Noticias del mercado

-

22:06

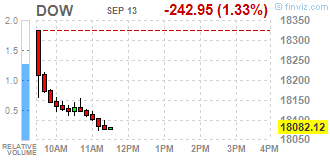

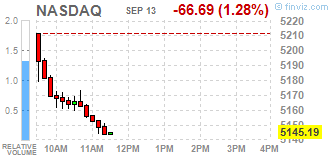

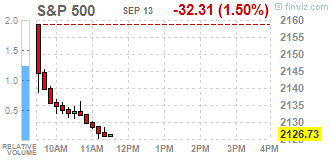

Major US stock indexes finished trading in the red zone

Major stock indexes in Wall Street fell more than a percent on the background of the collapse of the energy sector stocks due to lower oil prices.

On the trading dynamics also affect underestimated prospects of higher interest rates in the near future. Recall, on the eve of comments voiced by the Federal Reserve Board of Governors member Lyell Breynar strengthened the confidence of market participants that at the September meeting of the regulator of any change in monetary policy will not be amended. The chances of a rate hike at the meeting in September were down after the publication of a number of macroeconomic reports, unrealistic expectations. These include, first of all, data on employment, as well as statistics on the ISM index and some other indicators. But despite published at the beginning of the month data, uncertainty about further Fed action was sufficiently high, the chances of a rate hike, according to the dynamics of futures on the federal funds, equal to about 30%. Statements Brainard substantially clarified the Fed's intentions, is now the probability of a rate hike next week is estimated at only 15%.

Oil prices have fallen by about 3% after the report of the International Energy Agency, which added to concerns about global oversupply. In addition, yesterday in its monthly report, OPEC reported that in 2016, production in the United States, Russia, Norway and several other countries will be approximately 190,000 barrels per day higher than expected. This factor may indicate that oil production outside OPEC was stable, despite low oil prices.

Most DOW components of the index closed in negative territory (29 of 30). More rest rose stocks Apple Inc. (AAPL, + 2.55%). Outsider were shares of Chevron Corporation (CVX, -2.75%).

All business sectors S & P index showed a decline. Most of the basic materials sector fell (-3.4%).

At the close:

Dow -1.41% 18,066.89 -258.18

Nasdaq -1.09% 5,155.26 -56.63

S & P -1.48% 2,127.04 -32.00

-

21:00

Dow -1.34% 18,080.41 -244.66 Nasdaq -1.15% 5,152.01 -59.88 S&P -1.53% 2,125.95 -33.09

-

18:00

European stocks closed: FTSE 100 -35.27 6665.63 -0.53% DAX -45.17 10386.60 -0.43% CAC 40 -52.62 4387.18 -1.19%

-

17:35

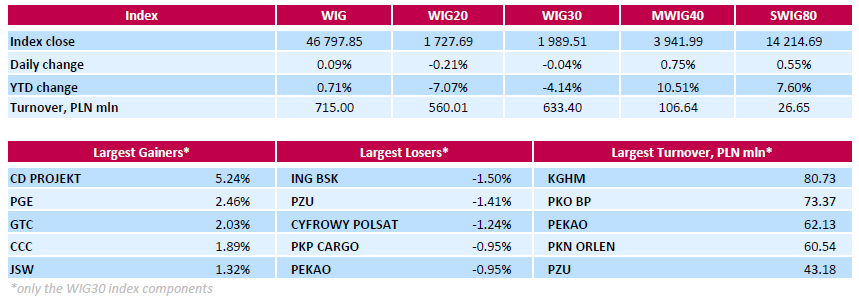

WSE: Session Results

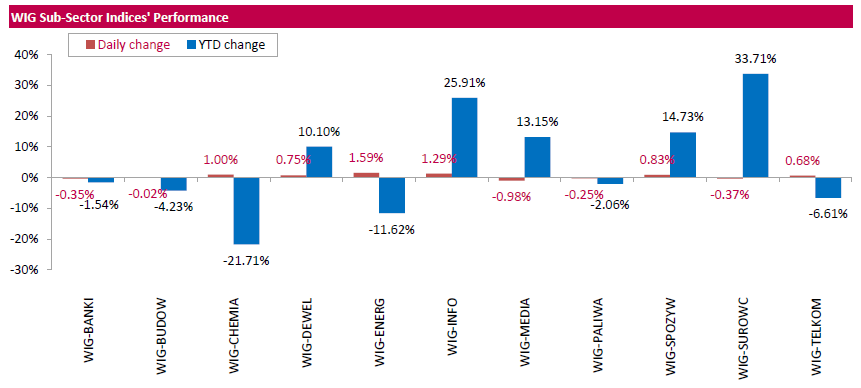

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index edged up 0.09%. Sector performance within the WIG Index was mixed. Utilities (+1.59%) outperformed, while media (-0.98%) lagged behind.

The large-cap stocks' measure, the WIG30 Index inched down 0.04%. Within the Index components, videogame developer CD PROJEKT (WSE: CDR) was the best-performing name, climbing by 5.24% and fully erasing its yesterday's losses. It was followed by genco PGE (WSE: PGE), property developer GTC (WSE: GTC) and footwear retailer CCC (WSE: CCC), advancing 2.46%, 2.03% and 1.89% respectively. On the other side of the ledger, bank ING BSK (WSE: ING), insurer PZU (WSE: PZU) and media group CYFROWY POLSAT (WSE: CPS) were the biggest decliners, dropping by 1.5%, 1.41% and 1.24% respectively.

-

17:33

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday, with energy stocks falling on lower oil prices and financials hit by diminished prospects of an interest rate hike in the near term. Oil prices were down more than 2,5% after a report from the International Energy Agency added to concerns about global oversupply. U.S. stocks had racked up their strongest gain in two months on Monday after Federal Reserve Board Governor Lael Brainard stuck to her dovish stance on interest rates and urged caution about removing monetary stimulus too quickly.

Most of Dow stocks in negative area (29 of 30). Top gainer - Apple Inc (AAPL, +2.62%). Top loser - Verizon Communications Inc. (VZ, -2.46%).

All S&P sectors also in negative area. Top gainer - Basic Materials (-3.2%).

At the moment:

Dow 18008.00 -238.00 -1.30%

S&P 500 2120.00 -32.00 -1.49%

Nasdaq 100 4710.25 -53.50 -1.12%

Oil 44.95 -1.34 -2.89%

Gold 1328.10 +2.50 +0.19%

U.S. 10yr 1.69 +0.02

-

16:31

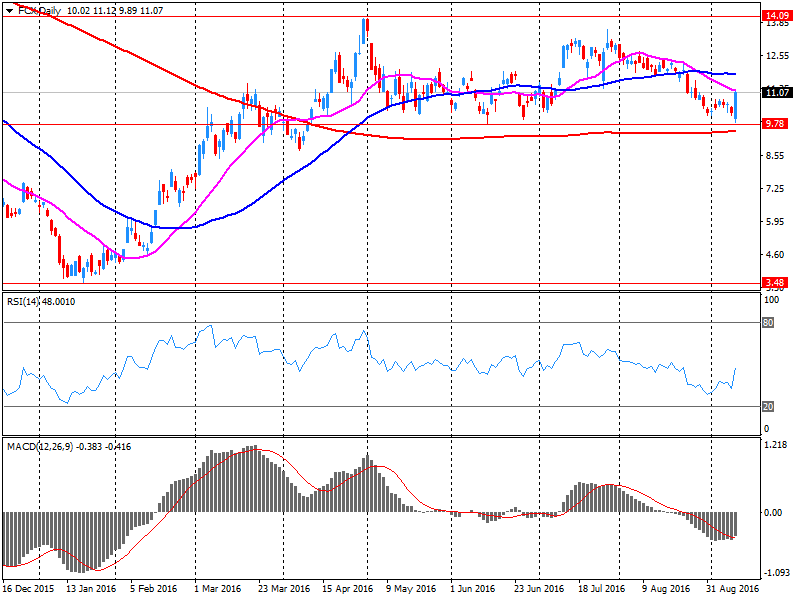

Company News: Freeport-McMoRan (FCX) is selling its deep-water assets in the Gulf of Mexico for $ 2 billion.

Freeport-McMoRan reported that its oil and gas subsidiary is selling deep-water assets in the Gulf of Mexico to Anadarko Petroleum for $ 2 billion.

At the end of the 12-month period ending June 30, 2016, these assets provided an average of 73 thousand barrels of oil per day. During this period, revenues reached $ 1.0 billion., Operating costs (before deducting administrative expenses) amounted to $ 0.3 billion., While capital expenditures totaled $ 1.6 billion. Freeport-McMoRan does not expect that the transaction will bring significant damages or losses.

FCX shares fell in premarket trading to $ 10.78 (-2.71%).

-

15:54

WSE: After start on Wall Street

The market in the US began with a discount of 0.6%, which increased slightly after the first transactions.

It's weak start, but generally in line with expectations. There is the interesting information, that the Bank of England has included Apple on the lists of companies qualified for its new economic stimulus bond-buying scheme.

An hour before the end of trading, the WIG20 index reached the level of 1,735 points (+ 0.25%).

-

15:34

U.S. Stocks open: Dow -0.81%, Nasdaq -0.53%, S&P -0.79%

-

15:28

Before the bell: S&P futures -0.79%, NASDAQ futures -0.62%

U.S. stock-index futures retreated amid renewed weakness in crude oil, and as investors remained on edge over central banks' ability to bolster growth.

Global Stocks:

Nikkei 16,729.04 +56.12 +0.34%

Hang Seng 23,215.76 -74.84 -0.32%

Shanghai 3,023.79 +1.81 +0.06%

FTSE 6,705.37 +4.47 +0.07%

CAC 4,434.39 -5.41 -0.12%

DAX 10,464.86 +33.09 +0.32%

Crude $45.18 (-2.40%)

Gold $1327.10 (+0.11%)

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Chevron (CVX) initiated with an Outperform at BMO Capital; target $120

Altria (MO) initiated with a Buy at Citigroup; target $72

-

13:11

WSE: Mid session comment

German ZEW index was slightly worse than forecast, but did not change its value compared to the previous month. The ZEW Institute indicates that the economic picture in the EU is improving, however it was not groundbreaking news for investors. Major indexes in France and Germany gaining cosmetically today's and session looks very calm with low volatility. At the same time it does not appear any will to quick make up for Friday's losses.

In the last hours the Polish zloty strengthened all along the line. This can be justified by an optimistic statement of the Minister of Finance regarding the implementation of the budget.

In the mid-session the WIG20 index was at the level of 1,729 points and the turnover in index of the largest companies was amounted to PLN 245 mln.

-

12:47

Major stock indices in Europe in the green zone

Stock indices in Western Europe recovered after declining for three sessions to the lowest in almost three weeks.

Various statements by members of the Federal Reserve in recent days have forced some investors to believe that the US seriously intends to increase the Central Bank base interest rate in September.

However, Leil Brainard, member of the Board of Governors of the Federal Reserve said that the central bank should be cautious in raising interest rates, the markets have calmed somewhat and reduced the likelihood of a rate hike at the next meeting.

Meanwhile, market sentiment improved after data showed that China's industrial output grew in August at an annualized rate of 6.3%, exceeding the expectations of +6.1%, after rising 6.0% in the previous month.

In addition, consumer prices in Germany, calculated by the standards of the European Union increased in August 2016 by 0.3%. The indicator has coincided with the expectations.

Meanwhile, prices in Spain fell by 0.3% in annual terms, after falling 0.7% in July. Deflation continues in the country since May, 2014.

In Sweden, inflation stood at 1.1%, the highest since 2012, although it was slightly worse than forecasts.

In the UK, inflation has remained stable, while there was a marked acceleration in producer prices in August, the Office for National Statistics said.

Consumer prices advanced 0.6 percent year on year in August, showing the same growth rate as in July. Prices were expected to rise by 0.7 percent.

Core inflation, which excludes energy, food, alcoholic beverages and tobacco, remained stable at 1.3 percent in August. Economists had forecasted core inflation at +1.4 percent in August.

On a monthly basis, consumer prices rose by 0.3 percent, slightly slower than the growth of 0.4 percent, which economists had expected.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1% - to 342.63 points.

The capitalization of the Swiss Foundation Partners Group Holding increased by 10% after the company reported an increase in profit in the first half of the year by 64%.

The cost of British sportswear retailer JD Sports Fashion has increased by 4.1% on profit growth in the first half of the year and the optimistic outlook for the second half of the year.

Meanwhile, the price of the UK online store Ocado Group Plc fell by 12%. The company said it does not expect any easing of pressure on margins in the near future.

RWE AG's shares fell 1% after analysts at DZ Bank confirmed its rating to "sell."

Shire Plc jumped 1.7% after Jefferies Group analysts confirmed their rating to "buy."

At the moment:

FTSE 6707.12 6.22 0.09%

DAX 10470.35 38.58 0.37%

CAC 4446.68 6.88 0.15%

-

10:02

Major stock exchanges trading in the green zone: FTSE + 0.2%, DAX + 0.5%, CAC40 + 0.5%, FTMIB + 0.6%, IBEX + 0.6%

-

09:16

WSE: After opening

WIG20 index opened at 1736.54 points (+0.30%)*

WIG 46951.94 0.42%

WIG30 2000.27 0.50%

mWIG40 3925.33 0.32%

*/ - change to previous close

The futures market began trading from increase by 0.17% to 1,735 points.

The cash market opens with an increase of 0.3% to 1,736 points. It is a reaction to yesterday's successful session in the United States, although the scale of growth is not spectacular. Investors' attention is still focused on the level of 1,750 points., which remains unconquered. So it appears that, although the situation has been stabilized after three days of declines, a smooth transition to growth will not be easy.

The decrease in the valuation of contracts on the S & P500 by approx. 0.5%. somewhat dampens possible earlier appetites, and on the Warsaw Stock Exchange may lead to a well-known stop.

-

08:57

Expected positive start of trading on the major stock exchanges in Europe: DAX futures + 0.9%, CAC40 + 0.7%, FTSE + 0.5%

-

08:27

WSE: Before opening

During yesterday's session on Wall Street, the S&P500 gained almost 1.5% in the move limiting most of the losses from Friday. However in the morning derivative market slightly adjusted, but so successful yesterday's session should find their impact on market performance in Europe. Seems that the risk of continuing price reductions on the present moment was averted.

Yesterday's comments of Lael Brainard, a significant member of the Fed, did not indicate imminent desire to raise the cost of money, what was positively received by investors and the likelihood of the next week rate hike decreased from 24% on Friday to 15% today.

The positive data came from China. Readings on industrial production, retail sales and investment slightly positively surprised, although it seems that investors passed them by indifferently. Modest gains in Asian parquets are interspersed with equally modest declines.

Today's macro calendar will not be rich. The most interesting issue will be the ZEW index in Germany. On the Warsaw market, we may expect attempts to rebound, especially in the range of small and medium-sized companies. In the case of blue-chips the main challenge is to return above the level of 1,750 points., which already was lost yesterday's opening.

-

06:41

Global Stocks

Global Stocks

European stocks slid Monday, with investors fleeing risky assets as the markets confronted the prospect that interest rates will be raised in the U.S. this month. Monday's selloff followed Friday's slide of 1.1% for the pan-European index. That drop came after Boston Federal Reserve President Eric Rosengren said a "reasonable case can be made" for raising interest rates in the U.S. A rate hike could hurt appetite for European assets as investors search for higher-yielding investments in the U.S.

U.S. stocks rallied Monday, finishing near session highs and taking back a chunk of Friday's losses, after Federal Reserve Gov. Lael Brainard called for prudence in raising interest rates. Investors were grappling with the prospect of the Federal Reserve tightening monetary policy following a series of hawkish comments from central-bank officials last week.

Asian shares rebounded Tuesday as fears of a rate increase by the U.S. Federal Reserve that had built up in recent days eased following dovish comments overnight from Fed Gov. Lael Brainard. She said that caution by the central bank concerning a rate rise "has served us well in recent months, helping to support continued gains in employment and progress on inflation."

-

00:30

Stocks. Daily history for Sep 12’2016:

(index / closing price / change items /% change)

Nikkei 225 16,672.92 -292.84 -1.73%

Shanghai Composite 3,020.94 -57.92 -1.88%

S&P/ASX 200 5,219.61 -119.57 -2.24%

FTSE 100 6,700.90 -76.05 -1.12%

CAC 40 4,439.80 -51.60 -1.15%

Xetra DAX 10,431.77 -141.67 -1.34%

S&P 500 2,159.04 +31.23 +1.47%

Dow Jones Industrial Average 18,325.07 +239.62 +1.32%

S&P/TSX Composite 14,597.14 +57.14 +0.39%

-