Noticias del mercado

-

23:59

Schedule for today, Wednesday, Mar 9’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans January 2.6% -2.3%

06:00 Japan Prelim Machine Tool Orders, y/y February -17.2%

09:30 United Kingdom Industrial Production (MoM) January -1.1% 0.5%

09:30 United Kingdom Industrial Production (YoY) January -0.4% 0.2%

09:30 United Kingdom Manufacturing Production (MoM) January -0.2% 0.2%

09:30 United Kingdom Manufacturing Production (YoY) January -1.7% -0.7%

12:00 U.S. MBA Mortgage Applications March -4.8%

15:00 United Kingdom NIESR GDP Estimate February 0.4%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:00 U.S. Wholesale Inventories January -0.1% -0.2%

15:30 U.S. Crude Oil Inventories March 10.374

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

-

20:20

American focus: The US dollar fell against major currencies

The euro lost ground against the previously-earned dollar, and returned to the level of opening of the session. The pressure on the currency has investors' anxiety before the meeting of the European Central Bank, which will take place on Thursday. Experts point out that there is likelihood of recurrence of the events of December, when the measures taken by the ECB fell short of market expectations.

The survey of 48 economists conducted by Bloomberg from 26 February to 3 March, showed that the ECB will extend the program to stimulate the economy. 98% predict that the ECB will take further steps to revive the economy and inflation. All of these 98% of respondents expect a rate cut on deposits, and nearly three-quarters - of the monthly increase in the volume of bond redemption. The median forecast shows that the ECB deposit rate will be reduced by 0.10% to 0.4%, and the volume of assets of the program (QE) will be increased to 75 billion. Euros per month from the current 60 billion. Euro. At the same time 72% of respondents do not expect new measures of quantitative easing since March, and 60% do not expect further reduction of interest rates on deposits after the meeting.

Market participants also continue to analyze today's data for the euro area, which showed that the economy grew, according to preliminary estimates, in the fourth quarter. GDP grew by 0.3 percent sequentially, according to estimates published on 12 February. The economy showed a similar expansion of 0.3 percent in the third quarter. In annual terms, GDP growth remained stable at 1.6 percent in the fourth quarter. The annual growth rate has been revised from 1.5 percent. A breakdown of the expenditure side of GDP shows that the growth of household expenditures fell to 0.2 percent from 0.5 percent sequentially. At the same time, the growth of government spending accelerated in half to 0.6 percent from 0.3 percent. In addition, investments increased by 1.3 percent, faster than the growth of 0.4 percent quarter ago. Export growth remained at 0.2 per cent, while imports rose 0.9 percent after rising 1.2 percent in the previous quarter.

The pound retreated from session low against the dollar, but still shows a moderate decrease. Initially, the currency decline was caused by the comments of the Bank of England Governor Mark Carney. He noted that the new agreement between the UK and the EU should contribute to the achievement of two objectives: maintaining low and stable inflation and maintaining financial stability. Reached by Prime Minister Cameron of the country in late February agreement touches on some important aspects of economic governance in the EU, the Bank of England believes that it is important to achieve the goals. In particular, the agreement makes it clear that for the management of the UK financial system meets the Bank of England and other governing bodies of the country.

Support for the pound had statements of the Bank of England representative Huila. He said that the next step is likely to be a rate hike, but added that there is scope for policy easing if necessary. "The Bank of England may expand asset purchases and reduce the rate if necessary also the Bank of England may start buying the assets of the private sector where appropriate.", - The politician said.

According to Reuters latest survey, the Bank of England will not raise interest rates before the beginning of 2017. It is worth emphasizing, since the beginning of this year, experts push back deadlines rate hike for the third time. None of the 59 economists polled this week, does not expect any change in rates at the next meeting of the Monetary Policy Committee of the Bank of England, which is scheduled for 17 March. The survey revealed that on average there is a 45 percent chance of growth rates by the end of this year. In late January, the probability was 55 percent. Meanwhile, the chances of a rate hike have increased to 75 percent by the end of next year. Analysts expect that by the end of next year the rate will be at 1.25 percent and then rise to 1.75 per cent until the end of 2018.

The Canadian dollar fell considerably against the US dollar, updating yesterday's low, which was associated with the publication of mixed statistics on Canada, as well as the resumption of decline in oil prices. The Canadian Mortgage and Housing Corporation (CMHC) reported that the number of new foundations bookmarks in Canada has increased from a seasonally adjusted annual rate of up to 212,594 units in February, compared to 165,071 units in January. The January figure was revised down from 165 900 units. The growing number of new foundations favorites was caused by an increase in single and multi-element segments. Meanwhile, Statistics Canada said that building permits in Canada fell 9.8% in January, losing to fall on expectations of 2.0%, after rising 7.7% in December. The December figure was revised from + 11.3%. The decline was due to the fall of permits for residential construction in British Columbia and Ontario.

-

17:00

National Australia Bank’s business confidence index remains unchanged at 3 points in February

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index remained unchanged at 3 points in February. January's figure was revised up from 2 points.

"Another above-average outcome for business conditions is a great result in the current global environment. It confirms that low interest rates and a more competitive AUD are clearly having the desired effect," NAB Group Chief Economist Alan Oster said.

The main business conditions index increased to 8 points in February from 5 points in January, while employment rose to 1 points from -1 points.

-

16:25

Japan’s consumer confidence index declines to 40.1 in February

Japan's Cabinet Office released its consumer confidence index on Tuesday. The consumer confidence index declined to 40.1 in February from 42.5 in January, missing expectations for a fall to 42.3. It was the lowest level since January 2015.

The decrease was driven by declines in all sub-indexes. The overall livelihood sub-index decreased to 38.5 in February from 40.9 in January, the income growth sub-index was down to 39.8 from 41.2, the employment sub-index fell to 42.1 from 45.8, while the willingness to buy durable goods sub-index dropped to 39.9 from 42.0.

-

16:04

Japan’s Eco Watchers' current conditions index falls to 44.6 in February, the lowest level since November 2014

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index fell to 44.6 in February from 46.6 in January. It was the lowest level since November 2014.

Japan's economy watchers' future conditions index decreased to 48.2 in February from 49.5 in January.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

15:40

National Federation of Independent Business’s small-business optimism index for the U.S. drops to 92.9 in February

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index dropped to 92.9 in February from 93.9 in January. It was the lowest level since February 2014.

6 of 10 sub-indexes declined last month, while 4 sub-indexes were flat.

"Monthly management of monetary policy using data subject to substantial revision is inconsistent with the acknowledged lags in policy and not supportive of real growth which requires more policy consistency. Financial markets of course thrive on the variability such policies produce and support a zero interest-rate policy," NFIB Chief Economist Bill Dunkelberg said.

-

14:58

OECD’s leading composite leading indicator declines to 99.62 in January

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator decreased to 99.62 in January from 99.7 in December.

It signalled stable growth in the Eurozone as a whole and Italy.

There were signs of stabilising growth momentum in France and India.

The index for the U.S., the U.K., Canada, Germany and Japan pointed to an easing in growth momentum.

The index for China confirmed the tentative signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:51

Option expiries for today's 10:00 ET NY cut

USD/JPY: 111.00 (USF 605m) 112.00 (253m) 113.00 (1.51bln) 113.85-90 (370m) 114.00 (555m) 115.00 (645m)

EUR/USD: 1.0800 (EUR 1.27bln) 1.0900 (831m) 1.0930-35 (260m) 1.1000 (338m) 1.1010-15 (400m) 1.1050 (314m) 1.1100 (438m)

GBP/USD: 1.4090 (GBP 318m)

AUD/USD: 0.7300 (AUD 653m)

USD/CAD 1.3235 (USD 1.19bln) 1.3295 (360m) 1.3390 (275m)

-

14:44

Building permits in Canada slide 9.8% in January

Statistics Canada released housing market data on Tuesday. Building permits in Canada slid 9.8% in January, missing expectations for a 2.0% fall, after a 7.7% rise in December. December's figure was revised down from a 11.3% increase.

The decrease was driven by a decline in building permits for multi-family dwellings in in British Columbia and Ontario.

Building permits for non-residential construction were down 4.8% in January, while permits in the residential sector plunged 12.5%.

-

14:39

Consumer credit in the U.S. increases by $10.54 billion in January

The Fed released its consumer credits figures on Monday. Consumer credit in the U.S. rose by $10.54 billion in January, missing expectations for a $16.75 billion increase, after a $21.38 billion gain December. December's figure was revised up from a $21.27 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit fell by $1.05 billion in January, while non-revolving credit jumped by $11.59 billion.

-

14:30

Canada: Building Permits (MoM) , January -9.8% (forecast -2%)

-

14:27

Housing starts in Canada climb to a seasonally adjusted annualized rate of 212,594 units in February

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada climbed to a seasonally adjusted annualized rate of 212,594 units in February from 165,071 units in January. January's figure was revised down from 165,900 units.

Housing starts were driven by a rise in the single and multi-unit segment.

"The national housing starts trend held steady in February, despite some important regional variances. Housing starts are trending at a 4-year low in the Prairies where low oil prices have weakened consumer confidence," the CMHC's Chief Economist Bob Dugan said.

-

14:14

Canada: Housing Starts, February 212.6 (forecast 180)

-

14:12

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence February 3 Revised From 2 3

02:00 China Trade Balance, bln February 63.30 50.15 32.59

05:00 Japan Eco Watchers Survey: Current February 46.6 47.5 44.6

05:00 Japan Eco Watchers Survey: Outlook February 49.5 48.2

05:00 Japan Consumer Confidence February 42.5 42.3 40.1

06:45 Switzerland Unemployment Rate (non s.a.) February 3.8% 3.8% 3.7%

07:00 Germany Industrial Production s.a. (MoM) January -0.3% Revised From -1.2% 0.5% 3.3%

07:45 France Trade Balance, bln January -3.70 Revised From -3.94 -4.1 -3.70

08:15 Switzerland Consumer Price Index (MoM) February -0.4% -0.1% 0.2%

08:15 Switzerland Consumer Price Index (YoY) February -1.3% -1.1% -0.8%

09:15 United Kingdom BOE Gov Mark Carney Speaks

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV 0.3% 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV 1.6% 1.5% 1.6%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar after the release of the GDP data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in fourth quarter, in line with the preliminary reading, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in fourth quarter, up from the preliminary reading of 1.5%, after a 1.6% rise in the third quarter.

Household spending gained 0.2% in the fourth quarter, while gross fixed capital formation climbed 1.3%.

Exports climbed by 0.2% in the fourth quarter, while imports rose by 0.9%.

In 2015 as whole, GDP increased 1.6%, up from the preliminary reading of 1.5%, after a 0.9% growth in 2014.

Destatis released its industrial production data for Germany on Tuesday. German industrial production jumped 3.3% in January, exceeding expectations for a 0.5% gain, after a 0.3% decline in December.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Bank of England (BoE) Governor Mark Carney said before Treasury Select Committee on Tuesday that a deal to keep Britain in the EU (European Union) was important for UK's monetary and financial stability.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian housing market data. The Canadian building permits are expected to fall 2.0% in January, after a 11.3% rise in December.

Housing starts in Canada are expected to rise to 180,000 in February from 165,900 in December.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Tuesday. Switzerland's consumer price index rose 0.2% in February, beating expectations for a 0.1% decline, after a 0.4% decrease in January.

The increase was mainly driven by higher prices for clothing, rents and airfares.

On a yearly basis, Switzerland's consumer price index increased to -0.8% in February from -1.3% in January, beating forecasts of a 1.1% decrease.

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in February.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.7% in February from 3.8% in January. Analysts had expected the unemployment rate to remain unchanged at 3.8%.

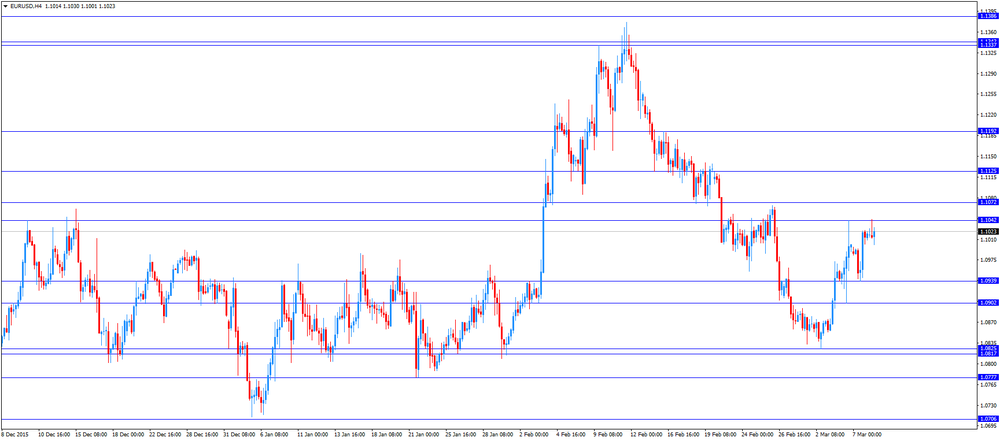

EUR/USD: the currency pair fell to $1.1001

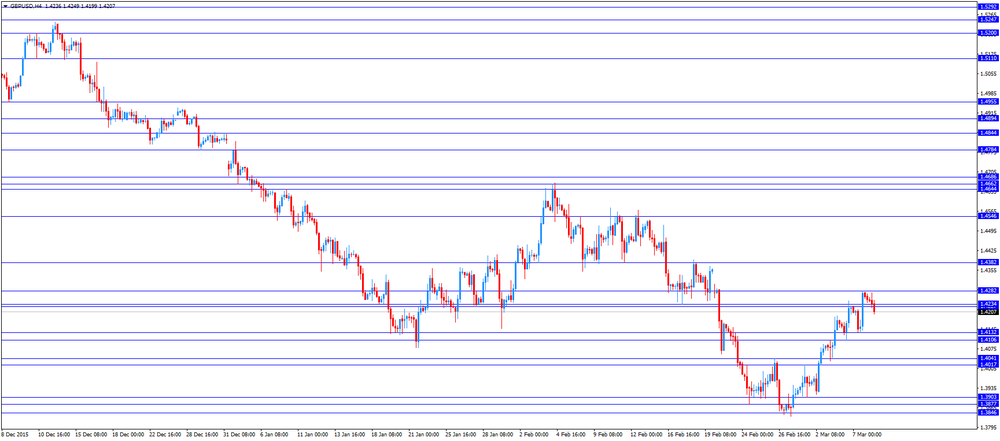

GBP/USD: the currency pair declined to $1.4199

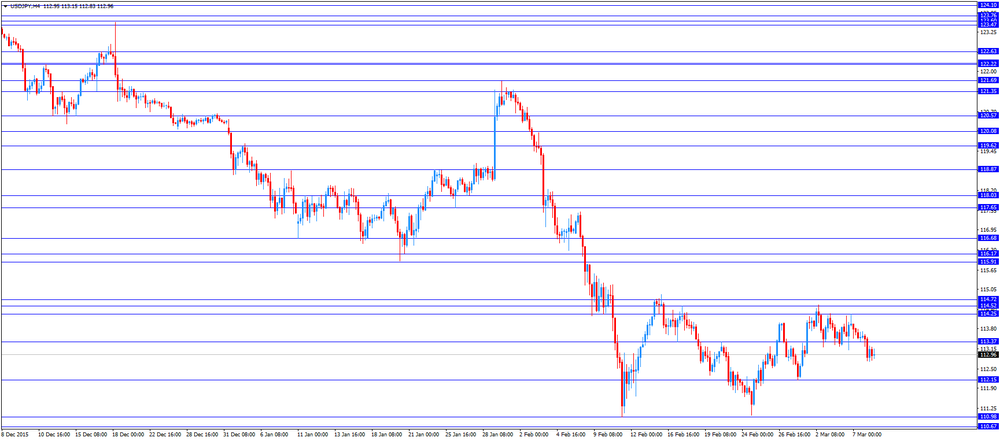

USD/JPY: the currency pair rose to Y113.15

The most important news that are expected (GMT0):

13:15 Canada Housing Starts February 165.9 180

13:30 Canada Building Permits (MoM) January 11.3% -2%

17:00 United Kingdom MPC Member Weale Speaks

23:30 Australia Westpac Consumer Confidence March 4.2%

-

12:36

Bank of England Governor Mark Carney: a deal to keep Britain in the EU is important for UK’s monetary and financial stability

Bank of England (BoE) Governor Mark Carney said before Treasury Select Committee on Tuesday that a deal to keep Britain in the EU (European Union) was important for UK's monetary and financial stability.

"The Settlement addresses the issues the Bank identified as being important, given the likely need for further integration of the euro area, to maintaining its ability to achieve its objectives," he wrote in a letter to the Treasury Select Committee.

"Finally, it makes a series of commitments to improve the competitiveness of the EU economy-commitments, to the extent they are fulfilled, that would reinforce the positive impact of EU membership on the Bank's secondary objectives," Carney added.

-

12:19

Industrial production in Spain declines 0.1% in January

Spanish statistical office INE released its industrial production figures for Spain on Tuesday. Industrial production in Spain declined 0.1% in January, after a 0.2% drop in December.

On a yearly basis, industrial production in Spain climbed at adjusted 3.5% in January, after a 4.1% increase in December. December's figure was revised up from a 3.7% gain.

Output of capital goods jumped at seasonally adjusted 9.3% year-on-year in January, output of intermediate goods climbed 5.2%, energy production was down 7.5%, while consumer goods output rose 5.7%.

-

12:14

France’s current account deficit rises to €1.4 billion in January

The Bank of France released its current account data on Tuesday. France's current account deficit was €1.4 billion in January, up from a deficit of €0.4 billion in December. December's figure was revised up from a deficit of €0.7 billion.

The trade goods deficit widened to €2.1 billion in January from €0.8 billion in December, while the surplus on services rose to €0.2 billion from €0.1 billion.

-

12:07

France's trade deficit widens to €3.71 billion in January

According to the French Customs, France's trade deficit widened to €3.71 billion in January from €3.68 billion in December, beating expectations for a decline to a deficit of €4.1 billion. December's figure was revised up from a deficit of €3.94 billion.

The increase in deficit was driven by higher imports. Exports increased 0.5% in January, while imports were up 0.6%.

-

12:02

German industrial production jumps 3.3% in January

Destatis released its industrial production data for Germany on Tuesday. German industrial production jumped 3.3% in January, exceeding expectations for a 0.5% gain, after a 0.3% decline in December. December's figure was revised up from a 1.2% drop.

The output of capital goods increased 5.3% in January, energy output gained 0.1%, and the production in the construction sector was up 7.0%, while the production of intermediate goods climbed 0.4%.

The output of consumer goods rose 3.7% in January.

German industrial production excluding energy and construction climbed by 3.2% in January.

-

11:57

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 0.1% on a like-for-like basis in February

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 0.1% on a like-for-like basis in February, after a 2.6% rise in January.

On a total basis, retail sales climbed 1.1% year-on-year in February.

"February's slowdown was noticeable across all product categories bar Stationery and Health & Beauty," BRC Chief Executive, Helen Dickinson, said.

"This slow growth reflects the increasing pressure the industry is under," she added.

-

11:53

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in February

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in February.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.7% in February from 3.8% in January. Analysts had expected the unemployment rate to remain unchanged at 3.8%.

The number of unemployed people in Switzerland fell by 2,227 to 161,417 in February from a month ago.

The youth unemployment rate was down to 3.6% in February from 3.8% in January.

-

11:48

Switzerland’s consumer price inflation rises 0.2% in February

The Swiss Federal Statistics Office released its consumer inflation data on Tuesday. Switzerland's consumer price index rose 0.2% in February, beating expectations for a 0.1% decline, after a 0.4% decrease in January.

The increase was mainly driven by higher prices for clothing, rents and airfares.

On a yearly basis, Switzerland's consumer price index increased to -0.8% in February from -1.3% in January, beating forecasts of a 1.1% decrease.

-

11:40

Eurozone's revised GDP climbs 0.3% in fourth quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in fourth quarter, in line with the preliminary reading, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in fourth quarter, up from the preliminary reading of 1.5%, after a 1.6% rise in the third quarter.

Household spending gained 0.2% in the fourth quarter, while gross fixed capital formation climbed 1.3%.

Exports climbed by 0.2% in the fourth quarter, while imports rose by 0.9%.

In 2015 as whole, GDP increased 1.6%, up from the preliminary reading of 1.5%, after a 0.9% growth in 2014.

-

11:15

Fed Governor Lael Brainard: the Fed should be patient in hiking its interest rate further

Fed Governor Lael Brainard said on Monday that the Fed should be patient in hiking its interest rate further.

"Tighter financial conditions and softer inflation expectations may pose risks to the downside for inflation and domestic activity. From a risk-management perspective, this argues for patience as the outlook becomes clearer," she said.

Brainard also said that developments abroad could have a negative impact on the U.S. economy.

-

11:05

Japan’s current account surplus declines to ¥520.8 billion in January

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥520.8 billion in January from ¥960.7 billion in December, missing expectations for a surplus of ¥719.0 billion.

The goods trade surplus turned into a deficit of ¥411.0 billion in January, down from a surplus of ¥188.7 billion in December.

Exports dropped at an annual rate of 15.4% in January, while imports plunged 19.8%.

The service balance deficit was ¥226.7 billion in January.

-

11:00

Eurozone: GDP (QoQ), Quarter IV 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter IV 1.6% (forecast 1.5%)

-

10:55

China's trade surplus drops to $32.59 billion in February

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus dropped to $32.59 billion in February from $63.30 billion in January, beating expectations for a decline to a surplus of $50.15 billion.

Exports fell at an annual rate of 25.4% in February, the biggest drop since May 2009, while imports slid at an annual rate of 13.8%, the fifteenth consecutive decline.

Chinese New Year is likely to have some impact on the data. Nevertheless, the trade data indicates that there is the slowdown in the Chinese economy.

-

10:50

Reserve Bank of Australia Deputy Governor Philip Lowe: the central bank could ease its monetary policy further to support demand growth

Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe said on Tuesday that the central bank could ease its monetary policy further to support demand growth.

"As the Reserve Bank has indicated for some time, this low inflation outlook provides scope for easier monetary policy should that be appropriate in supporting demand growth in the economy. An important factor here will be whether the growth in aggregate demand continues to be sufficient to accommodate the growth in our labour force," he said.

Lowe noted that he would prefer a weaker currency which should help to rebalance the economy.

-

10:33

Fed Vice Chairman Stanley Fischer: inflation will rise toward 2% target once oil prices and the value of the U.S. dollar stabilise

Fed Vice Chairman Stanley Fischer said in a speech on Monday that inflation will rise toward 2% target once oil prices and the value of the U.S. dollar stabilise.

Fischer pointed out that there was still a link between unemployment and inflation.

"It is sometimes argued that the link between unemployment and inflation must have been broken. I don't believe that. Rather the link has never been very strong, but it exists, and we may well at present be seeing the first stirrings of an increase in the inflation rate--something that we would like to happen," he noted.

-

10:22

Japan’s final GDP falls 0.3% in the fourth quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP decreased by 0.3% in the fourth quarter, up from the preliminary reading of a 0.4% decline, after a 0.3% rise in the third quarter.

Capital expenditure rose 1.5% in the fourth quarter, up from a preliminary reading of a 1.4% gain, while household spending decrease 0.9%, down from a preliminary reading of a 0.8% fall.

On a yearly basis, Japan's economy contracted by 1.1% in the fourth quarter, from the preliminary reading of a 1.5% drop, after a 1.3% growth in the third quarter.

-

10:10

Fitch Ratings downgrades its global growth forecasts

Rating agency Fitch Ratings downgraded its global growth forecasts on Monday. The agency expects the global economy to expand 2.5% in 2016, down from its December estimate of 2.9%. Advanced economies are expected to grow 1.7% this year, down from its December estimate of 2.1%, while emerging economies are expected to expand 4.0%, down from its December estimate of 4.4%.

Fitch expects the Chinese economy to grow 6.2% in 2016, down from its December estimate of 6.3%.

The agency noted that the downward revision was driven by the slowdown in the Chinese economy and lower spending in commodities-dependent countries.

Fitch pointed out that there was no recession.

"The breadth of the revisions is notable but still leaves the growth outlook a long way above global recession territory," the agency said.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY: 111.00 (USF 605m) 112.00 (253m) 113.00 (1.51bln) 113.85-90 (370m) 114.00 (555m) 115.00 (645m)

EUR/USD: 1.0800 (EUR 1.27bln) 1.0900 (831m) 1.0930-35 (260m) 1.1000 (338m) 1.1010-15 (400m) 1.1050 (314m) 1.1100 (438m)

GBP/USD: 1.4090 (GBP 318m)

AUD/USD: 0.7300 (AUD 653m)

USD/CAD 1.3235 (USD 1.19bln) 1.3295 (360m) 1.3390 (275m)

-

09:15

Switzerland: Consumer Price Index (MoM) , February 0.2% (forecast -0.1%)

-

09:15

Switzerland: Consumer Price Index (YoY), February -0.8% (forecast -1.1%)

-

08:45

France: Trade Balance, bln, January -3.70 (forecast -4.1)

-

08:33

Options levels on tuesday, March 8, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1179 (1549)

$1.1140 (3095)

$1.1090 (111)

Price at time of writing this review: $1.1027

Support levels (open interest**, contracts):

$1.0960 (1017)

$1.0922 (1627)

$1.0872 (2078)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 35809 contracts, with the maximum number of contracts with strike price $1,0900 (3095);

- Overall open interest on the PUT options with the expiration date April, 8 is 48587 contracts, with the maximum number of contracts with strike price $1,0500 (4566);

- The ratio of PUT/CALL was 1.36 versus 1.31 from the previous trading day according to data from March, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.4508 (1085)

$1.4411 (2188)

$1.4316 (816)

Price at time of writing this review: $1.4250

Support levels (open interest**, contracts):

$1.4186 (455)

$1.4090 (327)

$1.3993 (1093)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 17374 contracts, with the maximum number of contracts with strike price $1,4700 (2262);

- Overall open interest on the PUT options with the expiration date April, 8 is 16607 contracts, with the maximum number of contracts with strike price $1,3850 (2990);

- The ratio of PUT/CALL was 0.96 versus 0.93 from the previous trading day according to data from March, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Asian session: Yen rose

Yen rose as Japan's fourth-quarter economic growth was revised up by 0.3 percentage points on Tuesday to a still gloomy annualised pace of -1.1 per cent, as the economy continues to stutter. The weakness of the data raises the pressure on the BoJ to consider further easing as spring wage negotiations reach a climax at the time of its policy meeting next week.

The Australian dollar fell as China's export slump deepened in February, highlighting the challenge for policy makers seeking to keep the economy humming at home while trade acts as a brake on growth. Overseas shipments tumbled 25.4 percent in U.S. dollar terms from a year earlier, the biggest decline since May 2009. Imports extended a streak of declines to 16 months, slumping 13.8 percent, leaving a trade surplus of $32.6 billion. The week-long Chinese new year holidays fell in February this year, closing factories and curbing shipments.

EUR/USD: during the Asian session the pair traded in the range of $1.1010-25

GBP/USD: during the Asian session the pair traded in the range of $1.4240-75

USD/JPY: during the Asian session the pair fell to a Y112.75

-

08:01

Switzerland: Unemployment Rate (non s.a.), February 3.7% (forecast 3.8%)

-

08:00

Germany: Industrial Production s.a. (MoM), January 3.3% (forecast 0.5%)

-

06:01

Japan: Consumer Confidence, February 40.1 (forecast 42.3)

-

03:46

China: Trade Balance, bln, February 32.59 (forecast 50.15)

-

01:30

Australia: National Australia Bank's Business Confidence, February 3

-

00:51

Japan: Current Account, bln, January 521 (forecast 719)

-

00:50

Japan: GDP, y/y, Quarter IV -1.1% (forecast -1.5%)

-

00:50

Japan: GDP, q/q, Quarter IV -0.3% (forecast -0.4%)

-

00:30

Currencies. Daily history for Mar 7’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1013 +0,11%

GBP/USD $1,4263 +0,29%

USD/CHF Chf0,9952 +0,19%

USD/JPY Y113,45 -0,44%

EUR/JPY Y124,95 -0,32%

GBP/JPY Y162,82 +0,48%

AUD/USD $0,7466 +0,48%

NZD/USD $0,6800 -0,09%

USD/CAD C$1,3280 -0,31%

-