Noticias del mercado

-

20:21

American focus: The US dollar fell against most major currencies

The euro has appreciated considerably against the dollar, recouping almost all of the previously lost positions today. Experts point out that the reason for the growth of the EUR / USD has been a new wave of US currency sales. Investors also drew attention to the statements of representatives of the ECB. As it became known, a spokesman for the ECB Liikanen expects to maintain low interest rates for a long time. "The ECB Actions speak about a serious attitude to fulfill its obligations in the long term, the ECB will continue to take action until inflation reaches or at least closer to the target level in the medium term.", - Said the politician.

Meanwhile, Vice-President of the ECB Vitor Constancio said that "while there are limits to unconventional measures of the central bank to abandon the monetary policy is really dangerous when the fiscal and structural reforms can not contribute to the stimulation of growth." In addition, Constancio said if the ECB did not take measures to stimulate earlier, inflation in the euro zone would be one-third per cent negative in 2015 and would remain significantly negative in the course of this year. Constancio also said that two-thirds of growth in the euro-zone economy, which has been registered in the past two years, have been associated with the monetary policy of the Central Bank.

Meanwhile, people familiar with the matter, said that the Bundesbank was opposed yesterday's stimulus package the ECB measures. Bundesbank President Weidmann was particularly against the decision to increase the size of the bond purchase program. However, Weidmann could not vote at a meeting on Thursday because of the ECB's system of rotation. He was willing to discuss a more standard tools, such as changing rates and long-term loans, but probably would prefer not to do anything at all. Some of the 25 members of the Governing Council of the ECB were concerned that after several years of easy money policy, a fresh stimulus measures become less effective. 19 members of the ECB Governing Council voted last stimulus measures, 2 council members voted against (the head of the Central Bank of the Netherlands, and a member of the ECB executive board Lautenshleger Sabina), and four members were not allowed to vote.

The pound rose almost 150 pips against the dollar, reaching a peak on 16 February that was mainly due to the widespread weakening of the US currency. In focus were also statistics on Britain, which, however, did not prevent the pound to go up. Office for National Statistics reported that the volume of construction fell by 0.2 percent in January from December, as expected by economists. In general, the new work fell by 0.8 per cent, while repairs and maintenance increased by 0.8 percent. On an annual basis, construction output fell by 0.8 percent in January, but slower than the expected decline of 1.7 percent. There was a reduction of both new work and repair and maintenance, 0.4 percent and 1.4 percent respectively.

Meanwhile, the results of a quarterly survey by the Bank of England showed that British inflation expectations for the year ahead fell in February to its lowest level in more than 16 years. According to the new forecast, inflation in the next 12 months will be 1.8 percent, compared with 2 per cent, expected in November. This is the lowest inflation expectations since November 1999. Inflation expectations for two years ahead decreased to 2.1 percent from 2.3 percent. After five years, the inflation rate is projected to be 2.9 percent. Last result coincided with the November estimates.

Also today, the British Chamber of Commerce (BCC) has lowered its forecast for economic growth in the United Kingdom, referring to the "global headwinds and uncertainty." Now BCC experts expect that the economy will grow by 2.2% this year, compared with a previous estimate of . 2.5% of BCC also cut its growth forecast for 2017 - to 2.3% from 2.5% in addition, the BCC said that the forecast economic expansion of 2.4% in 2018. Analysts.. It noted that the revised estimates was associated with weaker growth in most areas of the economy, reflecting the global slowdown.

The Canadian dollar rose significantly against the US dollar, supported by the growth of quotations of oil on the background of the report of the International Energy Agency (IEA). Recall now the IEA raised its forecast for oil demand in the world in 2016 to 95.8 million barrels per day. The pace of oil demand growth this year will remain at 1.2 million b / d. At the same time the IEA believes that the freezing of the main producers of oil in the level of January will not give rapid effect to stabilize the market. "Factors that are supporting prices include possible actions for production stabilization of oil producers, reducing production in Iraq, Nigeria and the United Arab Emirates, signs of declining production outside OPEC, maintaining expectations about the pace of global oil demand growth and weakening of the US dollar" - said the agency review. Meanwhile, Goldman Sachs experts said that they had seen the signs began to restore the balance of supply and demand on the oil market. Against this background, the bank raised its forecast for oil prices in the II quarter of 2016 from US $ 20-40 per barrel to $ 25-45 per barrel. According to forecasts of Goldman Sachs analysts, the average price of oil in the 2 nd quarter could reach $ 35 per barrel. And in the 3rd and 4th quarters of the average cost

-

17:38

German Economy Ministry: the German economy is expected to continue to expand solidly

German Economy Ministry said in its monthly report on Friday that the country's economy was expected to continue to expand solidly despite the slowdown in emerging economies.

"The German economy made a good start in 2016, and remains on a growth track, despite the economic uncertainty in the global environment," the ministry said.

The ministry noted that household spending remained the key growth driver.

-

17:15

German Bundesbank was against further stimulus measures by the ECB

News reported on Friday that the German Bundesbank was against further stimulus measures by the European Central Bank (ECB).

The ECB on Thursday cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:58

Japan’s business survey index (BSI) of manufacturers' sentiment drops to -7.9 in first quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Thursday evening. The business survey index (BSI) of manufacturers' sentiment dropped to -7.9 in first quarter from 3.8 in fourth quarter, missing expectations for a rise to 4.2.

The BSI for non-manufacturing slid to -0.7 in the first quarter from 5 in the fourth quarter.

The BSI for all industries was down to -3.2 in the first quarter from 4.6 in the fourth quarter.

The BSI for manufacturers in the second quarter of 2016 is expected to rise to -3.5, while the BSI for non-manufacturing is expected to decrease to -1.5.

-

16:31

European Central Bank Governing Council member Erkki Liikanen: the central bank still had tools to boost the economy and inflation

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Friday that the central bank still had tools to boost the economy and inflation in the Eurozone.

"We did what was essential in this situation, but it is clear that the ECB's ability to act has not run out. We have the capability and the tools if needed," he said in an interview.

Liikanen pointed out that the ECB would act until 2% inflation was reached.

-

16:22

European Central Bank Vice President Vitor Constancio: the central bank’s monetary policy had limits

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank's monetary policy had limits.

"So if these other policies either can't or won't contribute to a significant degree, then not only is it wrong to start talking down monetary policy - it's actually dangerous," he said.

Constancio noted that structural and fiscal reforms should be implemented to help to boost the economic growth and inflation.

He pointed out that ECB's monetary policy contributed to inflation and economic growth in 2015.

-

15:38

British Chambers of Commerce downgrades its U.K. GDP growth forecasts

The British Chambers of Commerce (BCC) released its U.K. GDP growth forecast on Friday. The U.K. economy is expected to grow at 2.2% in 2016, down from the previous forecast of a 2.5% rise, 2.3% in 2017, down from the previous forecast of a 2.5% gain, and 2.4% in 2018.

The downgrade was driven by the weaker than expected growth across most areas of the economy.

The BCC noted that the U.K. economy is expected to expand moderately and at a relatively steady pace over the next three years, adding that services and consumer spending will remain the key growth drivers.

"In the face of a slowing economy, and with further potential risks on the horizon, there is a case for sustained government action to improve prospects for business," Dr Adam Marshall, Acting Director General of the British Chambers of Commerce, said.

"The UK's economic performance is reasonably good when measured against our main competitors, but it's only mediocre when compared against long-term trends," he added.

-

14:55

U.S. import price index falls 0.3% in February

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index fell by 0.3% in February, beating expectations for a 0.6% decrease, after a 1.0% decline in January. January's figure was revised up from a 1.1% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 4.0% in February.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.4% in February, after a 0.8% fall in January.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 113.00 (869m) 114.00-10 (916m) 114.50 (282m) 115.00 (1.11bln)

EUR/USD: 1.0800 (EUR 1.69bln) 1.0845-50 (1.6bln) 1.0870-75 (1.35bln) 1.0900 (1.86bln) 1.0925-30 (630m) 1.0945-50 (1.34bln) 1.1000-10 (962m) 1.1050 (502m) 1.1100 (911m) 1.1150 (829m) 1.1260 (290m)

EUR/GBP 0.7650 (EUR 432m) 0.7775 (308m) 0.7800 (200m)

USD/CAD 1.3300 (USD 350m) 1.3350-65 (1.45bln) 1.3400-05 (275m) 1.3500 (236m) 1.3550 (238m)

AUD/USD 0.7375 ( AUD 200m) 0.7420-25 ( 936m) 0.7550 (201m)

NZD/USD 0.6500 (NZD 200m) 0.6590 (200m) 0.6675 (259m)

AUD/NZD 1.1000 (AUD 300m)

-

14:42

Canada’s unemployment rate rises rose to 7.3% in February

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.3% in February from 7.2% in January. Analysts had expected the unemployment rate to remain unchanged at 7.2%.

The labour participation rate remained unchanged at 65.9% in February.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people fell by 2,300 jobs in February, missing expectations for a rise of 9,000 jobs, after a 5,400 decrease in January.

The decrease was driven by a drop in full-time work. Full-time employment dropped by 51,800 in February, while part-time employment climbed by 49,500 jobs.

Employment declined in health care and social assistance, educational services, 'other services,' and natural resources.

-

14:30

Canada: Unemployment rate, February 7.3% (forecast 7.2%)

-

14:30

U.S.: Import Price Index, February -0.3% (forecast -0.6%)

-

14:30

Canada: Employment , February -2.3 (forecast 9)

-

14:15

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the U.K. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany CPI, m/m (Finally) February -0.8% 0.4% 0.4%

07:00 Germany CPI, y/y (Finally) February 0.5% 0% 0.0%

09:30 United Kingdom Total Trade Balance January -3.69 Revised From -2.71 -3.0 -3.46

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. import price index data. The U.S. import price index is expected to decline 0.6% in February, after a 1.1% fall in January.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Yesterday's interest rate decision by the European Central Bank (ECB) weighed on the euro. The central bank cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December. The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 7.2% in February.

Canada's economy is expected to add 9,000 jobs in February.

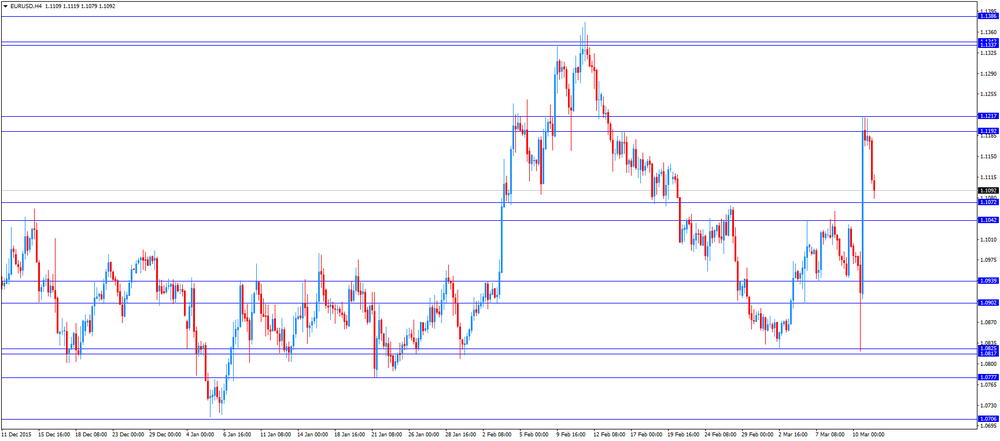

EUR/USD: the currency pair declined to $1.1079

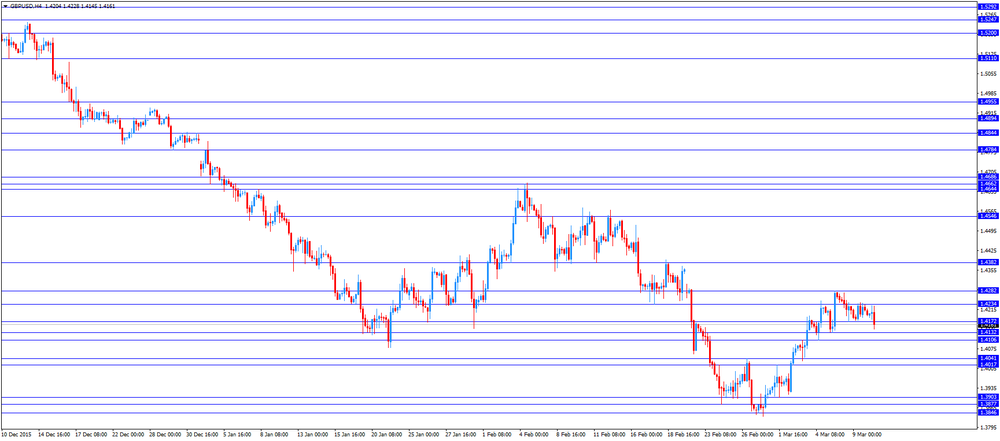

GBP/USD: the currency pair rose to $1.4308

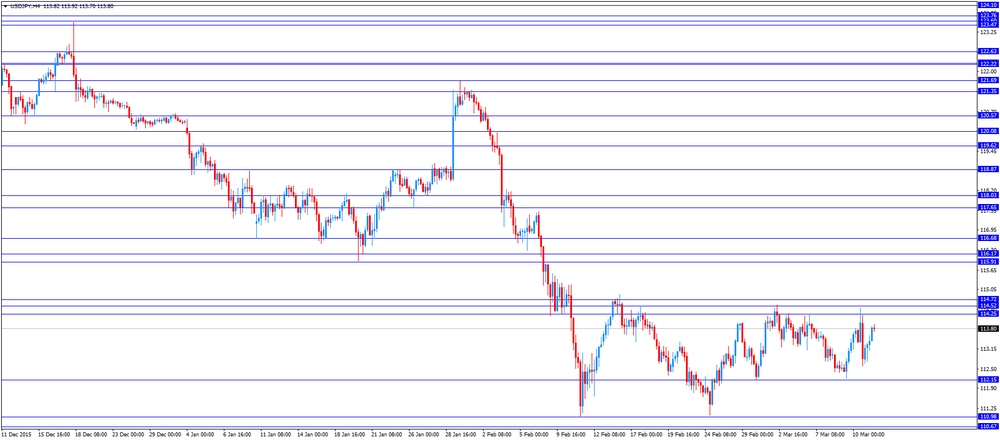

USD/JPY: the currency pair increased to Y113.92

The most important news that are expected (GMT0):

13:30 Canada Employment February -5.7 9

13:30 Canada Unemployment rate February 7.2% 7.2%

13:30 U.S. Import Price Index February -1.1% -0.6%

-

14:00

Orders

EUR/USD

Offers: 1.1150 1.1180 1.1200 1.1230 1.1250-60 1.1275 1.1300 1.1310-20

Bids: 1.1100 1.1080 1.1050 1.1030 1.1000 1.0985 1.0950 1.0925-30 1.0900 1.0880 1.0850

GBP/USD

Offers: 1.4285 1.4300 1.4335 1.4350 1.4380 1.4400 1.4420-25 1.4450

Bids: 1.4250 1.4225-30 1.4200 1.4180-85 1.4150 1.4120 1.4100 1.4070 1.4045-50

EUR/JPY

Offers: 127.00 127.30 127.50 127.80 128.00 128.50

Bids: 126.20 126.00 125.75 125.50 125.00 124.50 124.20 124.00

EUR/GBP

Offers: 0.7820 0.7850 0.7880 0.7900 0.7930 0.7950

Bids: 0.7770-75 0.7750 0.7720 0.7700 0.7675 0.7650

USD/JPY

Offers: 114.00 114.25-30 114.50 114.75 114.85 115.00 115.30 115.50

Bids: 113.50 113.20 113.00 112.80 112.40 112.20 112.00 111.85 111.50

AUD/USD

Offers: 0.7500 0.7530 0.7550 0.7575 0.7600 0.7650

Bids: 0.7475-80 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

12:11

Greek industrial production decreases 0.9% in January

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Friday. Greek industrial production decreased 0.9% in January, after a 2.2% rise in December.

On a yearly basis, industrial production in Greece rose at an adjusted rate of 4.6% in January, after a 6.2% increase in December. December's figure was revised up from a 5.2% gain.

Production in the manufacturing sector increased at an annual rate of 5.8% in January, output in the mining and quarrying sector dropped 13.6%, while electricity production jumped by 6.8%.

-

12:04

German final consumer price inflation falls 0.4% in February

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.4% in February, in line with the preliminary estimate, after a 0.8% decline in January.

On a yearly basis, German final consumer price index declined to 0.0% in February from 0.5% in January, in line with the preliminary estimate.

Energy prices dropped 8.5% year-on-year in February, while food prices climbed 0.8%.

Consumer prices excluding energy increased 0.9% year-on-year in February.

-

11:58

Final consumer price inflation in Spain falls 0.4% in February

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.4% in February, down from the preliminary reading of -0.3%, after a 1.9% decrease in January.

The monthly drop was mainly driven by a fall in clothing and footwear, and housing prices. Prices for clothing and footwear, and housing both plunged 1.6% in February.

On a yearly basis, consumer prices fell by 0.8% in February from a year ago, in line with preliminary reading, after a 0.3% fall reading in January.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:52

Industrial production in Italy climbs 1.9% in January

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 1.9% in January, after a 0.6% decline in December. December's figure was revised up from a 0.7% fall.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 3.9% in January, after a 1.0% decrease in December.

Output of capital goods rose 9.5% year-on-year in January, output of consumer goods was up 1.2%, output of energy increased 2.8%, while output of intermediate goods increased 2.3%.

-

11:44

UK’s construction output declines 0.2% in January

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December.

The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

On a yearly basis, construction output decreased 0.8% in January, after a 1.7% fall in December.

-

11:35

U.K. trade deficit in goods narrows to £10.29 billion in January

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

-

11:18

German wholesale prices fall 0.5% in February

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.5% in February, after a 0.4% decrease in January.

On a yearly basis, wholesale prices in Germany dropped 1.9% in February, after a 1.0% decline in January. Wholesale prices have been declining since July 2013.

The annual fall was mainly driven by a 15.1% drop in solid fuels and related products.

-

11:11

Business NZ performance of manufacturing index for New Zealand declines to 56.0 in February

According to the Business NZ Survey published on late Thursday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand declined to 56.0 in February from 57.9 in January.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was mainly driven by drops in new orders and production.

Business NZ's executive director for manufacturing, Catherine Beard, said that the expansion was still healthy in the sector.

-

11:02

Net worth of households and non-profits in the U.S. climbs by $1.64 trillion in the fourth quarter

The Federal Reserve released its financial accounts report on Thursday. The net worth of households and non-profits in the U.S. climbed by $1.64 trillion to $86.8 trillion in the fourth quarter of 2015, after a 1.5% decline in the third quarter. The rise was driven by higher home prices and a recovery in equity prices.

Household debt rose at an annual rate of 3.4% in the fourth quarter of 2015, after a 1.6% increase in the third quarter.

-

10:40

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.8 in in the week ended March 06

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.8 in in the week ended March 06 from 44.6 the prior week.

The increase was driven by more favourable assessment of the U.S. economy. The measure of views of the economy rose to 35.9 from 35.0, the buying climate index was down to 39.4 from 39.9, while the personal finances index fell to 55.9 from 56.0.

-

10:30

United Kingdom: Total Trade Balance, January -3.46 (forecast -3.0)

-

10:23

French Finance Minister Michel Sapin said: talks about a financial transaction tax end without results

French Finance Minister Michel Sapin said that talks among 10 European countries for a financial transaction tax ended without results on reservations from Belgium, Slovakia and Spain.

"We have reached a point of deadlock," he said.

Germany, France, Italy, Austria, Belgium, Estonia, Greece, Portugal, Slovakia, Slovenia and Spain originally agreed to create the tax, which should help recover public funds used to bail out banks during the financial crisis. But Estonia said last year that it would not participate in creation of such tax.

-

10:09

U.S. budget deficit is $192.6 billion in February

The U.S. Treasury Department released its federal budget data on Thursday. The budget surplus turned into a deficit of $192.6 billion in February, beating expectations for a deficit of $200.0 billion, after a surplus of $55.2 billion growth in January.

The budget deficit was driven by higher expenditure, which was $362 billion in February.

In the five months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $353.0 billion, down 8.7% from a year ago.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY: 113.00 (869m) 114.00-10 (916m) 114.50 (282m) 115.00 (1.11bln)

EUR/USD: 1.0800 (EUR 1.69bln) 1.0845-50 (1.6bln) 1.0870-75 (1.35bln) 1.0900 (1.86bln) 1.0925-30 (630m) 1.0945-50 (1.34bln) 1.1000-10 (962m) 1.1050 (502m) 1.1100 (911m) 1.1150 (829m) 1.1260 (290m)

EUR/GBP 0.7650 (EUR 432m) 0.7775 (308m) 0.7800 (200m)

USD/CAD 1.3300 (USD 350m) 1.3350-65 (1.45bln) 1.3400-05 (275m) 1.3500 (236m) 1.3550 (238m)

AUD/USD 0.7375 ( AUD 200m) 0.7420-25 ( 936m) 0.7550 (201m)

NZD/USD 0.6500 (NZD 200m) 0.6590 (200m) 0.6675 (259m)

AUD/NZD 1.1000 (AUD 300m) -

08:28

Options levels on friday, March 11, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1309 (2671)

$1.1279 (1736)

$1.1235 (118)

Price at time of writing this review: $1.1161

Support levels (open interest**, contracts):

$1.1080 (1203)

$1.1021 (2512)

$1.0951 (3510)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 36698 contracts, with the maximum number of contracts with strike price $1,0900 (3140);

- Overall open interest on the PUT options with the expiration date April, 8 is 61177 contracts, with the maximum number of contracts with strike price $1,0700 (6850);

- The ratio of PUT/CALL was 1.67 versus 1.53 from the previous trading day according to data from March, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.4508 (1418)

$1.4411 (2327)

$1.4316 (923)

Price at time of writing this review: $1.4266

Support levels (open interest**, contracts):

$1.4188 (540)

$1.4091 (504)

$1.3994 (1428)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20063 contracts, with the maximum number of contracts with strike price $1,4400 (2327);

- Overall open interest on the PUT options with the expiration date April, 8 is 18727 contracts, with the maximum number of contracts with strike price $1,3850 (3254);

- The ratio of PUT/CALL was 0.93 versus 0.94 from the previous trading day according to data from March, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Asian session: The euro remains at the highest levels

The euro remains at the highest levels after European Central Bank President Mario Draghi indicated the bank doesn't anticipate cutting interest rates further into negative territory in the future. Those efforts include cutting its benchmark interest rate from 0.05% to 0%, its deposit facility from minus 0.3% to minus 0.4% and its marginal lending facility from 0.3% to 0.25%. The central bank also unveiled new corporate bonds purchases and new loans to banks.

New Zealand rose despite the fact, the manufacturing sector in New Zealand continued to expand in February, albeit at a slower pace, the latest survey from Business NZ revealed on Friday with a Performance of Manufacturing Index score of 56.0. That's down from the upwardly revised 58.0 (originally 57.9), although it remains well above the boom-or-bust line of 50 that separates expansion from contraction. In all, the index has been in expansion since October 2012.

EUR/USD: during the Asian session the pair fell to $1.0970

GBP/USD: during the Asian session the pair fell to $1.4185

USD/JPY: during the Asian session the pair rose to Y113.80

-

08:00

Germany: CPI, y/y , February 0.0% (forecast 0%)

-

08:00

Germany: CPI, m/m, February 0.4% (forecast 0.4%)

-

01:00

Currencies. Daily history for Mar 10'2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1177 +1,60%

GBP/USD $1,4279 +0,46%

USD/CHF Chf0,9848 -1,25%

USD/JPY Y113,17 -0,14%

EUR/JPY Y126,51 +1,46%

GBP/JPY Y161,59 +0,30%

AUD/USD $0,7453 -0,42%

NZD/USD $0,6666 +0,21%

USD/CAD C$1,3344 +0,73%

-

00:50

Japan: BSI Manufacturing Index, Quarter I -7.9 (forecast 4.2)

-

00:02

Schedule for today, Friday, Mar 11’2016:

(time / country / index / period / previous value / forecast)

07:00 Germany CPI, m/m (Finally) February -0.8% 0.4%

07:00 Germany CPI, y/y (Finally) February 0.5% 0%

09:30 United Kingdom Total Trade Balance January -2.71 -2.9

13:30 Canada Employment February -5.7 9

13:30 Canada Unemployment rate February 7.2% 7.2%

13:30 U.S. Import Price Index February -1.1% -0.6%

-