Noticias del mercado

-

21:00

New Zealand: RBNZ Interest Rate Decision, 2.25% (forecast 2.5%)

-

20:19

American focus: the US dollar declined significantly against most major currencies

The euro has appreciated considerably against the US dollar, updating the maximum of the session, which was caused by the correction position before tomorrow's meeting of the ECB, as well as the publication of weak US data. According to a survey conducted by Bloomberg, almost all economists (98%) expect that the ECB will take additional measures to support the economy and inflation stabilization. All of these 98% of respondents expect a rate cut on deposits, and nearly three-quarters - increase QE. On average, it is assumed that the ECB deposit rate will be reduced by 10 basis points to -0.40%. The average forecast is for an increase in the volume of bonds repurchase up to € 75 billion per month from the current 60 billion euros.

With regard to statistics, the US Commerce Department reported that wholesale inventories unexpectedly rose in January, as sales fell. This change suggests that companies efforts to reduce inventories may continue in 2016, which in turn will restrain economic growth. According to the report, seasonally adjusted inventories in the warehouses of wholesale trade increased in January by 0.3%, reaching $ 584.2 billion. Experts expect that stocks will fall by 0.2% after the zero change in December (revised from -0.1 %). Compared with January 2015, stocks increased by 2.0%. Component wholesale inventories, which goes into the calculation of GDP - wholesale inventories excluding cars - rose 0.1% in January. In addition, the report showed that wholesale sales of $ 433.1 billion., A decrease of 1.3% compared with December. In annual terms, sales decreased by 3.1%. Also, the Ministry of Commerce said that the ratio of stocks to sales ratio was 1.35 months in January (up to April 2009) vs. 1.33 months in December.

The pound rose against the dollar mildly, returning to a maximum session. Experts point out that investors remain cautious on the eve of the world's Central Bank meeting, which will take place later this month. A slight influence also provided data for the UK. The Office for National Statistics said that industrial production rose by 0.3 percent on a monthly basis, offsetting the decline in December to 1.1 per cent. It was the first increase in three months, and the fastest in five months. However, growth was slightly slower than the expected increase of 0.5 percent. At the same time, manufacturing output grew by 0.7 per cent, faster than expected growth of 0.2 percent. On an annual basis, total production rose by 0.2 percent, while manufacturing output fell by 0.1 per cent. Economists had forecast that total production will grow by 0.2 percent, while manufacturing output will fall by 0.7 percent.

The Canadian dollar rose almost 200 pips against the US dollar, reaching a maximum of 12 November 2015. Support currency was the outcome of the meeting of the Central Bank of Canada, as well as a marked increase in oil prices. As it became known, the Bank of Canada left its key interest rate unchanged at 0.5%, confirming the expectations of experts. "Recent reports indicate that the US economic recovery is continuing at the same time the low level of oil prices will continue to undermine the economy of Canada and other exporting countries.", - Stated in the report of the Central Bank. However, the Central Bank said that the recent recovery in oil prices and other raw materials has allowed the Canadian dollar to recover from multi-year lows. The Bank of Canada noted that the overall risks to inflation are balanced. Meanwhile, the probability of the uncertainty of growth in the financial sector is growing, partly due to the situation in the regions associated with the structural changes in the Canadian economy. According to forecasts of the Bank's growth in the global economy will continue to recover this year, despite the lingering downside risks.

With regard to the dynamics of oil quotations, today jumped more than 3%, helped by data on stocks of petroleum products in the United States, which convinced the market that the demand for gasoline is gradually improving. Oil also got support from speculation that the top oil producers may agree to freeze production in the near future.

US Department of Energy reported that in the week of February 27 - March 4 oil inventories rose 3.88 million barrels to 521.9 million barrels. Analysts had expected an increase of 3.5 mln. Barrels. Meanwhile, gasoline stocks fell by 4.5 million barrels to 250.5 million barrels. Analysts had expected stocks to fall 1.5 million barrels.

-

17:32

The Japanese government could delay a second planned sales tax hike

The Japanese government could delay a second planned sales tax hike in April. Prime Minister Shinzo Abe's economic adviser Etsuro Honda said to Reuters on Wednesday that a delay was favourable due to the weakness in the Japanese economy.

-

16:40

NIESR’s gross domestic product rises by 0.3% in three months to February

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.3% in three months to February, after a 0.4% growth in three months to January.

A softer growth was partly driven by a slight decline in the production and private services sector.

According to the NIESR, the U.K. economy is expected to expand 2.3% in 2016 and 2.7% in 2017.

"It looks as if output growth at the start of 2016 has been subdued. However, it appears that December 2015 may have been a low point for GDP and as this drops out of the calculation of quarterly growth rates, output growth for the first quarter may strengthen slightly," Jack Meaning, NIESR Research Fellow, said.

-

16:32

Wholesale inventories in the U.S. rise 0.3% in January

The U.S. Commerce Department released wholesale inventories on Wednesday. Wholesale inventories in the U.S. rose 0.3% in January, beating expectations for a 0.2 decline, after a flat reading in December. December's figure was revised up from a 0.1% decline.

The rise was driven by an increase in inventories of non-durable goods. Inventories of non-durable goods increased 1.1% in January, while inventories of durable goods fell 0.3%.

Wholesale sales slid 1.3% in January, after a 0.6% fall in December.

-

16:30

U.S.: Crude Oil Inventories, March 3.88 (forecast 3.5)

-

16:13

Bank of Canada keeps its interest rate unchanged at 0.50% in March

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy was appropriate. This decision was expected by analysts.

The BoC said that financial market volatility seemed to dissipate, while the downside risks remained.

The BoC noted that the Canadian economic growth was better than expected in the fourth quarter. Employment improved, the central bank added.

According to the central bank, inflation was evolving broadly as anticipated.

Risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

16:00

U.S.: Wholesale Inventories, January 0.3% (forecast -0.2%)

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:01

Italian economy is expected to expand 0.1% in the first quarter

The Italian statistical office Istat released its gross domestic product (GDP) forecast data for Italy on Wednesday. The Istat expects the Italian economy to expand moderately in the first quarter. The Italian GDP is expected to rise 0.1% in the first quarter, after a 0.1% growth in the fourth quarter of 2015.

The Istat said that domestic demand was expected to be the main driver of the economic growth, exports were expected to fall, while investment will remain stable.

In 2016 as a whole, the Italian economy is expected to grow 0.4%, after a 0.8% rise in 2015.

-

14:50

Option expiries for today's 10:00 ET NY cut

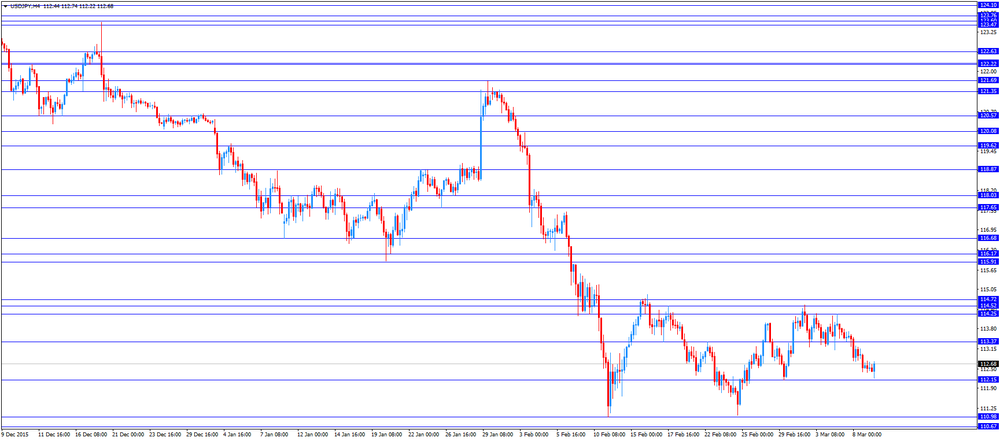

USD/JPY: 111.05 (USD 584m) 113.00 (320m)

EUR/USD: 1.0750 (EUR 657m) 1.0800 (330m) 1.0900 (357m) 1.0945 (200m) 1.0965 (784m) 1.0985 (417m) 1.1000 (1.3bln) 1.1025 (282m) 1.1075-85 (502m) 1.1100 (1.06bln)

GBP/USD: 1.4200 (GBP 469m)

USD/CAD 1.4000 (236m)

EUR/JPY 123.00 (EUR 123m) 126.50 (463m)

AUD/JPY 82.00 (AUD 233m) 83.67 (263m) 85.00 (253m)

AUD/NZD 1.0900 (AUD 673m) 1.0950 (200m) 1.1000 (180m)

-

14:30

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the better-than-expected industrial production data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans January 2.7% Revised From 2.6% -2.3% -3.9%

06:00 Japan Prelim Machine Tool Orders, y/y February -17.2% -22.6%

09:30 United Kingdom Industrial Production (MoM) January -1.1% 0.5% 0.3%

09:30 United Kingdom Industrial Production (YoY) January -0.2% Revised From -0.4% 0.2% 0.2%

09:30 United Kingdom Manufacturing Production (MoM) January -0.3% Revised From -0.2% 0.2% 0.7%

09:30 United Kingdom Manufacturing Production (YoY) January -1.7% -0.7% -0.1%

12:00 U.S. MBA Mortgage Applications March -4.8% 0.2%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. wholesale sales data. Wholesale inventories in the U.S. are expected to decline 0.2% in January, after a 0.1% decrease in December.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Expectations for further stimulus measures by the European Central Bank (ECB) weighed on the currency pair. Market participants expect the central bank to cut its deposit further or/ and to expand its monthly asset purchases. The ECB's is -0.3%, and monthly asset purchases total €60 billion.

The British pound traded higher against the U.S. dollar after the release of the better-than-expected industrial production data from the U.K. The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in January, missing forecasts of a 0.5% increase, after a 1.1% decline in December.

The increase was mainly driven by a gain in water supply, sewerage & waste management, which soared 9.3% in January.

On a yearly basis, industrial production in the U.K. increased 0.2% in January, in line with expectations, after a 0.2% decrease in December. December's figure was revised up from a 0.4% fall.

Manufacturing production in the U.K. climbed 0.7% in January, exceeding expectations for a 0.2% gain, after a 0.3% decrease in December. December's figure was revised down from a 0.2% drop.

Manufacturing output was mainly driven by a rise in other manufacturing and repair, which climbed by 4.8% in January.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in January, beating forecast of a 0.7% fall, after a 1.7% drop in December.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of the Bank of Canada's interest rate decision. The central bank is expected to keep its interest rate unchanged.

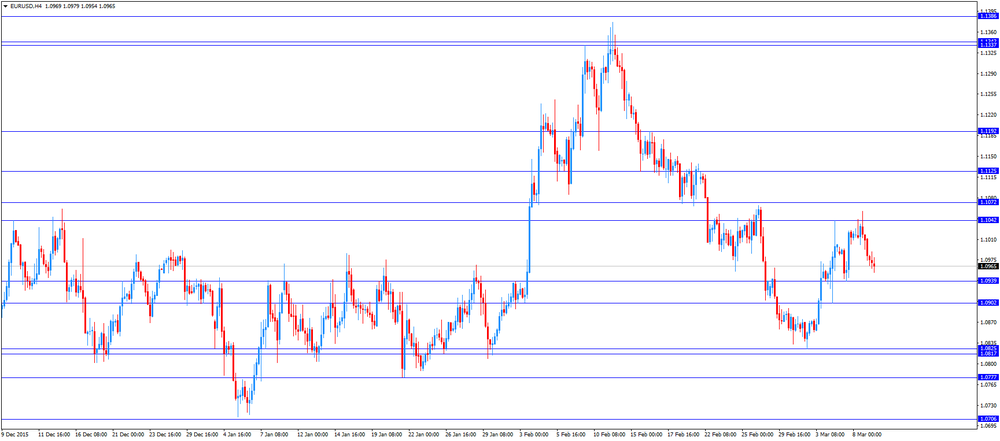

EUR/USD: the currency pair fell to $1.0954

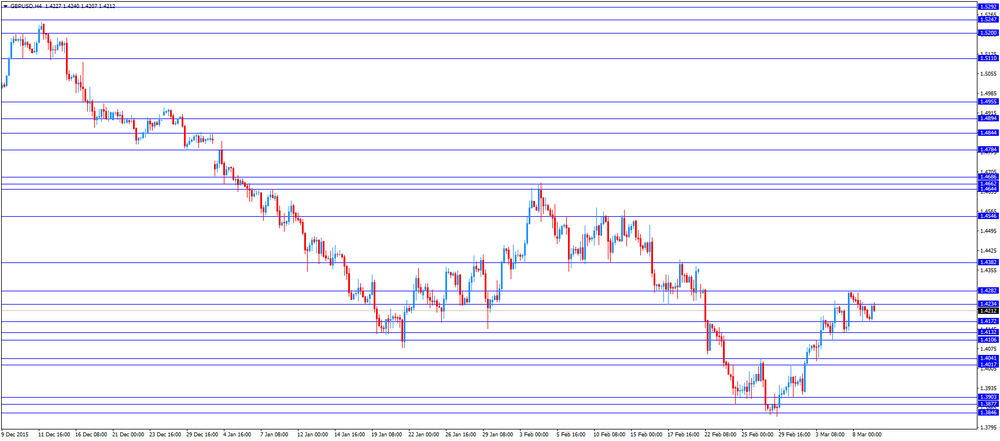

GBP/USD: the currency pair increased to $1.4240

USD/JPY: the currency pair rose to Y112.74

The most important news that are expected (GMT0):

15:00 United Kingdom NIESR GDP Estimate February 0.4%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:00 U.S. Wholesale Inventories January -0.1% -0.2%

15:30 U.S. Crude Oil Inventories March 10.374 3.5

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

-

13:49

Orders

EUR/USD

Offers: 1.0985 1.1000 1.1020 1.1050 1.1080 1.1100 1.1130 1.1150

Bids: 1.0955-60 1.0940 1.0920 1.0900 1.08875-80 1.0850

GBP/USD

Offers: 1.4200 1.4220 1.4235 1.4250 1.4270 1.4285 1.4300 1.4335 1.4350

Bids: 1.4170-75 1.4150 1.4120 1.4100 1.4070 1.4045-50 1.4030 1.4000

EUR/JPY

Offers: 123.60 123.80 124.00 124.50 124.85 125.00 125.30 125.50

Bids: 123.20 123.00 122.50 122.30 122.00 121.50

EUR/GBP

Offers: 0.7750-55 0.7780-85 0.7800 0.7820-25 0.7850 0.7880 0.7900

Bids: 0.7720 0.7700 0.7675 0.7650 0.7630 0.7600

USD/JPY

Offers: 112.75-80 113.00 113.20-25 113.50 113.80-85 114.00 114.25-30 114.50

Bids: 112.40 112.20 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers: 0.7475-80 0.7500 0.7530 0.7550

Bids: 0.7435 0.7420 0.7400 0.7385 0.7350 0.7330 0.7300

-

13:00

U.S.: MBA Mortgage Applications, March 0.2%

-

11:39

Home loans in Australia drop 3.9% in January

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia dropped 3.9% in January, missing expectations for a 2.3% decline, after 2.7% increase in December. December's figure was revised up from a 2.6% rise.

The value of owner occupied loans plunged at a seasonally adjusted 4.3% in January, investment lending decreased 1.6%, while the number of loans for the construction of dwellings slid 2.8%.

-

11:33

House prices in Spain decline 0.1% in the fourth quarter

The Spanish statistical office INE released its house prices data on Wednesday. House prices in Spain declined 0.1% in the fourth quarter, after a 0.7% increase in the third quarter.

Prices for new houses climbed 1.3% in the fourth quarter, while prices for second-hand houses fell 0.3%.

On a yearly basis, house prices rose 4.2% in the fourth quarter, after a 4.5% gain in the third quarter.

Prices for new houses soared 5.8% year-on-year in the fourth quarter, while prices for second-hand houses increased 4.0%.

-

11:19

Bank of France cuts its growth forecast for the first quarter

The Bank of France cuts its growth forecast for the first quarter on Wednesday. The central bank expects the French economy to expand 0.3% in the first quarter, down from the previous estimate of a 0.4% growth.

The manufacturing business confidence index fell to 98 in February from 101 in January.

The services business sentiment index remained unchanged at 96 in February.

The construction business sentiment index remained unchanged at 96 in February.

-

11:09

U.K. industrial production rises 0.3% in January

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 0.3% in January, missing forecasts of a 0.5% increase, after a 1.1% decline in December.

The increase was mainly driven by a gain in water supply, sewerage & waste management, which soared 9.3% in January.

On a yearly basis, industrial production in the U.K. increased 0.2% in January, in line with expectations, after a 0.2% decrease in December. December's figure was revised up from a 0.4% fall.

Manufacturing production in the U.K. climbed 0.7% in January, exceeding expectations for a 0.2% gain, after a 0.3% decrease in December. December's figure was revised down from a 0.2% drop.

Manufacturing output was mainly driven by a rise in other manufacturing and repair, which climbed by 4.8% in January.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in January, beating forecast of a 0.7% fall, after a 1.7% drop in December.

-

10:40

Bank of England's Monetary Policy Committee member Martin Weale: the central bank will likely hike its interest rate than lower it over the next two years

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Martin Weale said in a speech on Tuesday that the central bank will likely hike its interest rate than lower it over the next two years.

"It is appreciably more likely that monetary tightening rather than monetary easing will be needed in the United Kingdom over the next two years," he said.

Weale pointed out that the BoE could buy more assets if there is need for more monetary policy easing.

"Should the need for further easing arise because of a sharp weakening in the outlook for inflation, the scope for further asset purchases is substantial, while the obstacles we saw to reducing Bank Rate below 0.5 per cent are no longer material," MPC member said.

He also said that negative interest rates could lead to a currency war (competitive exchange rate devaluations).

-

10:30

United Kingdom: Industrial Production (MoM), January 0.3% (forecast 0.5%)

-

10:30

United Kingdom: Industrial Production (YoY), January 0.2% (forecast 0.2%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , January 0.7% (forecast 0.2%)

-

10:30

United Kingdom: Manufacturing Production (YoY), January -0.1% (forecast -0.7%)

-

10:22

Deputy managing director of the International Monetary Fund David Lipton: the downside risks to the global economic growth increased since January

The first deputy managing director of the International Monetary Fund (IMF), David Lipton, said on Tuesday that the downside risks to the global economic growth increased since January. But he added that the global economic recovery continued.

Lipton pointed out that a combination of monetary and fiscal policy and structural reforms, and collective action was needed to boost the global economy.

-

10:12

Westpac’ consumer confidence index for Australia falls 2.2% in March

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 2.2% in March, after a 4.2% rise in February.

The index was driven by declines in three of the five sub-indexes.

"The Reserve Bank Board next meets on April 5. As we have been successfully arguing since June last year that we expect the Bank will keep rates on hold through 2016," Westpac Chief Economist Bill Evans said.

"Recent dollar strength has been associated with a more positive outlook for China and commodity prices and as such would not be grounds for a policy adjustment. Equally, while most indicators, including our own, one of which is quoted in this survey, point to an overall improvement in the labour market over the last six months, actual jobs growth appears to be running ahead of those indicators," he added.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY: 111.05 (USD 584m) 113.00 (320m)

EUR/USD: 1.0750 (EUR 657m) 1.0800 (330m) 1.0900 (357m) 1.0945 (200m) 1.0965 (784m) 1.0985 (417m) 1.1000 (1.3bln) 1.1025 (282m) 1.1075-85 (502m) 1.1100 (1.06bln)

GBP/USD: 1.4200 (GBP 469m)

USD/CAD 1.4000 (236m)

EUR/JPY 123.00 (EUR 123m) 126.50 (463m)

AUD/JPY 82.00 (AUD 233m) 83.67 (263m) 85.00 (253m)

AUD/NZD 1.0900 (AUD 673m) 1.0950 (200m) 1.1000 (180m)

-

08:27

Options levels on wednesday, March 9, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1167 (1546)

$1.1126 (3079)

$1.1059 (118)

Price at time of writing this review: $1.0976

Support levels (open interest**, contracts):

$1.0919 (1645)

$1.0870 (2540)

$1.0810 (5124)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 36270 contracts, with the maximum number of contracts with strike price $1,0900 (3079);

- Overall open interest on the PUT options with the expiration date April, 8 is 49849 contracts, with the maximum number of contracts with strike price $1,0900 (5124);

- The ratio of PUT/CALL was 1.37 versus 1.36 from the previous trading day according to data from March, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4409 (2240)

$1.4313 (813)

$1.4218 (313)

Price at time of writing this review: $1.4190

Support levels (open interest**, contracts):

$1.4088 (332)

$1.3992 (1213)

$1.3894 (656)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 18495 contracts, with the maximum number of contracts with strike price $1,4700 (2305);

- Overall open interest on the PUT options with the expiration date April, 8 is 17211 contracts, with the maximum number of contracts with strike price $1,3850 (3095);

- The ratio of PUT/CALL was 0.93 versus 0.96 from the previous trading day according to data from March, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Asian session: The euro weakened

The euro weakened against the other major currencies in the Asian session on Wednesday. Financial markets expect the European Central Bank to cut its deposit rate by at least 10 basis points and expand its asset-buying programme this week, but they still do not expect it to hit its inflation target in the near future. Markets are pricing in a deposit rate cut to -0.4 percent and 10 billion to 30 billion euros of extra bond buying every month. Long-term inflation expectations suggest, however, that those measures may not be effective - consumer price growth is not forecast to hit the ECB's target of just under 2 percent .

The Aussie dollar fell as the Westpac Melbourne Institute Index of Consumer Sentiment fell by 2.2% in March from 101.3 in February to 99.1 in March. The Index is back to around its average reading over the last six months. Following the change of leadership of the Federal Government in September the Index lifted by 8.3% over the subsequent two months. It has broadly held those gains with today's reading off that high in November by 2.5% although we are now slightly back in the region where pessimists outnumber optimists.

EUR/USD: during the Asian session the pair fell to $1.0965

GBP/USD: during the Asian session the pair fell to $1.4175

USD/JPY: during the Asian session the pair traded in the range Y112.40-70

-

07:00

Japan: Prelim Machine Tool Orders, y/y , February -22.6%

-

01:30

Australia: Home Loans , January -3.9% (forecast -2.3%)

-

01:01

Currencies. Daily history for Mar 8’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1010 -0,03%

GBP/USD $1,4215 -0,34%

USD/CHF Chf0,9956 +0,04%

USD/JPY Y112,61 -0,75%

EUR/JPY Y124,00 -0,77%

GBP/JPY Y160,07 -1,72%

AUD/USD $0,7437 -0,39%

NZD/USD $0,6744 -0,83%

USD/CAD C$1,3407 +0,95%

-

00:30

Australia: Westpac Consumer Confidence, March -2.2%

-