Noticias del mercado

-

21:00

DJIA 18180.09 -299.82 -1.62%, NASDAQ 5156.09 -103.39 -1.97%, S&P 500 2139.80 -41.50 -1.90%

-

18:03

European stocks closed: FTSE 6776.95 -81.75 -1.19%, DAX 10573.44 -101.85 -0.95%, CAC 4491.40 -50.80 -1.12%

-

17:47

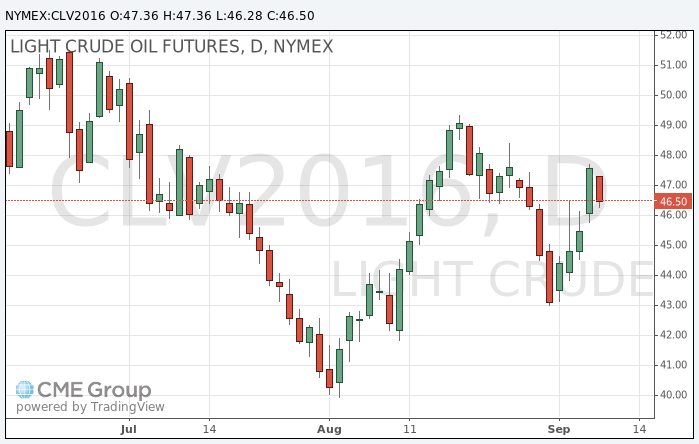

Oil prices fell

Oil prices fell on skepticism regarding the sharp fall in US oil inventories last week. Traders do not expect that this trend to continue in the future.

However, at the end of this week the price of oil is likely to show growth against the backdrop of the strongest stocks drop over the past 17 years, and also because of signs of high demand.

On Thursday, oil prices rose sharply after US Department of Energy's data shown a significant reduction in inventories - 14.5 million barrels last week. This is the strongest fall in the last 17 years.

However, the oil in the world is near record values, keeping low prices. Traders are closely watching the reserves data, waiting for signs of declining global oversupply.

However, many traders and fund managers believe that the reduction of inventories only turned a single anomaly due to interruptions in production and oil imports due to worsening weather conditions in the Gulf of Mexico.

"The storm caused interruptions in the production and import of crude oil last week," - said Norbert Rücker from Julius Baer. "Oil and gas production in the Gulf of Mexico almost recovered in volume and tankers again stood in line to unload, inventory reduction is likely to be a single event".

The cost of October futures for WTI (Light Sweet Crude Oil) fell to 46.28 dollars per barrel on the New York Mercantile Exchange.

October futures price for North Sea petroleum mix of mark Brent fell to 48.53 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:37

WSE: Session Results

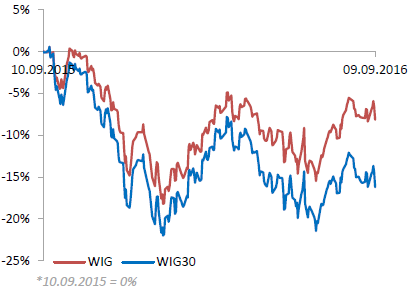

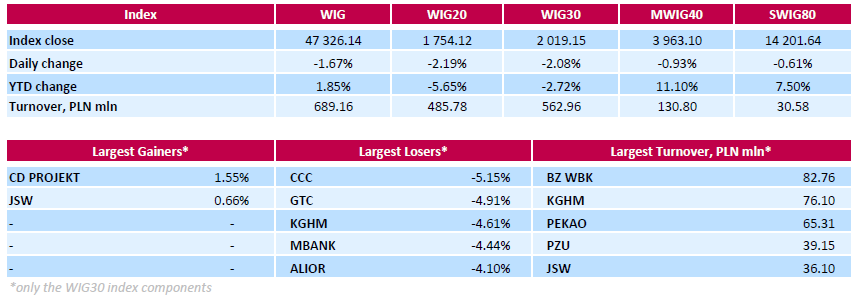

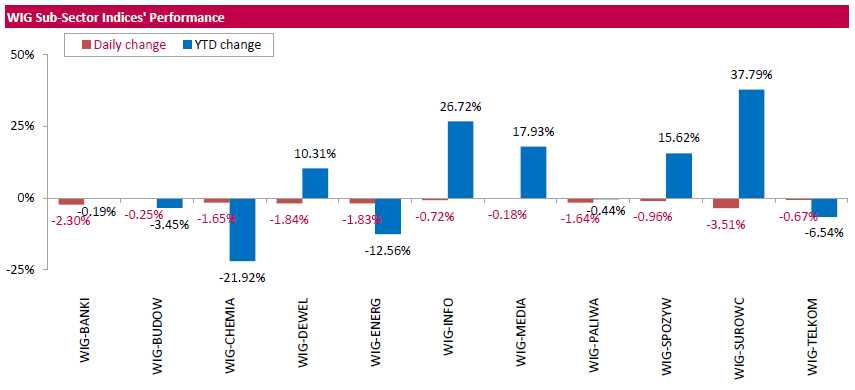

Polish equity market closed lower on Friday, with the broad-market measure, the WIG Index, dropping by 1.67%. All sectors in the WIG retreated, with materials (-3.51%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, plunged by 2.08%. Only two index constituents managed to generate positive returns. Videogame developer CD PROJEKT (WSE: CDR) added 1.55%, while coking coal producer JSW (WSE: JSW) rose 0.66%. At the same time, the session's biggest loser was footwear retailer CCC (WSE: CCC), which tumbled by 5.15%. It was followed by property developer GTC (WSE: GTC), copper producer KGHM (WSE: KGH) and two banking names ALIOR (WSE: ALR) and MBANK (WSE: MBK), which slumped by 4.1%-4.91%.

-

17:24

Gold continue to decline

Gold price fell for a third day against the dollar strengthening as gold traders are worried that the Fed may raise interest rates sooner than expected.

The Federal Reserve Bank of Boston President Eric Rosengren spoke in favor of raising interest rates, prompting speculation that the central bank may raise interest rates in September.

Economic data from the US in the last week, including reports on jobs and manufacturing supported gold, as it reduces expectations for a September hike. At the same time the gold market also reacts to the statements of the heads of the Fed, which leads to sharp fluctuations in prices in a low volume of transactions.

"This week it seems that activity in the market is low, and it seems that it will be the whole of September.", - Said Peter Hug from Kitco Metals. "It makes traders nervous, and so the market moves so smoothly", - he added.

The probability of a September rate hike makes investors nervous, prompting some of them to reduce long positions in gold, said Haq.

The cost of the October futures for gold on the COMEX fell to $ 1330.3 per ounce.

-

17:13

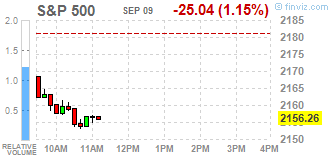

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday amid investor caution following a nuclear test by North Korea and comments by a U.S. Federal Reserve official that supported an interest rate hike. North Korea conducted its fifth and biggest nuclear test on Friday and said it had mastered the ability to mount a warhead on a ballistic missile, drawing condemnation from the United States as well as China, Pyongyang's main ally.

All Dow stocks in negative area (30 of 30). Top loser - Caterpillar Inc. (CAT, -2.11%).

All S&P sectors also in negative area. Top loser - Utilities (-2.3%).

At the moment:

Dow 18212.00 -169.00 -0.92%

S&P 500 2148.50 -22.50 -1.04%

Nasdaq 100 4746.75 -45.75 -0.95%

Oil 46.38 -1.24 -2.60%

Gold 1336.60 -5.00 -0.37%

U.S. 10yr 1.67 +0.05

-

16:25

US wholesale inventories flat in July. The dollar continue to rise

The U.S. Census Bureau announced today that July 2016 sales of merchant wholesalers, except manufacturers' sales branches and offices, after adjustment for seasonal variations and trading-day differences but not for price changes, were $441.9 billion, down 0.4 percent (+/-0.4%)* from the revised June level and were down 1.0 percent (+/-0.9%) from the July 2015 level. The May 2016 to June 2016 percent change was revised from the preliminary estimate of up 1.9 percent (+/-0.5%) to up 1.7 percent (+/-0.6%). July sales of durable goods were up 0.2 percent (+/-0.5%)* from last month and were up 0.7 percent (+/-1.4%)* from a year ago. Sales of nondurable goods were down 1.0 percent (+/-0.5%) from June and were down 2.6 percent (+/-1.4%) from last July. Sales of petroleum and petroleum products were down 3.5 percent from last month and sales of beer, wine, and distilled alcoholic beverages were down 2.4 percent.

-

16:00

U.S.: Wholesale Inventories, July 0% (forecast 0%)

-

15:53

WSE: After start on Wall Street

Declining start on Wall Street does not help for quotations on the Warsaw market. The S&P500 index started trading from a clear "bear gap" and almost immediately went to test the minimum level of the first session of September.

It does not help us also the situation on the currency market. Today we will face a new, awaited decision on the rating of the Polish debt. The zloty, however, is not waiting for the decision of the agency and clearly losing on the broad market. The reason of the weakness is quite surprising rally of the dollar, which began yesterday after the decision of the European Central Bank. While the return of the US currency appreciation was a matter of time, whereas the rate of return is surprising. There are signs that the market does not negate the possibility of interest rate increases in September.

An hour before the end of the trading the WIG20 index was at the level of 1,757 points (-2,00%).

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1100 (EUR 292m) 1.1150 (471m) 1.1190-95 (371m) 1.1200 (1.24bln) 1.1215-25 (742m) 1.1250 (2.15bln) 1.1300 (1.1bln) 1.1315-25 (737m) 1.1350 (351m) 1.1400 (538m) 1.1450 (727m) 1.1500 (619m)

USDJPY: 101.00-05 (382m) 101.50-55 (655m) 102.00 (960m) 102.50 (1.31bln)102.60 (300m) 104.00 (986m) 104.50 (945m) 105.00 (2.75bln)

GBPUSD: 1.3300 (GBP 209m)

AUDUSD: 0.7450 ( AUD 992m) 0.7500 (216m) 0.7700 (217m) 0.7800 (364m)

USDCAD 1.2615-35 (USD 635m) 1.2700 (330m) 1.2715 (240m) 1.2850 (310m) 1.3000 (473m) 1.3160-65 (363m) 1.3200 (1.26bln)

NZDUSD 0.7100-10 (849m)

-

15:33

-

15:32

U.S. Stocks open: Dow -0.69%, Nasdaq -0.75%, S&P -0.76%

-

15:28

Before the bell: S&P futures -0.61%, NASDAQ futures -0.68%

U.S. stock-index futures declined amid signals that central banks are becoming less willing to boost stimulus efforts to bolster growth.

Global Stocks:

Nikkei 16,965.76 +6.99 +0.04%

Hang Seng 24,099.70 +180.36 +0.75%

Shanghai 3,078.85 -17.10 -0.55%

FTSE 6,808.94 -49.76 -0.73%

CAC 4,513.10 -29.10 -0.64%

DAX 10,615.56 -59.73 -0.56%

Crude $46.61 (-2.12%)

Gold $1340.00 (-0.12%)

-

15:05

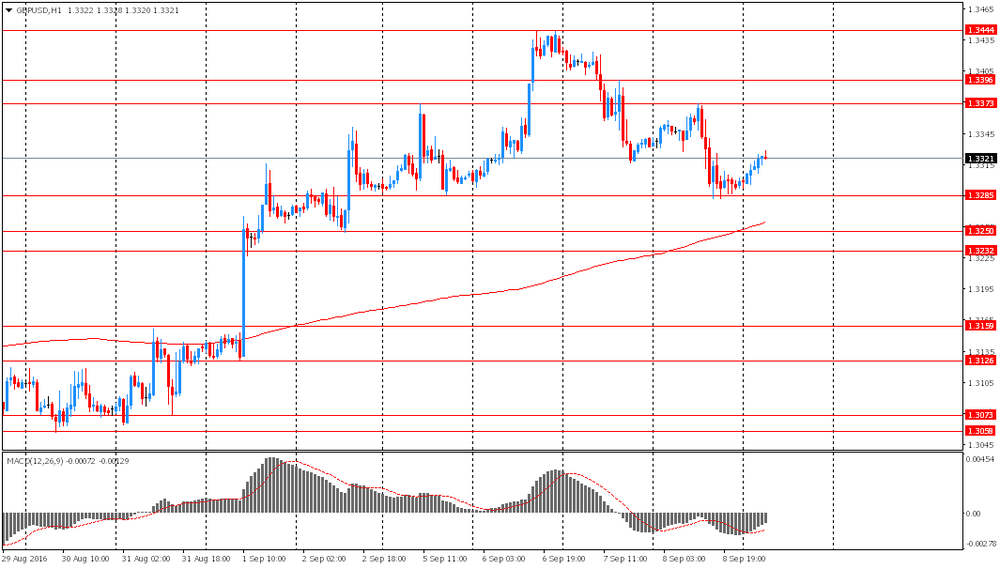

Whats next for GBP/USD - Credit Agricole

"GBP has been rebounding from this year's Brexit-driven lows. This is mainly due to the recent better-than-expected macroeconmic data, suggesting less scope for the BoE to consider a more aggressive monetary policy stance anytime soon. However, with uncertainty regarding Brexit negotiations remaining high, it may be early days to suggest an 'all clear'. Indeed, BoE Governor Mark Carney stressed as part of this week's parliamentary testimony that a more aggressive policy stance could be considered if needed. If anything, long-term uncertainty suggests that the central bank will do its utmost to keep investors' expectations of central bank monetary policy strongly capped. Assuming there is little scope of BoE rate expectations to rise from their current levels, it would be up to position squaring to make a case for more sustained currency upside beyond levels of 1.35 in majors such as GBP/USD. This is especially true should Fed monetary policy expectations start to stabilise anew.

In fact, further potential for an upward correction has been widely stressed, mainly due to IMM data suggesting that speculative short positioning remains close to multi-year highs. However, our positioning gauge implies that positioning is back to the levels it was at when the referendum was held. Considering that our data incorporates measures such as risk reversals, it may provide a more reliable indication. Elsewhere, it must be noted that our data puts a strong focus on corporate flows, which should not be disregarded in the current environment.

In conclusion, one may want to assume that the GBP pain trade has nearly run its course already, at least when relating the past few weeks' upside to positions entered around the time of the EU referendum. Short positions entered ahead of it may have a much higher pain threshold or have been taken off already. There may be less upside correction risk left. On the contrary, with interest rates having settled at considerably lower levels, the currency may be subject to renewed downside risks later on.

As such, we believe GBP will stay subject to range-trading behaviour, at least from a broader angle".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

14:44

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Outperform at Macquarie

Other:

Facebook (FB) added to focus list at Goldman

American Express (AXP) initiated with a Underweight at Atlantic Equities

-

14:40

Fed's Rosengren warns low rates are raising the chance of overheating the US economy - CNBC

-

14:37

Canadian unemployment rate up to 7.0%

Following a decline in July, employment edged up in August (+26,000 or +0.1%). The unemployment rate rose 0.1 percentage points to 7.0%, as more people participated in the labour market.

Compared with 12 months earlier, employment increased by 77,000 (+0.4%), with all of the gains in part-time work. Over the same period, the total number of hours worked fell slightly (-0.4%).

In August, employment increased among youths aged 15 to 24 and people aged 55 and older. At the same time, employment was down among those aged 25 to 54.

Employment rose in Quebec and in Newfoundland and Labrador, while it declined in New Brunswick. There was little change in the other provinces.

There were more people working in public administration and fewer people working in professional, scientific and technical services.

Public sector employment increased in August, while self-employment fell and the number of private sector employees was little changed.

-

14:30

Canada: Unemployment rate, August 7% (forecast 6.9%)

-

14:30

Canada: Employment , August 26.2 (forecast 15)

-

14:21

European session review: Euro weakened against the US currency

The following data was published:

(Time / country / index / period / previous value / forecast)

8:45 Switzerland's unemployment rate (not seasonally adjusted) in August 3.1% 3.1% 3.2%

9:00 Germany Balance of Payments, July 26.3 18.6 bn

9:00 Germany Trade balance (excluding seasonal adjustments) 24.7 19.5 bln in July

9:45 France Industrial Production m / m in July -0.7% 0.2% -0.6%

11:30 UK Trade Balance Revised to -5.6 in July -5.1 -4.5

The pound fell against the dollar, returning to yesterday's low. Pressure on the currency has continued risk aversion caused by the drop in oil prices. At the same time, ONS reported that the UK's deficit on trade in goods and services was estimated to have been £4.5 billion in July 2016, a narrowing of £1.1 billion from June 2016. Exports increased by £0.8 billion and imports decreased by £0.3 billion.

The deficit on trade in goods was £11.8 billion in July 2016, narrowing by £1.2 billion from June 2016. This narrowing reflected an increase in exports of £0.8 billion to £24.8 billion and a decrease in imports of £0.3 billion to £36.6 billion.

Between the 3 months to April 2016 and the 3 months to July 2016, the total trade deficit for goods and services widened by £5.1 billion to £14.0 billion.

Certain influence on the currency also had the results of a survey by the Bank of England. The Central Bank reported that 21 percent of respondents expect an increase in Central Bank rates in the next 12 months compared to 41 percent in May. The last reading was the lowest since 1999. Meanwhile, 19 percent of respondents believe that the Central Bank will cut rates next year, compared with 5 percent in May. This figure is the highest since November 2008. The survey also pointed to a moderate growth of expectations for inflation next year.- rate rose to 2.2 percent from 2.0 percent in May. At the same time, expectations regarding inflation two years ahead remained at 2.2 percent. However, 5-year inflation expectations fell to 3.0 percent from 3.4 percent in May.

The euro fell against the dollar, having lost all previously earned positions today, which was associated with the publication of the weak German and French data. As it became known, the volume of German exports unexpectedly fell in July. Imports also fell, showing that Europe's largest economy began the third quarter on a weak note after Brexit.

According to the report of the Federal Bureau of Statistics, seasonally adjusted exports fell in July by 2.6 percent. It was the biggest monthly drop since August 2015. Analysts had expected exports to grow by 0.25 per cent. Meanwhile, the volume of imports (seasonally adjusted) decreased by 0.7 per cent, also confounding expert forecasts (+0.8 percent). The sudden drop in exports led to the fact that the trade surplus dropped to 19.4 billion euros from 21.4 billion euros. In June. (Revised from 21.7 billion euros). It was expected a surplus of 21.2 billion. Falling exports largely reflects factors such as more holidays on July. A breakdown of trade figures showed that demand for German goods from countries outside the EU fell the most. Exports to the so-called third countries, which include China, Russia, Japan and the United States declined by 13.8 per cent. Meanwhile, German exports to the EU countries outside the euro area, which includes the United Kingdom, decreased by 8.8 percent.

Meanwhile, the statistical office Insee said that French industrial production fell in July by 0.6 percent compared to June vs expectations for an increase of 0.3 percent. This was the third consecutive monthly decline in production. The figure for June was revised to -0.7 percent from -0.8 percent. Manufacturing output fell by 0.3 percent in July, which was slower than the fall of 1.1 percent in June. Economists had forecast an increase of 0.7 per cent. On the other hand, construction output increased by 4.8 per cent, offset by a drop of 0.4 per cent recorded in June.

EUR / USD: during the European session, the pair fell to $ 1.1259 from $ 1.1284

GBP / USD: during the European session, the pair fell to $ 1.3285, but then partially recovered

USD / JPY: during the European session, the pair rose to Y102.78

-

14:15

Canada: Housing Starts, August 182.7 (forecast 190)

-

14:11

-

14:09

ECB's Coeure: Preserving monetary support is still necessary

-

Urges Greece to complete milestones

-

There are positive signs coming out of Greece

-

Planning discussions on the sustainability of Greek debt

-

Economy is resilient to global uncertainty

*via forexlive -

-

13:57

BOJ to mull cutting negative rates further for easing: Kyodo

-

13:45

Orders

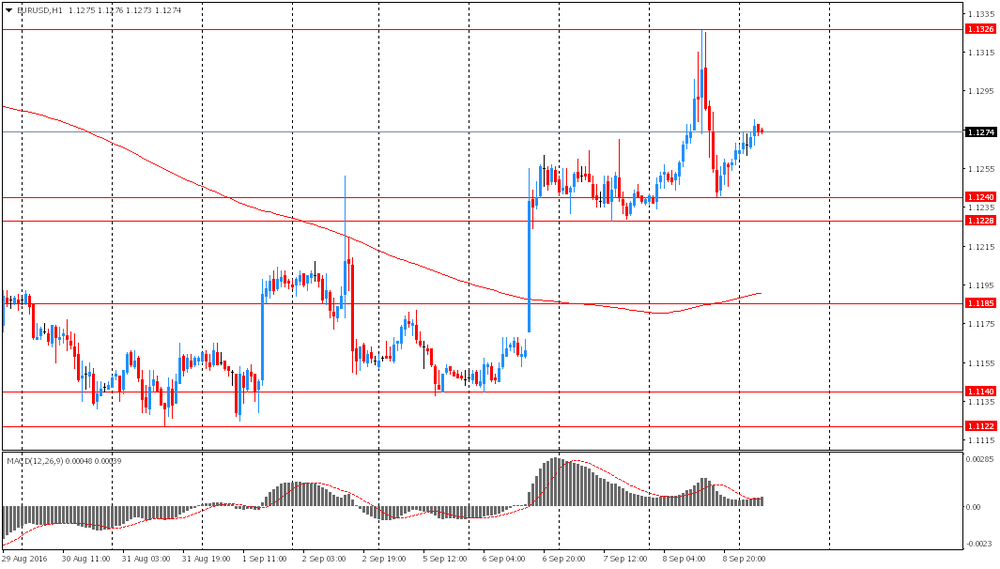

EUR/USD

Offers 1.1300 1.1325-30 1.1350 1.1365 1.1380 1.1400

Bids 1.1250 1.1240 1.1220-25 1.1200 1.1185 1.1170 1.1145-50 1.1120 1.1100

GBP/USD

Offers 1.3335 1.3355-60 1.3380 1.3400 1.3425 1.3435 1.3450 1.3475-80 1.3500

Bids 1.3295-1.3300 1.3280-85 1.3255-60 1.3230 1.3200 1.3175-80 1.315

EUR/GBP

Offers 0.8485 0.8495-0.8500 0.8520-25 0.8550

Bids 0.8455-60 0.8435 0.8420 0.8400 0.8385 0.8365 0.8350

EUR/JPY

Offers 115.40-45 115.60 115.85 116.00 116.35 116.50 117.00

Bids 115.00 114.80 114.50 114.00 113.80 113.50 113.00

USD/JPY

Offers 102.20 102.50 102.75-80 103.00 103.20 103.60

Bids 102.00 101.80-85 101.60 101.40 101.20 101.00 100.80 100.50

AUD/USD

Offers 0.7660 0.7685 0.7700 0.7720-25 0.7750

Bids 0.7600 0.7580 0.7565 0.7550 0.7535 0.7500

-

13:03

WSE: Mid session comment

In the mid-session the WIG20 lost 1,36% and the turnover counter for this index shows PLN 268 mln. The consolation may be just the fact that we are not alone in this decline. The last part of the trade brings in fact visible weakness of parquets in Euroland. Loses both the DAX as the CAC40. Unfortunately, as a relatively weaker market, the WSE lose disproportionately harder.

The weakness of the Warsaw Stock Exchange may be due to the fear of a possible cut rating for Poland today by Moody's. Investor behavior probably reflects the carefulness while on the exchange market we do not see any major shifts.

-

11:31

Oil is trading in the red zone

This morning New York WTI crude oil futures fell by 1.05% to $ 47.12 and Brent oil futures fell 1.16% to $ 49.40 per barrel. Thus, the black gold is traded lower corecting after the up move due to a sharp decline in US oil inventories due to falling imports on the US Gulf Coast to a record low. The reserves of black gold in the United States fell for the week by 14.51 million barrels - the most since January 1999, according to the Energy Information Administration. Import in the US Gulf of Mexico has fallen to 2.5 million barrels per day. Analysts said imports fell because of the Tropical Storm Hermine, which provoked the suspension of shipments in Texas and Louisiana.

-

11:25

UK construction output flat in July

The reporting period for this release covers the calendar month of July 2016 and therefore includes data for the month following the EU referendum. Construction output was flat in July 2016 and there is very little anecdotal evidence at present to suggest that the referendum has had an impact on output. You should note that we always warn against overly interpreting one month's figures.

In July 2016, construction output was estimated to have shown no growth compared with June 2016.

All new work increased by 0.5% while all repair and maintenance decreased by 1.1%.

Compared with July 2015, construction output decreased by 1.5%. All new work, and repair and maintenance decreased by 0.6% and 3.2% respectively.

The underlying pattern as suggested by the 3 month on 3 month movement in output in the construction industry decreased by 1.2%.

-

11:19

The UK’s deficit on trade in goods and services increased in July

UK trade shows import and export activity and is a main contributor to the overall economic growth of the UK. This is the first release of UK trade covering a complete calendar month of data post EU referendum.

All data are shown on a seasonally adjusted, balance of payments basis, at current prices unless otherwise stated.

The UK's deficit on trade in goods and services was estimated to have been £4.5 billion in July 2016, a narrowing of £1.1 billion from June 2016. Exports increased by £0.8 billion and imports decreased by £0.3 billion.

The deficit on trade in goods was £11.8 billion in July 2016, narrowing by £1.2 billion from June 2016. This narrowing reflected an increase in exports of £0.8 billion to £24.8 billion and a decrease in imports of £0.3 billion to £36.6 billion.

Between the 3 months to April 2016 and the 3 months to July 2016, the total trade deficit for goods and services widened by £5.1 billion to £14.0 billion.

-

11:08

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 292m) 1.1150 (471m) 1.1190-95 (371m) 1.1200 (1.24bln) 1.1215-25 (742m) 1.1250 (2.15bln) 1.1300 (1.1bln) 1.1315-25 (737m) 1.1350 (351m) 1.1400 (538m) 1.1450 (727m) 1.1500 (619m)

USD/JPY: 101.00-05 (382m) 101.50-55 (655m) 102.00 (960m) 102.50 (1.31bln) 102.60 (300m) 104.00 (986m) 104.50 (945m) 105.00 (2.75bln)

GBP/USD: 1.3300 (GBP 209m)

AUD/USD: 0.7450 ( AUD 992m) 0.7500 (216m) 0.7700 (217m) 0.7800 (364m)

USD/CAD 1.2615-35 (USD 635m) 1.2700 (330m) 1.2715 (240m) 1.2850 (310m) 1.3000 (473m) 1.3160-65 (363m) 1.3200 (1.26bln)

NZD/USD 0.7100-10 (849m)

-

10:30

United Kingdom: Total Trade Balance, July -4.5

-

09:11

WSE: After opening

WIG20 index opened at 1792.55 points (-0.05%)*

WIG 48062.45 -0.14%

WIG30 2057.84 -0.20%

mWIG40 4001.00 0.01%

*/ - change to previous close

After yesterday, the next loss by the WIG20 index the level of 1,800 points today's session begins with the deepening of the departure. Bears in the morning, of course, are favored by the outer atmosphere, including declines in contracts for the major European indices. There also were not without significance weaker than expected macro data from Germany. A clear decline in both exports as well as imports in the German economy in July is not optimistic.

-

09:02

France: the output decreased slightly in the manufacturing industry

In July 2016, output decreased slightly in the manufacturing industry (-0.3%), after a sharper fall in June (-1.1%). It declined again in the whole industry (-0.6% after -0.7%).

Manufacturing output diminished over the past three months (-0.4%)

Over the past three months, output decreased in the manufacturing industry (-0.4% q-o-q). It fell more markedly in the overall industry (-0.7% q-o-q).

Output decreased sharply in mining and quarrying; energy; water supply (-2.4%), in the manufacture of food products and beverages (-1.2%), in the manufacture of machinery and equipment goods (-0.7%) and in that of transport equipment (-0.8%). It tumbled in the manufacture of coke and refined petroleum products (-13.6%). By contrast it was virtually stable in "other manufacturing".

-

08:45

France: Industrial Production, m/m, July -0.6% (forecast 0.2%)

-

08:31

EUR/USD: En-Route To 1.08 As ECB Passes Baton To The Fed - BNPP

"The ECB refrained from announcing new easing measures at today's monetary policy meeting. President Mario Draghi stated in the press conference that the central bank did not discuss an extension of the current asset purchase programme. He stressed that risks to economic growth lie to the downside but that, for the time being, changes to the ECB's growth and inflation forecasts are not large enough to warrant more easing. However, our economists view today's decision as a postponement rather than a rejection of further easing with new announcements likely soon, most probably at the December ECB meeting after a full evaluation of the options available.

The EUR initially benefitted modestly from the ECB's decision to leave policy unchanged with EURUSD rising from 1.1290 before the announcement to a high of 1.1328. Given that short EUR positioning is quite light, at -8 in the range of -50 to +50 according to BNP Paribas FX Positioning Analysis, we would not expect the EUR's squeeze upward to extend on the topside and be sustained.

The ECB has passed the baton to the US Federal Reserve in terms of determining EURUSD's direction. Overall, disappointment at the lack of an ECB policy adjustment has only been worth about 2bp on the EUR 2y swap rate. Hawkish comments from key members of the US Federal Reserve ahead of next Tuesday's start to the comment blackout period could easily move US front-end yields by several times that amount very quickly.

We continue to forecast a fall in EURUSD to 1.08 by the end of the year, consistent with our economists' view that the Fed is likely to raise US rates by 25bp at the 21 September meeting (versus market pricing in of only a 20% probability of such a rate hike)".

Copyright © 2016 BNP Paribas™, eFXnews™

-

08:29

WSE: Before opening

Thursday's trading on Wall Street was dominated by low volatility and ended practically at the same levels as the opening. Significantly increased oil prices, which stores, as reported by the US Department of Energy, fell by 14.51 million barrels, the highest since January 1999.

The American trade was influenced by atmosphere from Europe after a disappointing conference of the head of the ECB.

Current quotations of futures contracts on the S&P500 does not indicate any major changes and the beginning of the session in Europe should be at the light cons.

Some concerns awaken after reports from Asia, where markets responded to the nuclear test in North Korea, although changes in Asian indices are not spectacular.

On the Warsaw market yesterday's correlation with core markets and exit down by the WIG20 index negated the gains from Wednesday's session. Thus, it is difficult to expect today any fireworks.

During today's session, there is no important macroeconomic publications from the country. Also, the wide macro calendar contains no key indications. As a result, the session may pass under the sign of waiting for a move by the Moody's regarding rating for Poland, which will have great importance for the Polish currency and will determine the opening of trading on the stock market on Monday.

-

08:29

Asian session review: The Australian dollar traded without significant changes

The Australian dollar traded almost unchanged in spite weaker data from Australia and China. According to data released today by the Australian Bureau of Statistics, the number of approved housing loans in July fell by -4.2% compared to June. At the same time, the June value was revised upward and reached +1.7% instead of 1.2%. It is also worth noting that the July value was much worse than economists forecast (-1.5%). At the same time, the consumer price index published by the National Bureau of Statistics of China, in August was 0.1%, below analysts' expectations of 0.3% and the previous value of 0.2%. In annual terms, the indicator rose by 1.3%, after rising 1.8% in July, a year earlier. The report of the National Bureau of Statistics says that a slowdown in the growth of food prices was the main factor that put pressure on the overall rate of inflation. The growth index of consumer prices was the lowest since October 2015 and well below the maximum target for this year of 3%, which gives Chinese authorities the opportunity to continue easing monetary policy against the backdrop of slowing economic growth.

Today, the markets expects the speech by the President of the Federal Reserve Bank of Boston Eric Rosengren. His comments can be a stimulus to the growth of the dollar.

The euro traded moderately higher after ECB. The central bank that the expansion of the quantitative easing program was not discussed. Draghi confirmed that the Committee decided to maintain the interest rate at a record low 0.0%, in line with market expectations. The central bank also left unchanged the deposit rate at 0.4% and kept the margin rate at around 0.25%. Draghi said that the current monetary policy is still effective, and changes in the bank's forecasts are not so essential to decide on additional measures.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1265-85 range

GBP / USD: during the Asian session, the pair rose to $ 1.3335

USD / JPY: it fell to Y101.95 in the Asian session

-

08:21

Investment housing commitments rose 1.1% in Australia

The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.3%. Investment housing commitments rose 1.1%, while owner occupied housing commitments fell 0.1%.

In seasonally adjusted terms, the total value of dwelling finance commitments excluding alterations and additions fell 1.8%.

In trend terms, the number of commitments for owner occupied housing finance fell 0.1% in July 2016.

In trend terms, the number of commitments for the construction of dwellings fell 0.3%, while the number of commitments for the purchase of new dwellings rose 0.4%, and the number of commitments for the purchase of established dwellings fell 0.1%.

-

08:17

Chinese CPI inflation lower than forecast

According to rttnews, consumer prices in China were up just 1.3 percent on year in August, the National Bureau of Statistics said on Friday.

That was beneath expectations for 1.7 percent and down from 1.8 percent in July.

On a monthly basis, consumer prices were up 0.1 percent after gaining 0.2 percent a month earlier.

Producer prices were down an annual 0.8 percent versus expectations for a fall of 0.9 percent after sliding 1.7 percent in the previous month.

-

08:10

North Korea claims it is now able to produce miniaturised nuclear arms, says it will continue weapons programme --State TV

-

08:09

German trade balance declines in July

Germany exported goods to the value of 106.8 billion euros and imported goods to the value of 82.0 billion euros in June 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 1.2% and imports by 0.3% in June 2016 year on year. Compared with May 2016, exports increased by a calendar and seasonally adjusted 0.3%, and imports by 1.0%.

The foreign trade balance showed a surplus of 24.9 billion euros in June 2016. In June 2015, the surplus amounted to 23.9 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 21.7 billion euros in June 2016.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 26.3 billion euros in June 2016, which takes into account the balances of trade in goods including supplementary trade items (+26.8 billion euros), services (-2.7 billion euros), primary income (+4.4 billion euros) and secondary income (-2.1 billion euros). In June 2015, the German current account showed a surplus of 25.3 billion euros.

-

08:00

Germany: Current Account , July 18.6

-

08:00

Germany: Trade Balance (non s.a.), bln, July 19.5

-

07:45

Switzerland: Unemployment Rate (non s.a.), August 3.2% (forecast 3.1%)

-

06:56

Options levels on friday, September 9, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1401 (4413)

$1.1352 (3553)

$1.1307 (4270)

Price at time of writing this review: $1.1280

Support levels (open interest**, contracts):

$1.1213 (1967)

$1.1182 (3124)

$1.1142 (3593)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52387 contracts, with the maximum number of contracts with strike price $1,1250 (4620);

- Overall open interest on the PUT options with the expiration date September, 9 is 58099 contracts, with the maximum number of contracts with strike price $1,1000 (5655);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from September, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.3600 (790)

$1.3500 (1852)

$1.3400 (2398)

Price at time of writing this review: $1.3325

Support levels (open interest**, contracts):

$1.3200 (805)

$1.3100 (1495)

$1.3000 (1707)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32844 contracts, with the maximum number of contracts with strike price $1,3300 (2955);

- Overall open interest on the PUT options with the expiration date September, 9 is 28856 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.88 versus 0.88 from the previous trading day according to data from September, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:32

Global Stocks

European stocks closed lower Thursday, weighed down by a slide in German equities and a rising euro, after the European Central Bank held off from expanding its monetary stimulus. The moves came as ECB President Mario Draghi spoke after the bank's monetary policy meeting in Frankfurt. He said while there are still risks to the eurozone economy, the current outlook for the bloc does not warrant a decision for the central bank to act now.

U.S. stocks on Thursday closed lower after the European Central Bank kept key interest rates steady but disappointed some by not announcing additional measures to boost Europe's sluggish economy.

Asian markets were mixed after a North Korean earthquake was likely caused by an explosion, possibly from a nuclear test in the isolated nation.

-

03:31

Australia: Home Loans , July -4.2% (forecast -1.5%)

-

03:30

China: CPI y/y, August 1.3% (forecast 1.7%)

-

03:30

China: PPI y/y, August -0.8% (forecast -0.9%)

-

00:29

Commodities. Daily history for Sep 07’2016:

(raw materials / closing price /% change)

Oil 47.32-0.63%

Gold 1,342.20+0.04%

-

00:29

Stocks. Daily history for Sep 08’2016:

(index / closing price / change items /% change)

Nikkei 225 16,958.77 -53.67 -0.32%

Shanghai Composite 3,096.60 +4.67 +0.15%

S&P/ASX 200 5,385.75 -38.50 -0.71%

FTSE 100 6,858.70 +12.12 +0.18%

CAC 40 4,542.20 -15.46 -0.34%

Xetra DAX 10,675.29 -77.69 -0.72%

S&P 500 2,181.30 -4.86 -0.22%

Dow Jones Industrial Average 18,479.91 -46.23 -0.25%

S&P/TSX Composite 14,803.26 +6.51 +0.04%

-

00:28

Currencies. Daily history for Sep 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1264 +0,22%

GBP/USD $1,3298 -0,26%

USD/CHF Chf0,9718 +0,25%

USD/JPY Y102,38 +0,66%

EUR/JPY Y115,33 +0,89%

GBP/JPY Y136,15 +0,40%

AUD/USD $0,7642 -0,41%

NZD/USD $0,7401 -0,66%

USD/CAD C$1,2927 +0,32%

-

00:01

Schedule for today, Friday, Sep 09’2016

Schedule for today, Friday, Sep 09'2016

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans July 1.2% -1.5%

01:30 China PPI y/y August -1.7% -0.9%

01:30 China CPI y/y August 1.8% 1.7%

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1%

06:00 Germany Current Account July 26.3

06:00 Germany Trade Balance (non s.a.), bln July 24.9

06:45 France Industrial Production, m/m July -0.8% 0.2%

08:30 United Kingdom Total Trade Balance July -5.1

11:45 U.S. FOMC Member Rosengren Speaks

12:15 Canada Housing Starts August 198.4 190

12:30 Canada Unemployment rate August 6.9% 6.9%

12:30 Canada Employment August -31.2 15

14:00 U.S. Wholesale Inventories July 0.3% 0.1%

-