Noticias del mercado

-

21:00

Dow +1.04% 17,171.09 +175.96 Nasdaq +1.44% 4,729.21 +67.05 S&P +1.29% 2,015.27 +25.70

-

19:09

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-index rallied on Friday as steadying oil drove energy shares, putting the major stock indexes on track for their fourth straight weekly gains in more than four months. U.S. crude pared some of their gains, but were up more than 1% after the International Energy Agency said oil prices might have bottomed as output in the United States and other non-OPEC countries was beginning to fall quickly. Investors also took a positive view of European Central Bank's new stimulus package unveiled on Thursday, despite ECB President Mario Draghi signaling an end to further rate cuts.

Most of Dow stocks in positive area (27 of 30). Top looser - The Procter & Gamble Company (PG, -0,54%). Top gainer - E. I. du Pont de Nemours and Company (DD, +2,69%).

All of S&P sectors in positive area. Top looser - Basic Materials (+2,5%).

At the moment:

Dow 17101.00 +201.00 +1.19%

S&P 500 2006.50 +27.00 +1.36%

Nasdaq 100 4331.75 +56.00 +1.31%

Oil 38.66 +0.82 +2.17%

Gold 1260.00 -12.80 -1.01%

U.S. 10yr 1.98 +0.05

-

18:01

European stocks closed: FTSE 100 6,139.79 +103.09 +1.71% CAC 40 4,492.79 +142.44 +3.27% DAX 9,831.13 +332.98 +3.51%

-

18:00

European stocks close: stocks closed higher on the ECB’s further stimulus measures

Stock indices closed Stock indices traded higher on further stimulus measures by the European Central Bank's (ECB). The central bank cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank's monetary policy had limits. He noted that structural and fiscal reforms should be implemented to help to boost the economic growth and inflation.

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Friday that the central bank still had tools to boost the economy and inflation in the Eurozone.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December. The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,139.79 +103.09 +1.71 %

DAX 9,831.13 +332.98 +3.51 %

CAC 40 4,492.79 +142.44 +3.27 %

-

17:43

WSE: Session Results

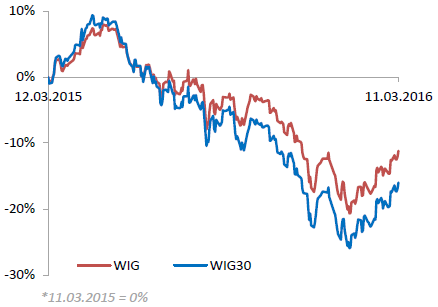

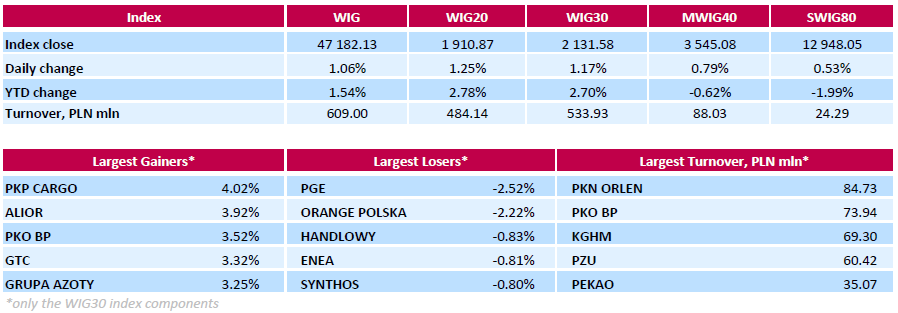

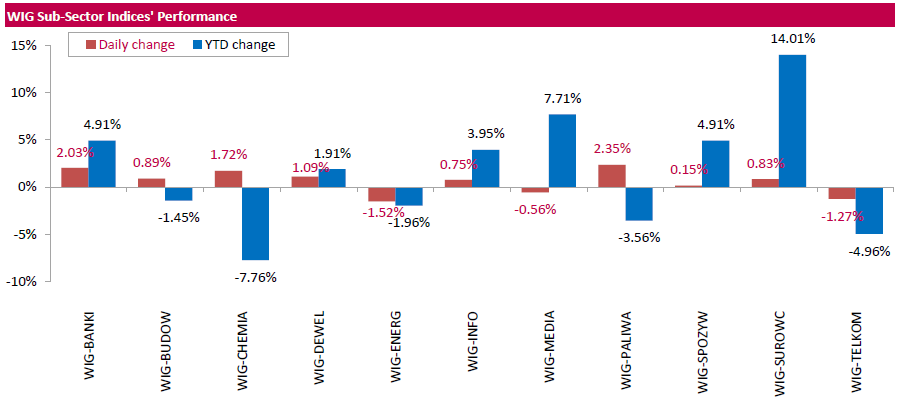

Polish equity market surged on Friday. The broad market measure, the WIG Index, surged by 1.06%. Sector-wise, oil and gas sector (+2.835) fared the best, while utilities (-1.52%) tumbled the most.

The large-cap stocks' measure, the WIG30 Index, advanced 1.17%. 2/3 of all index components returned gains, with the way up led by railway freight transport operator PKP CARGO (WSE: PKP), property developer GTC (WSE: GTC) and two banks ALIOR (WSE: ALR) and PKO BP (WSE: PKO), increasing by 3.32%-4.02%. Chemical producer GRUPA AZOTY (WSE: ATT) also produced noticeable gains, up 3.25%, on better-than-expected FY2015 earnings: the company posted FY2015 net profit of PLN 609 mln versus analysts' consensus of PLN 576 mln. On the other side of the ledger, genco PGE (WSE: PGE) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were the biggest decliners, falling by 2.52% and 2.22% respectively.

Beyond the WIG30 Index, ZA PULAWY (WSE: ZAP) and ZCH POLICE (WSE: PCE), both belonging to GRUPA AZOTY (WSE: ATT), climbed by 7.87% and 12.09% respectively on the back of publication of strong financial reports.

-

17:38

German Economy Ministry: the German economy is expected to continue to expand solidly

German Economy Ministry said in its monthly report on Friday that the country's economy was expected to continue to expand solidly despite the slowdown in emerging economies.

"The German economy made a good start in 2016, and remains on a growth track, despite the economic uncertainty in the global environment," the ministry said.

The ministry noted that household spending remained the key growth driver.

-

17:15

German Bundesbank was against further stimulus measures by the ECB

News reported on Friday that the German Bundesbank was against further stimulus measures by the European Central Bank (ECB).

The ECB on Thursday cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:58

Japan’s business survey index (BSI) of manufacturers' sentiment drops to -7.9 in first quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Thursday evening. The business survey index (BSI) of manufacturers' sentiment dropped to -7.9 in first quarter from 3.8 in fourth quarter, missing expectations for a rise to 4.2.

The BSI for non-manufacturing slid to -0.7 in the first quarter from 5 in the fourth quarter.

The BSI for all industries was down to -3.2 in the first quarter from 4.6 in the fourth quarter.

The BSI for manufacturers in the second quarter of 2016 is expected to rise to -3.5, while the BSI for non-manufacturing is expected to decrease to -1.5.

-

16:31

European Central Bank Governing Council member Erkki Liikanen: the central bank still had tools to boost the economy and inflation

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Friday that the central bank still had tools to boost the economy and inflation in the Eurozone.

"We did what was essential in this situation, but it is clear that the ECB's ability to act has not run out. We have the capability and the tools if needed," he said in an interview.

Liikanen pointed out that the ECB would act until 2% inflation was reached.

-

16:22

European Central Bank Vice President Vitor Constancio: the central bank’s monetary policy had limits

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank's monetary policy had limits.

"So if these other policies either can't or won't contribute to a significant degree, then not only is it wrong to start talking down monetary policy - it's actually dangerous," he said.

Constancio noted that structural and fiscal reforms should be implemented to help to boost the economic growth and inflation.

He pointed out that ECB's monetary policy contributed to inflation and economic growth in 2015.

-

15:38

British Chambers of Commerce downgrades its U.K. GDP growth forecasts

The British Chambers of Commerce (BCC) released its U.K. GDP growth forecast on Friday. The U.K. economy is expected to grow at 2.2% in 2016, down from the previous forecast of a 2.5% rise, 2.3% in 2017, down from the previous forecast of a 2.5% gain, and 2.4% in 2018.

The downgrade was driven by the weaker than expected growth across most areas of the economy.

The BCC noted that the U.K. economy is expected to expand moderately and at a relatively steady pace over the next three years, adding that services and consumer spending will remain the key growth drivers.

"In the face of a slowing economy, and with further potential risks on the horizon, there is a case for sustained government action to improve prospects for business," Dr Adam Marshall, Acting Director General of the British Chambers of Commerce, said.

"The UK's economic performance is reasonably good when measured against our main competitors, but it's only mediocre when compared against long-term trends," he added.

-

15:34

U.S. Stocks open: Dow +0.80%, Nasdaq +0.93%, S&P +0.85%

-

15:34

After start on Wall Street

Increasingly positive sentiment of core European markets helped reach the area of 1913 points for the Warsaw WIG20. WIG20 peaked today at the highest level since the beginning of December and the highest level year to date.

As we approach the opening of Wall Street, moods in Europe were getting better and the DAX with an increase of 3 percent, approaching the level of resistance breached yesterday.

Wall Street began the sessions in gains, which was signaled by the trading of contracts on major US indices. Looking at the charts, we see that the indices S&P500 and DJIA caught shortness of breath at the psychological resistance - respectively - 2000 and 17000 points. Today's session in the US will determine whether the S&P500 decline in over a week or it will be another success round for the bulls.

-

15:27

Before the bell: S&P futures +0.86%, NASDAQ futures +1.08%

U.S. stock-index rose.

Global Stocks:

Nikkei 16,938.87 +86.52 +0.51%

Hang Seng 20,199.6 +215.18 +1.08%

Shanghai Composite 2,809.17 +4.44 +0.16%

FTSE 6,131.42 +94.72 +1.57%

CAC 4,476.67 +126.32 +2.90%

DAX 9,785.16 +287.01 +3.02%

Crude oil $38.75 (+2.40%)

Gold $1266.40 (-0.50%)

-

14:55

U.S. import price index falls 0.3% in February

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index fell by 0.3% in February, beating expectations for a 0.6% decrease, after a 1.0% decline in January. January's figure was revised up from a 1.1% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 4.0% in February.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.4% in February, after a 0.8% fall in January.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Neutral from Sell at Goldman

Downgrades:

Other:

Alcoa (AA) initiated with a Outperform at Credit Suisse

-

14:42

Canada’s unemployment rate rises rose to 7.3% in February

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.3% in February from 7.2% in January. Analysts had expected the unemployment rate to remain unchanged at 7.2%.

The labour participation rate remained unchanged at 65.9% in February.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people fell by 2,300 jobs in February, missing expectations for a rise of 9,000 jobs, after a 5,400 decrease in January.

The decrease was driven by a drop in full-time work. Full-time employment dropped by 51,800 in February, while part-time employment climbed by 49,500 jobs.

Employment declined in health care and social assistance, educational services, 'other services,' and natural resources.

-

12:42

Mid session comment

The forenoon period of the session clearly shows that the market is moving towards a consolidation phase after high opening. As a result, the WIG20 is located at a level above 1,900 points with less than impressive turnover. Noticeable is the growing difference between the dynamics of WSE vs that of the environment. The German DAX has been growing by 2.85 percent, on the back of weakening EURO and a 2% increase in crude prices. The futures contracts on the S&P500 are going up by about 1 percent which should translate into higher opening in the US.

This favorable external atmosphere allowed for an increase in the WIG 20 index to the level of 1,905 points (+ 0.94%).

-

12:17

European stock markets mid session: stocks traded higher on the ECB’s further stimulus measures

Stock indices traded higher on further stimulus measures by the European Central Bank's (ECB). The central bank cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December. The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

-

12:11

Greek industrial production decreases 0.9% in January

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Friday. Greek industrial production decreased 0.9% in January, after a 2.2% rise in December.

On a yearly basis, industrial production in Greece rose at an adjusted rate of 4.6% in January, after a 6.2% increase in December. December's figure was revised up from a 5.2% gain.

Production in the manufacturing sector increased at an annual rate of 5.8% in January, output in the mining and quarrying sector dropped 13.6%, while electricity production jumped by 6.8%.

-

12:04

German final consumer price inflation falls 0.4% in February

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.4% in February, in line with the preliminary estimate, after a 0.8% decline in January.

On a yearly basis, German final consumer price index declined to 0.0% in February from 0.5% in January, in line with the preliminary estimate.

Energy prices dropped 8.5% year-on-year in February, while food prices climbed 0.8%.

Consumer prices excluding energy increased 0.9% year-on-year in February.

-

11:58

Final consumer price inflation in Spain falls 0.4% in February

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.4% in February, down from the preliminary reading of -0.3%, after a 1.9% decrease in January.

The monthly drop was mainly driven by a fall in clothing and footwear, and housing prices. Prices for clothing and footwear, and housing both plunged 1.6% in February.

On a yearly basis, consumer prices fell by 0.8% in February from a year ago, in line with preliminary reading, after a 0.3% fall reading in January.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:52

Industrial production in Italy climbs 1.9% in January

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 1.9% in January, after a 0.6% decline in December. December's figure was revised up from a 0.7% fall.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 3.9% in January, after a 1.0% decrease in December.

Output of capital goods rose 9.5% year-on-year in January, output of consumer goods was up 1.2%, output of energy increased 2.8%, while output of intermediate goods increased 2.3%.

-

11:44

UK’s construction output declines 0.2% in January

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December.

The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

On a yearly basis, construction output decreased 0.8% in January, after a 1.7% fall in December.

-

11:35

U.K. trade deficit in goods narrows to £10.29 billion in January

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

-

11:18

German wholesale prices fall 0.5% in February

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.5% in February, after a 0.4% decrease in January.

On a yearly basis, wholesale prices in Germany dropped 1.9% in February, after a 1.0% decline in January. Wholesale prices have been declining since July 2013.

The annual fall was mainly driven by a 15.1% drop in solid fuels and related products.

-

11:11

Business NZ performance of manufacturing index for New Zealand declines to 56.0 in February

According to the Business NZ Survey published on late Thursday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand declined to 56.0 in February from 57.9 in January.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was mainly driven by drops in new orders and production.

Business NZ's executive director for manufacturing, Catherine Beard, said that the expansion was still healthy in the sector.

-

11:02

Net worth of households and non-profits in the U.S. climbs by $1.64 trillion in the fourth quarter

The Federal Reserve released its financial accounts report on Thursday. The net worth of households and non-profits in the U.S. climbed by $1.64 trillion to $86.8 trillion in the fourth quarter of 2015, after a 1.5% decline in the third quarter. The rise was driven by higher home prices and a recovery in equity prices.

Household debt rose at an annual rate of 3.4% in the fourth quarter of 2015, after a 1.6% increase in the third quarter.

-

10:57

Net profit of AmRest Holdings SE increased y/y to PLN 160.04 mln in 2015.

AmRest Holdings SE recorded PLN 160.04 mln consolidated net profit attributable to shareholders of the parent company in 2015 compared to PLN 51.67 mln of profit a year earlier, the company said in a report.

Operating profit amounted to PLN 195.74 mln compared to PLN 109.9 mln profit a year earlier.

Consolidated sales revenues amounted to PLN 3 338.74 mln in 2015 compared to PLN 952.65 mln a year earlier.

AmRest Holdings SE (AmRest, WSE: EAT) is the largest independent restaurant operator in Central and Eastern Europe. Since 1993, the company building a portfolio of excellent brands, leaders in their categories, such as KFC, Pizza Hut, Burger King and Starbucks based on solid franchise and joint venture partnerships.

Number of restaurants has increased to 904 at the end of 2015 compared to 800 a year earlier. Most - 464 - accounted for KFC. Starbucks was 100 units, 77 of Pizza Hut, Burger King 41, La Tagliatella 193, Blue Frog 25, Kaab 4. In Poland, AmRest had 346 restaurants. Most foreign location was in Spain (216), Russia (109) and the Czech Republic (102).

-

10:40

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.8 in in the week ended March 06

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.8 in in the week ended March 06 from 44.6 the prior week.

The increase was driven by more favourable assessment of the U.S. economy. The measure of views of the economy rose to 35.9 from 35.0, the buying climate index was down to 39.4 from 39.9, while the personal finances index fell to 55.9 from 56.0.

-

10:23

French Finance Minister Michel Sapin said: talks about a financial transaction tax end without results

French Finance Minister Michel Sapin said that talks among 10 European countries for a financial transaction tax ended without results on reservations from Belgium, Slovakia and Spain.

"We have reached a point of deadlock," he said.

Germany, France, Italy, Austria, Belgium, Estonia, Greece, Portugal, Slovakia, Slovenia and Spain originally agreed to create the tax, which should help recover public funds used to bail out banks during the financial crisis. But Estonia said last year that it would not participate in creation of such tax.

-

10:09

U.S. budget deficit is $192.6 billion in February

The U.S. Treasury Department released its federal budget data on Thursday. The budget surplus turned into a deficit of $192.6 billion in February, beating expectations for a deficit of $200.0 billion, after a surplus of $55.2 billion growth in January.

The budget deficit was driven by higher expenditure, which was $362 billion in February.

In the five months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $353.0 billion, down 8.7% from a year ago.

-

09:14

After opening

The WIG20 futures contract (WSE: FW20H16) takes off 7 points above yesterday's closing, an increase of 0.4 percent. In the markets we have today an improvement in sentiment that occurred after the yesterday's announcement of the head of the ECB, that there will be no further rate cuts. After these negative emotions calm returns to the markets and encourage reflections in the first phase of the European session. This is also confirmed by successful Asian session.

The WIG20 index opened at 1892.86 points (+0.29%) and after a few minutes had more than 1900 points.

The beginning of trading for remaining indices were as follow:

WIG 46938.20 + 0.54 %;

WIG30 2119.54 +0.60 %

mWIG40 3537.94 + 0.59 %

-

08:31

Before opening

Thursday's session on Wall Street ended with a modest change in the major indices.

Taking into account the fact that yesterday stock markets were correlated with the currency markets, today we can also look into currencies while searching for tips as to how the stock markets would open today. Flat quotations of EUR / USD indicate that the atmosphere has improved. Contracts on the S&P500 and the DAX record a rise this morning and if the mood will be maintained until 9:00 am, the opening could be optimistic.

The WSE WIG20 index seems to follow core markets, where revitalized derivative indices are accompanied by increases in the prices of oil and copper.

-

07:39

Global Stocks: investors brushed off a bigger than expected stimulus package from the European Central Bank

A rally in European stocks vanished Thursday, with German shares relinquishing gains of nearly 3%, as the euro jumped on the prospect that the European Central Bank may not continue cutting interest rates. A sharp turn lower in oil prices also played spoiler in the intraday surge for European equities.

The S&P 500 and the Dow industrials finished little-changed in frenetic trading on Thursday, as investors dismissed new easing measures from the European Central Bank and crude futures declined.

Asian stocks were choppy Friday as investors brushed off a bigger than expected stimulus package from the European Central Bank. The reaction in Asia was largely muted on rising doubts that the ECB has enough policy tools to bolster growth and inflation in the eurozone.

Based on MarketWatch materials

-

03:02

Nikkei 225 16,686.72 -165.63 -0.98 %, Hang Seng 19,927.04 -57.38 -0.29 %, Shanghai Composite 2,773.96 -30.76 -1.10 %

-

01:02

Stocks. Daily history for Sep Mar 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,852.35 +210.15 +1.26 %

Hang Seng 19,984.42 -11.84 -0.06 %

Shanghai Composite 2,804.73 -57.83 -2.02 %

FTSE 100 6,036.7 -109.62 -1.78 %

CAC 40 4,350.35 -75.30 -1.70 %

Xetra DAX 9,498.15 -224.94 -2.31 %

S&P 500 1,989.57 +0.31 +0.02 %

NASDAQ Composite 4,662.16 -12.22 -0.26 %

Dow Jones 16,995.13 -5.23 -0.03 %

-