Noticias del mercado

-

16:30

U.S.: Crude Oil Inventories, September -0.559 (forecast 4)

-

15:54

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1150 (EUR 265m) 1.1200 (297m) 1.1220 (721m) 1.1225 (380m) 1.1230 (1.2bln) 1.1250 (570m) 1.1270 (222m) 1.1300 (301m) 1.1350 (444m) 1.1360 (653m)

USD/JPY: 100.00-05 (315m) 101.02( 240m) 101.47-50 (560m) 102.00 (541m) 104.00-05 (1.16bln)

AUD/USD: 0.7370-75( AUD 300m)

USD/CAD 1.3100 (USD 590m) 1.3275 (400m)

NZD/USD 0.7450 (262m)

AUD/JPY 77.50 (AUD 445m) 77.95-0.7600 (619m)

-

15:09

Bullish USD S/T & M/T: Long USD/CAD & USD/JPY - Goldman Sachs

"We became Dollar bulls in April 2014, forecasting that the greenback would rise 15 percent against the majors. We reasoned that slack was diminishing, allowing the Fed to normalize monetary policy, which would move rate differentials in favor of the Dollar. In the event, the Dollar rose more and faster than we expected, but for a different reason. BoJ and ECB pursuit of QE drove the Dollar up, while the Fed has done little to normalize policy, amid signs that it is increasingly targeting the currency (Exhibit 1).

Following recent Fed speak, which first raised hopes of a September hike only to dash them, we revisit prospects for the Dollar at a time when many see little, if any, upside. We distance ourselves from the near-term debate over September versus December and, instead, work back from the medium term. Through mid-2019 interest rate futures price only two hikes, which is low even by the standards of the recent R-Star debate.

The medium-term outlook for the Dollar is therefore very supportive, even if this hiking cycle falls short of the historical template. In the short term, the discussion over September versus December ignores that markets price only 15 bps for the two meetings combined. Given that Vice Chair Fischer talked about the possibility of two hikes this year, one hike is very much on the table.

The short-term picture is therefore constructive as well, with our favorite implementation long $/CAD into the October MPR meeting (Oct 19). This cross could approach our 12-month forecast of 1.40 by year-end.

We also like long $/JPY, given that long Yen positioning is extreme and markets are overdue for a re-think on the BoJ being out of bullets. We target 110 by year-end.

Finally, it is time to re-initiate short RMB positions, given that Dollar strength remains a stumbling block for China's currency".

Copyright © 2016 Goldman Sachs, eFXnews™

-

15:02

US export/import prices decline as signs of inflation are rare

U.S. import prices declined 0.2 percent in August, the U.S. Bureau of Labor Statistics reported today, after ticking up 0.1 percent in July. The August downturn was driven by lower fuel prices. Prices for U.S. exports decreased 0.8 percent in August following a 0.2-percent increase in July.

U.S. export prices decreased 0.8 percent in August, the first monthly drop since the index edged down 0.1 percent in March and the largest decline since the index fell 0.9 percent in January. In August, lower prices for both agricultural and nonagricultural exports contributed to the overall drop in

export prices. The price index for U.S. exports decreased 2.4 percent over the past year, the smallest 12- month decline since the index fell 1.7 percent in November 2014.Exports Excluding Agriculture: Prices for nonagricultural exports decreased 0.4 percent in August, after rising 0.2 percent the previous month. The August decline in nonagricultural export prices was the first monthly drop since the index fell 0.6 percent in February. Lower prices for industrial supplies and materials, automotive vehicles, capital goods, and consumer goods all contributed to the August downturn. The price index for nonagricultural exports decreased 2.2 percent over the past 12 months, primarily driven by a 5.3-percent decline in nonagricultural industrial supplies and materials prices.

-

13:48

Orders

EUR/USD

Offers : 1.1235 1.1250 1.1265 1.1285 1.1300 1.1325-30 1.1350 1.1365 1.1380 1.1400

Bids : 1.1200 1.1185 1.1170 1.1145-50 1.1120 1.1100

GBP/USD

Offers : 1.3225-30 1.3250 1.3280 1.3300 1.3335 1.3350-55 1.3380 1.3400

Bids : 1.3180 1.3165 1.3150 1.3130 1.3100 1.3080 1.3050 1.3030 1.3000

EUR/GBP

Offers : 0.8520-25 0.8540 0.8560-65 0.8580 0.8600

Bids : 0.8485 0.8450 0.8420 0.8400 0.8385 0.8365 0.8350

EUR/JPY

Offers : 116.00 116.30 116.50 116.85 117.00 117.50

Bids : 115.50 115.20 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers : 103.35 103.50 103.75 104.00 104.30 104.50

Bids : 103.00 102.80 102.50 102.00 101.75-80 101.60 101.40 101.20 101.00

AUD/USD

Offers : 0.7500 0.7535 0.7550 0.7560 0.7580 0.7600 0.7630 0.7655-60

Bids : 0.7450 0.7420-25 0.7400 0.7385 0.7365 0.7350

-

13:42

UK and Argentina agreed to work together to remove measures restricting the oil and gas industries

-

Have agreed to work together to remove measures restricting the oil and gas industries and shipping and fishing around the Falklands Islands.

-

Discussions with Argentina do not affect sovereignty of Falklands.

-

UK clear in support for rights of Islanders.

*via forexlive -

-

13:12

Boj to consider cut of negative rate to minus 0.2%: Kyodo

-

12:29

BOJ may debate deepening negative rates - Reuters

-

11:07

Euro zone industrial production fell by 1.1% in June

In July 2016 compared with June 2016, seasonally adjusted industrial production fell by 1.1% in the euro area (EA19) and by 1.0% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In June 2016 industrial production rose by 0.8% in the euro area and by 0.7% in the EU28. In July 2016 compared with July 2015, industrial production decreased by 0.5% in the euro area and by 0.1% in the EU28.

-

11:01

Eurozone: Industrial production, (MoM), July -1.1% (forecast -0.9%)

-

11:01

Eurozone: Industrial Production (YoY), July -0.5% (forecast -0.7%)

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), September 2.7

-

10:36

UK: stable employment but better average ernings

Between February to April 2016 and May to July 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.77 million people in work, 174,000 more than for February to April 2016 and 559,000 more than for a year earlier.

There were 23.25 million people working full-time, 434,000 more than for a year earlier. There were 8.51 million people working part-time, 126,000 more than for a year earlier.

The unemployment rate was 4.9%, down from 5.5% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.1% excluding bonuses compared with a year earlier.

-

10:31

United Kingdom: ILO Unemployment Rate, July 4.9% (forecast 4.9%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, July 2.1% (forecast 2.2%)

-

10:30

United Kingdom: Claimant count , August 2.4 (forecast 1.8)

-

10:30

United Kingdom: Average Earnings, 3m/y , July 2.3% (forecast 2.1%)

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1150 (EUR 265m) 1.1200 (297m) 1.1220 (721m) 1.1225 (380m) 1.1230 (1.2bln) 1.1250 (570m) 1.1270 (222m) 1.1300 (301m) 1.1350 (444m) 1.1360 (653m)

USD/JPY: 100.00-05 (315m) 101.02( 240m) 101.47-50 (560m) 102.00 (541m) 104.00-05 (1.16bln)

AUD/USD: 0.7370-75( AUD 300m)

USD/CAD 1.3100 (USD 590m) 1.3275 (400m)

NZD/USD 0.7450 (262m)

AUD/JPY 77.50 (AUD 445m) 77.95-0.7600 (619m)

-

10:19

Romanian industrial production unchanged in July

According to rttnews, Romania's industrial production remained unchanged from a year ago in July, figures from the National Institute of Statistics showed Wednesday.

Industrial production, on a seasonally and working-day adjusted basis, was unchanged from the same month last year. Manufacturing output rose 3.5 percent, output tumbled 13.8 percent and 5.9 percent, respectively, in mining and utility sectors.

Month-on-month, industrial production rose 0.7 percent in July, led by a 1 percent gain in manufacturing and 0.9 percent increase in mining and quarrying.

On an unadjusted basis, production declined 3.4 percent annually and 1.4 percent from the previous month.

-

09:11

French CPI up 0.3% in August, as expected

In August 2016, the Consumer Prices Index (CPI) grew by 0.3% over a month, after a decrease of 0.4% in July. Seasonally adjusted, it fell by 0.1%, after a stability in July. Year-on-year, the CPI rose by 0.2%, as in the two previous months.

This month-on-month drop was largely seasonal: it arose mainly from the seasonal rebound in the manufactured product prices at the end of the summer sales in Metropolitan France and in some tourism-related services. In addition, food prices kept on rising slightly, especially due to fresh foodstuffs. These increases were partially offset by a further decline in petroleum product prices.

-

09:10

Some BoJ Members Still Favour JGBs In Any Stimulus Boost - Livesquawk

-

09:08

Second major data set from UK up next as wage inflation and employment will be carefully watched. Volatility expected on GBP pairs

-

09:05

Today’s events

At 09:30 GMT Germany will hold an auction of 30-year bonds

At 09:50 GMT RBA Assistant Governor Guy Debell deliver a speech

At 11:05 GMT, First Deputy Governor of the Bank of Canada, Carolyn Wilkins will deliver a speech

China celebrates Mid-Autumn Festival

-

08:38

BoE On Hold On Thurs; GBP/USD En-Route To 1.27 - Barclays

"This week's BoE meeting (Thursday) will be the key event risk for GBP and we expect no change in the MPC's monetary policy settings.

We look for unanimous voting in favour of the status quo for the current APF (9-0) but do believe that dovish Committee member Gertjan Vlieghe is likely to dissent and vote for a cut (8-1). Moreover, we expect the minutes to echo the testimony of Governor Mark Carney and Committee members Jon Cunliffe, Kristin Forbes, and Gertjan Vlieghe to the Treasury Select Committee and think the MPC is comfortable with its recently announced easing package.

A confirmation of this and openness towards further easing, should downside risks to the economy materialize, will likely keep GBPUSD under pressure, in our view".

Barclays targets GBP/USD at 1.27 by the end of the year.

Copyright © 2016 Barclays Capital, eFXnews™

-

08:36

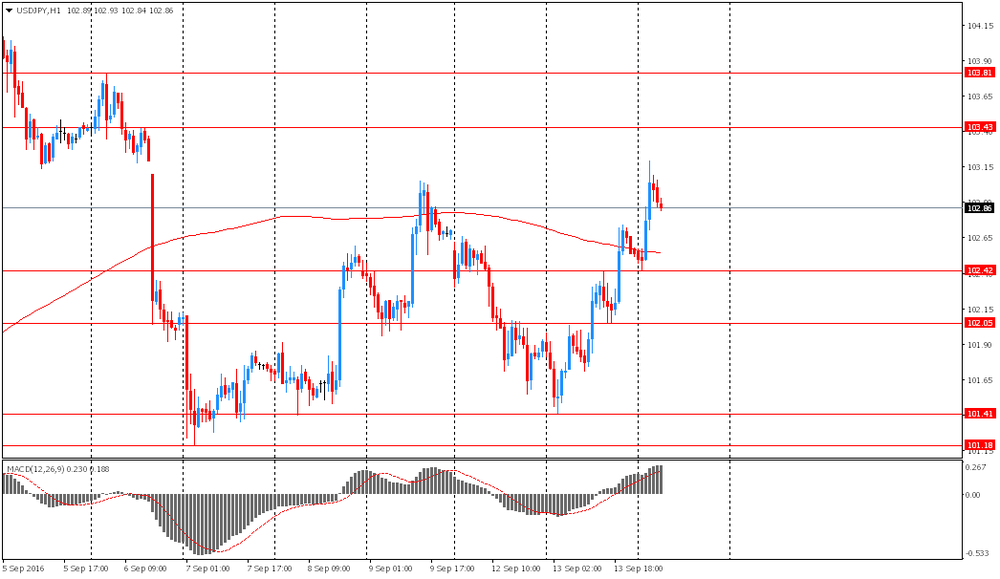

Asian session review: The Yen fell against the US dollar

The yen fell against the dollar after the Japanese financial magazine Nikkei reported that the Bank of Japan at the upcoming meeting will likely consider to further reduce deposit rates. Experts point out that at the meeting on 20-21 September, the central bank will mainly discuss it negative rate, as an element of additional monetary easing. Analysts also suggest that to deal with the side effects of negative interest rates on deposits, the regulator can cut the volume of purchases of Japanese bonds maturing in 25 years and above. In addition, the Bank of Japan will once again abandon the anchor to achieve the target level of inflation at 2% in two years.

The New Zealand dollar declined on negative data on the balance of payments of New Zealand. As reported today, the Bureau of Statistics New Zealand's current account deficit in the second quarter was NZ $ 0.945 billion while analysts had expected a balance decline of NZ $ 0,411 billion The value of the balance of payments in the first quarter was revised from NZ $ 1,31 billion to NZ $ 1, 84 billion.

The Australian dollar fell on weaker data from the Westpac consumer confidence index. According to the studies of the Faculty of Economics and Commerce at the University of Melbourne, consumer confidence index in Australia increased by 0.3% in September, down from the previous value of 2.0%.

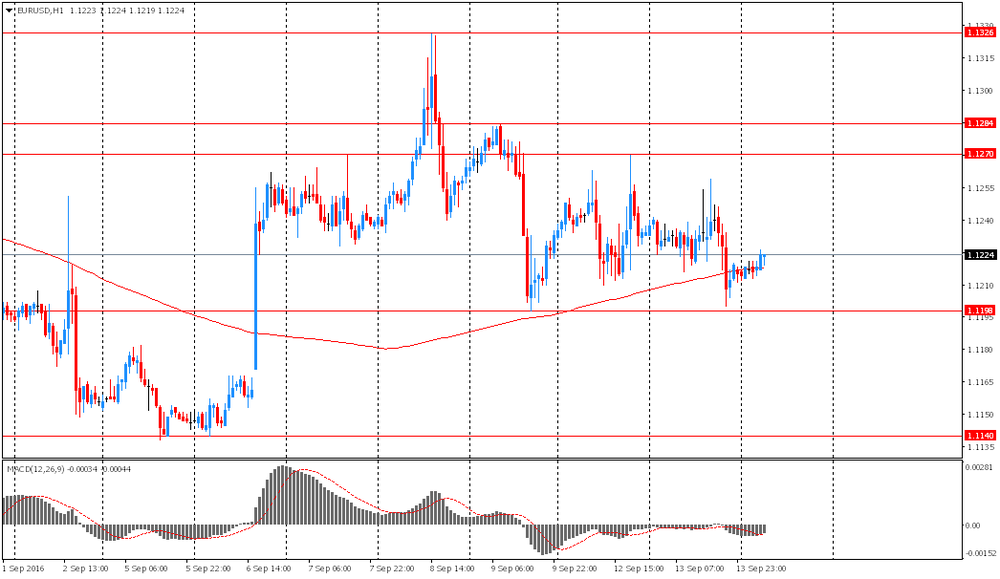

EUR / USD: during the Asian session, the pair was trading in the $ 1.1215-25 range

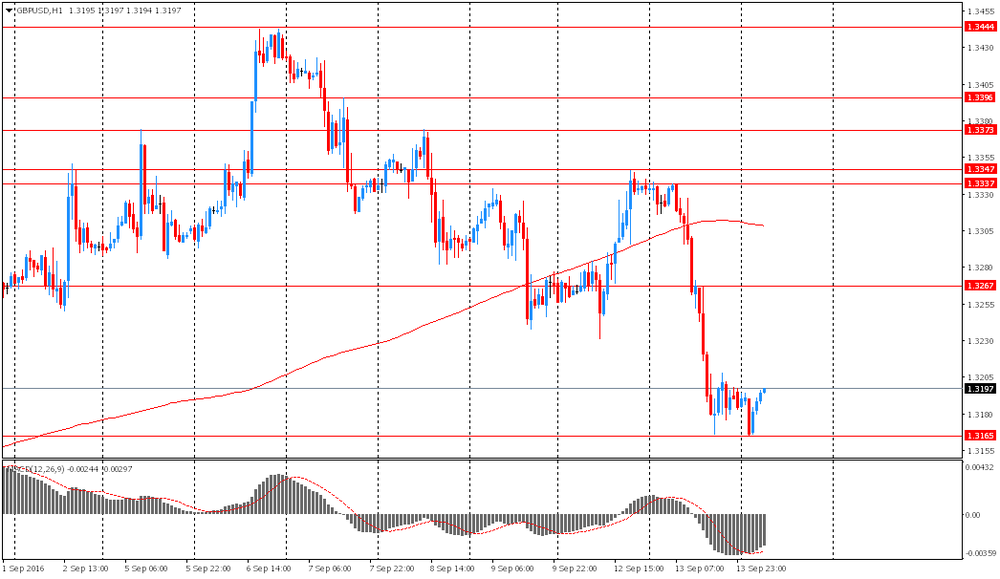

GBP / USD: during the Asian session, the pair was trading in the $ 1.3165-00 range

USD / JPY: during the Asian session, the pair rose to Y103.20

-

08:25

Options levels on wednesday, September 14, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1364 (2222)

$1.1316 (2104)

$1.1269 (425)

Price at time of writing this review: $1.1225

Support levels (open interest**, contracts):

$1.1188 (2101)

$1.1135 (3763)

$1.1102 (3453)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35835 contracts, with the maximum number of contracts with strike price $1,1500 (5354);

- Overall open interest on the PUT options with the expiration date October, 7 is 37881 contracts, with the maximum number of contracts with strike price $1,1100 (5357);

- The ratio of PUT/CALL was 1.06 versus 1.05 from the previous trading day according to data from September, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1805)

$1.3405 (2004)

$1.3308 (966)

Price at time of writing this review: $1.3201

Support levels (open interest**, contracts):

$1.3092 (792)

$1.2995 (3330)

$1.2897 (700)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 21405 contracts, with the maximum number of contracts with strike price $1,3450 (2774);

- Overall open interest on the PUT options with the expiration date October, 7 is 20252 contracts, with the maximum number of contracts with strike price $1,3000 (3330);

- The ratio of PUT/CALL was 0.95 versus 0.98 from the previous trading day according to data from September, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Japanese Prime Minister Abe: We are in the process of emerging from deflation

During his speech today, the Prime Minister of Japan Shinzo Abe said that the country is in the process of emerging from deflation. "The effect of the Central Bank's soft monetary policy is obvious and at the moment we are on the verge of exiting a deflationary period," - said the head of the Cabinet. However, Abe warned that there are risks in the global economy.

-

08:21

New Zeeland current account deficit higher in the last quarter

Record spending by New Zealanders travelling overseas was behind a larger current account deficit in the June 2016 quarter, Statistics New Zealand said today. The current account deficit was $1.8 billion for the June quarter, $187 million larger than the March 2016 quarter's deficit.

"More New Zealanders went overseas this quarter than in previous June quarters. And they spent the most ever recorded while travelling for work and holidays," international statistics manager Stuart Jones said. This caused services imports to increase, while services exports decreased, resulting in the $144 million fall in the services surplus; the biggest since March 2012.

The decrease in services exports was mainly influenced by a decrease in transportation services. Spending by international visitors to New Zealand also decreased slightly.

The primary income deficit increased by $135 million to $2,040 million in the June 2016 quarter, due to an increase in income on foreign direct investment in New Zealand.

"Overall, the profits earned by foreign-owned New Zealand companies increased this quarter," Mr Jones said. "The majority of this income was reinvested in the June quarter, rather being than paid out as dividends as it was last quarter."

The seasonally adjusted goods balance was a deficit of $452 million in the June 2016 quarter, $71 million smaller than the March 2016 quarter's deficit. The value of both exports and imports of goods grew strongly in the latest quarter; however, goods exports increased more than imports, narrowing the goods deficit.

-

08:16

Japan's industrial production declined in July

Japan's industrial production declined in July from the previous month after revision, latest data from the Ministry of Economy, Trade and Industry showed Wednesday.

Industrial production decreased 0.4 percent from June, while the initial report had shown no change.

Shipments grew 0.7 percent, while inventories declined 2.4 percent.

The year-on-year decline was revised to -4.2 percent from -3.8 percent.

Capacity utilization grew a seasonally adjusted 0.6 percent.

-

06:46

Japan: Industrial Production (YoY), July -4.2% (forecast -3.8%)

-

06:46

Japan: Industrial Production (MoM) , July -0.4% (forecast 0.0%)

-

02:30

Australia: Westpac Consumer Confidence, September 0.3%

-

00:45

New Zealand: Current Account , Quarter II -0.94 (forecast -0.411)

-

00:28

Currencies. Daily history for Sep 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1215 -0,17%

GBP/USD $1,3184 -1,14%

USD/CHF Chf0,9771 +0,54%

USD/JPY Y102,54 +0,60%

EUR/JPY Y115,01 +0,44%

GBP/JPY Y135,19 -0,52%

AUD/USD $0,7661 +1,29%

NZD/USD $0,7249 -1,39%

USD/CAD C$1,3161 +0,93%

-

00:00

Schedule for today,Wednesday, Sep 14’2016

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence September 2.0%

04:30 Japan Industrial Production (MoM) (Finally) July 2.3% 0.0%

04:30 Japan Industrial Production (YoY) (Finally) July -1.5% -3.8%

08:30 United Kingdom Average Earnings, 3m/y July 2.4% 2.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y July 2.3% 2.2%

08:30 United Kingdom Claimant count August -8.6 1.8

08:30 United Kingdom ILO Unemployment Rate July 4.9% 4.9%

09:00 Eurozone Industrial production, (MoM) July 0.6% -0.9%

09:00 Eurozone Industrial Production (YoY) July 0.4% -0.7%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) September -2.8

09:50 Australia RBA Assist Gov Debelle Speaks

10:30 Canada Gov Council Member Wilkins Speaks

14:30 U.S. Crude Oil Inventories September -14.513

22:30 New Zealand Business NZ PMI August 55.8

22:45 New Zealand GDP y/y Quarter II 2.8% 3.7%

22:45 New Zealand GDP q/q Quarter II 0.7% 1.1%

-