Noticias del mercado

-

20:21

American focus: the US dollar declined significantly against most major currencies

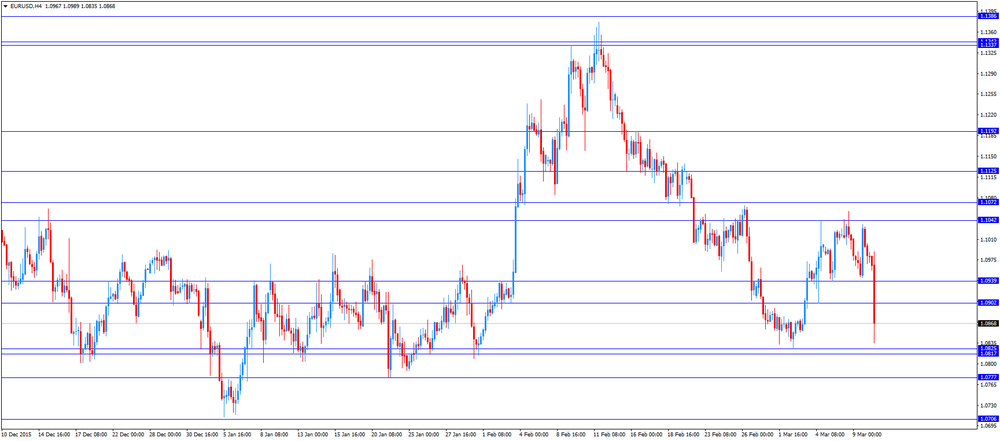

The euro has fallen more than 150 pips against the US dollar, reacted to the news about lowering the ECB's three main interest rates and increasing the size of the bond purchase program by a third. However, the currency quickly recovered all the lost ground and reached a peak on February 15 against the backdrop of comments by ECB President Draghi and closing of short positions. Initially, the ECB reported: (1) March 16, 2016 the interest rate on the main refinancing operations will be reduced by 5 basis points to 0.00%; (2) The interest rate on the marginal lending since March 16, 2016 will be reduced by 5 basis points, to 0.25%; (3) The interest rate on deposits with the March 16, 2016 will be reduced by 10 basis points, to -0.40%; (4) since April, monthly purchases under the asset purchase program will be expanded to 80 billion euros per month with 60 billion euros a month..; (5) to the list of purchased assets include corporate bonds of investment grade non-banking corporations; (6) since June, it will launch a new series of four targeted long-term refinancing operations, each with a term of four years. Credit conditions for these operations can be as low as interest rates on deposits. All of these articulated action provoked a sharp weakening of the euro, but Draghi comments during a press conference provided significant support for the euro. CB Chairman noted that he sees no need for further reduction of the interest rate. This statement is somewhat contrary to its earlier comments that rates will remain at current or lower level for a long time. Draghi also said the ECB rejected the idea to introduce a multi-tiered deposit rate, as this could be considered a signal of further lowering of interest rates. In general, market participants interpreted the statement as a hint that the ECB has a limited number of tools to control monetary policy. Meanwhile, ABN Amro analysts explained that the President of the ECB meant that the policy of the Central Bank is not aimed at weakening the euro. Also today, the ECB lowered its growth forecast for the euro zone GDP for 2016 minutes and 2017. Evaluation of the growth of the currency bloc's economy in 2016 deteriorated from 1.7% to 1.4%, in 2017 - to 1.7% from 1.9%. Forecast GDP growth for 2018 is 1.8%. In addition, the regulator has lowered the forecast for inflation in the euro area for 2016 to 0.1% from 1%, to 2017 - to 1.3% from 1.6%. In 2018 it is expected to rise in consumer prices by 1.6% in annual terms.

The Canadian dollar depreciated significantly against the dollar, having lost to the beginning of the session more than 150 points, and almost completely offset by yesterday's growth. The pressure on the currency has had a decrease in quotations of oil after the Reuters news agency reported that a meeting of oil producers in Moscow on March 20 to discuss the freezing of production agreements can not take place because of the unwillingness of Iran to join the initiative. According to representatives of some exporters, they fear another oil prices weakening, if gathered too early and can not come to an agreement. On the representative of OPEC said last week that the oil-producing countries of the Persian Gulf would prefer to meet in the first half of April. In February, Russia, Saudi Arabia, Venezuela and Qatar have agreed to freeze production of oil at the January level, subject to adherence to the agreement of the other major exporters. Analysts warn that the world market oil supply still exceeds demand due to the boom of shale oil in the United States and after the decision OPEC to cut production. Most experts expect the oversupply of oil will remain until 2017 or 2018. Only after 2020, oil prices may start to rise and reach $ 70 a barrel, analysts say. -

20:00

U.S.: Federal budget , February -193 (forecast -200)

-

17:15

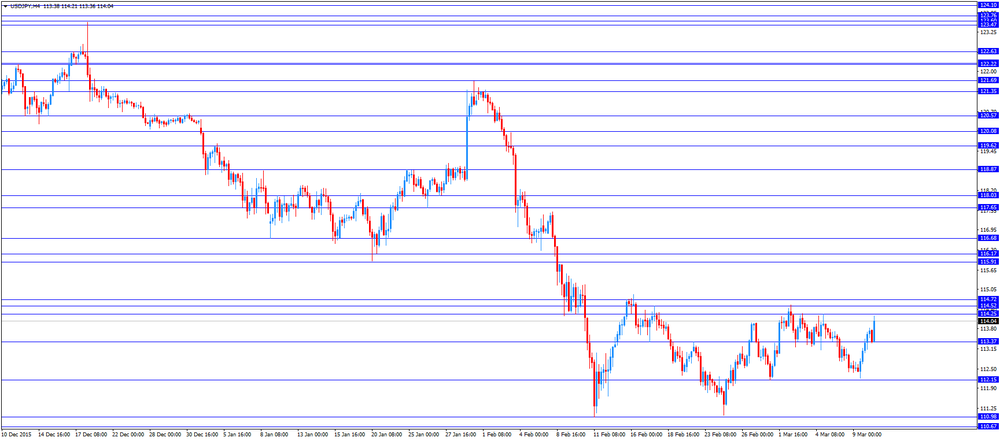

Producer prices in Japan fall 0.2% in February

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Wednesday evening. Producer prices in Japan declined 0.2% in February, after a 1.0% fall in January. January's figure was revised down from a 0.9% decrease.

Export prices fell 0.2% in February, while import prices declined 2.9%.

On a yearly basis, producer prices slid 3.4% in February, after a 3.2% drop in January. January's figure was revised down from a 3.1% fall.

Export prices dropped 5.2% year-on-year in February, while import prices plunged 15.1%.

-

16:59

Germany’s labour costs per hour worked rise 0.5% in the fourth quarter

The German statistical office Destatis released its labour costs data for the fourth quarter on Thursday. Labour costs per hour worked rose 0.5% in the fourth quarter on a seasonally and calendar adjusted basis, after a 0.1% increase in the third quarter.

On a yearly basis, labour costs per hour worked increased 2.1% in the fourth quarter on a calendar adjusted basis, after a 2.4% gain in the third quarter.

The costs of gross earnings climbed a calendar adjusted 1.6% year-on-year in the fourth quarter, while non-wage costs were up 3.7%.

In 2015 as whole, labour costs per hour worked climbed 2.6%, after a 1.9% growth in 2014.

-

16:27

Greek unemployment rate declines to 24.0% in December

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.0% in December from 24.4% in November. November's figure was revised down from 24.6%.

The number of unemployed fell by 19,365 persons compared with November 2015.

In 2015 as whole, the unemployment rate was 24.0%, down from 25.9% in 2014.

-

16:18

European Central Bank President Mario Draghi: new stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone

The European Central Bank (ECB) President Mario Draghi said in a press conference on Thursday:

- New stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone;

- Interest rate would remain at low levels for an extended period of time, and as well past the horizon of net asset purchases;

- Negative inflation was unavoidable over the next few months, driven by low oil prices;

- The Eurozone's economy expanded weaker than expected at the beginning of this year;

- The economy is expected to continue to grow moderately;

- Low oil prices should lift up domestic demand;

- The slowdown in the global economy and geopolitical risks are the downside risks to the outlook;

- Effective structural and fiscal policies should be implemented by government to support the monetary policy.

- New stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone;

-

15:47

European Central Bank downgrades its inflation and growth forecasts

The European Central Bank (ECB) lowered its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.1% in 2016, down from its December estimate of 1.0%, 1.3% in 2017, down from its December estimate of 1.6%, and 1.6% in 2018.

The central bank expects the economy in the Eurozone to expand 1.4% in 2016, down from its December estimate of 1.7%, 1.7% in 2017, down from its December forecast of 1.9%, and 1.8% in 2018.

-

15:00

Canada’s new housing price index climbs 0.1% in January

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in January, missing expectations of a 0.2% gain, after a 0.1% rise in December.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.2% in January, while prices in Vancouver climbed 0.4%.

-

14:50

Canadian capacity utilisation rate is down to 81.1% in the fourth quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate declined to 81.1% in the fourth quarter from 81.6% in the third quarter. The third quarter's figure was revised down from 82.0%.

The decrease was mainly driven by declines in the mining, quarrying, and oil and gas extraction industries, and construction. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry fell to 76.2% in the fourth quarter from 76.8% in the third quarter, while the capacity utilisation rate in construction declined to 83.7% from 84.7%.

In 2015 as whole, capacity utilisation rate was 81.3%, down from 82.3% in 2014.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.00 (USD 112.00 (310m) 112.15-20 (500m) 113.00 (760m) 113.45-60 (770m) 114.00 (1.9bln) 114.70 (555m) 115.00 (1.25bln) 116.00 (1.24bln)

EUR/USD: 1.0700 (EUR 860m) 1.0745-50 (434m) 1.0770-75 (755m) 1.0800 (829m) 1.0845-50 (1.01bln) 1.0865-80 (1.4bln) 1.0885-90 (550m) 1.0900-10 (3.25ln) 1.0915 (302m) 1.0950 (982m) 1.0957 (401m) 1.0970 (526m) 1.0985-90 (557m) 1.1000-10 (957m) 1.1040 (703m) 1.1085 (1.15bln) 1.1100 (783m) 1.1150 (527m)

EUR/GBP 0.7650 (EUR 401m) 0.7800 (941m)

USD/CAD 1.3250 (USD 205m) 1.3335 (212m) 1.3350(600m) 1.3500 (290m)

AUD/USD 0.7250 (AUD 332m) 0.7300 379m) 0.7500 (275m)

NZD/USD 0.6390 (NZD 601m) 0.6600 (269m) 0.6685 (296m)

AUD/NZD 1.1000 (AUD 480m)

-

14:40

Initial jobless claims slide to 259,000 in the week ending March 05

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 05 in the U.S. decreased by 18,000 to 259,000 from 277,000 in the previous week. It was the lowest reading since mid-October.

The previous week's figure was revised down from 278,000.

Analysts had expected jobless claims to decline to 275,000.

Jobless claims remained below 300,000 the 53rd straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 32,000 to 2,225,000 in the week ended February 27.

-

14:30

U.S.: Initial Jobless Claims, March 259 (forecast 275)

-

14:30

U.S.: Continuing Jobless Claims, February 2225 (forecast 2255)

-

14:30

Canada: Capacity Utilization Rate, Quarter IV 81.1% (forecast 81.6%)

-

14:30

Canada: New Housing Price Index, MoM, January 0.1% (forecast 0.2%)

-

14:25

European Central Bank cut its interest rate to 0.00% in March

The European Central Bank (ECB) cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%.

The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

14:19

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the ECB’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation 3.6% 3.4%

01:30 China PPI y/y February -5.3% -4.9% -4.9%

01:30 China CPI y/y February 1.8% 1.9% 2.3%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0.1% Revised From 0% 0.2% 0.2%

07:00 Germany Current Account January 26.3 Revised From 25.6 13.2

07:00 Germany Trade Balance (non s.a.), bln January 19.0 Revised From 18.8 13.6

07:45 France Industrial Production, m/m January -0.6% Revised From -1.6% 0.8% 1.3%

07:45 France Industrial Production, y/y January 2.0% 1.9%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.00%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. initial jobless claims data. The number of initial jobless claims in the U.S. is expected to decline by 3,000 to 275,000 last week.

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) interest rate decision. The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

A press conference is scheduled to be at 13:30 GMT.

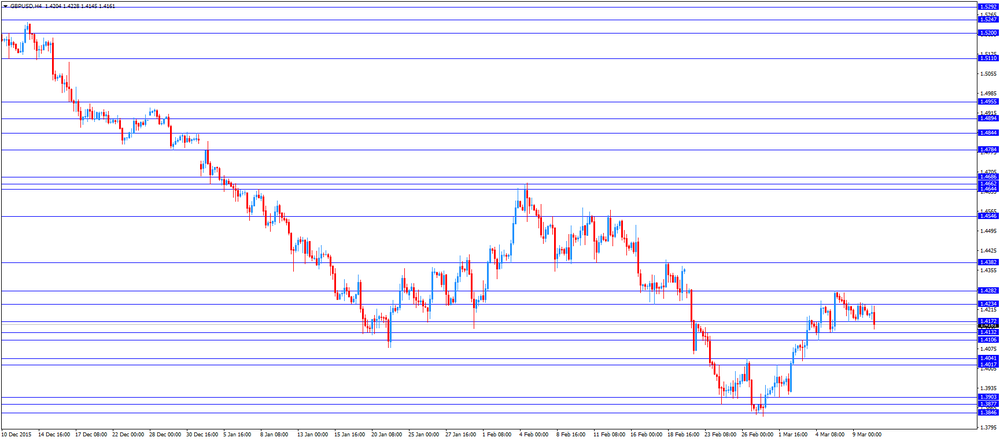

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Britain's Prime Minister David Cameron will warn on Thursday that Britain's exit from the European Union (Brexit) would weigh on the pound.

"It means pressure on the pound sterling. It means jobs being lost. It means mortgage rates might rise. It means businesses closing. It means hardworking people losing their livelihoods," he will say according to extracts of his speech reported in local media.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in January, after a 0.1% gain in December.

The Canadian capacity utilization rate is expected to decrease 81.6% in the fourth quarter from 82.0% in the third quarter.

EUR/USD: the currency pair declined to $1.0835

GBP/USD: the currency pair fell to $1.4145

USD/JPY: the currency pair rose to Y114.21

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 Canada New Housing Price Index, MoM January 0.1% 0.2%

13:30 U.S. Initial Jobless Claims March 278 275

21:15 Canada BOC Gov Stephen Poloz Speaks

21:45 New Zealand Business NZ PMI February 57.9

23:50 Japan BSI Manufacturing Index Quarter I 3.8 4.2

-

14:01

Orders

EUR/USD

Offers: 1.0985 1.1000 1.1020 1.1050 1.1080 1.1100 1.1130 1.1150 1.1180 1.1200 1.1230 1.1250 1.1275 1.1300

Bids: 1.0950 1.0940 1.0920 1.0900 1.0880-85 1.0850 1.0830 1.0800 1.0780 1.0750 1.0730 1.0700 1.0685 1.0650

GBP/USD

Offers: 1.4250 1.4270 1.4285 1.4300 1.4335 1.4350 1.4380 1.4400 1.4420-25

Bids: 1.4200 1.4180-85 1.4150 1.4120 1.4100 1.4070 1.4045-50 1.4030 1.4000

EUR/JPY

Offers: 124.85 125.00 125.30 125.50 126.00 126.50

Bids: 124.20 124.00 123.60 123.20 123.00 122.50 122.30 122.00 121.50

EUR/GBP

Offers: 0.7730 0.7750-55 0.7780-85 0.7800 0.7820-25 0.7850 0.7880 0.7900

Bids: 0.7700 0.7675 0.7650 0.7630 0.7600 0.7585 0.7565 0.7550

USD/JPY

Offers: 113.80-85 114.00 114.25-30 114.50 114.75 114.85 115.00 115.30 115.50

Bids: 113.20 113.00 112.80 112.40 112.20 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers: 0.7500 0.7530 0.7550 0.7575 0.7600 0.7650

Bids: 0.7470 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350 0.7330 0.7300

-

13:45

Eurozone: ECB Interest Rate Decision, 0.00% (forecast 0.05%)

-

11:55

Britain’s Prime Minister David Cameron will warn that Brexit would weigh on the pound

Britain's Prime Minister David Cameron will warn on Thursday that Britain's exit from the European Union (Brexit) would weigh on the pound.

"It means pressure on the pound sterling. It means jobs being lost. It means mortgage rates might rise. It means businesses closing. It means hardworking people losing their livelihoods," he will say according to extracts of his speech reported in local media.

-

11:50

RICS house price balance for the U.K. rises to +50% in February

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance rose to +50% in February from +48% in January. January's figure was revised down from +49%.

"It is inevitable that over the coming months, April's Stamp Duty changes will take a little of the heat out of the investor market," RICS Chief Economist, Simon Rubinsohn, said.

-

11:41

French final non-farm employment increases 0.2% in the fourth quarter

The French statistical office Insee released its final non-farm employment data on Thursday. French non-farm employment increased 0.2% in the fourth quarter, in line with the preliminary reading, after a 0.1% increase in the third quarter. The third quarter's figure was revised up from a flat reading.

Employment excluding temporary work rose 0.1% in the fourth quarter.

Temporary employment rose by 3.3% in the fourth quarter.

Employment in the industry was down by 0.3% in the fourth quarter, while employment in construction declined by 0.5%.

Overall, job creation in the market services sector climbed by 0.4% in the fourth quarter.

-

11:35

French industrial production climbs 1.3% in January

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France climbed 1.3% in January, exceeding expectations for a 0.8% increase, after a 0.6% fall in December. December's figure was revised up from a 1.6% drop.

Manufacturing output increased 0.8% in January, while construction output jumped 7.3%.

Output in mining and quarrying, energy, water supply and waste management climbed 4.9% in January.

On a yearly basis, the French industrial production climbed 1.9% in January, after a 2.0% gain in December.

-

11:30

Greek consumer prices decline 0.4% in February

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Thursday. Greek consumer prices slid 0.4% in February, after a 1.9% drop in January.

On a yearly basis, the Greek consumer price index declined 0.5% in February, after a 0.7 fall in January. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.1% in February, transport costs dropped by 5.4%, clothing and footwear prices were down 1.0%, while household equipment prices decreased 2.8%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 0.9% in February, while alcoholic beverages and tobacco prices increased by 2.0%.

-

11:20

Retail sales in Spain rise at a seasonally adjusted rate of 0.4% in January

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.4% in January, after a 0.1% increase in December.

Food sales were up 0.6% in January, while non-food sales increased by 1.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.3% in January, after a 2.7% rise in December. December's figure was revised up from a 2.2% gain.

Sales of non-food products fell 0.5% in January from a year ago, while food sales jumped 6.6%.

-

11:12

Germany's trade surplus falls to €18.9 billion in January

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to a seasonally adjusted €18.9 billion in January from 20.3 in December.

Exports fell 0.5% in January, while imports increased 1.2%.

On a yearly basis, German exports decreased 1.4% in January, while imports rose by 1.5%.

Germany's current account surplus was €13.2 billion in January, down from €26.3 billion in December. December's figure was revised down from a surplus of €25.6 billion.

-

10:53

Reserve Bank of New Zealand lowers its interest rate to 2.25% in March

The Reserve Bank of New Zealand (RBNZ) on Wednesday lowered its interest rate to 2.25% from 2.50%. This decision was not expected by market participants.

The RBNZ Graeme Wheeler pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said.

He noted that there were risks to the outlook from the weakness in the dairy sector, the fall in inflation expectations, the high net immigration, and pressures in the housing market.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports, adding that headline inflation was expected to rise over 2016.

Wheeler pointed out that the outlook for global growth deteriorated since the December, due the slowdown in emerging markets, and slower growth in Europe.

-

10:21

Chinese consumer price index rises at annual rate of 2.3% in February

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in February, exceeding expectations for a 1.9% increase, after a 1.8% gain in January. It was the biggest rise since July 2014.

Food prices rose at an annual rate of 7.3% in February, while non-food prices increased 1.0%.

On a monthly basis, consumer price inflation increased 1.6% in February, after a 0.5% rise in January.

The Chinese producer price index (PPI) dropped 4.9% in February, in line with expectations, after a 5.3% decline in January.

-

10:10

Unemployment rate in the OECD area declines to 6.5% in January

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Wednesday. The OECD unemployment rate declined to 6.5% in January from 6.6% in December.

The unemployment rate in Eurozone was down by 0.1% to 10.3% in January.

The U.S. unemployment rate fell by 0.1% to 4.9% in January.

39.9 million people were unemployed in the OECD area in January.

The youth unemployment fell to 13.3% in January from 13.6 in December. The highest youth unemployment was in Spain with 45.0%, followed by Italy with 39.3% and Portugal with 29.9%.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.00 (USD 112.00 (310m) 112.15-20 (500m) 113.00 (760m) 113.45-60 (770m) 114.00 (1.9bln) 114.70 (555m) 115.00 (1.25bln) 116.00 (1.24bln)

EUR/USD: 1.0700 (EUR 860m) 1.0745-50 (434m) 1.0770-75 (755m) 1.0800 (829m) 1.0845-50 (1.01bln) 1.0865-80 (1.4bln) 1.0885-90 (550m) 1.0900-10 (3.25ln) 1.0915 (302m) 1.0950 (982m) 1.0957 (401m) 1.0970 (526m) 1.0985-90 (557m) 1.1000-10 (957m) 1.1040 (703m) 1.1085 (1.15bln) 1.1100 (783m) 1.1150 (527m)

EUR/GBP 0.7650 (EUR 401m) 0.7800 (941m)

USD/CAD 1.3250 (USD 205m) 1.3335 (212m) 1.3350(600m) 1.3500 (290m)

AUD/USD 0.7250 (AUD 332m) 0.7300 379m) 0.7500 (275m)

NZD/USD 0.6390 (NZD 601m) 0.6600 (269m) 0.6685 (296m)

AUD/NZD 1.1000 (AUD 480m)

-

09:01

France: Industrial Production, y/y, January 1.9%

-

08:46

France: Industrial Production, m/m, January 1.3% (forecast 0.8%)

-

08:25

Options levels on thursday, March 10, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1168 (1612)

$1.1128 (3088)

$1.1061 (118)

Price at time of writing this review: $1.0965

Support levels (open interest**, contracts):

$1.0916 (1635)

$1.0867 (2655)

$1.0807 (5126)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 37114 contracts, with the maximum number of contracts with strike price $1,1300 (3559);

- Overall open interest on the PUT options with the expiration date April, 8 is 56962 contracts, with the maximum number of contracts with strike price $1,0700 (7063);

- The ratio of PUT/CALL was 1.53 versus 1.37 from the previous trading day according to data from March, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.4409 (2304)

$1.4313 (812)

$1.4218 (313)

Price at time of writing this review: $1.4183

Support levels (open interest**, contracts):

$1.4089 (362)

$1.3992 (1379)

$1.3895 (905)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 19592 contracts, with the maximum number of contracts with strike price $1,4400 (2304);

- Overall open interest on the PUT options with the expiration date April, 8 is 18395 contracts, with the maximum number of contracts with strike price $1,3850 (3269);

- The ratio of PUT/CALL was 0.94 versus 0.93 from the previous trading day according to data from March, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Trade Balance (non s.a.), bln, January 13.6

-

08:00

Germany: Current Account , January 13.2

-

07:46

France: Non-Farm Payrolls, Quarter IV 0.2% (forecast 0.2%)

-

02:30

China: CPI y/y, February 2 (forecast 1.9%)

-

02:30

China: PPI y/y, February -4.9% (forecast -4.9%)

-

01:01

Australia: Consumer Inflation Expectation, 3.4%

-

00:29

Currencies. Daily history for Mar 9’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0998 -0,11%

GBP/USD $1,4214 -0,01%

USD/CHF Chf0,9971 +0,15%

USD/JPY Y113,33 +0,64%

EUR/JPY Y124,66 +0,53%

GBP/JPY Y161,1 +0,64%

AUD/USD $0,7484 +0,63%

NZD/USD $0,6652 -1,38%

USD/CAD C$1,3246 -1,22%

-

00:01

Schedule for today, Thursday, Mar 10’2016:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation 3.6% 3.4%

01:30 China PPI y/y February -5.3% -4.9%

01:30 China CPI y/y February 1.8% 1.9%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0% 0.2%

07:00 Germany Current Account January 25.6

07:00 Germany Trade Balance (non s.a.), bln January 18.8

07:45 France Industrial Production, m/m January -1.6% 0.8%

07:45 France Industrial Production, y/y January 2.0%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 Canada Capacity Utilization Rate Quarter IV 82.0% 81.6%

13:30 Canada New Housing Price Index, MoM January 0.1% 0.2%

13:30 U.S. Continuing Jobless Claims February 2257 2255

13:30 U.S. Initial Jobless Claims March 278 275

19:00 U.S. Federal budget February 55.2 -200

21:15 Canada BOC Gov Stephen Poloz Speaks

21:45 New Zealand Business NZ PMI February 57.9

23:50 Japan BSI Manufacturing Index Quarter I 3.8 4.2

-