Noticias del mercado

-

17:47

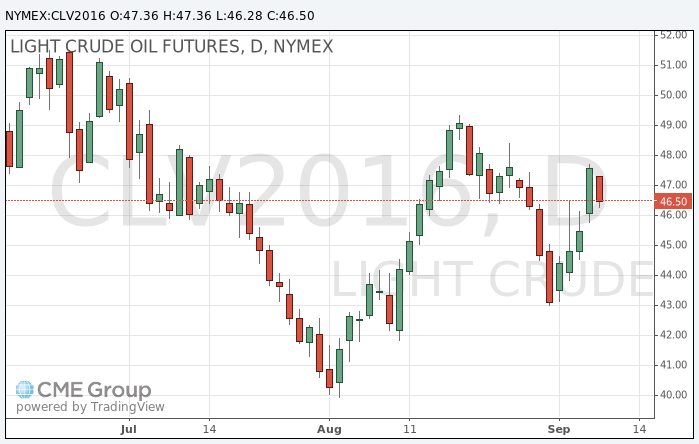

Oil prices fell

Oil prices fell on skepticism regarding the sharp fall in US oil inventories last week. Traders do not expect that this trend to continue in the future.

However, at the end of this week the price of oil is likely to show growth against the backdrop of the strongest stocks drop over the past 17 years, and also because of signs of high demand.

On Thursday, oil prices rose sharply after US Department of Energy's data shown a significant reduction in inventories - 14.5 million barrels last week. This is the strongest fall in the last 17 years.

However, the oil in the world is near record values, keeping low prices. Traders are closely watching the reserves data, waiting for signs of declining global oversupply.

However, many traders and fund managers believe that the reduction of inventories only turned a single anomaly due to interruptions in production and oil imports due to worsening weather conditions in the Gulf of Mexico.

"The storm caused interruptions in the production and import of crude oil last week," - said Norbert Rücker from Julius Baer. "Oil and gas production in the Gulf of Mexico almost recovered in volume and tankers again stood in line to unload, inventory reduction is likely to be a single event".

The cost of October futures for WTI (Light Sweet Crude Oil) fell to 46.28 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of mark Brent fell to 48.53 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:24

Gold continue to decline

Gold price fell for a third day against the dollar strengthening as gold traders are worried that the Fed may raise interest rates sooner than expected.

The Federal Reserve Bank of Boston President Eric Rosengren spoke in favor of raising interest rates, prompting speculation that the central bank may raise interest rates in September.

Economic data from the US in the last week, including reports on jobs and manufacturing supported gold, as it reduces expectations for a September hike. At the same time the gold market also reacts to the statements of the heads of the Fed, which leads to sharp fluctuations in prices in a low volume of transactions.

"This week it seems that activity in the market is low, and it seems that it will be the whole of September.", - Said Peter Hug from Kitco Metals. "It makes traders nervous, and so the market moves so smoothly", - he added.

The probability of a September rate hike makes investors nervous, prompting some of them to reduce long positions in gold, said Haq.

The cost of the October futures for gold on the COMEX fell to $ 1330.3 per ounce.

-

11:31

Oil is trading in the red zone

This morning New York WTI crude oil futures fell by 1.05% to $ 47.12 and Brent oil futures fell 1.16% to $ 49.40 per barrel. Thus, the black gold is traded lower corecting after the up move due to a sharp decline in US oil inventories due to falling imports on the US Gulf Coast to a record low. The reserves of black gold in the United States fell for the week by 14.51 million barrels - the most since January 1999, according to the Energy Information Administration. Import in the US Gulf of Mexico has fallen to 2.5 million barrels per day. Analysts said imports fell because of the Tropical Storm Hermine, which provoked the suspension of shipments in Texas and Louisiana.

-

00:29

Commodities. Daily history for Sep 07’2016:

(raw materials / closing price /% change)

Oil 47.32-0.63%

Gold 1,342.20+0.04%

-