's news from the ECB, as seen in the course.

At the halfway point of quotations the WIG20 index stood at 1,808 points (-0,08%). The turnover in the segment of blue chips was on the level of PLN 215 mln.

-

12:53

Major stock indices in Europe trading mixed ahead of ECB

European stocks traded mixed as investors are waiting for the outcome of the ECB meeting. Some support for markets has higher oil prices in response to data from API, reporting the largest reduction in US oil inventories since 1999.

Also today, the ECB will present updated forecasts for GDP growth and inflation. It is expected that GDP will be revised lower, given Brexit. At the same time, experts note that the assessment of inflation may also be revised downward.

"Instead of waiting for concrete action from the ECB this time we will continue to look for any signals about what could be done, if necessary, - said Alan Higgins, chief investment officer of Coutts & Co. - This means that The ECB may hint for an extension of QE and increase purchases of government bonds. The Central bank could clarify the question of whether the QE program could include bank bonds. "

The composite index of the largest companies in the region Stoxx Europe 600 grew by 0.1 percent.

Shares of ASML Holding NV fell 2.6 percent after Samsung Electronics said to sell about 6.3 million of the company's shares.

The cost of Micro Focus has increased by 16.1 percent, as Hewlett Packard Enterprise reported that they plan to combine the non-core assets, specializing in software from Micro Focus.

The capitalization of Banca Monte dei Paschi di Siena has increased by 3.7 per cent after Morgan Stanley raised its rating.

Pearson shares fell 2.1 percent after its US partner, John Wiley & Sons, reported a decline in profits and revenues in the first fiscal quarter.

Air France-KLM Quotes climbed 0.9 percent after the company said that the number of passengers increased in August by 1.9 percent.

At the moment:

FTSE 100 +34.37 6880.95 + 0.50%

DAX -18.00 10734.98 -0.17%

CAC 40 -1.15 4556.51 -0.03%

-

12:32

-

12:03

The average annual price of oil in 2016 is estimated at $ 41-42 per barrel - MED

The average annual price of oil in 2016 will develop in the range of $ 41-42 per barrel - director of the Department for Macroeconomic Forecasting of the Ministry of Economic Development, Kirill Tremasov.

"This year is likely to be somewhere in the 41-42 (per barrel) average price. The following 3 years $ 40 per barrel as stated by the forecast for budget projections," - Tremasov said.

In January - August 2016, according to the Ministry of Finance, the average price of Urals oil decreased compared to the same period of the previous year by more than 16 dollars to 39.36 dollars per barrel.

The average price of Urals oil in 2015 has developed at a average rate of $ 51.23 per barrel vs $ 97.6 per barrel in 2014.

-

10:58

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 788m) 1.1115 (324m) 1.1130-32 (624m) 1.1150 (353m) 1.1160 (621m) 1.1197-1.1200 (746m) 1.1300 (421m) 1.1335 (550m)

USD/JPY: 100.50 (USD 312m) 101.00 (318m) 102.00 (520m) 102.14 (500m) 102.30 (550m) 103.00 (610m) 103.30 (256m) 103.50 (580m) 103.70 (912m) 104.50 (1.8bln)

GBP/USD: 1.3400 (GBP 343m) 1.3500 (743m)

AUD/USD: 0.7550 ( AUD 519m) 0.7600 (363m) 0.7640 (558m) 0.7800 (364m)

USD/CAD 1.2600 (USD 300m) 1.2650-55 (290m) 1.2800 (436m) 1.2950 (942m) 1.3000 (320m)

NZD/USD 0.7260 (450m) 0.7300 (233m)

-

10:52

Russian oil minister Novak: risks remain that oil prices will fall in winter 2016/17 - TASS

-

Japanese companies have expressed an interest in taking part in Rosneft and Bashneft privatisations

-

oil output freeze not on agenda of meeting with Algeria

-

-

10:22

Today’s events

At 11:45 GMT ECB's decision on interest rate

At 12:30 GMT the ECB Press Conference

At 16:20 GMT the Bank of Canada Deputy Governor Timothy Lane will deliver a speech

-

09:28

ECB takes center stage as markets don’t price in a dovish statement. Will we have the usual EUR/USD down move than a sharp reversal? Or no down move at all?

-

09:24

Major stock exchanges trading mixed after opening: FTSE + 0.1%, DAX flat, CAC40 -0.1%, FTMIB flat, IBEX + 0.2%

-

09:16

WSE: After opening

WIG20 index opened at 1811.76 points (+0.10%)*

WIG 48533.07 0.11%

WIG30 2082.08 0.08%

mWIG40 4024.19 0.09%

*/ - change to previous close

Traditionally, the first transactions on the futures market were with no surprises. The cash market also began in the area of the reference level, encouraged by the lack of major changes in environment. Still the highest turnover collects JSW, but also point Action (WSE: ACT) and Wielton (WSE: WLT) -very good reading of results. It should be noted that in the case of the WIG20 index has been outdone exponential average of 21 sessions and the resistance level of 1,800 points.

-

08:54

Mixed start expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 -0.1%, FTSE + 0.1%

-

08:32

Trading The ECB - Views From 10 Major Banks

JP Morgan: On Hold, QE Extension In December

We no longer expect a rate cut and think that a decision to extend QE beyond March 2017 will be taken only in December. In addition, we think the staff will assume only a modest 0.2%-pt hit to the level of GDP from the Brexit vote, taking a tenth off 2017 and a bit off 2018.

Morgan Stanley: On Hold, Bullish EUR On Crosses.

We remain bullish on EUR. The eurozone economy has held up well post-Brexit, supported by the recent release of eurozone August PMIs. Our economists are now expecting the ECB to ease only in December instead of September, with the risk that it may not ease at all, supporting our bullish EUR view on crosses. Even if the ECB extends its QE programme or cuts rates further, we think it will not be able to push down long-term bond yields substantially to weaken the currency, as eurozone bond yields are already low or negative

Credit Agricole: On Hold, Upside EUR Risk.

In conclusion we see limited scope of Draghi making a case of more policy action being considered anytime soon, especially as its adverse effects as related to the banking sector may just intensify. As a result of the above outlined conditions position squaring related upside risks cannot be excluded, especially as EUR short positioning has risen of late.

Barclays: ECB To Adopt Wait & See Stance; EUR/USD Neutral.

This week's ECB policy meeting (Thursday) will likely be neutral for EURUSD, in our view. Without significant changes to EA activity since June, we expect the ECB to adopt a 'wait and see' response, keeping all policy settings unchanged Our own expectation for European growth is that the political and policy risks, which were already elevated for Europe, have become even more pronounced post-Brexit. We think these risk factors will eventually lead to investment weakening by the end of 2016 but do not think the ECB will factor in these political risks at this juncture. We also expect only marginal downward revisions to the ECB's inflation projections with risks still skewed to the downside. Our expectation for further policy easing in H2 16 remains in place, however, with the ECB likely expanding its QE by six to nine months at its October or December meetings, accompanied by modifications to the programme's technical parameters. We think that this move is highly expected by the FX markets.

BTMU: ECB To Delay QE Extension To Oct Or Dec; EUR Positive.

We had for some time been calling for an extension to the deadline for QE to be announced at the September meeting but our sense now is that the ECB may well delay that announcement until the October meeting or possibly the December meeting. As usual, the reaction in the markets and for the euro will very much depend on the tone of comments from President Draghi. What is clear is that an extension to the QE timeline is widely expected by the financial markets and as long as President Draghi makes clear that this is likely to be forthcoming rather than being abandoned, then the upside for the euro should be limited.We certainly do not see the ECB meeting this week as being any catalyst for a notable move one way or the other and while a delay in announcing a QE extension might be EUR supportive, we expect President Draghi to be explicit enough in providing forward guidance that reassures market participants that further easing will be forthcoming. In addition, President Draghi will signal technical changes to address concerns over sovereign debt securities becoming too scarce for the ECB to meet its monetary policy commitment.

Danske: ECB Will Keep The Powder Dry: No QE Extension At September Meeting.

We have changed our view and now expect the ECB to remain on hold at the meeting in September. We believe that in the ECB's view the incoming information since July does not warrant additional easing. We still firmly believe the ECB will eventually extend QE purchases beyond March 2017 due to the lack of a sustainable path in inflation. However, for now, we expect it to keep its powder dry. A QE extension could be accompanied by changes to the purchase restrictions but we do not expect this to be announced in September. Previously, we also expected a temporary step-up in QE purchases as we looked for a weakening in economic data.

RBS: QE Extension On Thursday; Another Depo Cut In December.

We do not expect any changes to interest rate settings or to the monthly pace or the scope of the asset purchase programme (APP) at this Thursday's meeting. But we are now expecting the ECB to extend the APP from March 2017 to September 2017. We think the ECB would rather act on this timing issue now rather than delay what we believe to be an inevitable adjustment to the programme at a later date. We expect another cut in the depo rate and a further upscaling of the QE programme in December.

BofA Merrill: QE Extension; No Large EUR Impact But Risk Likely To The Upside.

We argue the ECB cannot keep its options open until December. With macro data still weak and high market expectations after a dovish July meeting, we believe a commitment to continuing QE after March 2017 is the least markets expect. While the ECB is aware of the adverse consequences of its unconventional policies, we think its communication is still consistent with a full commitment to deliver on its price target, even if the other branches of policy are not as helpful. We do not see a large EUR impact from the ECB QE extension. The distance from the ECB's inflation target is so long that we do not believe there is any investor who does not already expect the ECB to continue QE after March 2017. The market impact will depend more on the length of the extension and the technical changes to the QE program to allow extending it. As we expect only a six-month QE extension, with the technical details left for later this year, and no changes in the depo rate, we do not see a sustained EUR move from this meeting. Once we know the technical details, the impact on the EUR will depend on how much more room, if any, the changes to the QE program will create beyond the QE extension. Moreover, the risks to the Euro from the meeting may be to the upside. If the ECB does not announce QE extension in this meeting, markets could take it as a signal of strong disagreements within the ECB on how to extend QE. We are surprised we have not heard any ECB officials referring to scenarios for policies ahead, in contrast to what happened ahead of previous policy changes. This could suggest the internal debate has not progressed much. FX positioning suggests the market does not expect any surprises from the ECB.

Citi: ECB To Announce 3 Easing Measures.

We look for three ECB policy announcements: 1- We think extension of asset purchases for at least six months would be a first step in the right direction, 2- alongside changes to QE modalities to circumvent any scarcity issues. 3- We also expect a 10bp cut in the refinancing rate to -0.1% to be the first step, ahead of a 10bp cut in the deposit rate to -0.5% in March 2017.

BNPP: 3 Possible Changes To ECB's Purchase Rules Of Government Bonds.

We expect the ECB to announce an extension of its QE program beyond its March 2017 expiration at this week's meeting. In order to address concerns about scarcity of paper, we also expect changes to the rules governing the purchase of government bonds. Our rates team sees three possible changes 1) increasing the issue share limit; 2) removing deposit rate floor; 3) moving away from capital key based allocation of purchases. Our rates strategy team see risks that long-end core yields rise in the aftermath of the decision, even if the ECB does deliver.

Copyright © 2016 eFXplus™

-

08:29

Asian session review: the yen strengthened slightly

The yen strengthened slightly after the speech of Deputy Governor of the Bank of Japan, Hiroshi Nakas, who noted the importance of continuing the Central Bank commitment to achieving the inflation target of 2%. The banker said that the combination of negative interest rates and bond purchases used now provides a very powerful and positive effect. However, according to Nakas structural reforms, monetary easing should be carried out "simultaneously" and still may require additional measures by the Central Bank.

Also today, it was reported that Japan's GDP in the second quarter increased compared to the previous quarter by 0.7% year on year, higher than the expectations of 0.2%. Slightly improved data on investment, increase in inventories, as well as public investment were the reasons growth was revised upwards.

The Australian dollar rose slightly on more positive than expected data on foreign trade of Australia and China. The trade balance published by the Australian Bureau of Statistics, and assessing the ratio between exports and imports of goods in July amounted to A $ -2,4 Bln. The forecast of analysts was A $ -2.7 Bln. Imports to Australia remained unchanged, while exports rose by 3.0%. As reported today by the Chinese customs administration, foreign trade surplus of China in August was $ 52.05 billion, below the forecast of $ 58.00 billion and the previous value of 52.30 billion. The total volume of China's foreign trade decreased by 1.8% year on year. China's imports in August rose by 1.5%, while analysts expected a decline to -5.0%. Chinese Exports from China decreased by 2.8%, year on year. Economists had expected a decline to -4.0%

EUR / USD: during the Asian session, the pair was trading in the $ 1.1235-55 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3330-55 range

USD / JPY: fell to Y101.40 in the Asian session

-

08:25

Options levels on thursday, September 8, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1357 (3516)

$1.1316 (3994)

$1.1285 (5022)

Price at time of writing this review: $1.1253

Support levels (open interest**, contracts):

$1.1213 (1967)

$1.1182 (3124)

$1.1142 (3593)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52593 contracts, with the maximum number of contracts with strike price $1,1250 (5022);

- Overall open interest on the PUT options with the expiration date September, 9 is 58249 contracts, with the maximum number of contracts with strike price $1,1000 (5625);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from September, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.3600 (790)

$1.3500 (1852)

$1.3402 (2733)

Price at time of writing this review: $1.3336

Support levels (open interest**, contracts):

$1.3298 (961)

$1.3199 (754)

$1.3100 (1495)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32755 contracts, with the maximum number of contracts with strike price $1,3300 (2793);

- Overall open interest on the PUT options with the expiration date September, 9 is 28664 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from September, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Deputy Governor of the Bank of Japan, Hiroshi Nakas: It is important that the Bank of Japan continue to persue the inflation target of 2%

During his speech today, the Deputy Governor of the Bank of Japan, Hiroshi Nakas noted the importance of the continuation of the Bank of Japan's commitment to achieving the inflation target of 2%. The banker said that the combination of negative interest rates and bond purchases used now provides a very powerful and positive effect. However, according to Nakas structural reforms, monetary easing should be carried out "simultaneously" and still may require additional measures by the Central Bank.

-

08:21

WSE: Before opening

Yesterday's trading on Wall Street ended in neutral. Once again, a light support proved to be published two hours before the end of the American session, the Fed beige book. Asian markets are dominated by modest declines. In the US, Apple demonstrated the new iPhone 7, the main changes are a bit longer operating battery, better camera and waterproofness achieved by the elimination of a standard headphone jack. Shares of the company gained a modest 0.6%.

During today's session, there is no more significant macroeconomic publications from the domestic market. NBP will give away only the data regarding financial situation of households in the first quarter. Investor's attention will focus today on the ECB meeting. The market is expected to extend the QE program and possible changes in parameters of the purchase of European debt. The least likely change is the further reduction in interest.

After closing of yesterday's session, there were reports that PKO BP (WSE: PKO) and Alior Bank (WSE: ALR) made an offer to buy Raiffeisen Polbank. It seems that they are the only candidate seriously interested in the purchase.

-

08:19

Japan's GDP grew in the second quarter by 0.2%

According to data released today by the Institute of Economic and Social Research of Japan, GDP grew in the second quarter 0.2% compared to the first quarter. It is worth noting that the majority of economists expected Japan's economy flat. Year-on-year figure was also up by 0.7%. Positive impact on the growth of the economy has had an extension of inventory, increase public investment and improvement in the investment data.

It is worth noting that over the past two years the growth rate of Japan's GDP is constantly alternating recession and growth and only in this quarter for the first time in more than a year we have seen an increase in 2 quarters in a row.

-

08:16

Australian trade deficit declines in July

In trend terms, the balance on goods and services was a deficit of $2,485m in July 2016, an increase of $62m (3%) on the deficit in June 2016.

In seasonally adjusted terms, the balance on goods and services was a deficit of $2,410m in July 2016, a decrease of $840m (26%) on the deficit in June 2016.

In seasonally adjusted terms, goods and services credits rose $719m (3%) to $26,425m. Non-monetary goldrose $912m (62%), rural goods rose $42m (1%) and net exports of goods under merchanting rose $6m (21%).Non-rural goods fell $249m (2%). Services credits rose $8m.

-

08:08

China's imports and exports improved

According to rttnews, China's exports declined at a slower than expected pace in August, while imports logged the the first growth since 2014 on strong domestic demand.

Exports declined 2.8 percent year-on-year in August but slower than the 4.4 percent decrease seen in July, the National Bureau of Statistics said Thursday. Economists had expected a 4 percent fall.

Meanwhile, imports grew 1.5 percent in contrast to a 12.5 percent decline in July. This was the first increase since late 2014 and confounded expectations for a 5.4 percent drop.

The trade surplus came in at $52.05 billion versus July's $52.31 billion balance. The surplus was forecast to rise to $58.8 billion in August.

Looking ahead, a gradual recovery in global demand probably means some further upside to export growth in the coming quarters, Julian Evans-Pritchard at Capital Economics, said.

The economist said import growth should also pick up further on the back of stronger domestic demand and a further recovery in global commodity prices.

In yuan terms, exports increased 5.9 percent and imports advanced 10.8 percent from the same period last year.

-

08:07

French employment stable in Q2

In Q2 2016, payroll employment in the non-farm market sectors continued to increase (+29,500 jobs, that is 0.2%, after +21,500 jobs in the previous quarter). The increase is due to employment excluding temporary work (+29,500 jobs, i.e. +0.2%, after +21,100 jobs in Q1 2016). Year-on-year, the principally market sectors created 121,300 jobs (+0.8%).

-

07:31

France: Non-Farm Payrolls, Quarter II 0.2% (forecast 0.2%)

-

07:16

Japan: Eco Watchers Survey: Outlook, August 47.4

-

07:16

Japan: Eco Watchers Survey: Current , August 45.6 (forecast 45.2)

-

06:51

Global Stocks

European stocks darted between small gains and losses Wednesday, with investors assessing a larger-than-expected drop in German industrial production before the European Central Bank issues its next policy decision on Thursday.

U.S. stocks fell on Wednesday as the Federal Reserve's Beige Book report painted a generally positive picture of the U.S. economy, providing more fodder for the central bank as it contemplates an interest rate hike in the near term.

-

04:46

China: Trade Balance, bln, August 52.05 (forecast 58)

-

03:30

Australia: Trade Balance , July 4 (forecast -2.8)

-

01:56

Japan: Current Account, bln, July 1938.2 (forecast 2090)

-

01:50

Japan: GDP, y/y, Quarter II 0.7% (forecast 0.0%)

-

01:50

Japan: GDP, q/q, Quarter II 0.2% (forecast 0%)

-

00:30

Commodities. Daily history for Sep 07’2016:

(raw materials / closing price /% change)

Oil 46.14 +1.41%

Gold 1,349.50 +0.02%

-

00:29

Stocks. Daily history for Sep 07’2016:

(index / closing price / change items /% change)

Nikkei 225 17,012.44 -69.54 -0.41%

Shanghai Composite 3,092.41 +1.69 +0.05%

S&P/ASX 200 5,424.25 +10.62 +0.20%

FTSE 100 6,846.58 +20.53 +0.30%

CAC 40 4,557.66 +27.70 +0.61%

Xetra DAX 10,752.98 +65.84 +0.62%

S&P 500 2,186.16 -0.32 -0.01%

Dow Jones Industrial Average 18,526.14 -11.98 -0.06%

S&P/TSX Composite 14,796.75 -16.27 -0.11%

-

00:28

Currencies. Daily history for Sep 07’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1239 -0,08%

GBP/USD $1,3332 -0,68%

USD/CHF Chf0,9694 -0,05%

USD/JPY Y101,70 -0,38%

EUR/JPY Y114,30 +0,16%

GBP/JPY Y135,6 -1,05%

AUD/USD $0,7673 -0,10%

NZD/USD $0,7450 +0,54%

USD/CAD C$1,2885 +0,30%

-

00:00

Schedule for today, Thursday, Sep 08’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance July -3.19 -2.8

02:00 China Trade Balance, bln August 52.31 58

05:00 Japan Eco Watchers Survey: Outlook August 47.1

05:00 Japan Eco Watchers Survey: Current August 45.1 45.2

05:30 France Non-Farm Payrolls (Finally) Quarter II 0.2% 0.2%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0%

12:30 Eurozone ECB Press Conference

12:30 Canada Capacity Utilization Rate Quarter II 81.4% 81.5%

12:30 Canada Building Permits (MoM) July -5.5% 3%

12:30 Canada New Housing Price Index, MoM July 0.1% 0.2%

12:30 U.S. Continuing Jobless Claims 2159 2153

12:30 U.S. Initial Jobless Claims 263 265

15:00 U.S. Crude Oil Inventories September 2.276

19:00 U.S. Consumer Credit July 12.32 16

-