Noticias del mercado

-

16:07

UK Conference Board Coincident Economic Index almost flat

The Conference Board Coincident Economic Index® (CEI) for the U.K. increased 0.3 percent in July to 108.2 (2010=100).

According to prnewswire, the composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading and coincident economic indexes are essentially composite averages of several individual leading or coincident indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component - primarily because they smooth out some of the volatility of individual components.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1200 (EUR 324m) 1.1300 (904m) 1.1310 (225m) 1.1325 (359)

USD/JPY: 103.00 (330m) 104.00 (300m) 104.50 (430m) 104.70 (385m)

AUD/USD: 0.7250 ( AUD 248m) 0.7425 (520m) 0.7450 (220m) 0.7500 (364m)

USD/CAD 1.2905 (USD 330m) 1.2990 (270m) 1.3000 (1.15bln)

NZD/USD 0.7115 (281m)

AUD/JPY 79.70 (AUD 301m)

AUD/NZD 1.0400 (AUD 869m)

-

14:26

Fed's Kashkari responds to Trump: There's no politics involved in Fed meetings - CNBC

-

14:25

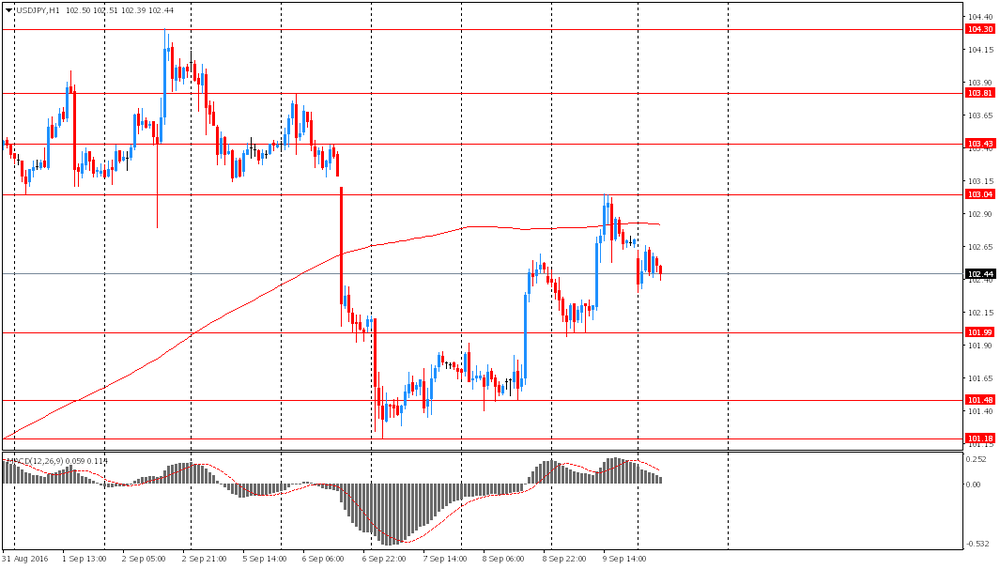

European session review: the US dollar lower against the yen

The following data was published:

(Time / country / index / period / previous value / forecast)

-------

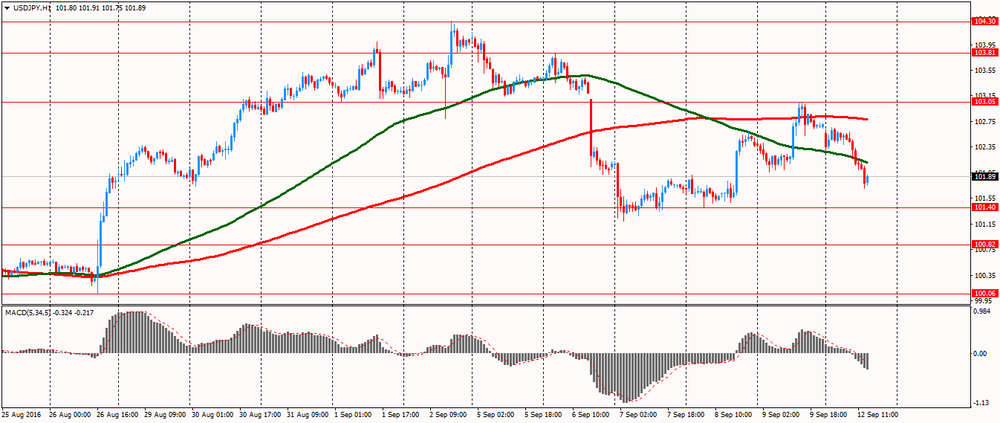

The US dollar was lower against the yen and is trading almost unchanged against the euro and the British pound. Against commodity currencies and emerging market currencies the dollar was trading higher.

According to analysts, investors tend to avoid risk, which leads to a drop in stock indices, the growth in demand for the yen, perceived as an asset of refuge, and the weakening of currencies which are considered a risky investment.

Market focus is now on the speech of the Fed Board of Governors member Leil Brainard - this will be the last Fed official commenting before FOMC meeting on 20-21 September.

In addition, traders are waiting for the next meeting of the Bank of England, which will be held September 14-15. In August, the British Central Bank lowered the interest rate from 0.5% to 0.25%, a new historical minimum. Previous level of the rate remained unchanged from March 2009. The Bank of England also increased its asset purchase program by 60 billion pounds to 435 billion pounds.

Danske Bank said that market participants fear "arguments in favor of a rate hike by Brainard, which had previously always been in favor of keeping them at a low level." At the same time the market feared a soft rhetoric from the Fed representative.

The UK data on consumer prices for August, which will be released on Tuesday, show whether the British began to pay more for everyday purchases. In addition, analysts also await the release of labor market data on Wednesday. In July, the number of applications for unemployment benefits fell, signaled that immediately after the referendum the situation on the labor market was quite acceptable.

Thursday data on retail sales is expected, which immediately after the referendum were good. In addition, on Thursday, the Bank of England will announce its decision on rates. According to analysts, the Central Bank will leave rates unchanged at 0.25%

EUR / USD: during the European session fell to $ 1.1210 from $ 1.1263

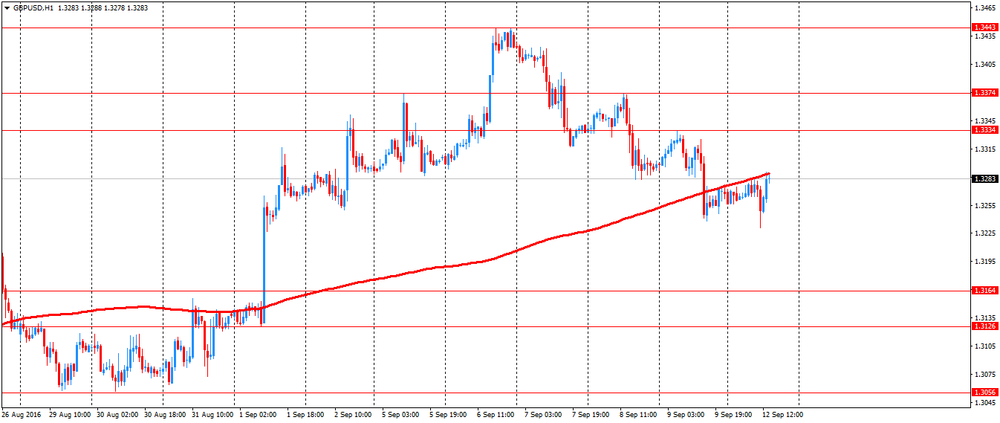

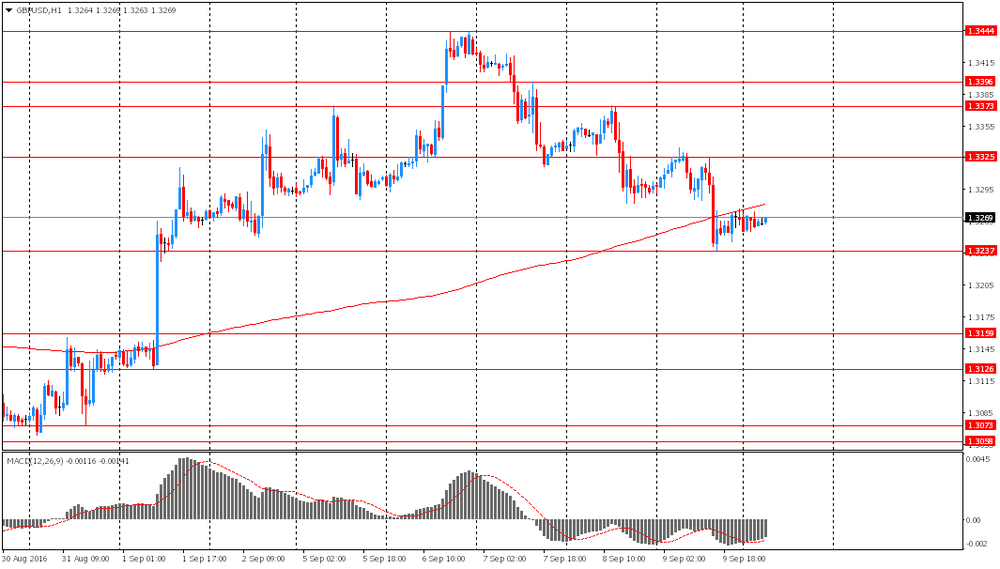

GBP / USD: fell to $ 1.3231, but then recovered to $ 1.3290

USD / JPY: during the European session, the pair fell to Y101.71

-

14:11

Fed Lockhart won't comment on likely outcome of next three Fed meetings

-

Expects a lively discussion over whether current inflation and unemployment readings are consistent with the policy rate still close to zero

-

The economic momentum is adequate to achieve the Feds goals in the medium-term

-

Won't comment on likely outcome of next three meetings

-

Expects strong second half growth this year of 3% annualised rate

-

Remaining labour market slack is relatively small

-

Lack of progress on inflation remains an awkward piece of the Fed's puzzle but is confident it will increase as the labour market improves

-

Serious discussion on hike is needed at the September meeting

*via forexlive -

-

13:49

Orders

EUR/USD

Offers : 1.1265 1.1285 1.1300 1.1325-30 1.1350 1.1365 1.1380 1.1400

Bids : 1.1235-40 1.1220 1.1200 1.1185 1.1170 1.1145-50 1.11201.1100

GBP/USD

Offers : 1.3285 1.3300 1.3320 1.3335 1.3355-60 1.3380 1.3400 1.3425 1.3435 1.3450

Bids : 1.3255-60 1.3230 1.3200 1.3175-80 1.3150 1.3125-30 1.3100

EUR/GBP

Offers : 0.8485 0.8495-0.8500 0.8520-25 0.8560-65 0.8580 0.8600

Bids : 0.8465 0.8450 0.8435 0.8420 0.8400 0.8385 0.8365 0.8350

EUR/JPY

Offers : 115.60 115.85 116.00 116.35 116.50 117.00

Bids : 115.00 114.80 114.50 114.00 113.80 113.50 113.00

USD/JPY

Offers : 102.75-80 103.00 103.20 103.60 103.75 104.00

Bids : 102.25-30 102.00 101.80-85 101.60 101.40 101.20 101.00

AUD/USD

Offers : 0.7560 0.7580 0.7600 0.7630 0.7655-60 0.7685 0.7700

Bids : 0.7520 0.7500 0.7485 0.7450 0.7420-25 0.7400

-

13:26

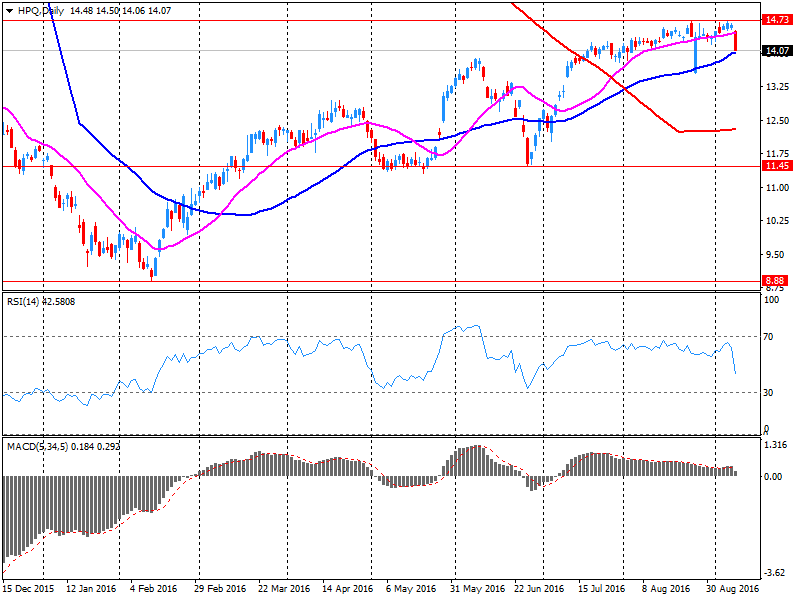

Company news: HP Inc. (HPQ) have confirmed the purchase of Samsung Electronics Printer

HP Inc. (HPQ) announced that it has signed a definitive agreement to acquire the business for the production of Samsung Electronics printers, Reuters reports citing Seoul Economic Daily. According to HP, the amount of the transaction is $ 1.05 billion. (Compared to $ 1.8 billion in Seoul Economic Daily material).

The transaction is expected to be completed within 12 months after obtaining the necessary approvals from regulators and perform other customary conditions of transactions.

According to the reached agreement, HP will invest in $ 100-300 mln in equity through the purchase of shares on the open market.

HPQ shares fell in premarket trading to $ 13.66 (-2.05%).

-

13:20

OPEC Monthly Oil Market Report

Crude Oil Price Movements

The OPEC Reference Basket rose 42¢ to $43.10/b in August. ICE Brent ended up 62¢ at $47.16/b, while NYMEX WTI was unchanged at $44.80/b. The Brent/WTI spread widened further to $2.36/b in August. Crude price rose on signs of an improving supply/demand balance and US dollar weakness, although a surprise build in US crude stocks, increasing supplies and worries about Chinese demand pressured prices at the end of the month.

World Economy

World economic growth was revised down to 2.9% for 2016 and remains at 3.1% for 2017. Weak 1H16 growth caused a downward revision to the US growth forecast for 2016 to 1.5%, while the 2017 forecast remains at 2.1%. Growth in Japan was also revised down to 0.7% given weak 1H16 growth. Euro-zone growth remains unchanged at 1.5% for this year and 1.2% for 2017. Forecasts for China and India are also unchanged at 6.5% and 7.5%for 2016 and 6.1% and 7.2% for 2017. The figures for Brazil and Russia remain unchanged from the August MOMR, with growth forecast at 0.4% and 0.7% respectively for next year.

World Oil Demand

World oil demand growth in 2016 is now anticipated to increase by 1.23 mb/d after a marginal upward revision, mainly to reflect better-than-expected OECD data for the first half of the year. Oil demand in 2016 is expected to average 94.27 mb/d. In 2017, world oil demand is anticipated to rise by 1.15 mb/d, unchanged from the August MOMR, to average 95.42 mb/d. The main growth centres for next year continue to be India, China and the US.

World Oil Supply

Non-OPEC oil supply in 2016 is now expected to contract by 0.61 mb/d, following an upward revision of 0.18 mb/d from the August MOMR to average 56.32 mb/d. This has been mainly due to a lower-than-expected decline in US tight oil and a better-thanexpected performance in Norway, as well as the early start-up of Kashagan field in Kazakhstan. In 2017, non-OPEC supply was revised up by 0.35 mb/d to show growth of 0.20 mb/d to average of 56.52 mb/d, mainly due to new production from Kashagan. OPEC NGLs are expected to average 6.43 mb/d in 2017, an increase of 0.15 mb/d over the current year. OPEC output, according to secondary sources, dropped by 23 tb/d in

August to 33.24 mb/d.

Product Markets and Refining Operations Product markets in the Atlantic Basin strengthened in August. Refining margins were supported by the positive performance at the top of the barrel due to strong gasoline demand and export opportunities to the EU, as well as concerns about weather disruptions

from tropical storms and flooding in the US Gulf Coast. In Asia, margins showed a slight recovery on the back of firm demand and falling inventories ahead of autumn maintenance.

Tanker Market

Dirty tanker spot freight rates remained under pressure in August, with negative developments among all classes. VLCC, Suexmax and Aframax spot freight rates declined by 12%, 30% and 14% since July. The drop in rates was mainly driven by excess tonnage supply due to new deliveries at a time when cargo loading requirements remain limited.

Stock Movements

OECD total commercial stocks fell in July to stand at 3,091 mb, some 341 mb above the latest five-year average. Crude and product inventories showed surpluses of 200 mb and 141 mb, respectively. In terms of days of forward cover, OECD commercial stocks in July stood at 66.1 days, around 7 days higher than the seasonal average.

Balance of Supply and Demand

Demand for OPEC crude in 2016 is estimated to stand at 31.7 mb/d, some 1.7 mb/d over last year. In 2017, demand for OPEC crude is forecast at 32.5 mb/d, an increase of 0.8 mb/d over the current year.

-

12:50

Financial Times poll: The September Fed hike can be a strong shock for the markets

Most Wall Street economists do not believe in a rate hike by the Federal Reserve at the September meeting. However, writes Financial Times, if such a decision will still be made, it would be the strongest shock of all Janet Yellen's presidency, from February 2014.

Friday's statement by two Fed officials caused equity and bond markets the most significant drop since June 24 - Brexit.

Only 13% of the 46 economists surveyed by Financial Times, are waiting for a move at Fed's next meeting. In an independent survey of The Wall Street Journal, this figure is also 13%. However, some experts believe that traders underestimate the Fed's determination.

"Given recent statements by Fed officials, who began to signal that a rate hike in the short term is appropriate, we believe that the market is too calm," - say Goldman Sachs economists.

The next meeting of the Federal Reserve will be held September 20-21.

According to Fed Watch CME, traders estimate the probability ta 24% for a hike in September, in November - to 28.7% and in December to 59.3%. On Bloomberg: 32% in September, November 36% and 60% in December.

-

11:34

Deputy Governor Minouche Shafik to leave Bank of England

According to the Bank of England, Minouche Shafik, Deputy Governor for Markets and Banking, will leave the Bank at the end of February 2017 to become the Director of the London School of Economics (LSE).

Bank of England Governor Mark Carney said: "We will say farewell to Minouche with gratitude and regret. She helped drive vital reforms on the domestic and international stages, perhaps most prominently in the successful completion of the Fair and Effective Markets Review which she co-chaired. She has overseen a transformation in how we manage our balance sheet and is modernising our high-value payments system. This has been alongside the invaluable insight she brings to all three main policy committees of the Bank and the inspirational leadership she gives to her colleagues. In her work and by her example, she leaves an important legacy. We wish her the very best for the future."

Minouche said: "It has been such a privilege to work with colleagues at the Bank of England and to serve alongside fellow members of the MPC, FPC, PRA Board and Court of Directors. I have especially enjoyed connecting the dots and the people across the Bank's monetary, macroprudential and microprudential policy responsibilities. Together we have stood up to every test, maintaining stability with a modern approach. The Bank is a vital institution full of talented people committed to serving the public good - I will miss them a great deal. While it was impossible to resist the opportunity to lead a world-class university like the LSE, I leave the Bank with a deep appreciation for its work and much admiration of its staff."

-

11:32

Market Positioning Signals Short GBPUSD An Attractive Relative Value Trade - BNPP

"We are now most focused on the USD and GBP for relative value opportunities

Rates markets have been persistently unwilling to increase pricing for Fed hikes since June, despite a fairly steady stream of hawkish comments from officials and strong labour market data. Our economics team continues to expect a rate hike in September, implying an adjustment higher in Fed pricing is likely in the weeks ahead. The Bank of England has had a run of upside surprises on key releases for August, and, as a result, the markets have scaled back expectations for further easing. Our economists expect data to be less robust going forward and still believes as its base-case scenario that the Bank is likely to deliver a further 15bp of rate cuts in November.

Market positioning has adjusted to reflect the shift in rate hike expectations for the BOE and the Fed, with cable short positioning recovering sharply from an extreme short position in July to only a modestly short position now. The short covering process could have further to run in the near term, but the lightening of positions should ultimately create opportunities for shorts.

Short GBPUSD is likely to be an attractive trade again as we move into autumn".

Copyright © 2016 BNP Paribas™, eFXnews™

-

10:37

Hawkish Fed statements from last week to dictate price action in early trading?

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1200 (EUR 324m) 1.1300 (904m) 1.1310 (225m) 1.1325 (359)

USD/JPY: 103.00 (330m) 104.00 (300m) 104.50 (430m) 104.70 (385m)

AUD/USD: 0.7250 ( AUD 248m) 0.7425 (520m) 0.7450 (220m) 0.7500 (364m)

USD/CAD 1.2905 (USD 330m) 1.2990 (270m) 1.3000 (1.15bln)

NZD/USD 0.7115 (281m)

AUD/JPY 79.70 (AUD 301m)

AUD/NZD 1.0400 (AUD 869m)

-

10:13

Oil lower in early trading

This morning New York WTI crude oil futures fell 1.33% to $ 45.27 and Brent oil futures fell by 1.08% to $ 47.49 per barrel. Thus, the black gold is traded lower on the background growing US rigs. Meanwhile, oil producers are trying to adapt to the drop in prices, as speculators closed positions, hoping for further price growth. According to experts, the fall in oil prices was a consequence of growth in drilling activity in the US, which means that oil producers can operate profitably at the current cost of raw materials.

-

10:10

Today’s events

At 12:05 GMT FOMC member Dennis Lockhart will give a speech

At GMT FOMC members Neil Kashkari will deliver a speech

At 17:01 GMT the United States will hold an auction of 10-year bonds

At 17:15 GMT FOMC members Lyell Braynard deliver a speech

At 22:30 GMT RBA assistant governor Christopher Kent will deliver a speech

-

08:42

Asian session review: Euro rose slightly

The euro rose slightly on the eve of tomorrow's data on the dynamics of consumer prices in Germany. It is expected that prices in August remained unchanged from July and rose only slightly in comparison with the same period last year. In addition to this, on Wednesday inflation data will be released in France and Italy, which are the second and third largest economies in the euro zone. In France, as expected by economists, consumer prices increased in comparison with the previous month and the same period of the previous year, and in Italy - fell slightly compared with the same period of the previous year, but increased compared to July.

The yen traded almost unchanged after the publication of mixed economic data from Japan. According to a report published by the Cabinet of Ministers of Japan, in July the country's orders for engineering products increased by 4.9%, after rising in June by 8.3%. Analysts had expected a decline of -3.5%. In annual terms, the indicator was also higher than economists forecast, and its growth was 5.2%. In July, a year earlier, the number of orders was -0.9%. Also today, the Bank of Japan said that the price index for corporate goods decreased by 0.3% in August, which is slightly more than the 0.2% expected decline. In annual terms, the price index declined in August to -3.6% after easing 3.9% prior.

The dollar fell slightly against the major currencies, after a significant increase after Friday's comments from the US Fed's Eric Rosengren, who signaled a tendency to tighten monetary policy. Boston Fed President Eric Rosengren said on Friday that "there are substantial grounds" for the tightening of monetary policy, which will allow to avoid overheating of the economy.

EUR / USD: during the Asian session, the pair rose to $ 1.1250

GBP / USD: during the Asian session, the pair was trading in the $ 1.3255-75 range

USD / JPY: during the Asian session, the pair was trading in Y102.30-65 range

-

08:10

Here Is The Most Vulnerable Currency From A December Fed Hike - CIBC

"Through the will-they-or-won't they of Fed rate hike expectations one thing is clear - much less is currently priced into markets than was the case in late May. Since then the US$ has been generally lower, with the clear exception of course been against a Brexit-hit GBP. Interestingly, it's been the NZD, and not JPY that's gained the most since Fed hike expectations were at their peak.

High interest rates, at least relative to those available in most major economies, have made New Zealand a magnet for investors.

However, with Fed expectations now getting too low again, the NZD could be more vulnerable than others in the run up to the next FOMC move".

Copyright © 2016 CIBC, eFXnews™

-

08:08

British Chambers of Commerce about the growth of UK’s GDP

According to forecasts from the British Chambers of Commerce the volume of gross domestic product in the UK will grow this year by 1.8%, compared with the March forecast of 2.2%. In addition, BCC expects economic growth of just 1% in 2017 against the previous forecast of 2.3%.

Experts believe that the uncertainty surrounding the negotiations with the EU will weaken the growth prospects of the Kingdom's GDP along with consumer spending. In general, the Chamber of Commerce said that the UK economy is likely to lose £ 43.8 bln. "While some companies claim keep good trading conditions, the overall picture points to a sharp slowdown in economic growth in the UK in the near future", - said the director general of British Chambers of Commerce, Dr Adam Marshall.

-

08:02

Japan: Prelim Machine Tool Orders, y/y , August -8.4%

-

08:01

Fed Mineapolis Neel Kashkari: policy largely doing what it can

-

monetary policy largely doing what it can to support robust recovery

-

Need regulatory, fiscal policies to boost US growth

-

skeptical that large-scale government spending can boost growth

*via forexlive

-

-

07:51

Hillary Clinton Reportedly Suffers "Medical Episode", Rushed Away From Ground Zero: Fox News

-

07:50

Core machine orders in Japan advanced 4.9 percent in July

According to rttnews, Ccore machine orders in Japan advanced 4.9 percent on month in July, the Cabinet Office said on Monday - standing at 891.9 billion yen.

That beat forecasts for a decline of 2.9 percent following the 8.3 percent spike in June.

On a yearly basis, core machine orders jumped 5.2 percent - also beating expectations for 0.3 percent following the 0.9 percent contraction in the previous month.

The total number of machinery orders, including those volatile ones for ships and from electric power companies, fell 1.2 percent on month and 0.3 percent on year to 983.8 billion yen.

-

07:08

Options levels on monday, September 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1379 (1877)

$1.1336 (2166)

$1.1292 (425)

Price at time of writing this review: $1.1242

Support levels (open interest**, contracts):

$1.1168 (3027)

$1.1137 (3540)

$1.1103 (3395)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 33301 contracts, with the maximum number of contracts with strike price $1,1400 (4373);

- Overall open interest on the PUT options with the expiration date October, 7 is 33544 contracts, with the maximum number of contracts with strike price $1,1000 (4580);

- The ratio of PUT/CALL was 1.01 versus 1.11 from the previous trading day according to data from September, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.3505 (1115)

$1.3408 (1721)

$1.3312 (902)

Price at time of writing this review: $1.3268

Support levels (open interest**, contracts):

$1.3192 (1829)

$1.3095 (652)

$1.2997 (3071)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 18770 contracts, with the maximum number of contracts with strike price $1,3450 (2353);

- Overall open interest on the PUT options with the expiration date October, 7 is 19453 contracts, with the maximum number of contracts with strike price $1,3000 (3071);

- The ratio of PUT/CALL was 1.04 versus 0.88 from the previous trading day according to data from September, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:50

Japan: Core Machinery Orders, y/y, August 5.2% (forecast 0.3%)

-

01:50

Japan: Core Machinery Orders, August 4.9% (forecast -3.5%)

-

00:28

Currencies. Daily history for Sep 09’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1233 -0,28%

GBP/USD $1,3267 -0,23%

USD/CHF Chf0,9754 +0,37%

USD/JPY Y102,70 +0,31%

EUR/JPY Y115,32 -0,01%

GBP/JPY Y136,26 +0,08%

AUD/USD $0,7537 -1,39%

NZD/USD $0,7321 -1,09%

USD/CAD C$1,3044 +0,90%

-

00:00

Schedule for today, Monday, Sep 12’2016

(time / country / index / period / previous value / forecast)

06:00 Japan Prelim Machine Tool Orders, y/y August -19.6%

17:15 U.S. FOMC Member Brainard Speaks

22:30 Australia RBA Assist Gov Kent Speaks

23:50 Japan BSI Manufacturing Index Quarter III -11.1

-