Noticias del mercado

-

21:00

Dow -0.35% 17,013.61 -60.34 Nasdaq -0.78% 4,671.71 -36.54 S&P -0.73% 1,987.16 -14.60

-

18:52

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as oil prices tumbled and weak Chinese data rekindled fears of a global economic slowdown led by the world's second-biggest economy. China's February trade performance was far worse than economists had expected, with exports tumbling the most in over six years. The report weighed on markets worldwide. Oil prices fell nearly 3% in volatile trading.

Most of Dow stocks in negative area (18 of 30). Top looser - Caterpillar Inc. (CAT, -2,97%). Top gainer - NIKE, Inc. (NKE, +2,08%).

Almost all of S&P sectors in negative area. Top looser - Basic Materials (-3,1%). Top gainer - Utilities (+0,5%).

At the moment:

Dow 17016.00 -32.00 -0.19%

S&P 500 1987.75 -11.25 -0.56%

Nasdaq 100 4294.75 -5.25 -0.12%

Oil 36.66 -1.24 -3.27%

Gold 1266.90 +2.90 +0.23%

U.S. 10yr 1.82 -0.08

-

18:00

European stocks closed: FTSE 100 6,125.44 -56.96 -0.92% CAC 40 4,404.02 -38.27 -0.86% DAX 9,692.82 -86.11 -0.88%

-

18:00

European stocks close: stocks closed lower on the Chinese trade data

Stock indices closed lower on the weaker-than-expected Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus dropped to $32.59 billion in February from $63.30 billion in January, beating expectations for a decline to a surplus of $50.15 billion. Exports fell at an annual rate of 25.4% in February, the biggest drop since May 2009, while imports slid at an annual rate of 13.8%, the fifteenth consecutive decline.

Falling oil prices also weighed on stocks. Oil prices declined as hopes for the freeze of the oil production seemed to disappear.

Market participants also eyed the economic data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in fourth quarter, in line with the preliminary reading, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in fourth quarter, up from the preliminary reading of 1.5%, after a 1.6% rise in the third quarter.

Household spending gained 0.2% in the fourth quarter, while gross fixed capital formation climbed 1.3%.

Exports climbed by 0.2% in the fourth quarter, while imports rose by 0.9%.

In 2015 as whole, GDP increased 1.6%, up from the preliminary reading of 1.5%, after a 0.9% growth in 2014.

Destatis released its industrial production data for Germany on Tuesday. German industrial production jumped 3.3% in January, exceeding expectations for a 0.5% gain, after a 0.3% decline in December.

Bank of England (BoE) Governor Mark Carney said before Treasury Select Committee on Tuesday that a deal to keep Britain in the EU (European Union) was important for UK's monetary and financial stability.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,125.44 -56.96 -0.92 %

DAX 9,692.82 -86.11 -0.88 %

CAC 40 4,404.02 -38.27 -0.86 %

-

17:53

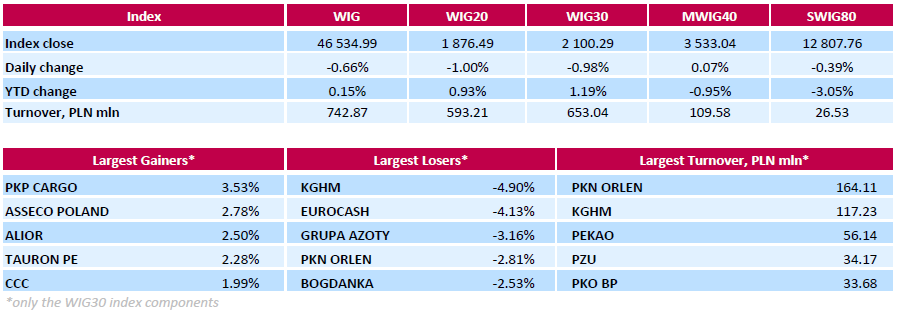

WSE: Session Results

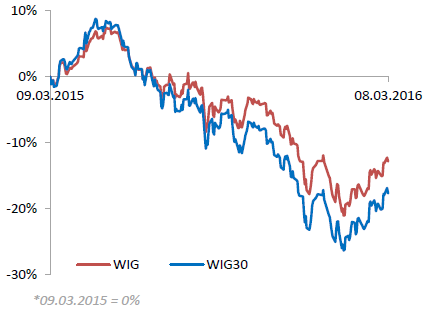

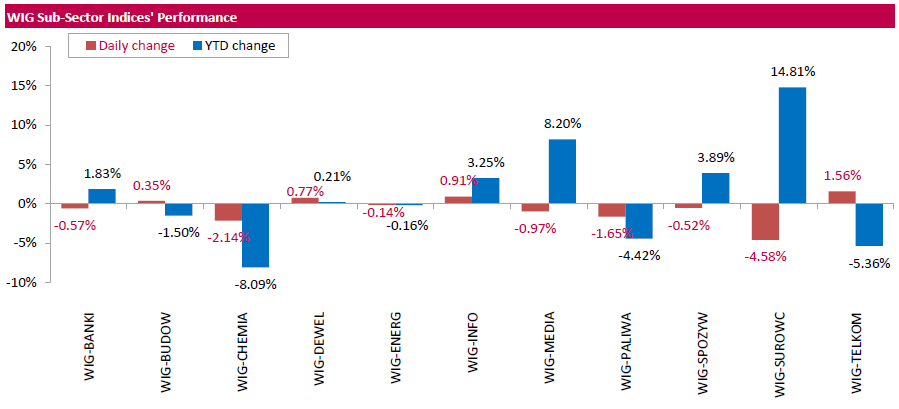

Polish equity market closed lower on Tuesday amid commodities slump and ahead of ECB meeting. The broad market benchmark, the WIG Index, declined by 0.66%. Sector-wise, materials (-4.58%) fared the worst, while telecommunication services sector (+1.56%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, fell by 0.98%. Copper producer KGHM (WSE: KGH) and oil refiner PKN ORLEN (WSE: PKN) were among the biggest laggards in the index, losing a respective 4.9% and 2.81% due to deterioration in sentiment towards commodities. Crude lost nearly 3% after reaching the resistance level at local maximum at the end of December. Contracts for copper with a fall of 2.4% also suggest that the market is entering a stronger correction of recent increases. Aside from that, FMCG-wholesaler EUROCASH (WSE: EUR), chemical producer GRUPA AZOTY (WSE: ATT) and thermal coal miner BOGDANKA (WSE: LWB) also recorded significant losses of 4.13%, 3.16% and 2.53% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and IT-company ASSECO POLAND (WSE: ACP) managed to record the biggest daily gains, climbing by 3.53% and 2.78% respectively. Elsewhere, banking sector name ALIOR (WSE: ALR) added 2.5% on news the bank is in talks to buy its rival Bank BPH from General Electric.

-

17:00

National Australia Bank’s business confidence index remains unchanged at 3 points in February

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index remained unchanged at 3 points in February. January's figure was revised up from 2 points.

"Another above-average outcome for business conditions is a great result in the current global environment. It confirms that low interest rates and a more competitive AUD are clearly having the desired effect," NAB Group Chief Economist Alan Oster said.

The main business conditions index increased to 8 points in February from 5 points in January, while employment rose to 1 points from -1 points.

-

16:25

Japan’s consumer confidence index declines to 40.1 in February

Japan's Cabinet Office released its consumer confidence index on Tuesday. The consumer confidence index declined to 40.1 in February from 42.5 in January, missing expectations for a fall to 42.3. It was the lowest level since January 2015.

The decrease was driven by declines in all sub-indexes. The overall livelihood sub-index decreased to 38.5 in February from 40.9 in January, the income growth sub-index was down to 39.8 from 41.2, the employment sub-index fell to 42.1 from 45.8, while the willingness to buy durable goods sub-index dropped to 39.9 from 42.0.

-

16:04

Japan’s Eco Watchers' current conditions index falls to 44.6 in February, the lowest level since November 2014

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index fell to 44.6 in February from 46.6 in January. It was the lowest level since November 2014.

Japan's economy watchers' future conditions index decreased to 48.2 in February from 49.5 in January.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

15:47

After start on Wall Street

Quotations of contracts for US indices pointed to a downward start on Wall Street. The opening on Wall Street is downward, but the market is not much lower compared to yesterday at the same time, S&P 500 hovering below the level of 2000. Weaker US performance seems to be mimicked by the Warsaw Exchange. The supply side is increasingly prominent in shares that have the greatest negative impact on the WIG20. In the case of PKN Orlen, we can see descent to new session minimum, while turnover has already exceeded 100 mln PLN, and at the end of the day will probably be higher than yesterday. Very similar pressure also applies to KGHM, and in the last minutes to Pekao.

-

15:40

National Federation of Independent Business’s small-business optimism index for the U.S. drops to 92.9 in February

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index dropped to 92.9 in February from 93.9 in January. It was the lowest level since February 2014.

6 of 10 sub-indexes declined last month, while 4 sub-indexes were flat.

"Monthly management of monetary policy using data subject to substantial revision is inconsistent with the acknowledged lags in policy and not supportive of real growth which requires more policy consistency. Financial markets of course thrive on the variability such policies produce and support a zero interest-rate policy," NFIB Chief Economist Bill Dunkelberg said.

-

15:34

U.S. Stocks open: Dow -0.56%, Nasdaq -0.78%, S&P -0.67%

-

15:18

Before the bell: S&P futures -0.45%, NASDAQ futures -0.49%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,783.15 -128.17 -0.76%

Hang Seng 20,011.58 -148.14 -0.73%

Shanghai Composite 2,899.9 +2.57 +0.09%

FTSE 6,164.14 -18.26 -0.30%

CAC 4,430.22 -12.07 -0.27%

DAX 9,762.47 -16.46 -0.17%

Crude oil $38.23 (+0.87%)

Gold $1272.40 (+0.66%)

-

15:04

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

14.07

1.52%

52.5K

Chevron Corp

CVX

90.94

0.30%

12.7K

Cisco Systems Inc

CSCO

27.19

0.18%

14.6K

American Express Co

AXP

59.00

0.00%

0.9K

Procter & Gamble Co

PG

83.07

-0.04%

0.8K

Wal-Mart Stores Inc

WMT

67.83

-0.09%

0.3K

Hewlett-Packard Co.

HPQ

11.30

-0.09%

5.0K

Boeing Co

BA

122.75

-0.12%

0.2K

Pfizer Inc

PFE

29.74

-0.17%

0.5K

Merck & Co Inc

MRK

52.54

-0.19%

0.1K

United Technologies Corp

UTX

96.72

-0.21%

0.2K

Verizon Communications Inc

VZ

52.10

-0.21%

14.1K

Visa

V

71.77

-0.24%

6.3K

McDonald's Corp

MCD

116.85

-0.26%

0.4K

Tesla Motors, Inc., NASDAQ

TSLA

204.75

-0.26%

3.6K

Citigroup Inc., NYSE

C

42.47

-0.33%

0.9K

AT&T Inc

T

38.00

-0.34%

1.8K

Yandex N.V., NASDAQ

YNDX

14.49

-0.34%

0.1K

Exxon Mobil Corp

XOM

84.15

-0.37%

3.0K

Walt Disney Co

DIS

98.99

-0.40%

0.9K

International Business Machines Co...

IBM

139.54

-0.44%

1.7K

Ford Motor Co.

F

13.56

-0.44%

0.5K

Intel Corp

INTC

30.80

-0.45%

28.1K

General Electric Co

GE

30.15

-0.46%

17.7K

E. I. du Pont de Nemours and Co

DD

64.40

-0.48%

116.4K

Facebook, Inc.

FB

105.21

-0.49%

49.4K

ALTRIA GROUP INC.

MO

61.50

-0.50%

1K

The Coca-Cola Co

KO

43.78

-0.52%

0.5K

Amazon.com Inc., NASDAQ

AMZN

559.60

-0.57%

2.0K

Google Inc.

GOOG

691.16

-0.58%

1.4K

Microsoft Corp

MSFT

50.73

-0.59%

190.8K

Home Depot Inc

HD

124.67

-0.65%

0.5K

Apple Inc.

AAPL

101.20

-0.66%

115.4K

JPMorgan Chase and Co

JPM

59.54

-0.67%

0.1K

Starbucks Corporation, NASDAQ

SBUX

57.60

-0.69%

7.0K

Nike

NKE

58.81

-0.74%

8.1K

Yahoo! Inc., NASDAQ

YHOO

33.70

-0.77%

1.1K

General Motors Company, NYSE

GM

31.31

-0.89%

8.2K

Caterpillar Inc

CAT

73.94

-1.11%

4.3K

Twitter, Inc., NYSE

TWTR

18.95

-1.15%

16.6K

ALCOA INC.

AA

9.78

-2.59%

24.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.51

-3.55%

50.8K

-

14:58

OECD’s leading composite leading indicator declines to 99.62 in January

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator decreased to 99.62 in January from 99.7 in December.

It signalled stable growth in the Eurozone as a whole and Italy.

There were signs of stabilising growth momentum in France and India.

The index for the U.S., the U.K., Canada, Germany and Japan pointed to an easing in growth momentum.

The index for China confirmed the tentative signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:44

Building permits in Canada slide 9.8% in January

Statistics Canada released housing market data on Tuesday. Building permits in Canada slid 9.8% in January, missing expectations for a 2.0% fall, after a 7.7% rise in December. December's figure was revised down from a 11.3% increase.

The decrease was driven by a decline in building permits for multi-family dwellings in in British Columbia and Ontario.

Building permits for non-residential construction were down 4.8% in January, while permits in the residential sector plunged 12.5%.

-

14:39

Consumer credit in the U.S. increases by $10.54 billion in January

The Fed released its consumer credits figures on Monday. Consumer credit in the U.S. rose by $10.54 billion in January, missing expectations for a $16.75 billion increase, after a $21.38 billion gain December. December's figure was revised up from a $21.27 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit fell by $1.05 billion in January, while non-revolving credit jumped by $11.59 billion.

-

14:27

Housing starts in Canada climb to a seasonally adjusted annualized rate of 212,594 units in February

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada climbed to a seasonally adjusted annualized rate of 212,594 units in February from 165,071 units in January. January's figure was revised down from 165,900 units.

Housing starts were driven by a rise in the single and multi-unit segment.

"The national housing starts trend held steady in February, despite some important regional variances. Housing starts are trending at a 4-year low in the Prairies where low oil prices have weakened consumer confidence," the CMHC's Chief Economist Bob Dugan said.

-

12:49

WSE: Mid-session Comment

The situation in major markets remains unchanged. Ever since the session opening, pressure accumulates on the supply side. Fluctuations are indeed small, but persistent supply in the coming hours will likely be fueling bearish sentiment. The market has largely ignored the latter in the first phase of the session, but with the passage of time and the approaching opening of Wall Street this condition may be more difficult to maintain. Indeed, this also suggests that the observed revocation of market may continue.

The list of declining stocks is headed, just as yesterday, by raw material suppliers. Among blue chips, the weakest company today is PKN Orlen (WSE:PKN), the largest Polish petrochemical operator. Share price lost more than 2.5 per cent., which after yesterday's strong growth and the breaking up of the 2-week consolidation may be cause for concern.

-

12:39

European stock markets mid session: stocks traded lower on Chinese trade data

Stock indices traded lower on the weaker-than-expected Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus dropped to $32.59 billion in February from $63.30 billion in January, beating expectations for a decline to a surplus of $50.15 billion. Exports fell at an annual rate of 25.4% in February, the biggest drop since May 2009, while imports slid at an annual rate of 13.8%, the fifteenth consecutive decline.

Market participants also eyed the economic data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in fourth quarter, in line with the preliminary reading, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in fourth quarter, up from the preliminary reading of 1.5%, after a 1.6% rise in the third quarter.

Household spending gained 0.2% in the fourth quarter, while gross fixed capital formation climbed 1.3%.

Exports climbed by 0.2% in the fourth quarter, while imports rose by 0.9%.

In 2015 as whole, GDP increased 1.6%, up from the preliminary reading of 1.5%, after a 0.9% growth in 2014.

Destatis released its industrial production data for Germany on Tuesday. German industrial production jumped 3.3% in January, exceeding expectations for a 0.5% gain, after a 0.3% decline in December.

Bank of England (BoE) Governor Mark Carney said before Treasury Select Committee on Tuesday that a deal to keep Britain in the EU (European Union) was important for UK's monetary and financial stability.

Current figures:

Name Price Change Change %

FTSE 100 6,129.99 -52.41 -0.85 %

DAX 9,652.43 -126.50 -1.29 %

CAC 40 4,376.14 -66.15 -1.49 %

-

12:36

Bank of England Governor Mark Carney: a deal to keep Britain in the EU is important for UK’s monetary and financial stability

Bank of England (BoE) Governor Mark Carney said before Treasury Select Committee on Tuesday that a deal to keep Britain in the EU (European Union) was important for UK's monetary and financial stability.

"The Settlement addresses the issues the Bank identified as being important, given the likely need for further integration of the euro area, to maintaining its ability to achieve its objectives," he wrote in a letter to the Treasury Select Committee.

"Finally, it makes a series of commitments to improve the competitiveness of the EU economy-commitments, to the extent they are fulfilled, that would reinforce the positive impact of EU membership on the Bank's secondary objectives," Carney added.

-

12:19

Industrial production in Spain declines 0.1% in January

Spanish statistical office INE released its industrial production figures for Spain on Tuesday. Industrial production in Spain declined 0.1% in January, after a 0.2% drop in December.

On a yearly basis, industrial production in Spain climbed at adjusted 3.5% in January, after a 4.1% increase in December. December's figure was revised up from a 3.7% gain.

Output of capital goods jumped at seasonally adjusted 9.3% year-on-year in January, output of intermediate goods climbed 5.2%, energy production was down 7.5%, while consumer goods output rose 5.7%.

-

12:14

France’s current account deficit rises to €1.4 billion in January

The Bank of France released its current account data on Tuesday. France's current account deficit was €1.4 billion in January, up from a deficit of €0.4 billion in December. December's figure was revised up from a deficit of €0.7 billion.

The trade goods deficit widened to €2.1 billion in January from €0.8 billion in December, while the surplus on services rose to €0.2 billion from €0.1 billion.

-

12:07

France's trade deficit widens to €3.71 billion in January

According to the French Customs, France's trade deficit widened to €3.71 billion in January from €3.68 billion in December, beating expectations for a decline to a deficit of €4.1 billion. December's figure was revised up from a deficit of €3.94 billion.

The increase in deficit was driven by higher imports. Exports increased 0.5% in January, while imports were up 0.6%.

-

12:02

German industrial production jumps 3.3% in January

Destatis released its industrial production data for Germany on Tuesday. German industrial production jumped 3.3% in January, exceeding expectations for a 0.5% gain, after a 0.3% decline in December. December's figure was revised up from a 1.2% drop.

The output of capital goods increased 5.3% in January, energy output gained 0.1%, and the production in the construction sector was up 7.0%, while the production of intermediate goods climbed 0.4%.

The output of consumer goods rose 3.7% in January.

German industrial production excluding energy and construction climbed by 3.2% in January.

-

11:57

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 0.1% on a like-for-like basis in February

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 0.1% on a like-for-like basis in February, after a 2.6% rise in January.

On a total basis, retail sales climbed 1.1% year-on-year in February.

"February's slowdown was noticeable across all product categories bar Stationery and Health & Beauty," BRC Chief Executive, Helen Dickinson, said.

"This slow growth reflects the increasing pressure the industry is under," she added.

-

11:53

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in February

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in February.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.7% in February from 3.8% in January. Analysts had expected the unemployment rate to remain unchanged at 3.8%.

The number of unemployed people in Switzerland fell by 2,227 to 161,417 in February from a month ago.

The youth unemployment rate was down to 3.6% in February from 3.8% in January.

-

11:48

Switzerland’s consumer price inflation rises 0.2% in February

The Swiss Federal Statistics Office released its consumer inflation data on Tuesday. Switzerland's consumer price index rose 0.2% in February, beating expectations for a 0.1% decline, after a 0.4% decrease in January.

The increase was mainly driven by higher prices for clothing, rents and airfares.

On a yearly basis, Switzerland's consumer price index increased to -0.8% in February from -1.3% in January, beating forecasts of a 1.1% decrease.

-

11:40

Eurozone's revised GDP climbs 0.3% in fourth quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in fourth quarter, in line with the preliminary reading, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in fourth quarter, up from the preliminary reading of 1.5%, after a 1.6% rise in the third quarter.

Household spending gained 0.2% in the fourth quarter, while gross fixed capital formation climbed 1.3%.

Exports climbed by 0.2% in the fourth quarter, while imports rose by 0.9%.

In 2015 as whole, GDP increased 1.6%, up from the preliminary reading of 1.5%, after a 0.9% growth in 2014.

-

11:15

Fed Governor Lael Brainard: the Fed should be patient in hiking its interest rate further

Fed Governor Lael Brainard said on Monday that the Fed should be patient in hiking its interest rate further.

"Tighter financial conditions and softer inflation expectations may pose risks to the downside for inflation and domestic activity. From a risk-management perspective, this argues for patience as the outlook becomes clearer," she said.

Brainard also said that developments abroad could have a negative impact on the U.S. economy.

-

11:05

Japan’s current account surplus declines to ¥520.8 billion in January

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥520.8 billion in January from ¥960.7 billion in December, missing expectations for a surplus of ¥719.0 billion.

The goods trade surplus turned into a deficit of ¥411.0 billion in January, down from a surplus of ¥188.7 billion in December.

Exports dropped at an annual rate of 15.4% in January, while imports plunged 19.8%.

The service balance deficit was ¥226.7 billion in January.

-

10:55

China's trade surplus drops to $32.59 billion in February

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus dropped to $32.59 billion in February from $63.30 billion in January, beating expectations for a decline to a surplus of $50.15 billion.

Exports fell at an annual rate of 25.4% in February, the biggest drop since May 2009, while imports slid at an annual rate of 13.8%, the fifteenth consecutive decline.

Chinese New Year is likely to have some impact on the data. Nevertheless, the trade data indicates that there is the slowdown in the Chinese economy.

-

10:50

Reserve Bank of Australia Deputy Governor Philip Lowe: the central bank could ease its monetary policy further to support demand growth

Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe said on Tuesday that the central bank could ease its monetary policy further to support demand growth.

"As the Reserve Bank has indicated for some time, this low inflation outlook provides scope for easier monetary policy should that be appropriate in supporting demand growth in the economy. An important factor here will be whether the growth in aggregate demand continues to be sufficient to accommodate the growth in our labour force," he said.

Lowe noted that he would prefer a weaker currency which should help to rebalance the economy.

-

10:33

Fed Vice Chairman Stanley Fischer: inflation will rise toward 2% target once oil prices and the value of the U.S. dollar stabilise

Fed Vice Chairman Stanley Fischer said in a speech on Monday that inflation will rise toward 2% target once oil prices and the value of the U.S. dollar stabilise.

Fischer pointed out that there was still a link between unemployment and inflation.

"It is sometimes argued that the link between unemployment and inflation must have been broken. I don't believe that. Rather the link has never been very strong, but it exists, and we may well at present be seeing the first stirrings of an increase in the inflation rate--something that we would like to happen," he noted.

-

10:22

Japan’s final GDP falls 0.3% in the fourth quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP decreased by 0.3% in the fourth quarter, up from the preliminary reading of a 0.4% decline, after a 0.3% rise in the third quarter.

Capital expenditure rose 1.5% in the fourth quarter, up from a preliminary reading of a 1.4% gain, while household spending decrease 0.9%, down from a preliminary reading of a 0.8% fall.

On a yearly basis, Japan's economy contracted by 1.1% in the fourth quarter, from the preliminary reading of a 1.5% drop, after a 1.3% growth in the third quarter.

-

10:10

Fitch Ratings downgrades its global growth forecasts

Rating agency Fitch Ratings downgraded its global growth forecasts on Monday. The agency expects the global economy to expand 2.5% in 2016, down from its December estimate of 2.9%. Advanced economies are expected to grow 1.7% this year, down from its December estimate of 2.1%, while emerging economies are expected to expand 4.0%, down from its December estimate of 4.4%.

Fitch expects the Chinese economy to grow 6.2% in 2016, down from its December estimate of 6.3%.

The agency noted that the downward revision was driven by the slowdown in the Chinese economy and lower spending in commodities-dependent countries.

Fitch pointed out that there was no recession.

"The breadth of the revisions is notable but still leaves the growth outlook a long way above global recession territory," the agency said.

-

09:42

EUROFIRST 300 1,324.58 -16.74 -1.25%, DAX 9,631.08 -147.85 -1.51%, CAC 40 4,373.15 -69.14 -1.56%, FTSE 100 6,116.7 -65.70 -1.06%

-

09:12

WSE: Market opening

Futures market declined by 0.32% to 1,883 points at the beginning and a similar downward scale is preparing to open in the spot market.

Spot market declined by 0.43% to 1,887 points, at a moderate turnover, focused, like yesterday, on the shares of KGHM and PKN Orlen, which slightly adjusted downwards. The same opening is a part of a global sentiment spreading across Europe from Asia. In this environment, the chances are more in favor of consolidation at the nearest support level of around 1,880 points, rather than reaching over the 1900 points resistance level.

The WSE Indices Open Change vs Yesterday's Close:

WIG 46620.00 -0.48%

WIG20 1887.19 -0.43%

WIG30 2106.43 -0.69%

mWIG40 3535.31 0.14%

-

08:29

WSE: Pre-Opening

Yesterday's session displayed very clearly different behaviors of stronger stock markets of developing countries (including WSE) against weaker stock markets of developed countries. Today, however, the advantage of the former ones may deteriorate due to weaker economic data from China on trade and the lackluster morning performance of commodities. Similarly, currencies of countries associated with the exports of raw materials, such as Australia, yesterday even gained in value, and today in the morning already corrected. At the moment, it looks like a correction after a strong movement, which in recent days concerned the market for raw materials and all related assets. The correction may reverse during the session, but in the morning it seems that the current sentiment indicates of the former to persist.

Regarding important upcoming events, investors seem to be waiting for the ECB meeting, the BoJ and, most importantly, of the Federal Reserve. From the point of view of the Warsaw Stock Exchange, Thursday's ECB decision is seen mainly in terms of possible risks. This is due to the fact that the Polish market in the past has not shown positive responses to the statements by Mario Draghi. More chances that positive developments will from Fed, which has a more significant impact on the strength of emerging markets.

Domestic market is expected to retain yesterday's behavioral pattern, with the very high closing being in favor of the scenario of today's attack on the level of 1900 points. That can not be ruled out, and the technical analysis indicators seem encouraging. Prevailing morning mood, however, indicates that bullish attitude may not be powerful enough so as to break through the resistance level.

-

07:29

Global Stocks: European stocks finished lower as gloomy German economic data

European stocks finished lower Monday as gloomy German economic data and a warning about global central bank effectiveness dampened sentiment ahead of the European Central Bank's highly anticipated policy decision later this week.

U.S. stocks eked out small gains Monday, allowing the S&P 500 and Dow industrials to extend their winning streak to five straight sessions, in part thanks to a jump in oil prices.

China shares fell Tuesday and were on track to end a five-day winning streak on worries that the government might try to cool speculative activity in the country's top property markets.

Based on MarketWatch materials

-

03:03

Nikkei 225 16,652.33 -258.99 -1.53 %, Hang Seng 19,988.99 -170.73 -0.85 %, Shanghai Composite 2,886.16 -11.18 -0.39 %

-

00:30

Stocks. Daily history for Sep Mar 7’2016:

(index / closing price / change items /% change)

Nikkei 225 16,911.32 -103.46 -0.61 %

Hang Seng 20,159.72 -16.98 -0.08 %

Shanghai Composite 2,898.64 +24.50 +0.85 %

FTSE 100 6,182.4 -17.03 -0.27 %

CAC 40 4,442.29 -14.33 -0.32 %

Xetra DAX 9,778.93 -45.24 -0.46 %

S&P 500 2,001.76 +1.77 +0.09 %

NASDAQ Composite 4,708.25 -8.77 -0.19 %

Dow Jones 17,073.95 +67.18 +0.40 %

-