Noticias del mercado

-

21:00

DJIA 18180.09 -299.82 -1.62%, NASDAQ 5156.09 -103.39 -1.97%, S&P 500 2139.80 -41.50 -1.90%

-

18:03

European stocks closed: FTSE 6776.95 -81.75 -1.19%, DAX 10573.44 -101.85 -0.95%, CAC 4491.40 -50.80 -1.12%

-

17:37

WSE: Session Results

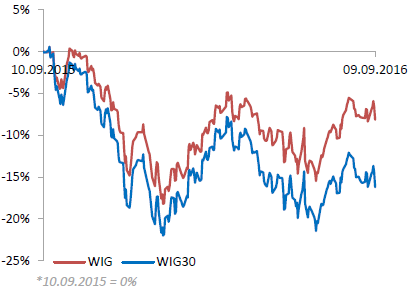

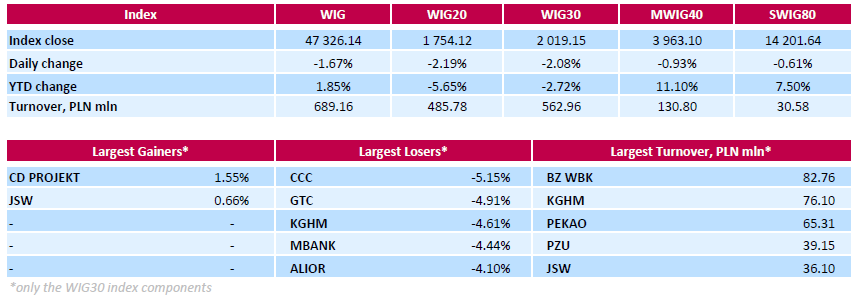

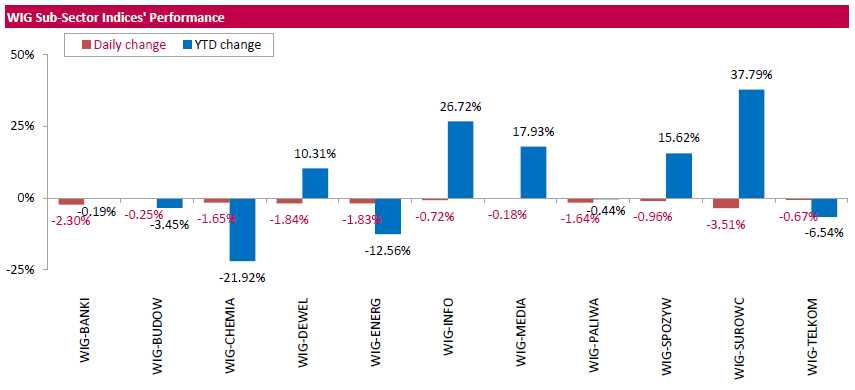

Polish equity market closed lower on Friday, with the broad-market measure, the WIG Index, dropping by 1.67%. All sectors in the WIG retreated, with materials (-3.51%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, plunged by 2.08%. Only two index constituents managed to generate positive returns. Videogame developer CD PROJEKT (WSE: CDR) added 1.55%, while coking coal producer JSW (WSE: JSW) rose 0.66%. At the same time, the session's biggest loser was footwear retailer CCC (WSE: CCC), which tumbled by 5.15%. It was followed by property developer GTC (WSE: GTC), copper producer KGHM (WSE: KGH) and two banking names ALIOR (WSE: ALR) and MBANK (WSE: MBK), which slumped by 4.1%-4.91%.

-

17:13

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday amid investor caution following a nuclear test by North Korea and comments by a U.S. Federal Reserve official that supported an interest rate hike. North Korea conducted its fifth and biggest nuclear test on Friday and said it had mastered the ability to mount a warhead on a ballistic missile, drawing condemnation from the United States as well as China, Pyongyang's main ally.

All Dow stocks in negative area (30 of 30). Top loser - Caterpillar Inc. (CAT, -2.11%).

All S&P sectors also in negative area. Top loser - Utilities (-2.3%).

At the moment:

Dow 18212.00 -169.00 -0.92%

S&P 500 2148.50 -22.50 -1.04%

Nasdaq 100 4746.75 -45.75 -0.95%

Oil 46.38 -1.24 -2.60%

Gold 1336.60 -5.00 -0.37%

U.S. 10yr 1.67 +0.05

-

15:53

WSE: After start on Wall Street

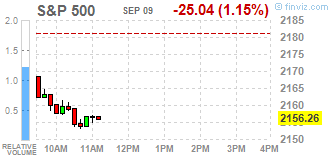

Declining start on Wall Street does not help for quotations on the Warsaw market. The S&P500 index started trading from a clear "bear gap" and almost immediately went to test the minimum level of the first session of September.

It does not help us also the situation on the currency market. Today we will face a new, awaited decision on the rating of the Polish debt. The zloty, however, is not waiting for the decision of the agency and clearly losing on the broad market. The reason of the weakness is quite surprising rally of the dollar, which began yesterday after the decision of the European Central Bank. While the return of the US currency appreciation was a matter of time, whereas the rate of return is surprising. There are signs that the market does not negate the possibility of interest rate increases in September.

An hour before the end of the trading the WIG20 index was at the level of 1,757 points (-2,00%).

-

15:32

U.S. Stocks open: Dow -0.69%, Nasdaq -0.75%, S&P -0.76%

-

15:28

Before the bell: S&P futures -0.61%, NASDAQ futures -0.68%

U.S. stock-index futures declined amid signals that central banks are becoming less willing to boost stimulus efforts to bolster growth.

Global Stocks:

Nikkei 16,965.76 +6.99 +0.04%

Hang Seng 24,099.70 +180.36 +0.75%

Shanghai 3,078.85 -17.10 -0.55%

FTSE 6,808.94 -49.76 -0.73%

CAC 4,513.10 -29.10 -0.64%

DAX 10,615.56 -59.73 -0.56%

Crude $46.61 (-2.12%)

Gold $1340.00 (-0.12%)

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Outperform at Macquarie

Other:

Facebook (FB) added to focus list at Goldman

American Express (AXP) initiated with a Underweight at Atlantic Equities

-

13:03

WSE: Mid session comment

In the mid-session the WIG20 lost 1,36% and the turnover counter for this index shows PLN 268 mln. The consolation may be just the fact that we are not alone in this decline. The last part of the trade brings in fact visible weakness of parquets in Euroland. Loses both the DAX as the CAC40. Unfortunately, as a relatively weaker market, the WSE lose disproportionately harder.

The weakness of the Warsaw Stock Exchange may be due to the fear of a possible cut rating for Poland today by Moody's. Investor behavior probably reflects the carefulness while on the exchange market we do not see any major shifts.

-

09:11

WSE: After opening

WIG20 index opened at 1792.55 points (-0.05%)*

WIG 48062.45 -0.14%

WIG30 2057.84 -0.20%

mWIG40 4001.00 0.01%

*/ - change to previous close

After yesterday, the next loss by the WIG20 index the level of 1,800 points today's session begins with the deepening of the departure. Bears in the morning, of course, are favored by the outer atmosphere, including declines in contracts for the major European indices. There also were not without significance weaker than expected macro data from Germany. A clear decline in both exports as well as imports in the German economy in July is not optimistic.

-

08:29

WSE: Before opening

Thursday's trading on Wall Street was dominated by low volatility and ended practically at the same levels as the opening. Significantly increased oil prices, which stores, as reported by the US Department of Energy, fell by 14.51 million barrels, the highest since January 1999.

The American trade was influenced by atmosphere from Europe after a disappointing conference of the head of the ECB.

Current quotations of futures contracts on the S&P500 does not indicate any major changes and the beginning of the session in Europe should be at the light cons.

Some concerns awaken after reports from Asia, where markets responded to the nuclear test in North Korea, although changes in Asian indices are not spectacular.

On the Warsaw market yesterday's correlation with core markets and exit down by the WIG20 index negated the gains from Wednesday's session. Thus, it is difficult to expect today any fireworks.

During today's session, there is no important macroeconomic publications from the country. Also, the wide macro calendar contains no key indications. As a result, the session may pass under the sign of waiting for a move by the Moody's regarding rating for Poland, which will have great importance for the Polish currency and will determine the opening of trading on the stock market on Monday.

-

06:32

Global Stocks

European stocks closed lower Thursday, weighed down by a slide in German equities and a rising euro, after the European Central Bank held off from expanding its monetary stimulus. The moves came as ECB President Mario Draghi spoke after the bank's monetary policy meeting in Frankfurt. He said while there are still risks to the eurozone economy, the current outlook for the bloc does not warrant a decision for the central bank to act now.

U.S. stocks on Thursday closed lower after the European Central Bank kept key interest rates steady but disappointed some by not announcing additional measures to boost Europe's sluggish economy.

Asian markets were mixed after a North Korean earthquake was likely caused by an explosion, possibly from a nuclear test in the isolated nation.

-

00:29

Stocks. Daily history for Sep 08’2016:

(index / closing price / change items /% change)

Nikkei 225 16,958.77 -53.67 -0.32%

Shanghai Composite 3,096.60 +4.67 +0.15%

S&P/ASX 200 5,385.75 -38.50 -0.71%

FTSE 100 6,858.70 +12.12 +0.18%

CAC 40 4,542.20 -15.46 -0.34%

Xetra DAX 10,675.29 -77.69 -0.72%

S&P 500 2,181.30 -4.86 -0.22%

Dow Jones Industrial Average 18,479.91 -46.23 -0.25%

S&P/TSX Composite 14,803.26 +6.51 +0.04%

-