Noticias del mercado

-

16:32

NZD on the rise after GDT auction

-

Global DairyTrade prices: +7.7%.

-

Milk powder: +3.7%.

NZD/USD up around 50 pips so far.

-

-

16:07

Huge miss for US non-manufacturing ISM. Big offers on USD/JPY

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 51.4 percent in August, 4.1 percentage points lower than the July reading of 55.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate.

The Non-Manufacturing Business Activity Index decreased substantially to 51.8 percent, 7.5 percentage points lower than the July reading of 59.3 percent, reflecting growth for the 85th consecutive month, at a notably slower rate in August.

The New Orders Index registered 51.4 percent, 8.9 percentage points lower than the reading of 60.3 percent in July. The Employment Index decreased 0.7 percentage point in August to 50.7 percent from the July reading of 51.4 percent. The Prices Index decreased 0.1 percentage point from the July reading of 51.9 percent to 51.8 percent, indicating prices increased in August for the fifth consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth in August. The majority of the respondents' comments indicate that there has been a slowing in the level of business for their respective companies."

-

16:05

-

16:01

U.S.: Labor Market Conditions Index, August -0.7

-

16:00

U.S.: ISM Non-Manufacturing, August 51.4 (forecast 55)

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900, 1.0950, 1.0990 1.1000, 1.1050, 1.1095 1.1100/05, 1.1115 (1.75bn), 1.1120/25 (1.35bn), 1.1170 1.1240, 1.1250/55/60 (1.09bn), 1.1275 1.1300, 1.1315/20 (652m)

USDJPY 100.00/05 (1.45bn), 100.40/45/50 101.00 (570m), 101.25/30 102.00 (906m), 102.30 (500m), 102.55 103.00 (1.33bn), 103.30, 103.75 104.00 (925m), 104.20/25, 104.50/55 105.00

GBPUSD 1.3000, 1.3025 1.3300

AUDUSD 0.7395/400 (975m) 0.7520 0.7625/30/34 0.7700, 0.7745/50, 0.7790 0.7800

NZDUSD 0.7075/80 0.7350 (347m)

AUDNZD 1.1050

AUDJPY 81.65

EURGBP 0.8475 0.8675 (401m)

USDCAD 1.2600 1.2800 1.2900, 1.2975 (1.32bn) 1.3000/10 (645m), 1.3050 (569m), 1.3080 1.3220

USDCHF 1.0900

EURJPY 113.50 116.05

-

14:22

European session review: the euro rose against USD

The following data was published:

(Time / country / index / period / previous value / forecast)

5:45 Switzerland GDP q / q II quarter 0.3% 0.4% 0.6%

5:45 Switzerland GDP y / y in the II quarter 1.1% 0.9% 2.0%

6:00 Germany Factory Orders m / m in July -0.3% 0.5% 0.2%

7:15 Switzerland Consumer Price Index m / m in August -0.4% -0.1% -0.1%

7:15 Switzerland Consumer Price Index y / y in August -0.2% -0.1% -0.1%

9:00 Eurozone GDP q / q (final data) II quarter 0.5% 0.3% 0.3%

9:00 Eurozone GDP y / y (final data) II quarter 1.7% 1.6% 1.6%

The euro rose against the US dollar, heading to yesterday's high on overall bearish view of the US currency, statistical data on the GDP of the eurozone, as well as the expectations of the ECB meeting scheduled for Thursday.

The final data from Eurostat showed that the euro zone economy continued to expand in the 2nd quarter, helped by the increase in exports and strong internal demand. However, the growth rate slowed down in comparison with the 1st quarter. Gross domestic product increased by 0.3 percent in quarterly terms and by 1.6 per cent y/y, in line with previous estimates and forecasts of experts. In the 1st quarter the economy expanded by 0.5 percent and 1.7 percent respectively. The largest contribution to GDP growth was from net trade - added 0.4 percentage points to the final result. Demand on the part of the population has contributed 0.1 percentage points. Falling inventories took away 0.2 percentage points of GDP, slowing investment, in contrast to previous quarters. In quarterly terms, the economic growth slowed sharply in France - from 0.7 percent to zero and in Italy from 0.3 percent to zero. In Germany, the rate of expansion eased to 0.4 percent from 0.7 percent.

With regard to the ECB meeting, analysts expect the Central Bank to leave its monetary policy unchanged, but may hint at expanding bond purchase program. At the ECB meeting in July, the head of the Central Bank Draghi said that officials have shown that they can adjust the program of quantitative easing (QE) in the case of need, and there should be no doubt that they can extend the life of QE after March 2017.

The pound rose slightly against the dollar, helped by strengthening risk appetite in response to the rising cost of a number of commodities. In addition, support for the pound have the latest data on the UK, signaling a more favorable economic situation than had been expected after Brexit.

Investors also await the publication of new statistics from Britain - tomorrow industrial production and production in the manufacturing sector. Economists predict that both indicators have decreased slightly compared to June, but rose in annual terms. Also in Halifax will present its house price index, which was closely monitoring the market in the hope of receiving signals in regard to how the instability associated with Brexit affect the housing market. However, on Friday, investors will examine data on foreign trade in order to understand whether the weakening of the pound was able to support exports.

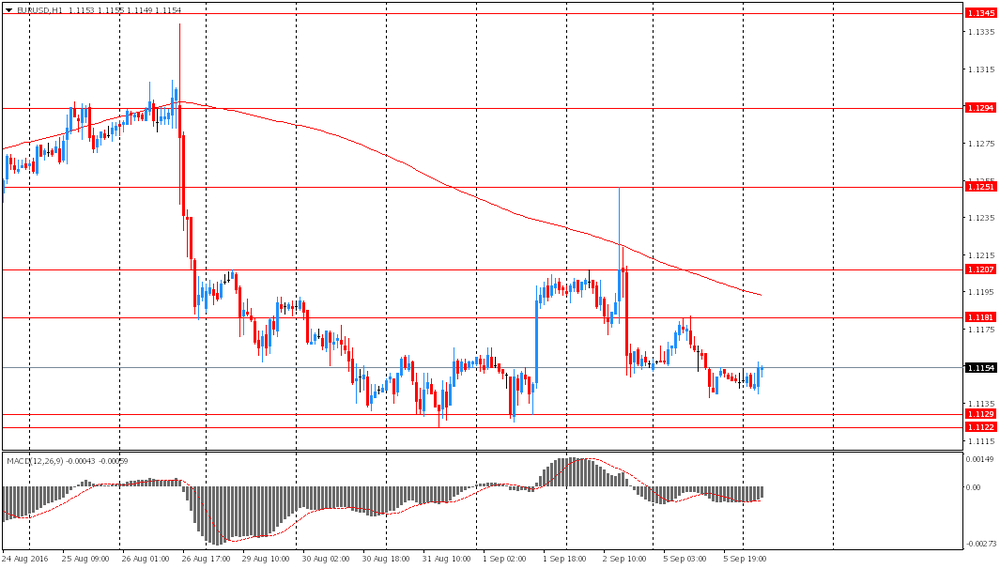

EUR / USD: during the European session, the pair rose to $ 1.1168

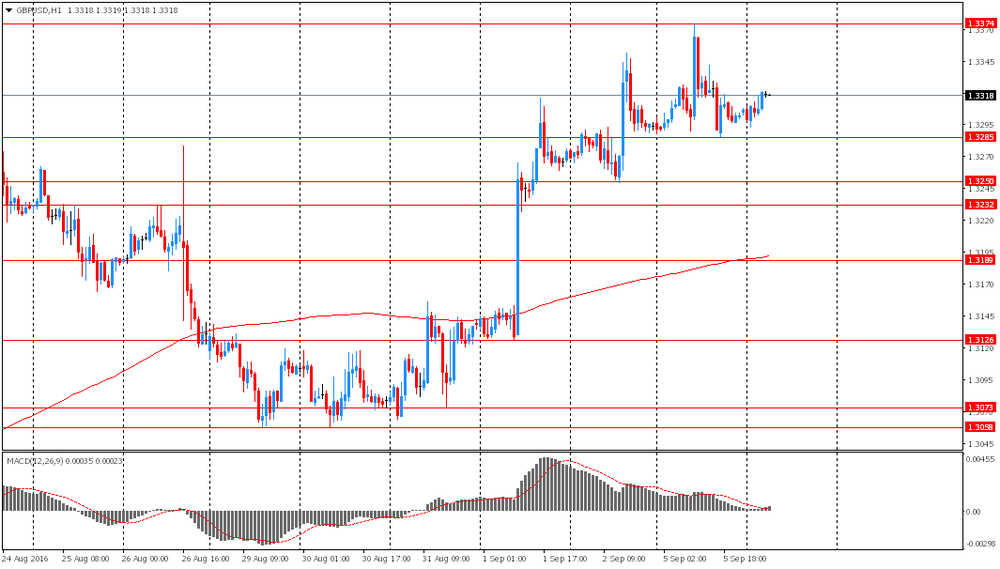

GBP / USD: during the European session, the pair has risen to $ 1.3360

USD / JPY: during the European session, the pair fell to Y103.15

-

14:01

Orders

EUR/USD

Offers 1.1185 1.1200 1.1225-30 1.1250 1.1280 1.1300 1.1320 1.1350-55

Bids 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.3350 1.3370-75 1.3390-1.3400 1.3420 1.3450

Bids 1.3300 1.3275-80 1.3255-60 1.3230 1.3200 1.3175-80 1.3250 1.3120 1.3100

EUR/GBP

Offers 0.8400 0.8420 0.8445-50 0.8480 0.8500 0.8520-25 0.8535 0.8550

Bids 0.8350 0.8330 0.8300

EUR/JPY

Offers 115.65 115.85 116.00 116.20 116.50 117.00

Bids 115.00 114.80 114.50 114.00 113.80 113.50

USD/JPY

Offers 103.80 104.00 104.45-50 104.75 105.00 105.50

Bids 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers 0.7680 0.7700 0.7730 0.7750

Bids 0.7600 0.7580 0.7560 0.7520 0.7500 0.7485 0.7450 0.7430 0.7400

-

13:57

May has an open mind on the UK's future relationship with the EU - Reuters

-

It's not always appropriate to put all cards on the table at the start of negotiations - spokesman

-

-

12:39

German Finance Minister Schaeuble: Germany to use budget leeway to boost investment

-

Germany is doing well

-

Employment is at a record high, unemployment at a 25yr low

-

Germany must prove that integration can succeed

-

Will link spending to increases in GDP growth

-

More growth needed to end low rate policy

-

More structural reforms are needed globally

-

Debt must be cut globally

-

Central bank created liquidity is worrying

-

Investment boost should be driven by private sector

-

Junker fund should be expanded if needed

*via forexlive

-

-

12:10

USD Direction & The Fed's Effort To Get Out - Bank of America Merrill

"Despite the Fed having effectively told us that they will hike this year again, the USD has not been able to rally by much and market positioning is well below last year's levels.

The EUR cannot weaken by much, as the ECB has reached its self-imposed QE constraints and Draghi has to fight relaxing them one-by one. The JPY cannot weaken without a BoJ endorsement of fiscal stimulus in the absence of a long-term fiscal consolidation plan, in our opinion. GBP is actually strengthening, as the market was too short and the data has surprised to the upside. And EM FX still finds support from the Fed's policy put.

If the Fed does not hike ahead of the elections, December is the only real option, but lots of things can happen until then. A number of times this year the Fed thought that the road was clear for the next hike, but unexpected shocks kept it on hold.

We still expect the Fed to hike faster than markets are pricing (Dec this year and two more next year), which would support the USD, but do not expect a sharp USD move higher".

Copyright © 2016 BofAML, eFXnews™

-

11:04

Final euro zone GDP up 0.3% q/q

GDP and main aggregates estimate for the second quarter of 2016 GDP up by 0.3% in the euro area and by 0.4% in the EU28 +1.6% and +1.8% respectively compared with the second quarter of 2015.

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the second quarter of 2016, compared with the previous quarter, according to an estimate published by Eurostat, the statistical office of the European Union.

In the first quarter of 2016, GDP grew by 0.5% in both zones. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.6% in the euro area and by 1.8% in the EU28 in the second quarter of 2016, after +1.7% and +1.9% respectively in the previous quarter.

During the second quarter of 2016, GDP in the United States increased by 0.3% compared with the previous quarter (after +0.2% in the first quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.2% (after +1.6% in the previous quarter).

-

11:00

Eurozone: GDP (QoQ), Quarter II 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter II 1.6% (forecast 1.6%)

-

10:25

August saw a rise in eurozone retail sales led by solid growth in Germany

August saw a rise in eurozone retail sales, led by solid growth in Germany. Retailers in France also recorded an increase in sales, however their Italian counterparts recorded a fall for the eighth consecutive month.

Phil Smith, economist at IHS Markit which compiles the Eurozone Retail PMI survey, said: "Retail sector performances across the euro area remained divided in August, with sales growth in France accelerating to the highest seen for almost five years, but sales down notably again in Italy. Not forgetting Germany, the overall top performer and where sales have now risen for seven months on the bounce. Overall the data point to modest growth in consumer spending in the eurozone, which adds to the picture from the sister manufacturing and services surveys of a moderate pace of expansion in the broader economy."

-

10:17

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900, 1.0950, 1.0990, 1.1000, 1.1050, 1.1095, 1.1100/05, 1.1115 (1.75bn), 1.1120/25 (1.35bn), 1.1170, 1.1240, 1.1250/55/60 (1.09bn), 1.1275, 1.1300, 1.1315/20 (652m)

USDJPY 100.00/05 (1.45bn), 100.40/45/50, 101.00 (570m), 101.25/30, 102.00 (906m), 102.30 (500m), 102.55, 103.00 (1.33bn), 103.30, 103.75, 104.00 (925m), 104.20/25, 104.50/55, 105.00

GBPUSD 1.3000, 1.3025, 1.3300

AUDUSD 0.7395/400 (975m), 0.7520, 0.7625/30/34, 0.7700, 0.7745/50, 0.7790, 0.7800

NZDUSD 0.7075/80, 0.7350 (347m)

AUDNZD 1.1050

AUDJPY 81.65

EURGBP 0.8475, 0.8675 (401m)

USDCAD 1.2600, 1.2800, 1.2900, 1.2975 (1.32bn), 1.3000/10 (645m), 1.3050 (569m), 1.3080, 1.3220

USDCHF 1.0900

EURJPY 113.50, 116.05

-

09:57

Romania's economic growth accelerated in the three months to June

According to rttnews, Romania's economic growth accelerated in the three months ended June as initially estimated, latest figures from the National Institute of Statistics showed Tuesday.

Gross domestic product advanced an unadjusted 6.0 percent year-over-year in the second quarter, confirming the flash data, faster than previous quarter's 4.3 percent expansion.

On the expenditure side, total final consumption grew 7.6 percent annually in the June quarter and gross fixed capital formation rose by 2.6 percent.

On a seasonally adjusted basis, the annual economic growth quickened to 5.9 percent from 4.2 percent in the first quarter.

Quarter-on-quarter, GDP expanded at a stable pace of 1.5 percent in the three-month period to June, in line with the flash data published on August 12.

-

09:15

Switzerland: Consumer Price Index (MoM) , August -0.1% (forecast -0.1%)

-

09:15

Switzerland: Consumer Price Index (YoY), August -0.1% (forecast -0.1%)

-

09:14

Today’s events

At 15:30 GMT the United States will hold an auction of 4, 3 and 6-month bills.

At 09:30 GMT Britain will place 10-year bonds.

At 16:15 GMT The head of the SNB, Thomas Jordan will deliver a speech.

-

08:36

Credit Suisse Trade Of The Week: Buy GBP/USD

"With a light data schedule for the US week ahead, we see potential for the GBP to rally the most among G10 currencies against the USD.

Firstly, the market is only beginning to acknowledge that the UK economic data may not come in as weakly as expected. Good data prints in services PMI, IP and house prices following other positive prints in manufacturing PMI and retail sales should continue to alleviate market concerns regarding the Brexit result and lead to an asymmetrically large rally in GBP crosses.

This leads directly to the second point - that market positioning is still extremely short and still has some way to unwind.

Finally, while the headline US payrolls number was not particularly weak, slow labor wage growth and a shortened work week should be sufficient (in combination with other weak data prints such as ISM and US political risks) to keep the Fed on hold and progressively price a Sep hike out of the picture over the week.

The main risks to the trade are if the upcoming data print unexpectedly worse, and if UK political developments signal a consensus forming around a "hard Brexit" policy cocktail,"

As a technical trade, CS booked profit today on its GBP/USD long from 1.3064 at 1.3355.

Copyright © 2016 Credit Suisse, eFXnews™

-

08:33

Asian session review: the Australian dollar rose after RBA holds rate as expected

The Australian dollar traded higher after the Reserve Bank of Australia decided to maintain the cash rate unchanged at around 1.5%. It is worth noting that the decision coincided with forecasts of most economists. The Central Bank pointed out that the decision to keep rates unchanged meets the objectives in relation to GDP and inflation. "With regard to the labor market, indicators of employment remain somewhat ambiguous and point to the growth of this sector in the short term," - said the Reserve Bank of Australia. In addition, analysts say that low interest rates are supporting domestic demand in the country. The RBA also commented on the Australian dollar, saying that the strengthening of the national currency may complicate the transition and recovery in the economy. At the same time, a lower rate of the Australian dollar has supported the trade sector.

Previously, data on the balance of payments have been published. Australia's current account deficit amounted to $ 15.54 billion in Q2 vs A -$ 19,75 mlrd forecast. In the first quarter a deficit of A -$ 20.8 was recorded. It also became known that the net external debt of Australia in the second quarter increased by 2.0%. The contribution of net exports to GDP growth fell by 0.2 percentage points in the 2nd quarter

The pound rose slightly despite the publication of weak statistics on retail sales in the UK. According to the poll of the British Retail Consortium (BRC), retail sales in the UK declined in August after rising in July by 0.9% compared to the same period of the previous year. In July, this indicator increased by 1.1%. Total sales decreased by 0.3% vs +0.1% in August 2015.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1140-55 range

GBP / USD: during the Asian session, the pair rose to $ 1.3325

USD / JPY: during the Asian session, the pair was trading in Y103.35-80 range

-

08:24

Abe advisor Hamada: Bank of Japan should wait for the Federal Reserve before acting itself

-

08:22

Australian current account deficit decline in Q2

The current account deficit, seasonally adjusted, increased $636m (4%) to $15,535m in the June quarter 2016. The deficit on the balance on goods and services decreased $652m (8%) to $7,996m. The net primary income deficit increased $1,351m (23%) to $7,160m.

In seasonally adjusted chain volume terms, the surplus on goods and services decreased $999m (8%) from $11,796m in the March quarter 2016 to $10,797m in the June quarter 2016. This is expected to detract 0.2 percentage points from growth in the June quarter 2016 volume measure of GDP.

-

08:17

RBA holds rates at +1.50%. AUD rose

"At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

The global economy is continuing to grow, at a lower than average pace. Several advanced economies have recorded improved conditions over the past year, but conditions have become more difficult for a number of emerging market economies. Actions by Chinese policymakers have been supporting growth, but the underlying pace of China's growth appears to be moderating.

Commodity prices are above recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Financial markets have continued to function effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative.

In Australia, recent data suggest that overall growth is continuing, despite a very large decline in business investment, helped by growth in other areas of domestic demand and exports. Labour market indicators continue to be somewhat mixed, but suggest continued expansion in employment in the near term" - Statement by Glenn Stevens, Governor.

-

08:13

Switzerland's GDP grew by 0.6% in the 2nd quarter of 2016

Switzerland's real gross domestic product (GDP) grew by 0.6% in the 2nd quarter of 2016. Positive contributions to GDP came from foreign trade as well as government consumption, while household consumption expenditure stagnated, and investment in construction and equipment fell slightly. On the production side of GDP, growth was broadly based across sectors. The biggest boosts came from the energy sector, government-related sectors and other services. In comparison to the 2nd quarter of 2015, real GDP grew by 2.0%.

Exports of goods (excluding non-monetary gold, valuables and merchanting) rose by 0.8% in the 2nd quarter of 2016. The chemicals/pharmaceuticals category provided the strongest contribution to growth, while in particular the precision tools/watches/jewellery and machinery/appliances/electronics categories had a negative impact. Imports of goods (excluding non-monetary gold and valuables) rose by 0.5% in the 2nd quarter of 2016, with the chemicals/pharmaceuticals category showing the highest growth. Imports in the vehicles and precision tools/watches/jewellery categories fell.

-

08:10

German price-adjusted new orders in manufacturing had increased in July 2016

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in July 2016 a seasonally and working-day adjusted 0.2% on June 2016. For June 2016, revision of the preliminary outcome resulted in a decrease of 0.3% compared with May 2016 (primary -0.4%). Price-adjusted new orders without major orders in manufacturing had decreased in July 2016 a seasonally and working-day adjusted 1.3% on June 2016.

In July 2016, domestic orders decreased by 3.0%, while foreign orders increased by 2.5% on the previous month. New orders from the euro area were up 5.9% on the previous month and new orders from other countries increased by 0.6% compared to June 2016.

In July 2016 the manufacturers of intermediate goods saw new orders unchanged in real terms adjusted for seasonally fluctuations and working-day variations compared with June 2016. The manufacturers of capital goods showed increases of 0.8% on the previous month. For consumer goods, a decrease in new orders of 4.3% was recorded.

-

08:00

Germany: Factory Orders s.a. (MoM), July 0.2% (forecast 0.5%)

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter II 0.6% (forecast 0.4%)

-

07:45

Switzerland: Gross Domestic Product (YoY), Quarter II 2.0% (forecast 0.9%)

-

07:04

Options levels on tuesday, September 6, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1308 (4349)

$1.1266 (4926)

$1.1205 (3163)

Price at time of writing this review: $1.1146

Support levels (open interest**, contracts):

$1.1110 (3171)

$1.1078 (4559)

$1.1038 (5710)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52786 contracts, with the maximum number of contracts with strike price $1,1250 (4926);

- Overall open interest on the PUT options with the expiration date September, 9 is 58292 contracts, with the maximum number of contracts with strike price $1,1000 (5757);

- The ratio of PUT/CALL was 1.10 versus 1.12 from the previous trading day according to data from September, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.3600 (817)

$1.3501 (1818)

$1.3402 (2234)

Price at time of writing this review: $1.3319

Support levels (open interest**, contracts):

$1.3197 (874)

$1.3099 (1051)

$1.3000 (1856)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32510 contracts, with the maximum number of contracts with strike price $1,3300 (2716);

- Overall open interest on the PUT options with the expiration date September, 9 is 27378 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.84 versus 0.82 from the previous trading day according to data from September, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

03:30

Australia: Current Account, bln, Quarter II -15.5 (forecast -19.75)

-

00:28

Currencies. Daily history for Sep 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1146 -0,09%

GBP/USD $1,3306 +0,09%

USD/CHF Chf0,9797 -0,06%

USD/JPY Y103,42 -0,55%

EUR/JPY Y115,28 -0,53%

GBP/JPY Y137,61 -0,31%

AUD/USD $0,7583 +0,17%

NZD/USD $0,7302 +0,16%

USD/CAD C$1,2925 -0,47%

-

00:00

Schedule for today, Tuesday, Sep 06’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Current Account, bln Quarter II -20.8 -19.75

04:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

04:30 Australia RBA Rate Statement

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II 0.1% 0.4%

05:45 Switzerland Gross Domestic Product (YoY) Quarter II 0.7% 0.9%

06:00 Germany Factory Orders s.a. (MoM) July -0.4% 0.5%

07:15 Switzerland Consumer Price Index (MoM) August -0.4% -0.1%

07:15 Switzerland Consumer Price Index (YoY) August -0.2% -0.1%

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.6% 0.3%

09:00 Eurozone GDP (YoY) (Finally) Quarter II 1.7% 1.6%

13:45 U.S. Services PMI (Finally) August 51.4 50.9

14:00 U.S. Labor Market Conditions Index August 1

14:00 U.S. ISM Non-Manufacturing August 55.5 55

16:15 Switzerland SNB Chairman Jordan Speaks

23:30 Australia AiG Performance of Construction Index August 51.6

-