Noticias del mercado

-

21:00

DJIA 18512.37 -25.75 -0.14%, NASDAQ 5274.27 -1.64 -0.03%, S&P 500 2184.65 -1.83 -0.08%

-

18:35

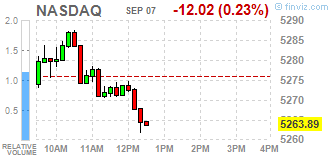

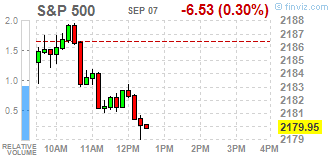

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes were slightly lower on Wednesday as investors awaited a key report by the Federal Reserve to gauge the health of the U.S. economy. Investors will wait until they get more clarity on presidential elections, the quality of third-quarter earnings and the timing of the next rate hike, Courtney said. While the Fed has been hinting at higher rates in the near-term, a recent set of weak economic data, including last week's jobs numbers, have muddied the outlook.

Most of Dow stocks in negative area (21 of 30). Top gainer - Caterpillar Inc. (CAT, +1.55%). Top loser - The Home Depot, Inc. (HD, -1.36%).

Most of S&P sectors also in negative area. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-0.6%).

At the moment:

Dow 18478.00 -45.00 -0.24%

S&P 500 2179.00 -5.50 -0.25%

Nasdaq 100 4817.75 -9.75 -0.20%

Oil 45.51 +0.68 +1.52%

Gold 1348.10 -5.90 -0.44%

U.S. 10yr 1.54 +0.00

-

18:00

European stocks closed: FTSE 6846.58 20.53 0.30%, DAX 10752.98 65.84 0.62%, CAC 4557.66 27.70 0.61%

-

17:52

Oil prices stable

Oil prices have stabilized, as market participants focused attention on US weekly data on oil and petroleum products.

Today at 20:30 GMT the American Petroleum Institute will issue its weekly inventory report. Official data from Energy Information Administration will be published on Thursday.

Reports will be a day later than usual due to the celebrations of Labor Day in the US on Monday.

Traders continue to assess the prospects of oil exporters meeting later this month.

The Organization of Petroleum Exporting Countries, led by Saudi Arabia and other major exporters of crude oil in the Middle East, will meet non-OPEC producers, led by Russia, on the sidelines of the International Energy Conference in Algiers on 26-28 September.

On Monday, Brent soared in value after Saudi Arabia and Russia pledged to work together to stabilize the market. However, since the agreement does not provide for early action to combat oversaturation supply the moves could not be sustained.

On Tuesday, Iranian Oil Minister Bijan Zanganeh met with OPEC Secretary General Mohammed Barkindo in Tehran and said that he would support any measures to stabilize crude oil around $ 50-60 per barrel.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 45.42 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of Brent crude rose to 47.94 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:38

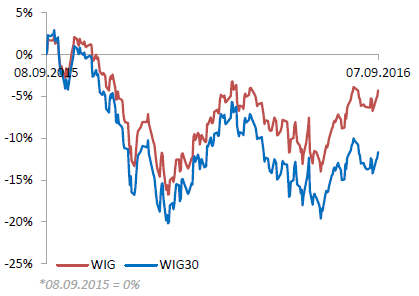

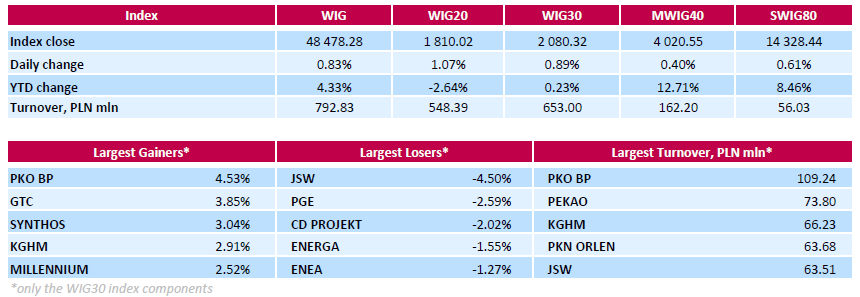

WSE: Session Results

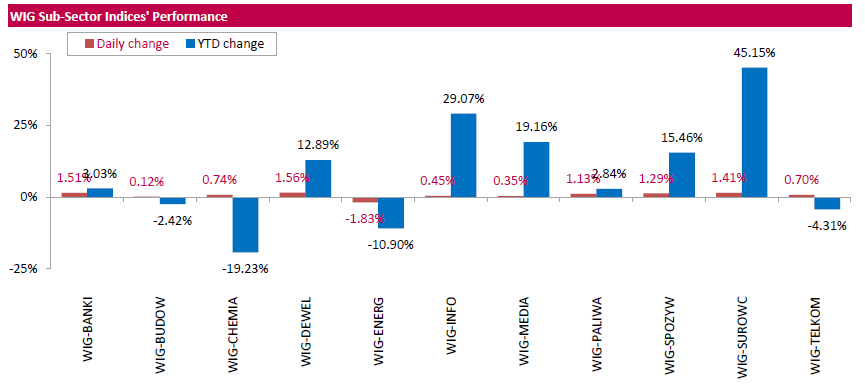

Polish equity market closed higher on Wednesday. The broad market benchmark, the WIG Index, surged by 0.83%. All sectors, but for utilities (-1.83%), rose, with developing sector (+1.56%) outperforming.

The large-cap stocks grew by 0.89%, as measured by the WIG30 Index. Within the index components, bank PKO BP (WSE: PBO) and property developer GTC (WSE: GTC) recorded the biggest gains, up 4.53% and 3.85% respectively. Other major advancers were chemical producer SYNTHOS (WSE: SNS), copper producer KGHM (WSE: KGHM) and bank MILLENNIUM (WSE: MIL), adding 3.04%, 2.91% and 2.52% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the decliners with a 4.5% drop, followed by genco PGE (WSE: PGE) and videogame developer CD PROJEKT (WSE: CDR), losing 2.59% and 2.02% respectively.

-

17:26

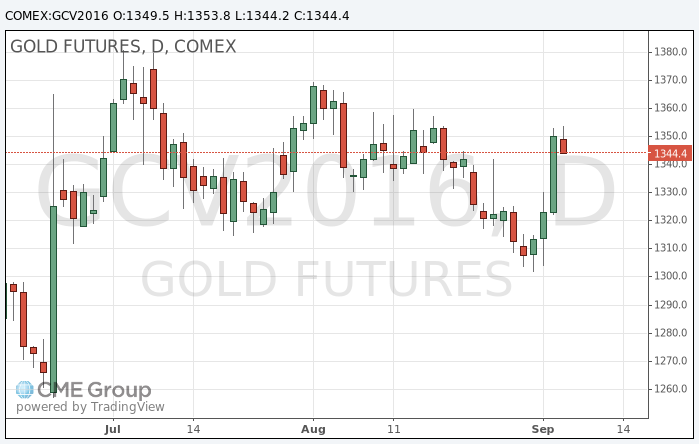

Gold price fell slightly

Gold remained almost unchanged, as investors tried to assess the likelihood of interest rate hike by the Federal Reserve later this year.

The volume of trading in the market after a strong growth in recent days have been reduced, as investors' expectations about the Fed raising US interest rates decreased, said William Adams of FastMarkets.

"I think, on this background, the dollar weakened giving the necessary support for gold," - said the analyst. If expectations of rising interest rates will continue to decrease, the price of gold may continue to rise, he said.

Fed officials have previously made it clear that this year the interest rates may be increased twice. However, weak economic data last week has convinced market participants that the central bank is unlikely to raise interest rates in the short term.

Investors are also awaiting the outcome of the meeting of the European Central Bank, which will end on Thursday. Analysts generally do not expect announcements of further measures to stimulate the European economy. Soft monetary policy usually provides support to gold

The cost of the October futures for gold on the COMEX fell to $ 1343.5 per ounce.

-

16:12

-

16:09

US job openings rose more than forecast in July

The number of job openings increased to 5.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 4.9 million, respectively. Within separations, the quits rate was 2.1 percent and the layoffs and discharges rate was 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

On the last business day of July, there were 5.9 million job openings, an increase of 228,000 from June. The job openings rate was 3.9 percent in July. The number of job openings increased over the month for total private (+243,000) and was little changed for government. Job openings increased in professional and business services (+166,000) and durable goods manufacturing (+27,000) but decreased in health care and social assistance (-63,000). The number of job openings was little changed in all four regions. -

16:06

Bank of Canda Holds rates at 0.50%

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Global growth in the first half of 2016 was slower than the Bank had projected in its July Monetary Policy Report (MPR), although the Bank continues to expect it to strengthen gradually in the second half of this year. The US economy was weaker than expected in the second quarter, notably reflecting a contraction in business and residential investment. While a healthy labour market and solid consumption should remain supportive of growth in the rest of the year, the outlook for business investment has become less certain. Meanwhile, global financial conditions have become even more accommodative since July.

While Canada's economy shrank in the second quarter, the Bank still projects a substantial rebound in the second half of this year. Second-quarter GDP was pulled down by the Alberta wildfires in May and by a drop in exports that was larger and more broad-based than expected. Exports disappointed even after accounting for weaker business and residential investment in the United States, adjustments in the resource sector, and cutbacks in auto production. The economy is expected to rebound in the third quarter as oil production recovers, rebuilding commences in Alberta, and consumer spending gets an additional lift from Canada Child Benefit payments. As federal infrastructure spending starts to have more impact, growth in the fourth quarter is projected to remain above potential. While the strength in exports during July was encouraging, the ground lost over previous months raises the possibility that the profile for economic activity will be somewhat lower than anticipated in July.

-

16:02

WSE: After start on Wall Street

The beginning of trading on Wall Street took place at the neutral level and with low volatility, which indicates a desire to remain in ongoing for some time consolidation. In this situation, we do not have yet any indication form the side of the American market. The WIG20 index after a few hours of stagnation lasting from the beginning of trading, around 14:00 began to march up and reported on the new daily maximum.

Increases are accompanied by greater market activity, so the demand has a chance to confirm the "buy" signal by the turnover. After breaking out of from consolidation, the demand has appeared and modestly but consistently improving earlier daily highs.

An hour before the end of the session the WIG20 index was at the level of 1,814 points (+ 1.33%).

-

16:01

Canada: Ivey Purchasing Managers Index, August 52.3 (forecast 56.3)

-

16:01

United Kingdom: NIESR GDP Estimate, Quarter III 0.3%

-

16:00

U.S.: JOLTs Job Openings, July 5.871 (forecast 5.58)

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1100 (EUR 675m) 1.1125-30 (317m) 1.1265 (293m) 1.1400-05 (1.01bln) 1.1410 (1.17bln) 1.1415-25 (914m)

USDJPY: 101.00 (USD 221m) 101.50 (250m) 101.70 (344m) 102.55 (230m) 103.00 (610m) 103.50 (480m)

GBPUSD 1.3300 (GBP 451m) 1.3500 (747m)

EURGBP 0.8300 (340m)

USDCHF 0.9650 (USD 301m) 0.9850 (200m)

AUDUSD: 0.7445-50 ( AUD 519m) 0.7620 (409m)

USDCAD 1.2580 (USD 200m) 1.3021-30 (525m)

AUDJPY 75.10 (AUD 1.05bln)

-

15:40

Bank of England Forbes: the scale of a slowdown in demand is impossible to accurately predict

- Forced to rely on "less reliable" economic data to make predictions after Brexit.

- Now is the time when you need to wait, to assess the necessary response.

- Additional measures could cause a drop in the pound.

-

15:33

U.S. Stocks open: Dow -0.12%, Nasdaq -0.04%, S&P -0.14%

-

15:29

Bank of England inflation report hearings: BoE comfortable with decision to add stimulus

BoE Governor Carney:

-

Says he's serene about comments since the Brexit vote

-

Great uncertainty followed Brexit

-

says he's comfortable with decision to add stimulus

-

Stimulus ensures sustainable inflation return

-

Without stimulus unemployment would have been higher

-

Reiterates that all elements of stimulus can be increased

-

Says BOE must be prepared to adjust policy as necessary

*via forexlive -

-

15:26

Before the bell: S&P futures -0.08%, NASDAQ futures +0.07%

U.S. stock-index futures were little changed, with equities near a record, as investors brooded over the direction of Federal Reserve monetary policy after mixed economic reports.

Global Stocks:

Nikkei 17,012.44 -69.54 -0.41%

Hang Seng 23,741.81 -45.87 -0.19%

Shanghai 3,092.41 +1.69 +0.05%

FTSE 6,827.38 +1.33 +0.02%

CAC 4,545.32 +15.36 +0.34%

DAX 10,744.31 +57.17 +0.53%

Crude $44.66 (-0.38%)

Gold $1354.20 (+0.01%)

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Caterpillar (CAT) initiated with Buy at Deutsche Bank

Deere (DE) initiated with Hold at Deutsche Bank

Barrick Gold (ABX) initiated with a Sell at Berenberg

Facebook (FB) target increased to $160 at Morgan Stanley

-

14:39

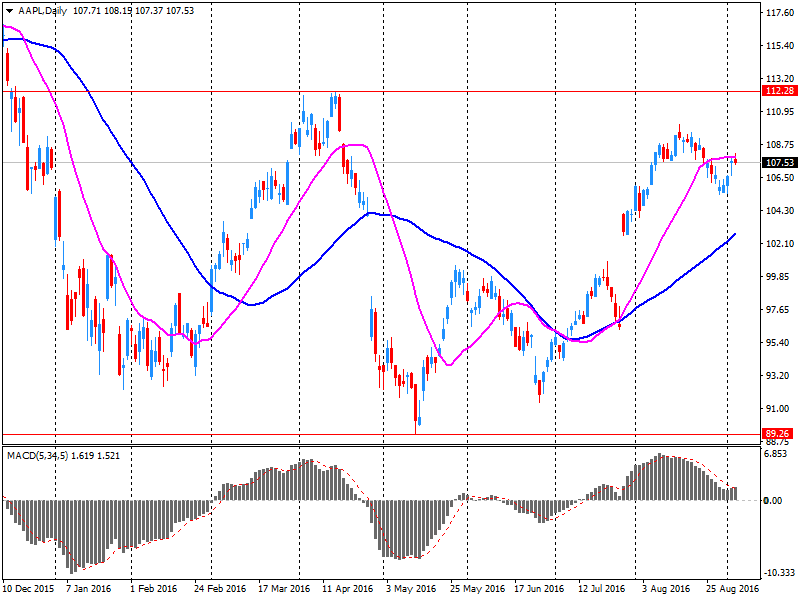

The lack of a headphone jack and a new shade of black: what to expect from Apple’s presentation

Today, 7 September, Apple (AAPL) will hold its annual autumn event in San Francisco, during which traditionally presents the new iPhone. According to CNN, this year we can even see the version of the smartphone in the new color to be closer to black.

New smartphone iPhone 7 and iPhone 7 Plus, most likely, will not differ significantly from their predecessors. Apple, apparently, decided to reserve significant changes to the iPhone for the 10th anniversary next year.

Rumors of the main innovations have already caused anger among potential buyers. Apple is expected to deprive the new Phone 7 Plus of its connector for headphones. Instead, you will need to use a wireless headset or connect via the existing Lightning-port. Probably, the company will provide users with adapters.

Positive changes include the improvement of the cameras installed on the iPhone 7 and iPhone 7 Plus. iPhone 7 Plus is expected to get two cameras to provide higher quality images in low light. In addition, Apple will abandon the 16-gigabyte model and increase the amount of storage of the initial models of the iPhone line up to 32 GB. There are also rumors that the new iPhone may be a waterproof or at least water resistant.

In addition the company will also introduce a lot of other innovations, including a new version of Apple Watch and updated software for all Apple products.

The event is scheduled for 17:00 GMT.

AAPL shares rose in premarket trading to $ 107.95 (+ 0.23%).

-

14:20

European session review: the pound has fallen against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Industrial Production (m / m) July 1.1% 0.2% -1.5%

France 6:45 Trade balance, bn -3.5 -3.7 -4.5 July

7:00 UK House Price Index from Halifax, m / m in August -1% -0.2%

7:00 UK House Price Index from Halifax, 3m y / y in August 8.4% 6.9%

8:30 UK Industrial Production m / m in July 0% -0.2% 0.1%

8:30 UK Industrial Production y / y in July 1.4% 1.9% 2.1%

8:30 UK Manufacturing production m / m in July -0.2% -0.4% -0.9%

8:30 UK Manufacturing production, y / y in July 0.6% 1.7% 0.8%

The pound depreciated moderately against the dollar, having lost part of the earned positions yesterday, which was caused by the publication of controversial statistical data on industrial production in the UK. The pressure also helped the dollar to recover against major currencies.

Office for National Statistics (ONS) showed that industrial production in the UK rose in July by 0.1 percent after flat in June. Experts predicted that the production will be reduced by 0.2 percent. Production decreased by 0.9 per cent, exceeding the estimate (-0.4 per cent) in the manufacturing sector, and speeding up the pace compared to June (-0.2 percent). Meanwhile, production in the mining and quarrying sector increased by 4.7 percent. In addition, the ONS reported that annual industrial production growth accelerated to 2.1 percent compared to 1.4 percent in June. This was the fastest growth in three months. It was expected that the figure will increase by 1.9 percent. Manufacturing output increased by 0.8 per cent y/y, after rising 0.6 percent in June (revised from +0.9 per cent). Analysts had forecast an increase in production by 1.7 per cent.

However, the report submitted by Halifax showed that house prices in Britain fell in August, continuing the July trend. As a result of this change the annual growth rate fell to its lowest level for more than a year. House prices fell in August by 0.2 percent after declining 1.1 percent in July. Meanwhile, the annualized price growth slowed to 6.9 percent from 8.4 percent the previous month. Economists had forecast that prices will fall by 0.4 percent compared to July, and will grow by 7.0 percent y/y. For the three months (to August) prices were 0.7 percent higher than in the previous three months, but it was the slowest quarterly growth rate since December 2014. Halifax noted that the number of real estate transactions is also falling - in July, the number of home sales decreased by 1 percent compared with the previous month.

The euro traded in a narrow range against the US dollar, which was due to the lack of new catalysts, as well as the expectations of the ECB meeting. The Statistical Office of Germany reported that industrial output fell sharply at the end of July, registering the largest drop in 23 months, which is another sign of slowing from Europe's largest economy. The report stated that the volume of industrial production decreased by 1.5 percent compared to June. Economists had expected an increase of 0.2 percent. Increased production in the construction sector (+1.8 per cent) and energy production (2.6 percent) was offset by a decline in the manufacturing industry (-2.3 percent).

According to a poll of 70 economists, conducted by Reuters, the ECB will leave its monetary policy unchanged in September, but by the end of the year a QE extension is likely. In addition, many analysts expect the Central Bank will hold its refinancing rate and the deposit rate - at 0.0 percent and -0.4 percent respectively by the end of 2017. The majority of economists said that the central bank will extend its monthly bond purchase program, which will end in March 2017. Few economists have noted that the ECB will soften the policy again by the end of the year, either by reducing the rate and / or expansion of QE program.

EUR / USD: during the European session, the pair is trading in the $ 1.1228- $ 1.1264 range

GBP / USD: during the European session, the pair fell to $ 1.3357

USD / JPY: during the European session, the pair rebounded to Y101.71 from Y101.19

-

13:50

Orders

EUR/USD

Offers 1.1265 1.1280 1.1300-10 1.1325 1.1350-55

Ордера на покупку: 1.1220-25 1.1200 1.1185 1.1170 1.1145-50 1.1120 1.1100

GBP/USD

Offers 1.3425 1.3435 1.3450 1.3475-80 1.3500 1.3520-25 1.3550-60

Bids 1.3385-90 1.3355-60 1.3325 1.3300 1.3275-80 1.3255-60 1.3230 1.3200

EUR/GBP

Offers 0.8400 0.8420 0.8445-50 0.8480 0.8500 0.8520-25

Bids 0.8365 0.8350 0.8330 0.8300 0.8280 0.8250

EUR/JPY

Offers 114.50 114.80 115.00 115.40 115.85 116.00

Bids 114.00 113.80 113.50 113.00 112.80 112.50

USD/JPY

Offers 101.80 102.00 102.20 102.50 102.75-80 103.00 103.45-50

Bids 101.20 101.00 100.80 100.50 100.30 100.00 99.75 99.50-55

AUD/USD

Offers 0.7680 0.7700 0.7730 0.7750

Bids 0.7650 0.7625-30 0.7600 0.7580 0.7560 0.7520 0.7500

-

13:11

WSE: Mid session comment

The first half of trading on the Warsaw parquet ends with moderate success of the bulls side in form of increases of the WIG20 index by 0.7 percent. In this phase of trading usually not much happens and the activity should increase after Americans entering into the game. Besides recent increases in volatility in energy companies (which may mean the end of their relative weakness) is currently worth to pay attention to the banking sector. Particularly well act today PKO BP (WSE: PKO), which valuation rises above 3 percent.

-

12:56

Major European stock indices trading in the green zone

European stock indices show a moderate increase, fueled by the growth of oil prices, as well as the expectations of the European Central Bank meeting.

According to a poll of 70 economists, conducted by Reuters, the ECB will leave its monetary policy unchanged in September, but by the end of the year a QE extension is likely. In addition, many analysts expect the Central Bank will hold its refinancing rate and the deposit rate - at 0.0 percent and -0.4 percent respectively by the end of 2017. The majority of economists said that the central bank will extend its monthly bond purchase program, which will end in March 2017. Few economists have noted that the ECB will soften the policy again by the end of the year, either by reducing the rate and / or expansion of QE program.

Some influence on the course of trading also provided data for Germany and the UK. The Statistical Office of Germany reported that industrial output fell sharply at the end of July, registering the largest drop in 23 months, which is another sign of slowing from Europe's largest economy. The report stated that the volume of industrial production decreased by 1.5 percent compared to June. Economists had expected an increase of 0.2 percent. Increased production in the construction sector (+1.8 per cent) and energy production (2.6 percent) was offset by a decline in the manufacturing industry (-2.3 percent).

The report published by the Office for National Statistics (ONS) showed that industrial production in the UK rose in July by 0.1 percent after flat in June. Experts predicted that the production will be reduced by 0.2 percent. Production decreased by 0.9 per cent, exceeding the estimate (-0.4 per cent) in the manufacturing sector, and speeding up the pace compared to June (-0.2 percent). Meanwhile, production in the mining and quarrying sector increased by 4.7 percent. In addition, the ONS reported that annual industrial production growth accelerated to 2.1 percent compared to 1.4 percent in June. This was the fastest growth in three months. It was expected that the figure will increase by 1.9 percent. Manufacturing output increased by 0.8 per cent y/y, after rising 0.6 percent in June (revised from +0.9 per cent). Analysts had forecast an increase in production by 1.7 per cent.

The composite index of the largest companies in the region Stoxx Europe 600 is trading almost unchanged. "Today the markets breath and look forward to tomorrow's ECB meeting. I do not expect that European stocks to rise markedly, unless the ECB does announce some additional measures.", - Said Michael Milcom, a senior analyst at Danske Bank A / S.

Shares of Royal Dutch Shell Plc, BP Plc and Total SA closed in positive territory for the third time in the last four days.

Banks shares lower the third day in a row, which is the longest series since mid-August. Quotes of UniCredit SpA fell 2.6 percent after the Italian Prime Minister Renzi said that the creditor may have to raise new capital.

CMC Markets Plc fell by 12 percent after the British broker reported a decline in net operating income.

The capitalization of Deutsche Lufthansa AG and Air France-KLM Group fell more than 2.5 percent as Deutsche Bank AG analysts downgraded shares of airlines to "sell."

Ashtead Group Plc Shares rose 6.7 percent after the British company said that the financial performance are likely to be better.

Quotes of Weir Group Plc rose 3.4 percent as Morgan Stanley analysts raised their rating to "buy".

At the moment:

FTSE 100 +6.04 6832.09 + 0.09%

DAX +31.61 10718.75 + 0.30%

CAC 40 +10.36 4540.32 + 0.23%

-

12:22

The outcome of the forthcoming US Presidential election will not impact the United States' Aaa stable credit rating - Moody's

"The outcome of the forthcoming US Presidential election will not impact the United States' Aaa stable credit rating, says Moody's Investors Service in a report.

That credit rating reflects the US sovereign's very high economic and institutional strength, strong debt affordability and its very low susceptibility to event risk given the role of the US dollar as global reserve currency and US Treasuries as global bond benchmark. These credit strengths indicate the credit rating is resilient to policy shifts or changes in government.

However, spending on non-discretionary social programs is projected to cause the federal deficit to widen significantly over the medium term, which will weaken the US' credit profile if not addressed. The choices made during the next US administration regarding fiscal policy and entitlement spending will have a greater impact on the medium-term credit profile of the United States than has been the case in the recent past, according to the report "Next President's fiscal policies will drive US's credit profile".

-

11:35

Expect These 3 ECB Policy Announcmnets - Citi

"The Governing Council is not closer to being able to demonstrate convincingly that its current policy settings are compatible with headline inflation returning to target by the end of the forecast horizon.

We look for three ECB policy announcements:

1- We think extension of asset purchases for at least six months would be a first step in the right direction.

2- alongside changes to QE modalities to circumvent any scarcity issues.

3- We also expect a 10bp cut in the refinancing rate to -0.1% to be the first step, ahead of a 10bp cut in the deposit rate to -0.5% in March 2017".

Copyright © 2016 CitiFX, eFXnews™

-

10:57

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 675m) 1.1125-30 (317m) 1.1265 (293m) 1.1400-05 (1.01bln) 1.1410 (1.17bln) 1.1415-25 (914m0

USD/JPY: 101.00 (USD 221m) 101.50 (250m) 101.70 (344m) 102.55 (230m) 103.00 (610m) 103.50 (480m)

GBP/USD 1.3300 (GBP 451m) 1.3500 (747m)

EUR/GBP 0.8300 (340m)

USD/CHF 0.9650 (USD 301m) 0.9850 (200m)

AUD/USD: 0.7445-50 ( AUD 519m) 0.7620 (409m)

USD/CAD 1.2580 (USD 200m) 1.3021-30 (525m)

AUD/JPY 75.10 (AUD 1.05bln)

-

10:43

UK: In July 2016 total production output was estimated to have increased by 2.1%

ONS: this is the first release of Index of Production (IoP) covering data post EU referendum. The release shows production is relatively flat month on month in July 2016 with a fall in manufacturing negated by a rise in oil and gas. Users should note that ONS always warns against overly interpreting one month's figures.

In July 2016, total production output was estimated to have increased by 2.1% compared with July 2015. All main sectors saw production increase with mining & quarrying providing the largest contribution to growth, increasing by 7.2%.

Manufacturing was estimated to have increased by 0.8% over the same period. Transport equipment provided the largest contribution to growth, increasing by 5.7%.

Comparing July 2016 with June 2016, production output is estimated to have increased by 0.1%.

Manufacturing was the only sector to contract from June 2016, falling by 0.9% with the largest contribution from pharmaceuticals. However, this was offset by growth in the other three sectors, particularly mining & quarrying, which increased by 4.7%.

-

10:30

United Kingdom: Manufacturing Production (YoY), July 0.8% (forecast 1.7%)

-

10:30

United Kingdom: Industrial Production (MoM), July 0.1% (forecast -0.2%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , July -0.9% (forecast -0.4%)

-

10:30

United Kingdom: Industrial Production (YoY), July 2.1% (forecast 1.9%)

-

10:15

Oil continue to rise

This morning New York WTI crude oil futures rose by 0.89% to $ 45.26 and Brent crude oil futures rose by + 0.97% to $ 47.70 per barrel. Thus, the black gold is trading in the green zone on the background of the collapse of the dollar and forecasts relating to the agreement between Moscow and Riyadh on a possible joint action to stabilize the market.

-

10:13

Today’s events

At 09:15 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

At 09:30 GMT Germany will hold an auction of 10-year bonds

At 13:15 GMT, the Bank of England will held parliamentary hearings on the issues of inflation and Governor Mark Carney will deliver a speech, member of the Commission of the Bank of England Kristin Forbes will deliver a speech, and the Commission of the Bank of England member Gertjan Vlige will deliver a speech

At 14:00 GMT the Bank of Canada decision on the interest rate

AT 14:00 FOMC Member Easter George will deliver a speech

At 22:55 GMT RBA Deputy Governor Philip Lowe will deliver a speech

-

09:28

WSE: After opening

WIG20 index opened at 1792.71 points (+0.10%)*

WIG 48232.99 0.32%

WIG30 2070.28 0.40%

mWIG40 4011.06 0.16%

At the start of the spot market virtually all of the largest companies are on the green side of the quotations. Start of European markets were without major changes. Growth of the German DAX-a by 0.2 per cent is not surprising after yesterday's US session. Against this background boosters the WIG20, which after quarter of trade grows by 0.5 percent and show force and market confidence in the response to growth impulse from other emerging markets. This movement also help the currency, the Polish zloty strengthened against the euro and the dollar. Output of the WIG20 index over 1,800 points indicates that the market has found strength to overcome the psychological barrier.

-

09:21

Major stock exchanges began trading in the green zone: DAX + 0.3%, CAC40 + 0.3%, FTSE + 0.4%

-

08:46

France: Trade Balance, bln, July -4.5 (forecast -3.7)

-

08:37

BoC To Stay The Course; USD/CAD Dips A Buying Opportunity - Credit Agricole

"Q2 GDP fell by 1.6% QoQ, confirming a significant slowdown in growth even after accounting for the impact of the Fort McMurray wildfire. Without the updated macroeconomic projections we believe the BoC will largely stay the course at the September meeting.

There should be some acknowledgement of an even Q2 GDP result than the central bank had been expecting but the BoC will wait until the October monetary policy report before considering any changes to the forward guidance or changing its assessment that the "overall balance of risks remains within the zone for which the current stance of monetary policy is appropriate".

Going forward the BoC's margin for error is quite small in our view. With potential growth of about 1.5% it will take a GDP expansion of well above 3% during the second half of the year to make any meaningful impact on reducing the output gap. This means that BoC may need to change its message in October if incoming data disappoints.

Nearterm volatility in USD/CAD is still mainly driven by external factors and with crude likely to remain under USD50/bl we continue to see dips in USD/CAD below 1.30 as buying opportunities".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

08:34

Big day for the pound as traders are waiting for industrial production and Carney’s inflation report. I put my money on a hawkish speech

-

08:29

Options levels on wednesday, September 7, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1361 (3523)

$1.1323 (4058)

$1.1295 (5080)

Price at time of writing this review: $1.1254

Support levels (open interest**, contracts):

$1.1214 (1936)

$1.1182 (2933)

$1.1141 (3529)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52986 contracts, with the maximum number of contracts with strike price $1,1250 (5080);

- Overall open interest on the PUT options with the expiration date September, 9 is 58198 contracts, with the maximum number of contracts with strike price $1,1000 (5662);

- The ratio of PUT/CALL was 1.10 versus 1.10 from the previous trading day according to data from September, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.3700 (695)

$1.3601 (791)

$1.3502 (1790)

Price at time of writing this review: $1.3418

Support levels (open interest**, contracts):

$1.3299 (849)

$1.3200 (709)

$1.3100 (1495)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32552 contracts, with the maximum number of contracts with strike price $1,3300 (2814);

- Overall open interest on the PUT options with the expiration date September, 9 is 28228 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.87 versus 0.84 from the previous trading day according to data from September, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.2%, FTSE -0.2%

-

08:29

WSE: Before opening

The yesterday's trading on Wall Street took place in the shadow of another weak reading of ISM index. This time a negative surprise comes from the ISM index for service sector, which reading was clearly worse than forecasts. As a result, the first halves of the session three key US averages were on cons and at the closing gained value. Broad the S&P 500 rose 0.3 percent and the Nasdaq Composite set a new all-time record in terms of closing levels.

Weak ISM readings with worse-than-expected labor market data for August will reduce the fear of investors for the September decision about interest rate rises.

Increases in the US should be sufficient for a positive opening session in Europe.

The Warsaw market have to deal today with two factors. The first one - pro-growth - weak data in the US and the likely lack of increases in the price of credit by the Fed favors bulls in emerging markets. The second element is the fluctuation of the index of the largest companies in the defeat of the level of 1,800 points.

Wednesday's morning trading on the currency market brings further recovery in valuations of the Polish zloty. Polish currency is quoted as follows: PLN 4.3308 per euro, PLN 3.8478 against the US dollar. Yields on domestic debt amounts to 2,811% for 10-year bonds.

-

08:28

Fed's Williams: US economy is in good shape, headed in right direction

-

Says it makes sense to raise interest rates gradually, sooner than later

-

Says US economy is in good shape, headed in right direction

-

Sees unemployment rate dropping to 4.5 pct over coming year

-

Sees inflation rising to 2 pct in next year or two

-

Fed's low inflation target is not well suited to era of persistently low interest rates

-

Fed should consider raising inflation target, switching to nominal GDP-targeting

-

Says now is the time for Fed to actively study new policy options

*via forexlive -

-

08:26

Aussie GDP below forecasts in Q2

According to rttnews, Australia's gross domestic product expanded a seasonally adjusted 0.5 percent on quarter in the second quarter of 2016, the Australian Bureau of Statistics said on Wednesday.

That was shy of expectations for 0.6 percent following the downwardly revised 1.0 percent increase in the first quarter (originally 1.1 percent).

On a yearly basis, GDP gained 3.3 percent - matching forecasts and up from the downwardly revised 3.0 percent gain in the three months prior (originally 3.1 percent).

Terms of trade increased 2.3 percent on quarter and fell 5.4 percent on year.

-

08:23

German production in industry was down by 1.5% from the previous month

In July 2016,production in industry was down by 1.5% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In June 2016, the corrected figure shows an increase of 1.1% (primary +0.8%) from May 2016.

In July 2016, production in industry excluding energy and construction was down by 2.3%. Within industry, the production of capital goods decreased by 3.6% and the production of consumer goods by 2.6%.The production of intermediate goods decreased by 0.8%. Energy production was up by 2.6% in July 2016 and the production in construction increased by 1.8%.

-

08:00

Germany: Industrial Production s.a. (MoM), July -1.5% (forecast 0.2%)

-

07:02

Japan: Coincident Index, July 112.8

-

07:01

Japan: Leading Economic Index , July 100.0 (forecast 98.6)

-

07:01

Japan: Leading Economic Index , July 100.0 (forecast 98.6)

-

06:31

Global Stocks

European stocks ended in the red on Tuesday after disappointing U.S. services data reignited worries about economic growth in the world's largest economy. The pan-European benchmark wobbled between small gains and losses for most of the day, after a mixed bag of corporate news, including a revenue warning from Ingenico Group SA and a takeover bid from Fresenius S.E.

U.S. stocks closed slightly higher Tuesday, with the tech-heavy Nasdaq logging a record close as investors digested a weak services-sector report, which might help convince the Federal Reserve to stay its hand as it considers raising interest rates. The prospect of lower rates for longer tends to be a negative for the currency, but a lower dollar is beneficial to multinational companies, making their exports relatively cheaper.

Asian shares were broadly higher on Wednesday, with the notable exception of Japan, which retreated amid a soaring yen. In Japan, the yen's rise also comes amid market speculation the Bank of Japan may not be able to act more decisively on further monetary easing at its policy meeting later this month, said Akira Moroga, a joint general manager in the market products division at Aozora Bank.

-

03:30

Australia: Gross Domestic Product (QoQ), Quarter II 0.5% (forecast 0.6%)

-

03:30

Australia: Gross Domestic Product (YoY), Quarter II 3.3% (forecast 3.4%)

-

01:46

Australia: AiG Performance of Construction Index, August 46.6

-

00:45

Commodities. Daily history for Sep 06’2016:

(raw materials / closing price /% change)

Oil$44.88+0.11%

Gold$1,354.00-0.07%

-

00:42

Stocks. Daily history for Sep 06’2016:

(index / closing price / change items /% change)

Nikkei 225 17,081.98 +44.35 +0.26%

Shanghai Composite 3,091.45 +19.35 +0.63%

S&P/ASX 200 5,413.63 -15.95 -0.29%CAC 40

CAC 4,529.96 -11.12 -0.24%

Xetra DAX 10,687.14 +14.92 +0.14%

FTSE 100 6,826.05 -53.37 -0.78%

S&P 500 2,186.48 +6.50 +0.30%

Dow Jones Industrial Average 18,538.12 +46.16 +0.25%

S&P/TSX Composite 14,813.02 +17.32 +0.12%

-

00:37

Currencies. Daily history for Sep 06’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1248 +0,91%

GBP/USD $1,3423 +0,87%

USD/CHF Chf0,9699 -1,01%

USD/JPY Y102,09 -1,30%

EUR/JPY Y114,12 -1,02%

GBP/JPY Y137,02 -0,74%

AUD/USD $0,7681 +1,28%

NZD/USD $0,7410 +1,46%

USD/CAD C$1,2846 -0,61%

-

00:01

Schedule for today, Wednesday, Sep 07’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Gross Domestic Product (QoQ) Quarter II 1.1% 0.4%

01:30 Australia Gross Domestic Product (YoY) Quarter II 3.1% 3.2%

05:00 Japan Leading Economic Index (Preliminary) July 99.2

05:00 Japan Coincident Index (Preliminary) July 111.1

06:00 Germany Industrial Production s.a. (MoM) July 0.8% 0.2%

06:45 France Trade Balance, bln July -3.4

07:00 United Kingdom Halifax house price index August -1%

07:00 United Kingdom Halifax house price index 3m Y/Y August 8.4%

08:30 United Kingdom Industrial Production (MoM) July 0.1% -0.2%

08:30 United Kingdom Industrial Production (YoY) July 1.6% 1.9%

08:30 United Kingdom Manufacturing Production (MoM) July -0.3% -0.4%

08:30 United Kingdom Manufacturing Production (YoY) July 0.9% 1.7%

14:00 United Kingdom NIESR GDP Estimate Quarter III 0.3%

14:00 Canada Ivey Purchasing Managers Index August 57

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 U.S. JOLTs Job Openings July 5.624

18:00 U.S. Fed's Beige Book

23:50 Japan Current Account, bln July 974.4 2090

23:50 Japan GDP, q/q (Finally) Quarter II 0.5% 0%

23:50 Japan GDP, y/y (Finally) Quarter II 2% 0.0%

-