Noticias del mercado

-

21:00

Dow +0.06% 17,017.73 +10.96 Nasdaq -0.71% 4,683.52 -33.50 S&P -0.29% 1,994.15 -5.84

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock indexes slightly rose. The New York state comptroller said in a report that also warned of weaker profits and job cuts for the industry this year.

Most of Dow stocks in positive area (17 of 30). Top looser - NIKE, Inc. (NKE, -2,82%). Top gainer - Caterpillar Inc. (CAT, +3,51%).

Most of S&P sectors in positive area. Top looser - Consumer goods (-0,5%). Top gainer - Basic Materials (+1,7%).

At the moment:

Dow 17046.00 +79.00 +0.47%

S&P 500 1999.75 +4.75 +0.24%

Nasdaq 100 4317.75 -4.75 -0.11%

Oil 37.63 +1.71 +4.76%

Gold 1267.60 -3.10 -0.24%

U.S. 10yr 1.92 +0.03

-

18:23

WSE: Session Results

Today's session brought a positive picture of the Warsaw market, which seems to be a derivative of similar conduct of other emerging markets. These grow from a few days in the wake of higher commodity prices and today, looking at the behavior of Turkey, Hungary or Russia can be seen a continuation of this trend. In this environment, the West of Europe looks a bit worse. General atmosphere is still good, and short-term trends remain on most floors growth.

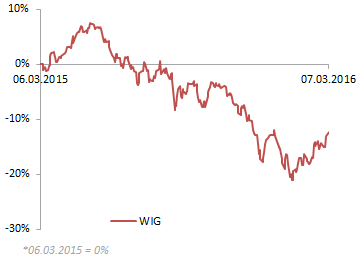

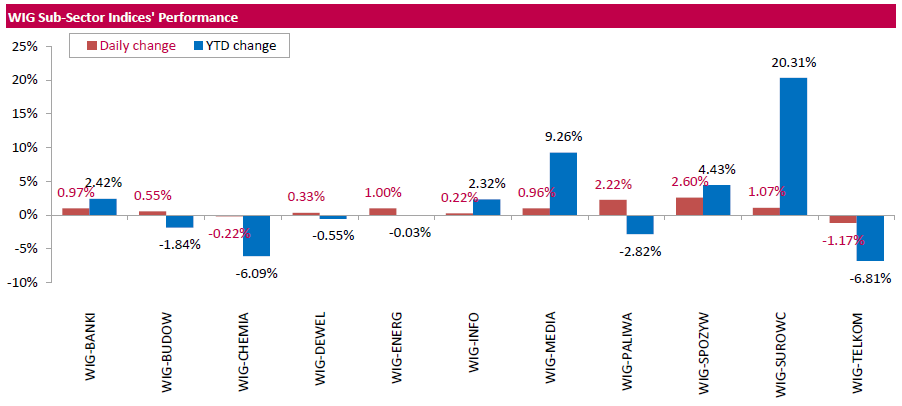

The broad market measure, the WIG Index, added 0.95%. Except for telecommunication sector (-1.17%) and chemicals (-0.22%), every sector in the WIG Index gained, with food sector (+2.60%) outperforming.

Oil and gas producer SERINUS (WSE: SEN) recorded the strongest daily advance of 12%. Coking coal miner JSW (WSE: JSW) also produced noticeable gains, up 6.18%, after Poland's gas company PGNIG (WSE: PGN; +2.53%) had submitted an offer to buy a district heating plant from the company.

On the contrary, SYNTHOS (WSE: SNS), one of the largest manufacturers of chemical raw materials in Poland, posted a 6% decrease, as a response to information that the company's Board will recommend to the General Meeting to pay no dividend for 2015 year. Elsewhere, ACTION (WSE: ACT), a company which operates in the areas of trade and production of IT-equipment, withdrew its FY2015 financial forecasts, after a previuos 2-times reduction. As a result the company lost 10.4%.

-

18:00

European stocks closed: FTSE 100 6,182.4 -17.03 -0.27% CAC 40 4,442.29 -14.33 -0.32% DAX 9,778.93 -45.24 -0.46%

-

18:00

European stocks close: stocks closed lower on the negative data from the Eurozone and on news from China

Stock indices closed lower on the negative data from the Eurozone and on news from China. China's Premier Li Keqiang said at the National People's Congress over the weekend that the government forecasted the Chinese economy to expand 6.5% - 7.0% this year. The economic growth in 2016 - 2020 is expected to be not less than 6.5%.

Meanwhile, the economic data from the Eurozone was negative. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,182.4 -17.03 -0.27 %

DAX 9,778.93 -45.24 -0.46 %

CAC 40 4,442.29 -14.33 -0.32 %

-

17:45

U.K. manufacturers' association EEF lowers its manufacturing growth forecasts

The U.K. manufacturers' association EEF lowered its manufacturing growth forecasts on Monday. The manufacturing sector in the U.K. is expected to rise 0.6% in 2016, down from the previous estimate of 0.8%.

The EEF expects the U.K. economy to expand 1.9% in 2016, down from the previous estimate of 2.1%.

The EEF said that output balance increased after hitting weakest point in six years in Q4 2015, while total orders also rose from a six year low.

"After the gloomy end to 2015, this latest data shows a chink of light. But, we should not be getting the deckchairs out yet. The slide is bottoming out, but manufacturing is still in negative territory and faces a precarious climb back up amidst a storm of real uncertainty. In a two-speed scenario, the fact that even those sectors in the fast lane are not relaxed about the global outlook probably says it all," EEF Chief Economist, Lee Hopley, said.

-

16:30

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 129.09 in February

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index decreased to 129.09 in February from 129.15 in January. January's figure was revised up from 128.90.

Five of the eight components declined.

"The flatness of the Employment trends index since September suggests that the rapid job growth in recent months is likely to slow down. In particular, we are concerned about the temporary help industry component, one of the most powerful leading indicators of employment growth, which has declined for the second month in a row in February," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

16:22

European Central Bank purchases €13.24 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.24 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.90 billion of covered bonds, and €258 million of asset-backed securities.

The ECB could add further stimulus measures at its meeting this week. The central bank could cut its deposit rate further or expand its monthly asset purchases.

-

15:53

Fitch Ratings on Friday affirms Portugal’s sovereign debt rating but cuts the outlook

Rating agency Fitch Ratings on Friday affirmed Portugal's sovereign debt rating at 'BB+' but downgraded the outlook to 'stable' from 'positive'. The agency noted that the downward revision of the outlook was driven by the bigger-than-expected fiscal deficit.

"Fiscal performance was well off-target in 2015, with the general government deficit at an estimated 4.2% of GDP compared with the 2.7% initially expected," Fitch said.

"The government's plans for fiscal deficit reduction in 2016 are also at risk," the agency added.

-

15:34

U.S. Stocks open: Dow -0.35%, Nasdaq -0.54%, S&P -0.49%

-

15:18

Before the bell: S&P futures -0.51%, NASDAQ futures -0.54%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,911.32 -103.46 -0.61%

Hang Seng 20,159.72 -16.98 -0.08%

Shanghai Composite 2,898.64 +24.50 +0.85%

FTSE 6,131.22 -68.21 -1.10%

CAC 4,410.4 -46.22 -1.04%

DAX 9,722.01 -102.16 -1.04%

Crude oil $36.21 (+0.81%)

Gold $1269.20 (-0.12%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

E. I. du Pont de Nemours and Co

DD

65.15

3.12%

11.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.97

2.36%

16.8K

Barrick Gold Corporation, NYSE

ABX

14.00

2.04%

14.7K

ALCOA INC.

AA

9.61

0.42%

3.9K

Hewlett-Packard Co.

HPQ

11.09

0.31%

0.3K

3M Co

MMM

160.20

0.08%

4.5K

Apple Inc.

AAPL

103.00

-0.01%

132.9K

General Motors Company, NYSE

GM

31.35

-0.06%

2.1K

Procter & Gamble Co

PG

83.41

-0.10%

4.7K

Exxon Mobil Corp

XOM

82.20

-0.11%

2.9K

ALTRIA GROUP INC.

MO

62.90

-0.13%

3.7K

Deere & Company, NYSE

DE

84.75

-0.15%

1.0K

Facebook, Inc.

FB

108.21

-0.17%

9.6K

American Express Co

AXP

58.18

-0.19%

0.6K

Walt Disney Co

DIS

98.29

-0.19%

28.0K

Boeing Co

BA

120.83

-0.20%

0.2K

AT&T Inc

T

37.83

-0.26%

1.1K

Amazon.com Inc., NASDAQ

AMZN

573.51

-0.28%

0.6K

General Electric Co

GE

30.36

-0.33%

3.3K

Starbucks Corporation, NASDAQ

SBUX

58.50

-0.34%

11.1K

Cisco Systems Inc

CSCO

26.70

-0.37%

0.4K

Pfizer Inc

PFE

29.60

-0.37%

6.5K

Ford Motor Co.

F

13.54

-0.37%

3.3K

Johnson & Johnson

JNJ

106.07

-0.40%

0.7K

Nike

NKE

61.00

-0.42%

2.5K

The Coca-Cola Co

KO

43.92

-0.43%

0.3K

Chevron Corp

CVX

87.53

-0.45%

7.5K

Caterpillar Inc

CAT

72.50

-0.47%

0.4K

Google Inc.

GOOG

707.50

-0.48%

14.5K

Tesla Motors, Inc., NASDAQ

TSLA

200.00

-0.52%

2.4K

Yahoo! Inc., NASDAQ

YHOO

33.68

-0.53%

2.4K

Microsoft Corp

MSFT

51.75

-0.54%

3.6K

Citigroup Inc., NYSE

C

42.59

-0.56%

1.5K

Goldman Sachs

GS

155.93

-0.58%

0.8K

JPMorgan Chase and Co

JPM

59.70

-0.58%

148.0K

Verizon Communications Inc

VZ

51.50

-0.60%

1.6K

Intel Corp

INTC

30.35

-0.91%

2.0K

Twitter, Inc., NYSE

TWTR

19.16

-1.03%

2.5K

Yandex N.V., NASDAQ

YNDX

14.29

-1.31%

0.2K

-

14:49

Producer prices in Italy decrease 0.7% in January

The Italian statistical office Istat released its producer price inflation data for Italy on Monday. Italian producer prices decreased 0.7% in January, after a 0.6% decline in December. December's figure was revised up from a 0.7% drop.

Producer price declined by 0.8% on domestic market and by 0.4% on non-domestic market in January.

On a yearly basis, Italian PPI fell 2.5% in January, after a 3.2% drop in December. December's figure was revised up from a 3.3% fall.

Producer price slid 3.0% on domestic market and by 0.9% on non-domestic market in January.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Hewlett Packard Enterprise (HPE) target raised to $19 from $13.50 at Maxim Group

Apple (AAPL) target lowered to $127 from $132 at Pacific Crest

Intel (INTC) target lowered to $36 from $40 at BofA/Merrill

-

12:38

WSE: Mid-Session comment

The first part of the trade session was marked with moderately positive response of the market to the environment and satisfactory activity, such as the beginning of a new week.

WIG20 Index approached the highs of recent changes, and hit the resistance level of 1,880 pts., which is expected to restrict further movements up to the circular barrier of 1900 points.

Although Euroland developments send mixed signals to the Polish market, the latter remains strong.

Slight declines that marked the opening of European market sessions have now widened, and southern phase of trade brings a discount of 1% for both the DAX-a and CAC40. The biggest drops are so far in the sector of mining companies. Weaker are also banks that are second on the list of declining sectors.

Meanwhile, WSE evidenced outstanding performance of Serinus Energy Inc. (SEN) that gained more than 12% during the session so far.

Serinus Energy Inc. (formerly: Kulczyk Oil Ventures) it is an international company active in the exploration and production of oil and gas, which has a diverse portfolio of assets, includes both projects at the stage of exploration and development of deposits, as well as projects with significant exploration potential. The main assets of the company are interests in five gas fields in Ukraine, land concession areas in Brunei and shares in huge onshore exploration block in Syria. The shares Serinus Energy Inc. are listed on the WSE from May, 2010.

-

12:00

European stock markets mid session: stocks traded lower on the negative data from the Eurozone and on news from China

Stock indices traded lower on the negative data from the Eurozone and on news from China. China's Premier Li Keqiang said at the National People's Congress over the weekend that the government forecasted the Chinese economy to expand 6.5% - 7.0% this year. The economic growth in 2016 - 2020 is expected to be not less than 6.5%.

Meanwhile, the economic data from the Eurozone was negative. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

Current figures:

Name Price Change Change %

FTSE 100 6,149.33 -50.10 -0.81 %

DAX 9,707.22 -116.95 -1.19 %

CAC 40 4,410.09 -46.53 -1.04 %

-

11:44

Australian ANZ job advertisements decline 1.2% in February

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements declined 1.2% in February, after a 0.9% rise in January. January's figure was revised down from a 1.0% rise.

The decrease was mainly driven by a drop in internet job advertisements, which fell by 1.3% in February.

"Growth in job advertising has slowed sharply in recent months. The fall in job ads in February may reflect some caution on behalf of businesses amid heightened financial markets volatility and negative news flow on the global economy. It could also partly reflect the tricky nature of seasonal adjustment at this time of year," the ANZ Chief Economist Warren Hogan noted.

-

11:34

Japan's leading index declines to 101.4 in January, the lowest level since December 2012

Japan's Cabinet Office released its preliminary leading index data on Monday. The leading index decreased to 101.4 in January from 101.8 in December. It was the lowest level since December 2012.

December's figure was revised down from 102.1.

Japan's coincident index climbed to 113.8 in January from 110.9 in December. The index was mainly driven by an increase in output in the electronic parts and devices sector.

-

11:28

China’s foreign-exchange reserves decline by $28.57 billion in February

According to data released by the People's Bank of China (PBoC) on Monday, China's foreign-exchange reserves declined by $28.57 billion to $3.20 trillion in February, after a drop by $99.5 billion in January. It was the lowest level since December 2011, and the fourth consecutive monthly decline.

-

11:23

Ai Group/HIA Australian Performance of Construction Index is down to 46.1 in February

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 46.1 in February from 46.3 in January.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by a drop in house building activity.

-

11:17

German seasonal adjusted factory orders decline 0.1% in January

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

New orders from the Eurozone jumped 7.5% in January, while orders from other countries declined 2.7%.

Orders of the intermediate goods decreased by 4.0% in January, capital goods orders were up 1.7%, while consumer goods orders climbed 3.9%.

On a yearly basis, factory orders rose 1.1% in January, after a 2.2% decline in December.

-

11:10

Sentix investor confidence index for the Eurozone falls to 5.5 in March

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

The current conditions index fell to 8.3 in March from 10.5 in February.

The expectations index climbed to 2.8 in March from 1.5 in February.

German investor confidence index rose to 16.9 in March from 14.5 in February.

-

10:54

Change of the composition of the WSE Main List indices

The Warsaw Stock Exchange announces that following the trading session on March 18 2016, there will be an annual revision concerning WIG20, WIG20TR, mWIG40, sWIG80, WIG30 and WIG30TR composition.

In the WIG20 and WIG20TR portfolios, LOTOS will be added while SYNTHOS will be removed.

In the mWIG40 portfolio, there will be following changes:

· new companies: GRAJEWO, ROBYG, SYNTHOS, UNIWHEELS;

· removed companies: GETIN, LOTOS, STALPROD, ZEPAK.

In the sWIG80 portfolio there will be following changes:

· new companies: CPGROUP, GETIN, GRAAL, OPONEO, POLIMEXMS, SKOTAN, STALPROD, WIELTON, ZEPAK;

· removed companies: BOS, GINOROSSI, GRAJEWO, INDYGO, KANIA, ROBYG, SERINUS, SMT, UNIWHEELS.

In the WIG30 and WIG30TR, HANDLOWY will be replaced by MILLENNIUM;

Weightings of PEKAO, PKNORLEN, PKOBP and PZU companies in the WIG30 and WIG30TR will be reduced to 10%.

-

10:45

China’s government expects the Chinese economy to expand 6.5% - 7.0% this year

China's Premier Li Keqiang said at the National People's Congress over the weekend that the government forecasted the Chinese economy to expand 6.5% - 7.0% this year. The economic growth in 2016 - 2020 is expected to be not less than 6.5%.

"This is the crucial period in which China currently finds itself and during which we must build up powerful new drivers in order to accelerate the development of the new economy," he said.

The government plans to invest $120 billion in railway construction and $240 billion to build roads. The government also plans to create 50 million jobs.

-

10:22

Bank of Japan Governor Haruhiko Kuroda: the central bank would analyse the effect of negative interest rates

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Monday that the central bank would analyse the effect of negative interest rates.

"The Bank will continue to carefully monitor developments in the money market," he said.

Kuroda reiterated that the BoJ would expand its quantitative easing if needed.

The BoJ expects the inflation in Japan to reach 2% target.

"Deflation will not return to Japan. Price stability with 2 percent inflation will definitely be achieved," he noted.

-

09:23

Market opening

The new week on the WSE starts quite calm, there was no major deviations at the beginning of our session on the futures market, which was more or less a copy of behavior of contracts on European indices. Futures contracts on the WIG20 index recorded a slight decline at the opening (FW20H16 1874 points (-3 points)).

WSE Main List stock indexes opening Quotations:

WIG 46467,99 0,15 %

WIG20 1874,03 0,03 %

WIG30 2097,46 0,12 %

mWIG40 3515,79 0,32 %

WIGdiv 978,40 0,10 %

The eyes of investors today are turned to the market of copper and other industrial metals which are in a correction phase, because market players believe that last week's increases in metals prices were excessive, taking into account the fundamental data of raw materials. Copper prices on the London Metal Exchange falling sharply, the first time in 5 sessions, in response to the information that comes from China.

The financial statement showed out this morning that Bank that PKO BP posted PLN 444.3 mln Q4 attributable net profit, much above the market consensus for PLN 371.4 mln profit.

-

07:40

Global Stocks: stocks closed higher as official data showed jobs growth in USA

European stocks and U.S. stocks closed higher for the fourth straight day Friday as crude oil prices climbed and official data showed jobs growth in February was stronger than economists' expected. The world's largest economy added 242,000 jobs last month, and the unemployment rate stayed at 4.9%. Investors world-wide look to the report as the labor market is a key consideration of the Federal Reserve's in deciding monetary policy.

Chinese shares rose Monday after authorities mapped plans to buoy growth even as they try to steer the economy toward a new quarter-century-low growth target this year. Investors appeared to focus on China's message of economic growth during the opening of the National People's Congress (NPC) last Saturday, rather than its outlines for painful layoffs as it moves to cut excess production in steel and coal industries.

Based on MarketWatch materials

-

03:32

Nikkei 225 16,956.83 -57.95 -0.34 %, Hang Seng 20,254.73 +78.03 +0.39 %, Shanghai Composite 2,903.17 +29.03 +1.01 %

-

01:04

Stocks. Daily history for Sep Mar 4’2016:

(index / closing price / change items /% change)

Nikkei 225 17,014.78 +54.62 +0.32 %

Hang Seng 20,176.7 +234.94 +1.18 %

Shanghai Composite 2,874.06 +14.30 +0.50 %

FTSE 100 6,199.43 +68.97 +1.13 %

CAC 40 4,456.62 +40.54 +0.92 %

Xetra DAX 9,824.17 +72.25 +0.74 %

S&P 500 1,999.99 +6.59 +0.33 %

NASDAQ Composite 4,717.02 +9.60 +0.20 %

Dow Jones 17,006.77 +62.87 +0.37 %

-