Noticias del mercado

-

21:01

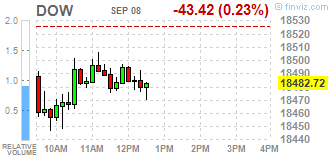

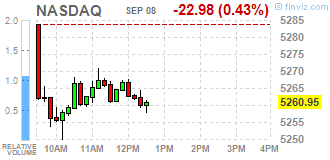

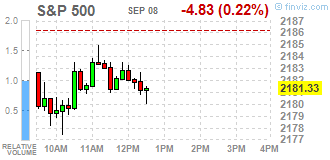

DJIA 18490.35 -35.79 -0.19%, NASDAQ 5261.24 -22.69 -0.43%, S&P 500 2182.53 -3.63 -0.17%

-

18:41

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes lower on Thursday as a drop in Apple shares weighed, a day after the tech giant unveiled the new iPhone 7 that failed to impress Wall Street. Oil prices soared more than 3%, limiting some losses on Wall Street. Investor reaction to a drop in weekly jobless claims and the European Central Bank's expected decision to leave rates and stimulus program unchanged was largely muted.

Most of Dow stocks in negative area (21 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.13%). Top loser - Apple Inc. (AAPL, -2.40%).

Most of S&P sectors also in negative area. Top gainer - Basic Materials (+0.8%). Top loser - Consumer goods (-0.9%).

At the moment:

Dow 18397.00 -36.00 -0.20%

S&P 500 2172.75 -5.25 -0.24%

Nasdaq 100 4799.00 -25.25 -0.52%

Oil 47.15 +1.65 +3.63%

Gold 1341.20 -8.00 -0.59%

U.S. 10yr 1.59 +0.05

-

18:01

European stocks closed: FTSE 6859.06 12.48 0.18%, DAX 10672.23 -80.75 -0.75%, CAC 4543.08 -14.58 -0.32%

-

17:50

WSE: Session Results

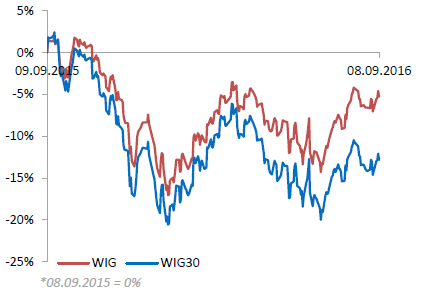

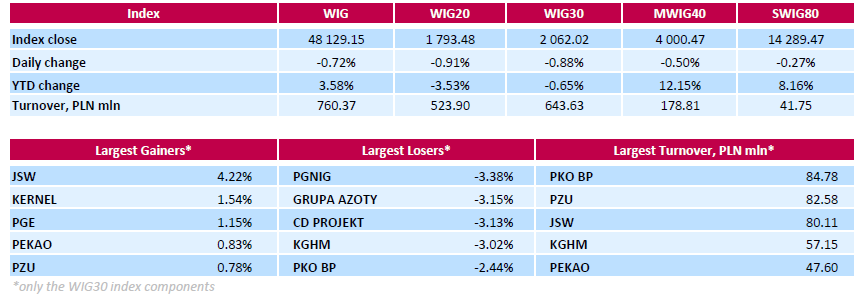

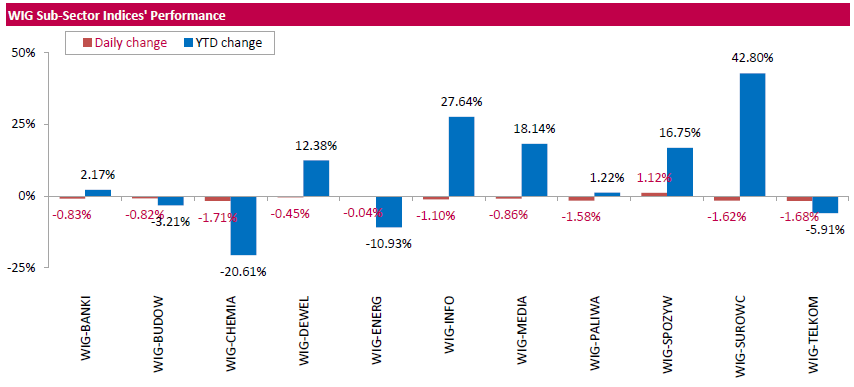

Polish equities were lower on Thursday, with the broad-market measure, the WIG index, losing 0.72%. All sectors, but for food (+1.12%), were down, with chemicals (-1.71%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, slid down 0.88%. Within the index components, oil and gas producer PGNIG (WSE: PGN) suffered the steepest decline of 3.38%. The company's CEO Piotr Wozniak announced plans to buy gas deposits in Norway. According to Mr. Wozniak, PGNIG wants to increase its gas output in Norway to 2.0-2.5 bln cubic meters annually by 2022 (up from 573 mln cubic meters in 2015). Elsewhere, chemical producer GRUPA AZOTY (WSE: ATT) sank by 3.15% on news the Russian fertilizer manufacturer ACRON is in talks with Poland's treasury ministry on selling its ~20% stake in GRUPA AZOTY. Other biggest decliners were videogame developer CD PROJEKT (WSE: CDR), copper producer KGHM (WSE: KGH) and two banking sector names PKO BP (WSE: PKO) and MBANK (WSE: MBK), plunging by 2.22%-3.13%. On the other side of the ledger, coking coal producer JSW (WSE: JSW) topped the gainers' list, correcting upwards by 4.22% after two consecutive sessions of declines. It was followed by agricultural producer KERNEL (WSE: KER) and genco PGE (WSE: PGE), advancing 1.54% and 1.15% respectively.

-

15:55

WSE: After start on Wall Street

Behind us the press conference after the ECB meeting. The communication of the ECB announced that it does not change any parameters of their policies. Interest rates remain maintained, as the scope and duration of the purchase of assets (that is, to March the next year). This was a slight disappointment, which causes the strengthening of the euro and the weakening of the DAX-a.

At a press conference on the direct question whether during the meeting was discussed the extend of the asset purchase program, Mario Draghi denied. This negative answer was not quite a big surprise, but caused a clear deterioration in sentiment in the markets.

The market in the United States began a decline of 0.2%, which was obvious growing. This is to some extent due to the disappointing words of the head of the ECB. However ECB policy impact is greater in Europe and here the market effect is also greater. The WIG20 index an hour before the close of trading falls by 0.85%.

-

15:33

U.S. Stocks open: Dow -0.27%, Nasdaq -0.35%, S&P -0.24%

-

15:25

Before the bell: S&P futures -0.23%, NASDAQ futures -0.24%

U.S. stock-index futures fell as European Central Bank policy President Mario Draghi downplayed the need for more stimulus.

Global Stocks:

Nikkei 16,958.77 -53.67 -0.32%

Hang Seng 23,919.34 +177.53 +0.75%

Shanghai 3,096.60 +4.67 +0.15%

FTSE 6,864.08 +17.50 +0.26%

CAC 4,556.84 -0.82 -0.02%

DAX 10,719.09 -33.89 -0.32%

Crude $46.29 (+1.74%)

Gold $1352.00 (+0.21%)

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Neutral from Overweight at Piper Jaffray

Hewlett Packard Enterprise (HPE) downgraded to Market Perform at Wells Fargo

Apple (AAPL) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Tesla Motors (TSLA) initiated with a Underperform at Cowen; target $160

Hewlett Packard Enterprise (HPE) target raised to $20 from $16 at Mizuho

Hewlett Packard Enterprise (HPE) target raised to $24 from $22 at Needham

-

13:54

Company News: Hewlett Packard Enterprise (HPE) posts mixed Q3 financials and announces plans for a spin-off and merger of its non-core software assets with British software firm Micro Focus

Hewlett Packard Enterprise (HPE) reported Q3 FY2016 earnings of $0.49 per share, beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $12.210 bln (-3.9% y/y), missing analysts' consensus estimate of $12.611 bln.

Hewlett Packard Enterprise issued downside guidance for Q4, projecting EPS of $0.44-0.49 versus analysts' consensus estimate of $0.60.

In addition, the company announced plans for a spin-off and merger of its non-core software assets with British software firm Micro Focus in a transaction valued at approx. $8.8 bln. HPE shareholders will own 50.1% of the newly merged firm.

HPE fell to $21.82 (-1.22%) in pre-market trading.

-

13:05

WSE: Mid session comment

The Warsaw market in the first phase of the session, after an initial decline, smoothly passed to the expected stabilization. Only the mid companies correct somewhat, which is supported among others by the downward movement of the JSW shares.

In Europe, the euro slightly strengthened, but banks gain, which may indicate a lack of distinct expectations about the tone of comments from the ECB. The stronger growth of the Eurodollar pair due to approach of EBC decisions and conference, may signal that markets are discounting a future element of expression. However, it seems that the market is positive about the prospects for the euro in the context of today's news from the ECB, as seen in the course.

At the halfway point of quotations the WIG20 index stood at 1,808 points (-0,08%). The turnover in the segment of blue chips was on the level of PLN 215 mln.

-

09:24

Major stock exchanges trading mixed after opening: FTSE + 0.1%, DAX flat, CAC40 -0.1%, FTMIB flat, IBEX + 0.2%

-

09:16

WSE: After opening

WIG20 index opened at 1811.76 points (+0.10%)*

WIG 48533.07 0.11%

WIG30 2082.08 0.08%

mWIG40 4024.19 0.09%

*/ - change to previous close

Traditionally, the first transactions on the futures market were with no surprises. The cash market also began in the area of the reference level, encouraged by the lack of major changes in environment. Still the highest turnover collects JSW, but also point Action (WSE: ACT) and Wielton (WSE: WLT) -very good reading of results. It should be noted that in the case of the WIG20 index has been outdone exponential average of 21 sessions and the resistance level of 1,800 points.

-

08:54

Mixed start expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 -0.1%, FTSE + 0.1%

-

08:21

WSE: Before opening

Yesterday's trading on Wall Street ended in neutral. Once again, a light support proved to be published two hours before the end of the American session, the Fed beige book. Asian markets are dominated by modest declines. In the US, Apple demonstrated the new iPhone 7, the main changes are a bit longer operating battery, better camera and waterproofness achieved by the elimination of a standard headphone jack. Shares of the company gained a modest 0.6%.

During today's session, there is no more significant macroeconomic publications from the domestic market. NBP will give away only the data regarding financial situation of households in the first quarter. Investor's attention will focus today on the ECB meeting. The market is expected to extend the QE program and possible changes in parameters of the purchase of European debt. The least likely change is the further reduction in interest.

After closing of yesterday's session, there were reports that PKO BP (WSE: PKO) and Alior Bank (WSE: ALR) made an offer to buy Raiffeisen Polbank. It seems that they are the only candidate seriously interested in the purchase.

-

06:51

Global Stocks

European stocks darted between small gains and losses Wednesday, with investors assessing a larger-than-expected drop in German industrial production before the European Central Bank issues its next policy decision on Thursday.

U.S. stocks fell on Wednesday as the Federal Reserve's Beige Book report painted a generally positive picture of the U.S. economy, providing more fodder for the central bank as it contemplates an interest rate hike in the near term.

-

00:29

Stocks. Daily history for Sep 07’2016:

(index / closing price / change items /% change)

Nikkei 225 17,012.44 -69.54 -0.41%

Shanghai Composite 3,092.41 +1.69 +0.05%

S&P/ASX 200 5,424.25 +10.62 +0.20%

FTSE 100 6,846.58 +20.53 +0.30%

CAC 40 4,557.66 +27.70 +0.61%

Xetra DAX 10,752.98 +65.84 +0.62%

S&P 500 2,186.16 -0.32 -0.01%

Dow Jones Industrial Average 18,526.14 -11.98 -0.06%

S&P/TSX Composite 14,796.75 -16.27 -0.11%

-