Noticias del mercado

-

23:58

Schedule for today, Tuesday, Mar 8’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence February 2

02:00 China Trade Balance, bln February 63.30 50.15

05:00 Japan Eco Watchers Survey: Current February 46.6

05:00 Japan Eco Watchers Survey: Outlook February 49.5

05:00 Japan Consumer Confidence February 42.5

06:45 Switzerland Unemployment Rate (non s.a.) February 3.8% 3.8%

07:00 Germany Industrial Production s.a. (MoM) January -1.2% 0.5%

07:45 France Trade Balance, bln January -3.94 -4.15

08:15 Switzerland Consumer Price Index (MoM) February -0.4% -0.1%

08:15 Switzerland Consumer Price Index (YoY) February -1.3% -1.1%

09:15 United Kingdom BOE Gov Mark Carney Speaks

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV 1.6% 1.5%

13:15 Canada Housing Starts February 165.9 180

13:30 Canada Building Permits (MoM) January 11.3% -2%

17:00 United Kingdom MPC Member Weale Speaks

23:30 Australia Westpac Consumer Confidence March 4.2%

-

21:00

U.S.: Consumer Credit , January 10.54 (forecast 16.75)

-

20:20

American focus: The US dollar fell against major currencies

The euro and the pound strengthened significantly against the US dollar, helped by the increase in risk appetite against the backdrop of rising oil prices. However, the room for growth is limited as investors remain cautious ahead of the ECB meeting and the pound under pressure on fears of output the UK from the European Union. Market participants expect that against the background against the backdrop of high economic risk and weak inflation, the ECB will launch additional measures to mitigate the monetary policy. However, once in December, the ECB disappointed markets by their actions, policies will be difficult to live up to expectations, since the bar pretty high. Most experts interviewed to Reuters, believe that in the course of the March meeting of the ECB will lower the deposit rate by another 0.1% to 0.4%, but leave unchanged its key refinancing rate - at 0.05%. Also Reuters survey results showed that the probability of increasing the amount of asset purchases (QE) is 68%. On average, it is expected that the amount will increase QE by 10 billion. Euros to 70 billion euros. Per month. However, some experts predict increase in QE to 90 billion. Per month. Also at the March meeting, the ECB will present new economic forecasts for 2016-2018 years, probably, the new forecast for inflation this year will be much lower than December, taking into account the latest data. Analysts at Goldman Sachs believe that the ECB will revise the estimates of inflation for 2016 to 0.1% from 1.0%, and for 2017 - from 1.6% to 1.5%.

Meanwhile, the pound also affected by expectations the publication of data on industrial production in the UK, which will be released on Wednesday. Probably, the statistics would indicate a recovery in industrial production in January. It can strengthen the hope that the situation in the economy at the beginning of 2016 was more positive than the results of the polls indicate. According to the forecast, compared with the previous month, the industrial production in January, likely rose 0.5% after falling 1.1% in December. Growth in industrial production eliminates concerns that emerged after the publication of Markit Economics index PMI.

The Canadian dollar rose substantially against the US dollar, reaching a maximum of 20 November 2015. In the course of trading affect the rise in price of oil and the widespread weakening of the US currency. Today, the price of a barrel of Brent crude for the first time since December 2015 exceeded the mark of $ 40 per barrel. Meanwhile, WTI crude closer to the level of 38 dollars per barrel. Support for oil quotations has improved prospects for the global economy and signs of demand reduction. On Friday, Baker Hughes reported that the number of the US oil rigs last week dropped to 392 units, the lowest level since 2009. Reducing the number of units is marked now the eleventh week in a row. At the moment, the number of installations of all types decreased by 69% from its peak in October 1609, 2014. Prospects of demand in the world oil market are also improving. On Friday it became known that in February the growth of employment in the United States resumed - the number of jobs outside agriculture rose by 242 000, and the growth of the previous two months was revised upward to 30 000. Meanwhile, the Commission on Commodity Future US announced that hedge funds and other speculators last week closed bets on falling oil prices, the fastest pace in 10 months. In the short positions in WTI crude oil decreased by 15% ended March 1 week - up to 150 thousand 718 futures and options.. Positions on the growth of oil prices fell by 753 contracts, resulting in net long positions increased by 24 thousand. 886 contracts. But analysts warn that the world oil market remains a significant oversupply, prices may well fall back.

-

17:45

U.K. manufacturers' association EEF lowers its manufacturing growth forecasts

The U.K. manufacturers' association EEF lowered its manufacturing growth forecasts on Monday. The manufacturing sector in the U.K. is expected to rise 0.6% in 2016, down from the previous estimate of 0.8%.

The EEF expects the U.K. economy to expand 1.9% in 2016, down from the previous estimate of 2.1%.

The EEF said that output balance increased after hitting weakest point in six years in Q4 2015, while total orders also rose from a six year low.

"After the gloomy end to 2015, this latest data shows a chink of light. But, we should not be getting the deckchairs out yet. The slide is bottoming out, but manufacturing is still in negative territory and faces a precarious climb back up amidst a storm of real uncertainty. In a two-speed scenario, the fact that even those sectors in the fast lane are not relaxed about the global outlook probably says it all," EEF Chief Economist, Lee Hopley, said.

-

16:30

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 129.09 in February

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index decreased to 129.09 in February from 129.15 in January. January's figure was revised up from 128.90.

Five of the eight components declined.

"The flatness of the Employment trends index since September suggests that the rapid job growth in recent months is likely to slow down. In particular, we are concerned about the temporary help industry component, one of the most powerful leading indicators of employment growth, which has declined for the second month in a row in February," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

16:22

European Central Bank purchases €13.24 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.24 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.90 billion of covered bonds, and €258 million of asset-backed securities.

The ECB could add further stimulus measures at its meeting this week. The central bank could cut its deposit rate further or expand its monthly asset purchases.

-

16:01

U.S.: Labor Market Conditions Index, February -2.4

-

15:53

Fitch Ratings on Friday affirms Portugal’s sovereign debt rating but cuts the outlook

Rating agency Fitch Ratings on Friday affirmed Portugal's sovereign debt rating at 'BB+' but downgraded the outlook to 'stable' from 'positive'. The agency noted that the downward revision of the outlook was driven by the bigger-than-expected fiscal deficit.

"Fiscal performance was well off-target in 2015, with the general government deficit at an estimated 4.2% of GDP compared with the 2.7% initially expected," Fitch said.

"The government's plans for fiscal deficit reduction in 2016 are also at risk," the agency added.

-

14:49

Producer prices in Italy decrease 0.7% in January

The Italian statistical office Istat released its producer price inflation data for Italy on Monday. Italian producer prices decreased 0.7% in January, after a 0.6% decline in December. December's figure was revised up from a 0.7% drop.

Producer price declined by 0.8% on domestic market and by 0.4% on non-domestic market in January.

On a yearly basis, Italian PPI fell 2.5% in January, after a 3.2% drop in December. December's figure was revised up from a 3.3% fall.

Producer price slid 3.0% on domestic market and by 0.9% on non-domestic market in January.

-

14:49

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.40 (USD 380m) 113.00 (423m) 114.00 (458m) 114.35 (200m)

EUR/USD: 1.0750 (EUR 1.27bln) 1.0825 (203m) 1.0850-55 (697m) 1.0870-75 (537m) 1.0960 (210m) 1.0970-75 (454m)

GBP/USD: 1.4200 (GBP 406m)

EUR/GBP: 0.7800 (EUR 386m)

AUD/USD: 0.7260 (AUD 807m) 0.7280 (315m) 0.7300 181m) 0.7425 (348m)

NZD/USD 0.6650-60 (331m)

-

14:34

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) February 0.9% Revised From 1.0% -1.2%

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Coincident Index (Preliminary) January 110.9 113.8

05:00 Japan Leading Economic Index (Preliminary) January 101.8 Revised From 102.1 101.4

07:00 Germany Factory Orders s.a. (MoM) January -0.2% Revised From -0.7% -0.3% -0.1%

09:10 United Kingdom MPC Member Andy Haldane Speaks

09:30 Eurozone Sentix Investor Confidence March 6.0 5.5

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Market participants continued to eye Friday's U.S. labour market data. According to the U.S. Labor Department's data, the U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs. The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services. The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations. Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

The euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

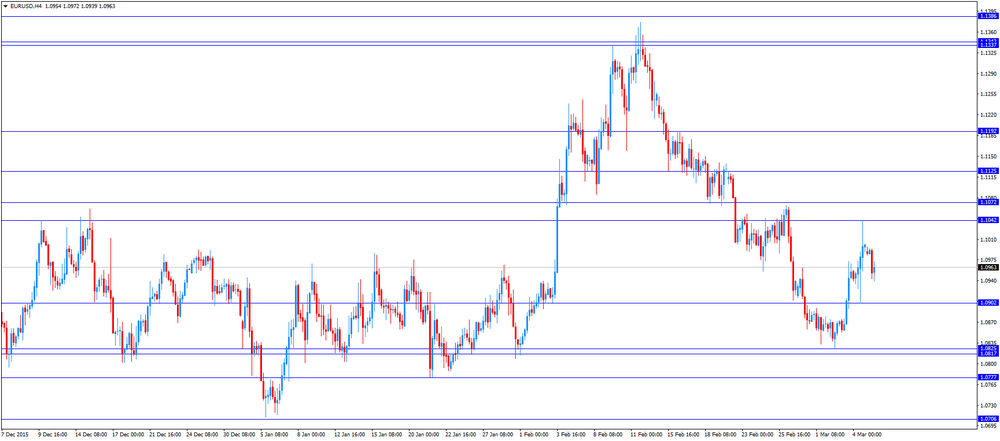

EUR/USD: the currency pair traded mixed

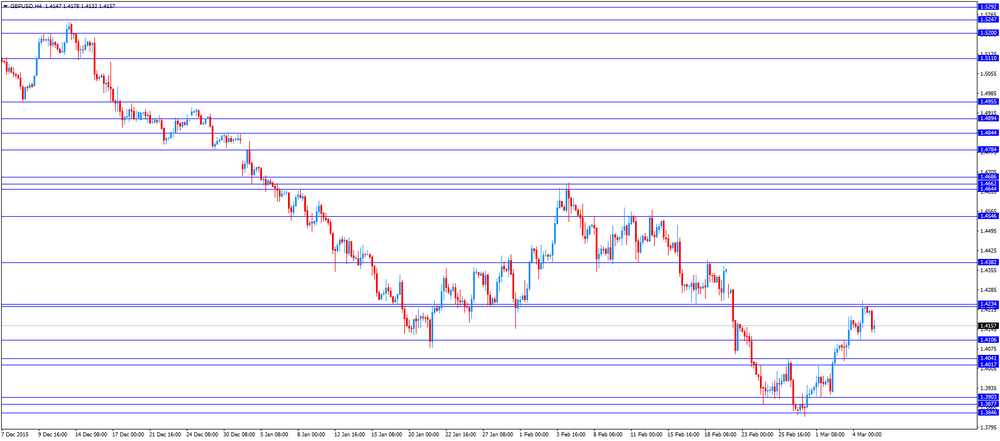

GBP/USD: the currency pair declined to $1.4132

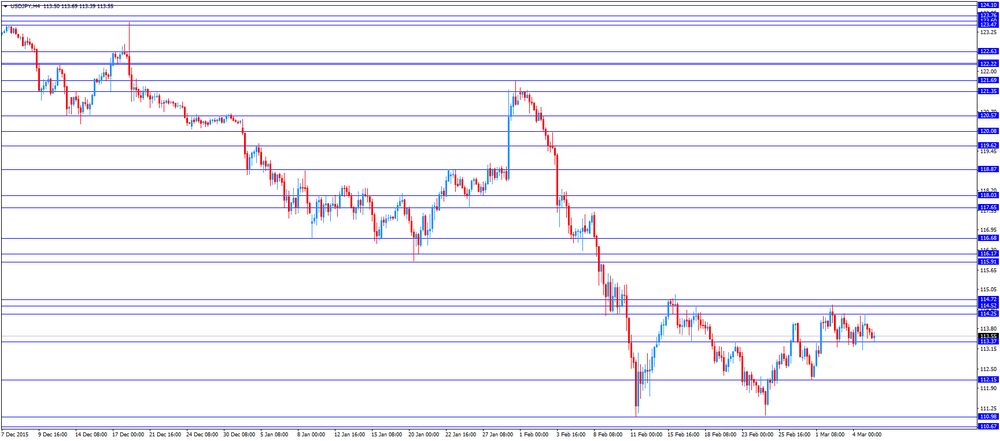

USD/JPY: the currency pair fell to Y113.39

The most important news that are expected (GMT0):

15:00 U.S. Labor Market Conditions Index February 0.4

17:00 U.S. FOMC Member Brainard Speaks

17:30 U.S. FED Vice Chairman Stanley Fischer Speaks

20:00 U.S. Consumer Credit January 21.27 16.75

23:20 Australia RBA Assist Gov Lowe Speaks

23:50 Japan Current Account, bln January 960.7 719

23:50 Japan GDP, q/q (Finally) Quarter IV 0.3% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter IV 1.3% -1.5%

-

13:50

Orders

EUR/USD

Offers: 1.0975-80 1.1000 1.1025-30.1050 1.1080 1.1100

Bids: 1.0945-50 1.0920 1.0900 1.08875-80 1.0850 1.0830 1.0800 1.0785 1.0750

GBP/USD

Offers: 1.4185-90 1.4200 1.4225 1.4250 1.4280 1.4300 1.4335 1.4350

Bids: 1.4150 1.4120 1.4100 1.4070 1.4045-50 1.4020 1.4000 1.3985 1.3945-50

EUR/JPY

Offers: 124.60 124.85 125.00 125.30 125.50 125.75 126.00

Bids: 124.00-05 123.60 123.20 123.00 122.50 122.30 122.00

EUR/GBP

Offers: 0.7750 0.7760 0.7775-80 0.7800 0.7820-25 0.7850

Bids: 0.7720 0.7700 0.7675 0.7650

USD/JPY

Offers: 113.80-85 114.00 114.25-30 114.50 114.75-80 115.00

Bids: 113.50 113.50 113.20 113.00 112.70-75 112.50 112.30 112.00

AUD/USD

Offers: 0.7420-25 0.7435 0.7450 0.7475 0.7500

Bids: 0.7385 0.7350 0.7330 0.7300 0.7280 0.7260 0.7220 0.7200

-

11:44

Australian ANZ job advertisements decline 1.2% in February

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements declined 1.2% in February, after a 0.9% rise in January. January's figure was revised down from a 1.0% rise.

The decrease was mainly driven by a drop in internet job advertisements, which fell by 1.3% in February.

"Growth in job advertising has slowed sharply in recent months. The fall in job ads in February may reflect some caution on behalf of businesses amid heightened financial markets volatility and negative news flow on the global economy. It could also partly reflect the tricky nature of seasonal adjustment at this time of year," the ANZ Chief Economist Warren Hogan noted.

-

11:34

Japan's leading index declines to 101.4 in January, the lowest level since December 2012

Japan's Cabinet Office released its preliminary leading index data on Monday. The leading index decreased to 101.4 in January from 101.8 in December. It was the lowest level since December 2012.

December's figure was revised down from 102.1.

Japan's coincident index climbed to 113.8 in January from 110.9 in December. The index was mainly driven by an increase in output in the electronic parts and devices sector.

-

11:28

China’s foreign-exchange reserves decline by $28.57 billion in February

According to data released by the People's Bank of China (PBoC) on Monday, China's foreign-exchange reserves declined by $28.57 billion to $3.20 trillion in February, after a drop by $99.5 billion in January. It was the lowest level since December 2011, and the fourth consecutive monthly decline.

-

11:23

Ai Group/HIA Australian Performance of Construction Index is down to 46.1 in February

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 46.1 in February from 46.3 in January.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by a drop in house building activity.

-

11:17

German seasonal adjusted factory orders decline 0.1% in January

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

New orders from the Eurozone jumped 7.5% in January, while orders from other countries declined 2.7%.

Orders of the intermediate goods decreased by 4.0% in January, capital goods orders were up 1.7%, while consumer goods orders climbed 3.9%.

On a yearly basis, factory orders rose 1.1% in January, after a 2.2% decline in December.

-

11:10

Sentix investor confidence index for the Eurozone falls to 5.5 in March

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

The current conditions index fell to 8.3 in March from 10.5 in February.

The expectations index climbed to 2.8 in March from 1.5 in February.

German investor confidence index rose to 16.9 in March from 14.5 in February.

-

10:45

China’s government expects the Chinese economy to expand 6.5% - 7.0% this year

China's Premier Li Keqiang said at the National People's Congress over the weekend that the government forecasted the Chinese economy to expand 6.5% - 7.0% this year. The economic growth in 2016 - 2020 is expected to be not less than 6.5%.

"This is the crucial period in which China currently finds itself and during which we must build up powerful new drivers in order to accelerate the development of the new economy," he said.

The government plans to invest $120 billion in railway construction and $240 billion to build roads. The government also plans to create 50 million jobs.

-

10:22

Bank of Japan Governor Haruhiko Kuroda: the central bank would analyse the effect of negative interest rates

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Monday that the central bank would analyse the effect of negative interest rates.

"The Bank will continue to carefully monitor developments in the money market," he said.

Kuroda reiterated that the BoJ would expand its quantitative easing if needed.

The BoJ expects the inflation in Japan to reach 2% target.

"Deflation will not return to Japan. Price stability with 2 percent inflation will definitely be achieved," he noted.

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.40 (USD 380m) 113.00 (423m) 114.00 (458m) 114.35 (200m)

EUR/USD: 1.0750 (EUR 1.27bln) 1.0825 (203m) 1.0850-55 (697m) 1.0870-75 (537m) 1.0960 (210m) 1.0970-75 (454m)

GBP/USD: 1.4200 (GBP 406m)

EUR/GBP: 0.7800 (EUR 386m)

AUD/USD: 0.7260 (AUD 807m) 0.7280 (315m) 0.7300 181m) 0.7425 (348m)

NZD/USD 0.6650-60 (331m)

-

08:20

Asian session: The U.S. dollar was slightly lower against the yen

The U.S. dollar was slightly lower against the yen during the Asia trading session Monday.

The European Central Bank's board members are expected to meet Thursday, when the central bank is expected to push a key interest rate even further into negative territory. Meanwhile, the Bank of Japan and the U.S. Federal Reserve are scheduled to hold policy meetings next week.

The Australian dollar fell as Australian job advertisements fell back in February, adding to signs that the breakneck hiring spree seen in the second half of 2015 may cool in the month ahead. According to the ANZ, job advertisements fell by 1.2% to 154,748 after seasonal adjustments, leaving the number at the lowest level seen since October last year. Despite the mild decline registered in February, advertisements still grew 8.2% from 12 months earlier.

EUR/USD: during the Asian session the pair traded in the range of $1.0980-00

GBP/USD: during the Asian session the pair traded in the range of $1.4195-25

USD/JPY: during the Asian session the pair fell to Y113.50

German factory orders at 07.00 GMT is the only release of note but we do have the latest Eurogroup meeting taking place to provide some rhetoric/hot air. Two US Fed talking heads later.

-

08:00

Germany: Factory Orders s.a. (MoM), January -1.0% (forecast -0.3%)

-

06:59

Options levels on monday, March 7, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1168 (1584)

$1.1127 (3088)

$1.1075 (111)

Price at time of writing this review: $1.0991

Support levels (open interest**, contracts):

$1.0949 (1016)

$1.0913 (1621)

$1.0865 (2109)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 35027 contracts, with the maximum number of contracts with strike price $1,0900 (3088);

- Overall open interest on the PUT options with the expiration date April, 8 is 46040 contracts, with the maximum number of contracts with strike price $1,0500 (4522);

- The ratio of PUT/CALL was 1.31 versus 1.19 from the previous trading day according to data from March, 4

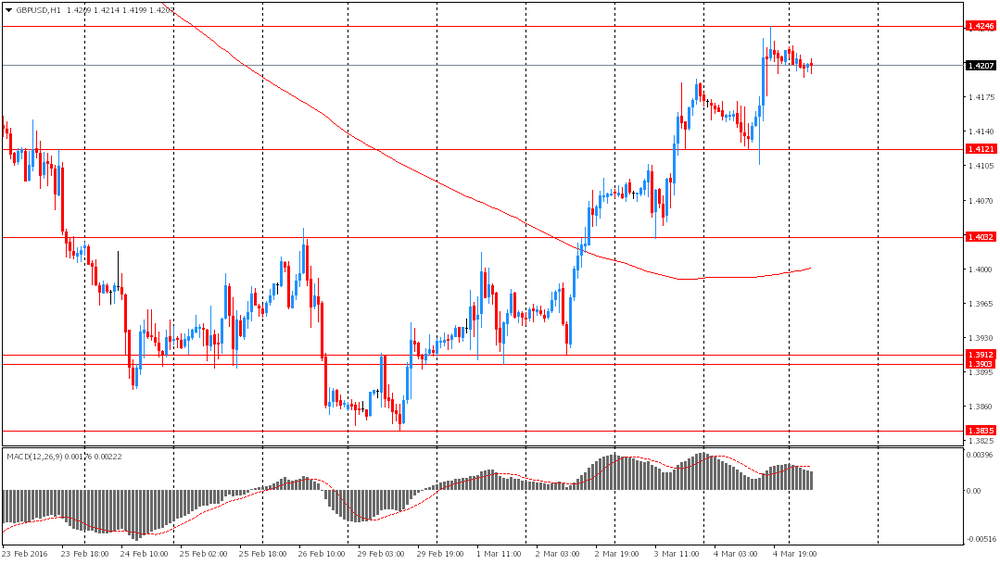

GBP/USD

Resistance levels (open interest**, contracts)

$1.4507 (1002)

$1.4410 (2116)

$1.4314 (819)

Price at time of writing this review: $1.4209

Support levels (open interest**, contracts):

$1.4087 (233)

$1.3991 (966)

$1.3993 (429)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 16586 contracts, with the maximum number of contracts with strike price $1,4700 (2233);

- Overall open interest on the PUT options with the expiration date April, 8 is 15415 contracts, with the maximum number of contracts with strike price $1,3850 (2866);

- The ratio of PUT/CALL was 0.93 versus 0.96 from the previous trading day according to data from March, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:01

Japan: Leading Economic Index , January 101.4

-

06:01

Japan: Coincident Index, January 113.8

-

01:30

Australia: ANZ Job Advertisements (MoM), February -1.2%

-

01:02

Currencies. Daily history for Mar 4’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1001 +0,41%

GBP/USD $1,4222 +0,32%

USD/CHF Chf0,9933 +0,13%

USD/JPY Y113,95 +0,24%

EUR/JPY Y125,35 +0,65%

GBP/JPY Y162,04 +0,56%

AUD/USD $0,7430 +1,08%

NZD/USD $0,6806 +1,22%

USD/CAD C$1,3321 -0,61%

-

00:01

Schedule for today, Monday, Mar 7’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia ANZ Job Advertisements (MoM) February 1.0%

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Coincident Index (Preliminary) January 110.9

05:00 Japan Leading Economic Index (Preliminary) January 102.1

07:00 Germany Factory Orders s.a. (MoM) January -0.7% -0.3%

09:10 United Kingdom MPC Member Andy Haldane Speaks

09:30 Eurozone Sentix Investor Confidence March 6.0

15:00 U.S. Labor Market Conditions Index February 0.4

17:00 U.S. FOMC Member Brainard Speaks

17:30 U.S. FED Vice Chairman Stanley Fischer Speaks

20:00 U.S. Consumer Credit January 21.27 16.5

23:20 Australia RBA Assist Gov Lowe Speaks

23:50 Japan Current Account, bln January 960.7 719

23:50 Japan GDP, q/q (Finally) Quarter IV 0.3% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter IV 1.3% -1.5%

-