Noticias del mercado

-

22:10

Major US stock indexes finished trading without any dynamics

Major stock indexes in Wall Street closed mixed, as growth in consumer sector stocks was offset by a fall in quotations conglomerates sphere.

The pressure on the indices also had a Bloomberg survey results indicated that the Ohio residents are more supportive of the US Republican presidential candidate Donald Trump, and Hillary Clinton. "If Trump becomes president, it will be a surprise, and not very good for the markets and for the economy as a whole - said UniCredit analyst Christian Stocker. - While all attention is focused on the Fed, but the election topic is becoming increasingly important. "

Before the Fed meeting next week, is expected to be the focus of investors this week will be economic reports, including data on retail sales, unemployment, inflation, consumer and business sentiment and industrial production. Analysts predict that by the end of August, retail sales decreased by 0.1%, while industrial production fell by 0.3%. As for inflation, it is expected that the CPI rose in August by 0.1% after the zero change in July. If these estimates are correct, this number will increase the chances of a Fed rate increase in September. According to the futures market, at present, the probability of monetary tightening by the Fed's policy is 15% in September.

Oil prices fell by about 2.5%, which was caused by the publication of the controversial report on US petroleum inventories. US Department of Energy reported that in the week ended Sept. 9 oil inventories unexpectedly declined, but gasoline inventories rose slightly. According to the report, oil inventories fell by 559,000 barrels to 510.8 million barrels. The experts predicted an increase of 4 million barrels. Gasoline stocks rose by 567,000 barrels to 228.4 million barrels. Analysts had expected an increase of 600,000 barrels. Meanwhile, oil production in the US rose to 8.493 million barrels per day versus 8.458 million barrels per day in the previous week. US consumption of oil fell by 0.2 million. Barrels per day to 16.73 million barrels per day.

Most of the DOW index components recorded a decline (24 of 30). More rest rose stocks Apple Inc. (AAPL, + 3.58%). Outsider were shares of American Express Company (AXP, -1.38%).

Sector S & P index closed mixed. conglomerates (-0.8%) sectors fell most. The leader turned out to be the sector of consumer goods (+ 0.2%).

At the close:

Dow -0.18% 18,034.36 -32.39

Nasdaq + 0.36% 5,173.77 +18.51

S & P -0.06% 2,125.83 -1.19

-

21:00

Dow -0.05% 18,057.98 -8.77 Nasdaq +0.48% 5,180.05 +24.79 S&P +0.07% 2,128.56 +1.54

-

18:16

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocl-indexes rose on Wednesday, supported by gains in technology stocks and in tandem with the recent oscillation as investors fret over interest rates. Apple (AAPL.O) shares were up more 4%, giving the three major indexes their biggest boost and rising for the third day in a row on reports of strong demand positive review for the new iPhones.

Most of Dow stocks in positive area (18 of 30). Top gainer - Apple Inc. (AAPL, +4.45%). Top loser - American Express Company (AXP, -0.76%).

Almost all of S&P sectors also in positive area. Top gainer - Consumer goods (+0.6%). Top loser - Basic Materials (-0.2%).

At the moment:

Dow 18036.00 +27.00 +0.15%

S&P 500 2126.75 +4.50 +0.21%

Nasdaq 100 4759.25 +35.25 +0.75%

Oil 44.01 -0.89 -1.98%

Gold 1327.50 +3.80 +0.29%

U.S. 10yr 1.68 -0.05

-

18:00

European stocks closed: FTSE 100 +7.68 6673.31 +0.12% DAX -8.20 10378.40 -0.08% CAC 40 -16.92 4370.26 -0.39%

-

17:36

WSE: Session Results

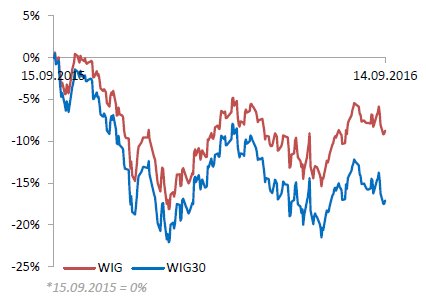

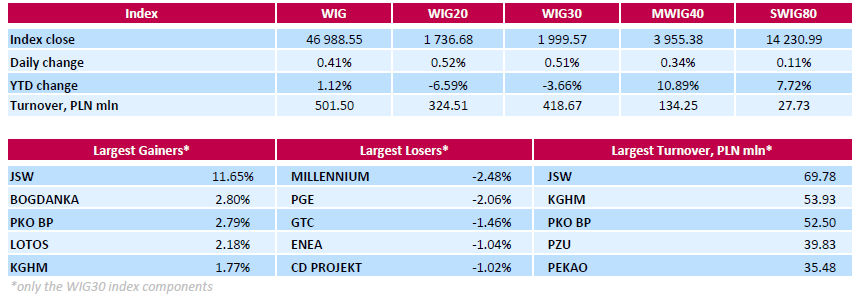

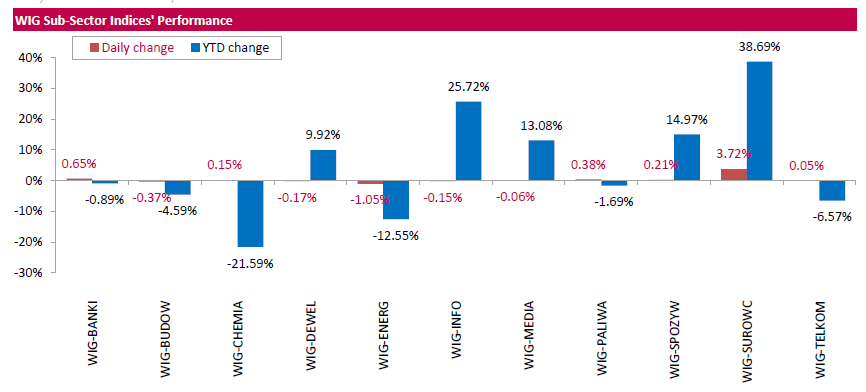

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, surged by 0.41%. Sector performance within the WIG Index was mixed. Materials (+3.72%) outperformed, while utilities (-1.05%) lagged behind.

The large-cap stocks gained 0.51%, as measured by the WIG30 Index, with the way up led by coking coal producer JSW (WSE: JSW), skyrocketing by 11.65%. Other major advancers were thermal coal miner BOGDANKA (WSE: LWB), bank PKO BP (WSE: PKO) and oil refiner LOTOS (WSE: LTS), increasing by 2.8%, 2.79% and 2.18% respectively. On the other side of the ledger, bank MILLENNIUM (WSE: MIL) and genco PGE (WSE: PGE) were the biggest decliners, falling by 2.48% and 2.06% respectively.

-

15:51

WSE: After start on Wall Street

A slight breeze of optimism from the opening of the US market encouraged our WIG20 index to growth, although small trading volume does not confirm the acquisition of shares by "strong hands".

Among companies of the WIG20 index we may observe a decline valuation of energy sector. In the sites there is information that PGE, Tauron (WSE: TPE), Energa (WSE: ENG) and Enea (WSE: ENA) (ie, companies with a large share of the Treasury) want to set up a company to produce electric cars. Each of the four companies is to cover 25 percent equity in the new company. We may guess that this government echo of ideas for innovation in the economy. The American example of Tesla in terms of financial results (losses) shows that it is not necessarily goose with the golden eggs.

An hour before the close of trading WIG20 index stood at the level of 1,739 points (+0,69%).

-

15:34

U.S. Stocks open: Dow +0.04%, Nasdaq +0.27%, S&P +0.09%

-

15:28

Before the bell: S&P futures +0.23%, NASDAQ futures +0.34%

U.S. stock-index futures rose slightly after three days of renewed volatility left equities at a two-month low.

Global Stocks:

Nikkei 16,614.24 -114.80 -0.69%

Hang Seng 23,190.64 -25.12 -0.11%

Shanghai 3,002.67 -20.84 -0.69%

FTSE 6,706.37 +40.74 +0.61%

CAC 4,382.32 -4.86 -0.11%

DAX 10,440.43 +53.83 +0.52%

Crude $44.65 (-0.56%)

Gold $1324.70 (+0.08%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

176.5

0.43(0.2442%)

415

ALCOA INC.

AA

9.68

0.16(1.6807%)

68162

ALTRIA GROUP INC.

MO

63.5

-0.05(-0.0787%)

1045

Amazon.com Inc., NASDAQ

AMZN

763.05

2.04(0.2681%)

6702

Apple Inc.

AAPL

108.7

0.75(0.6948%)

462710

AT&T Inc

T

39.99

0.02(0.05%)

1920

Barrick Gold Corporation, NYSE

ABX

17.5

0.21(1.2146%)

36746

Caterpillar Inc

CAT

80.16

-0.07(-0.0872%)

364

Chevron Corp

CVX

99.6

0.17(0.171%)

1043

Citigroup Inc., NYSE

C

47.15

0.23(0.4902%)

13698

Exxon Mobil Corp

XOM

85.4

0.19(0.223%)

1678

Facebook, Inc.

FB

127.49

0.28(0.2201%)

43558

Ford Motor Co.

F

12.28

-0.10(-0.8078%)

1675875

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.19

0.04(0.3941%)

440557

General Electric Co

GE

29.97

0.12(0.402%)

9379

General Motors Company, NYSE

GM

30.9

-0.04(-0.1293%)

13203

Google Inc.

GOOG

763

3.31(0.4357%)

425

Intel Corp

INTC

35.73

0.12(0.337%)

3639

Johnson & Johnson

JNJ

117.3

-0.31(-0.2636%)

542

JPMorgan Chase and Co

JPM

66.8

0.27(0.4058%)

1360

Microsoft Corp

MSFT

56.67

0.14(0.2477%)

7326

Nike

NKE

55.68

0.31(0.5599%)

954

Starbucks Corporation, NASDAQ

SBUX

54

0.02(0.0371%)

1000

Tesla Motors, Inc., NASDAQ

TSLA

196.98

0.93(0.4744%)

6771

Twitter, Inc., NYSE

TWTR

17.9

0.14(0.7883%)

54928

Verizon Communications Inc

VZ

51.57

0.12(0.2332%)

2798

Visa

V

81.94

0.05(0.0611%)

840

Yahoo! Inc., NASDAQ

YHOO

43.07

0.03(0.0697%)

1178

Yandex N.V., NASDAQ

YNDX

20.39

0.01(0.0491%)

5059

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Freeport-McMoRan (FCX) downgraded to Underweight from Equal-Weight at Morgan Stanley

Other:

-

13:07

WSE: Mid session comment

The first half of trading brought mute on the Warsaw Stock Exchange and the session does not carry great emotions. Volatility is also low, and the offset from the opening rather cosmetic.

For stabilization in Warsaw helps environment where change of indices deviate in small extent from the shift of the WIG20. Chance of breaking the market from this marasmus may be traditionally traced, when the US capital will enter in the markets. At the halfway point of the session the index of the largest companies reached the level of 1,728 points (+0,07%). The turnover was amounted to PLN 138 mln.

-

12:42

Major stock indices in Europe show a positive trend

European stocks rose for the first time after declining during the past several sessions, as investors seek safe assets after a global sell-off in the markets due to doubts about the effectiveness of central bank policy.

Statistical data from the UK, released on Wednesday showed that the country's decision to withdraw from the European Union did not lead to cooling of the labor market. Unemployment in the UK in May-July 2016 remained at 4.9%, which is 11 years low, according to the country's National Statistical Management (ONS). The number of unemployed in the three months fell by 39 thousand., The number of employees (aged 16 to 64 years) increased by 174 thousand.

Market focus is on Bank of England's meeting ending tomorow. British Central Bank is expected to hold the policy after taking aggressive measures at the August meeting.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,4% to 340.03 points.

Mining stocks rise in price in the bidding against the backdrop of rising prices for metals.

Glencore shares cost increased by 3,9%, Anglo American by 3.8%.

Share of European manufacturers of luxury goods fell during trading.

The world's largest jewelry manufacturer Financiere Richemont SA warned to reduce the operating profit in the fiscal first half to 45%, noting the difficult operating environment in the sector, as well as the general weakening of global economic growth.

Meanwhile, the French fashion house Hermes International SCA increased profit and revenues in the 1 st half of 2016, but declined the mid-term forecast increase in revenue, noting the growing economic and geopolitical tensions around the world.

Stocks of Richemont and Hermes fell 4.2% and 7% and Burberry -2.6%.

The cost of the Swiss watch manufacturer Swatch Group decreased by 3.4%.

At the moment:

FTSE 6710.19 44.56 0.67%

DAX 10421.15 34.55 0.33%

CAC 4389.06 1.88 0.04%

-

09:40

Major stock exchanges trading in the green zone: FTSE + 0.3%, DAX + 0.3%, CAC40 + 0.4%, FTMIB + 0.5%, IBEX + 0.4%

-

09:19

WSE: After opening

WIG20 index opened at 1730.91 points (+0.19%)*

WIG 46911.63 0.24%

WIG30 1996.01 0.33%

mWIG40 3942.95 0.02%

* - change to previous close

The valuation of September series contracts rose on opening by 0.3 per cent (to the level of 1,735 points).

European markets started the sessions with increases. In the first minutes of trading on the Warsaw Stock Exchange we have lightweight drama in terms of trading in the WIG20 components, and it seems that no one of large players are on the parquet. Market movement is conservative and therefore difficult to talk about a serious reflection on the recent discounts.

The session is not going to be exciting - looks more as a consolidation.

-

08:43

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.5%, CAC40 + 0.6%, FTSE + 0.3%

-

08:29

WSE: Before opening

Tuesday's session on Wall Street brought back to a repricing and the S&P500 index lost 1.48 percent.

The impact on this situation have undoubtedly four factors; uncertainty about the September rate hike in the US, the appreciation of the dollar, the decline in oil prices and an increase in the profitability of the debt.

The morning trading in Europe should bring some attempts to rebound. Now oil is going up by 0.5 percent and futures on the DAX are listed on a slight positive territory.

Today's macro calendar does not contain any significant publication. We will know today read of the dynamics of industrial production in the euro zone, but these data do not arouse strong emotions. Some investors will pay attention to the reading of unemployment in the UK, which may reflect an echo on the pound and indirectly affect the main currency pair EURUSD.

Assuming that world markets will slightly rebuild, the WIG20 index should return to the area of 1,750 points and start looking for stability. However, we expect that in the next days the index will move under the dictation of news from overseas about the possibility of interest rate hikes in the US. Potential increases will not help the entire Polish market.

-

06:33

Global Stocks

European stocks were also dropping as investors grappled with mixed messages from the Federal Reserve. Recent Fed speakers have hinted interest rates could go up as soon as next week, but after European trading closed on Monday, the central bank's Gov. Lael Brainard said the lack of inflation pressure means "the case to tighten policy pre-emptively is less compelling."

The Dow industrials on Tuesday finished nearly 260 points lower as equities suffered a sharp sell-off amid a slump in energy shares and uncertainty about the Federal Reserve's plans for monetary policy. A decline in crude-oil prices, as the International Energy Agency warned of slowing growth in demand, also helped to fuel the downdraft for the stock benchmarks.

Asian shares were broadly mixed Wednesday on weakness in U.S. equities and continued worries that global central banks will soon reverse their easing schemes. In Japan, banks were particularly hard hit Wednesday on speculation that the Bank of Japan will reduce its purchases of superlong bonds to steepen the yield curve, while maintaining the negative rate on excess reserves.

-

00:29

Stocks. Daily history for Sep 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,729.04 +56.12 +0.34%

Shanghai Composite 3,023.79 +1.81 +0.06%

S&P/ASX 200 5,207.78 -11.83 -0.23%

FTSE 100 6,665.63 -35.27 -0.53%

CAC 40 4,387.18 -52.62 -1.19%

Xetra DAX 10,386.60 -45.17 -0.43%

S&P 500 2,127.02 -32.02 -1.48%

Dow Jones Industrial Average 18,066.75 -258.32 -1.41%

S&P/TSX Composite 14,349.10 -248.04 -1.70%

-