Noticias del mercado

-

21:00

DJIA 18512.37 -25.75 -0.14%, NASDAQ 5274.27 -1.64 -0.03%, S&P 500 2184.65 -1.83 -0.08%

-

18:35

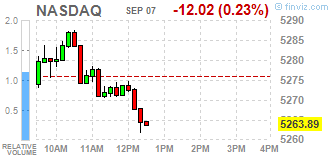

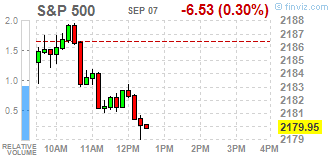

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes were slightly lower on Wednesday as investors awaited a key report by the Federal Reserve to gauge the health of the U.S. economy. Investors will wait until they get more clarity on presidential elections, the quality of third-quarter earnings and the timing of the next rate hike, Courtney said. While the Fed has been hinting at higher rates in the near-term, a recent set of weak economic data, including last week's jobs numbers, have muddied the outlook.

Most of Dow stocks in negative area (21 of 30). Top gainer - Caterpillar Inc. (CAT, +1.55%). Top loser - The Home Depot, Inc. (HD, -1.36%).

Most of S&P sectors also in negative area. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-0.6%).

At the moment:

Dow 18478.00 -45.00 -0.24%

S&P 500 2179.00 -5.50 -0.25%

Nasdaq 100 4817.75 -9.75 -0.20%

Oil 45.51 +0.68 +1.52%

Gold 1348.10 -5.90 -0.44%

U.S. 10yr 1.54 +0.00

-

18:00

European stocks closed: FTSE 6846.58 20.53 0.30%, DAX 10752.98 65.84 0.62%, CAC 4557.66 27.70 0.61%

-

17:38

WSE: Session Results

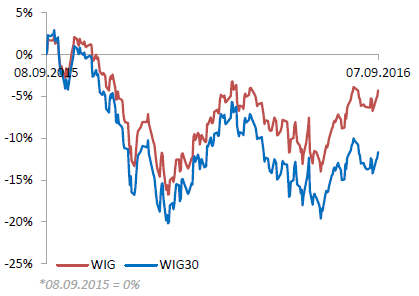

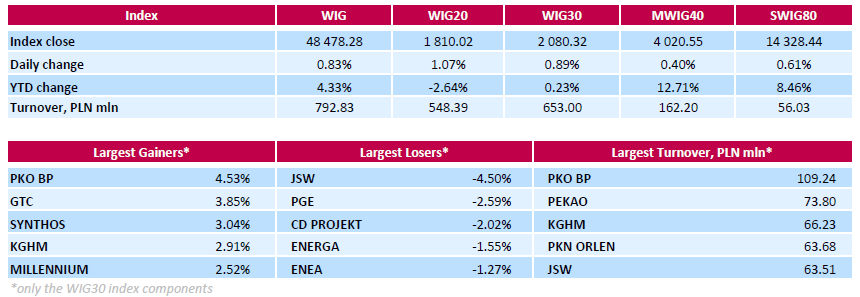

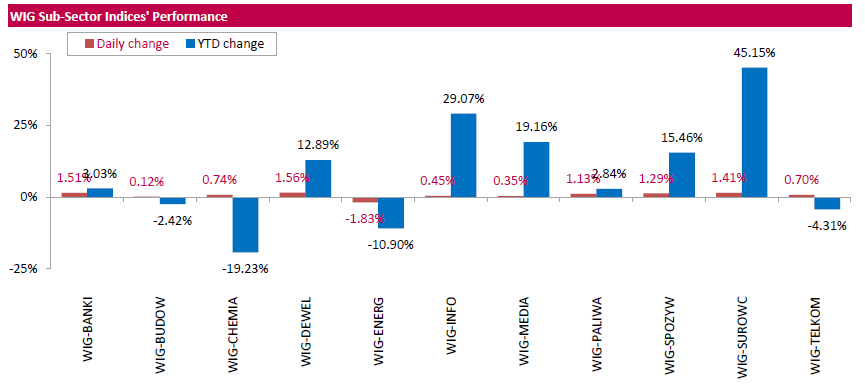

Polish equity market closed higher on Wednesday. The broad market benchmark, the WIG Index, surged by 0.83%. All sectors, but for utilities (-1.83%), rose, with developing sector (+1.56%) outperforming.

The large-cap stocks grew by 0.89%, as measured by the WIG30 Index. Within the index components, bank PKO BP (WSE: PBO) and property developer GTC (WSE: GTC) recorded the biggest gains, up 4.53% and 3.85% respectively. Other major advancers were chemical producer SYNTHOS (WSE: SNS), copper producer KGHM (WSE: KGHM) and bank MILLENNIUM (WSE: MIL), adding 3.04%, 2.91% and 2.52% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the decliners with a 4.5% drop, followed by genco PGE (WSE: PGE) and videogame developer CD PROJEKT (WSE: CDR), losing 2.59% and 2.02% respectively.

-

16:02

WSE: After start on Wall Street

The beginning of trading on Wall Street took place at the neutral level and with low volatility, which indicates a desire to remain in ongoing for some time consolidation. In this situation, we do not have yet any indication form the side of the American market. The WIG20 index after a few hours of stagnation lasting from the beginning of trading, around 14:00 began to march up and reported on the new daily maximum.

Increases are accompanied by greater market activity, so the demand has a chance to confirm the "buy" signal by the turnover. After breaking out of from consolidation, the demand has appeared and modestly but consistently improving earlier daily highs.

An hour before the end of the session the WIG20 index was at the level of 1,814 points (+ 1.33%).

-

15:33

U.S. Stocks open: Dow -0.12%, Nasdaq -0.04%, S&P -0.14%

-

15:26

Before the bell: S&P futures -0.08%, NASDAQ futures +0.07%

U.S. stock-index futures were little changed, with equities near a record, as investors brooded over the direction of Federal Reserve monetary policy after mixed economic reports.

Global Stocks:

Nikkei 17,012.44 -69.54 -0.41%

Hang Seng 23,741.81 -45.87 -0.19%

Shanghai 3,092.41 +1.69 +0.05%

FTSE 6,827.38 +1.33 +0.02%

CAC 4,545.32 +15.36 +0.34%

DAX 10,744.31 +57.17 +0.53%

Crude $44.66 (-0.38%)

Gold $1354.20 (+0.01%)

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Caterpillar (CAT) initiated with Buy at Deutsche Bank

Deere (DE) initiated with Hold at Deutsche Bank

Barrick Gold (ABX) initiated with a Sell at Berenberg

Facebook (FB) target increased to $160 at Morgan Stanley

-

14:39

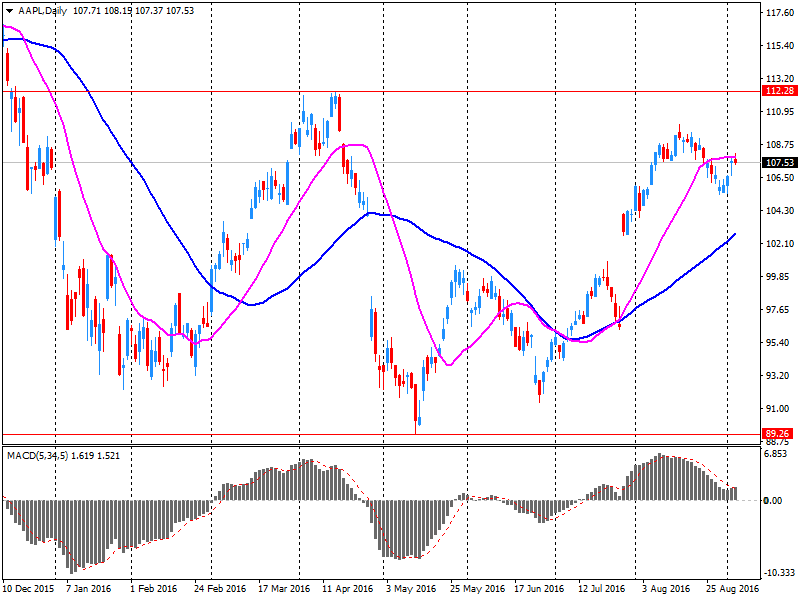

The lack of a headphone jack and a new shade of black: what to expect from Apple’s presentation

Today, 7 September, Apple (AAPL) will hold its annual autumn event in San Francisco, during which traditionally presents the new iPhone. According to CNN, this year we can even see the version of the smartphone in the new color to be closer to black.

New smartphone iPhone 7 and iPhone 7 Plus, most likely, will not differ significantly from their predecessors. Apple, apparently, decided to reserve significant changes to the iPhone for the 10th anniversary next year.

Rumors of the main innovations have already caused anger among potential buyers. Apple is expected to deprive the new Phone 7 Plus of its connector for headphones. Instead, you will need to use a wireless headset or connect via the existing Lightning-port. Probably, the company will provide users with adapters.

Positive changes include the improvement of the cameras installed on the iPhone 7 and iPhone 7 Plus. iPhone 7 Plus is expected to get two cameras to provide higher quality images in low light. In addition, Apple will abandon the 16-gigabyte model and increase the amount of storage of the initial models of the iPhone line up to 32 GB. There are also rumors that the new iPhone may be a waterproof or at least water resistant.

In addition the company will also introduce a lot of other innovations, including a new version of Apple Watch and updated software for all Apple products.

The event is scheduled for 17:00 GMT.

AAPL shares rose in premarket trading to $ 107.95 (+ 0.23%).

-

13:11

WSE: Mid session comment

The first half of trading on the Warsaw parquet ends with moderate success of the bulls side in form of increases of the WIG20 index by 0.7 percent. In this phase of trading usually not much happens and the activity should increase after Americans entering into the game. Besides recent increases in volatility in energy companies (which may mean the end of their relative weakness) is currently worth to pay attention to the banking sector. Particularly well act today PKO BP (WSE: PKO), which valuation rises above 3 percent.

-

12:56

Major European stock indices trading in the green zone

European stock indices show a moderate increase, fueled by the growth of oil prices, as well as the expectations of the European Central Bank meeting.

According to a poll of 70 economists, conducted by Reuters, the ECB will leave its monetary policy unchanged in September, but by the end of the year a QE extension is likely. In addition, many analysts expect the Central Bank will hold its refinancing rate and the deposit rate - at 0.0 percent and -0.4 percent respectively by the end of 2017. The majority of economists said that the central bank will extend its monthly bond purchase program, which will end in March 2017. Few economists have noted that the ECB will soften the policy again by the end of the year, either by reducing the rate and / or expansion of QE program.

Some influence on the course of trading also provided data for Germany and the UK. The Statistical Office of Germany reported that industrial output fell sharply at the end of July, registering the largest drop in 23 months, which is another sign of slowing from Europe's largest economy. The report stated that the volume of industrial production decreased by 1.5 percent compared to June. Economists had expected an increase of 0.2 percent. Increased production in the construction sector (+1.8 per cent) and energy production (2.6 percent) was offset by a decline in the manufacturing industry (-2.3 percent).

The report published by the Office for National Statistics (ONS) showed that industrial production in the UK rose in July by 0.1 percent after flat in June. Experts predicted that the production will be reduced by 0.2 percent. Production decreased by 0.9 per cent, exceeding the estimate (-0.4 per cent) in the manufacturing sector, and speeding up the pace compared to June (-0.2 percent). Meanwhile, production in the mining and quarrying sector increased by 4.7 percent. In addition, the ONS reported that annual industrial production growth accelerated to 2.1 percent compared to 1.4 percent in June. This was the fastest growth in three months. It was expected that the figure will increase by 1.9 percent. Manufacturing output increased by 0.8 per cent y/y, after rising 0.6 percent in June (revised from +0.9 per cent). Analysts had forecast an increase in production by 1.7 per cent.

The composite index of the largest companies in the region Stoxx Europe 600 is trading almost unchanged. "Today the markets breath and look forward to tomorrow's ECB meeting. I do not expect that European stocks to rise markedly, unless the ECB does announce some additional measures.", - Said Michael Milcom, a senior analyst at Danske Bank A / S.

Shares of Royal Dutch Shell Plc, BP Plc and Total SA closed in positive territory for the third time in the last four days.

Banks shares lower the third day in a row, which is the longest series since mid-August. Quotes of UniCredit SpA fell 2.6 percent after the Italian Prime Minister Renzi said that the creditor may have to raise new capital.

CMC Markets Plc fell by 12 percent after the British broker reported a decline in net operating income.

The capitalization of Deutsche Lufthansa AG and Air France-KLM Group fell more than 2.5 percent as Deutsche Bank AG analysts downgraded shares of airlines to "sell."

Ashtead Group Plc Shares rose 6.7 percent after the British company said that the financial performance are likely to be better.

Quotes of Weir Group Plc rose 3.4 percent as Morgan Stanley analysts raised their rating to "buy".

At the moment:

FTSE 100 +6.04 6832.09 + 0.09%

DAX +31.61 10718.75 + 0.30%

CAC 40 +10.36 4540.32 + 0.23%

-

09:28

WSE: After opening

WIG20 index opened at 1792.71 points (+0.10%)*

WIG 48232.99 0.32%

WIG30 2070.28 0.40%

mWIG40 4011.06 0.16%

At the start of the spot market virtually all of the largest companies are on the green side of the quotations. Start of European markets were without major changes. Growth of the German DAX-a by 0.2 per cent is not surprising after yesterday's US session. Against this background boosters the WIG20, which after quarter of trade grows by 0.5 percent and show force and market confidence in the response to growth impulse from other emerging markets. This movement also help the currency, the Polish zloty strengthened against the euro and the dollar. Output of the WIG20 index over 1,800 points indicates that the market has found strength to overcome the psychological barrier.

-

09:21

Major stock exchanges began trading in the green zone: DAX + 0.3%, CAC40 + 0.3%, FTSE + 0.4%

-

08:29

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.2%, FTSE -0.2%

-

08:29

WSE: Before opening

The yesterday's trading on Wall Street took place in the shadow of another weak reading of ISM index. This time a negative surprise comes from the ISM index for service sector, which reading was clearly worse than forecasts. As a result, the first halves of the session three key US averages were on cons and at the closing gained value. Broad the S&P 500 rose 0.3 percent and the Nasdaq Composite set a new all-time record in terms of closing levels.

Weak ISM readings with worse-than-expected labor market data for August will reduce the fear of investors for the September decision about interest rate rises.

Increases in the US should be sufficient for a positive opening session in Europe.

The Warsaw market have to deal today with two factors. The first one - pro-growth - weak data in the US and the likely lack of increases in the price of credit by the Fed favors bulls in emerging markets. The second element is the fluctuation of the index of the largest companies in the defeat of the level of 1,800 points.

Wednesday's morning trading on the currency market brings further recovery in valuations of the Polish zloty. Polish currency is quoted as follows: PLN 4.3308 per euro, PLN 3.8478 against the US dollar. Yields on domestic debt amounts to 2,811% for 10-year bonds.

-

06:31

Global Stocks

European stocks ended in the red on Tuesday after disappointing U.S. services data reignited worries about economic growth in the world's largest economy. The pan-European benchmark wobbled between small gains and losses for most of the day, after a mixed bag of corporate news, including a revenue warning from Ingenico Group SA and a takeover bid from Fresenius S.E.

U.S. stocks closed slightly higher Tuesday, with the tech-heavy Nasdaq logging a record close as investors digested a weak services-sector report, which might help convince the Federal Reserve to stay its hand as it considers raising interest rates. The prospect of lower rates for longer tends to be a negative for the currency, but a lower dollar is beneficial to multinational companies, making their exports relatively cheaper.

Asian shares were broadly higher on Wednesday, with the notable exception of Japan, which retreated amid a soaring yen. In Japan, the yen's rise also comes amid market speculation the Bank of Japan may not be able to act more decisively on further monetary easing at its policy meeting later this month, said Akira Moroga, a joint general manager in the market products division at Aozora Bank.

-

00:42

Stocks. Daily history for Sep 06’2016:

(index / closing price / change items /% change)

Nikkei 225 17,081.98 +44.35 +0.26%

Shanghai Composite 3,091.45 +19.35 +0.63%

S&P/ASX 200 5,413.63 -15.95 -0.29%CAC 40

CAC 4,529.96 -11.12 -0.24%

Xetra DAX 10,687.14 +14.92 +0.14%

FTSE 100 6,826.05 -53.37 -0.78%

S&P 500 2,186.48 +6.50 +0.30%

Dow Jones Industrial Average 18,538.12 +46.16 +0.25%

S&P/TSX Composite 14,813.02 +17.32 +0.12%

-