Noticias del mercado

-

22:06

Major US stock indexes finished trading in the green zone

Major US stock indexes rose after Fed officials in a less aggressive tone commented on the possibility of raising interest rates.

Boston Fed President Rosengren on Friday pointed to a strengthening of the risk of overheating of the US economy due to low interest rates. Another Fed - Federal Reserve Bank of Atlanta President Lockhart today suggested that the Fed will be conducted a lively discussion on the issue of raising rates. At the same time, the head of the Federal Reserve Bank of Minneapolis Kashkari said that at the moment to stimulate the economy are necessary instruments of fiscal policy, as well as regulatory measures.

In addition, a representative of the Federal Reserve Brainard said that in view of the fact that the labor market impact on inflation is likely to be moderate and gradual, the arguments in favor of premature policy tightening less convincing. "Right now, the impact of external negative shocks stronger than before Better to change the policy, focusing on downside risks than pre-emptively raise rates.", - Stated policies.

Oil futures rose moderately, supported by the fall in the US currency and the Fed officials. The US Dollar Index, showing the relationship of the US dollar against a basket of six major currencies, was down 0.2%, to a session low. As oil prices are tied to the dollar, a weaker dollar makes oil cheaper for holders of foreign currencies. Investors also drew attention to the monthly report of OPEC. It was reported that in 2016, production in the United States, Russia, Norway and several other countries will be approximately 190,000 barrels per day higher than expected. This factor may indicate that oil production outside OPEC was stable, despite low oil prices.

Almost all the components of DOW index closed in positive territory (29 of 30). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 2.60%). Outsider were shares of E. I. du Pont de Nemours and Company (DD, -0.44%).

All Sector S & P Index showed an increase. The leader turned out to be the health sector (+ 1.8%).

At the close:

Dow + 1.32% 18,324.38 +238.93

Nasdaq + 1.68% 5,211.89 +85.98

S & P + 1.47% 2,159.03 +31.22

-

21:00

DJIA +1.28% 18,316.34 +230.89 Nasdaq +1.58% 5,206.88 +80.97 S&P +1.46% 2,158.92 +31.11

-

19:10

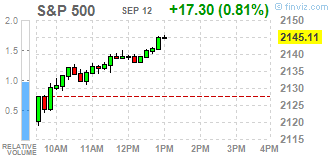

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday after two Federal Reserve officials struck a less hawkish tone on interest rate hikes, quelling some investor fears about a move as early as next week. Atlanta Fed Bank President Dennis Lockhart said current economic conditions warranted a "serious discussion" on whether to raise rates at the Fed meeting on 20-21 of September, but later said there was no "urgency" to act at any particular meeting.

Most of Dow stocks in positive area (27 of 30). Top gainer - Apple Inc. (AAPL, +1.49%). Top loser - E. I. du Pont de Nemours and Company (DD, -1.32%).

All S&P sectors also in positive area. Top gainer - Healthcare (+1.0%).

At the moment:

Dow 18133.00 +166.00 +0.92%

S&P 500 2137.00 +21.00 +0.99%

Nasdaq 100 4734.00 +66.25 +1.42%

Oil 46.25 +0.37 +0.81%

Gold 1325.10 -9.40 -0.70%

U.S. 10yr 1.69 +0.02

-

18:01

European stocks closed: FTSE 100 -76.05 6700.90 -1.12% DAX -141.67 10431.77 -1.34% CAC 40 -51.60 4439.80 -1.15%

-

17:36

WSE: Session Results

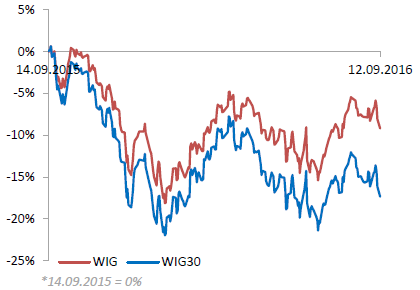

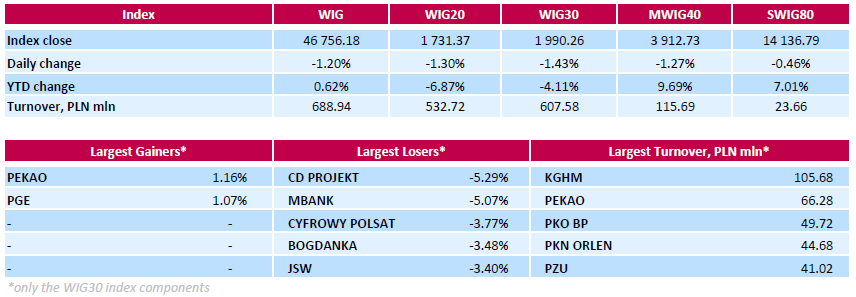

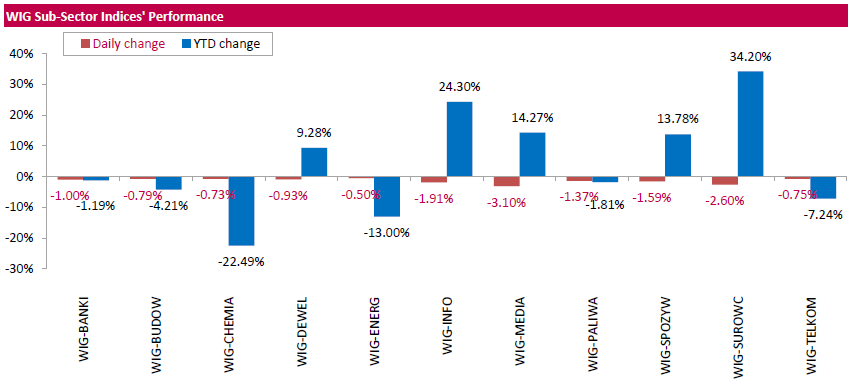

Polish equity market closed lower on Monday. The broad market measure, the WIG Index, fell by 1.2%. All sectors in the WIG posted negative daily returns, with media (-3.10%) and materials (-2.6%) recording the biggest declines.

The large-cap stocks lost 1.43%, as measured by the WIG30 Index. Bank PEKAO (WSE: PEO) and genco PGE were the only advancers among the WIG30 index's components, surging by 1.16% and 1.07% respectively. At the same time, videogame developer CD PROJEKT (WSE: CDR) and bank MBANK (WSE: MBK) were hit the hardest, down 5.29% and 5.07% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS) and two coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW), which slumped by 3.40%-3.77%.

-

15:52

WSE: After start on Wall Street

The afternoon part of trading has brought some improvement evident in the main markets. Stabilization also appeared on the Warsaw Stock Exchange and the WIG20 index has ceased to plot the next session lows.

Discounts stopped also among small and medium-sized companies, however the mWIG40 and the sWIG80 are down more than 1% and extending the negative trend for the third consecutive day.

American market began sessions at moderate cons, that after the first transactions began to be leveled. It looks like today the American bulls want to recover from the recent declines

An hour before the close of trading the WIG20 index was at 1,726 points (-1,60%).

-

15:32

U.S. Stocks open: Dow -0.42%, Nasdaq -0.42%, S&P -0.34%

-

15:07

Before the bell: S&P futures -0.19%, NASDAQ futures -0.29%

U.S. stock-index futures declined amid concerns that Fed could raise borrowing costs as soon as this month.

Global Stocks:

Nikkei 16,672.92 -292.84 -1.73%

Hang Seng 23,290.60 -809.10 -3.36%

Shanghai 3,020.94 -57.92 -1.88%

FTSE 6,675.27 -101.68 -1.50%

CAC 4,412.71 -78.69 -1.75%

DAX 10,389.85 -183.59 -1.74%

Crude $44.92 (-2.09%)

Gold $1328.10 (-0.48%)

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Wal-Mart (WMT) upgraded to Outperform from Market Perform at Cowen; target raised to $83 from $76

Downgrades:

Other:

Cisco Systems (CSCO) target raised to $35 from $32 at UBS; Buy

-

13:08

WSE: Mid session comment

In European markets declines today are very common and almost everywhere are at least minus 1%. The weakest present themselves commodity producers and banks, which indexes go down more than 3%. Thereby negatively are characterized sectors sensitive to monetary policy. Against this background, our market falls worse.

It would seem that the external supply-side pulses in conjunction with the maintenance of the rating for the Polish market will help us a bit. But it does not seem

After the news from National Bank of Poland about calculations on the cost of the foreign currency loans resolution, where it is estimated that these costs may be even more than two times higher, the sentiment on our parquet deteriorated again and new intraday lows become a reality.

At the halfway point of today's session the WIG20 index was at the level of 1,719 points (-1,96%). The turnover was PLN 225 mln.

-

12:41

Major stock indices in Europe are trading in the red zone

European stocks fall amid a general withdrawal of investors from risky assets due to the increased expectations of a rate hike by the Federal Reserve.

On Friday, statements raised expectations of a hike this year - this move, according to experts, would reduce the interest in European assets, taking into account the record low interest rates in the region.

Market focus is now on the speech of the Fed Board of Governors member Leil Brainard - this will be the last Fed official commenting before FOMC meeting on 20-21 September.

In addition, traders are waiting for the next meeting of the Bank of England, which will be held September 14-15. In August, the British Central Bank lowered the interest rate from 0.5% to 0.25%, a new historical minimum. Previous level of the rate remained unchanged from March 2009. The Bank of England also increased its asset purchase program by 60 billion pounds to 435 billion pounds.

The composite index of the largest companies in the region Stoxx Europe 600 fell 1,7% - to 339.69 points.

Linde AG share price fell 7,4%. The German company and the American Praxair Inc. discontinued merger talks that could lead to the creation of the world's largest producer of industrial gases.

SVG Capital shares soared by more than 15% on the information that the American fund HarbourVest Partners made an offer for 1 billion pounds ($ 1.3 billion) in cash.

Shares of the largest German energy company EON have decreased by 13.1% after Uniper formed a separate company.

Shares of Associated British Foods fell 4.8% despite the company's message on Monday of better annual forecast.

At the moment:

FTSE 6670.29 -106.66 -1.57%

DAX 10360.42 -213.02 -2.01%

CAC 4400.56 -90.84 -2.02%

-

09:29

Major stock markets trading in the red zone: FTSE -1.3%, DAX -1.9%, CAC40 -1.6%, FTMIB -1.6%, IBEX -1.9%

-

09:17

WSE: After opening

WIG20 index opened at 1746.60 points (-0.43%)*

WIG 46904.26 -0.89%

WIG30 1996.22 -1.14%

mWIG40 3944.96 -0.46%

*/ - change to previous close

The futures market (WSE: FW20U1620) started the new week from the discount of 0.62% (1,749 points).

The cash market (the WIG20 index) opened at the discount of 0.43% to 1,746 points.

Among the companies included in the WIG20 index, at the beginning we have a set of red. The German DAX falls 1.7% up, and so, presents even worse attitude than the Warsaw Stock Exchange, although the scale of our market declines rapidly been increased.

After fifteen minutes of trade the WIG20 index was at the level of 1,735 points (-1,09%). The turnover is now PLN 22 million.

-

08:43

Expected negative start of trading on the major stock exchanges in Europe: DAX futures -1.5%, CAC40 -1.4%, FTSE -1.3%

-

08:29

WSE: Before opening

The mood this morning does not seem good. On Friday, the S&P 500 lost almost 2.5%, US futures this morning already losing another 0.7% and in addition to this there are significant discounts in Asia.

It seems that the main reason for this situation is the change of the attitude of central banks. At Thursday's meeting of the ECB, Mario Draghi changed his tone and disappointed investors about the buy-back program. Despite a series of weaker data from the US, Fed does not withdraw from the possibility of a rate hike in September and the BoJ today, according to reports, is considering the possibility of reducing the scale of purchasing long-term bonds. Thus, all three major central banks spoiled sentiment around the world.

On the Warsaw market will be important and quite surprising news, that on Friday, Moody's did not revise the rating for Poland. It is definitely good news, but looking through the prism of world events, local support on the WIG20 index at 1,750 points seems to be in danger.

In the US, it may be important that Hillary Clinton because of a diagnosis of pneumonia is forced to stop the campaign. This is prejudicial message, as rewards Donald Trump.

-

06:19

Global Stocks

European stocks were pushed sharply lower Friday, cementing a decline for the week, as a selloff accelerated on the prospect of higher U.S. interest rates. European stocks had already been under pressure a day after the European Central Bank decided not to unleash more stimulus for the eurozone economy.

U.S. stocks on Friday suffered the worst slide since the U.K.'s surprise decision to exit from the European Union, as hawkish comments from Federal Reserve officials slammed bond and equity markets. Comments from Boston Fed President Eric Rosengren-a voter this year on the Fed's interest-rate setting board-helped to contribute toe the selloff. He said on Friday that the U.S. central bank could resume gradual rate increases as the risks facing the economy are more in balance, reigniting Wall Street's fears about the end of easy-money policies.

Asian shares started the week notably weaker as investor anticipation continues to build regarding a pause in global central banks' easing policies, which have helped prop up asset prices. Emerging markets in Asia are particularly vulnerable to a rate increase in the U.S. as better returns there could prompt a flight of capital from less-developed locales.

-

00:29

Stocks. Daily history for Sep 09’2016:

(index / closing price / change items /% change)

Nikkei 225 16,965.76 +6.99 +0.04%

Shanghai Composite 3,078.85 -17.10 -0.55%

S&P/ASX 200 5,339.18 -46.57 -0.86%

FTSE 100 6,776.95 -81.75 -1.19%

CAC 40 4,491.40 -50.80 -1.12%

Xetra DAX 10,573.44 -101.85 -0.95%

S&P 500 2,127.81 -53.49 -2.45%

Dow Jones Industrial Average 18,085.45 -394.46 -2.13%

S&P/TSX Composite 14,540.00 -263.26 -1.78%

-