Noticias del mercado

-

22:07

Major US stock indices ended the session with a certain increase

Major stock indexes of Wall Street markedly increased on higher shares of Apple and weak macroeconomic data, reducing the prospects of higher interest rates in the near future.

Thus, US retail sales fell more than expected in August, amid weak purchases of cars and other goods, pointing to cooling domestic demand. The Commerce Department reported that retail sales fell by 0.3% after a revised gain in the direction of growth of 0.1% in July. Retail sales in July, as previously reported, were unchanged. Sales rose by 1.9% compared to last year. Excluding automobiles, gasoline, building materials and food services, retail sales fell 0.1% last month after a downwardly revised fall of 0.1% in July.

At the same time, the number of Americans who applied for unemployment benefits rose less than expected last week, pointing to a further tightening of labor market conditions. unemployment initial claims for benefits rose by 1000 and to reach a seasonally adjusted 260,000 for the week ended September 10. Appeals have not been revised for the previous week. Economists had forecast that the treatment will rise to 265,000.

Oil futures rose slightly, helped by the partial closure of short positions after the two-day drop. However, further price growth is limited by the strengthening of the US dollar and fears of a resumption of crude oil deliveries from Nigeria and Libya.

All components of the DOW index closed in positive territory (30 of 30). More rest rose stocks Apple Inc. (AAPL, + 3.32%). Minimum growth recorded shares of The Boeing Company (BA, + 0.04%).

All business sectors S & P index also ended the session in positive territory. The leader turned out to be the technology sector (+ 1.3%). Less rest utilities sector grew (+ 0.5%).

At the close:

Dow + 0.99% 18,212.89 +178.12

Nasdaq + 1.47% 5,249.69 +75.92

S & P + 1.01% 2,147.29 +21.52

-

21:00

Dow +1.13% 18,237.72 +202.95 Nasdaq +1.51% 5,251.88 +78.11 S&P +1.12% 2,149.58 +23.81

-

18:37

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rallied on Thursday, boosted by Apple and lackluster economic data that further dimmed the prospects of an interest rate hike in the near term. Retail sales and industrial activity fell more than expected in August. The data follows reports showing a slowdown in job growth and a slump in manufacturing activity for the month. However, jobless claims rose less than expected last week, indicating strength in the labor market - a key barometer the Federal Reserve considers while deciding monetary policy.

Most of Dow stocks in positive area (29 of 30). Top gainer - Apple Inc. (AAPL, +3.33%). Top loser - NIKE, Inc. (NKE, -0.18%).

All of S&P sectors also in positive area. Top gainer - Basic Materials (+1.2%).

At the moment:

Dow 18096.00 +176.00 +0.98%

S&P 500 2136.25 +23.00 +1.09%

Nasdaq 100 4805.25 +76.75 +1.62%

Oil 44.31 +0.73 +1.68%

Gold 1322.10 -4.00 -0.30%

U.S. 10yr 1.71 +0.02

-

18:00

European stocks closed: FTSE 100 +56.99 6730.30 +0.85% DAX +52.80 10431.20 +0.51% CAC 40 +2.96 4373.22 +0.07%

-

17:35

WSE: Session Results

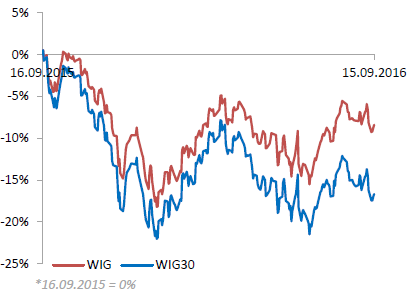

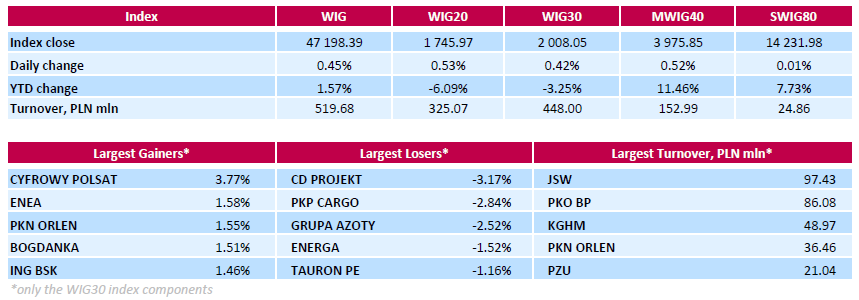

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, added 0.45%. Except for chemicals (-0.40%) and information technology (-0.48%), every sector in the WIG Index gained, with media (+2.37%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.42%. Media group CYFROWY POLSAT (WSE: CPS) was the growth leader among the index components, recording advance of 3.77%. It was followed by genco ENEA (WSE: ENA), oil refiner PKN ORLEN (WSE: PKN), thermal coal miner BOGDANKA (WSE: LWB) and bank ING BSK (WSE: ING), gaining 1.46%-1.58%. On the other side of the ledger, videogame developer CD PROJEKT (WSE: CDR) was the weakest name, dropping 3.17%. Other largest decliners were railway freight transport operator PKP CARGO (WSE: PKP) and chemical producer GRUPA AZOTY (WSE: ATT), declining by 2.84% and 2.52% respectively.

-

15:54

WSE: After start on Wall Street

The first series of US data showed a slightly negative retail sales. Car sales fell by 0.9%. Total year-to-year sales continues to grow, this time by 1.9%, so the data were not fata. In addition, the number of weekly applications for unemployment benefits remained at a very low level. Overall, the data were not so bad and reduce the pressure on interest rate increases, which is favorable for emerging markets, including the WSE.

Further data showed a drop in industrial production and a lower-than-expected capacity utilization, however their impact on the atmosphere of the market was zero. There was no the slightest reaction or on the dollar, or the stock markets.

The market in the United States opens at neutral levels that could be expected from early morning.

An hour before the close of trading the WIG20 index was at the level of 1,741 points (+0,28%).

-

15:35

U.S. Stocks open: Dow +0.03%, Nasdaq +0.17%, S&P 0.00%

-

15:29

Before the bell: S&P futures +0.15%, NASDAQ futures +0.25%

U.S. stock-index futures advanced after data on retail sales and producer prices did little to alter speculation on the timing of a Federal Reserve interest-rate increase.

Global Stocks:

Nikkei 16,405.01 -209.23 -1.26%

Hang Seng 23,335.59 +144.95 +0.63%

Shanghai Closed

FTSE 6,708.03 +34.72 +0.52%

CAC 4,360.03 -10.23 -0.23%

DAX 10,364.92 -13.48 -0.13%

Crude $43.79 (+0.48%)

Gold $1321.50 (-0.35%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.43

0.04(0.426%)

24380

3M Co

MMM

175

-0.62(-0.353%)

284

ALTRIA GROUP INC.

MO

63.15

0.03(0.0475%)

705

Amazon.com Inc., NASDAQ

AMZN

762.62

1.53(0.201%)

16237

Apple Inc.

AAPL

113.92

2.15(1.9236%)

1134935

AT&T Inc

T

39.92

0.03(0.0752%)

5022

Barrick Gold Corporation, NYSE

ABX

17.3

0.11(0.6399%)

77937

Chevron Corp

CVX

98.85

0.43(0.4369%)

8785

Citigroup Inc., NYSE

C

46.7

-0.05(-0.107%)

11895

Exxon Mobil Corp

XOM

84.75

0.15(0.1773%)

3130

Facebook, Inc.

FB

127.98

0.21(0.1644%)

88833

Ford Motor Co.

F

12.17

0.03(0.2471%)

73641

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.83

0.03(0.3061%)

66558

General Electric Co

GE

29.54

0.07(0.2375%)

33386

General Motors Company, NYSE

GM

30.8

0.09(0.2931%)

7960

Google Inc.

GOOG

764.5

2.01(0.2636%)

681

Home Depot Inc

HD

126.49

0.23(0.1822%)

243

Intel Corp

INTC

35.63

0.01(0.0281%)

2874

Microsoft Corp

MSFT

56.2

-0.06(-0.1066%)

19094

Nike

NKE

55.11

-0.02(-0.0363%)

248

Procter & Gamble Co

PG

87

-0.01(-0.0115%)

102

Starbucks Corporation, NASDAQ

SBUX

54.12

0.22(0.4082%)

1256

Tesla Motors, Inc., NASDAQ

TSLA

195.9

-0.51(-0.2597%)

9387

The Coca-Cola Co

KO

42.21

0.10(0.2375%)

3159

Twitter, Inc., NYSE

TWTR

18.45

0.37(2.0465%)

180887

Verizon Communications Inc

VZ

51.67

0.18(0.3496%)

500

Walt Disney Co

DIS

93

0.74(0.8021%)

950

Yahoo! Inc., NASDAQ

YHOO

43.7

0.24(0.5522%)

646

Yandex N.V., NASDAQ

YNDX

20.47

0.15(0.7382%)

2247

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $133 from $124 at BTIG Research

Apple (AAPL) maintained with an Outperform rating and price target of $150 at Credit Suisse

-

13:04

WSE: Mid session comment

Entry into southern phase of trading takes place in Europe under the sign of light increases, similarly behaving the Warsaw market. Also American contracts come to session highs, which further stabilize the situation in anticipation of subsequent data from the US.

A turnover of PLN 100 million after 4 hours of trade on the WIG20 index clearly indicate that investors refrain from decisions and waiting for the afternoon quite a large portion of the US data (retail sales, industrial production, PPI), which may affect the Fed's decision with regard to a possible increases in interest rates. In addition, tomorrow we have "three witches day", which is also not conducive to increased activity in the period immediately prior to such event. At the halfway point of today's session the WIG20 index was at the level of 1,741 points (+0,28%).

-

12:44

Major stock indices in Europe trading mixed

Major stock indices in Western Europe are traded with lower volatility after declining for five consecutive sessions.

The main market focus is now on the Bank of England's decision on intrest rates. Analysts do not expect any action from the Central Bank, but will wait for the bank's assessment of the situation in the British economy after the country's decision to leave the EU.

The focus of investors was also the data of the eurozone and the UK. British retail sales fell at a slower-than-expected pace in August, after recovering in the previous month. Retail sales, including automotive fuel, decreased by 0.2 percent for the month in August, vs +1.9 percent in July. Sales are expected to decline by 0.4 percent. In the same way, except automotive fuel, retail sales fell by 0.3 percent from July, when it grew by 2.1 per cent. That was below the 0.7 percent decline expected by economists. In annual terms, retail sales growth declined slightly to 6.2 percent in August, compared with 6.3 percent a month earlier. Economists had forecast an increase of 5.4 percent. Sales excluding auto fuel advanced 5.9 percent annually in August, after rising 5.8 percent the previous month.

Eurozone annual inflation was 0.2% in August 2016, stable compared with July. In August 2015, this figure was 0.1%. In the European Union annual inflation was 0.3% compared with 0.2% in July. A year earlier the rate was 0.0%. These figures comes from Eurostat.. In August 2016 were reported negative rates in twelve Member States. The lowest annual rates were recorded in Croatia (-1.5%), Bulgaria (-1.1%) and Slovakia (-0.8%). The highest rates were recorded in Belgium (2.0%), Sweden (1.2%) and Estonia (1.1%). Compared with July 2016, annual inflation fell in seven Member States, remained stable in six and rose in fifteen. The largest upward impact on the annual inflation in the euro area came from restaurants & cafés (+0.10 percentage points), fruits and vegetables (+0.07 percentage points), while fuels for transport (-0.35 p. n.), heating oil and gas (-0.12 percentage points) were the biggest downward impacts.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1% - to 338.86 points. On September 7 the indicator fell by 3.4%.

Shares of Wm Morrison Supermarkets Plc rose 5.7% as its quarterly profit and revenue exceeded market expectations.

The capitalization of Italian Banca Monte dei Paschi di Siena has increased by 2.4%. The bank announced the appointment of a new CEO and Chairman of the Board of Directors.

The cost of the Swedish retailer H & M fell by 2.5%, as its August sales fell short of forecasts.

Quotes of the cell operator TeliaSonera AB were down 1%. US and Dutch authorities offer companies settle claims of paying bribes in Uzbekistan, paying a fine of $ 1.4 billion.

Shares of Zodiac Aerospace, which last year issued a series of warnings about earnings, also gained 4.8% after reporting annual revenue that exceeded forecasts.

However, shares of Next fell 3% after the British clothing retailer warned of volatile trading, reported on the drop in profits in the first half.

At the moment:

FTSE 6688.75 15.44 0.23%

DAX 10383.30 4.90 0.05%

CAC 4366.86 -3.40 -0.08%

-

09:44

Major stock markets trading in the red zone: FTSE -0.1%, DAX -0.2%, CAC40 -0.3%, FTMIB -0.2%, IBEX -0.2%

-

09:12

WSE: After opening

WIG20 index opened at 1736.24 points (-0.03%)*

WIG 47067.56 0.17%

WIG30 2002.47 0.15%

mWIG40 3975.00 0.50%

*/ - change to previous close

The WIG20 futures took off exactly from yesterday's close, which is part of a small variation during yesterday's session on Wall Street and in the absence of a clear direction of morning trading futures on the major European indices.

With no major attractions began trading on the spot market with virtually zero change on the WIG20 index The small distinctions among the largest companies are more than one percent increases in the values of Enea (WSE: ENA), KGHM and mBank (WSE:MBK), which are offset by small declines of PKO, PKN Orlen, PZU and PGE. It is obviously stronger the second line of companies where the mWIG40 rising by 0.6 percent in the first minutes of the session.

-

08:42

Expected negative start of trading on the major stock exchanges in Europe: DAX futures -0.3%, CAC 40 -0.2%, FTSE -0.4%

-

08:22

WSE: Before opening

Wednesday's session on the New York stock exchanges did not bring significant changes. At the end of the day the Dow Jones Industrial fell 0.18 percent, Nasdaq Comp. increased by 0.36 percent and the S&P 500 fell by 0.06 percent.

Recent sessions both in the US and in Europe were marked by increased volatility. High volatility is the effect of speculation on the future of monetary policy in the US. Trading of futures contracts shows that the likelihood of increases in the next week Fed meeting valued by traders is 20 percent.

Today's session promises to be far more interesting than the rest of this week, at least from the information point of view. In the macro calendar we will find two decisions of the central banks: of Switzerland and the United Kingdom and significant US data on retail sales and industrial production.

In the case of central banks should not expect any significant movements and only tons of messages will be valid.

The behavior of the markets in the morning does not indicate any breakthrough.

In Asia negatively stand out, falling by more than 1%, Nikkei beyond which dominate green colour. There is a lack of trade in China, where, because of public holidays, today and tomorrow exchanges do not work.

On the Warsaw market we should be aware of expiring contracts on Friday, which may have significant impact on the market. Thus closing the week can be misleading due to the settlement of the September series of futures contracts.

-

06:31

Global Stocks

European stocks edged lower at Wednesday's close, with Cartier's parent Cie. Financière Richemont SA and other luxury stocks hit after lackluster financial updates. But Bayer AG posted a small rise following plans to buyout agrochemical heavyweight Monsanto Co. Bayer shares "gave up around half of the gains amid a mixed reaction to both the price and the concept of the deal," said CMC Markets analyst Jasper Lawler in a note.

The Dow industrials and the S&P 500 closed in negative territory Wednesday in the wake of slumping crude-oil prices, erasing earlier gains for the major benchmarks, while the tech-heavy Nasdaq bucked the losing trend. A rebound in Treasury prices had earlier buoyed the market, according to Mark Kepner, managing director of sales and trading at Themis Trading. "The stable bond market gave investors some comfort, encouraging them to buy some of the dip," he said.

Asian stocks were largely treading water Thursday, as investors stayed focused on key monetary policy meetings next week, but a firmer yen pressured Japanese stocks. Nevertheless, the dollar-yen currency pair is expected to remain directionless, with many investors sitting on the sidelines ahead of monetary-policy meetings in the U.S. and Japan next week, said Osao Iizuka, head of FX trading at Sumitomo Mitsui Trust Bank.

-

00:29

Stocks. Daily history for Sep 14’2016:

(index / closing price / change items /% change)

Nikkei 225 16,614.24 -114.80 -0.69%

Shanghai Composite 3,002.67 -20.84 -0.69%

S&P/ASX 200 5,227.69 +19.92 +0.38%

CAC 40 4,370.26 -16.92 -0.39%

Xetra DAX 10,378.40 -8.20 -0.08%

FTSE 100 6,673.31 +7.68 +0.12%

S&P 500 2,125.77 -1.25 -0.06%

Dow Jones Industrial Average 18,034.77 -31.98 -0.18%

S&P/TSX Composite 14,366.46 +17.36 +0.12%

-